Achieves 11th Consecutive Quarter of Positive

Rent Spreads

All Centers Open and Operating after Multiple

Storms

Tanger® (NYSE:SKT), a leading owner and operator of

outlet and open-air retail shopping destinations, today reported

financial results and operating metrics for the three and nine

months ended September 30, 2024.

“I am pleased to announce another quarter of strong performance

and an increase in our full-year guidance,” said Stephen Yalof,

President and Chief Executive Officer. “Our team remains focused on

elevating our shopper experience and attracting in-demand retailer

brands and a diversified tenant mix, along with more food and

beverage and experiential destinations. Our strategy is driving

total rents, including our 11th consecutive quarter of positive

leasing spreads, and we will continue leveraging our platform to

realize additional growth. With our strong balance sheet and

liquidity, including no significant maturities until late 2026, we

have the flexibility to remain opportunistic and are

well-positioned to unlock additional value for all our

stakeholders.”

Mr. Yalof continued, “A core value of Tanger is to ‘Consider

Community First,’ and our team has recently demonstrated this

commitment as we have responded to the impacts of Hurricanes Helene

and Milton in the Southeastern U.S. While our team members and

their families remained safe and our centers experienced only minor

damage from the storms, Tanger Outlets Asheville closed temporarily

due to a lack of utilities and served as a staging location for

emergency response teams as they provided life-sustaining support

for the surrounding community. We are continuing to support the

Asheville community in many ways and have now fully reopened and

welcomed back shoppers.”

Third Quarter Results

- Net income available to common shareholders was $0.22 per

share, or $24.6 million, compared to $0.26 per share, or $27.2

million, for the prior year period.

- Funds From Operations (“FFO”) available to common shareholders

was $0.54 per share, or $62.7 million, compared to $0.50 per share,

or $55.8 million, for the prior year period.

- Core Funds From Operations (“Core FFO”) available to common

shareholders was $0.54 per share, or $62.7 million, compared to

$0.50 per share, or $55.8 million, for the prior year period.

Year-to-Date Results

- Net income available to common shareholders was $0.65 per

share, or $71.4 million, compared to $0.70 per share, or $74.5

million, for the prior year period.

- FFO available to common shareholders was $1.58 per share, or

$182.2 million, compared to $1.45 per share, or $160.2 million, for

the prior year period.

- Core FFO available to common shareholders was $1.60 per share,

or $183.7 million, compared to $1.44 per share, or $159.4 million,

for the prior period. Core FFO in the first nine months of 2024

excluded executive severance costs of approximately $0.01 per

share. Core FFO in the first nine months of 2023 excluded the

reversal of previously expensed compensation related to a voluntary

executive departure of approximately $0.01 per share. The Company

does not consider these items to be indicative of its ongoing

operating performance.

FFO and Core FFO are widely accepted supplemental non-GAAP

financial measures used in the real estate industry to measure and

compare the operating performance of real estate companies.

Complete reconciliations containing adjustments from GAAP net

income to FFO and Core FFO, if applicable, and further information

regarding these non-GAAP measures can be found later in this

release. Per share amounts for net income, FFO and Core FFO are on

a diluted basis.

Operating Metrics

Key portfolio results for the total stabilized portfolio,

including the Company’s pro rata share of unconsolidated joint

ventures, were as follows:

- Occupancy was 97.4% on September 30, 2024, compared to 96.5% on

June 30, 2024 and 98.0% on September 30, 2023. On a same center

basis (excluding Tanger Outlets Asheville and Bridge Street Town

Centre in Huntsville, AL, which were acquired in the fourth quarter

of 2023), occupancy was 97.5% on September 30, 2024, 97.1% on June

30, 2024 and 98.0% on September 30, 2023.

- Same center net operating income (“Same Center NOI”), which is

presented on a cash basis, increased 4.3% to $91.7 million for the

third quarter of 2024 from $87.9 million for the third quarter of

2023 and increased 5.8% to $269.2 million for the first nine months

of 2024 from $254.4 million for the first nine months of 2023.

- Average tenant sales per square foot was $438 for the twelve

months ended September 30, 2024 compared to $439 for the twelve

months ended June 30, 2024 and $437 for the twelve months ended

September 30, 2023.

- On a same center basis, average tenant sales per square foot

was $435 for the twelve months ended September 30, 2024 compared to

$436 for the twelve months ended June 30, 2024 and $437 for the

twelve months ended September 30, 2023.

- The occupancy cost ratio (“OCR”), representing annualized

occupancy costs as a percentage of tenant sales, was 9.5% for the

twelve months ended September 30, 2024 compared to 9.4% for the

twelve months ended June 30, 2024 and 9.1% for the twelve months

ended September 30, 2023.

- Lease termination fees (which are excluded from Same Center

NOI) for the total portfolio totaled $351,000 for the third quarter

of 2024 and $925,000 for the first nine months of 2024, compared to

$409,000 for the third quarter of 2023 and $484,000 for the first

nine months of 2023.

Same Center NOI is a supplemental non-GAAP financial measure of

operating performance. A complete definition of Same Center NOI and

a reconciliation to the nearest comparable GAAP measure can be

found later in this release.

Leasing Activity

Leasing activity in the Company’s portfolio continues to be

robust. For the total domestic portfolio, including the Company’s

pro rata share of domestic unconsolidated joint ventures, total

renewed or re-tenanted leases (including leases for both comparable

and non-comparable space) executed during the twelve months ended

September 30, 2024 included 543 leases, totaling 2.6 million square

feet, compared to 528 leases, totaling 2.2 million square feet,

during the twelve months ended September 30, 2023.

Blended average rental rates were positive for the 11th

consecutive quarter at 14.4% on a cash basis for leases executed

for comparable space during the twelve months ended September 30,

2024. These blended rent spreads are comprised of re-tenanted rent

spreads of 45.7% and renewal rent spreads of 12.0%.

