Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 11 2025 - 5:05AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: February 11, 2025

Commission File Number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

TIM S.A.

Publicly-held company

CNPJ/ME 02.421.421/0001-11

NIRE 33.300.324.631

MATERIAL FACT

TIM ends disputes with C6 Group and monetizes

its stake

TIM S.A. ("TIM" or "Company")

(B3: TIMS3 and NYSE: TIMB), in compliance with Section 157 of Law No. 6,404/76 and the provisions of CVM Resolution No. 44/21, hereby

informs its shareholders, the market in general and other interested parties as follows:

The Company and Banco C6 S.A ("C6" or

"Bank"), together referred to as the "Companies" or "Companies", have entered into an agreement ("Agreement")

that will end all disputes related to the partnership between the two Companies ("Partnership") and, consequently, extinguish

the four arbitration proceedings currently in progress.

Throughout the Partnership period, TIM obtained

the right to a minority stake in the bank's capital and, with the termination of the Partnership, TIM will have earned a total gross revenue

of approximately R$280 million. In addition, the combination of financial services with mobile telephony has produced positive effects

in other areas of TIM's business, such as increasing customer loyalty, increasing digitalization in the purchase of recharges and in the

payment of invoices.

The Agreement, signed today, provides for the

termination of the Partnership, in addition to the transfer of all shares held by TIM to C6, as well as all outstanding subscription bonuses,

in the amount of R$ 520 million (pre-tax). The transfer of shares is subject to approval by the Cayman Islands Monetary Authority (CIMA).

Once such approval is obtained, the Agreement will be concluded and the Partnership will be terminated. Other details are protected by

confidentiality clauses.

TIM believes in the importance of the Customer

Platform strategy in generating value for the Company, so it will continue to build its ecosystem of digital services.

The Company will keep its shareholders and the

market informed about its projects and commercial partnerships, under the terms of the applicable regulations.

Rio de Janeiro, February 11, 2025.

TIM S.A.

Alberto Griselli

Chief Executive Officer and

Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

TIM S.A. |

| Date:

February 11, 2025 |

|

By: |

/s/ Alberto

Mario Griselli |

| |

|

|

Alberto

Mario Griselli |

| |

|

|

Chief

Executive Officer, Chief Financial Officer and Investor Relations Officer |

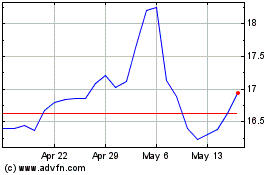

TIM (NYSE:TIMB)

Historical Stock Chart

From Jan 2025 to Feb 2025

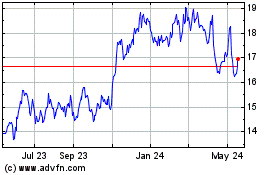

TIM (NYSE:TIMB)

Historical Stock Chart

From Feb 2024 to Feb 2025