Gross margin reached 35.2% as operating

income increased 19.1% QoQ

Earnings per share in 1H was NT$1.95

Second Quarter 2024 Overview1:

- Revenue: NT$56.80 billion (US$1.75 billion)

- Gross margin: 35.2%; Operating margin: 24.5%

- Revenue from 22/28nm: 33%

- Capacity utilization rate: 68%

- Net income attributable to shareholders of the parent:

NT$13.79 billion (US$425 million)

- Earnings per share: NT$1.11; earnings per ADS:

US$0.171

United Microelectronics Corporation (NYSE: UMC; TWSE:

2303) (“UMC” or “The Company”), a leading global semiconductor

foundry, today announced its consolidated operating results for the

second quarter of 2024.

Second quarter consolidated revenue was NT$56.80 billion,

increasing 4.0% from NT$54.63 billion in 1Q24. Compared to a year

ago, 2Q24 revenue increased 0.9%. Consolidated gross margin for

2Q24 was 35.2%. Net income attributable to the shareholders of the

parent was NT$13.79 billion, with earnings per ordinary share of

NT$1.11.

Jason Wang, co-president of UMC, said, “In the second quarter,

wafer shipments increased 2.6% QoQ and fab utilization rate

improved to 68% as we saw notable demand momentum in the consumer

segment. Contribution from our 22/28nm business rose sequentially

on healthy demand for WiFi and digital TV applications. Together

with a favorable exchange rate and improved product mix,

second-quarter gross margin was better than what was previously

guided. During the quarter, we announced technology updates

including a 3D IC solution to stack RFSOI wafers, which is the

first of its kind in the industry, and a 22nm embedded high voltage

platform, currently the most advanced display driver foundry

solution in the market. They reflect UMC’s commitment to building

on our leadership across a number of specialty technologies that

are crucial for the development of AI, 5G, and automotive.”

Co-president Wang commented, “Looking to the third quarter, we

expect to see end market dynamics improve further, particularly in

the communication and computing segments, which will drive higher

fab utilization. Our 22/28nm business remains a promising growth

driver, with a number of tape-outs taking place in the second half

for applications including display drivers, connectivity and

networking. At the same time, we do expect to face some margin

pressure going into the second half due to a pickup in depreciation

expense related to capacity expansions as well as higher utility

rates. Despite these cost challenges, we believe we will continue

to demonstrate our resilience as we did during the recent market

downturn, and deliver on our strategy of providing differentiated

technology solutions and a diversified manufacturing footprint to

help our customers to strengthen their supply chain

management.”

Co-president Wang added, “In pursuit of our net-zero by 2050

goal, UMC continues to take concrete steps to drive emissions

reduction in our operations and supply chain, and to increase our

use of renewable energy. We are on track to achieving our

progressive 2025 and 2030 targets. More details on our ESG progress

will be made available to stakeholders in our upcoming

Sustainability Report.”

Summary of Operating Results

Operating Results

(Amount: NT$ million)

2Q24

1Q24

QoQ % change

2Q23

YoY % change

Operating Revenues

56,799

54,632

4.0

56,296

0.9

Gross Profit

19,983

16,899

18.2

20,252

(1.3

)

Operating Expenses

(6,311

)

(5,747

)

9.8

(5,718

)

10.4

Net Other Operating Income and

Expenses

219

513

(57.3

)

1,141

(80.8

)

Operating Income

13,891

11,665

19.1

15,675

(11.4

)

Net Non-Operating Income and Expenses

2,529

1,056

139.4

2,810

(10.0

)

Net Income Attributable to Shareholders of

the Parent

13,786

10,456

31.8

15,641

(11.9

)

EPS (NT$ per share)

1.11

0.84

1.27

(US$ per ADS)

0.171

0.130

0.196

Second quarter operating revenues increased 4.0% sequentially to

NT$56.80 billion. Revenue contribution from 40nm and below

technologies represented 45% of wafer revenue. Gross profit grew

18.2% QoQ to NT$19.98 billion, or 35.2% of revenue. Operating

expenses increased 9.8% to NT$6.31 billion. Net other operating

income decreased to NT$0.22 billion. Net non-operating income

reached NT$2.53 billion. Net income attributable to shareholders of

the parent amounted to NT$13.79 billion.

