Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

May 28 2024 - 8:28AM

Edgar (US Regulatory)

Tri-Continental Corporation

March 31, 2024 (Unaudited)

|

|

No Financial Institution Guarantee

|

|

Portfolio of Investments

Tri-Continental Corporation, March 31, 2024 (Unaudited)

(Percentages represent value of investments compared to net assets)

Investments in securities

|

|

|

|

|

|

Communication Services 5.7%

|

Diversified Telecommunication Services 0.7%

|

|

|

|

|

Verizon Communications, Inc.

|

|

|

|

|

|

|

Interactive Media & Services 4.7%

|

Alphabet, Inc., Class A(a)

|

|

|

Meta Platforms, Inc., Class A

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Communication Services

|

|

Consumer Discretionary 6.9%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotels, Restaurants & Leisure 1.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TJX Companies, Inc. (The)

|

|

|

|

|

|

|

Common Stocks (continued)

|

|

|

|

|

Textiles, Apparel & Luxury Goods 0.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Consumer Discretionary

|

|

|

|

|

|

Molson Coors Beverage Co., Class B

|

|

|

Consumer Staples Distribution & Retail 0.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Procter & Gamble Co. (The)

|

|

|

|

|

|

|

Personal Care Products 0.2%

|

|

|

|

|

|

|

|

|

|

|

Philip Morris International, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels 3.9%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

Tri-Continental Corporation | First Quarter Report 2024

Portfolio of Investments (continued)

Tri-Continental Corporation, March 31, 2024 (Unaudited)

Common Stocks (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blackstone Secured Lending Fund

|

|

|

Carlyle Group, Inc. (The)

|

|

|

Cboe Global Markets, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clovis Liquidation Trust(a),(b),(c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marsh & McLennan Companies, Inc.

|

|

|

|

|

|

|

Prudential Financial, Inc.

|

|

|

|

|

|

|

Mortgage Real Estate Investment Trusts (REITS) 0.8%

|

Blackstone Mortgage Trust, Inc.

|

|

|

Starwood Property Trust, Inc.

|

|

|

|

|

|

|

|

|

|

Common Stocks (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BioMarin Pharmaceutical, Inc.(a)

|

|

|

Regeneron Pharmaceuticals, Inc.(a)

|

|

|

Vertex Pharmaceuticals, Inc.(a)

|

|

|

|

|

|

|

Health Care Equipment & Supplies 2.5%

|

Align Technology, Inc.(a)

|

|

|

Baxter International, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Providers & Services 1.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Molina Healthcare, Inc.(a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Air Freight & Logistics 1.5%

|

|

|

|

|

United Parcel Service, Inc., Class B

|

|

|

|

|

|

|

Tri-Continental Corporation | First Quarter Report 2024

3

Portfolio of Investments (continued)

Tri-Continental Corporation, March 31, 2024 (Unaudited)

Common Stocks (continued)

|

|

|

|

|

|

|

Builders FirstSource, Inc.(a)

|

|

|

|

|

|

|

|

|

|

|

Ground Transportation 0.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stanley Black & Decker, Inc.

|

|

|

|

|

|

|

Professional Services 0.8%

|

Automatic Data Processing, Inc.

|

|

|

|

|

|

Information Technology 17.9%

|

Communications Equipment 1.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Equipment, Instruments & Components 0.4%

|

|

|

|

|

|

|

International Business Machines Corp.

|

|

|

Semiconductors & Semiconductor Equipment 6.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stocks (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Palo Alto Networks, Inc.(a)

|

|

|

|

|

|

|

|

|

|

|

Technology Hardware, Storage & Peripherals 3.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Information Technology

|

|

|

|

|

|

CF Industries Holdings, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Containers & Packaging 0.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hotel & Resort REITs 0.2%

|

Host Hotels & Resorts, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real Estate Management & Development 0.0%

|

|

|

|

|

|

|

4

Tri-Continental Corporation | First Quarter Report 2024

Portfolio of Investments (continued)

