Sunlands Technology Group (NYSE: STG) (“Sunlands”

or the “Company”), a leader in China’s adult online education

market and China’s adult personal interest learning market, today

announced its unaudited financial results for the second quarter

ended June 30, 2024.

Second Quarter 2024 Financial and

Operational Snapshots

- Net revenues were RMB492.2 million

(US$67.7 million), compared to RMB526.4 million in the second

quarter of 2023.

- Gross billings (non-GAAP) were

RMB383.9 million (US$52.8 million), compared to RMB354.1 million in

the second quarter of 2023.

- Gross profit was RMB415.6 million

(US$57.2 million), compared to RMB466.9 million in the second

quarter of 2023.

- Net income was RMB82.3 million

(US$11.3 million), compared to RMB173.9 million in the second

quarter of 2023.

- Net income margin1 was 16.7% in the

second quarter of 2024, compared to 33.0% in the second quarter of

2023.

- New student enrollments2 were

168,296, compared to 154,209 in the second quarter of 2023.

- As of June 30, 2024, the Company’s

deferred revenue balance was RMB986.9 million (US$135.8 million),

compared to RMB1,113.9 million as of December 31, 2023.

_______________1 Net income margin is defined as

net income as a percentage of net revenues. 2 New student

enrollments for a given period refer to the total number of orders

placed by students that newly enroll in at least one course during

that period, including those students that enroll and then

terminate their enrollment with us, excluding orders of our

low-price courses, such as “mini courses” and “RMB1 courses”, which

we offer in the form of recorded videos or short live streaming, to

strengthen our competitiveness and improve customer experience.

“In the face of challenging macroeconomic

conditions, our company demonstrated enough strategic flexibility

to deliver solid results in the second quarter. We achieved net

revenues of RMB492.2 million and net income of RMB82.3 million.

This underscored our resilience and ability to adapt in the face of

adversity and demonstrates our strong commitment to cost

optimization and sustainable growth. This solid financial position

not only enables us to respond effectively to unpredictable

circumstances, but also creates opportunities for our business to

grow.

Looking ahead to the second half of the year,

our top priorities are to enhance brand awareness and improve the

quality of our existing products and services. We're taking a

prudent but proactive approach to expanding and refining the

offerings. Our commitment to these key growth initiatives remains

unwavering as we continue to focus on improving operational

efficiency and profitability.” said Mr. Tongbo Liu, Chief Executive

Officer of Sunlands.

Mr. Hangyu Li, Finance Director of Sunlands,

commented, “We had another excellent quarter in our core business.

Although business of post-secondary courses has been rather slow in

recent quarters, we achieved year-over-year growth in gross

billings for the fourth consecutive quarter due to new enrollments

in our interest courses offerings. In addition, we realised net

income of RMB82.3 million and positive operating cash flows for the

quarter. This gives us the confidence to face the challenge in a

dynamic environment. Looking ahead, we will continue to optimize

our courses offerings while maintaining efficient operations. These

strategic initiatives will enable us to capitalize on emerging

opportunities, strengthen our leadership position in the industry

and continue to create value for our shareholders.”

Financial Results for the Second Quarter

of 2024

Net Revenues

In the second quarter of 2024, net revenues

decreased by 6.5% to RMB492.2 million (US$67.7 million) from

RMB526.4 million in the second quarter of 2023. The decrease was

primarily driven by the decline in gross billings from

post-secondary courses over the recent quarters, partially offset

by the growth in revenues from interest courses offerings and sales

of goods such as books and learning materials.

Cost of Revenues

Cost of revenues increased by 28.8% to RMB76.6

million (US$10.5 million) in the second quarter of 2024 from

RMB59.5 million in the second quarter of 2023. The increase was

primarily due to an increase in the cost of revenues from sales of

goods such as books and learning materials.

Gross Profit

Gross profit decreased by 11.0% to RMB415.6

million (US$57.2 million) in the second quarter of 2024 from

RMB466.9 million in the second quarter of 2023.

