Fourth Quarter RevPAR increased 2.2% and

Total Revenues increased 3.2%

Fourth Quarter Adjusted EBITDA increased

2.4%

Repurchased 2.3 million shares of common

stock for $22.0 million in 2024

RLJ Lodging Trust (the “Company”) (NYSE: RLJ) today reported

results for the three months and year ended December 31, 2024.

Fourth Quarter

Highlights

- Portfolio Comparable RevPAR of $137.53, an increase of 2.2%

over the prior year

- Total Revenues of $330.0 million, an increase of 3.2% over the

prior year

- Net loss attributable to common shareholders of $0.9

million

- Net loss per diluted share attributable to common shareholders

of $0.01

- Adjusted EBITDA of $81.1 million, an increase of 2.4% over the

prior year

- Adjusted FFO per diluted common share and unit of $0.33

- Repurchased 0.3 million common shares for $3.0 million at an

average price per share of $9.16

- Ended year with $0.9 billion of liquidity, including

approximately $409.8 million of unrestricted cash and $500.0

million in undrawn revolver capacity

Full Year Highlights

- Portfolio Comparable RevPAR of $144.72, an increase of 2.0%

over the prior year

- Total Revenues of $1.4 billion, an increase of 3.3% over the

prior year

- Net income attributable to common shareholders of $42.9

million

- Net income per diluted share attributable to common

shareholders of $0.27

- Adjusted EBITDA of $361.6 million

- Adjusted FFO per diluted common share and unit of $1.57

- Repurchased 2.3 million common shares for $22.0 million at an

average price per share of $9.39

"We were pleased with our fourth quarter results, which once

again achieved top quartile RevPAR growth, reflecting the positive

momentum in our urban-centric portfolio. The quarter was driven by

growth in all segments of demand and the continuing strong ramp

from our conversions," commented Leslie D. Hale, President and

Chief Executive Officer. "Throughout the year, our team also

successfully executed several strategic objectives, including

advancing our multiyear conversion pipeline, executing two

high-quality acquisitions, strengthening our balance sheet, and

returning capital to shareholders through accretive share

repurchases and increasing our well-covered dividend. Successful

execution of these initiatives has positioned RLJ to build on our

momentum in 2025 against a backdrop of continued demand growth, a

favorable market footprint, and potentially a more business

friendly environment. All of these should allow RLJ to continue

unlocking embedded value while enhancing shareholder returns.”

The prefix “comparable” as defined by the Company, denotes

operating results which include results for periods prior to its

ownership and excludes sold hotels. Explanations of EBITDA,

EBITDAre, Adjusted EBITDA, Hotel EBITDA, Hotel EBITDA Margin, FFO,

and Adjusted FFO, as well as reconciliations of those measures to

net income or loss, if applicable, are included within this

release.

Financial and

Operating Highlights

($ in millions, except ADR, RevPAR, and

per share amounts)

(unaudited)

For the three months

ended

December 31,

For the year ended

December 31,

2024

2023

Change

2024

2023

Change

Operational Overview: (1)

Comparable ADR

$198.71

$193.96

2.4%

$199.38

$197.68

0.9%

Comparable Occupancy

69.2%

69.4%

(0.3)%

72.6%

71.8%

1.1%

Comparable RevPAR

$137.53

$134.57

2.2%

$144.72

$141.93

2.0%

Financial Overview:

Total Revenues

$330.0

$319.7

3.2%

$1,369.4

$1,325.6

3.3%

Comparable Hotel Revenue

$330.0

$320.4

3.0%

$1,369.3

$1,327.8

3.1%

Net (loss) income attributable to common

shareholders

($0.9)

$1.7

(152.9)%

$42.9

$51.3

(16.4)%

Comparable Hotel EBITDA

$90.4

$89.9

0.6%

$398.0

$402.1

(1.0)%

Comparable Hotel EBITDA Margin

27.4%

28.1%

(67) bps

29.1%

30.3%

(122) bps

Adjusted EBITDA

$81.1

$79.2

2.4%

$361.6

$364.5

(0.8)%

Adjusted FFO

$50.2

$53.4

(6.0)%

$241.8

$260.4

(7.1)%

Adjusted FFO Per Diluted Common Share and

Unit - Diluted

$0.33

$0.34

(2.9)%

$1.57

$1.66

(5.4)%

Note:

(1) Comparable statistics reflect the

Company's 95 hotel portfolio owned as of December 31, 2024.