As of September 30, 2024, Tanger had renewals executed or in

process for 72.5% of the space scheduled to expire during 2024

compared to 88.0% of expiring 2023 space as of September 30, 2023

(total portfolio, including the Company’s pro rata share of

unconsolidated joint ventures). Relative to 2023, the Company

continues to expect a higher re-tenanting rate in 2024 as it

focuses on portfolio enhancement and further elevating and

diversifying its retailer mix.

Hurricane Update

In late September 2024, Hurricane Helene severely impacted the

Southeastern U.S., including the Asheville, North Carolina region.

All team members remained safe, and Tanger Outlets Asheville

sustained relatively minor damage and served as a staging location

for emergency response teams serving the surrounding community. Due

to a lack of utilities, Tanger Asheville was closed from September

27 and reopened with reduced hours on October 11, along with nearly

half of its retailers. Additional retailers reopened throughout

October, with all reopened and the center operating at regular

hours by October 27.

While several Tanger centers were within the path of Hurricane

Helene and Hurricane Milton, which impacted Florida in October

2024, no other centers sustained damage or ongoing closures. Tanger

maintains insurance coverage to mitigate the financial impacts of

physical damage and business interruption at its centers as part of

its ongoing risk management plans.

Dividend

In October 2024, the Company’s Board of Directors authorized a

quarterly cash dividend of $0.275 per share, payable on November

15, 2024 to holders of record on October 31, 2024.

Balance Sheet and

Liquidity

During the three and nine months ended September 30, 2024, the

Company sold 0.8 million common shares under its at-the-market

stock offering (the “ATM Offering”) at a weighted average price of

$30.53 per share, generating gross proceeds of $25.0 million. In

October 2024, the Company sold an additional 0.5 million common

shares at a weighted average price of $33.38 per share, totaling

approximately $16.2 million of gross proceeds. As of October 31,

2024, the Company had $179.0 million of common shares remaining

available for sale under the ATM Offering.

The following balance sheet and liquidity metrics are presented

for the total portfolio, including the Company’s pro rata share of

unconsolidated joint ventures. As of September 30, 2024:

- Net debt to Adjusted EBITDAre (calculated as net debt divided

by Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization for Real Estate (“Adjusted EBITDAre”)) improved to

5.0x for the twelve months ended September 30, 2024 from 5.8x for

the year ended December 31, 2023. Management estimates that Net

debt to Adjusted EBITDAre would be in a range of 4.8x to 4.9x for

the September 30, 2024 period assuming a full twelve months of

Adjusted EBITDAre for Tanger Nashville, Tanger Asheville, and

Bridge Street Town Centre, which were added to the portfolio during

the fourth quarter of 2023.

- Interest coverage ratio (calculated as Adjusted EBITDAre

divided by interest expense) was 4.6x for the first nine months of

2024 and 4.7x for the twelve months ended September 30, 2024.

- Cash and cash equivalents and short-term investments totaled

$18.8 million with full availability on the Company’s $620.0

million unsecured lines of credit.

- Total outstanding debt aggregated $1.6 billion with $66.2

million (principal) of floating rate debt, representing

approximately 4% of total debt outstanding and 1% of total

enterprise value.

- Weighted average interest rate was 4.1%, including executed

swaps, and weighted average term to maturity of outstanding debt,

including extension options, was approximately 4.0 years.

- Approximately 89% of the total portfolio’s square footage was

unencumbered by mortgages with secured debt of $220.0 million

(principal), representing 14% of total debt outstanding.

- Funds Available for Distribution (“FAD”) payout ratio was 61%

for the first nine months of 2024.

Adjusted EBITDAre, Net debt and FAD are supplemental non-GAAP

financial measures of operating performance. Definitions of

Adjusted EBITDAre, Net debt and FAD and reconciliations to the

nearest comparable GAAP measures are included later in this

release.

Guidance for 2024

Based on the Company’s results to date along with its outlook

for the remainder of 2024, management is increasing its full-year

2024 guidance with its current expectations for net income, FFO and

Core FFO per share for 2024 as follows:

For the year ending December 31,

2024:

Revised

Previous

Low Range

High Range

Low Range

High Range

Estimated diluted net income per

share

$0.88

$0.92

$0.85

$0.92

Depreciation and amortization of real

estate assets - consolidated and the Company’s share of

unconsolidated joint ventures

1.20

1.20

1.19

1.19

Estimated diluted FFO per share

$2.08

$2.12

$2.04

$2.11

Executive severance costs (1)

0.01

0.01

0.01

0.01

Estimated diluted Core FFO per

share

$2.09

$2.13

$2.05

$2.12

Tanger’s estimates reflect the following key assumptions

(dollars in millions):

For the year ending December 31,

2024:

Revised

Previous

Low Range

High Range

Low Range

High Range

Same Center NOI growth - total portfolio

at pro rata share

4.25

%

5.00

%

3.25

%

4.75

%

General and administrative expense,

excluding executive severance (1)

$75.5

$78.5

$76.5

$79.5

Interest expense - consolidated

$60.0

$61.0

$60.0

$61.5

Other income (expense) (2)

$0.5

$1.5

$—

$2.0

Annual recurring capital expenditures,

renovations and second generation tenant allowances

$55.0

$60.0

$50.0

$60.0

(1)

Executive severance costs of $1.6 million

were recorded during the first quarter of 2024.

(2)

Includes interest income.

Weighted average diluted common shares are expected to

approximate 110.5 million for earnings per share and 115.5 million

for FFO and Core FFO per share. The estimates above do not include

the impact of the acquisition or sale of any outparcels, properties

or joint venture interests, or any additional financing

activity.

Third Quarter 2024 Conference

Call

Tanger will host a conference call to discuss its third quarter

2024 results for analysts, investors and other interested parties

on Thursday, November 7, 2024, at 8:30 a.m. Eastern Time. To access

the conference call, listeners should dial 1-877-605-1702.

