Fourth Quarter Results

- Net income available to RGA shareholders of $2.37 per diluted

share

- Adjusted operating income* of $4.73 per diluted share

- Premium growth of 19.2% over the prior-year quarter, 18.7% on a

constant currency basis1

- Deployed capital of $346 million into in-force

transactions

- Total shareholder capital returns of $106 million: $50 million

of share repurchases and $56 million of shareholder dividends

Full Year Results

- Net income available to RGA shareholders of $13.44 per diluted

share

- Adjusted operating income* of $19.88 per diluted share

- Premium growth of 15.3% over the prior year, 16.3% on a

constant currency basis1

- ROE of 11.4%, adjusted operating ROE* of 14.5%, and adjusted

operating ROE, excluding notable items*2 of 14.4% for the trailing

twelve months

- Deployed capital of $933 million into in-force

transactions

- Total shareholder capital returns of $419 million: $200 million

of share repurchases and $219 million of shareholder dividends

1 Actual amounts reflect impact of currency fluctuations.

Constant currency amounts reflect foreign denominated activity

translated to U.S. dollars at a constant exchange rate.

2 RGA completed its annual actuarial assumption review related

to business subject to Long-Duration Targeted Improvements (LDTI)

during the third quarter. The impact from the actuarial assumption

review is reflected in the results as notable items.

Reinsurance Group of America, Incorporated (NYSE: RGA), a

leading global provider of life and health reinsurance, reported

fourth quarter net income available to RGA shareholders of $158

million, or $2.37 per diluted share, compared with $291 million, or

$4.30 per diluted share, in the prior-year quarter. Adjusted

operating income* for the fourth quarter totaled $316 million, or

$4.73 per diluted share, compared with $312 million, or $4.60 per

diluted share, the year before. Adjusted operating income,

excluding notable items* for the fourth quarter, totaled $316

million, or $4.73 per diluted share, compared with $266 million, or

$3.91 per diluted share, the year before. Net foreign currency

fluctuations had an adverse effect of $0.01 per diluted share on

net income available to RGA shareholders, and a favorable effect of

$0.04 per diluted share on adjusted operating income as compared

with the prior year.

Quarterly Results

Year-to-Date Results

($ in millions, except per share

data)

2023

2022

2023

2022

Net premiums

$

4,108

$

3,446

$

15,085

$

13,078

Net income available to RGA

shareholders

158

291

902

517

Net income available to RGA shareholders

per diluted share

2.37

4.30

13.44

7.64

Adjusted operating income*

316

312

1,334

927

Adjusted operating income, excluding

notable items *

316

266

1,334

1,111

Adjusted operating income per diluted

share*

4.73

4.60

19.88

13.69

Adjusted operating income, excluding

notable items per diluted share*

4.73

3.91

19.88

16.40

Book value per share

138.39

106.19

Book value per share, excluding

accumulated other comprehensive income (AOCI)*

144.01

134.26

Total assets

97,623

84,904

*

See “Non-GAAP Financial Measures”

below

Full year net income available to RGA shareholders totaled $902

million, or $13.44 per diluted share, compared with $517 million,

or $7.64 per diluted share in 2022. Adjusted operating income for

the full year totaled $1,334 million, or $19.88 per diluted share,

compared with $927 million, or $13.69 per diluted share the year

before. Adjusted operating income, excluding notable items for the

full year, totaled $1,334 million, or $19.88 per diluted share,

compared with $1,111 million, or $16.40 per diluted share, the year

before. Net foreign currency fluctuations had an adverse effect of

$0.18 per diluted share on net income available to RGA

shareholders, and $0.21 per diluted share on adjusted operating

income as compared with 2022.

In the fourth quarter, consolidated net premiums totaled $4.1

billion, an increase of 19.2% over the 2022 fourth quarter, with a

favorable net foreign currency effect of $18 million. Excluding the

net foreign currency effect, consolidated net premiums increased

18.7% in the quarter. Net premiums for the quarter include a $500

million contribution from a single premium pension risk transfer

transaction in the U.S. Financial Solutions business. For the full

year, net premiums totaled $15.1 billion, an increase of 15.3% from

2022, with an adverse net foreign currency effect of $126 million.

Excluding the net foreign currency effect, consolidated net

premiums increased 16.3% for the full year. Net premiums for the

full year include a $1.5 billion contribution from single premium

pension risk transfer transactions in the U.S. Financial Solutions

business.

Compared with the year-ago period, excluding spread-based

businesses, fourth quarter investment income increased 14.8%,

reflecting higher yields. For the full year, investment income,

excluding spread-based businesses, increased 4.2%, reflecting

higher yields. Average investment yield increased to 4.86% in the

fourth quarter from 4.45% in the prior-year period due to higher

yields. For the full year, average investment yield was flat at

4.68% compared with the prior-year period of 4.69% due to higher

yields that were offset by lower variable investment income.

The effective tax rate for the quarter was 2.2% on pre-tax

income, below the expected range of 23% to 24%, primarily due to

losses in certain higher tax jurisdictions, tax credits and the

release of tax liabilities associated with uncertain tax positions.

For the full year, the effective tax rate was 21.8% on pre-tax

income, below the expected range of 23% to 24%, due to lower than

expected income in certain higher tax jurisdictions, tax credits

and the release of tax liabilities associated with uncertain tax

positions.