Acquisitions

During 2024, the Company acquired the 110-room Hotel Teatro in

Denver for $35.5 million and the fee simple interest in the land

underlying the 304-room Wyndham Boston Beacon Hill for $125.0

million, which was previously subject to a ground lease that was

set to expire in 2028. The Company funded both acquisitions with

cash on hand.

Dispositions

During 2024, the Company sold two non-core properties,

generating a combined $20.8 million of gross proceeds.

Conversions

During 2024, the Company completed the physical conversions of

the Wyndham Houston Medical Center to a DoubleTree by Hilton and

the Hotel Indigo in New Orleans to the Hotel Tonnelle, a Marriott

Tribute Hotel. Additionally, the Company completed the conversion

of the Wyndham Pittsburgh University Center to a Courtyard by

Marriott during the fourth quarter.

Share Repurchases

During 2024, the Company repurchased 2.3 million shares for

$22.0 million, at an average price per share of $9.39, which

included approximately 0.3 million common shares repurchased for

$3.0 million at an average price per share of $9.16 during the

fourth quarter. Additionally, year-to-date the Company has

purchased an additional 1.2 million shares for $12.0 million at an

average price per share of $9.77. The Company's share buyback

program currently has approximately $217.3 million of remaining

capacity.

Balance Sheet

As of December 31, 2024, the Company had over $900 million of

total liquidity, comprising approximately $409.8 million of

unrestricted cash and $500.0 million available under its revolving

credit facility ("Revolver"), and $2.2 billion of debt

outstanding.

Dividends

The Company’s Board of Trustees declared a quarterly cash

dividend of $0.15 per common share of beneficial interest of the

Company in the fourth quarter. The dividend was paid on January 15,

2025 to shareholders of record as of December 31, 2024.

The Company's Board of Trustees declared a quarterly cash

dividend of $0.4875 on the Company’s Series A Preferred Shares in

the fourth quarter. The dividend was paid on January 31, 2025 to

shareholders of record as of December 31, 2024.

2025 Outlook

($ in millions, except growth and per share amounts)

The Company is providing its annual outlook for all hotels owned

as of February 25, 2025.

FY 2025

Comparable RevPAR Growth

1.0% to 3.0%

Comparable Hotel EBITDA

$378.0M to $408.0M

Adjusted EBITDA

$345.0M to $375.0M

Adjusted FFO per diluted share

$1.46 to $1.66

Additionally, the Company's full year 2025 outlook includes:

- Net interest expense of $94.0 million to $96.0 million

- Cash corporate G&A in the range of $34.0 million to $35.0

million

- Capital expenditures related to renovations in the range of

$80.0 million to $100.0 million

- Diluted weighted average common shares and units of 152.5

million

Potential future acquisitions, dispositions, financings, or

share repurchases are not incorporated into the Company's outlook

above and could result in a material change to the Company's

outlook.

Earnings Call

The Company will conduct its quarterly analyst and investor

conference call on February 26, 2025 at 10:00 a.m. (Eastern Time).

The conference call can be accessed by dialing (877) 407-3982 or

(201) 493-6780 for international participants and requesting RLJ

Lodging Trust’s fourth quarter earnings conference call.

Additionally, a live webcast of the conference call will be

available through the Company’s website at

http://www.rljlodgingtrust.com. A replay of the conference call

webcast will be archived and available through the Investor

Relations section of the Company’s website for two weeks.

Supplemental Information

Please refer to the schedule of supplemental information for

additional detail and Comparable operating statistics, which will

be posted to the Investor Relations section of the Company's

website.

About Us

RLJ Lodging Trust ("RLJ") is a self-advised, publicly traded

real estate investment trust that owns 95 premium-branded,

rooms-oriented, high-margin, urban-centric hotels located within

the heart of demand locations. Our hotels are geographically

diverse and concentrated in major urban markets that provide

multiple demand generators from business, leisure, and other

travelers.