Earnings per ordinary share for the quarter was NT$1.11.

Earnings per ADS was US$0.171. The basic weighted average number of

shares outstanding in 2Q24 was 12,414,189,313, compared with

12,414,087,724 shares in 1Q24 and 12,348,986,144 shares in 2Q23.

The diluted weighted average number of shares outstanding was

12,529,942,186 in 2Q24, compared with 12,577,525,057 shares in 1Q24

and 12,526,182,161 shares in 2Q23. The fully diluted shares counted

on June 30, 2024 were approximately 12,530,243,000.

Detailed Financials Section

Operating revenues increased to NT$56.80 billion. COGS declined

2.4% to NT$36.82 billion. Gross profit grew 18.2% QoQ to NT$19.98

billion. Operating expenses increased to NT$6.31 billion, as

R&D grew 13.1% to NT$3.85 billion or 6.8% of revenue, while

G&A also increased 6.0% to NT$1.80 billion. Net other operating

income was NT$0.22 billion. In 2Q24, operating income increased

19.1% QoQ to NT$13.89 billion.

COGS & Expenses

(Amount: NT$ million)

2Q24

1Q24

QoQ % change

2Q23

YoY % change

Operating Revenues

56,799

54,632

4.0

56,296

0.9

COGS

(36,816

)

(37,733

)

(2.4

)

(36,044

)

2.1

Depreciation

(9,460

)

(9,335

)

1.3

(8,467

)

11.7

Other Mfg. Costs

(27,356

)

(28,398

)

(3.7

)

(27,577

)

(0.8

)

Gross Profit

19,983

16,899

18.2

20,252

(1.3

)

Gross Margin (%)

35.2

%

30.9

%

36.0

%

Operating Expenses

(6,311

)

(5,747

)

9.8

(5,718

)

10.4

Sales & Marketing

(678

)

(684

)

(0.9

)

(716

)

(5.4

)

G&A

(1,804

)

(1,702

)

6.0

(1,715

)

5.2

R&D

(3,853

)

(3,407

)

13.1

(3,317

)

16.1

Expected credit impairment gain

24

46

(47.9

)

30

(21.5

)

Net Other Operating Income &

Expenses

219

513

(57.3

)

1,141

(80.8

)

Operating Income

13,891

11,665

19.1

15,675

(11.4

)

Net non-operating income in 2Q24 was NT$2.53 billion, primarily

due to the NT$1.44 billion in net investment gain, the NT$0.70

billion in net interest income and the NT$0.41 billion in exchange

gain.

Non-Operating Income and

Expenses

(Amount: NT$ million)

2Q24

1Q24

2Q23

Non-Operating Income and Expenses

2,529

1,056

2,810

Net Interest Income and Expenses

701

676

974

Net Investment Gain and Loss

1,440

(324

)

1,042

Exchange Gain and Loss

407

697

799

Other Gain and Loss

(19

)

7

(5

)

In 2Q24, cash inflow from operating activities was NT$22.73

billion. Cash outflow from investing activities totaled NT$15.13

billion, which included NT$20.83 billion in capital expenditure,

resulting in free cash inflow of NT$1.90 billion. Cash outflow from

financing was NT$5.71 billion, primarily from NT$3.00 billion in

redemption of bonds and NT$2.50 billion in bank loans. Net cash

flow in 2Q24 amounted to NT$2.23 billion. Over the next 12 months,

the company expects to repay NT$4.32 billion in bank loans.

Cash Flow Summary

(Amount: NT$ million)

For the 3-Month Period

Ended

Jun. 30, 2024

For the 3-Month Period

Ended

Mar. 31, 2024

Cash Flow from Operating Activities

22,728

20,820

Net income before tax

16,420

12,721

Depreciation & Amortization

11,117

10,886

Share of profit of associates and

joint ventures

(1,267

)

(101

)

Income tax paid

(5,831

)

(253

)

Changes in working capital &

others

2,289

(2,433

)

Cash Flow from Investing Activities

(15,131

)

(29,915

)

Decrease in financial assets measured at

amortized cost

3,219

739

Acquisition of PP&E

(20,042

)

(28,498

)

Changes in refundable deposits

1,507

(536

)

Acquisition of intangible assets

(578

)

(846

)

Others

763

(774

)

Cash Flow from Financing Activities

(5,705

)

(6,439

)

Bank loans

(2,503

)

(3,888

)

Redemption of bonds

(3,000

)

(2,100

)

Decrease in deposits-in

(33

)

(282

)

Others

(169

)

(169

)

Effect of Exchange Rate

341

2,411

Net Cash Flow

2,233

(13,123

)

Beginning balance

119,431

132,554

Changes in non-current assets held for

sale

(430

)

-

Ending balance

121,234

119,431

Cash and cash equivalents increased to NT$121.23 billion. Days

of inventory increased 3 days to 88 days.

