Stantec (TSX, NYSE:STN), a global leader in sustainable design and

engineering, released its third quarter 2024 results today which

are underpinned by continued strong demand and solid project

execution.

During the quarter, net revenue increased 15.8% year-over-year

to $1.5 billion, primarily driven by 7.8% acquisition and 6.5%

organic net revenue growth1. Organic growth was achieved in each of

Stantec's regional and business operating units, with the exception

of Energy & Resources. Double-digit organic growth was achieved

in both the Water and Buildings businesses of 11.9% and 10.0%,

respectively. Adjusted EBITDA for the third quarter of 2024

increased 13.8% or $33.3 million, and adjusted EBITDA margin was

18.0%. Stantec delivered diluted earnings per share (EPS) of $0.90

and adjusted diluted EPS of $1.30, a 14% year-over-year increase.

Backlog at September 30, 2024 increased to $7.3 billion, setting a

new all-time record.

“Stantec’s momentum continued throughout the third quarter of

2024, showcasing exceptional growth in both revenue and earnings,”

said Gord Johnston, President and CEO. "With our strong third

quarter results, 2024 is looking to be another record setting year.

We now expect to be near the high end of our previously disclosed

net revenue range, and we are raising our adjusted EPS outlook for

the year,” Mr. Johnston continued, “We’ve made great progress

towards our 2024-2026 strategic plan. With our record backlog of

$7.3 billion, and a robust set of further growth opportunities in

front of us, we are confident we can successfully execute on our

plan and continue to deliver compelling shareholder value in the

years to come.”

____________________________1 Adjusted diluted EPS, adjusted net

income, adjusted EBITDA, and adjusted EBITDA margin are non-IFRS

measures, and organic growth, acquisition growth and DSO are other

financial measures (discussed in the Definitions section of the Q3

2024 MD&A).

2024 Outlook

Based on continued strong performance in Q3 2024

and expectations for Q4, Stantec is raising certain targets in our

guidance and narrowing ranges further as follows:

|

|

Previously Published 2024 Annual Range |

Revised 2024 Annual Range |

|

Targets |

|

|

| Net revenue growth |

12% to 15% |

14.5% to 15.0% |

| Adjusted EBITDA as % of net

revenue (note) |

16.5% to 16.9% |

16.5% to 16.9% |

| Adjusted net income as % of

net revenue (note) |

above 8% |

above 8% |

| Adjusted diluted EPS growth

(note) |

12% to 16% |

16% to 18% |

|

Adjusted ROIC (note) |

above 11% |

above 12% |

Stantec's targets and guidance initially assumed the average

value for the US dollar to be $1.35, GBP to be $1.70, and AU dollar

$0.90; Stantec now assumes the US dollar to be $1.36, GBP to be

$1.76, and AU dollar to be $0.91. For all other underlying

assumptions, see the Assumptions section of the Q3 2024 MD&A.

These targets do not include the impact of revaluing our

share-based compensation, which fluctuates primarily due to share

price movements subsequent to December 31, 2023, as further

described below.

note: Adjusted EBITDA, adjusted net income, adjusted diluted

EPS, and adjusted ROIC are non-IFRS measures discussed in

the Definitions section of the Q3 2024 MD&A.

Stantec's outlook for net revenue growth remains robust. The

Company now expects net revenue growth to be in the range of 14.5%

to 15.0% from 12% to 15%. Stantec reaffirms expectations for

organic net revenue growth in the mid to high-single digits. The

Company continues to expect the US and Global regions to deliver

organic growth in the mid to high-single digits and Canada to be in

the mid-single digits. Stantec expects acquisition net revenue

growth to be in the high-single digits.

The Company's target range for adjusted EBITDA margin remains at

16.5% to 16.9%. This reflects the continuing confidence in solid

project execution and operational performance. Stantec continues to

expect adjusted net income to achieve a margin above 8%. With the

increased expectations for net revenue growth, Stantec now expects

adjusted diluted EPS growth to be in the range of 16% to 18% from

12% to 16%, and adjusted ROIC to now be above 12% from 11%.

