SAP to Take Extra Costs From Russian Pullback as 1Q Profit Fell -- Update

April 22 2022 - 2:19AM

Dow Jones News

By Ed Frankl

SAP SE said Friday that it would take further costs from its

pullback from Russia after first-quarter profit fell, though kept

its full-year outlook after cloud-revenue growth accelerated.

Reporting on a non-IFRS basis, the German cloud-computing

company's quarterly operating profit was 1.68 billion euros ($1.82

billion), down from EUR1.74 billion last year, which it blamed on

expenses related to the war, as well as accelerated investments

into research & development and sales & marketing.

At the beginning of March, SAP stopped all new sales in Russia

and Belarus, adding earlier this week that it would stop support

and maintenance of its on-premise products in Russia.

SAP's net profit in the three months was also down, to EUR1.18

billion from EUR1.65 billion in the same period last year, though

revenue grew 7% in constant currencies to EUR7.08 billion. Its

cloud-business revenue grew 25% to EUR2.82 billion.

Current cloud backlog, a measure of the growth momentum of its

cloud business, was EUR9.73 billion in the quarter, up 23% at

constant currencies, but SAP's decision to curtail some operations

in Russia reduced backlog growth by 0.8 percentage points, the

company said.

SAP took a EUR60 million hit on its current cloud backlog by the

termination of existing cloud engagements in Russia, and operating

profit was hit by about EUR70 million due to reduced on-premise

revenues, accelerated depreciation of data center assets and

capitalized sales commissions in the country, the Walldorf-based

company said.

It said it would take a full-yearnegative revenue impact of

EUR300 million from lack of new business and discontinuation of

existing business, and EUR350 million on non-IFRS operating

profit.

SAP said it would also incur restructuring expenses of EUR80

million-EUR100 million for the year, though that wouldn't affect

non-IFRS results.

Despite the extra costs, the company kept its full-year outlook

including operating profit between EUR7.8 billion and EUR8.25

billion, cloud revenue at EUR11.55 billion-EUR11.85 billion and

free cash flow above EUR4.5 billion.

"Despite the current macroeconomic environment, cloud revenue

growth accelerated further, fueling total revenue growth. Current

cloud backlog grew at a healthy rate and continues to support our

confidence in our long-term plans and outlook for the year," Chief

Financial Officer Luka Mucic said.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

April 22, 2022 03:04 ET (07:04 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

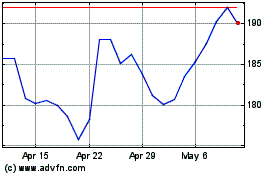

SAP (NYSE:SAP)

Historical Stock Chart

From Jan 2025 to Feb 2025

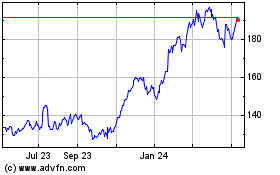

SAP (NYSE:SAP)

Historical Stock Chart

From Feb 2024 to Feb 2025