The effective tax rate for the quarter was 18.2% on pre-tax

adjusted operating income, below the expected range of 23% to 24%,

primarily due to losses in higher tax jurisdictions and tax

credits. For the full year, the effective tax rate was 21.5% on

pre-tax adjusted operating income, below the expected range of 23%

to 24%, due to lower than expected income in higher tax

jurisdictions and tax credits.

Tony Cheng, President and Chief Executive Officer, commented,

“In the quarter, we saw a continuation of the many positive trends

that we experienced in the first nine months, and this helped us

produce record results for the year. Our Financial Solutions

business continued to deliver very strong results across regions

and product lines. We continued to see good momentum in organic

business activity in the traditional business, and our in-force

transactions were especially strong, with $346 million of capital

deployed in the quarter. This brought our annual capital deployment

into in-force transactions to $933 million, a record for RGA.

“Additionally, we repurchased $50 million of common shares,

bringing the full year total to $200 million. Our balance sheet

remains strong, and we ended the quarter with excess capital of

approximately $1.0 billion. Based on favorable business conditions

and RGA's global leadership position, we are optimistic about the

future and expect to continue to deliver attractive financial

results over time.”

SEGMENT RESULTS

U.S. and Latin America

Traditional

Quarterly Results

Year-to-Date Results

($ in millions)

2023

2022

2023

2022

Net premiums

$

1,912

$

1,778

$

7,023

$

6,590

Pre-tax income

30

114

318

195

Pre-tax adjusted operating income

25

108

313

147

Pre-tax adjusted operating income,

excluding notable items

25

108

330

317

Quarterly Results

- Results reflected favorable Group and Individual Health

experience and slightly unfavorable experience and client reporting

adjustments in Individual Life, which had a larger unfavorable

financial impact due to the mix of experience in uncapped and

capped cohorts.

Full Year Results

- Results reflected $17 million of unfavorable impacts from

assumption updates, which are reflected as notable items.

- Excluding notable items, results reflected favorable in-force

management actions, the impact of higher yields and favorable

Individual Health and Group experience.

- Individual Life experience was favorable, however, the mix of

experience between uncapped and capped cohorts led to unfavorable

financial impacts.

Financial Solutions

Quarterly Results

Year-to-Date Results

($ in millions)

2023

2022

2023

2022

Asset-Intensive:

Pre-tax income (loss)

$

(140

)

$

(32

)

$

89

$

1

Pre-tax adjusted operating income

81

77

370

304

Pre-tax adjusted operating income,

excluding notable items

81

77

348

301

Capital Solutions:

Pre-tax income

$

20

$

24

$

81

$

144

Pre-tax adjusted operating income

20

24

81

144

Pre-tax adjusted operating income,

excluding notable items

20

24

81

144

Quarterly Results

- Asset-Intensive results reflected strong investment spreads due

to higher yields, including those on floating rate securities.

- Capital Solutions results were in line with expectations.

Full Year Results

- Asset-Intensive results reflected $22 million of favorable

impacts from assumptions updates, which are reflected as notable

items.

- Excluding notable items, Asset-Intensive results reflected

strong investment spreads, including those on floating rate

securities.

- Capital Solutions results were in line with expectations.

Canada

Traditional

Quarterly Results

Year-to-Date Results

($ in millions)

2023

2022

2023

2022

Net premiums

$

311

$

308

$

1,215

$

1,219

Pre-tax income

21

50

91

104

Pre-tax adjusted operating income

20

47

91

108

Pre-tax adjusted operating income,

excluding notable items

20

42

104

109

Net Premiums

- Foreign currency exchange rates had an adverse effect on net

premiums of $1 million for the quarter and $45 million for the full

year.

Quarterly Results

- Results reflected unfavorable claims experience on Group

business and unfavorable impacts from a one-time item.

- Foreign currency exchange rates had a favorable effect of $4

million on pre-tax income and $5 million on pre-tax adjusted

operating income.

Full Year Results

- Results reflected $13 million of unfavorable impacts from

assumptions updates, which are reflected as notable items.

- Excluding notable items, results reflected unfavorable Group

claims experience.

- Foreign currency exchange rates had an adverse effect of $1

million on pre-tax income and an immaterial effect on pre-tax

adjusted operating income.

Financial Solutions

Quarterly Results

Year-to-Date Results

($ in millions)

2023

2022

2023

2022

Pre-tax income

$

6

$

9

$

52

$

31

Pre-tax adjusted operating income

6

9

52

31

Pre-tax adjusted operating income,

excluding notable items

6

9

30

31

Quarterly Results

- Results reflected favorable longevity experience.

- Foreign currency exchange rates had an immaterial effect on

pre-tax income and an adverse effect of $1 million on pre-tax

adjusted operating income.

Full Year Results

- Results reflected $22 million of favorable impacts from

assumption updates, which are reflected as notable items.

- Excluding notable items, results reflected favorable longevity

experience.

- Foreign currency exchange rates had an adverse effect of $1

million on pre-tax income and $2 million on pre-tax adjusted

operating income.

Europe, Middle East and Africa

(EMEA)

Traditional

Quarterly Results

Year-to-Date Results

($ in millions)

2023

2022

2023

2022

Net premiums

$

461

$

422

$

1,775

$

1,736

Pre-tax income (loss)

8

3

(21

)

46

Pre-tax adjusted operating income

(loss)

8

3

(20

)

46

Pre-tax adjusted operating income,

excluding notable items

8

3

27

59

Net Premiums

- Foreign currency exchange rates had a favorable effect on net

premiums of $14 million for the quarter and an adverse effect of

$13 million for the full year.

