Tortoise today announced the following unaudited balance sheet

information and asset coverage ratio updates for TYG, NTG, TTP,

NDP, TPZ and TEAF.

Tortoise Energy Infrastructure Corp. (NYSE: TYG) today

announced that as of December 31, 2020, the company’s unaudited

total assets were approximately $456.5 million and its unaudited

net asset value was $311.0 million, or $26.08 per share.

As of December 31, 2020, the company’s asset coverage ratio

under the 1940 Act with respect to senior securities representing

indebtedness was 490 percent, and its coverage ratio for preferred

shares was 359 percent. For more information on the company’s

coverage ratios, please refer to the leverage summary web page at

https://cef.tortoiseecofin.com.

Set forth below is a summary of the company’s unaudited balance

sheet at December 31, 2020.

Unaudited balance sheet

(in Millions)

Per Share

Investments

$401.5

$33.67

Cash and Cash Equivalents

1.9

0.16

Income Tax Receivable

52.1

4.36

Other Assets

1.0

0.08

Total Assets

456.5

38.27

Senior Notes

87.9

7.37

Preferred Stock

32.3

2.71

Total Leverage

120.2

10.08

Payable for Investments Purchased

9.7

0.81

Other Liabilities

2.2

0.18

Current Tax Liability

13.4

1.12

Net Assets

$ 311.0

$ 26.08

11.93 million common shares currently outstanding.

TYG has completed its share repurchases under the publicly

announced repurchase plan allowing up to $25.0 million through

December 31, 2020. Under the program, TYG repurchased 1,406,336

shares of its common stock at an average price of $17.762 and an

average discount to NAV of 24.1%.

Tortoise Midstream Energy Fund, Inc. (NYSE: NTG) today

announced that as of December 31, 2020, the company’s unaudited

total assets were approximately $225.9 million and its unaudited

net asset value was $152.0 million, or $26.93 per share.

As of December 31, 2020, the company’s asset coverage ratio

under the 1940 Act with respect to senior securities representing

indebtedness was 448 percent, and its coverage ratio for preferred

shares was 356 percent. For more information on the company’s

coverage ratios, please refer to the leverage summary web page at

https://cef.tortoiseecofin.com.

Set forth below is a summary of the company’s unaudited balance

sheet at December 31, 2020.

Unaudited balance sheet

(in Millions)

Per Share

Investments

$225.0

$ 39.86

Cash and Cash Equivalents

0.4

0.07

Other Assets

0.5

0.09

Total Assets

225.9

40.02

Short-Term Borrowings

31.8

5.64

Senior Notes

15.3

2.71

Preferred Stock

12.2

2.16

Total Leverage

59.3

10.51

Payable for Investments Purchased

5.5

0.97

Other Liabilities

1.2

0.21

Current Tax Liability

7.9

1.40

Net Assets

$ 152.0

$ 26.93

5.64 million common shares currently outstanding.

NTG has completed its share repurchases under the publicly

announced repurchase plan allowing up to $12.5 million through

December 31, 2020. Under the program, NTG repurchased 677,848

shares of its common stock at an average price of $18.426 and an

average discount to NAV of 24.3%.

Tortoise Pipeline & Energy Fund, Inc. (NYSE: TTP)

today announced that as of December 31, 2020, the company’s

unaudited total assets were approximately $70.6 million and its

unaudited net asset value was $47.5 million, or $20.28 per

share.

As of December 31, 2020, the company’s asset coverage ratio

under the 1940 Act with respect to senior securities representing

indebtedness was 471 percent, and its coverage ratio for preferred

shares was 331 percent. For more information on the company’s

coverage ratios, please refer to the leverage summary web page at

https://cef.tortoiseecofin.com.

Set forth below is a summary of the company’s unaudited balance

sheet at December 31, 2020.

Unaudited balance sheet

(in Millions)

Per Share

Investments

$67.5

$ 28.83

Cash and Cash Equivalents

2.8

1.22

Other Assets

0.3

0.14

Total Assets

70.6

30.19

Senior Notes

14.5

6.18

Preferred Stock

6.1

2.61

Total Leverage

20.6

8.79

Payable for Investments Purchased

2.1

0.90

Other Liabilities

0.4

0.22

Net Assets

$47.5

$ 20.28

2.34 million common shares currently outstanding.

TTP has completed approximately $2.6 million of share

repurchases under the publicly announced repurchase plan allowing

up to $5.0 million through March 31, 2021. Under the program, TTP

has repurchased 165,601 shares of its common stock at an average

price of $15.711 and an average discount to NAV of 21.8%.

Tortoise Energy Independence Fund, Inc. (NYSE:

NDP) today announced that as of December 31, 2020, the

company’s unaudited total assets were approximately $36.8 million

and its unaudited net asset value was $31.1 million, or $16.84 per

share.

As of December 31, 2020, the company’s asset coverage ratio

under the 1940 Act with respect to senior securities representing

indebtedness was 1,210 percent. For more information on the

company’s coverage ratios, please refer to the leverage summary web

page at https://cef.tortoiseecofin.com.

Set forth below is a summary of the company’s unaudited balance

sheet at December 31, 2020.