Alternatively, a live audio webcast of this call will be available

to the public on Tanger’s Investor Relations website,

investors.tanger.com. A telephone replay of the call will be

available from November 7, 2024 at approximately 11:30 a.m. through

November 21, 2024 at 11:59 p.m. by dialing 1-877-660-6853, replay

access code #13748540. An online archive of the webcast will also

be available through November 21, 2024.

Upcoming Events

The Company is scheduled to participate in the following

upcoming events:

- Nareit’s REITworld: 2024 Investor Conference held at the Wynn

Las Vegas in Las Vegas, NV from November 19 through November 20,

2024

- Tour of Tanger Outlets Phoenix in Glendale, AZ on November 21,

2024 in connection with Citi’s Phoenix Retail Tour Post-Nareit

About Tanger®

Tanger Inc. (NYSE: SKT) is a leading owner and operator of

outlet and open-air retail shopping destinations, with over 43

years of expertise in the retail and outlet shopping industries.

Tanger’s portfolio of 38 outlet centers, one adjacent managed

center, and one open-air lifestyle center includes over 15 million

square feet well positioned across tourist destinations and vibrant

markets in 20 U.S. states and Canada. A publicly traded REIT since

1993, Tanger continues to innovate the retail experience for its

shoppers with over 3,000 stores operated by more than 700 different

brand name companies. Tanger is furnishing a Form 8-K with the

Securities and Exchange Commission (“SEC”) that includes a

supplemental information package for the quarter ended September

30, 2024. For more information on Tanger, call 1-800-4TANGER or

visit tanger.com.

The Company uses, and intends to continue to use, its Investor

Relations website, which can be found at investors.tanger.com, as a

means of disclosing material nonpublic information and for

complying with its disclosure obligations under Regulation FD.

Additional information about the Company can also be found through

social media channels. The Company encourages investors and others

interested in the Company to review the information on its Investor

Relations website and on social media channels. The information

contained on, or that may be accessed through, our website or

social media platforms is not incorporated by reference into, and

is not a part of, this document.

Safe Harbor Statement

Certain statements made in this earnings release contain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. We intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and included this

statement for purposes of complying with these safe harbor

provisions. Forward-looking statements, which are based on certain

assumptions and describe our future plans, strategies, beliefs and

expectations, are generally identifiable by use of the words

“anticipate,” “believe,” “can,” “continue,” “could,” “designed,”

“estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,”

“plan,” “possible,” “potential,” “predict,” “project,” “should,”

“target,” “will,” “would,” or similar expressions. Such

forward-looking statements include the Company’s expectations

regarding future financial results and assumptions underlying that

guidance, long-term growth, trends in retail traffic and tenant

revenues, development initiatives and strategic partnerships, the

anticipated impact of the Company’s recently acquired assets in

Huntsville and Asheville, as well as its recently opened Nashville

development and related costs and anticipated yield, expectations

regarding operational metrics, renewal trends, new revenue streams,

its strategy and value proposition to retailers, participation in

upcoming events, uses of and efforts to reduce costs of capital,

liquidity, dividend payments and cash flows.

Other important factors that may cause actual results to differ

materially from current expectations include, but are not limited

to: our inability to develop new retail centers or expand existing

retail centers successfully; risks related to the economic

performance and market value of our retail centers; the relative

illiquidity of real property investments; impairment charges

affecting our properties; our acquisitions or dispositions of

assets may not achieve anticipated results; competition for the

acquisition and development of retail centers, and our inability to

complete the acquisitions of retail centers we may identify;

competition for tenants with competing retail centers; the

diversification of our tenant mix and our entry into the operation

of full price retail may not achieve our expected results;

environmental regulations affecting our business; risks associated

with possible terrorist activity or other acts or threats of

violence and threats to public safety; risks related to the impact

of macroeconomic conditions, including rising interest rates and

inflation, on our tenants and on our business, financial condition,

liquidity, results of operations and compliance with debt

covenants; our dependence on rental income from real property; the

fact that certain of our leases include co-tenancy and/or

sales-based provisions that may allow a tenant to pay reduced rent

and/or terminate a lease prior to its natural expiration; our

dependence on the results of operations of our retailers and their

bankruptcy, early termination or closing could adversely affect us;

the impact of geopolitical conflicts; the immediate and long-term

impact of the outbreak of a highly infectious or contagious disease

on our tenants and on our business (including the impact of actions

taken to contain the outbreak or mitigate its impact); the fact

that certain of our properties are subject to ownership interests

held by third parties, whose interests may conflict with ours;

risks related to climate change; increased costs and reputational

harm associated with the increased focus on environmental,

sustainability and social initiatives; risks related to uninsured

losses; the risk that consumer, travel, shopping and spending

habits may change; risks associated with our Canadian investments;

risks associated with attracting and retaining key personnel; risks

associated with debt financing; risks associated with our

guarantees of debt for, or other support we may provide to, joint

venture properties; the effectiveness of our interest rate hedging

arrangements; our potential failure to qualify as a REIT; our legal

obligation to pay dividends to our shareholders; legislative or

regulatory actions that could adversely affect our shareholders,

our dependence on distributions from the Operating Partnership to

meet our financial obligations, including dividends; the risk of a

cyber-attack or an act of cyber-terrorism or the impact of outages

on our technology systems or technology systems generally; the

uncertainties of costs to comply with regulatory changes (including

potential costs to comply with proposed rules of the SEC to

standardize climate-related disclosures); and other important

factors which may cause actual results to differ materially from

current expectations include, but are not limited to, those set

forth under Item 1A - “Risk Factors” in the Company’s and the

Operating Partnership’s Annual Report on Form 10-K for the year

ended December 31, 2023.

We qualify all of our forward-looking statements by these

cautionary statements. The forward-looking statements in this

earnings release are only predictions. We have based these

forward-looking statements largely on our current expectations and

projections about future events and financial trends that we

believe may affect our business, financial condition and results of

operations. Because forward-looking statements are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified, you should not rely on these

forward-looking statements as predictions of future events. The

events and circumstances reflected in our forward-looking

statements may not be achieved or occur and actual results could

differ materially from those projected in the forward-looking

statements. Except as required by applicable law, we do not plan to

publicly update or revise any forward-looking statements contained

herein, whether as a result of any new information, future events,

changed circumstances or otherwise.