The retrospective revision impact from the change in accounting

policy related to the treatment of deferred payments in a business

combination did not have an impact to our targets as the impacts

are included as adjusted items associated with acquisition

integration costs (see Change in Accounting Policy in Stantec's Q3

2024 MD&A).

Effect of Long-term Incentive PlanConsistent with guidance

previously provided, the targets do not include the impact of

revaluing Stantec's share-based compensation, which fluctuates

primarily due to share price movements subsequent to December 31,

2023. Year to date, the revaluation resulted in a $2.6 million

expense (pre-tax), the equivalent of 6 basis points as a percentage

of net revenue and less than $0.02 EPS. If the LTIP metrics

existing at Q3 2024 remain constant to the end of the year, the

impact of higher share-based compensation expense for the remaining

quarter would be negligible, and the full year impact would be

approximately $2.0 million (pre-tax) or $0.01 EPS.

The above targets do not include any assumptions for additional

acquisitions given the unpredictable nature of the size and timing

of such acquisitions, or the impact from share price movements

subsequent to December 31, 2023 and the relative total shareholder

return components on our share-based compensation programs.

Q3 2024 compared to Q3 2023

- Net revenue

increased 15.8% or $208.0 million, to $1.5 billion, primarily

driven by 7.8% acquisition and 6.5% organic net revenue growth.

Stantec achieved organic growth in all regional and business

operating units with the exception of Energy & Resources.

Double-digit organic growth was achieved in the Water and Buildings

businesses.

- Project margin

increased 14.8% or $107.0 million, to $828.1 million. As

a percentage of net revenue, project margin decreased by 50 basis

points to 54.3% reflecting a minor shift in project mix and certain

project recoveries and change order approvals in the prior

period.

- Adjusted EBITDA increased 13.8% or $33.3 million, to $274.6

million. Adjusted EBITDA margin was 18.0%, in line with the

Company's expectations. Compared to Q3 2023, adjusted EBITDA margin

decreased by 30 basis points and by 110 basis points when

normalized for the Q3 2023 increase in long-term incentive plan

(LTIP) expense that resulted from strong price appreciation in the

prior period. The quarter-over-quarter change in margin primarily

reflects lower project margins as a percentage of net revenue and

higher administrative and marketing expenses as a percentage of net

revenue due in part to increased software costs to support growth

and slightly lower utilization due to staff transitioning from the

wind down of certain major projects to new projects.

- Net income increased

1.9% or $1.9 million, to $103.2 million, and diluted EPS of $0.90

was largely consistent, compared to Q3 2023 at $0.91, mainly due to

strong net revenue growth, partly offset by a non-cash lease

impairment charge of $13.7 million resulting from the Company's

real estate optimization strategy and higher administrative and

marketing expenses as a percentage of net revenue.

- Adjusted net income

grew 16.7% or $21.2 million, to $147.9 million, achieving 9.7% of

net revenue—an increase of 10 basis points. Adjusted diluted EPS

increased 14.0% or $0.16, to $1.30. The LTIP revaluation had an

upward impact of $0.03 on our Q3 2024 adjusted diluted EPS and a

downward impact of $0.05 in Q3 2023.

- Contract backlog

remains robust and increased to $7.3 billion at September 30,

2024, reflecting 9.5% acquisition growth and 4.7% organic growth

from December 31, 2023. Compared to September 30, 2023,

Stantec's backlog grew 5.5%, organically. Organic backlog growth

was achieved in all regional and business operating units, with the

exception of Environmental Services which remained consistent.

Contract backlog represents approximately 12 months of work.

- Operating cash flows

decreased $33.8 million or 15.9%, with cash inflows of $178.9

million, reflecting an increased investment in net working capital

to support organic growth and the financial system integration of

Morrison Hershfield which began this quarter.

- DSO was 80 days,

remaining within the target of 80 days.

- Net debt to adjusted

EBITDA (on a trailing twelve-month basis) at September 30,

2024 was 1.5x, reflecting the funding of recent acquisitions, and

remaining within the internal target range of 1.0x to 2.0x.

- On November 7,

2024, the Company's Board of Directors declared a dividend of $0.21

per share, payable on January 15, 2025, to shareholders of

record on December 31, 2024.

Year-to-date Q3 2024 compared to year-to-date Q3

2023

- Net revenue

increased 14.8% or $564.2 million, to $4.4 billion, primarily

driven by 7.4% acquisition and 6.7% organic net revenue growth.

Stantec achieved organic growth in all regional and business

operating units with the exception of Energy & Resources.

Double-digit organic growth was achieved in the Water and Buildings

businesses.

- Project margin

increased $307.2 million or 14.8%, to $2,382.3 million. As a

percentage of net revenue, project margin remained consistent with

the prior period at 54.3%.

