Tecnoglass Announces Proposed Secondary Offering of Ordinary Shares by Energy Holding Corporation

May 16 2023 - 4:28PM

Tecnoglass Inc.

(NYSE: TGLS)

(“Tecnoglass” or the

“Company”),

today announced the

commencement of an underwritten public offering of an aggregate of

2,000,000 ordinary shares to be sold by Energy Holding Corporation

(“Selling Stockholder”). In addition, the Selling Stockholder

expects to grant the underwriters a 30-day option to purchase up to

an additional 300,000 ordinary shares. All of the ordinary shares

to be sold in the proposed offering are being offered by the

Selling Stockholder. The Company will not receive any proceeds from

the sale of the ordinary shares being offered by the Selling

Stockholder.

Baird, Raymond James and Stifel are acting as

lead joint book-running managers for the proposed offering.

The securities described above are being offered

pursuant to an automatic shelf registration statement on Form S-3

filed with the U.S. Securities and Exchange Commission (“SEC”) on

May 16, 2023. The offering will be made only by means of a

prospectus supplement and accompanying prospectus that forms part

of the registration statement referred to above. This press release

shall not constitute an offer to sell or the solicitation of an

offer to buy, nor shall there be any sale of these securities in

any state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction.

Copies of the preliminary prospectus supplement

and accompanying prospectus related to the offering may be obtained

from Robert W. Baird & Co. Incorporated, Attn: Syndicate

Department, 777 E. Wisconsin Avenue, Milwaukee, WI 53202,

syndicate@rwbaird.com, telephone: (800) 792-2473; Raymond James

& Associates, Inc., Attention: Equity Syndicate, 880 Carillon

Parkway, St. Petersburg, Florida 33716, or by telephone at (800)

248-8863, or by e-mail to prospectus@raymondjames.com; or Stifel,

Nicolaus & Company, Incorporated, One South Street, 15th Floor,

Baltimore, MD 21202, Attention: Syndicate Department, email:

Syndprospectus@stifel.com. You may also obtain these documents by

visiting the SEC’s website at www.sec.gov.

About

Tecnoglass

Tecnoglass Inc. is a leading producer of

architectural glass, windows, and associated aluminum products

serving the multi-family, single-family, and commercial end

markets. Tecnoglass is the second largest glass fabricator serving

the U.S. and the #1 architectural glass transformation company in

Latin America. Located in Barranquilla, Colombia, the Company’s 4.1

million square foot, vertically integrated, and state-of-the-art

manufacturing complex provides efficient access to nearly 1,000

customers in North, Central and South America, with the United

States accounting for 96% of total revenues. Tecnoglass’ tailored,

high-end products are found on some of the world’s most distinctive

properties, including One Thousand Museum (Miami), Paramount

(Miami), Salesforce Tower (San Francisco), Via 57 West (NY),

Hub50House (Boston), Aeropuerto Internacional El Dorado (Bogotá),

One Plaza (Medellín), and Pabellon de Cristal

(Barranquilla).

Forward Looking Statements

This press release includes certain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding future financial performance, future

growth, future acquisitions and the completion, timing and size of

the proposed public offering that involve risks and uncertainties,

including, without limitation, risks and uncertainties related to

market conditions and the satisfaction of closing conditions

related to the proposed public offering. These statements are based

on Tecnoglass’ current expectations or beliefs and are subject to

uncertainty and changes in circumstances. Actual results may vary

materially from those expressed or implied by the statements herein

due to changes in economic, business, competitive and/or regulatory

factors, and other risks and uncertainties affecting the operation

of Tecnoglass’ business. These risks, uncertainties and

contingencies are indicated from time to time in Tecnoglass’

filings with the SEC, including those set forth in the risk factors

section of the prospectus supplement used in connection with the

offering. No assurance can be given that the offering discussed

above will be completed on the terms described, or at all, or that

the net proceeds of the offering will be used as indicated. The

information set forth herein should be read in light of such risks.

Further, investors should keep in mind that Tecnoglass’ financial

results in any particular period may not be indicative of future

results. All forward-looking statements contained in this press

release speak only as of the date on which they were made.

Tecnoglass is under no obligation to, and expressly disclaims any

obligation to, update or alter its forward-looking statements,

whether as a result of new information, future events and changes

in assumptions or otherwise, except as required by law. For a

further description of the risks and uncertainties that could cause

actual results to differ from those expressed in these

forward-looking statements, as well as risks relating to the

Company’s business in general, please refer to the Company’s

preliminary prospectus supplement to be filed with the SEC on May

16, 2023, including the documents incorporated by reference

therein, which include the Company’s Annual Report on Form 10-K for

the year ended December 31, 2022, its Quarterly Report on Form 10-Q

for the quarter ended March 31, 2023 and its other periodic reports

filed with the SEC.

Investor Relations:

Santiago

GiraldoCFO305-503-9062investorrelations@tecnoglass.com

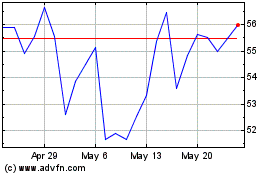

Tecnoglass (NYSE:TGLS)

Historical Stock Chart

From Jan 2025 to Feb 2025

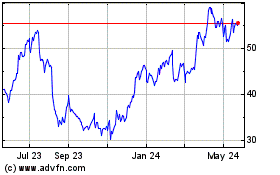

Tecnoglass (NYSE:TGLS)

Historical Stock Chart

From Feb 2024 to Feb 2025