false

0001819516

0001819516

2024-09-22

2024-09-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 22, 2024

WHEELS UP EXPERIENCE INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-39541 |

98-1617611 |

| (State or other jurisdiction |

(Commission |

(I.R.S. Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 2135 American Way |

|

| Chamblee, Georgia |

30341 |

| (Address of principal executive offices) |

(Zip Code) |

(212) 257-5252

(Registrant’s telephone number, including

area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A common stock, $0.0001 par value per share |

|

UP |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

On September 22, 2024, Wheels Up Experience Inc.

(the “Company”) entered into Amendment No. 2 to Investment and Investor Rights Agreement (the “Investor Rights

Agreement Amendment”), with each of Delta Air Lines, Inc. (“Delta”), CK Wheels LLC (“CK Wheels”),

Cox Investment Holdings, LLC (“CIH” and, collectively with Delta and CK Wheels, the “Lead Investors”),

Whitebox Multi-Strategy Partners, LP (“Whitebox MSP”), Whitebox Relative Value Partners, LP (“Whitebox RVP”),

Pandora Select Partners, LP (“Pandora”), Whitebox GT Fund, LP (“Whitebox GT” and, collectively with Whitebox MSP,

Whitebox RVP and Pandora, the “Whitebox Entities”) and Kore Air LLC (“Kore” and, collectively

with the Whitebox Entities, the “Additional Investors” and, collectively with the Lead Investors, the “Investors”),

to amend and extend, among others, certain transfer restrictions set forth in the Investment and Investor Rights Agreement, dated September 20, 2023,

by and among, the Company and the Investors (as amended by Amendment No. 1 thereto, dated as of November 15, 2023, the

“Investor Rights Agreement”). Pursuant to the Investor Rights Agreement Amendment, the Lead Investors agreed to extend the

lock-up restriction with respect to all of their shares of the Company’s Class A common stock, $0.0001 par value per share

(“Common Stock”), issued pursuant to the Investor Rights Agreement (“Shares”) for an additional year, until September 20, 2025,

and the Additional Investors agreed to extend the lock-up restriction with respect to 72.5% of their Shares for an additional year, until

September 20, 2025, in each case subject to limited exceptions for transfers to Permitted Transferees (as defined in the Investor

Rights Agreement); provided, that any transfers or sales of Shares held by the Additional Investors that are not subject to the extended

lock-up restriction shall not be at a price less than the minimum price per share specified in the Investor Rights Agreement Amendment.

Pursuant to the Investor Rights Agreement Amendment, approximately 97.2% of the Shares will remain subject to a lock-up restriction until

September 20, 2025.

In addition, on September 22, 2024, the holders that collectively beneficially own in excess of 66.67% of the Registrable Securities (as

defined in the Registration Rights Agreement, dated as of September 20, 2023, by and among the Company and the equity holders set forth

on Schedule 1 thereto) extended the deadline by which the Company must file an initial shelf registration statement to register the Shares

under the Securities Act of 1933, as amended (the “Securities Act”), to September 20, 2025.

At

the time the Investor Rights Agreement Amendment was entered into: (i) Delta beneficially owned

approximately 37.8% of the outstanding shares of Common Stock, of which any shares in excess of 29.9% of shares of Common Stock

entitled to vote at any annual meeting of the Company's stockholders that are held by Delta will be neutral shares with respect to

voting rights; (ii) CK Wheels beneficially owned approximately 37.0% of the outstanding shares of Common Stock;

(iii) CIH beneficially owned approximately 12.1% of the outstanding shares of Common Stock; and (iv)(a) each Investor was

a lender under the Company’s secured credit facility, and was a party to certain other agreements concerning the governance of

the Company and commercial arrangements, in each case as disclosed under the heading “Related Person Transactions with Holders

of More than 5% of Our Voting Stock” in the

Company’s definitive proxy statement on Schedule 14A, which was filed with the U.S. Securities and Exchange

Commission (“SEC”) on April 24, 2024, and (b) Delta and the Company were parties to certain transactions

described in Item 1.01 of the Company’s

Current Report on Form 8-K filed with the SEC on June 17, 2024. The Investor Rights Agreement Amendment was approved by the disinterested, independent members of the Company’s Board of Directors (the

“Board”) and Audit Committee of the Board.