- Adjusted EBITDA

increased $97.4 million or 15.3%, to $733.8 million. Adjusted

EBITDA margin increased by 10 basis points over the prior period to

16.7% and decreased by 40 basis points after normalizing for the

LTIP revaluation. The year over year change to adjusted EBITDA

margin primarily reflects higher administrative and marketing

expenses as a percentage of net revenue resulting from claim

provision estimates increasing to historically normal levels

compared to 2023 and slightly lower utilization due to staff

transitioning from the wind down of certain major projects to new

projects.

- Net income increased

7.1% or $17.5 million, to $263.5 million, and diluted EPS

increased 4.1%, or $0.09, to $2.31, mainly due to strong net

revenue growth, partly offset by a non-cash lease impairment charge

of $30.6 million resulting from our real estate optimization

strategy.

- Adjusted net income

grew 19.3% or $61.1 million, to $378.1 million, achieving 8.6% of

net revenue—an increase of 30 basis points, and adjusted diluted

EPS increased 15.7%, or $0.45, to $3.31. The LTIP revaluation

impact was $0.02 on the 2024 year-to-date adjusted diluted EPS and

$0.15 in the comparative period.

- Operating cash flows

increased $35.4 million or 13.6%, with cash inflows of

$296.3 million, reflecting continued strong organic revenue

growth, partly offset by an increased investment in net working

capital in support of organic revenue growth and the impact from

the Morrison Hershfield financial system integration.

Q3 2024 Financial Highlights

| |

For the quarter endedSeptember 30, |

For the three quarters endedSeptember 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