Unaudited balance sheet

(in Millions)

Per Share

Investments

$ 35.8

$ 19.40

Cash and Cash Equivalents

0.2

0.15

Receivable for Investments Sold

0.7

0.39

Other Assets

0.1

0.02

Total Assets

36.8

19.96

Credit Facility Borrowings

2.8

1.52

Payable for Investments Purchased

2.7

1.47

Other Liabilities

0.2

0.13

Net Assets

$ 31.1

$ 16.84

1.85 million common shares currently outstanding.

Tortoise Power and Energy Infrastructure Fund, Inc. (NYSE:

TPZ) today announced that as of December 31, 2020, the

company’s unaudited total assets were approximately $117.5 million

and its unaudited net asset value was $91.2 million, or $13.44 per

share.

As of December 31, 2020, the company’s asset coverage ratio

under the 1940 Act with respect to senior securities representing

indebtedness was 480 percent. For more information on the company’s

coverage ratios, please refer to the leverage summary web page at

https://cef.tortoiseecofin.com.

Set forth below is a summary of the company’s unaudited balance

sheet at December 31, 2020.

Unaudited balance sheet

(in Millions)

Per Share

Investments

$ 115.3

$ 17.01

Cash and Cash Equivalents

1.0

0.14

Other Assets

1.2

0.17

Total Assets

117.5

17.32

Credit Facility Borrowings

24.0

3.54

Payable for Investments Purchased

1.7

0.25

Other Liabilities

0.6

0.09

Net Assets

$ 91.2

$ 13.44

6.78 million common shares currently outstanding.

TPZ has completed approximately $1.8 million of share

repurchases under the publicly announced repurchase plan allowing

up to $5.0 million through August 31, 2021. Under the program, TPZ

has repurchased 172,427 shares of its common stock at an average

price of $10.488 and an average discount to NAV of 20.8%.

Tortoise Essential Assets Income Term Fund (NYSE: TEAF)

today announced that as of December 31, 2020, the company’s

unaudited total assets were approximately $249.9 million and its

unaudited net asset value was $221.9 million, or $16.45 per

share.

As of December 31, 2020, the company’s asset coverage ratio

under the 1940 Act with respect to senior securities representing

indebtedness was 928 percent. For more information on the company’s

coverage ratios, please refer to the leverage summary web page at

https://cef.tortoiseecofin.com.

Set forth below is a summary of the company’s unaudited balance

sheet at December 31, 2020.

Unaudited balance sheet

(in Millions)

Per Share

Investments

$245.9

$18.23

Cash and Cash Equivalents

0.8

0.06

Other Assets

3.2

0.23

Total Assets

249.9

18.52

Credit Facility Borrowings

26.8

1.99

Other Liabilities

1.2

0.08

Net Assets

$221.9

$16.45

13.49 million common shares outstanding.

The top 10 holdings for TYG, NTG, TTP, NDP, TPZ and TEAF as of

the most recent month-end can be found on each fund’s portfolio web

page at https://cef.tortoiseecofin.com.

About Tortoise

Tortoise focuses on energy & power infrastructure and the

transition to cleaner energy. Tortoise’s solid track record of

energy value chain investment experience and research dates back

more than 20 years. As one of the earliest investors in midstream

energy, Tortoise believes it is well-positioned to be at the

forefront of the global energy evolution that is underway. With a

steady wins approach and a long-term perspective, Tortoise strives

to make a positive impact on clients and communities. For

additional information, please visit www.TortoiseEcofin.com.

Tortoise Capital Advisors, L.L.C. is the Adviser to Tortoise

Energy Infrastructure Corp., Tortoise Midstream Energy Fund, Inc.,

Tortoise Pipeline & Energy Fund, Inc., Tortoise Energy

Independence Fund, Inc., Tortoise Power and Energy Infrastructure

Fund, Inc. and Tortoise Essential Assets Income Term Fund. Ecofin

Advisors Limited is a sub-adviser to Tortoise Essential Assets

Income Term Fund.

For additional information on these funds, please visit

cef.tortoiseecofin.com.

Safe harbor statement

This press release shall not constitute an offer to sell or a

solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or

qualification under the laws of such state or jurisdiction.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains certain statements that may include

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. All statements, other than statements of

historical fact, included herein are "forward-looking statements."

Although the funds and Tortoise Capital Advisors believe that the

expectations reflected in these forward-looking statements are

reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. Actual results

could differ materially from those anticipated in these

forward-looking statements as a result of a variety of factors,

including those discussed in the fund’s reports that are filed with

the Securities and Exchange Commission. You should not place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. Other than as required by law,

the funds and Tortoise Capital Advisors do not assume a duty to

update this forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210104005878/en/

Maggie Zastrow (913) 981-1020 info@tortoiseadvisors.com

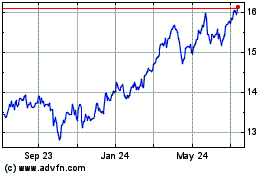

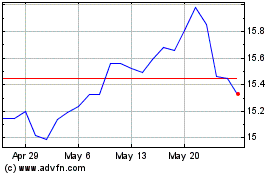

Common Stock (NYSE:TPZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

Common Stock (NYSE:TPZ)

Historical Stock Chart

From Jan 2024 to Jan 2025