The foregoing description of the Investor Rights Agreement Amendment does not purport to be complete and is qualified in its entirety

by reference to a copy thereof, which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

| Item 7.01 | Regulation FD Disclosure. |

On September 23, 2024, the Company issued

a press release regarding the lock-up extension described in Item 1.01 of this Current Report on Form 8-K (this “Current

Report”), a copy of which is furnished as Exhibit 99.1 and incorporated by reference herein.

The information in Item 7.01 of this Current

Report and Exhibit 99.1 is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the

Securities Act or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| * | Filed herewith. |

| ** | Furnished herewith. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

WHEELS UP EXPERIENCE INC. |

| |

|

|

|

| |

|

|

|

| Date: September 23, 2024 |

By: |

/s/ George Mattson |

| |

|

Name: |

George Mattson |

| |

|

Title: |

Chief Executive Officer |

Exhibit 10.1

AMENDMENT NO. 2 TO INVESTMENT AND INVESTOR RIGHTS

AGREEMENT

This Amendment No. 2 (“Amendment

No. 2”), dated as of September 22, 2024, to the Investment and Investor Rights Agreement, dated as of September 20,

2023 (the “Original Investment Agreement”, as amended by Amendment No. 1 thereto, dated as of November 15, 2023

(“Amendment No. 1”), and as supplemented by the several Joinders thereto, dated November 15, 2023

(collectively, the “Investment Agreement Joinders”), collectively the “Investment Agreement”), by

and among Wheels Up Experience Inc., a Delaware corporation (the “Company”), and the entities listed on Schedule A

to the Investment Agreement (each, an “Investor” and collectively, the “Investors”), is made

and entered into by and between the Company and the Investors listed on the signature pages hereto. Capitalized terms used herein

without definition have the meanings assigned to them in the Investment Agreement.

W I T N E S S E T H:

WHEREAS, Section 8.03(b) of

the Investment Agreement permits the amendment of the Investment Agreement provided such amendment is in writing and signed by each of

the Parties to the Investment Agreement affected by such amendment; and

WHEREAS, the Investors and

the Company desire to amend the Investment Agreement as set forth in this Amendment No. 2.

NOW THEREFORE, in consideration

of the foregoing and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties

hereto agree as follows:

1. The

Investment Agreement is hereby amended by deleting Section 6.06(a) in its entirety and replacing with the following:

| (i) | (A) For the period beginning on the date of issuance of Shares under this Agreement until September 20, 2024

(the “Initial Restricted Period”), no Investor shall Transfer or permit the Transfer of any or all of its or its Affiliates’

Shares, except to one or more of its Permitted Transferees; and (B) during the period beginning immediately upon the end of the Initial

Restricted Period until September 20, 2025 (the “Extended Restricted Period” and, together with the Initial

Restricted Period, the “Restricted Period”), (y) each Additional Investor shall not Transfer or permit the Transfer

of 72.5% of the number of Shares originally issued to the Additional Investor or its Affiliates, except to one or more of its Permitted

Transferees, and (z) none of Delta, CK Opps I or Cox (collectively, the “Initial Investors”) shall Transfer

or permit the Transfer of any or all of their Shares or respective Affiliates’ Shares, except to one or more of their respective

Permitted Transferees. Upon the expiration of the Extended Restricted Period, all Shares held by the Investors shall cease to be subject

to the restrictions set forth in this Section 6.06(a); provided, however, that such Shares shall continue to

be subject to all other provisions applicable to the Shares as set forth in this Agreement. The use of “Restricted Period”

in Section 6.06(b) shall mean (i) the Initial Restricted Period, with respect to the Transfer of Additional Investor

Unrestricted Shares (as defined herein), and (ii) the Extended Restricted Period, for the Transfer of all Shares other than the Additional

Investor Unrestricted Shares. |

| (ii) | Subject to compliance with the other provisions of this Agreement, during the Extended Restricted Period,

each Additional Investor shall be permitted to Transfer or permit the Transfer of up to 27.5% of the number of Shares originally issued

to the Additional Investor or its Affiliates (collectively such Shares, the “Additional Investor Unrestricted Shares”)

by or to any Selected Broker (as defined herein) on an agency or principal basis at a price per share of Common Stock of not less than

the Minimum Price (as defined herein). “Minimum Price” shall mean $1.50 per share of Common Stock; provided,

however, that if during the Extended Restricted Period the Company consummates any issuance and sale of Common Stock in a public

offering (a “Qualified Offering”) or pursuant to any at-the-market offering program (an “Equity Distribution