Operating Expenses

In the second quarter of 2024, operating

expenses were RMB338.9 million (US$46.6 million), representing a

9.0% increase from RMB311.0 million in the second quarter of

2023.

Sales and marketing expenses increased by 10.2%

to RMB297.4 million (US$40.9 million) in the second quarter of 2024

from RMB270.0 million in the second quarter of 2023. The increase

was mainly due to a growth in spending on sales activities,

including enhanced compensation for sales personnel as well as

increased spending on branding and marketing activities focusing on

interest courses offerings.

General and administrative expenses increased by

2.2% to RMB33.8 million (US$4.7 million) in the second quarter of

2024 from RMB33.1 million in the second quarter of 2023.

Product development expenses decreased by 4.2%

to RMB7.7 million (US$1.1 million) in the second quarter of 2024

from RMB8.0 million in the second quarter of 2023. The decrease was

mainly due to declined compensation expenses related to headcount

reduction of our product development personnel.

Net Income

Net income for the second quarter of 2024 was

RMB82.3 million (US$11.3 million), as compared to RMB173.9 million

in the second quarter of 2023.

Basic and Diluted Net Income Per

Share

Basic and diluted net income per share was

RMB12.00 (US$1.65) in the second quarter of 2024.

Cash, Cash Equivalents, Restricted Cash

and Short-term Investments

As of June 30, 2024, the Company had RMB758.6

million (US$104.4 million) of cash, cash equivalents and restricted

cash and RMB243.9 million (US$33.6 million) of short-term

investments, as compared to RMB766.4 million of cash, cash

equivalents and restricted cash and RMB142.1 million of short-term

investments as of December 31, 2023.

Deferred Revenue

As of June 30, 2024, the Company had a deferred

revenue balance of RMB986.9 million (US$135.8 million), as compared

to RMB1,113.9 million as of December 31, 2023.

Share Repurchase

On December 6, 2021, the Company’s board of

directors authorized a share repurchase program, under which the

Company may repurchase up to US$15.0 million of Class A ordinary

shares in the form of ADSs over the next 24 months. On December 1,

2023, the Company’s board of directors authorized to extend its

share repurchase program over the next 24 months. As of August 14,

2024, the Company had repurchased an aggregate of 542,172 ADSs for

approximately US$2.9 million under the share repurchase

program.

Financial Results for the First Six

Months of 2024

Net Revenues

In the first six months of 2024, net revenues

decreased by 7.1% to RMB1,015.5 million (US$139.7 million) from

RMB1,093.2 million in the first six months of 2023.

Cost of Revenues

Cost of revenues increased by 20.5% to RMB153.8

million (US$21.2 million) in the first six months of 2024 from

RMB127.6 million in the first six months of 2023. The increase was

primarily due to an increase in the cost of revenues from sales of

goods such as books and learning materials.

Gross Profit

Gross profit decreased by 10.8% to RMB861.7

million (US$118.6 million) from RMB965.6 million in the first six

months of 2023.

Operating Expenses

In the first six months of 2023, operating

expenses were RMB680.1 million (US$93.6 million), representing a

7.6% increase from RMB631.8 million in the first six months of

2023.

Sales and marketing expenses increased by 10.6%

to RMB599.0 million (US$82.4 million) in the first six months of

2024 from RMB541.4 million in the first six months of 2023.

General and administrative expenses decreased by

8.7% to RMB66.4 million (US$9.1 million) in the first six months of

2024 from RMB72.7 million in the first six months of 2023. The

decrease was mainly due to the decline in rental expenses as

certain leases for office space were partially terminated in 2023

before the expiration of the lease term for cost saving.

Product development expenses decreased by 17.0%

to RMB14.7 million (US$2.0 million) in the first six months of 2024

from RMB17.7 million in the first six months of 2023.