Quarterly Results

- Results reflected unfavorable mortality experience in the U.K.,

partially offset by new business in Continental Europe.

- Foreign currency exchange rates had a favorable effect of $1

million on pre-tax income and pre-tax adjusted operating

income.

Full Year Results

- Results reflected $47 million of unfavorable impacts from

assumption updates, primarily in the U.K., which are reflected as

notable items.

- Excluding notable items, results reflected unfavorable

mortality experience, primarily in the U.K.

- Foreign currency exchange rates had an adverse effect of $3

million on pre-tax income and pre-tax adjusted operating

income.

Financial Solutions

Quarterly Results

Year-to-Date Results

($ in millions)

2023

2022

2023

2022

Pre-tax income

$

106

$

56

$

301

$

182

Pre-tax adjusted operating income

112

73

355

244

Pre-tax adjusted operating income,

excluding notable items

112

59

321

230

Quarterly Results

- Results reflected favorable longevity and other

experience.

- Foreign currency exchange rates had a favorable effect of $5

million on pre-tax income and pre-tax adjusted operating

income.

Full Year Results

- Results reflected $34 million of favorable impacts from

assumption updates, which are reflected as notable items.

- Excluding notable items, results reflected favorable longevity

and other experience.

- Foreign currency exchange rates had a favorable effect of $5

million on pre-tax income and $6 million on pre-tax adjusted

operating income.

Asia Pacific

Traditional

Quarterly Results

Year-to-Date Results

($ in millions)

2023

2022

2023

2022

Net premiums

$

709

$

700

$

2,785

$

2,650

Pre-tax income

70

100

372

194

Pre-tax adjusted operating income

71

100

373

194

Pre-tax adjusted operating income,

excluding notable items

71

58

371

269

Net Premiums

- Foreign currency exchange rates had an adverse effect on net

premiums of $3 million for the quarter and $67 million for the full

year.

Quarterly Results

- Results reflected favorable underlying claims experience.

- Foreign currency exchange rates had an immaterial effect on

pre-tax income and a favorable effect of $1 million on pre-tax

adjusted operating income.

Full Year Results

- Results reflected $2 million of favorable impacts from

assumption updates, which are reflected as notable items.

- Excluding notable items, results reflected favorable claims

experience and strong new business.

- Foreign currency exchange rates had an adverse effect of $5

million on pre-tax income and pre-tax adjusted operating

income.

Financial Solutions

Quarterly Results

Year-to-Date Results

($ in millions)

2023

2022

2023

2022

Net premiums

$

47

$

64

$

218

$

236

Pre-tax income

122

109

113

46

Pre-tax adjusted operating income

66

38

212

161

Pre-tax adjusted operating income,

excluding notable items

66

38

212

161

Quarterly Results

- Results reflected higher investment spreads including variable

investment income and strong new business.

- Foreign currency exchange rates had an adverse effect of $6

million on pre-tax income and $2 million on pre-tax adjusted

operating income.

Full Year Results

- Results reflected higher investment spreads and strong new

business.

- Foreign currency exchange rates had an adverse effect of $5

million on pre-tax income and $9 million on pre-tax adjusted

operating income.

Corporate and Other

Quarterly Results

Year-to-Date Results

($ in millions)

2023

2022

2023

2022

Pre-tax income (loss)

$

(79

)

$

(52

)

$

(236

)

$

(225

)

Pre-tax adjusted operating income

(loss)

(23

)

(92

)

(128

)

(162

)

Pre-tax adjusted operating income (loss),

excluding notable items

(23

)

(92

)

(128

)

(162

)

Quarterly Results

- Results were favorable compared to the quarterly average run

rate, primarily due to higher investment income.

Full Year Results

- Results were favorable compared to the expected run rate,

primarily due to higher investment income.

Repurchase Authorization

On January 23, 2024, the board of directors authorized a share

repurchase program for up to $500 million of outstanding common

stock. The authorization was effective immediately and does not

have an expiration date. In connection with this authorization, the

board of directors terminated the stock repurchase authority

granted in 2022.

Repurchases would be made in accordance with applicable

securities laws and would be made through market transactions,

block trades, privately negotiated transactions or other means, or

a combination of these methods, with the timing and number of

shares repurchased dependent on a variety of factors, including

share price, corporate and regulatory requirements, and market and

business conditions. Repurchases may be commenced or suspended from

time to time without prior notice.

Dividend Declaration

Effective January 30, 2024, the board of directors declared a

regular quarterly dividend of $0.85, payable February 27, 2024, to

shareholders of record as of February 13, 2024.

Earnings Conference Call

A conference call to discuss fourth quarter results will begin

at 10 a.m. Eastern Time on Friday, February 2, 2024. Interested

parties may access the call by dialing 1-844-481-2753 (412-317-0669

international) and asking to be joined into the Reinsurance Group

of America, Incorporated (RGA) call. A live audio webcast of the

conference call will be available on the Company’s Investor

Relations website at www.rgare.com. A replay of the conference call

will be available at the same address for 90 days following the

conference call.

The Company has posted to its website an earnings presentation

and a Quarterly Financial Supplement that includes financial

information for all segments as well as information on its

investment portfolio. Additionally, the Company posts periodic

reports, press releases and other useful information on its

Investor Relations website.