Program”) at a price per share of Common Stock of less than $1.50, the Minimum Price shall be reduced to the price per share

of Common Stock sold by the Company in such Qualified Offering (as set forth in any final prospectus or final prospectus supplement filed

by the Company with the SEC for such public offering) or Equity Distribution Program (upon prompt written notice by the Company to each

Additional Investor that a sale of Common Stock pursuant to such Equity Distribution Program has been executed at a price per share of

Common Stock below the then applicable Minimum Price). Upon the occurrence of a stock split, reverse stock split, stock dividend, spin-off,

rights offering or similar event with respect to the Common Stock, all numbers of shares of Common Stock and prices per share of Common

Stock referenced in this Agreement shall be adjusted. |

| (iii) | Prior to any Transfers of Additional Investor Unrestricted Sales to any third-party during the Extended

Restricted Period, the Additional Investors, at their sole cost and expense, shall select one or more registered broker-dealer(s) (each,

a “Selected Broker”) through which the Additional Investors will facilitate any Transfer of Additional Investor Unrestricted

Shares during the Extended Restricted Period and the Additional Investors shall not Transfer any Additional Investor Unrestricted Shares

during the Extended Restricted Period other than through any such Selected Broker. If the Company determines, in its reasonable discretion,

that any Additional Investor’s use of a Selected Broker represents a conflict with any activity or proposed activity by the Company

involving such Selected Broker, the Additional Investors shall select one or more different Selected Broker(s) through which such

Transfers will be facilitated through the end of the Extended Restricted Period. For each monthly anniversary of the Initial Restricted

Period during the Extended Restricted Period, each Additional Investor shall provide to the Company, not later than 5 Business Days

after the end of such calendar month, a monthly transaction report with respect to any Transfers of Additional Investor Unrestricted Shares

by the Additional Investors or their respective Affiliates to a Selected Broker during the applicable calendar month in arrears. |

| (iv) | Following the end of the Initial Restricted Period, the Company shall promptly cooperate in good faith

with the Additional Investors, the transfer agent and registrar for the Common Stock (the “Transfer Agent”), and any

Selected Broker to remove any restrictive legends applicable to all of the Additional Investor Unrestricted Shares to facilitate a Transfer

to such Additional Investor’s Permitted Transferee or a Selected Broker’s account at the Depository Trust Company, and based

upon such Additional Investor complying with any applicable representations and covenants required by the Transfer Agent for the Common

Stock with respect to removal of such legends. Upon the expiration of the Extended Restricted Period, the Company shall cooperate in good

faith with the Investors, the Transfer Agent and any registered broker-dealer(s) designated by any Investor to remove any restrictive

legends applicable to the Shares to facilitate a Transfer to such Investor’s Permitted Transferee or such registered broker-dealer(s),

and based upon such Investor complying with any applicable requirements of the Transfer Agent for the Common Stock with respect to removal

of such legends. The Company shall not be obligated to remove any restrictive legends applicable to any Shares held by any Investor until

such time that any such Shares cease to be subject to the Initial Restricted Period or Extended Restricted Period, as applicable. Each

Investor agrees and consents to the entry of stop transfer instructions with the Transfer Agent for the Shares relating to the Transfer,

sale or disposal, or purported Transfer, sale or disposal, of such Investor’s Shares in violation of any provision of this Agreement. |

| (v) | Subject to the other provisions of this Agreement, nothing in this Section 6.06(a) shall

prohibit any Investor from establishing a trading plan intended to comply with the requirements of Rule 10b5-1 promulgated under

the Exchange Act (each, a “Rule 10b5-1 Trading Plan”) during the Restricted Period; provided, however,

that the effectiveness or application of such Rule 10b5-1 Trading Plan shall not result in the Transfer, sale or other disposal of

Shares in violation of any provision of this Agreement. |

| (vi) | In consideration for the provisions set forth in this Section 6.06(a), the Company and the

