Current Report Filing (8-k)

April 17 2023 - 4:31PM

Edgar (US Regulatory)

falsefalse00016921150000092416 0001692115 2023-04-17 2023-04-17 0001692115 swx:SouthwestGasCorporationMember 2023-04-17 2023-04-17

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 17, 2023

|

|

|

|

|

|

|

|

|

Exact name of registrant as specified in its charter and

principal office address and telephone number |

|

|

|

|

|

|

Southwest Gas Holdings, Inc. Las Vegas, Nevada 89193-8510 |

|

|

|

|

|

|

Southwest Gas Corporation Las Vegas, Nevada 89193-8510 |

|

|

|

|

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

☐ Pre-commencement communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Southwest Gas Holdings, Inc:

|

|

|

|

|

|

|

|

|

|

| Southwest Gas Holdings, Inc. Common Stock, $1 par value |

|

SWX |

|

New York Stock Exchange |

Southwest Gas Corporation:

None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Entry into a Material Definitive Agreement. |

On April 17, 2023, Southwest Gas Holdings, Inc. (the “Company”) entered into a Term Loan Credit Agreement (the “Term Loan Agreement”) with the lenders from time to time party thereto, JPMorgan Chase Bank, N.A., as Administrative Agent, Bank of America, N.A. as Syndication Agent, JPMorgan Chase Bank, N.A., BofA Securities, Inc., Wells Fargo Bank, N.A. and U.S. Bank, National Association as Joint Lead Arrangers and Joint Bookrunners, and Wells Fargo Bank, N.A. and U.S. Bank, National Association as

Co-Documentation

Agents. The Term Loan Agreement provides for a term loan (the “Term Loan”) of $550 million that matures on October 17, 2024.

The Company contributed a majority of the proceeds from the Term Loan to Southwest Gas Corporation, a wholly owned subsidiary of the

Company (“Southwest Gas Corporation”), to

repay the amounts outstanding under

Southwest Gas Corporation’s

364-day

term loan entered into in January 2023 (the “Southwest Gas Corporation Term Loan”), and will use the remainder for working capital and general corporate purposes. On April 17, 2023, Southwest

Gas Corporation

r

epaid in full the Southwest Gas Corporation Term Loan.

Interest rates for the Term Loan are calculated, at the Company’s option, at either the term Secured Overnight Financing Rate (“SOFR”) plus an adjustment of 0.100% or the “alternate base rate,” plus in each case an applicable margin. Loans bearing interest with reference to SOFR have an applicable margin of 1.300% and loans bearing interest with reference to the alternate base rate have an applicable margin of 0.300%. SOFR is calculated with a floor of 0.000% and alternative base rate is calculated with a floor of 1.000%.

The Term Loan Agreement contains certain customary representations and warranties and affirmative and negative covenants. In addition, the Term Loan Agreement contains a financial covenant requiring the Company to maintain a ratio of funded debt to total capitalization not to exceed 0.70 to 1.00 as of the end of any quarter of any fiscal year. The description of the Term Loan Agreement does not purport to be complete and is qualified in its entirety by reference to the Term Loan Agreement, which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The disclosure set forth under Item 1.01 is incorporated herein by reference.

|

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

|

|

|

| 10.1 |

|

Term Loan Credit Agreement, dated as of April 17, 2023, by and among Southwest Gas Holdings, Inc., the lenders from time to time party thereto, JPMorgan Chase Bank, N.A., as Administrative Agent, Bank of America, N.A. as Syndication Agent, JPMorgan Chase Bank, N.A., BofA Securities, Inc., Wells Fargo Bank, N.A. and U.S. Bank, National Association as Joint Lead Arrangers and Joint Bookrunners, and Wells Fargo Bank, N.A. and U.S. Bank, National Association as Co-Documentation Agents. |

| |

|

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| |

|

|

|

|

|

SOUTHWEST GAS HOLDINGS, INC. |

| |

|

|

|

| |

|

|

|

|

|

/s/ Robert J. Stefani Robert J. Stefani Senior Vice President/Chief Financial Officer |

| |

|

|

|

| Date: April 17, 2023 |

|

|

|

|

|

|

| |

|

|

|

| |

|

|

|

|

|

SOUTHWEST GAS CORPORATION |

| |

|

|

|

| |

|

|

|

|

|

/s/ Robert J. Stefani Robert J. Stefani Senior Vice President/Chief Financial Officer |

| |

|

|

|

| Date: April 17, 2023 |

|

|

|

|

|

|

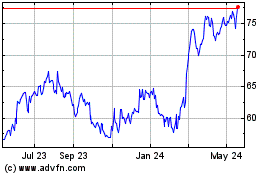

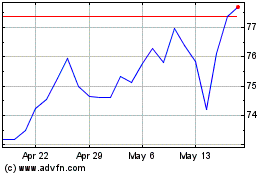

Southwest Gas (NYSE:SWX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Southwest Gas (NYSE:SWX)

Historical Stock Chart

From Dec 2023 to Dec 2024