UMH PROPERTIES, INC. Q3 2024 OPERATIONS UPDATE

October 03 2024 - 3:15PM

UMH Properties, Inc. (NYSE: UMH) (TASE: UMH), a real estate

investment trust (REIT) specializing in the ownership and operation

of manufactured home communities, is providing investors with an

update on our third quarter 2024 operating results:

- As of quarter end, UMH achieved an

equity market capitalization of over $1.5 billion.

- During the third quarter, UMH

converted 179 new homes from inventory to revenue generating homes.

UMH now owns approximately 10,300 rental homes with an occupancy

rate of 94.4%.

- During the third quarter, UMH sold

100 homes of which 32 were new home sales. Gross home sales revenue

for the third quarter was $8.7 million as compared to $7.9 million

last year, representing an increase of approximately 10%.

- Year to date, overall occupancy

increased by 235 units to 87%. During the third quarter, overall

occupancy increased by 39 units. Year over year, overall occupancy

increased by 271 units.

- Our occupancy gains and rent

increases achieved throughout 2023 and 2024 have increased our

September 2024 rental and related charges by approximately 8%,

resulting in our annualized monthly rent roll generating $206

million.

- We issued and sold approximately

5.7 million shares of Common Stock through our At-the-Market Sale

program at a weighted average price of $18.93 per share, generating

gross proceeds of $108.4 million.

Samuel A. Landy, President and CEO of UMH

Properties, Inc., stated “UMH’s operating results continue to meet

our expectations. Our communities are experiencing strong demand

for sales and rental homes as demonstrated by our increased

occupancy rates and our 10% increase in sales of manufactured

homes. We currently have 284 homes on site that are ready for

occupancy or being set up and another 240 homes expected to be

delivered soon. This inventory will allow us to continue our

organic growth through our sales and rental programs. With the

unfortunate widespread loss of homes resulting from Hurricane

Helene, we expect the demand for low cost, affordable housing to

only increase.

“We opportunistically raised approximately $108

million through our common ATM at share prices close to our 52-week

high. This capital was used in part to pay down our line of credit,

which should result in a reduction of interest expense.

Additionally, we are actively deploying this capital into our

rental home program, the financing of home sales, expansions and

capital improvements which should generate accretive returns.

“We have positioned the company with a strong

balance sheet so that we can continue to invest in our communities

and be prepared to acquire new communities when accretive

investment opportunities become available.”

It should be noted that the financial

information set forth above reflects our preliminary estimates with

respect to such information, based on information currently

available to management, and may vary from our actual financial

results as of and for the quarter ending September 30, 2024. UMH’s

full Third Quarter 2024 results will be released on Wednesday,

November 6, 2024, after the close of trading on the New York Stock

Exchange and will be available on the Company’s website at

www.umh.reit, in the Financials section. Senior management will

discuss the results, current market conditions and future outlook

on Thursday, November 7, 2024, at 10:00 a.m. Eastern Time.

UMH Properties, Inc., which was organized in

1968, is a public equity REIT that owns and operates 136

manufactured home communities containing approximately 25,800

developed homesites. These communities are located in New Jersey,

New York, Ohio, Pennsylvania, Tennessee, Indiana, Maryland,

Michigan, Alabama, South Carolina and Georgia. UMH also has an

ownership interest in and operates two communities in Florida,

containing 363 sites, through its joint venture with Nuveen Real

Estate.

Certain statements included in this press

release which are not historical facts may be deemed

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Any such forward-looking

statements are based on the Company’s current expectations and

involve various risks and uncertainties. Although the Company

believes the expectations reflected in any forward-looking

statements are based on reasonable assumptions, the Company can

provide no assurance those expectations will be achieved. The risks

and uncertainties that could cause actual results or events to

differ materially from expectations are contained in the Company’s

annual report on Form 10-K and described from time to time in the

Company’s other filings with the SEC. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements whether as a result of new information, future events,

or otherwise.

Contact: Nelli

Madden732-577-4062

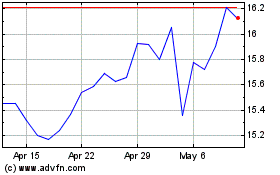

UMH Properties (NYSE:UMH)

Historical Stock Chart

From Dec 2024 to Jan 2025

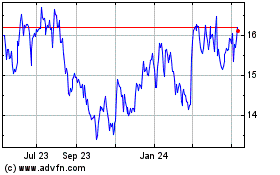

UMH Properties (NYSE:UMH)

Historical Stock Chart

From Jan 2024 to Jan 2025