Initial Investors agree that they will not amend the Registration Rights Agreement or Loan Documents (as defined in the Credit Facility)

in a manner that adversely affects any Additional Investor (solely in such Additional Investor’s capacity as a Holder (as defined

in the Registration Rights Agreement) or Lender (as defined in the Credit Facility) under the Credit Facility), as applicable, in a manner

that is materially different from the other Holders (as defined in the Registration Rights Agreement) or Lenders (as defined in the Credit

Facility), for so long as such Additional Investor shall hold any Registrable Securities (as defined in the Registration Rights Agreement),

with respect to the Registration Rights Agreement, or any Commitments or Loans (as each term defined in the Credit Facility), with respect

to the Loan Documents (as defined in the Credit Facility), as applicable. |

2. Miscellaneous.

| a. | The Minimum Price set forth herein has been determined solely for the purposes set forth in this Amendment

No. 2 as of the date hereof, and is intended by the contracting parties to provide for the orderly sale of the Additional Investor

Unrestricted Shares by the Additional Investors from time to time, is intended solely for the benefit of the parties to this Amendment

No. 2, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to

other of the Company’s investors. Such other Company investors are not third-party beneficiaries of this Amendment No. 2 and

should not rely on the Minimum Price as indicative of any view of the value of the price per share of Common Stock or of the Company. |

| b. | The Investment Agreement remains in full force and effect and nothing in this Amendment No. 2 shall

otherwise affect any other provision of the Investment Agreement or the rights and obligations of the parties. Sections 8.07 (Governing

Law; Jurisdiction), 8.08 (Specific Enforcement), 8.09 (Waiver of Jury Trial), 8.10 (Execution in Counterparts)

and 8.12 (Investors Not a Group) of the Investment Agreement are incorporated herein by reference, mutatis mutandis. This

Amendment No. 2, together with the Original Investment Agreement, Amendment No. 1 and the Investment Agreement Joinders shall

supersede and replace all prior agreements, promises, and understandings between the parties regarding the subject matter contained in

this Amendment No. 2. In the event of any conflict between this Amendment No. 2 and any other agreements or documents described

herein, the terms of this Amendment No. 2 shall govern and prevail. |

(Signature Page Follows; Remainder of Page Intentionally

Left Blank)

| IN WITNESS WHEREOF, the parties have executed this Amendment No. 2 to Investment and Investor Rights Agreement as of the date first above written. |

| |

WHEELS UP EXPERIENCE INC. |

| |

|

| |

|

| |

By: |

/s/ George Mattson |

| |

Name: |

George Mattson |

| |

Title: |

Chief Executive Officer |

(Signature

page to Amendment No. 2 to Investment and Investor Rights Agreement)

| |

DELTA AIR LINES, INC. |

| |

|

| |

|

| |

By: |

/s/ Kenneth W. Morge II |

| |

Name: |

Kenneth W. Morge II |

| |

Title: |

Senior Vice President- Finance & Treasurer |

(Signature

page to Amendment No. 2 to Investment and Investor Rights Agreement)

| |

CK WHEELS LLC |

| |

|

| |

|

| |

By: |

/s/ Laura L. Torrado |

| |

Name: |

Laura L. Torrado |

| |

Title: |

Authorized Signatory |

| |

By: |

/s/ Tom LaMacchia |

| |

Name: |

Tom LaMacchia |

| |

Title: |

Authorized Signatory |

(Signature

page to Amendment No. 2 to Investment and Investor Rights Agreement)

| |

COX INVESTMENT HOLDINGS LLC |

| |

(f/k/a Cox Investment Holdings, Inc.) |

| |

|

| |

|

| |

By: |

/s/ Deborah Lucy |

| |

Name: |

Deborah Lucy |

| |

Title: |

Assistant Secretary |

(Signature

page to Amendment No. 2 to Investment and Investor Rights Agreement)