Forward-Looking

Statements

This information contains certain statements, other than purely

historical information, including estimates, projections,

statements relating to the Company’s business plans, objectives and

expected operating results, and the assumptions upon which those

statements are based, that are “forward looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements generally are identified by the

use of the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “plan,” “may,” “will,” “will continue,” “intend,”

“should,” “may,” or similar expressions. Although the Company

believes that the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, beliefs and

expectations, such forward-looking statements are not predictions

of future events or guarantees of future performance and our actual

results could differ materially from those set forth in the

forward-looking statements. Except as required by law, the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise. The Company cautions investors not to

place undue reliance on these forward-looking statements and urges

investors to carefully review the disclosures the Company makes

concerning risks and uncertainties in the sections entitled “Risk

Factors,” “Forward- Looking Statements,” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2024, which will be filed on February 26,

2025, as well as risks, uncertainties and other factors discussed

in other documents filed by the Company with the Securities and

Exchange Commission.

For additional information or to receive press

releases via email, please visit our website:

http://www.rljlodgingtrust.com

RLJ Lodging Trust Non-GAAP and

Accounting Commentary

Non-Generally Accepted Accounting

Principles (“Non-GAAP”) Financial Measures

The Company considers the following non-GAAP financial measures

useful to investors as key supplemental measures of its

performance: (1) FFO, (2) Adjusted FFO, (3) EBITDA, (4) EBITDAre,

(5) Adjusted EBITDA, (6) Hotel EBITDA, and (7) Hotel EBITDA Margin.

These Non-GAAP financial measures should be considered along with,

but not as alternatives to, net income or loss as a measure of its

operating performance. FFO, Adjusted FFO, EBITDA, EBITDAre,

Adjusted EBITDA, Hotel EBITDA, and Hotel EBITDA Margin, as

calculated by the Company, may not be comparable to other companies

that do not define such terms exactly as the Company defines such

terms.

Funds From Operations

(“FFO”)

The Company calculates Funds from Operations (“FFO”) in

accordance with standards established by the National Association

of Real Estate Investment Trusts, or NAREIT, which defines FFO as

net income or loss (calculated in accordance with GAAP), excluding

gains or losses from sales of real estate, impairment, the

cumulative effect of changes in accounting principles, plus

depreciation and amortization, and adjustments for unconsolidated

partnerships and joint ventures. Historical cost accounting for

real estate assets implicitly assumes that the value of real estate

assets diminishes predictably over time. Since real estate values

have instead historically risen or fallen with market conditions,

most real estate industry investors consider FFO to be helpful in

evaluating a real estate company’s operations. The Company believes

that the presentation of FFO provides useful information to

investors regarding the Company’s operating performance and can

facilitate comparisons of operating performance between periods and

between real estate investment trusts (“REITs”), even though FFO

does not represent an amount that accrues directly to common

shareholders.

The Company’s calculation of FFO may not be comparable to

measures calculated by other companies who do not use the NAREIT

definition of FFO or do not calculate FFO per diluted share in

accordance with NAREIT guidance. Additionally, FFO may not be

helpful when comparing the Company to non-REITs. The Company

presents FFO attributable to common shareholders, which includes

unitholders of limited partnership interest (“OP units”) in RLJ

Lodging Trust, L.P., the Company’s operating partnership, because

the OP units may be redeemed for common shares of the Company. The

Company believes it is meaningful for the investor to understand

FFO attributable to all common shares and OP units.

EBITDA and EBITDAre

Earnings Before Interest, Taxes, Depreciation, and Amortization

(“EBITDA”) is defined as net income or loss excluding: (1) interest

expense; (2) provision for income taxes, including income taxes

applicable to sales of assets; and (3) depreciation and

amortization expense. The Company considers EBITDA useful to an

investor in evaluating and facilitating comparisons of its

operating performance between periods and between REITs by removing

the impact of its capital structure (primarily interest expense)

and asset base (primarily depreciation and amortization expense)

from its operating results. In addition, EBITDA is used as one

measure in determining the value of hotel acquisitions and

dispositions.

In addition to EBITDA, the Company presents EBITDAre in

accordance with NAREIT guidelines, which defines EBITDAre as net

income or loss (calculated in accordance with GAAP) excluding

interest expense, income tax benefit or expense, depreciation and

amortization expense, gains or losses from sales of real estate,

impairment, and adjustments for unconsolidated joint ventures. The

Company believes that the presentation of EBITDAre provides useful

information to investors regarding the Company's operating

performance and can facilitate comparisons of operating performance

between periods and between REITs.