Non-GAAP Financial Measures and Other Definitions

Reinsurance Group of America, Incorporated (the “Company”)

discloses certain financial measures that are not determined in

accordance with U.S. GAAP. The Company principally uses such

non-GAAP financial measures in evaluating performance because the

Company believes that such measures, when reviewed in conjunction

with relevant U.S. GAAP measures, present a clearer picture of our

operating performance and assist the Company in the allocation of

its resources. The Company believes that these non-GAAP financial

measures provide investors and other third parties with a better

understanding of the Company’s results of operations, financial

statements and the underlying profitability drivers and trends of

the Company’s businesses by excluding specified items which may not

be indicative of the Company’s ongoing operating performance and

may fluctuate significantly from period to period. These measures

should be considered supplementary to the Company’s financial

results that are presented in accordance with U.S. GAAP and should

not be viewed as a substitute for U.S. GAAP measures. Other

companies may use similarly titled non-GAAP financial measures that

are calculated differently from the way the Company calculates such

measures. Consequently, the Company’s non-GAAP financial measures

may not be comparable to similar measures used by other

companies.

The following non-GAAP financial measures are used in this

document or in other public disclosures made by the Company from

time to time:

- Adjusted operating income, on a pre-tax and after-tax basis,

and adjusted operating income per diluted share. The Company

uses these measures as a basis for analyzing financial results

because the Company believes that such measures better reflect the

ongoing profitability and underlying trends of the Company’s

continuing operations. Adjusted operating income is calculated as

net income available to the Company’s shareholders (or, in the case

of pre-tax adjusted operating income, income before income taxes)

excluding substantially all of the effect of net investment related

gains and losses, changes in the fair value of certain embedded

derivatives, and changes in the fair value of contracts that

provide market risk benefits, any of which can be volatile and may

not reflect the underlying performance of the Company’s businesses.

Additionally, adjusted operating income excludes, to the extent

applicable, any net gain or loss from discontinued operations, the

cumulative effect of any accounting changes, the impact of certain

tax-related items, and any other items that the Company believes

are not indicative of the Company’s ongoing operations. In

addition, adjusted operating income per diluted share is calculated

as adjusted operating income divided by weighted average diluted

shares outstanding. These measures also serve as a basis for

establishing target levels and awards under the Company’s

management incentive programs.

- Adjusted operating income (on a pre-tax and after-tax

basis), excluding notable items. Notable items are items the

Company believes may not be indicative of its ongoing operating

performance which are excluded from adjusted operating income to

provide investors and other third parties with a better

understanding of the Company’s results. Such items may be

unexpected, unknown when the Company prepares its business plan or

otherwise. Notable items presented may include the financial impact

of the Company’s assumption reviews on business subject to the

Financial Accounting Standards Board’s Accounting Standards Update

No. 2018-12, “Targeted Improvements to the Accounting for

Long-Duration Contracts” and related amendments, reflected in

future policy benefits remeasurement gains or losses.

- Adjusted operating revenue. This measure excludes the

effects of net realized capital gains and losses, and changes in

the fair value of certain embedded derivatives.

- Shareholders’ equity position excluding the impact of

accumulated other comprehensive income (loss) (“AOCI”),

shareholders’ average equity position excluding AOCI, and book

value per share excluding the impact of AOCI. The Company

believes that these measures provide useful information since such

measures exclude AOCI-related items that are not permanent and can

fluctuate significantly from period to period, and may not reflect

the impact of the underlying performance of the Company’s

businesses on shareholders’ equity and book value per share. AOCI

primarily relates to changes in interest rates, credit spreads on

its investment securities, future policy benefits discount rate

measurement gains (losses), market risk benefits

instrument-specific credit risk remeasurement gains (losses) and

foreign currency fluctuations. The Company also discloses a

non-GAAP financial measure called shareholders’ average equity

position excluding AOCI and notable items.

- Adjusted operating return on equity. This measure is

calculated as adjusted operating income divided by average

shareholders’ equity excluding AOCI. Adjusted operating return on

equity also serves as a basis for establishing target levels and

awards under the Company’s management incentive programs. The

Company also discloses a non-GAAP financial measure called adjusted

operating return on equity excluding notable items, which is

calculated as adjusted operating income excluding notable items

divided by average shareholders’ equity excluding notable items and

AOCI.

Reconciliations of the foregoing non-GAAP financial measures (to

the extent disclosed in this document) to the most comparable GAAP

financial measures are provided in the Appendix at the end of this

document.

Other definitions:

- Uncapped (profitable) cohorts: cohorts with a net premium ratio

under 100%

- Capped (loss) cohorts: cohorts with a net premium ratio equal

to or greater than 100%

- Floored cohorts: cohorts with reserves floored at zero as

reserves cannot be negative

About RGA

Reinsurance Group of America, Incorporated (NYSE: RGA) is a

global industry leader specializing in life and health reinsurance

and financial solutions that help clients effectively manage risk

and optimize capital. Founded in 1973, RGA is today one of the

world’s largest and most respected reinsurers and remains guided by

a powerful purpose: to make financial protection accessible to all.

As a global capabilities and solutions leader, RGA empowers

partners through bold innovation, relentless execution, and

dedicated client focus – all directed toward creating sustainable

long-term value. RGA has approximately $3.7 trillion of life

reinsurance in force and assets of $97.6 billion as of December 31,

2023. To learn more about RGA and its businesses, please visit

www.rgare.com or follow RGA on LinkedIn and Facebook. Investors can

learn more at investor.rgare.com.