TANGER INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per

share data)

(Unaudited)

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

2024

2023

Revenues:

Rental revenues

$125,221

$110,835

$365,349

$319,005

Management, leasing and other services

2,485

2,138

7,095

6,174

Other revenues

5,295

4,373

12,884

11,751

Total revenues

133,001

117,346

385,328

336,930

Expenses:

Property operating

40,247

36,758

113,261

103,618

General and administrative (1)

18,215

18,937

56,518

54,675

Depreciation and amortization

35,376

25,374

103,410

76,656

Total expenses

93,838

81,069

273,189

234,949

Other income (expense):

Interest expense

(15,493

)

(11,688

)

(45,546

)

(35,997

)

Other income (expense)

(52

)

1,899

755

7,023

Total other income (expense)

(15,545

)

(9,789

)

(44,791

)

(28,974

)

Income before equity in earnings of

unconsolidated joint ventures

23,618

26,488

67,348

73,007

Equity in earnings of unconsolidated joint

ventures

2,312

2,389

7,803

6,030

Net income

25,930

28,877

75,151

79,037

Noncontrolling interests in Operating

Partnership

(1,074

)

(1,253

)

(3,122

)

(3,422

)

Noncontrolling interests in other

consolidated partnerships

—

—

80

(248

)

Net income attributable to Tanger

Inc.

24,856

27,624

72,109

75,367

Allocation of earnings to participating

securities

(232

)

(414

)

(692

)

(854

)

Net income available to common

shareholders of Tanger Inc.

$24,624

$27,210

$71,417

$74,513

Basic earnings per common

share:

Net income

$0.23

$0.26

$0.66

$0.71

Diluted earnings per common

share:

Net income

$0.22

$0.26

$0.65

$0.70

(1)

The nine months ended September 30, 2024

includes $1.6 million of executive severance costs. The nine months

ended September 30, 2023 includes the reversal of $0.8 million of

previously expensed compensation related to a voluntary executive

departure.

TANGER INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

data)

(Unaudited)

September 30,

December 31,

2024

2023

Assets

Rental property:

Land

$303,605

$303,605

Buildings, improvements and fixtures

3,011,234

2,938,434

Construction in progress

9,421

29,201

3,324,260

3,271,240

Accumulated depreciation

(1,401,334

)

(1,318,264

)

Total rental property, net

1,922,926

1,952,976

Cash and cash equivalents

11,053

12,778

Short-term investments

—

9,187

Investments in unconsolidated joint

ventures

70,245

71,900

Deferred lease costs and other

intangibles, net

77,508

91,269

Operating lease right-of-use assets

76,431

77,400

Prepaids and other assets

117,128

108,609

Total assets

$2,275,291

$2,324,119

Liabilities and Equity

Liabilities

Debt:

Senior, unsecured notes, net

$1,041,240

$1,039,840

Unsecured term loan, net

322,967

322,322

Mortgages payable, net

60,186

64,041

Unsecured lines of credit

—

13,000

Total debt

1,424,393

1,439,203

Accounts payable and accrued expenses

86,761

118,505

Operating lease liabilities

85,079

86,076

Other liabilities

86,426

89,022

Total liabilities

1,682,659

1,732,806

Commitments and contingencies

Equity

Tanger Inc.:

Common shares, $0.01 par value,

300,000,000 shares authorized, 110,208,387 and 108,793,251 shares

issued and outstanding at September 30, 2024 and December 31, 2023,

respectively

1,102

1,088

Paid in capital

1,102,443

1,079,387

Accumulated distributions in excess of net

income

(507,833

)

(490,171

)

Accumulated other comprehensive loss

(27,418

)

(23,519

)

Equity attributable to Tanger

Inc.

568,294

566,785

Equity attributable to noncontrolling

interests:

Noncontrolling interests in Operating

Partnership

24,338

24,528

Noncontrolling interests in other

consolidated partnerships

—

—

Total equity

592,632

591,313

Total liabilities and equity

$2,275,291

$2,324,119

TANGER INC. AND

SUBSIDIARIES

CENTER INFORMATION

(Unaudited)

September 30,

2024

2023

Gross Leasable Area Open at End of

Period (in thousands):

Consolidated

12,690

11,349

Unconsolidated

2,113

2,113

Pro rata share of unconsolidated

1,056

1,056

Managed

758

758

Total Owned and/or Managed Properties

(1)

15,561

14,220

Total Owned Properties including pro

rata share of unconsolidated JVs (1)

13,746

12,405

Centers in Operation at End of

Period:

Consolidated

32

29

Unconsolidated

6

6

Managed

2

1

Total Owned and/or Managed

Properties

40

36

Ending Occupancy:

Consolidated (2)

97.3

%

97.9

%

Unconsolidated

98.2

%

98.4

%

Total Owned Properties including pro

rata share of unconsolidated JVs (2)

97.4

%

98.0

%

Total Owned Properties including pro

rata share of unconsolidated JVs - Same Center (3)

97.5

%

98.0

%

Total U.S. States Operated in at End of

Period (4)

20

20

(1)

Amounts may not recalculate due to the

effect of rounding.

(2)

Metrics for September 2024 include the

results of Tanger Outlets Asheville and Bridge Street Town Centre,

both of which were acquired in the fourth quarter of 2023, and

exclude the results of Tanger Outlets Nashville, which opened

during the fourth quarter of 2023 and has not yet stabilized.

(3)

Excludes the occupancy rates at Bridge

Street Town Centre, Tanger Asheville and Tanger Nashville for the

September 30, 2024 period.

(4)

The Company also has an ownership interest

in two centers located in Ontario, Canada.