Adjustments to FFO and

EBITDA

The Company adjusts FFO, EBITDA, and EBITDAre for certain items

that the Company considers outside the normal course of operations.

The Company believes that Adjusted FFO, Adjusted EBITDA, and

Adjusted EBITDAre provide useful supplemental information to

investors regarding its ongoing operating performance that, when

considered with net income or loss, FFO, EBITDA, and EBITDAre, are

beneficial to an investor’s understanding of the Company's

operating performance. The Company adjusts FFO, EBITDA, and

EBITDAre for the following items:

- Transaction Costs: The Company excludes transaction costs

expensed during the period

- Pre-Opening Costs: The Company excludes certain costs related

to pre-opening of hotels

- Non-Cash Expenses: The Company excludes the effect of certain

non-cash items such as the amortization of share-based

compensation, non-cash income tax expense or benefit, and non-cash

interest expense related to discontinued interest rate hedges

- Other Non-Operational Expenses: The Company excludes the effect

of certain non-operational expenses representing income and

expenses outside the normal course of operations

Hotel EBITDA and Hotel EBITDA

Margin

With respect to Consolidated Hotel EBITDA, the Company believes

that excluding the effect of corporate-level expenses and certain

non-cash items provides a more complete understanding of the

operating results over which individual hotels and operators have

direct control. The Company believes property-level results provide

investors with supplemental information about the ongoing

operational performance of the Company’s hotels and the

effectiveness of third-party management companies.

Comparable Hotel EBITDA and Comparable Hotel EBITDA margin

include prior ownership information provided by the sellers of the

hotels for periods prior to our acquisition of the hotels and

excludes results from sold hotels as applicable. The following is a

summary of Comparable hotel adjustments:

Comparable adjustments: Acquired

hotel

For the three and twelve months ended December 31, 2024,

Comparable adjustments included the following acquired hotel:

- Hotel Teatro acquired in June 2024

Comparable adjustments: Sold

hotels

For the three and twelve months ended December 31, 2024,

Comparable adjustments included the following sold hotels:

- Residence Inn Merrillville sold in May 2024

- Fairfield Inn & Suites Denver Cherry Creek sold in

September 2024

RLJ Lodging Trust

Consolidated Balance

Sheets

(Amounts in thousands, except

share and per share data)

(unaudited)

December 31,

2024

December 31, 2023

Assets

Investment in hotel properties, net

$

4,250,524

$

4,136,216

Investment in unconsolidated joint

ventures

7,457

7,398

Cash and cash equivalents

409,809

516,675

Restricted cash reserves

23,516

38,652

Hotel and other receivables, net of

allowance of $169 and $265, respectively

25,494

26,163

Lease right-of-use assets

128,111

136,140

Prepaid expense and other assets

38,968

58,051

Total assets

$

4,883,879

$

4,919,295

Liabilities and Equity

Debt, net

$

2,220,081

$

2,220,778

Accounts payable and other liabilities

154,643

147,819

Advance deposits and deferred revenue

40,242

32,281

Lease liabilities

119,102

122,588

Accrued interest

20,900

22,539

Distributions payable

30,634

22,500

Total liabilities

2,585,602

2,568,505

Equity

Shareholders’ equity:

Preferred shares of beneficial interest,

$0.01 par value, 50,000,000 shares authorized

Series A Cumulative Convertible Preferred

Shares, $0.01 par value, 12,950,000 shares authorized; 12,879,475

shares issued and outstanding, liquidation value of $328,266, at

December 31, 2024 and 2023

366,936

366,936

Common shares of beneficial interest,

$0.01 par value, 450,000,000 shares authorized; 153,295,577 and

155,297,829 shares issued and outstanding at December 31, 2024 and

2023, respectively

1,533

1,553

Additional paid-in capital

2,992,487

3,000,894

Accumulated other comprehensive income

13,788

22,662

Distributions in excess of net

earnings

(1,090,186

)

(1,055,183

)

Total shareholders’ equity

2,284,558

2,336,862

Noncontrolling interest:

Noncontrolling interest in consolidated

joint ventures

7,589

7,634

Noncontrolling interest in the Operating

Partnership

6,130

6,294

Total noncontrolling interest

13,719

13,928

Total equity

2,298,277

2,350,790

Total liabilities and equity

$

4,883,879

$

4,919,295

Note:

The corresponding notes to the

consolidated financial statements can be found in the Company’s

Annual Report on Form 10-K.