Cautionary Note Regarding Forward-Looking Statements

This document contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 and

federal securities laws including, among others, statements

relating to projections of the future operations, strategies,

earnings, revenues, income or loss, ratios, financial performance

and growth potential of Reinsurance Group of America, Incorporated

(the “Company”). Forward-looking statements often contain words and

phrases such as “anticipate,” “assume,” “believe,” “continue,”

“could,” “estimate,” “expect,” “if,” “intend,” “likely,” “may,”

“plan,” “potential,” “pro forma,” “project,” “should,” “will,”

“would,” and other words and terms of similar meaning or that are

otherwise tied to future periods or future performance, in each

case in all derivative forms. Forward-looking statements are based

on management’s current expectations and beliefs concerning future

developments and their potential effects on the Company.

Forward-looking statements are not a guarantee of future

performance and are subject to risks and uncertainties, some of

which cannot be predicted or quantified. Future events and actual

results, performance, and achievements could differ materially from

those set forth in, contemplated by or underlying the

forward-looking statements.

Factors that could also cause results or events to differ,

possibly materially, from those expressed or implied by

forward-looking statements, include, among others: (1) adverse

changes in mortality (whether related to COVID-19 or otherwise),

morbidity, lapsation or claims experience, (2) inadequate risk

analysis and underwriting, (3) adverse capital and credit market

conditions and their impact on the Company’s liquidity, access to

capital and cost of capital, (4) changes in the Company’s financial

strength and credit ratings and the effect of such changes on the

Company’s future results of operations and financial condition, (5)

the availability and cost of collateral necessary for regulatory

reserves and capital, (6) requirements to post collateral or make

payments due to declines in the market value of assets subject to

the Company’s collateral arrangements, (7) action by regulators who

have authority over the Company’s reinsurance operations in the

jurisdictions in which it operates, (8) the effect of the Company

parent’s status as an insurance holding company and regulatory

restrictions on its ability to pay principal of and interest on its

debt obligations, (9) general economic conditions or a prolonged

economic downturn affecting the demand for insurance and

reinsurance in the Company’s current and planned markets, (10) the

impairment of other financial institutions and its effect on the

Company’s business, (11) fluctuations in U.S. or foreign currency

exchange rates, interest rates, or securities and real estate

markets, (12) market or economic conditions that adversely affect

the value of the Company’s investment securities or result in the

impairment of all or a portion of the value of certain of the

Company’s investment securities that in turn could affect

regulatory capital, (13) market or economic conditions that

adversely affect the Company’s ability to make timely sales of

investment securities, (14) risks inherent in the Company’s risk

management and investment strategy, including changes in investment

portfolio yields due to interest rate or credit quality changes,

(15) the fact that the determination of allowances and impairments

taken on the Company’s investments is highly subjective, (16) the

stability of and actions by governments and economies in the

markets in which the Company operates, including ongoing

uncertainties regarding the amount of U.S. sovereign debt and the

credit ratings thereof, (17) the Company’s dependence on third

parties, including those insurance companies and reinsurers to

which the Company cedes some reinsurance, third-party investment

managers and others, (18) financial performance of the Company’s

clients, (19) the threat of natural disasters, catastrophes,

terrorist attacks, pandemics, epidemics or other major public

health issues anywhere in the world where the Company or its

clients do business, (20) competitive factors and competitors’

responses to the Company’s initiatives, (21) development and

introduction of new products and distribution opportunities, (22)

execution of the Company’s entry into new markets, (23) integration

of acquired blocks of business and entities, (24) interruption or

failure of the Company’s telecommunication, information technology

or other operational systems, or the Company’s failure to maintain

adequate security to protect the confidentiality or privacy of

personal or sensitive data and intellectual property stored on such

systems, (25) adverse developments with respect to litigation,

arbitration or regulatory investigations or actions, (26) the

adequacy of reserves, resources and accurate information relating

to settlements, awards and terminated and discontinued lines of

business, (27) changes in laws, regulations, and accounting

standards applicable to the Company or its business, including

Long-Duration Targeted Improvement accounting changes and (28)

other risks and uncertainties described in this document and in the

Company’s other filings with the Securities and Exchange Commission

(“SEC”).

Forward-looking statements should be evaluated together with the

many risks and uncertainties that affect the Company’s business,

including those mentioned in this document and described in the

periodic reports the Company files with the SEC. These

forward-looking statements speak only as of the date on which they

are made. The Company does not undertake any obligation to update

these forward-looking statements, even though the Company’s

situation may change in the future, except as required under

applicable securities law. For a discussion of the risks and

uncertainties that could cause actual results to differ materially

from those contained in the forward-looking statements, you are

advised to see Item 1A – “Risk Factors” in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2022, as may be

supplemented by Item 1A - “Risk Factors” in the Company’s

subsequent Quarterly Reports on Form 10-Q and in our other periodic

and current reports filed with the SEC.

REINSURANCE GROUP OF AMERICA, INCORPORATED AND SUBSIDIARIES

Reconciliation of Consolidated

Net Income to Adjusted Operating Income

(Dollars in millions, except per

share data)

(Unaudited)

Three Months Ended December

31,

2023

2022

Diluted Earnings Per Share

Diluted Earnings Per Share

Net income (loss) available to RGA

shareholders

$

158

$

2.37

$

291

$

4.30

Reconciliation to adjusted operating

income:

Realized (gains) losses, derivatives and

other, included in investment related gains (losses), net

(14

)

(0.22

)

(14

)

(0.21

)

Market risk benefits remeasurement (gains)

losses

22

0.33

(15

)

(0.22

)

Realized (gains) losses on funds withheld,

included in investment income, net of related expenses

(2

)

(0.03

)

2

0.03

Embedded derivatives:

Included in investment related

gains/losses, net

143

2.14

53

0.78

Included in interest credited

4

0.06

1

0.01

Investment (income) loss on unit-linked

variable annuities

(2

)

(0.03

)

2

0.03

Interest credited on unit-linked variable

annuities

2

0.03

(2

)

(0.03

)

Interest expense on uncertain tax

positions

(1

)

(0.01

)

—

—

Other

23

0.34

1

0.01

Uncertain tax positions and other tax

related items

(19

)

(0.28

)

(9

)

(0.13

)

Net income attributable to noncontrolling

interest

2

0.03

2

0.03

Adjusted operating income

316

4.73

312

4.60

Notable items

—

—

(46

)

(0.69

)

Adjusted operating income, excluding

notable items

$

316

$

4.73

$

266

$

3.91

(Unaudited)

Twelve Months Ended December

31,

2023

2022

Diluted Earnings Per Share

Diluted Earnings Per Share

Net income available to RGA

shareholders

$

902

$

13.44

$

517

$

7.64

Reconciliation to adjusted operating

income:

Realized (gains) losses, derivatives and

other, included in investment related gains (losses), net

280

4.18

352

5.19

Market risk benefits remeasurement (gains)

losses

(8

)

(0.12

)

8

0.12

Realized (gains) losses on funds withheld,

included in investment income, net of related expenses

(4

)

(0.06

)

19

0.28

Embedded derivatives:

Included in investment related

gains/losses, net

129

1.92

137

2.02

Included in interest credited

(5

)

(0.07

)

(42

)

(0.62

)

Investment (income) loss on unit-linked

variable annuities

1

0.01

19

0.28

Interest credited on unit-linked variable

annuities

(1

)

(0.01

)

(19

)

(0.28

)

Interest expense on uncertain tax

positions

—

—

—

—

Other

29

0.43

(63

)

(0.93

)

Uncertain tax positions and other tax

related items

4

0.06

(5

)

(0.07

)

Net income attributable to noncontrolling

interest

7

0.10

4

0.06

Adjusted operating income

1,334

19.88

927

13.69

Notable items

—

—

184

2.71

Adjusted operating income, excluding

notable items

$

1,334

$

19.88

$

1,111

$

16.40

REINSURANCE GROUP OF AMERICA,

INCORPORATED AND SUBSIDIARIES

Reconciliation of Consolidated

Effective Income Tax Rates

(Dollars in millions)

(Unaudited)

Three Months Ended December 31,

2023

Twelve Months Ended December 31,

2023

Pre-tax Income (Loss)

Income Taxes

Effective Tax Rate (1)

Pre-tax Income (Loss)

Income Taxes

Effective Tax Rate (1)

GAAP income

$

164

$

4

2.2

%

$

1,160

$

251

21.8

%

Reconciliation to adjusted operating

income:

Realized and unrealized (gains) losses,

derivatives and other, included in investment related gains

(losses), net

(18

)

(4

)

360

80

Market risk benefits remeasurement (gains)

losses

28

6

(10

)

(2

)

Realized (gains) losses on funds withheld,

included in investment income, net of related expenses

(3

)

(1

)

(5

)

(1

)

Embedded derivatives:

Included in investment related

gains/losses, net

181

38

163

34

Included in interest credited

5

1

(6

)

(1

)

Investment (income) loss on unit-linked

variable annuities

(3

)

(1

)

1

—

Interest credited on unit-linked variable

annuities

3

1

(1

)

—

Interest expense on uncertain tax

positions

(1

)

—

—

—

Other

30

7

37

8

Uncertain tax positions and other tax

related items

—

19

—

(4

)

Adjusted operating income

386

70

18.2

%

1,699

365

21.5

%

Notable items

—

—

(3

)

(3

)

Adjusted operating income, excluding

notable items

$

386

$

70

$

1,696

$

362

(1)

The Company rounds amounts in the

financial statements to millions and calculates the effective tax

rate from the underlying whole-dollar amounts. Thus certain amounts

may not recalculate based on the numbers due to rounding.

REINSURANCE GROUP OF AMERICA,

INCORPORATED AND SUBSIDIARIES

Reconciliation of Consolidated

Income before Income Taxes to Pre-tax Adjusted Operating Income

(Dollars in millions)

(Unaudited)

Three Months Ended December

31,

2023

2022

Income (loss) before income taxes

$

164

$

381

Reconciliation to pre-tax adjusted

operating income:

Realized (gains) losses, derivatives and

other, included in investment related gains (losses), net

(18

)

(46

)

Market risk benefits remeasurement (gains)

losses

28

(19

)

Realized (gains) losses on funds withheld,

included in investment income, net of related expenses

(3

)

2

Embedded derivatives:

Included in investment related

gains/losses, net

181

67

Included in interest credited

5

1

Investment (income) loss on unit-linked

variable annuities

(3

)

2

Interest credited on unit-linked variable

annuities

3

(2

)

Interest expense on uncertain tax

positions

(1

)

—

Other

30

1

Pre-tax adjusted operating income

386

387

Notable items

—

(61

)

Pre-tax adjusted operating income,

excluding notable items

$

386

$

326

(Unaudited)

Twelve Months Ended December

31,

2023

2022

Income before income taxes

$

1,160

$

718

Reconciliation to pre-tax adjusted

operating income:

Realized (gains) losses, derivatives and

other, included in investment related gains (losses), net

360

425

Market risk benefits remeasurement (gains)

losses

(10

)

10

Realized (gains) losses on funds withheld,

included in investment income, net of related expenses

(5

)