(In millions of Canadian dollars, except per share amounts and

percentages) |

$ |

|

% of NetRevenue |

|

$ |

|

% of NetRevenue |

|

$ |

|

% of NetRevenue |

|

$ |

|

% of NetRevenue |

|

|

Gross revenue |

1,929.4 |

|

126.5 |

% |

1,693.2 |

|

128.6 |

% |

5,540.5 |

|

126.3 |

% |

4,870.6 |

|

127.4 |

% |

| Net

revenue |

1,524.8 |

|

100.0 |

% |

1,316.8 |

|

100.0 |

% |

4,388.2 |

|

100.0 |

% |

3,824.0 |

|

100.0 |

% |

| Direct

payroll costs |

696.7 |

|

45.7 |

% |

595.7 |

|

45.2 |

% |

2,005.9 |

|

45.7 |

% |

1,748.9 |

|

45.7 |

% |

|

Project margin |

828.1 |

|

54.3 |

% |

721.1 |

|

54.8 |

% |

2,382.3 |

|

54.3 |

% |

2,075.1 |

|

54.3 |

% |

|

Administrative and marketing expenses (note 1) |

571.6 |

|

37.5 |

% |

490.8 |

|

37.3 |

% |

1,695.8 |

|

38.6 |

% |

1,477.5 |

|

38.6 |

% |

| Depreciation of property and

equipment |

17.4 |

|

1.1 |

% |

14.8 |

|

1.1 |

% |

50.4 |

|

1.1 |

% |

45.0 |

|

1.2 |

% |

| Depreciation of lease

assets |

31.7 |

|

2.1 |

% |

30.1 |

|

2.3 |

% |

95.2 |

|

2.2 |

% |

91.2 |

|

2.4 |

% |

| Net impairment (reversal) of

lease assets |

13.7 |

|

0.9 |

% |

(0.8 |

) |

(0.1 |

%) |

30.6 |

|

0.7 |

% |

(2.9 |

) |

(0.1 |

%) |

| Amortization of intangible

assets |

36.7 |

|

2.4 |

% |

25.6 |

|

1.9 |

% |

99.5 |

|

2.3 |

% |

78.3 |

|

2.0 |

% |

| Net interest expense and other

net finance expense |

26.9 |

|

1.8 |

% |

26.2 |

|

2.0 |

% |

78.5 |

|

1.8 |

% |

70.7 |

|

1.8 |

% |

| Other (income) expense |

(2.1 |

) |

(0.2 |

%) |

4.0 |

|

0.4 |

% |

(6.9 |

) |

(0.1 |

%) |

(1.3 |

) |

0.2 |

% |

| Income

taxes (note 1) |

29.0 |

|

1.9 |

% |

29.1 |

|

2.2 |

% |

75.7 |

|

1.7 |

% |

70.6 |

|

1.8 |

% |

|

Net income (note 1) |

103.2 |

|

6.8 |

% |

101.3 |

|

7.7 |

% |

263.5 |

|

6.0 |

% |

246.0 |

|

6.4 |

% |

| Basic and diluted earnings per

share (EPS) |

0.90 |

|

n/m |

|

0.91 |

|

n/m |

|

2.31 |

|

n/m |

|

2.22 |

|

n/m |

|

|

Adjusted EBITDA (note 2) |

274.6 |

|

18.0 |

% |

241.3 |

|

18.3 |

% |

733.8 |

|

16.7 |

% |

636.4 |

|

16.6 |

% |

| Adjusted net income (note

2) |

147.9 |

|

9.7 |

% |

126.7 |

|

9.6 |

% |

378.1 |

|

8.6 |

% |

317.0 |

|

8.3 |

% |

| Adjusted diluted EPS (note

2) |

1.30 |

|

n/m |

|

1.14 |

|

n/m |

|

3.31 |

|

n/m |

|

2.86 |

|

n/m |

|

|

Dividends declared per common share |

0.210 |

|

n/m |

|

0.195 |

|

n/m |

|

0.630 |

|

n/m |

|

0.585 |

|

n/m |

|

note 1: Results for the quarter ended September 30, 2023 and for

the three quarters ended September 30, 2023 have been

retrospectively revised for the change in accounting policy related

to the treatment of deferred payments from our historical

acquisitions. Refer to the Critical Accounting Developments,

Estimates, and Measurements section of the Q3 2024 MD&A for

further details.

note 2: Adjusted EBITDA, adjusted net income, and adjusted

diluted EPS are non-IFRS measures (discussed in the Definitions

section of the Q3 2024 MD&A).

n/m = not meaningful

Net Revenue by Reportable Segment

|

(In millions of Canadian dollars, except

percentages) |

Q3 2024 |

Q3 2023 |

Total Change |

|

Change Due to Acquisitions |

|

Change Due to Foreign Exchange |

|

Change Due to Organic Growth |

|

% of Organic Growth |

|

|

Canada |

371.5 |

315.9 |

55.6 |

|

27.0 |

|

n/a |

|

28.6 |

|

9.1 |

% |

|

United States |

775.9 |

711.6 |

64.3 |

|

12.4 |

|

11.9 |

|

40.0 |

|

5.6 |

% |

|

Global |

377.4 |

289.3 |

88.1 |

|

63.6 |

|

7.7 |

|

16.8 |

|

5.8 |

% |

|

Total |

1,524.8 |

1,316.8 |

208.0 |

|

103.0 |

|

19.6 |

|

85.4 |

|

|

|

Percentage Growth |

|

|

15.8 |

% |

7.8 |

% |

1.5 |

% |

6.5 |

% |

|

Backlog

|

(In millions of Canadian dollars, except percentages) |

Sep 30, 2024 |

Dec 31, 2023 |

Total Change |

|

Change Due to Acquisitions |

|

Change Due to Foreign Exchange |

|

Change Due to Organic Growth |

|

% of Organic Growth |

|

|

Canada |

1,700.4 |

1,342.6 |

357.8 |

|

173.6 |

|

n/a |

184.2 |

|

13.7 |

% |

|

United States |

4,169.2 |

3,950.8 |

218.4 |

|

46.7 |

|

80.4 |

|

91.3 |

|

2.3 |

% |

|

Global |

1,439.5 |

1,012.5 |

427.0 |

|

377.0 |

|

30.2 |

|

19.8 |

|

2.0 |

% |

|

Total |

7,309.1 |

6,305.9 |

1,003.2 |

|

597.3 |

|

110.6 |

|

295.3 |

|

|

|

Percentage Growth |

|

|

15.9 |

% |

9.5 |

% |

1.7 |

% |

4.7 |

% |

|

Webcast & Conference Call

Stantec will host a live webcast and conference call on Friday,

November 8, 2024, at 7:00 AM Mountain Time (9:00 AM Eastern

Time) to discuss the Company’s third quarter performance.

To listen to the webcast and view the slide presentation, please

join here.

If you are an analyst and would like to participate in the

Q&A, please register here.

The conference call and slideshow presentation will be broadcast

live and archived in their entirety in the Investors section of

Stantec.com.

About Stantec

Stantec empowers clients, people, and communities to rise to the

world’s greatest challenges at a time when the world faces more

unprecedented concerns than ever before.

We are a global leader in sustainable architecture, engineering,

and environmental consulting.

Our professionals deliver the expertise, technology, and

innovation communities need to manage aging infrastructure,

demographic and population changes, the energy transition, and

more.