TANGER INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP SUPPLEMENTAL MEASURES (1)

(in thousands, except per

share)

(Unaudited)

Below is a

reconciliation of Net Income to FFO and Core FFO:

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

2024

2023

Net income

$25,930

$28,877

$75,151

$79,037

Adjusted for:

Depreciation and amortization of real

estate assets - consolidated

34,357

24,953

100,764

75,077

Depreciation and amortization of real

estate assets - unconsolidated joint ventures

2,850

2,608

7,450

7,893

FFO

63,137

56,438

183,365

162,007

FFO attributable to noncontrolling

interests in other consolidated partnerships

—

—

80

(248

)

Allocation of earnings to participating

securities

(418

)

(651

)

(1,248

)

(1,560

)

FFO available to common shareholders

(2)

$62,719

$55,787

$182,197

$160,199

As further adjusted for:

Executive departure-related adjustments

(3)

—

—

1,554

(806

)

Impact of above adjustments to the

allocation of earnings to participating securities

—

—

(10

)

6

Core FFO available to common

shareholders (2)

$62,719

$55,787

$183,741

$159,399

FFO available to common shareholders

per share - diluted (2)

$0.54

$0.50

$1.58

$1.45

Core FFO available to common

shareholders per share - diluted (2)

$0.54

$0.50

$1.60

$1.44

Weighted Average Shares:

Basic weighted average common shares

108,972

104,461

108,675

104,308

Effect of notional units

799

1,026

746

898

Effect of outstanding options

933

832

925

783

Diluted weighted average common shares

(for earnings per share computations)

110,704

106,319

110,346

105,989

Exchangeable operating partnership

units

4,708

4,738

4,708

4,738

Diluted weighted average common shares

(for FFO and Core FFO per share computations) (2)

115,412

111,057

115,054

110,727

(1)

Refer to Non-GAAP Definitions beginning on

page xv for definitions of the non-GAAP supplemental measures used

in this release.

(2)

Assumes the Class A common limited

partnership units of the Operating Partnership held by the

noncontrolling interests are exchanged for common shares of the

Company. Each Class A common limited partnership unit is

exchangeable for one of the Company’s common shares, subject to

certain limitations to preserve the Company’s REIT status.

(3)

For the 2024 period, represents executive

severance costs. For the 2023 period, represents the reversal of

previously expensed compensation related to a voluntary executive

departure.

Below is a reconciliation of FFO to FAD

(1):

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

2024

2023

FFO available to common

shareholders

$62,719

$55,787

$182,197

$160,199

Adjusted for:

Corporate depreciation

1,019

421

2,646

1,579

Amortization of finance costs

914

796

2,609

2,395

Amortization of net debt discount

191

159

548

455

Amortization of equity-based

compensation

2,875

3,387

8,980

9,040

Straight-line rent adjustments

(374

)

409

(361

)

1,410

Market rent adjustments

166

257

393

545

Second generation tenant allowances and

lease incentives

(11,802

)

(3,389

)

(20,858

)

(7,718

)

Capital improvements

(10,418

)

(10,275

)

(23,707

)

(19,776

)

Adjustments from unconsolidated joint

ventures

(845

)

(423

)

(1,149

)

(528

)

FAD available to common shareholders

(2)

$44,445

$47,129

$151,298

$147,601

Dividends per share

$0.275

$0.245

$0.810

$0.710

FFO payout ratio

51

%

49

%

51

%

49

%

FAD payout ratio

71

%

58

%

61

%

53

%

Diluted weighted average common shares

(2)

115,412

111,057

115,054

110,727

(1)

Refer to page ix for a reconciliation of

net income to FFO available to common shareholders.

(2)

Assumes the Class A common limited

partnership units of the Operating Partnership held by the

noncontrolling interests are exchanged for common shares of the

Company. Each Class A common limited partnership unit is

exchangeable for one of the Company’s common shares, subject to

certain limitations to preserve the Company’s REIT status.

Below is a

reconciliation of Net Income to Portfolio NOI and Same Center NOI

for the consolidated portfolio and total portfolio at pro rata

share:

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

2024

2023

Net income

$25,930

$28,877

$75,151

$79,037

Adjusted to exclude:

Equity in earnings of unconsolidated joint

ventures

(2,312

)

(2,389

)

(7,803

)

(6,030

)

Interest expense

15,493

11,688

45,546

35,997

Other (income) expense

52

(1,899

)

(755

)

(7,023

)

Depreciation and amortization

35,376

25,374

103,410

76,656

Other non-property income

(199

)

(306

)

(1,000

)

(1,327

)

Corporate general and administrative

expenses

18,231

18,950

56,556

54,674

Non-cash adjustments (1)

(214

)

670

28

1,971

Lease termination fees

(335

)

(392

)

(875

)

(400

)

Portfolio NOI - Consolidated

92,022

80,573

270,258

233,555

Non-same center NOI - Consolidated

(7,702

)

(90

)

(22,978

)

(50

)

Same Center NOI - Consolidated

(2)

$84,320

$80,483

$247,280

$233,505

Portfolio NOI - Consolidated

$92,022

$80,573

$270,258

$233,555

Pro rata share of unconsolidated joint

ventures (3)

7,362

7,393

21,941

20,905

Portfolio NOI - Total portfolio at pro

rata share (3)

99,384

87,966

292,199

254,460

Non-same center NOI - Total portfolio at

pro rata share (3)

(7,702

)

(90

)

(22,978

)

(50

)

Same Center NOI - Total portfolio at

pro rata share (2) (3)

$91,682

$87,876

$269,221

$254,410

(1)

Non-cash items include straight-line rent,

above and below market rent amortization, straight-line rent

expense on land leases, and gains or losses on outparcel sales, as

applicable.

(2)

Centers excluded from Same Center NOI:

Nashville

October 2023

New Development

Consolidated

Asheville

November 2023

Acquired

Consolidated

Huntsville

November 2023

Acquired

Consolidated

(3)

Pro rata share metrics are presented on a

constant currency basis. Constant currency is a non-GAAP measure,

calculated by applying the average foreign exchange rate for the

current period to all periods presented.