RLJ Lodging Trust

Consolidated Statements of

Operations

(Amounts in thousands, except

share and per share data)

(unaudited)

For the three months ended

December 31,

For the year ended December

31,

2024

2023

2024

2023

Revenues

Operating revenues

Room revenue

$

267,690

$

261,612

$

1,121,586

$

1,095,028

Food and beverage revenue

39,593

36,024

153,108

141,625

Other revenue

22,706

22,072

94,746

88,924

Total revenues

329,989

319,708

1,369,440

1,325,577

Expenses

Operating expenses

Room expense

70,682

69,396

288,567

277,058

Food and beverage expense

29,487

28,103

117,766

109,707

Management and franchise fee expense

25,195

24,863

107,978

107,417

Other operating expenses

90,680

85,918

363,631

340,485

Total property operating expenses

216,044

208,280

877,942

834,667

Depreciation and amortization

45,386

44,455

179,431

179,103

Property tax, insurance and other

26,300

23,961

107,043

100,229

General and administrative

12,978

15,968

54,804

58,998

Transaction costs

21

197

320

223

Total operating expenses

300,729

292,861

1,219,540

1,173,220

Other income, net

673

858

5,342

4,364

Interest income

4,123

5,766

17,314

19,743

Interest expense

(28,208

)

(25,301

)

(111,358

)

(98,807

)

(Loss) gain on sale of hotel properties,

net

(39

)

(6

)

8,262

(34

)

Loss on extinguishment of indebtedness,

net

—

—

(129

)

(169

)

Income before equity in income from

unconsolidated joint ventures

5,809

8,164

69,331

77,454

Equity in income from unconsolidated joint

ventures

220

104

459

419

Income before income tax expense

6,029

8,268

69,790

77,873

Income tax expense

(518

)

(228

)

(1,599

)

(1,256

)

Net income

5,511

8,040

68,191

76,617

Net (loss) income attributable to

noncontrolling interests:

Noncontrolling interest in consolidated

joint ventures

(136

)

(96

)

45

35

Noncontrolling interest in the Operating

Partnership

1

(9

)

(215

)

(247

)

Net income attributable to RLJ

5,376

7,935

68,021

76,405

Preferred dividends

(6,279

)

(6,279

)

(25,115

)

(25,115

)

Net (loss) income attributable to common

shareholders

$

(903

)

$

1,656

$

42,906

$

51,290

Basic per common share data:

Net (loss) income per share attributable

to common shareholders

$

(0.01

)

$

0.01

$

0.27

$

0.32

Weighted-average number of common

shares

151,751,999

153,326,317

152,856,036

155,928,663

Diluted per common share data:

Net (loss) income per share attributable

to common shareholders

$

(0.01

)

$

0.01

$

0.27

$

0.32

Weighted-average number of common

shares

151,751,999

154,406,530

153,475,921

156,556,414

Note:

The Statements of Comprehensive Income and

corresponding notes to the consolidated financial statements can be

found in the Company’s Annual Report on Form 10-K.

RLJ Lodging Trust

Reconciliation of Non-GAAP

Measures

(Amounts in thousands, except

per share data)

(unaudited)

Funds From Operations (FFO)

Attributable to Common Shareholders and Unitholders

For the three months ended

December 31,

For the year ended December

31,

2024

2023

2024

2023

Net income

$

5,511

$

8,040

$

68,191

$

76,617

Preferred dividends

(6,279

)

(6,279

)

(25,115

)

(25,115

)

Depreciation and amortization

45,386

44,455

179,431

179,103

Loss (gain) on sale of hotel properties,

net

39

6

(8,262

)

34

Noncontrolling interest in consolidated

joint ventures

(136

)

(96

)

45

35

Adjustments related to consolidated joint

venture (1)

(48

)

(45

)

(187

)

(175

)

Adjustments related to unconsolidated

joint venture (2)