24

Embedded derivatives:

Included in investment related

gains/losses, net

163

173

Included in interest credited

(6

)

(53

)

Investment (income) loss on unit-linked

variable annuities

1

24

Interest credited on unit-linked variable

annuities

(1

)

(24

)

Interest expense on uncertain tax

positions

—

—

Other

37

(80

)

Pre-tax adjusted operating income

1,699

1,217

Notable items

(3

)

242

Pre-tax adjusted operating income,

excluding notable items

$

1,696

$

1,459

REINSURANCE GROUP OF AMERICA,

INCORPORATED AND SUBSIDIARIES

Reconciliation of Pre-tax Income

to Pre-tax Adjusted Operating Income

(Dollars in millions)

(Unaudited)

Three Months Ended December 31,

2023

Pre-tax income (loss)

Realized

(gains) losses,

derivatives

and other, net

Change in

value of

embedded

derivatives, net

Pre-tax adjusted operating

income (loss)

Notable Items

Pre-tax adjusted

operating

income (loss) ex. notable

items

U.S. and Latin America:

Traditional

$

30

$

(1

)

$

(4

)

$

25

$

—

$

25

Financial Solutions:

Asset-Intensive

(140

)

31

190

81

—

81

Capital Solutions

20

—

—

20

—

20

Total U.S. and Latin America

(90

)

30

186

126

—

126

Canada Traditional

21

(1

)

—

20

—

20

Canada Financial Solutions

6

—

—

6

—

6

Total Canada

27

(1

)

—

26

—

26

EMEA Traditional

8

—

—

8

—

8

EMEA Financial Solutions

106

6

—

112

—

112

Total EMEA

114

6

—

120

—

120

APAC Traditional

70

1

—

71

—

71

APAC Financial Solutions

122

(56

)

—

66

—

66

Total Asia Pacific

192

(55

)

—

137

—

137

Corporate and Other

(79

)

56

—

(23

)

—

(23

)

Consolidated

$

164

$

36

$

186

$

386

$

—

$

386

(Unaudited)

Three Months Ended December 31,

2022

Pre-tax income (loss)

Realized

(gains) losses,

derivatives

and other, net

Change in

value of

embedded

derivatives, net

Pre-tax adjusted

operating

income (loss)

Notable Items

Pre-tax adjusted

operating

income (loss) ex. notable

items

U.S. and Latin America:

Traditional

$

114

$

1

$

(7

)

$

108

$

—

$

108

Financial Solutions:

Asset-Intensive

(32

)

34

75

77

—

77

Capital Solutions

24

—

—

24

—

24

Total U.S. and Latin America

106

35

68

209

—

209

Canada Traditional

50

(3

)

—

47

(5

)

42

Canada Financial Solutions

9

—

—

9

—

9

Total Canada

59

(3

)

—

56

(5

)

51

EMEA Traditional

3

—

—

3

—

3

EMEA Financial Solutions

56

17

—

73

(14

)

59

Total EMEA

59

17

—

76

(14

)

62

APAC Traditional

100

—

—

100

(42

)

58

APAC Financial Solutions

109

(71

)

—

38

—

38

Total Asia Pacific

209

(71

)

—

138

(42

)

96

Corporate and Other

(52

)

(40

)

—

(92

)

—

(92

)

Consolidated

$

381

$

(62

)

$

68

$

387

$

(61

)

$

326

REINSURANCE GROUP OF AMERICA,

INCORPORATED AND SUBSIDIARIES

Reconciliation of Pre-tax Income

to Pre-tax Adjusted Operating Income

(Dollars in millions)

(Unaudited)

Twelve Months Ended December 31,

2023

Pre-tax income (loss)

Realized

(gains) losses,

derivatives

and other, net

Change in

value of

embedded

derivatives, net

Pre-tax adjusted operating

income (loss)

Notable Items

Pre-tax adjusted

operating

income (loss) ex. notable

items

U.S. and Latin America:

Traditional

$

318

$

(1

)

$

(4

)

$

313

$

17

$

330

Financial Solutions:

Asset-Intensive

89

120

161

370

(22

)

348

Capital Solutions

81

—

—

81

—

81

Total U.S. and Latin America

488

119

157

764

(5

)

759

Canada Traditional

91

—

—

91

13

104

Canada Financial Solutions

52

—

—

52

(22

)

30

Total Canada

143

—

—

143

(9

)

134

EMEA Traditional

(21

)

1

—

(20

)

47

27

EMEA Financial Solutions

301

54

—

355

(34

)

321

Total EMEA

280

55

—

335

13

348

APAC Traditional

372

1

—

373

(2

)

371

APAC Financial Solutions

113

99

—

212

—

212

Total Asia Pacific

485

100

—

585

(2

)

583

Corporate and Other

(236

)

108

—

(128

)

—

(128

)

Consolidated

$

1,160

$

382

$

157

$

1,699

$

(3

)

$

1,696

(Unaudited)

Twelve Months Ended December 31,

2022

Pre-tax income (loss)

Realized

(gains) losses,

derivatives

and other, net

Change in

value of

embedded

derivatives, net

Pre-tax adjusted

operating

income (loss)

Notable Items

Pre-tax adjusted

operating

income (loss) ex. notable

items

U.S. and Latin America:

Traditional

$

195

$

—

$

(48

)

$

147

$

170

$

317

Financial Solutions:

Asset-Intensive

1

135

168

304

(3

)