Below are

reconciliations of Net Income to Adjusted EBITDA:

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

2024

2023

Net income

$25,930

$28,877

$75,151

$79,037

Adjusted to exclude:

Interest expense, net

15,513

9,283

45,108

28,584

Income tax expense (benefit)

—

4

(248

)

(32

)

Depreciation and amortization

35,376

25,374

103,410

76,656

Executive departure-related adjustments

(1)

—

—

1,554

(806

)

Adjusted EBITDA

$76,819

$63,538

$224,975

$183,439

Twelve months ended

September 30,

December 31,

2024

2023

Net income

$99,996

$103,882

Adjusted to exclude:

Interest expense, net

54,673

38,149

Income tax expense (benefit)

(624

)

(408

)

Depreciation and amortization

135,643

108,889

Executive departure-related adjustments

(1)

1,554

(806

)

Adjusted EBITDA

$291,242

$249,706

(1)

For the 2024 period, represents executive

severance costs. For the 2023 period, represents the reversal of

previously expensed compensation related to a voluntary executive

departure.

Below are

reconciliations of Net Income to EBITDAre and Adjusted

EBITDAre:

Three months ended

Nine months ended

September 30,

September 30,

2024

2023

2024

2023

Net income

$25,930

$28,877

$75,151

$79,037

Adjusted to exclude:

Interest expense, net

15,513

9,283

45,108

28,584

Income tax expense (benefit)

—

4

(248

)

(32

)

Depreciation and amortization

35,376

25,374

103,410

76,656

Pro rata share of interest expense, net -

unconsolidated joint ventures

2,186

2,224

6,539

6,550

Pro rata share of depreciation and

amortization - unconsolidated joint ventures

2,850

2,608

7,450

7,893

EBITDAre

$81,855

$68,370

$237,410

$198,688

Executive departure-related adjustments

(1)

—

—

1,554

(806

)

Adjusted EBITDAre

$81,855

$68,370

$238,964

$197,882

Twelve months ended

September 30,

December 31,

2024

2023

Net income

$99,996

$103,882

Adjusted to exclude:

Interest expense, net

54,673

38,149

Income tax expense (benefit)

(624

)

(408

)

Depreciation and amortization

135,643

108,889

Pro rata share of interest expense, net -

unconsolidated joint ventures

8,768

8,779

Pro rata share of depreciation and

amortization - unconsolidated joint ventures

10,071

10,514

EBITDAre

$308,527

$269,805

Executive departure-related adjustments

(1)

1,554

(806

)

Adjusted EBITDAre

$310,081

$268,999

(1)

For the 2024 period, represents executive

severance costs. For the 2023 period, represents the reversal of

previously expensed compensation related to a voluntary executive

departure.

Below is a

reconciliation of Total Debt to Net Debt for the consolidated

portfolio and total portfolio at pro rata share:

September 30, 2024

Consolidated

Pro Rata Share of

Unconsolidated JVs

Total at Pro Rata

Share

Total debt

$1,424,393

$158,934

$1,583,327

Less:

Cash and cash equivalents

(11,053

)

(7,738

)

(18,791

)

Short-term investments (1)

—

—

—

Total cash and cash equivalents and

short-term investments

(11,053

)

(7,738

)

(18,791

)

Net debt

$1,413,340

$151,196

$1,564,536

December 31, 2023

Consolidated

Pro Rata Share of

Unconsolidated JVs

Total at Pro Rata

Share

Total debt

$1,439,203

$159,979

$1,599,182

Less:

Cash and cash equivalents

(12,778

)

(7,020

)

(19,798

)

Short-term investments (1)

(9,187

)

—

(9,187

)

Total cash and cash equivalents and

short-term investments

(21,965

)

(7,020

)

(28,985

)

Net debt

$1,417,238

$152,959

$1,570,197

(1)

Represents short-term bank deposits with

initial maturities greater than three months and less than or equal

to one year.

NON-GAAP DEFINITIONS

Funds From Operations

Funds From Operations (“FFO”) is a widely used measure of the

operating performance for real estate companies that supplements

net income (loss) determined in accordance with generally accepted

accounting principles in the United States (“GAAP”). We determine

FFO based on the definition set forth by the National Association

of Real Estate Investment Trusts (“Nareit”), of which we are a

member. In December 2018, Nareit issued “Nareit Funds From

Operations White Paper - 2018 Restatement,” which clarifies, where

necessary, existing guidance and consolidates alerts and policy

bulletins into a single document for ease of use. Nareit defines

FFO as net income (loss) available to the Company’s common

shareholders computed in accordance with GAAP, excluding (i)

depreciation and amortization related to real estate, (ii) gains or

losses from sales of certain real estate assets, (iii) gains and

losses from change in control, (iv) impairment write-downs of

certain real estate assets and investments in entities when the

impairment is directly attributable to decreases in the value of

depreciable real estate held by the entity and (v) after

adjustments for unconsolidated partnerships and joint ventures

calculated to reflect FFO on the same basis.

FFO is intended to exclude historical cost depreciation of real

estate as required by GAAP which assumes that the value of real

estate assets diminishes ratably over time. Historically, however,

real estate values have risen or fallen with market conditions.

Because FFO excludes depreciation and amortization of real estate

assets, gains and losses from property dispositions and

extraordinary items, it provides a performance measure that, when

compared year over year, reflects the impact to operations from

trends in occupancy rates, rental rates, operating costs,

development activities and interest costs, providing perspective

not immediately apparent from net income (loss).

We present FFO because we consider it an important supplemental

measure of our operating performance. In addition, a portion of

cash bonus compensation to certain members of management is based

on our FFO or Core FFO, which is described in the section below. We

believe it is useful for investors to have enhanced transparency

into how we evaluate our performance and that of our management. In

addition, FFO is frequently used by securities analysts, investors

and other interested parties in the evaluation of REITs, many of

which present FFO when reporting their results. FFO is also widely

used by us and others in our industry to evaluate and price

potential acquisition candidates. We believe that FFO payout ratio,

which represents regular distributions to common shareholders and

unitholders of the Operating Partnership expressed as a percentage

of FFO, is useful to investors because it facilitates the

comparison of dividend coverage between REITs. Nareit has

encouraged its member companies to report their FFO as a

supplemental, industry-wide standard measure of REIT operating

performance.