Current Assets

(Amount: NT$ billion)

2Q24

1Q24

2Q23

Cash and Cash Equivalents

121.23

119.43

163.10

Accounts Receivable

32.53

30.68

30.62

Days Sales Outstanding

51

50

47

Inventories, net

36.33

34.59

34.55

Days of Inventory

88

85

85

Total Current Assets

207.22

205.16

239.03

Current liabilities increased to NT$124.97 billion due to

dividends payable of NT$37.59 billion. Payables on equipment

increased to NT$22.36 billion. Total liabilities increased to

NT$230.87 billion, leading to a debt to equity ratio of 65%.

Liabilities

(Amount: NT$ billion)

2Q24

1Q24

2Q23

Total Current Liabilities

124.97

88.40

142.98

Accounts Payable

8.18

7.46

8.83

Short-Term Credit / Bonds

16.21

25.60

11.59

Payables on Equipment

22.36

13.97

13.01

Dividends Payable

37.59

-

45.02

Other

40.63

41.37

64.53

Long-Term Credit / Bonds

47.48

43.45

36.06

Total Liabilities

230.87

188.85

226.31

Debt to Equity

65%

50%

69%

Analysis of Revenue2

Revenue from Asia-Pacific was flattish at 64% while business

from North America remained unchanged at 25% of sales. Business

from Europe declined to 7% while contribution from Japan was

4%.

Revenue Breakdown by

Region

Region

2Q24

1Q24

4Q23

3Q23

2Q23

North America

25%

25%

23%

27%

27%

Asia Pacific

64%

63%

62%

58%

56%

Europe

7%

8%

11%

12%

12%

Japan

4%

4%

4%

3%

5%

Revenue contribution from 22/28nm was 33% of the wafer revenue,

while 40nm contribution declined to 12% of sales.

Revenue Breakdown by

Geometry

Geometry

2Q24

1Q24

4Q23

3Q23

2Q23

14nm and below

0%

0%

0%

0%

0%

14nm<x<=28nm

33%

33%

36%

32%

29%

28nm<x<=40nm

12%

14%

14%

13%

12%

40nm<x<=65nm

15%

18%

16%

19%

23%

65nm<x<=90nm

12%

10%

9%

8%

10%

90nm<x<=0.13um

11%

9%

9%

12%

10%

0.13um<x<=0.18um

10%

11%

9%

9%

9%

0.18um<x<=0.35um

5%

4%

5%

5%

5%

0.5um and above

2%

1%

2%

2%

2%

Revenue from fabless customers accounted for 87% of revenue.

Revenue Breakdown by Customer

Type

Customer Type

2Q24

1Q24

4Q23

3Q23

2Q23

Fabless

87%

82%

78%

79%

79%

IDM

13%

18%

22%

21%

21%

Revenue from the communication segment declined to 39%, while

business from computer applications grew to 15%. Business from

consumer applications reached 31% as other segments declined to 15%

of revenue.

Revenue Breakdown by

Application (1)

Application

2Q24

1Q24

4Q23

3Q23

2Q23

Computer

15%

13%

13%

13%

9%

Communication

39%

48%

47%

46%

44%

Consumer

31%

23%

23%

23%

26%

Others

15%

16%

17%

18%

21%

(1) Computer consists of ICs such

as CPU, GPU, HDD controllers, DVD/CD-RW control ICs, PC chipset,

audio codec, keyboard controller, monitor scaler, USB, I/O chipset,

WLAN. Communication consists of handset components,

broadband, bluetooth, Ethernet, LAN, DSP, etc. Consumer

consists of ICs used for DVD players, DTV, STB, MP3/MP4, flash

controller, game consoles, DSC, smart cards, toys, etc.