227

232

912

941

FFO

44,700

46,313

215,015

231,440

Transaction costs

21

197

320

223

Pre-opening costs (3)

247

163

1,335

1,351

Loss on extinguishment of indebtedness,

net

—

—

129

169

Amortization of share-based

compensation

4,544

6,258

20,804

24,285

Non-cash income tax expense (benefit)

10

(5

)

10

(5

)

Non-cash interest expense related to

discontinued interest rate hedges

305

482

1,592

1,929

Other expenses (income) (4)

385

(30

)

2,641

996

Adjusted FFO

$

50,212

$

53,378

$

241,846

$

260,388

Adjusted FFO per common share and

unit-basic

$

0.33

$

0.35

$

1.57

$

1.66

Adjusted FFO per common share and

unit-diluted

$

0.33

$

0.34

$

1.57

$

1.66

Basic weighted-average common shares and

units outstanding (5)

152,524

154,098

153,628

156,700

Diluted weighted-average common shares and

units outstanding (5)

153,042

155,178

154,248

157,328

Note:

(1) Includes depreciation and amortization

expense allocated to the noncontrolling interest in the

consolidated joint venture.

(2) Includes our ownership interest in the

depreciation and amortization expense of the unconsolidated joint

venture.

(3) Represents expenses related to the

brand conversions of certain hotel properties prior to opening.

(4) Represents expenses and income outside

of the normal course of operations.

(5) Includes 0.8 million weighted-average

operating partnership units for the three months and year ended

December 31, 2024 and 2023.

RLJ Lodging Trust

Reconciliation of Non-GAAP

Measures

(Amounts in thousands)

(unaudited)

Earnings Before Interest, Taxes,

Depreciation, and Amortization (EBITDA)

For the three months ended

December 31,

For the year ended December

31,

2024

2023

2024

2023

Net income

$

5,511

$

8,040

$

68,191

$

76,617

Depreciation and amortization

45,386

44,455

179,431

179,103

Interest expense, net of interest

income

24,085

19,535

94,044

79,064

Income tax expense

518

228

1,599

1,256

Adjustments related to unconsolidated

joint venture (1)

392

340

1,390

1,374

EBITDA

75,892

72,598

344,655

337,414

Loss (gain) on sale of hotel properties,

net

39

6

(8,262

)

34

EBITDAre

75,931

72,604

336,393

337,448

Transaction costs

21

197

320

223

Pre-opening costs (2)

247

163

1,335

1,351

Loss on extinguishment of indebtedness,

net

—

—

129

169

Amortization of share-based

compensation

4,544

6,258

20,804

24,285

Other expenses (income) (3)

385

(30

)

2,641

996

Adjusted EBITDA

81,128

79,192

361,622

364,472

General and administrative

8,434

9,710

34,000

34,713

Other corporate adjustments

848

1,022

3,133

3,031

Consolidated Hotel EBITDA

90,410

89,924

398,755

402,216

Comparable adjustments - income from sold

hotels

(47

)

(454

)

(1,279

)

(2,626

)

Comparable adjustments - income from

acquired hotel

—

407

525

2,551

Comparable Hotel EBITDA

$

90,363

$

89,877

$

398,001

$

402,141

Notes: Comparable statistics

reflect the Company's 95 hotel portfolio owned as of December 31,

2024.

(1) Includes our ownership interest in the

interest, depreciation, and amortization expense of the

unconsolidated joint venture.

(2) Represents expenses related to the

brand conversions of certain hotel properties prior to opening.

(3) Represents expenses and income outside

of the normal course of operations.

RLJ Lodging Trust

Reconciliation of Non-GAAP

Measures

(Amounts in thousands except

margin data)

(unaudited)

Comparable Hotel EBITDA Margin

For the three months ended

December 31,

For the year ended December

31,

2024

2023

2024

2023

Total revenue

$

329,989

$

319,708

$

1,369,440

$

1,325,577

Comparable adjustments - revenue from sold

hotels

—

(1,462

)

(3,879

)

(7,013

)

Comparable adjustments - revenue from

prior ownership of acquired hotels

—

2,151

3,834

9,318

Other corporate adjustments / non-hotel

revenue

(24

)

(18

)

(76

)

(70

)