Tri-Continental Corporation, March 31, 2024 (Unaudited)

Common Stocks (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simon Property Group, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pinnacle West Capital Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks

(Cost $945,452,424)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Airlines Group, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible Bonds (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beauty Health Co. (The)(e)

|

|

|

|

|

|

|

Diversified Manufacturing 0.5%

|

|

|

|

|

|

|

|

|

Greenbrier Companies, Inc. (The)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bread Financial Holdings, Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Media and Entertainment 0.2%

|

|

|

|

|

|

|

|

|

Tri-Continental Corporation | First Quarter Report 2024

5

Portfolio of Investments (continued)

Tri-Continental Corporation, March 31, 2024 (Unaudited)

Convertible Bonds (continued)

|

|

|

|

|

|

|

Other Financial Institutions 0.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Starwood Property Trust, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

American Water Capital Corp.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mirum Pharmaceuticals, Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CSG Systems International, Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Progress Software Corp.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transportation Services 0.2%

|

Air Transport Services Group, Inc.(e)

|

|

|

|

|

|

|

Total Convertible Bonds

(Cost $138,764,602)

|

|

Convertible Preferred Stocks 2.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apollo Global Management, Inc.

|

|

|

|

|

|

|

|

|

|

|

Chart Industries, Inc., ADR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Convertible Preferred Stocks

(Cost $46,122,174)

|

|

Corporate Bonds & Notes 16.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Airlines, Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

Tri-Continental Corporation | First Quarter Report 2024

Portfolio of Investments (continued)

Tri-Continental Corporation, March 31, 2024 (Unaudited)

Corporate Bonds & Notes (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Innophos Holdings, Inc.(e)

|

|

|

|

|

|

|

Olympus Water US Holding Corp.(e)

|

|

|

|

|

|

|

|

|

|

Construction Machinery 0.2%

|

PECF USS Intermediate Holding III Corp.(e)

|

|

|

|

|

|

|

Consumer Cyclical Services 0.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SWF Escrow Issuer Corp.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pacific Gas and Electric Co.

|

|

|

|

|

|

|

|

|

|

|

|

Triton Water Holdings, Inc.(e)

|

|

|

|

|

|

|

United Natural Foods, Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

Scientific Games Holdings LP/US FinCo, Inc.(e)

|

|

|

|

|

|

|

Corporate Bonds & Notes (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quotient Ltd.(b),(c),(e),(h)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Surgery Center Holdings, Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Hilcorp Energy I LP/Finance Co.(e)

|

|

|

|

|

|

|

Occidental Petroleum Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cedar Fair LP/Canada’s Wonderland Co./Magnum Management Corp./Millennium Op

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Media and Entertainment 1.5%

|

Clear Channel Outdoor Holdings, Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lions Gate Capital Holdings LLC(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nabors Industries Ltd.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

Tri-Continental Corporation | First Quarter Report 2024

7

Portfolio of Investments (continued)

Tri-Continental Corporation, March 31, 2024 (Unaudited)

Corporate Bonds & Notes (continued)

|

|

|

|

|

|

|

Transocean Aquila Ltd.(e)

|

|

|

|

|

|

|

Transocean Titan Financing Ltd.(e)

|

|

|

|

|

|

|

|

|

|

Other Financial Institutions 0.0%

|

WeWork Companies, Inc.(e),(f),(h)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mauser Packaging Solutions Holding Co.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bausch Health Companies, Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Panther Escrow Issuer LLC(e),(i)

|

|

|

|

|

|

|

|

|

Fertitta Entertainment LLC/Finance Co., Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Bonds & Notes (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cloud Software Group, Inc.(e)

|

|

|

|

|

|

|

Consensus Cloud Solutions, Inc.(e)

|

|

|

|

|

|

|

Minerva Merger Sub, Inc.(e)

|

|

|

|

|

|

|

Neptune Bidco US, Inc.(e)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transportation Services 0.2%

|

|

|

|

|

|

|

|

|

Total Corporate Bonds & Notes

(Cost $328,688,924)

|

|

|

|

|

|

|

|

|

|

|

|

Citigroup Capital XIII(j)

|

|

|

|

|

|

|

Total Preferred Debt

(Cost $4,210,207)

|

|

8

Tri-Continental Corporation | First Quarter Report 2024

Portfolio of Investments (continued)