Blended ASP Trend

Blended average selling price (ASP) remained firm in 2Q24.

(To view blended ASP trend, please click here for 2Q24 ASP)

Shipment and Utilization Rate3

Wafer shipments increased 2.6% QoQ to 831K during the second

quarter, while quarterly capacity was 1,257K. Overall utilization

rate in 2Q24 increased slightly to 68%.

Wafer Shipments

2Q24

1Q24

4Q23

3Q23

2Q23

Wafer Shipments (12” K equivalents)

831

810

775

795

814

Quarterly Capacity Utilization

Rate

2Q24

1Q24

4Q23

3Q23

2Q23

Utilization Rate

68%

65%

66%

67%

71%

Total Capacity (12” K equivalents)

1,257

1,212

1,204

1,182

1,167

Capacity4

Total capacity in the second quarter increased to 1,257K 12-inch

equivalent wafers. Capacity will grow in the third quarter of 2024

to 1,274K 12-inch equivalent wafers.

Annual Capacity in

thousands of wafers

Quarterly Capacity in

thousands of wafers

FAB

Geometry (um)

2023

2022

2021

2020

FAB

3Q24E

2Q24

1Q24

4Q23

WTK

6"

5 – 0.15

328

335

329

371

WTK

6"

83

83

82

83

8A

8"

3 – 0.11

811

765

755

802

8A

8"

207

207

206

207

8C

8"

0.35 – 0.11

473

459

459

452

8C

8"

119

119

119

119

8D

8"

0.18 – 0.09

440

410

380

371

8D

8"

118

118

118

118

8E

8"

0.6 – 0.14

490

469

457

449

8E

8"

131

131

130

131

8F

8"

0.18 – 0.11

570

550

514

485

8F

8"

145

145

144

145

8S

8"

0.18 – 0.11

447

443

408

373

8S

8"

114

114

113

114

8N

8"

0.5 – 0.11

996

952

917

917

8N

8"

254

254

252

254

12A

12"

0.13 – 0.014

1,305

1,170

1,070

1,044

12A

12"

403

386

358

346

12i

12"

0.13 – 0.040

655

655

641

628

12i

12"

172

172

164

164

12X

12"

0.080 – 0.022

317

314

284

217

12X

12"

80

80

79

80

12M

12"

0.13 – 0.040

438

436

395

391

12M

12"

115

115

110

110

Total(1)

4,674

4,458

4,201

4,083

Total

1,274

1,257

1,212

1,204

YoY Growth Rate

5%

6%

3%

13%

(1) One 6-inch wafer is converted into 0.25 (62/122) 12-inch

equivalent wafer; one 8-inch wafer is converted into 0.44 (82/122)

12-inch equivalent wafers. Total capacity figures are expressed in

12-inch equivalent wafers.

CAPEX

CAPEX spending in 2Q24 totaled US$644 million. 2024 cash-based

CAPEX budget will be US$3.3 billion.

Capital Expenditure by Year - in

US$ billion

Year

2023

2022

2021

2020

2019

CAPEX

$ 3.0

$ 2.7

$ 1.8

$ 1.0

$ 0.6

2024 CAPEX Plan

8"

12"

Total

5%

95%

US$3.3 billion

Third Quarter 2024 Outlook & Guidance

Quarter-over-Quarter Guidance:

- Wafer Shipments: Will increase by mid-single digit %

- ASP in USD: Will remain firm

- Gross Profit Margin: Will be in the mid-30% range

- Capacity Utilization: approximately 70%

- 2024 CAPEX: US$3.3 billion

Recent Developments / Announcements

Apr. 25, 2024

UMC Files Form 20-F for 2023 with US

Securities and Exchange Commission

Apr. 30, 2024

UMC Achieves Highest Corporate Governance

Ranking among Taiwan Listed Companies for 10th Consecutive Year

May 2, 2024

UMC Introduces Industry’s First 3D IC

Solution for RFSOI, Accelerating Innovations in the 5G Era

May 21, 2024

UMC’s Singapore Fab 12i Celebrates First

Tool Move-In for New Phase 3 Expansion

May 30, 2024

UMC Shareholders Elect 16th Term of

Directors at Annual Shareholders’ Meeting

Jun. 20, 2024

UMC Launches Most Advanced 22nm eHV

Platform to Power Next-Generation Smartphone Displays

Please visit UMC’s website for further details

regarding the above announcements

Conference Call / Webcast Announcement

Wednesday, July 31, 2024

Time: 5:00 PM (Taipei) / 5:00 AM (New York) / 10:00 AM

(London)