FFO has significant limitations as an analytical tool, and you

should not consider it in isolation, or as a substitute for

analysis of our results as reported under GAAP. Some of these

limitations are:

- FFO does not reflect our cash expenditures, or future

requirements, for capital expenditures or contractual

commitments;

- FFO does not reflect changes in, or cash requirements for, our

working capital needs;

- Although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced in the future, and FFO does not reflect any cash

requirements for such replacements; and

- Other companies in our industry may calculate FFO differently

than we do, limiting its usefulness as a comparative measure.

Because of these limitations, FFO should not be considered as a

measure of discretionary cash available to us to invest in the

growth of our business or our dividend paying capacity. We

compensate for these limitations by relying primarily on our GAAP

results and using FFO only as a supplemental measure.

Core FFO

We present Core Funds From Operations (“Core FFO”) as a

supplemental measure of our performance. We define Core FFO as FFO

further adjusted to eliminate the impact of certain items that we

do not consider indicative of our ongoing operating performance.

These further adjustments are itemized in the table above. You are

encouraged to evaluate these adjustments and the reasons we

consider them appropriate for supplemental analysis. In evaluating

Core FFO you should be aware that in the future we may incur

expenses that are the same as or similar to some of the adjustments

in this presentation. Our presentation of Core FFO should not be

construed as an inference that our future results will be

unaffected by unusual or non-recurring items.

We present Core FFO because we believe it assists investors and

analysts in comparing our performance across reporting periods on a

consistent basis by excluding items that we do not believe are

indicative of our core operating performance. In addition, we

believe it is useful for investors to have enhanced transparency

into how we evaluate management’s performance and the effectiveness

of our business strategies. We use Core FFO when certain material,

unplanned transactions occur as a factor in evaluating management’s

performance and to evaluate the effectiveness of our business

strategies, and may use Core FFO when determining incentive

compensation.

Core FFO has limitations as an analytical tool. Some of these

limitations are:

- Core FFO does not reflect our cash expenditures, or future

requirements, for capital expenditures or contractual

commitments;

- Core FFO does not reflect changes in, or cash requirements for,

our working capital needs;

- Although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced in the future, and Core FFO does not reflect any cash

requirements for such replacements;

- Core FFO does not reflect the impact of certain cash charges

resulting from matters we consider not to be indicative of our

ongoing operations; and

- Other companies in our industry may calculate Core FFO

differently than we do, limiting its usefulness as a comparative

measure.

Because of these limitations, Core FFO should not be considered

in isolation or as a substitute for performance measures calculated

in accordance with GAAP. We compensate for these limitations by

relying primarily on our GAAP results and using Core FFO only as a

supplemental measure.

Funds Available for Distribution

Funds Available for Distribution (“FAD”) is a non-GAAP financial

measure that we define as FFO (defined as net income (loss)

available to the Company’s common shareholders computed in

accordance with GAAP, excluding (i) depreciation and amortization

related to real estate, (ii) gains or losses from sales of certain

real estate assets, (iii) gains and losses from change in control,

(iv) impairment write-downs of certain real estate assets and

investments in entities when the impairment is directly

attributable to decreases in the value of depreciable real estate

held by the entity and (v) after adjustments for unconsolidated

partnerships and joint ventures calculated to reflect FFO on the

same basis), excluding corporate depreciation, amortization of

finance costs, amortization of net debt discount (premium),

amortization of equity-based compensation, straight-line rent

amounts, market rent amounts, second generation tenant allowances

and lease incentives, recurring capital improvement expenditures,

and our share of the items listed above for our unconsolidated

joint ventures. Investors, analysts and the Company utilize FAD as

an indicator of common dividend potential. The FAD payout ratio,

which represents regular distributions to common shareholders and

unitholders of the Operating Partnership expressed as a percentage

of FAD, facilitates the comparison of dividend coverage between

REITs.

We believe that net income (loss) is the most directly

comparable GAAP financial measure to FAD. FAD does not represent

cash generated from operating activities in accordance with GAAP

and should not be considered as an alternative to net income (loss)

as an indication of our performance or to cash flows as a measure

of liquidity or our ability to make distributions. Other companies

in our industry may calculate FAD differently than we do, limiting

its usefulness as a comparative measure.

Portfolio Net Operating Income and Same Center Net Operating

Income

We present portfolio net operating income (“Portfolio NOI”) and

same center net operating income (“Same Center NOI”) as

supplemental measures of our operating performance. Portfolio NOI

represents our property level net operating income which is defined

as total operating revenues less property operating expenses and

excludes termination fees and non-cash adjustments including

straight-line rent, net above and below market rent amortization,

impairment charges, loss on early extinguishment of debt and gains

or losses on the sale of assets recognized during the periods

presented. We define Same Center NOI as Portfolio NOI for the

properties that were operational for the entire portion of both

comparable reporting periods and which were not acquired, or

subject to a material expansion or non-recurring event, such as a

natural disaster, during the comparable reporting periods. We

present Portfolio NOI and Same Center NOI on both a consolidated

and total portfolio, including pro rata share of unconsolidated

joint ventures, basis.

We believe Portfolio NOI and Same Center NOI are non-GAAP

metrics used by industry analysts, investors and management to

measure the operating performance of our properties because they

provide performance measures directly related to the revenues and

expenses involved in owning and operating real estate assets and

provide a perspective not immediately apparent from net income

(loss), FFO or Core FFO. Because Same Center NOI excludes

properties developed, redeveloped, acquired and sold; as well as

non-cash adjustments, gains or losses on the sale of outparcels and

termination rents; it highlights operating trends such as occupancy

levels, rental rates and operating costs on properties that were

operational for both comparable periods. Portfolio NOI and

Same Center NOI should not be considered alternatives to net income

(loss) as an indication of our performance or to cash flows as a

measure of our liquidity or our ability to make distributions.