Net Income

Net income for the first six months of 2024 was

RMB195.0 million (US$26.8 million), compared with RMB354.0 million

in the first six months of 2023.

Basic and Diluted Net Income Per

Share

Basic and diluted net income per share was

RMB28.44 (US$3.91) in the first six months of 2024, compared with

RMB51.13 in the first six months of 2023.

Outlook

For the third quarter of 2024, Sunlands

currently expects net revenues to be between RMB490 million to

RMB510 million, which would represent a decrease of 2.8% to 6.6%

year-over-year. The above outlook is based on the current market

conditions and reflects the Company’s current and preliminary

estimates of market and operating conditions and customer demand,

which are all subject to substantial uncertainty.

Exchange Rate

The Company’s business is primarily conducted in

China and all revenues are denominated in Renminbi (“RMB”). This

announcement contains currency conversions of RMB amounts into U.S.

dollars (“US$”) solely for the convenience of the reader. Unless

otherwise noted, all translations from RMB to US$ are made at a

rate of RMB7.2672 to US$1.00, the effective noon buying rate for

June 28, 2024 as set forth in the H.10 statistical release of the

Federal Reserve Board. No representation is made that the RMB

amounts could have been, or could be, converted, realized or

settled into US$ at that rate on June 28, 2024, or at any other

rate.

Conference Call and Webcast

Sunlands’ management team will host a conference

call at 7:00 AM U.S. Eastern Time, (7:00 PM Beijing/Hong Kong time)

on August 16, 2024, following the quarterly results

announcement.

For participants who wish to join the call,

please access the link provided below to complete online

registration 15 minutes prior to the scheduled call start time.

Upon registration, participants will receive details for the

conference call, including dial-in numbers, a personal PIN and an

e-mail with detailed instructions to join the conference call.

Registration Link:

https://register.vevent.com/register/BI825ca1738fae48d2807c6faff61460db

Additionally, a live webcast and archive of the

conference call will be available on the Investor Relations section

of Sunlands’ website at https://ir.sunlands.com/.

About Sunlands

Sunlands Technology Group (NYSE: STG)

(“Sunlands” or the “Company”), formerly known as Sunlands Online

Education Group, is a leader in China’s adult online education

market and China’s adult personal interest learning market. With a

one to many live streaming platform, Sunlands offers various

interest, professional skills and professional certification

preparation courses as well as degree- or diploma-oriented

post-secondary courses. Students can access the Company’s services

either through PC or mobile applications. The Company’s online

platform cultivates a personalized, interactive learning

environment by featuring a virtual learning community and a vast

library of educational content offerings that adapt to the learning

habits of its students. Sunlands offers a unique approach to

education research and development that organizes subject content

into Learning Outcome Trees, the Company’s proprietary knowledge

management system. Sunlands has a deep understanding of the

educational needs of its prospective students and offers solutions

that help them achieve their goals.

About Non-GAAP Financial

Measures

We use gross billings, EBITDA,

non-GAAP operating cost and expenses, non-GAAP income

from operations and Non-GAAP net income per share, each a non-GAAP

financial measure, in evaluating our operating results and for

financial and operational decision-making purposes.

We define gross billings for a specific period

as the total amount of cash received for the sale of course

packages, net of the total amount of refunds paid in such period.

Our management uses gross billings as a performance measurement

because we generally bill our students for the entire course

tuition at the time of sale of our course packages and recognize

revenue proportionally over a period. EBITDA is defined as net

income excluding depreciation and amortization, interest expense,

interest income, and income tax expenses. We believe that gross

billings and EBITDA provide valuable insight into the sales of our

course packages and the performance of our business.