301

Capital Solutions

144

—

—

144

—

144

Total U.S. and Latin America

340

135

120

595

167

762

Canada Traditional

104

4

—

108

1

109

Canada Financial Solutions

31

—

—

31

—

31

Total Canada

135

4

—

139

1

140

EMEA Traditional

46

—

—

46

13

59

EMEA Financial Solutions

182

62

—

244

(14

)

230

Total EMEA

228

62

—

290

(1

)

289

APAC Traditional

194

—

—

194

75

269

APAC Financial Solutions

46

115

—

161

—

161

Total Asia Pacific

240

115

—

355

75

430

Corporate and Other

(225

)

63

—

(162

)

—

(162

)

Consolidated

$

718

$

379

$

120

$

1,217

$

242

$

1,459

REINSURANCE GROUP OF AMERICA,

INCORPORATED AND SUBSIDIARIES

Per Share and Shares Data

(In thousands, except per share

data)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2022

2023

2022

Earnings per share from net income

(loss):

Basic earnings per share

$

2.40

$

4.36

$

13.60

$

7.73

Diluted earnings per share (1)

$

2.37

$

4.30

$

13.44

$

7.64

Diluted earnings per share from adjusted

operating income

$

4.73

$

4.60

$

19.88

$

13.69

Weighted average number of common and

common equivalent shares outstanding

66,721

67,793

67,117

67,703

(1)

As a result of anti-dilutive impact, in

periods of a loss, weighted average common shares outstanding

(basic) are used in the calculation of diluted earnings per

share.

(Unaudited)

At December 31,

2023

2022

Treasury shares

19,690

18,635

Common shares outstanding

65,621

66,676

Book value per share outstanding

$

138.39

$

106.19

Book value per share outstanding, before

impact of AOCI

$

144.01

$

134.26

Reconciliation of Book Value Per Share to Book

Value Per Share Excluding AOCI

(Unaudited)

At December 31,

2023

2022

Book value per share outstanding

$

138.39

$

106.19

Less effect of AOCI:

Accumulated currency translation

adjustment

1.04

(1.73

)

Unrealized (depreciation) appreciation of

securities

(55.88

)

(82.44

)

Effect of updating discount rates on

future policy benefits

49.62

56.32

Change in instrument-specific credit risk

for market risk benefits

0.05

0.19

Pension and postretirement benefits

(0.45

)

(0.41

)

Book value per share outstanding, before

impact of AOCI

$

144.01

$

134.26

Reconciliation of Shareholders'

Average Equity to Shareholders' Average Equity Excluding AOCI

(Dollars in millions)

(Unaudited)

Trailing Twelve Months Ended December 31,

2023:

Average Equity

Shareholders' average equity

$

7,931

Less effect of AOCI:

Accumulated currency translation

adjustment

(30

)

Unrealized (depreciation) appreciation of

securities

(5,018

)

Effect of updating discount rates on

future policy benefits

3,774

Change in instrument-specific credit risk

for market risk benefits

10

Pension and postretirement benefits

(22

)

Shareholders' average equity, excluding

AOCI

9,217

Year-to-date notable items, net of tax

37

Shareholders' average equity, excluding

AOCI and notable items

$

9,254

Reconciliation of Trailing Twelve

Months of Consolidated Net Income to Adjusted Operating Income

and Related Return on Equity

(Dollars in millions)

(Unaudited)

Return on Equity

Trailing Twelve Months Ended December 31,

2023:

Income

Net income available to RGA

shareholders

$

902

11.4

%

Reconciliation to adjusted operating

income:

Capital (gains) losses, derivatives and

other, net

297

Change in fair value of embedded

derivatives

124

Tax expense on uncertain tax positions and

other tax related items

4

Net income attributable to noncontrolling

interest

7

Adjusted operating income

1,334

14.5

%

Notable items after tax

—

Adjusted operating income, excluding

notable items

$

1,334

14.4

%

REINSURANCE GROUP OF AMERICA,

INCORPORATED AND SUBSIDIARIES

Condensed Consolidated Statements

of Income

(Dollars in millions)

(Unaudited)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2022

2023

2022

Revenues:

Net premiums

$

4,108

$

3,446

$

15,085

$

13,078

Investment income, net of related

expenses

956

828

3,591

3,161

Investment related gains (losses), net

(155

)

(6

)

(481

)

(539

)

Other revenue

98

89

372

527

Total revenues

5,007

4,357

18,567

16,227

Benefits and expenses:

Claims and other policy benefits

3,837

3,125

13,872

11,982

Future policy benefits remeasurement

(gains) losses

33

(11

)

(62

)

291

Market risk benefits remeasurement (gains)

losses

28

(19

)

(10

)

10

Interest credited

217

214

864

682

Policy acquisition costs and other

insurance expenses

369

323

1,397

1,344

Other operating expenses

290

289

1,089

1,009

Interest expense

69

55

257

191

Total benefits and expenses

4,843

3,976

17,407

15,509

Income before income taxes

164

381

1,160

718

Provision for income taxes

4

88

251

197

Net income

160

293

909

521

Net income attributable to noncontrolling

interest

2

2

7

4

Net income available to RGA

shareholders

$

158

$

291

$

902

$

517

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240131497689/en/

Jeff Hopson Senior Vice President - Investor Relations (636)

736-2068

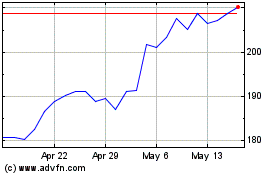

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Dec 2024 to Jan 2025

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Jan 2024 to Jan 2025