Schwab clients were net sellers of equities

overall; At a sector level, they were net buyers of Energy and

Consumer Staples, while Information Technology, Consumer

Discretionary, and Communication Services saw the most selling

The Schwab Trading Activity Index™ (STAX) decreased to 47.10 in

September, down from its score of 53.16 in August. The only index

of its kind, the STAX is a proprietary, behavior-based index that

analyzes retail investor stock positions and trading activity from

Schwab’s millions of client accounts to illuminate what investors

were actually doing and how they were positioned in the markets

each month.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241007024576/en/

The reading for the four-week period ending September 27, 2024,

ranks “moderate low” compared to historic averages.

“In September there was no shortage of market-affecting economic

data, and Schwab’s clients responded in kind by de-risking and

taking profit opportunities,” said Joe Mazzola, Head Trading &

Derivatives Strategist at Charles Schwab. “For now, it seems that

the market has accepted the proactive framing the Fed has adopted

with regards to its policy decision, and in large part we’re seeing

that clients are optimistic about the U.S.’s economic prospects.

But there’s no doubt that the extent of the rate cut in September

caught many by surprise and, taken in combination with all the

other economic data swirling during the month, it makes sense that

clients pulled back a bit even as the markets soared – although it

is worth noting that this is one of the biggest divergences we’ve

seen between market performance and the STAX score in the history

of this analysis.”

Equities got off to a rough start in September, with the S&P

500 down by more than four percent for the first week - its worst

week of 2024 to-date. Though equities recovered the very next week,

it’s possible that the weak start played into concerns over

seasonality (some traders may view September as a historically weak

month for stock performance), and amid a backdrop of rising

geopolitical tensions and an impending U.S. Federal Reserve

meeting, clients chose to de-risk and shed equities in the first

two weeks of the month. In contrast to August’s activity, those

sales were not met with corresponding equity dip buys. In fact,

many clients rotated a portion of their portfolios from equities

into fixed income, which experienced strong inflows during the STAX

period.

Both the Dow Jones Industrial Average® and the S&P 500 hit

new highs of 42,628.32 and 5,767.37 respectively in the closing

days of the September STAX period. The Nasdaq Composite closed the

period at 18,189.17, up 2.68% and within five percent of its

all-time-high set in July of this year.

The September STAX period was heavily impacted by market-moving

economic data. On September 5, initial jobless claims came in at

227,000, slightly fewer than expected. Despite this favorable data,

the S&P 500 sold off by 1.75% the following day. The U.S.

Bureau of Labor and Statistics released its Employment Situation

Summary on September 6, which showed non-farm payrolls rose by only

142,000 and revisions to prior months’ data that underscored a

softening labor market. The unemployment rate did fall to 4.2%, but

the S&P 500 sold off by more than 90 points regardless. The

Consumer Price Index (CPI) came in better than expected at 2.5% for

the trailing 12 months and the Producer Price Index (PPI) increased

0.2%, which was in-line with expectations. Second quarter Gross

Domestic Product (GDP) estimates remained at 3% while the real

first quarter GDP was revised upwards from 1.4% to 1.6%; the

primary drivers were increased consumer and federal government

spending.

On September 18, the FOMC announced a 50-basis point reduction

to the Fed Funds rate, its first rate cut in four years. While a

rate cut was widely anticipated, the decision to cut by 50 bps was

a surprise to many market participants. The S&P settled nearly

100 points higher the following day and continued to rally through

the remainder of the September STAX period.

The CBOE Volatility Index® (VIX) spiked (intra-month) by 50% for

the second consecutive month and closed the period 13% higher at

16.96. The 10-year Treasury yield fell by 4.14% to close the period

at 3.75%. The U.S. Dollar Index declined, closing at 100.42, down

1.26%. Front month WTI Crude Oil futures fell by 7.30% to close the

period at $68.18 per contract, as current supply and output

forecasts from Saudi Arabia continued to outpace demand.

Popular names bought by Schwab clients during the period

included:

- NVIDIA Corp. (NVDA)

- Palantir Technologies Inc. (PLTR)

- Intel Corp. (INTC)

- Alphabet Inc. (GOOG/GOOGL)

- Microsoft Corp. (MSFT)

Names net sold by Schwab clients during the period included:

- Tesla Inc. (TSLA)

- Advanced Micro Devices Inc. (AMD)

- Alibaba Group Holding Ltd. (BABA)

- AT&T Inc. (T)

- Nio Inc. (NIO)

About the STAX

The STAX value is calculated based on a complex proprietary

formula. Each month, Schwab pulls a sample from its client base of

millions of funded accounts, which includes accounts that completed

a trade in the past month. The holdings and positions of this

statistically significant sample are evaluated to calculate

individual scores, and the median of those scores represents the

monthly STAX.

For more information on the Schwab Trading Activity Index,

please visit www.schwab.com/investment-research/stax. Additionally,

Schwab clients can chart the STAX using the symbol $STAX in either

the thinkorswim® or thinkorswim Mobile platforms.

Investing involves risk, including loss of principal. Past

performance is no guarantee of future results. Content intended for

educational/informational purposes only. Not investment advice, or

a recommendation of any security, strategy, or account type.

Historical data should not be used alone when making investment

decisions. Please consult other sources of information and consider

your individual financial position and goals before making an

independent investment decision.

The STAX is not a tradable index. The STAX should not be used as

an indicator or predictor of future client trading volume or

financial performance for Schwab.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at aboutschwab.com. Follow us on

X, Facebook, YouTube, and LinkedIn.

1024-XAAL

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241007024576/en/

At the Company Margaret Farrell

Director, Corporate Communications (203) 434-2240

margaret.farrell@schwab.com

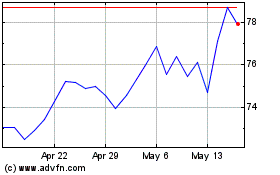

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Oct 2024 to Nov 2024

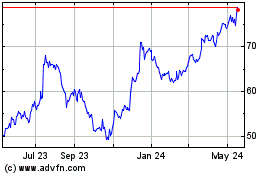

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Nov 2023 to Nov 2024