These non-GAAP financial measures should not be

considered in isolation from, or as a substitute for, their most

directly comparable financial measure prepared in accordance with

GAAP. A reconciliation of the historical non-GAAP financial

measures to their respective most directly comparable GAAP measure

has been provided in the tables included below. Investors are

encouraged to review the reconciliation of the historical non-GAAP

financial measures to their respective most directly comparable

GAAP financial measures. As gross billings, EBITDA, operating cost

and expenses excluding share-based compensation expenses, general

and administrative expenses excluding share-based compensation

expenses, sales and marketing expenses excluding share-based

compensation expenses, product development expenses excluding

share-based compensation expenses, non-GAAP net income exclude

share-based compensation expenses, and basic and diluted net income

per share excluding share-based compensation expenses have

material limitations as an analytical metric and may not be

calculated in the same manner by all companies, it may not be

comparable to other similarly titled measures used by other

companies. In light of the foregoing limitations, you should not

consider gross billings and EBITDA as a substitute for, or superior

to, their respective most directly comparable financial measures

prepared in accordance with GAAP. We encourage investors and others

to review our financial information in its entirety and not rely on

a single financial measure.

Safe Harbor Statement

This press release contains forward-looking

statements made under the “safe harbor” provisions of Section 21E

of the Securities Exchange Act of 1934, as amended, and the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “confident” and similar statements.

Sunlands may also make written or oral forward-looking statements

in its reports filed with or furnished to the U.S. Securities and

Exchange Commission, in its annual report to shareholders, in press

releases and other written materials and in oral statements made by

its officers, directors or employees to third parties. Any

statements that are not historical facts, including statements

about Sunlands’ beliefs and expectations, are forward-looking

statements that involve factors, risks and uncertainties that could

cause actual results to differ materially from those in the

forward-looking statements. Such factors and risks include, but not

limited to the following: Sunlands’ goals and strategies; its

expectations regarding demand for and market acceptance of its

brand and services; its ability to retain and increase student

enrollments; its ability to offer new courses and educational

content; its ability to improve teaching quality and students’

learning results; its ability to improve sales and marketing

efficiency and effectiveness; its ability to engage, train and

retain new faculty members; its future business development,

results of operations and financial condition; its ability to

maintain and improve technology infrastructure necessary to operate

its business; competition in the online education industry in

China; relevant government policies and regulations relating to

Sunlands’ corporate structure, business and industry; and general

economic and business condition in China Further information

regarding these and other risks, uncertainties or factors is

included in the Sunlands’ filings with the U.S. Securities and

Exchange Commission. All information provided in this press release

is current as of the date of the press release, and Sunlands does

not undertake any obligation to update such information, except as

required under applicable law.

For investor and media enquiries, please

contact: Sunlands Technology Group Investor Relations

Email: sl-ir@sunlands.com SOURCE: Sunlands Technology Group

| |

| SUNLANDS

TECHNOLOGY GROUP UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS (Amounts in thousands, except for

share and per share data, or otherwise noted) |

|

|

| |

|

As of December 31, |

|

As of June 30, |

|

|

|

2023 |

|

2024 |

|

2024 |

| |

|

RMB |

|

RMB |

|

US$ |

| ASSETS |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

763,800 |

|

753,559 |

|

103,693 |

|

Restricted cash |

|

2,578 |

|

5,013 |

|

690 |

|

Short-term investments |

|

142,084 |

|

243,858 |

|

33,556 |

|

Prepaid expenses and other current assets |

|

109,018 |

|

120,156 |

|

16,534 |

|

Deferred costs, current |

|

14,274 |

|

6,708 |

|

923 |

| Total

current assets |

|

1,031,754 |

|

1,129,294 |

|

155,396 |

| |

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

|

Property and equipment, net |

|

786,670 |

|

772,389 |

|

106,284 |

|

Intangible assets, net |

|

975 |

|

1,011 |

|

139 |

|

Right-of-use assets |

|

135,820 |

|

128,418 |

|

17,671 |

|

Deferred costs, non-current |

|

68,773 |

|

59,582 |

|

8,199 |

|

Long-term investments |

|

61,354 |

|

49,179 |

|

6,767 |

|

Deferred tax assets |

|

- |

|

14,713 |

|

2,025 |

|

Other non-current assets |

|

33,160 |

|

34,190 |

|

4,705 |

| Total

non-current assets |

|

1,086,752 |

|

1,059,482 |

|

145,790 |

| TOTAL

ASSETS |

|

2,118,506 |

|

2,188,776 |

|

301,186 |

| SUNLANDS

TECHNOLOGY GROUP UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS (Amounts in thousands, except for