Comparable Hotel Revenue

$

329,965

$

320,379

$

1,369,319

$

1,327,812

Comparable Hotel EBITDA

$

90,363

$

89,877

$

398,001

$

402,141

Comparable Hotel EBITDA Margin

27.4

%

28.1

%

29.1

%

30.3

%

RLJ Lodging Trust

Reconciliation of Non-GAAP

Measures - Full-Year Outlook

(Amounts in millions)

(unaudited)

Earnings Before Interest, Taxes,

Depreciation and Amortization (EBITDA)

For the year ended December

31, 2025

Low End

High End

Net income

$

50.0

$

78.0

Depreciation and amortization

180.0

180.0

Interest expense, net of interest

income

94.0

96.0

Income tax expense

1.6

1.6

Adjustments related to joint ventures

1.4

1.4

EBITDA/EBITDAre

327.0

357.0

Amortization of share-based

compensation

18.0

18.0

Adjusted EBITDA

345.0

375.0

General and administrative

34.0

35.0

Other corporate adjustments

(1.0

)

(2.0

)

Consolidated Hotel EBITDA/Comparable

Hotel EBITDA

$

378.0

$

408.0

Funds from Operations (FFO)

Attributable to Common Shareholders and Unitholders

For the year ended December

31, 2025

Low End

High End

Net income

$

50.0

$

78.0

Preferred dividends

(25.0

)

(25.0

)

Depreciation and amortization

180.0

180.0

Adjustments related to joint ventures

1.0

1.0

FFO

206.0

234.0

Amortization of share-based

compensation

18.0

18.0

All other items, net

(1.5

)

0.5

Adjusted FFO

$

222.5

$

252.5

Adjusted FFO per common share and

unit-diluted

$

1.46

$

1.66

Diluted weighted-average common shares and

units outstanding

152.5

152.5

RLJ Lodging Trust

Consolidated Debt

Summary

(Amounts in thousands except

interest rate data)

(unaudited)

Loan

Base Term (Years)

Maturity (incl.

extensions)

Floating / Fixed (1)

Interest Rate (2)

Balance as of December 31,

2024 (3)

Mortgage Debt

Mortgage loan - 1 hotel

10

Jan 2029

Fixed

5.06%

$

25,000

Mortgage loan - 3 hotels

5

Apr 2026

Floating

4.49%

96,000

Mortgage loan - 4 hotels

5

Apr 2026

Floating

4.93%

85,000

Weighted Average / Mortgage

Total

4.74%

$

206,000

Corporate Debt

Revolver (4)

4

May 2028

Floating

6.08%

$

100,000

$225 Million Term Loan Maturing 2026

3

May 2028

Floating

5.33%

225,000

$200 Million Term Loan Maturing 2026

3

January 2028

Floating

6.03%

200,000

$500 Million Term Loan Maturing 2027

3

September 2029

Floating

4.69%

500,000

$500 Million Senior Notes due 2026

5

July 2026

Fixed

3.75%

500,000

$500 Million Senior Notes due 2029

8

September 2029

Fixed

4.00%

500,000

Weighted Average / Corporate

Total

4.56%

$

2,025,000

Weighted-Average / Gross Debt

4.58%

$

2,231,000

Notes:

(1) The floating interest rate is hedged,

or partially hedged, with an interest rate swap.

(2) Interest rates as of December 31,

2024, inclusive of the impact of interest rate hedges.

(3) Excludes the impact of fair value

adjustments and deferred financing costs.

(4) As of December 31, 2024, there was

$500.0 million of borrowing capacity on the Revolver, which is

charged an unused commitment fee of 0.25% annually.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225541186/en/

Sean M. Mahoney, Executive Vice President and Chief Financial

Officer – (301) 280-7774

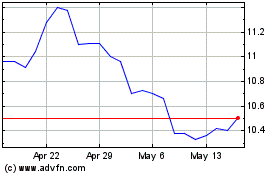

RLJ Lodging (NYSE:RLJ)

Historical Stock Chart

From Jan 2025 to Feb 2025

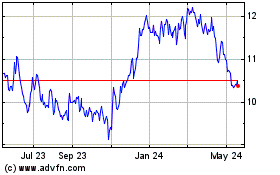

RLJ Lodging (NYSE:RLJ)

Historical Stock Chart

From Feb 2024 to Feb 2025