Tri-Continental Corporation, March 31, 2024 (Unaudited)

|

|

|

|

|

|

|

|

Health Care Equipment & Supplies —%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Columbia Short-Term Cash Fund, 5.543%(k),(l)

|

|

|

Total Money Market Funds

(Cost $17,352,744)

|

|

Total Investments in Securities

(Cost: $1,480,591,075)

|

|

Other Assets & Liabilities, Net

|

|

|

|

|

|

At March 31, 2024, securities and/or cash totaling $1,337,544 were pledged as collateral.

Investments in derivatives

|

|

|

|

|

|

|

|

Value/Unrealized

appreciation ($)

|

Value/Unrealized

depreciation ($)

|

|

|

|

|

|

|

|

|

Notes to Portfolio of Investments

|

|

Non-income producing investment.

|

|

|

Represents fair value as determined in good faith under procedures approved by the

Board of Directors. At March 31, 2024, the total value of these securities amounted

to $3,207,133, which represents 0.17% of total net assets.

|

|

|

Valuation based on significant unobservable inputs.

|

|

|

This security or a portion of this security has been pledged as collateral in connection

with derivative contracts.

|

|

|

Represents privately placed and other securities and instruments exempt from Securities

and Exchange Commission registration (collectively, private placements), such as Section 4(a)(2) and Rule 144A eligible securities, which are often sold only to qualified

institutional buyers. At March 31, 2024, the total value of these securities amounted

to $305,903,418, which represents 16.46% of total net assets.

|

|

|

Represents a security in default.

|

|

|

Perpetual security with no specified maturity date.

|

|

|

Payment-in-kind security. Interest can be paid by issuing additional par of the security

or in cash.

|

|

|

Represents a security purchased on a when-issued basis.

|

|

|

Represents a variable rate security with a step coupon where the rate adjusts according

to a schedule for a series of periods, typically lower for an initial period and then

increasing to a higher coupon rate thereafter. The interest rate shown was the current rate as

of March 31, 2024.

|

|

|

The rate shown is the seven-day current annualized yield at March 31, 2024.

|

|

|

As defined in the Investment Company Act of 1940, as amended, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company which is under common ownership or control with the Fund. The value of

the holdings and transactions in these affiliated companies during the period ended

March 31, 2024 are as follows:

|

|

|

|

|

|

Net change in

unrealized

appreciation

(depreciation)($)

|

|

|

|

|

Columbia Short-Term Cash Fund, 5.543%

|

|

|

|

|

|

|

|

|

|

|

|

|

American Depositary Receipt

|

Tri-Continental Corporation | First Quarter Report 2024

9

Portfolio of Investments (continued)

Tri-Continental Corporation, March 31, 2024 (Unaudited)

Currency Legend

Investments are valued using policies described in the Notes to Financial Statements

in the most recent shareholder report.

10

Tri-Continental Corporation | First Quarter Report 2024

[THIS PAGE INTENTIONALLY LEFT BLANK]

You may at any time request, free of charge, to receive a paper copy of this report

by calling 800.345.6611.

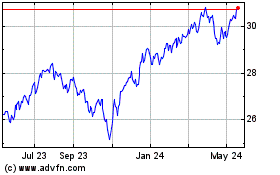

Tri Continental (NYSE:TY)

Historical Stock Chart

From Feb 2025 to Mar 2025

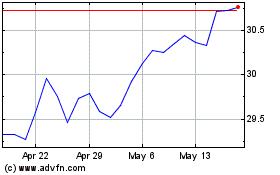

Tri Continental (NYSE:TY)

Historical Stock Chart

From Mar 2024 to Mar 2025