share and per share data, or otherwise noted) |

| |

| |

|

As of December 31, |

|

As of June 30, |

|

|

|

2023 |

|

2024 |

|

2024 |

| |

|

RMB |

|

RMB |

|

US$ |

| LIABILITIES

AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

Accrued expenses and other current liabilities |

|

409,691 |

|

|

424,117 |

|

|

58,362 |

|

|

Deferred revenue, current |

|

553,812 |

|

|

426,030 |

|

|

58,624 |

|

|

Lease liabilities, current portion |

|

8,019 |

|

|

8,673 |

|

|

1,193 |

|

|

Long-term debt, current portion |

|

38,654 |

|

|

38,654 |

|

|

5,319 |

|

| Total

current liabilities |

|

1,010,176 |

|

|

897,474 |

|

|

123,498 |

|

| |

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

|

Deferred revenue, non-current |

|

560,111 |

|

|

560,908 |

|

|

77,184 |

|

|

Lease liabilities, non-current portion |

|

157,269 |

|

|

152,944 |

|

|

21,046 |

|

|

Deferred tax liabilities |

|

3,742 |

|

|

2,841 |

|

|

391 |

|

|

Other non-current liabilities |

|

6,994 |

|

|

7,256 |

|

|

998 |

|

|

Long-term debt |

|

104,665 |

|

|

85,338 |

|

|

11,743 |

|

| Total

non-current liabilities |

|

832,781 |

|

|

809,287 |

|

|

111,362 |

|

| TOTAL

LIABILITIES |

|

1,842,957 |

|

|

1,706,761 |

|

|

234,860 |

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Class A ordinary shares (par value of US$0.00005, 796,062,195

shares |

|

|

|

|

|

|

|

authorized; 3,131,807 and 3,131,807 shares issued as of December

31, 2023 |

|

|

|

|

|

|

|

and June 30, 2024, respectively; 2,702,523 and 2,687,391

shares |

|

|

|

|

|

|

|

outstanding as of December 31, 2023 and June 30, 2024,

respectively) |

|

1 |

|

|

1 |

|

|

- |

|

|

Class B ordinary shares (par value of US$0.00005, 826,389

shares |

|

|

|

|

|

|

|

authorized; 826,389 and 826,389 shares issued and outstanding |

|

|

|

|

|

|

|

as of December 31, 2023 and June 30, 2024, respectively) |

|

- |

|

|

- |

|

|

- |

|

|

Class C ordinary shares (par value of US$0.00005, 203,111,416

shares |

|

|

|

|

|

|

|

authorized; 3,332,062 and 3,332,062 shares issued and

outstanding |

|

|

|

|

|

|

|

as of December 31, 2023 and June 30, 2024, respectively) |

|

1 |

|

|

1 |

|

|

- |

|

|

Treasury stock |

|

- |

|

|

- |

|

|

- |

|

| Accumulated

deficit |

|

(2,171,284 |

) |

|

(1,976,297 |

) |

|

(271,948 |

) |

| Additional

paid-in capital |

|

2,305,042 |

|

|

2,303,270 |

|

|

316,940 |

|

| Accumulated

other comprehensive income |

|

143,276 |

|

|

156,527 |

|

|

21,539 |

|

| Total

Sunlands Technology Group shareholders’ equity |

|

277,036 |

|

|

483,502 |

|

|

66,531 |

|

|

Non-controlling interest |

|

(1,487 |

) |

|

(1,487 |

) |

|

(205 |

) |

| TOTAL

SHAREHOLDERS’ EQUITY |

|

275,549 |

|

|

482,015 |

|

|

66,326 |

|

| TOTAL

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

2,118,506 |

|

|

2,188,776 |

|

|

301,186 |

|

| SUNLANDS

TECHNOLOGY GROUP UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (Amounts in thousands,