Dial-in numbers and Access Codes:

Taiwan Number:

02 3396 1191

Taiwan Toll Free:

0080 119 6666

US Toll Free:

+1 866 212 5567

Other Areas:

+886 2 3396 1191

Access Code:

1433531#

A live webcast and replay of the 2Q24 results

announcement will be available at www.umc.com under the “Investors

/ Events” section.

About UMC

UMC (NYSE: UMC, TWSE: 2303) is a leading global semiconductor

foundry company. The company provides high-quality IC fabrication

services, focusing on logic and various specialty technologies to

serve all major sectors of the electronics industry. UMC’s

comprehensive IC processing technologies and manufacturing

solutions include Logic/Mixed-Signal, embedded High-Voltage,

embedded Non-Volatile-Memory, RFSOI, BCD etc. Most of UMC’s 12-in

and 8-in fabs with its core R&D are in Taiwan, with additional

ones throughout Asia. UMC has a total of 12 fabs in production with

a combined capacity of more than 400,000 wafers per month (12-in

equivalent), and all of them are certified with IATF 16949

automotive quality standards. UMC is headquartered in Hsinchu,

Taiwan, plus local offices in the United States, Europe, China,

Japan, Korea, and Singapore, with a worldwide total of 20,000

employees. For more information, please visit:

http://www.umc.com.

Safe Harbor Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the United States Securities Act of

1933, as amended, and Section 21E of the United States Securities

Exchange Act of 1934, as amended, and as defined in the United

States Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to,

statements regarding anticipated financial results for the second

quarter of 2024; the expected wafer shipment and ASP; the

anticipated annual budget; capex strategies; environmental

protection goals and water management strategies; impact of foreign

currency exchange rates; expected foundry capacities; the ability

to obtain new business opportunities; and information under the

heading “Third Quarter 2024 Outlook and Guidance.”

These forward-looking statements involve known and unknown

risks, uncertainties and other factors that may cause the actual

performance, financial condition or results of operations of UMC to

be materially different from what is stated or may be implied in

such forward-looking statements. Investors are cautioned that

actual events and results could differ materially from those

statements as a result of a number of factors including, but not

limited to: (i) dependence upon the frequent introduction of new

services and technologies based on the latest developments in the

industry in which UMC operates; (ii) the intensely competitive

semiconductor, communications, consumer electronics and computer

industries and markets; (iii) the risks associated with

international business activities; (iv) dependence upon key

personnel; (v) general economic and political conditions; (vi)

possible disruptions in commercial activities caused by natural and

human-induced events and disasters, including natural disasters,

terrorist activity, armed conflict and highly contagious diseases;

(vii) reduced end-user purchases relative to expectations and

orders; and (viii) fluctuations in foreign currency exchange rates.

Further information regarding these and other risk factors is

included in UMC’s filings with the United States Securities and

Exchange Commission, including its Annual Report on Form 20-F. All

information provided in this release is as of the date of this

release and are based on assumptions that UMC believes to be

reasonable as of this date, and UMC does not undertake any

obligation to update any forward-looking statement as a result of

new information, future events or otherwise, except as required

under applicable law.

The financial statements included in this release are prepared

and published in accordance with Taiwan International Financial

Reporting Standards, or TIFRSs, recognized by the Financial

Supervisory Commission in the ROC, which is different from

International Financial Reporting Standards, or IFRSs, issued by

the International Accounting Standards Board. Investors are

cautioned that there may be significant differences between TIFRSs

and IFRSs. In addition, TIFRSs and IFRSs differ in certain

significant respects from generally accepted accounting principles

in the ROC and generally accepted accounting principles in the

United States.

