Auto Insurance Shopping Increased 19% Year over Year in Q3 2024

November 13 2024 - 7:00AM

The third quarter of 2024 saw a big spike in shopping for both auto

and property insurance, according to a report by TransUnion (NYSE:

TRU). Auto insurance was up 19%, while property insurance shopping

rose 16%, compared to the same time in 2023.

Auto insurance shopping increased across generations, though,

not equally. Baby Boomers shopped the most by far, at 34%. Younger

generations followed, with Gen Z (23%), Gen X (18%) and Millennials

(8%) also looking for lower rates. Property insurance shopping was

up among homeowners and renters alike.

These and other important findings are included in the 2025

Personal and Commercial Lines Annual Insurance Outlook, which

provides insights and guidance to address anticipated trends in the

new year.

“It’s important to note that consumers are also switching at

significant rates,” said Patrick Foy, senior director of strategic

planning for TransUnion’s Insurance business. “This should serve as

a reminder to insurers that marketing and digital experiences

matter for acquisition.”

The report found 38% of consumers who shopped for insurance in

the past six months ended up switching carriers. It also notes that

those who do not find better deals will often adjust their current

policy by raising deductibles or opting into a telematics program

to lower their premiums.

Insurers lean heavily on online marketingOver

the past two years, policy premiums have caught up with and

recently exceed loss costs in the auto market. Predictably,

insurers are also beginning to reinvest in marketing; however, not

across all channels.

Comperemedia’s Q2 Omnichannel Marketing Review found national TV

spending by property and casualty insurers dropped 15%, while

online display skyrocketed with a 346% increase. Similarly,

spending on social media rose 81% and online video advertising

55%.

“The focus on marketing through digital channels is encouraging,

but it has to be optimized with a robust identity-based approach,”

said Foy. “It is critical that insurers partner with a trusted

solution provider who can ensure that their ads consistently target

the right audiences and measure impact across channels.”

A generational shift for independent livingWith

prices in the housing market outpacing inflation, consumers across

generations find themselves cohabitating in greater numbers,

compared to just 15 years ago. When looking back to 2009, 34% of

households with adult-age Millennials were composed of either a

single individual living independently or with one or more people

of the same generation, while 66% comprised an adult-aged

Millennial cohabitating with someone in an older generation, such

as a parent or grandparent.

By comparison, today only 22% of households with adult-age Gen Z

consumers are composed of either a single individual living alone

or with one or more people in the same generation, while 78%

comprise a Gen Z adult living with someone from an older

generation. The findings have significant implications for insurers

who take on added risks with more people living in a household.

Insurers who understand the generational makeup of a household

can better calculate the associated behavioral risks that come with

its occupants. Here, again, occupant and identity-based solutions

can help carriers match individuals and devices to locations,

providing crucial insights that guide consumer acquisition and

risk-based pricing.

For more information about TransUnion’s TruAudience® suite of

solutions, click here.

Read the full 2025 Personal and Commercial Lines Annual

Insurance Outlook report.

About TransUnion’s Insurance Personal Lines Trends and

Perspectives ReportThis quarterly publication examines

trends in the personal lines insurance industry, including

shopping, migration, violation, credit-based insurance stability

and more. The Trends and Perspectives Report research is based

almost entirely on TransUnion’s extensive internal data and

analyses. It includes information on insurance shopping

transactions from January 2023 to June 2024. However, the report

excludes shopping data from insurance customers in California,

Hawaii (auto), Massachusetts (auto), and Maryland (property), where

credit-based insurance scoring information is not used for

insurance rating or underwriting.

About TransUnion (NYSE: TRU) TransUnion is a

global information and insights company with over 13,000 associates

operating in more than 30 countries. We make trust possible by

ensuring each person is reliably represented in the marketplace. We

do this with a Tru™ picture of each person: an actionable view of

consumers, stewarded with care. Through our acquisitions and

technology investments we have developed innovative solutions that

extend beyond our strong foundation in core credit into areas such

as marketing, fraud, risk and advanced analytics. As a result,

consumers and businesses can transact with confidence and achieve

great things. We call this Information for Good® — and it leads to

economic opportunity, great experiences and personal empowerment

for millions of people around the

world. http://www.transunion.com/business

|

Contact |

Dave

Blumberg |

| |

TransUnion |

| E-mail |

david.blumberg@transunion.com |

| Telephone |

312-972-6646 |

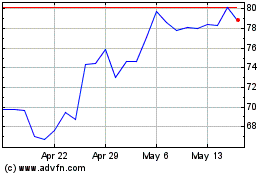

TransUnion (NYSE:TRU)

Historical Stock Chart

From Oct 2024 to Nov 2024

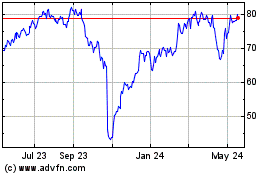

TransUnion (NYSE:TRU)

Historical Stock Chart

From Nov 2023 to Nov 2024