except for share and per share data, or otherwise

noted) |

| |

| |

|

For the Three Months Ended June 30, |

| |

|

2023 |

|

2024 |

|

2024 |

| |

|

RMB |

|

RMB |

|

US$ |

|

Net revenues |

|

526,353 |

|

|

492,223 |

|

|

67,732 |

|

| Cost of

revenues |

|

(59,491 |

) |

|

(76,627 |

) |

|

(10,544 |

) |

| Gross

profit |

|

466,862 |

|

|

415,596 |

|

|

57,188 |

|

| |

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

Sales and marketing expenses |

|

(269,969 |

) |

|

(297,443 |

) |

|

(40,930 |

) |

|

Product development expenses |

|

(7,992 |

) |

|

(7,657 |

) |

|

(1,054 |

) |

|

General and administrative expenses |

|

(33,085 |

) |

|

(33,829 |

) |

|

(4,655 |

) |

| Total

operating expenses |

|

(311,046 |

) |

|

(338,929 |

) |

|

(46,639 |

) |

| Income from

operations |

|

155,816 |

|

|

76,667 |

|

|

10,549 |

|

| Interest

income |

|

7,561 |

|

|

10,576 |

|

|

1,455 |

|

| Interest

expense |

|

(2,046 |

) |

|

(1,516 |

) |

|

(209 |

) |

| Other

income, net |

|

8,171 |

|

|

3,015 |

|

|

415 |

|

| Gain/(loss)

on disposal of subsidiaries |

|

247 |

|

|

(250 |

) |

|

(34 |

) |

| Income

before income tax benefit |

|

|

|

|

|

|

|

and gain/(loss) from equity method investments |

|

169,749 |

|

|

88,492 |

|

|

12,176 |

|

| Income tax

benefit |

|

1,404 |

|

|

78 |

|

|

11 |

|

| Gain/(loss)

from equity method investments |

|

2,730 |

|

|

(6,318 |

) |

|

(869 |

) |

| Net

income |

|

173,883 |

|

|

82,252 |

|

|

11,318 |

|

| |

|

|

|

|

|

|

| Less: net

income attributable to non-controlling interest |

|

- |

|

|

- |

|

|

- |

|

| Net income

attributable to Sunlands Technology Group |

|

173,883 |

|

|

82,252 |

|

|

11,318 |

|

| Net income

per share attributable to ordinary shareholders of |

|

|

|

|

|

|

|

Sunlands Technology Group: |

|

|

|

|

|

|

|

Basic and diluted |

|

25.12 |

|

|

12.00 |

|

|

1.65 |

|

| Weighted

average shares used in calculating net income |

|

|

|

|

|

|

|

per ordinary share: |

|

|

|

|

|

|

|

Basic and diluted |

|

6,921,304 |

|

|

6,852,828 |

|

|

6,852,828 |

|

| SUNLANDS

TECHNOLOGY GROUP UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME (Amounts in

thousands) |

|

|

| |

|

For the Three Months Ended June 30, |

|

|

|

2023 |

|

2024 |

|

2024 |

| |

|

RMB |

|

RMB |

|

US$ |

| Net

income |

|

173,883 |

|

82,252 |

|

11,318 |

| Other

comprehensive income, net of tax effect of nil: |

|

|

|

|

|

|

| Change in

cumulative foreign currency translation adjustments |

|

29,603 |

|

3,715 |

|

511 |

| Total

comprehensive income |

|

203,486 |

|

85,967 |

|

11,829 |

| Less:

comprehensive income attributable to non-controlling interest |

|

- |

|

- |

|

- |

|

Comprehensive income attributable to Sunlands Technology Group |

|

203,486 |

|

85,967 |

|

11,829 |

| SUNLANDS

TECHNOLOGY GROUP RECONCILIATION OF GAAP AND

NON-GAAP RESULTS (Amounts in

thousands) |

|

|

| |

|

For the Three Months Ended June 30, |

| |

|

2023 |

|

2024 |

| |

|

RMB |

|

RMB |

|

Net revenues |

|

526,353 |

|

|

492,223 |

|

| Less: other

revenues |

|

(42,377 |

) |

|

(62,094 |

) |

| Add: tax and

surcharges |

|

9,779 |

|

|

15,740 |

|

| Add: ending

deferred revenue |

|

1,379,073 |

|

|

986,938 |

|

| Add: ending

refund liability |

|

107,319 |

|

|

126,797 |

|

| Less:

beginning deferred revenue |

|

(1,513,896 |

) |

|

(1,044,866 |

) |

| Less:

beginning refund liability |

|

(112,188 |

) |

|

(130,840 |

) |

| Gross

billings (non-GAAP) |

|

354,063 |

|

|

383,898 |

|

| |

|

|

|

|

| Net

income |

|

173,883 |

|

|

82,252 |

|

| Add: income

tax benefit |

|

(1,404 |

) |

|

(78 |

) |

| Add:

depreciation and amortization |

|

7,677 |

|

|

7,362 |

|

| Add:

interest expense |

|

2,046 |

|

|

1,516 |

|

| Less:

interest income |

|

(7,561 |

) |

|

(10,576 |

) |

| EBITDA

(non-GAAP) |

|

174,641 |

|

|

80,476 |

|

| SUNLANDS

TECHNOLOGY GROUP UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (Amounts in thousands,

except for share and per share data, or otherwise

noted) |

| |

| |

|

For the Six Months Ended June 30, |

| |

|

2023 |

|

2024 |

|

2024 |

| |

|

RMB |

|

RMB |

|

US$ |

|

Net revenues |

|

1,093,229 |

|

|

1,015,463 |

|

|

139,732 |

|

| Cost of

revenues |

|

(127,646 |

) |

|

(153,790 |

) |

|

(21,162 |

) |

| Gross

profit |

|

965,583 |

|

|

861,673 |

|

|

118,570 |

|

| |

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

Sales and marketing expenses |

|

(541,383 |

) |

|

(599,018 |

) |

|

(82,428 |

) |

|

Product development expenses |

|

(17,672 |

) |

|

(14,667 |

) |

|

(2,018 |

) |

|

General and administrative expenses |

|

(72,725 |

) |

|

(66,381 |

) |

|

(9,134 |

) |

| Total

operating expenses |

|

(631,780 |

) |

|

(680,066 |

) |

|

(93,580 |

) |

| Income from

operations |

|

333,803 |

|

|

181,607 |

|

|

24,990 |

|

| Interest

income |

|

14,122 |

|

|

19,865 |

|

|

2,734 |

|

| Interest

expense |

|

(4,170 |

) |

|

(3,120 |

) |

|

(429 |

) |

| Other

income, net |

|

16,969 |

|

|

8,795 |

|

|

1,210 |

|

| Gain/(loss)