Today’s communities transcend geographic borders. At Stantec,

community means everyone with an interest in the work that we

do—from our project teams and industry colleagues to our clients

and the people our work impacts. The diverse perspectives of our

partners and interested parties drive us to think beyond what’s

previously been done on critical issues like climate change,

digital transformation, and future-proofing our cities and

infrastructure.

We are engineers, designers, scientists, project managers, and

strategic advisors. We innovate at the intersection of community,

creativity, and client relationships to advance communities

everywhere, so that together we can redefine what’s possible.

Stantec trades on the TSX and the NYSE under the symbol STN.

Cautionary Statements

Non-IFRS and Other Financial Measures

Stantec reports its financial results in accordance with IFRS.

This news release also reports the following non-IFRS and other

financial measures used by the Company: adjusted EBITDA, adjusted

net income, adjusted earnings per share (EPS), net debt to adjusted

EBITDA, days sales outstanding (DSO), margin (percentage of net

revenue), organic growth (retraction), acquisition growth, adjusted

return on invested capital (ROIC), and measures described as on a

constant currency basis and the impact of foreign exchange or

currency fluctuations, as well as measures and ratios calculated

using these non-IFRS or other financial measures. Additional

disclosure for these non-IFRS and other financial measures,

incorporated by reference, is included in the Definitions of

Non-IFRS and Other Financial Measures section of the Q3 2024

Management’s Discussion and Analysis, available on SEDAR+ at

sedarplus.ca, EDGAR at sec.gov, and the Company’s website at

Stantec.com and the reconciliation of Non-IFRS Financial Measures

appended hereto.

These non-IFRS and other financial measures do not have a

standardized meaning under IFRS and, therefore, may not be

comparable to similar measures presented by other issuers.

Management believes that, in addition to conventional measures

prepared in accordance with IFRS, these non-IFRS and other

financial measures and ratios provide useful information to

investors to assist them in understanding components of the

Company's financial results. These measures should not be

considered in isolation or viewed as a substitute for the related

financial information prepared in accordance with IFRS.

Forward-looking Statements

Certain statements contained in this news release constitute

forward-looking statements. These statements include, without

limitation, comments regarding the Company's ability to capture

future growth opportunities, adjusted diluted EPS and net revenue

growth, adjusted EBITDA margin, adjusted ROIC, and the 2024

outlook. Readers of this news release are cautioned not to place

undue reliance on forward-looking statements since a number of

factors could cause actual future results to differ materially from

the expectations expressed in these forward-looking statements.

These factors include, but are not limited to, the risk of economic

downturn, cash flow projections, project cancellations, access and

retention of skilled labor, decreased infrastructure spending

levels, decrease or end to stimulus programs, changing market

conditions for Stantec’s services, and the risk that Stantec fails

to capitalize on its strategic initiatives. Investors and the

public should carefully consider these factors, other

uncertainties, and potential events, as well as the inherent

uncertainty of forward-looking statements, when relying on these

statements to make decisions with respect to the Company.

Future outcomes relating to forward-looking statements may be

influenced by many factors and material risks. For the three and

nine month periods ended September 30, 2024, there has been no

significant change in the risk factors from those described in

Stantec's 2023 Annual Report. This report is accessible online by

visiting EDGAR on the SEC website at sec.gov or by visiting the CSA

website at sedarplus.ca or Stantec’s website, Stantec.com. You may

obtain a hard copy of the 2023 annual report free of charge from

the investor contact noted below.

Investor Contact

Jess NieukerkStantec Investor RelationsPh:

403-569-5389jess.nieukerk@stantec.com

To subscribe to Stantec’s email news alerts, please fill out the

subscription form.

Reconciliation of Non-IFRS Financial

Measures

| |

For the quarter endedSeptember

30, |

For the three quarters endedSeptember

30, |

|

(In millions of Canadian dollars, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net income (note 1) |

103.2 |

|

101.3 |

|

263.5 |

|

246.0 |

|

| Add back

(deduct): |

|

|

|

|

|

Income taxes (note 1) |

29.0 |

|

29.1 |

|

75.7 |

|

70.6 |

|

|

Net interest expense |

26.7 |

|

25.1 |

|

78.0 |

|

68.1 |

|

|

Net impairment (reversal) of lease assets (note 2) |

16.0 |

|

(1.8 |

) |

34.9 |

|

(3.8 |

) |

|

Depreciation and amortization |

85.8 |

|

70.5 |

|

245.1 |

|

214.5 |

|

|

Unrealized (gain) loss on equity securities |

(3.4 |

) |

3.1 |

|

(7.1 |

) |

(4.1 |

) |

|

Acquisition, integration, and restructuring costs (note 1,5,6) |

17.3 |

|

14.0 |

|

43.7 |

|

45.1 |

|

|

|

|

|

|

|

|

Adjusted EBITDA |

274.6 |

|

241.3 |

|

733.8 |

|

636.4 |

|

| |

For the quarter endedSeptember

30, |

For the three quarters endedSeptember

30, |

|

(In millions of Canadian dollars, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net income (note 1) |