- FINANCIAL TABLES TO FOLLOW -

UNITED MICROELECTRONICS CORPORATION AND SUBSIDIARIES

Consolidated Condensed Balance Sheet As of June 30, 2024

Figures in Millions of New Taiwan Dollars (NT$) and U.S. Dollars

(US$) June 30, 2024 US$ NT$ % Assets Current assets

Cash and cash equivalents

3,738

121,234

20.7%

Accounts receivable, net

1,003

32,525

5.6%

Inventories, net

1,120

36,334

6.2%

Other current assets

528

17,122

2.8%

Total current assets

6,389

207,215

35.3%

Non-current assets Funds and investments

2,418

78,404

13.4%

Property, plant and equipment

8,450

274,031

46.7%

Right-of-use assets

233

7,549

1.3%

Other non-current assets

609

19,763

3.3%

Total non-current assets

11,710

379,747

64.7%

Total assets

18,099

586,962

100.0%

Liabilities Current liabilities Short-term loans

96

3,119

0.5%

Payables

1,861

60,362

10.3%

Dividends payable

1,159

37,587

6.4%

Current portion of long-term liabilities

404

13,091

2.2%

Other current liabilities

334

10,814

1.9%

Total current liabilities

3,854

124,973

21.3%

Non-current liabilities Bonds payable

758

24,582

4.2%

Long-term loans

706

22,901

3.9%

Lease liabilities, noncurrent

163

5,288

0.9%

Other non-current liabilities

1,638

53,126

9.0%

Total non-current liabilities

3,265

105,897

18.0%

Total liabilities

7,119

230,870

39.3%

Equity Equity attributable to the parent company Capital

3,863

125,286

21.3%

Additional paid-in capital

443

14,346

2.5%

Retained earnings and other components of equity

6,665

216,147

36.8%

Total equity attributable to the parent company

10,971

355,779

60.6%

Non-controlling interests

9

313

0.1%

Total equity

10,980

356,092

60.7%

Total liabilities and equity

18,099

586,962

100.0%

Note: New Taiwan Dollars have been translated into U.S. Dollars at

the June 30, 2024 exchange rate of NT $32.43 per U.S. Dollar.

UNITED MICROELECTRONICS CORPORATION AND SUBSIDIARIES

Consolidated Condensed Statements of Comprehensive Income

Figures in Millions of New Taiwan Dollars (NT$) and U.S. Dollars

(US$) Except Per Share and Per ADS Data

Year over

Year Comparison Quarter over Quarter Comparison

Three-Month Period Ended Three-Month Period Ended June 30, 2024

June 30, 2023 Chg. June 30, 2024 March 31, 2024 Chg. US$ NT$ US$

NT$ % US$ NT$ US$ NT$ % Operating revenues

1,751

56,799

1,736

56,296

0.9

%

1,751

56,799

1,685

54,632

4.0

%

Operating costs

(1,135

)

(36,816

)

(1,112

)

(36,044

)

2.1

%

(1,135

)

(36,816

)

(1,164

)

(37,733

)

(2.4

%)

Gross profit

616

19,983

624

20,252

(1.3

%)

616

19,983

521

16,899

18.2

%

35.2

%

35.2

%

36.0

%

36.0

%

35.2

%

35.2

%

30.9

%

30.9

%

Operating expenses - Sales and marketing expenses

(21

)

(678

)

(22

)

(716

)

(5.4

%)

(21

)

(678

)

(21

)

(684

)

(0.9

%)

- General and administrative expenses

(56

)

(1,804

)

(53

)

(1,715

)

5.2

%

(56

)

(1,804

)

(52

)

(1,702

)

6.0

%

- Research and development expenses

(119

)

(3,853

)

(102

)

(3,317

)

16.1

%

(119

)

(3,853

)

(105

)

(3,407

)

13.1

%

- Expected credit impairment gain

1

24

1

30

(21.5

%)

1

24

1

46

(47.9

%)

Subtotal

(195

)

(6,311

)

(176

)

(5,718

)

10.4

%

(195

)

(6,311

)

(177

)

(5,747

)

9.8

%

Net other operating income and expenses

7

219

35

1,141

(80.8

%)

7

219

16

513

(57.3

%)

Operating income

428

13,891

483

15,675

(11.4

%)

428

13,891

360

11,665

19.1

%

24.5

%

24.5

%

27.8

%

27.8

%

24.5

%

24.5

%

21.4

%

21.4

%

Net non-operating income and expenses

78

2,529

87

2,810

(10.0

%)