on disposal of subsidiaries |

|

247 |

|

|

(250 |

) |

|

(34 |

) |

| Income

before income tax (expenses)/benefit |

|

|

|

|

|

|

|

and loss from equity method investments |

|

360,971 |

|

|

206,897 |

|

|

28,471 |

|

| Income tax

(expenses)/benefit |

|

(6,327 |

) |

|

469 |

|

|

65 |

|

| Loss from

equity method investments |

|

(654 |

) |

|

(12,379 |

) |

|

(1,703 |

) |

| Net

income |

|

353,990 |

|

|

194,987 |

|

|

26,833 |

|

| |

|

|

|

|

|

|

| Less: net

income attributable to non-controlling interest |

|

1 |

|

|

- |

|

|

- |

|

| Net income

attributable to Sunlands Technology Group |

|

353,989 |

|

|

194,987 |

|

|

26,833 |

|

| Net income

per share attributable to ordinary shareholders of |

|

|

|

|

|

|

|

Sunlands Technology Group: |

|

|

|

|

|

|

|

Basic and diluted |

|

51.13 |

|

|

28.44 |

|

|

3.91 |

|

| Weighted

average shares used in calculating net income |

|

|

|

|

|

|

|

per ordinary share: |

|

|

|

|

|

|

|

Basic and diluted |

|

6,923,858 |

|

|

6,854,922 |

|

|

6,854,922 |

|

| SUNLANDS

TECHNOLOGY GROUP UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME (Amounts in

thousands) |

|

|

| |

|

For the Six Months Ended June 30, |

|

|

|

2023 |

|

2024 |

|

2024 |

| |

|

RMB |

|

RMB |

|

US$ |

| Net

income |

|

353,990 |

|

194,987 |

|

26,833 |

| Other

comprehensive income, net of tax effect of nil: |

|

|

|

|

|

|

| Change in

cumulative foreign currency translation adjustments |

|

27,276 |

|

13,251 |

|

1,823 |

| Total

comprehensive income |

|

381,266 |

|

208,238 |

|

28,656 |

| Less:

comprehensive income attributable to non-controlling interest |

|

1 |

|

- |

|

- |

|

Comprehensive income attributable to Sunlands Technology Group |

|

381,265 |

|

208,238 |

|

28,656 |

| SUNLANDS

TECHNOLOGY GROUP RECONCILIATION OF GAAP AND

NON-GAAP RESULTS (Amounts in

thousands) |

|

|

| |

|

For the Six Months Ended June 30, |

| |

|

2023 |

|

2024 |

| |

|

RMB |

|

RMB |

|

Net revenues |

|

1,093,229 |

|

|

1,015,463 |

|

| Less: other

revenues |

|

(84,224 |

) |

|

(120,968 |

) |

| Add: tax and

surcharges |

|

27,774 |

|

|

32,109 |

|

| Add: ending

deferred revenue |

|

1,379,073 |

|

|

986,938 |

|

| Add: ending

refund liability |

|

107,319 |

|

|

126,797 |

|

| Less:

beginning deferred revenue |

|

(1,690,946 |

) |

|

(1,113,923 |

) |

| Less:

beginning refund liability |

|

(133,066 |

) |

|

(143,744 |

) |

| Gross

billings (non-GAAP) |

|

699,159 |

|

|

782,672 |

|

| |

|

|

|

|

| Net

income |

|

353,990 |

|

|

194,987 |

|

| Add: income

tax expenses/(benefit) |

|

6,327 |

|

|

(469 |

) |

| Add:

depreciation and amortization |

|

15,267 |

|

|

14,793 |

|

| Add:

interest expense |

|

4,170 |

|

|

3,120 |

|

| Less:

interest income |

|

(14,122 |

) |

|

(19,865 |

) |

| EBITDA

(non-GAAP) |

|

365,632 |

|

|

192,566 |

|

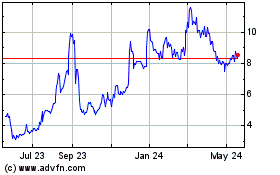

Sunlands Technology (NYSE:STG)

Historical Stock Chart

From Feb 2025 to Mar 2025

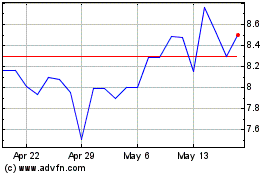

Sunlands Technology (NYSE:STG)

Historical Stock Chart

From Mar 2024 to Mar 2025