Synovus announces pricing of $500 million senior notes offering

October 29 2024 - 4:02PM

Business Wire

Synovus Financial Corp. (“Synovus”) (NYSE: SNV) today announced

the pricing of its previously-announced underwritten public

offering of $500 million of fixed rate / floating rate senior notes

due 2030 (the “Notes”). The Notes will bear interest (i) from and

including November 1, 2024 to but excluding November 1, 2029 at a

fixed rate of 6.168% per annum; and (ii) from and including

November 1, 2029 to but excluding November 1, 2030 in accordance

with the formula for SOFR described in the prospectus supplement

related to the offering, plus 2.347%. The offering is expected to

close on November 1, 2024, subject to customary closing conditions.

Synovus intends to use the net proceeds from the offering for

general corporate purposes, which may include the repayment of

existing debt.

BofA Securities, Inc. and Morgan Stanley & Co. LLC are the

active joint book-running managers for the offering, Synovus

Securities, Inc. is the passive book-running manager for the

offering and Citigroup Global Markets Inc., Goldman Sachs & Co.

LLC, J.P. Morgan Securities LLC, Keefe, Bruyette & Woods, Inc.

and RBC Capital Markets, LLC are the co-managers for the

offering.

Synovus is conducting the offering pursuant to an effective

registration statement under the Securities Act of 1933, as amended

(the “Securities Act”). The offering is being made solely by means

of a separate prospectus supplement and accompanying prospectus.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such state or

jurisdiction. A copy of the final prospectus supplement and

accompanying prospectus relating to the offering can be obtained by

contacting BofA Securities, Inc., NC1-022-02-25, 201 North Tryon

Street, Charlotte, NC 28255-0001, Attn: Prospectus Department,

email: dg.prospectus_requests@bofa.com; or Morgan Stanley & Co.

LLC, Attn: Prospectus Department, 180 Varick Street, 2nd Floor, New

York, NY 10014, email: prospectus@morganstanley.com. Potential

investors should first read the applicable prospectus supplement

and accompanying prospectus, the registration statement and the

other documents that Synovus has filed with the Securities and

Exchange Commission (the “SEC”) in connection with the offering.

Investors may obtain these documents free of charge by visiting the

SEC’s website at www.sec.gov.

Synovus Financial Corp.

Synovus Financial Corp. is a financial services company

based in Columbus, Georgia, with approximately $60 billion in

assets. Synovus provides commercial and consumer banking and a full

suite of specialized products and services, including wealth

services, treasury management, mortgage services, premium finance,

asset-based lending, structured lending, capital markets and

international banking. Synovus has branches in Georgia, Alabama,

Florida, South Carolina and Tennessee. Synovus is a Great Place to

Work-Certified Company. Learn more about Synovus at

synovus.com.

Forward-Looking Statements

This press release and certain of our other filings with the SEC

contain statements that constitute “forward-looking statements”

within the meaning of, and subject to the protections of, Section

27A of the Securities Act and Section 21E of the Securities

Exchange Act of 1934, as amended. All statements other than

statements of historical fact are forward-looking statements. You

can identify these forward-looking statements through Synovus’ use

of words such as “believes,” “anticipates,” “expects,” “may,”

“will,” “assumes,” “predicts,” “could,” “should,” “would,”

“intends,” “targets,” “estimates,” “projects,” “plans,” “potential”

and other similar words and expressions of the future or otherwise

regarding the outlook for Synovus’ future business and financial

performance and/or the performance of the financial services

industry and economy in general. These forward-looking statements

include, among others, our expectations regarding the expected use

of the net proceeds from the offering; our future operating and

financial performance; expectations on our growth strategy, expense

and revenue initiatives, capital management, balance sheet

management, and future profitability; expectations on credit

quality and performance; and the assumptions underlying our

expectations. Prospective investors are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve known and unknown risks and uncertainties which may

cause the actual results, performance or achievements of Synovus to

be materially different from the future results, performance or

achievements expressed or implied by such forward-looking

statements. Forward-looking statements are based on the current

beliefs and expectations of Synovus’ management and are subject to

significant risks and uncertainties. Actual results may differ

materially from those contemplated by such forward-looking

statements. A number of factors could cause actual results to

differ materially from those contemplated by the forward-looking

statements in this press release. Many of these factors are beyond

Synovus’ ability to control or predict.

These forward-looking statements are based upon information

presently known to Synovus’ management and are inherently

subjective, uncertain and subject to change due to any number of

risks and uncertainties, including, without limitation, the risks

and other factors set forth in Synovus’ filings with the SEC,

including its Annual Report on Form 10-K for the year ended

December 31, 2023, under the captions “Forward-Looking Statements”

and “Risk Factors” and in Synovus’ quarterly reports on Form 10-Q

and current reports on Form 8-K. We believe these forward-looking

statements are reasonable; however, undue reliance should not be

placed on any forward-looking statements, which are based on

current expectations and speak only as of the date that they are

made. We do not assume any obligation to update any forward-looking

statements as a result of new information, future developments or

otherwise, except as otherwise may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029663597/en/

Media Contact Audria Belton Media Relations

media@synovus.com

Investor Contact Jennifer H. Demba, CFA Investor

Relations investorrelations@synovus.com

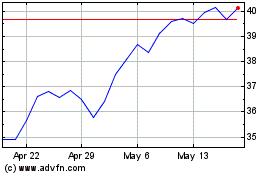

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Jan 2025 to Feb 2025

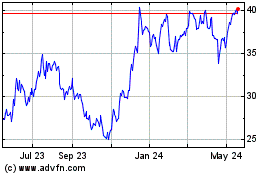

Synovus Financial (NYSE:SNV)

Historical Stock Chart

From Feb 2024 to Feb 2025