103.2 |

|

101.3 |

|

263.5 |

|

246.0 |

|

| Add back (deduct)

after tax: |

|

|

|

|

|

Net impairment (reversal) of lease assets (note 2) |

12.4 |

|

(1.4 |

) |

27.1 |

|

(3.0 |

) |

|

Amortization of intangible assets related to

acquisitions (note 3) |

21.2 |

|

12.6 |

|

58.2 |

|

41.7 |

|

|

Unrealized (gain) loss on equity securities (note 4) |

(2.6 |

) |

2.4 |

|

(5.5 |

) |

(3.2 |

) |

|

Acquisition, integration, and restructuring costs (note 1,5,6) |

13.7 |

|

11.8 |

|

34.8 |

|

35.5 |

|

|

|

|

|

|

|

|

Adjusted net income |

147.9 |

|

126.7 |

|

378.1 |

|

317.0 |

|

|

Weighted average number of shares outstanding - diluted |

114,066,995 |

|

110,958,545 |

|

114,066,995 |

|

110,955,101 |

|

| |

|

|

|

|

|

Adjusted earnings per share - diluted |

1.30 |

|

1.14 |

|

3.31 |

|

2.86 |

|

See the Definitions section of this MD&A for our discussion

of non-IFRS and other financial measures used and additional

reconciliations of non-IFRS financial measures.

note 1: Results for the quarter ended September 30, 2023 and for

the three quarters ended September 30, 2023 have been

retrospectively revised for the change in accounting policy related

to the treatment of deferred payments from our historical

acquisitions. Refer to the Critical Accounting Developments,

Estimates, and Measurements section of the Q3 2024 MD&A for

further details.

note 2: The net impairment (reversal) of lease assets and

property and equipment includes onerous contracts associated with

the impairment for the quarter ended September 30, 2024 of $2.3

(2023 - $(1.0)) and for the three quarters ended September 30,

2024 of $4.3 (2023 - $(0.9)). For the quarter ended September 30,

2024, this amount is net of tax of $3.6 (2023 - $(0.4)). For the

three quarters ended September 30, 2024, this amount is net of

tax of $7.8 (2023 - $(0.8)).

note 3: The add back of intangible amortization relates only to

the amortization from intangible assets acquired through

acquisitions and excludes the amortization of software purchased by

Stantec. For the quarter ended September 30, 2024, this amount is

net of tax of $6.0 (2023 - $3.7). For the three quarters ended

September 30, 2024 this amount is net of tax of $16.7 (2023 -

$12.1).

note 4: For the quarter ended September 30, 2024, this amount is

net of tax of $(0.8) (2023 - $0.7). For the three quarters ended

September 30, 2024 this amount is net of tax of $(1.6) (2023-

$(0.9)).

note 5: The add back of certain administrative and marketing

costs and depreciation primarily related to acquisition and

integration expenses associated with our acquisitions and

restructuring costs. For the quarter ended September 30, 2024, this

amount is net of tax of $3.9 (2023 - $3.1). For the three quarters

ended September 30, 2024, this amount is net of tax of $10.0

(2023- $10.1).

note 6: Acquisition, integration, and restructuring cost include

additional acquisition costs related to the change in accounting

policy described in note 1 for the quarter ended September 30, 2024

of $1.2 (2023 - $3.7) and for the three quarters ended

September 30, 2024 of $5.9 (2023 - $14.8).

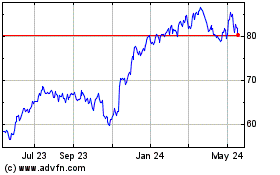

Stantec (NYSE:STN)

Historical Stock Chart

From Dec 2024 to Jan 2025

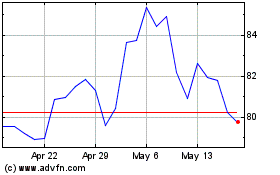

Stantec (NYSE:STN)

Historical Stock Chart

From Jan 2024 to Jan 2025