U.S. Physical Therapy, Inc. (NYSE: USPH), a national operator of

outpatient physical therapy clinics, today reported results for the

second quarter and six months ended June 30, 2014.

U.S. Physical Therapy’s net income attributable to common

shareholders from continuing operations for the second quarter of

2014 increased by 26.6% to $6.4 million as compared to

approximately $5.1 million in the second quarter of 2013. Diluted

earnings per share from continuing operations rose to $.53 in the

recent quarter as compared to $.42 in the comparable 2013

period.

U.S. Physical Therapy’s net income attributable to common

shareholders from continuing operations for the first six months of

2014 increased by 19.4% to $10.7 million as compared to

approximately $8.9 million in the first six months of 2013. Diluted

earnings per share from continuing operations rose to $.87 in the

recent period as compared to $.74 in the comparable 2013

period.

Second Quarter 2014 Compared to Second

Quarter 2013 from Continuing Operations

- Net revenues increased 16.9% from $66.9

million in the second quarter of 2013 to $78.2 million in the

second quarter of 2014, due to an increase in patient visits of

17.1% from 613,900 to 718,800 and a slight increase in the average

net revenue per visit to $106.39 from $106.25.

- Total clinic operating costs were $56.4

million, or 72.1% of net revenues, in the second quarter of 2014,

as compared to $49.3 million, or 73.7% of net revenues, in the 2013

period. Total clinic salaries and related costs, including that

from new clinics, were 51.3% of net revenues in the recent quarter

versus 53.1% in the 2013 period. Rent, clinic supplies, contract

labor and other costs as a percentage of net revenues were 19.4%

for the recent quarter versus 18.8% in the 2013 period. The

provision for doubtful accounts as a percentage of net revenues was

1.3% for the 2014 period and 1.8% in the 2013 period.

- The gross margin for the second quarter

of 2014 increased by 24.2% to $21.8 million from $17.6 million in

the second quarter of 2013. The gross margin percentage was 27.9%

for the 2014 quarter as compared to 26.3% for the comparable 2013

period.

- Corporate office costs were $7.6

million in the second quarter of 2014 as compared to $6.5 million

in the 2013 second quarter. Corporate office costs were 9.7% of net

revenues in the current period and 9.8% for the comparable 2013

period.

- Operating income for the recent quarter

increased by 28.6% to $14.2 million compared to $11.1 million in

the 2013 second quarter.

- Interest expense was $0.3 million in

the second quarter of 2014 versus $0.1 million in the second

quarter of last year. The increase in interest expense is due to a

higher average debt balance as the result of acquisitions.

- The provision for income taxes for the

2014 period was $4.5 million and for the 2013 period $3.3 million.

The provision for income taxes as a percentage of income before

taxes less net income attributable to non-controlling interest was

41.0% in the 2014 second quarter and 38.8% in the 2013 second

quarter.

- Net income attributable to

non-controlling interests, inclusive of discontinued operations,

was $3.0 million in the recent quarter as compared to $2.5 million

in the year earlier period.

- Net income attributable to common

shareholders for the three months ended June 30, 2014 was $6.4

million compared to $5.1 million for the three months ended June

30, 2013. Diluted earnings per share from continuing operations

were $.53 for the 2014 period and $.42 for the 2013 period.

- Same store visits increased 4.6% for de

novo and acquired clinics open for one year or more and same store

revenue increased 4.1% as the average net rate per visit decreased

by $.58.

First Six Months 2014 Compared to First

Six Months 2013 from Continuing Operations

- Net revenues increased 14.2% from

$129.6 million in the first six months of 2013 to $148.0 million in

the first six months of 2014, due to an increase in patient visits

of 14.4% from 1,191,000 to 1,363,000. The average net revenue per

visit remained relatively the same for the two periods at $106.31

for the current period and $106.30 for the comparable 2013

period.

- Total clinic operating costs were

$109.5 million, or 74.0% of net revenues, in the first six months

of 2014, as compared to $97.2 million, or 75.0% of net revenues, in

the 2013 period. Total clinic salaries and related costs were 52.7%

of net revenues in the first six months of 2014 versus 53.7% in the

2013 period. Rent, clinic supplies, contract labor and other costs

as a percentage of net revenues were 19.9% for the recent period

versus 19.5% in the 2013 period. The provision for doubtful

accounts as a percentage of net revenues was 1.4% for the 2014

period and 1.8% in the 2013 period.

- The gross margin for the first six

months of 2014 increased by 18.6% to $38.5 million from $32.4

million in the first six months of 2013. The gross margin

percentage was 26.0% for the 2014 first six months as compared to

25.0% for the comparable 2013 period.

- Corporate office costs were $14.7

million in the first six months of 2014 as compared to $12.9

million in the 2013 first six months. Corporate office costs were

10.0% of net revenues in both periods.

- Operating income for the first six

months of 2014 increased by 21.8% to $23.7 million compared to

$19.5 million in the 2013 first six months.

- Interest expense was $0.6 million in

the first six months of 2014 versus $0.3 million in the first six

months of last year. The increase in interest expense is due to a

higher average outstanding debt balance as the result of

acquisitions.