| |

PANDORA SELECT PARTNERS, L.P. |

| |

|

| |

|

| |

By: |

/s/ Andrew M. Thau |

| |

Name: |

Andrew M. Thau |

| |

Title: |

Managing Director |

| |

|

| |

|

| |

WHITEBOX GT FUND, LP |

| |

|

| |

|

| |

By: |

/s/ Andrew M. Thau |

| |

Name: |

Andrew M. Thau |

| |

Title: |

Managing Director |

| |

|

| |

|

| |

WHITEBOX MULTI-STRATEGY PARTNERS, L.P. |

| |

|

| |

|

| |

By: |

/s/ Andrew M. Thau |

| |

Name: |

Andrew M. Thau |

| |

Title: |

Managing Director |

| |

|

| |

|

| |

WHITEBOX RELATIVE VALUE PARTNERS, L.P. |

| |

|

| |

|

| |

By: |

/s/ Andrew M. Thau |

| |

Name: |

Andrew M. Thau |

| |

Title: |

Managing Director |

(Signature

page to Amendment No. 2 to Investment and Investor Rights Agreement)

| |

KORE AIR LLC |

| |

|

| |

|

| |

By: |

/s/ J. Gary Kosinski |

| |

Name: |

J. Gary Kosinski |

| |

Title: |

Director |

(Signature

page to Amendment No. 2 to Investment and Investor Rights Agreement)

Exhibit 99.1

Wheels Up Announces Investors Agree to One-Year

Lock-Up Extension

Approximately 97.2% of lead investor shares

will remain subject to the lock-up restriction until September 20, 2025

Atlanta, GA – September 23, 2024 –

Wheels Up Experience Inc. (NYSE: UP) today announced that lead investors, Delta Air Lines, Inc., CK Wheels LLC, and Cox Investment

Holdings, LLC, agreed to extend the lock-up restriction with respect to all their shares of common stock issued under the Investment

and Investor Rights Agreement, for an additional year, until September 20, 2025. In addition, Kore Capital LLC and funds managed

by Whitebox Advisors LLC, agreed to extend the lock-up restriction with respect to 72.5% of their shares until September 20, 2025.

As a result, approximately 97.2% of the shares issued under the Investment and Investor Rights Agreement will remain subject to a lock-up

restriction until September 20, 2025.

“I appreciate the confidence and support

of the company’s lead investors,” said Wheels Up Chief Executive Officer George Mattson. “We believe that this extended

commitment by our investors allows us to continue to execute on our strategic plan.”

Concurrently with this announcement, the company

is filing a Current Report on Form 8-K with the SEC related to the extension of the lock-up restrictions.

About Wheels Up

Wheels Up is a leading provider of on-demand private

aviation and one of the largest companies in the industry. Wheels Up offers a complete global aviation solution with a large and diverse

fleet and a global network of safety-vetted charter operators, all backed by an uncompromising commitment to safety and service. Customers

can access charter and membership programs, as well as unique commercial travel benefits through a one-of-a-kind, strategic partnership

with Delta Air Lines. Wheels Up also offers cargo, safety and security solutions and managed services to individuals, industry, government

and civil organizations.

Wheels Up is guided by the mission to deliver

a premium solution for every customer journey. With the Wheels Up mobile app and website, members and customers have the digital convenience

to search, book and fly.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain "forward-looking

statements" within the meaning of the federal securities laws. Forward-looking statements are predictions, projections and other

statements about future events that are based on current expectations and assumptions and, as a result, are subject to known and unknown

risks, uncertainties, assumptions, and other important factors, many of which are outside of the control of Wheels Up Experience Inc.

("Wheels Up"). The words "anticipate," "continue," "could," "expect," "plan,"

"potential," "should," "would," "pursue" and similar expressions, may identify forward-looking

statements, but the absence of these words does not mean that statement is not forward-looking. Factors that could cause actual

results to differ materially from those expressed or implied in forward-looking statements can be found in Wheels Up's Annual Report on

Form 10-K for the year ended December 31, 2023 filed with the U.S. Securities and Exchange Commission (the "SEC")

on March 7, 2024 and Wheels Up's other filings with the SEC from time to time. You are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made. Except as required by law, Wheels Up does not intend to update any of

these forward-looking statements after the date of this press release.

For more information, please visit: wheelsup.com

Media

Contact

press@wheelsup.com

* — * — * — * — *

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

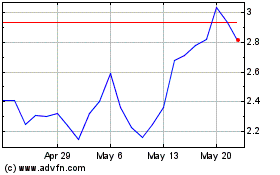

Wheels Up Experience (NYSE:UP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Wheels Up Experience (NYSE:UP)

Historical Stock Chart

From Jan 2024 to Jan 2025