78

2,529

32

1,056

139.4

%

Income from continuing operations before income tax

506

16,420

570

18,485

(11.2

%)

506

16,420

392

12,721

29.1

%

28.9

%

28.9

%

32.8

%

32.8

%

28.9

%

28.9

%

23.3

%

23.3

%

Income tax expense

(81

)

(2,645

)

(80

)

(2,588

)

2.2

%

(81

)

(2,645

)

(70

)

(2,291

)

15.4

%

Net income

425

13,775

490

15,897

(13.3

%)

425

13,775

322

10,430

32.1

%

24.3

%

24.3

%

28.2

%

28.2

%

24.3

%

24.3

%

19.1

%

19.1

%

Other comprehensive income (loss)

42

1,375

(7

)

(238

)

-

42

1,375

245

7,954

(82.7

%)

Total comprehensive income (loss)

467

15,150

483

15,659

(3.2

%)

467

15,150

567

18,384

(17.6

%)

Net income attributable to: Shareholders of the parent

425

13,786

482

15,641

(11.9

%)

425

13,786

322

10,456

31.8

%

Non-controlling interests

(0

)

(11

)

8

256

-

(0

)

(11

)

(0

)

(26

)

(58.8

%)

Comprehensive income (loss) attributable to: Shareholders of

the parent

467

15,161

475

15,403

(1.6

%)

467

15,161

568

18,410

(17.6

%)

Non-controlling interests

(0

)

(11

)

8

256

-

(0

)

(11

)

(1

)

(26

)

(58.8

%)

Earnings per share-basic

0.034

1.11

0.039

1.27

0.034

1.11

0.026

0.84

Earnings per ADS (2)

0.171

5.55

0.196

6.35

0.171

5.55

0.130

4.20

Weighted average number of shares outstanding (in millions)

12,414

12,349

12,414

12,414

Notes: (1) New Taiwan Dollars have been translated

into U.S. Dollars at the June 30, 2024 exchange rate of NT $32.43

per U.S. Dollar. (2) 1 ADS equals 5 common shares.

UNITED

MICROELECTRONICS CORPORATION AND SUBSIDIARIES Consolidated

Condensed Statements of Comprehensive Income Figures in

Millions of New Taiwan Dollars (NT$) and U.S. Dollars (US$) Except

Per Share and Per ADS Data For the Three-Month Period Ended

For the Six-Month Period Ended June 30, 2024 June 30, 2024 US$ NT$

% US$ NT$ % Operating revenues

1,751

56,799

100.0

%

3,436

111,431

100.0

%

Operating costs

(1,135

)

(36,816

)

(64.8

%)

(2,299

)

(74,548

)

(66.9

%)

Gross profit

616

19,983

35.2

%

1,137

36,883

33.1

%

Operating expenses - Sales and marketing expenses

(21

)

(678

)

(1.2

%)

(42

)

(1,362

)

(1.2

%)

- General and administrative expenses

(56

)

(1,804

)

(3.1

%)

(108

)

(3,506

)

(3.2

%)

- Research and development expenses

(119

)

(3,853

)

(6.8

%)

(224

)

(7,260

)

(6.5

%)

- Expected credit impairment gain

1

24

0.0

%

2

69

0.1

%

Subtotal

(195

)

(6,311

)

(11.1

%)

(372

)

(12,059

)

(10.8

%)

Net other operating income and expenses

7

219

0.4

%

23

732

0.6

%

Operating income

428

13,891

24.5

%

788

25,556

22.9

%

Net non-operating income and expenses

78

2,529

4.4

%

111

3,585

3.3

%

Income from continuing operations before income tax

506

16,420

28.9

%

899

29,141

26.2

%

Income tax expense

(81

)

(2,645

)

(4.6

%)

(153

)

(4,936

)

(4.5

%)

Net income

425

13,775

24.3

%

746

24,205

21.7

%

Other comprehensive income (loss)

42

1,375

2.4

%

288

9,329

8.4

%

Total comprehensive income (loss)

467

15,150

26.7

%

1,034

33,534

30.1

%

Net income attributable to: Shareholders of the parent

425

13,786

24.3

%

748

24,242

21.8

%

Non-controlling interests

(0

)

(11

)

(0.0

%)

(2

)

(37

)

(0.1

%)

Comprehensive income (loss) attributable to: Shareholders of the

parent

467

15,161

26.7

%

1,035

33,571

30.1

%

Non-controlling interests

(0

)

(11

)

(0.0

%)

(1

)

(37

)

(0.0

%)

Earnings per share-basic

0.034

1.11

0.060

1.95

Earnings per ADS (2)

0.171

5.55

0.301

9.75

Weighted average number of shares outstanding (in millions)

12,414

12,414

Notes: (1) New Taiwan Dollars have been translated into U.S.