Other REITs may use different methodologies for calculating

Portfolio NOI and Same Center NOI, and accordingly, our Portfolio

NOI and Same Center NOI may not be comparable to other REITs.

Portfolio NOI and Same Center NOI should not be considered

alternatives to net income (loss) or as an indicator of our

financial performance since they do not reflect the entire

operations of our portfolio, nor do they reflect the impact of

general and administrative expenses, acquisition-related expenses,

interest expense, depreciation and amortization costs, other

non-property income and losses, the level of capital expenditures

and leasing costs necessary to maintain the operating performance

of our properties, or trends in development and construction

activities which are significant economic costs and activities that

could materially impact our results from operations. Because of

these limitations, Portfolio NOI and Same Center NOI should not be

viewed in isolation or as a substitute for performance measures

calculated in accordance with GAAP. We compensate for these

limitations by relying primarily on our GAAP results and using

Portfolio NOI and Same Center NOI only as supplemental

measures.

Adjusted EBITDA, EBITDAre and Adjusted EBITDAre

We present Earnings Before Interest, Taxes, Depreciation and

Amortization (“EBITDA”) as adjusted for items described below

(“Adjusted EBITDA”), EBITDA for Real Estate (“EBITDAre”) and

Adjusted EBITDAre, all non-GAAP measures, as supplemental measures

of our operating performance. Each of these measures is defined as

follows:

We define Adjusted EBITDA as net income (loss) available to the

Company’s common shareholders computed in accordance with GAAP

before net interest expense, income taxes (if applicable),

depreciation and amortization, gains and losses on sale of

operating properties, joint venture properties, outparcels and

other assets, impairment write-downs of depreciated property and of

investment in unconsolidated joint ventures caused by a decrease in

value of depreciated property in the affiliate, compensation

related to voluntary retirement plan and other executive officer

severance, certain executive departure-related adjustments, gain on

sale of non-real estate asset, casualty gains and losses, gains and

losses on early extinguishment of debt, net and other items that we

do not consider indicative of the Company’s ongoing operating

performance.

We determine EBITDAre based on the definition set forth by

Nareit, which is defined as net income (loss) available to the

Company’s common shareholders computed in accordance with GAAP

before net interest expense, income taxes (if applicable),

depreciation and amortization, gains and losses on sale of

operating properties, gains and losses on change of control and

impairment write-downs of depreciated property and of investment in

unconsolidated joint ventures caused by a decrease in value of

depreciated property in the affiliate and after adjustments to

reflect our share of the EBITDAre of unconsolidated joint

ventures.

Adjusted EBITDAre is defined as EBITDAre excluding gains and

losses on early extinguishment of debt, net, casualty gains and

losses, compensation related to voluntary retirement plan and other

executive officer severance, gain on sale of non-real estate asset,

gains and losses on sale of outparcels, and other items that we do

not consider indicative of the Company’s ongoing operating

performance.

We present Adjusted EBITDA, EBITDAre and Adjusted EBITDAre as we

believe they are useful for investors, creditors and rating

agencies as they provide additional performance measures that are

independent of a Company’s existing capital structure to facilitate

the evaluation and comparison of the Company’s operating

performance to other REITs and provide a more consistent metric for

comparing the operating performance of the Company’s real estate

between periods.

Adjusted EBITDA, EBITDAre and Adjusted EBITDAre have significant

limitations as analytical tools, including:

- They do not reflect our net interest expense;

- They do not reflect gains or losses on sales of operating

properties or impairment write-downs of depreciated property and of

investment in unconsolidated joint ventures caused by a decrease in

value of depreciated property in the affiliate;

- Adjusted EBITDA and Adjusted EBITDAre do not reflect gains and

losses on extinguishment of debt and other items that may affect

operations; and

- Other companies in our industry may calculate these measures

differently than we do, limiting its usefulness as a comparative

measure.

Because of these limitations, Adjusted EBITDA, EBITDAre and

Adjusted EBITDAre should not be considered in isolation or as a

substitute for performance measures calculated in accordance with

GAAP. We compensate for these limitations by relying primarily on

our GAAP results and using Adjusted EBITDA, EBITDAre and Adjusted

EBITDAre only as supplemental measures.

Net Debt

We define Net Debt as Total Debt less Cash and Cash Equivalents

and Short-Term Investments and present this metric for both the

consolidated portfolio and for the total portfolio, including the

consolidated portfolio and the Company’s pro rata share of

unconsolidated joint ventures. Net debt is a component of the Net

debt to Adjusted EBITDA ratio, which is defined as Net debt for the

respective portfolio divided by Adjusted EBITDA (consolidated

portfolio) or Adjusted EBITDAre (total portfolio at pro rata

share). We use the Net debt to Adjusted EBITDA and the Net debt to

Adjusted EBITDAre ratios to evaluate the Company’s leverage. We

believe this measure is an important indicator of the Company’s

ability to service its long-term debt obligations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105603395/en/

Investor Contact Information

Doug McDonald SVP, Treasurer and Investments 336-856-6066

tangerir@tanger.com

Media Contact Information

KWT Global Tanger@kwtglobal.com

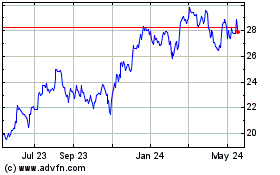

Tanger (NYSE:SKT)

Historical Stock Chart

From Jan 2025 to Feb 2025

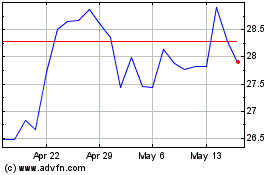

Tanger (NYSE:SKT)

Historical Stock Chart

From Feb 2024 to Feb 2025