Current Report Filing (8-k)

September 10 2021 - 5:05AM

Edgar (US Regulatory)

0000716643FALSE00007166432021-09-092021-09-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 9, 2021

REGIS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minnesota

|

|

1-12725

|

|

41-0749934

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No)

|

3701 Wayzata Boulevard

Minneapolis, MN 55416

(Address of principal executive offices and zip code)

(952) 947-7777

(Registrant’s telephone number, including area code)

(Not applicable)

(Former name or former address, if changed from last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.05 per share

|

|

RGS

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Regis Corporation

Current Report on Form 8-K

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATION ARRANGEMENTS OF CERTAIN OFFICERS.

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATION ARRANGEMENTS OF CERTAIN OFFICERS.

On September 9, 2021, the Board of Directors of Regis Corporation (the "Company") appointed Ms. Lockie Andrews to the Board of Directors of the Company, effective September 10, 2021. Ms. Andrews was appointed to serve as a member of the Technology Committee of the Board of Directors. Ms. Andrews will stand for re-election by the Company’s shareholders at the 2021 annual meeting of shareholders. Ms. Andrews will receive the Company's standard director compensation, which is described under the heading "How Our Directors Are Paid" in the Company’s proxy statement for its 2020 annual meeting of shareholders. Following the 2021 annual meeting of shareholders, the number of directors constituting the Board of Directors will be eight, as Ms. Virginia Gambale is not standing for re-election when her term ends at the 2021 annual meeting.

Also on September 9, 2021, the Compensation Committee of the Company’s Board of Directors amended and restated the Company’s Stock Purchase and Matching Program, including the exhibits and attachments thereto (the "SPMP"). The SPMP is the compensation program the Company first adopted in fiscal 2019 that allows the Company’s executive officers and other eligible employee participants to contribute up to one-half of their earned annual bonus, net of normalized tax withholding, to purchase shares of the Company’s common stock and receive a matching restricted stock unit grant. In addition to extending participation in the SPMP to a broader group of non-executive employees, the amendments, effective for earned annual bonuses for the fiscal year ended June 30, 2021, (i) change the vesting period of the matching RSUs from a five-year cliff vesting condition to three annual vesting installments equal to 20%, 20% and 60% of the RSUs on each of the first, second and third anniversaries of the date of grant, (ii) provide that any pro-rated accelerated vesting in the event of a qualifying termination under the matching RSU shall apply to the RSUs scheduled to vest on the next scheduled vesting date and shall be calculated based on (A) the number of days the participant was employed as a percentage of (B) the total number of days, in each case between the most recently completed and the next scheduled vesting date, and (iii) provide for forfeiture of unvested matching RSUs in the event of the sale of the corresponding shares purchased under the SPMP based on a schedule aligned to the revised vesting schedule of the matching RSUs.

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REGIS CORPORATION

|

|

|

|

|

|

|

|

|

|

Dated: September 9, 2021

|

|

By:

|

/s/ Amanda P. Rusin

|

|

|

|

|

Amanda P. Rusin

|

|

|

|

|

Executive Vice President, General Counsel and Corporate Secretary

|

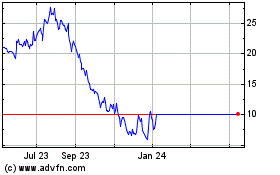

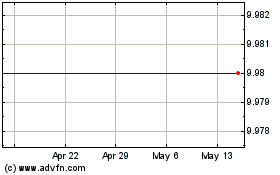

Regis (NYSE:RGS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Regis (NYSE:RGS)

Historical Stock Chart

From Jul 2023 to Jul 2024