Dollars at the June 30, 2024 exchange rate of NT $32.43 per U.S.

Dollar. (2) 1 ADS equals 5 common shares.

UNITED

MICROELECTRONICS CORPORATION AND SUBSIDIARIES Consolidated

Condensed Statement of Cash Flows For The Six-Month Period

Ended June 30, 2024 Figures in Millions of New Taiwan Dollars (NT$)

and U.S. Dollars (US$) US$ NT$

Cash flows from operating

activities : Net income before tax

899

29,141

Depreciation & Amortization

678

22,003

Share of profit of associates and joint ventures

(42

)

(1,368

)

Income tax paid

(188

)

(6,084

)

Changes in working capital & others

(4

)

(144

)

Net cash provided by operating activities

1,343

43,548

Cash flows from investing activities : Decrease in

financial assets measured at amortized cost

122

3,958

Acquisition of property, plant and equipment

(1,497

)

(48,540

)

Acquisition of intangible assets

(44

)

(1,424

)

Others

30

960

Net cash used in investing activities

(1,389

)

(45,046

)

Cash flows from financing activities : Decrease in

short-term loans

(321

)

(10,411

)

Redemption of bonds

(157

)

(5,100

)

Proceeds from long-term loans

358

11,600

Repayments of long-term loans

(234

)

(7,580

)

Others

(20

)

(653

)

Net cash used in financing activities

(374

)

(12,144

)

Effect of exchange rate changes on cash and cash equivalents

85

2,752

Net decrease in cash and cash equivalents

(335

)

(10,890

)

Cash and cash equivalents at beginning of period

4,087

132,554

Cash and cash equivalents at end of period

3,752

121,664

Reconciliation of the balances of cash and cash equivalents

at end of period : Cash and cash equivalents balances on the

consolidated balance sheets

3,738

121,234

Cash and cash equivalents included in non-current assets held for

sale

14

430

Cash and cash equivalents at end of period

3,752

121,664

Note: New Taiwan Dollars have been translated into

U.S. Dollars at the June 30, 2024 exchange rate of NT $32.43 per

U.S. Dollar.

1Unless otherwise stated, all financial figures discussed in

this announcement are prepared in accordance with TIFRSs recognized

by Financial Supervisory Commission in the ROC, which is different

from IFRSs issued by the International Accounting Standards Board.

They represent comparisons among the three-month period ending June

30, 2024, the three-month period ending March 31, 2024, and the

equivalent three-month period that ended June 30, 2023. For all

2Q24 results, New Taiwan Dollar (NT$) amounts have been converted

into U.S. Dollars at the June 30, 2024 exchange rate of NT$ 32.43

per U.S. Dollar.

2 Revenue in this section represents wafer sales

3 Utilization Rate = Quarterly Wafer Out / Quarterly

Capacity

4 Estimated capacity numbers are based on calculated maximum

output rather than designed capacity. The actual capacity numbers

may differ depending upon equipment delivery schedules, pace of

migration to more advanced process technologies, and other factors

affecting production ramp-up.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731242433/en/

Michael Lin / David Wong UMC, Investor Relations +

886-2-2658-9168, ext. 16900 jinhong_lin@umc.com

david_wong@umc.com

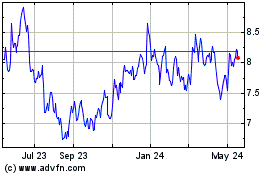

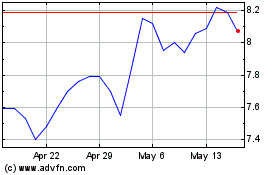

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Jul 2024 to Jul 2024

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Jul 2023 to Jul 2024