- The provision for income taxes for the

2014 period was $7.4 million and for the 2013 period $5.8 million.

The provision for income taxes as a percentage of income before

taxes less net income attributable to non-controlling interest was

41.0% in the 2014 first six months and 38.8% in the 2013 first six

months.

- Net income attributable to

non-controlling interests, inclusive of discontinued operations,

was $5.1 million in the first six months of 2014 as compared to

$4.3 million in the year earlier period.

- Net income attributable to common

shareholders for the six months ended June 30, 2014 was $10.7

million compared to $8.9 million for the six months ended June 30,

2013. Diluted earnings per share from continuing operations were

$.87 for the 2014 period and $.74 for the 2013 period.

- Same store visits increased 2.7% for de

novo and acquired clinics open for one year or more and revenue

increased 1.9% as the average net rate per visit decreased by

$.83.

Chris Reading, Chief Executive Officer, said, “I am extremely

proud of our entire team for their persistence and perseverance in

executing our Company’s plan for this year. Our partners, directors

and sales teams are working well together to drive referrals and

deliver superior service. Our Fit2WRK group continues to land

terrific employer accounts which have assisted us in further

improving our payor base while also driving new customers into our

many partnerships around the country. Our abundant internal

development resources are assisting our very capable acquired and

long-standing de novo partnerships with organic as well as tuck-in

opportunities which will further assist in our ability to

positively impact more patients' lives in the communities in which

we serve. While the environment is challenging many providers, we

continue to be delighted with the quality of the people we are

attracting to our team.”

Larry McAfee, Chief Financial Officer, noted, “U.S. Physical

Therapy’s net free cash flow remains strong. During the second

quarter the Company’s total debt was reduced slightly despite a 13

clinic acquisition for $11.2 million in April.”

Management Earnings

Guidance

U.S. Physical Therapy’s management is revising and raising the

Company’s earnings guidance from continuing operations for the year

2014 to be in the range of $20.0 million to $20.9 million in net

income and $1.64 to $1.70 in diluted earnings per share. Earlier

guidance issued in March was for annual net income in the range of

$18.8 million to $19.6 million and $1.53 to $1.60 in diluted

earnings per share. Management’s guidance range represents

projected earnings from existing operations only and excludes

future potential acquisitions. The annual guidance figures will not

be updated unless there is a material development that causes

management to believe that earnings will be significantly outside

the given range.

U.S. Physical Therapy Declares

Quarterly Dividend

The third quarterly dividend of 2014 for $.12 per share will be

paid on September 5 to shareholders of record as of August 18.

Second Quarter 2014 Conference

Call

U.S. Physical Therapy's management will host a conference call

at 10:30 a.m. Eastern Time, 9:30 a.m. Central Time, on Thursday,

August 7, 2014 to discuss the Company’s Quarter and First Six

Months Ended June 30, 2014 results. Interested parties may

participate in the call by dialing 1-888-335-5539 or 973-582-2857

and entering reservation number 70143106 approximately 10 minutes

before the call is scheduled to begin. To listen to the live call

via web-cast, go to the Company's website at www.usph.com at least

15 minutes early to register, download and install any necessary

audio software. The conference call will be archived and can be

accessed until November 7, 2014.

Forward-Looking

Statements

This press release contains statements that are considered to be

forward-looking within the meaning under Section 21E of the

Securities Exchange Act of 1934, as amended. These statements

contain forward-looking information relating to the financial

condition, results of operations, plans, objectives, future

performance and business of our Company. These statements (often

using words such as “believes”, “expects”, “intends”, “plans”,

“appear”, “should” and similar words) involve risks and

uncertainties that could cause actual results to differ materially

from those we expect. Included among such statements may be those

relating to new clinics, availability of personnel and the

reimbursement environment. The forward-looking statements are based

on our current views and assumptions and actual results could

differ materially from those anticipated in such forward-looking

statements as a result of certain risks, uncertainties, and

factors, which include, but are not limited to:

- changes as the result of government

enacted national healthcare reform;

- changes in Medicare guidelines and

reimbursement or failure of our clinics to maintain their Medicare

certification status;

- business and regulatory conditions

including federal and state regulations;

- changes in reimbursement rates or

payment methods from third party payors including government

agencies and deductibles and co-pays owed by patients;

- revenue and earnings expectations;

- general economic conditions;

- availability and cost of qualified

physical and occupational therapists;

- personnel productivity;

- competitive, economic or reimbursement

conditions in our markets which may require us to reorganize or

close certain operations and thereby incur losses and/or closure

costs including the possible write-down or write-off of goodwill

and other intangible assets;

- acquisitions, purchase of

non-controlling interests (minority interests) and the successful

integration of the operations of the acquired businesses;

- maintaining adequate internal

controls;

- availability, terms, and use of

capital; and

- weather and other seasonal

factors.

Many factors are beyond our control. Given these uncertainties,

you should not place undue reliance on our forward-looking

statements. Please see our periodic reports filed with the

Securities and Exchange Commission for more information on these

factors. Our forward-looking statements represent our estimates and

assumptions only as of the date of this press release. Except as

required by law, we are under no obligation to update any

forward-looking statement, regardless of the reason the statement

is no longer applicable.

About U.S. Physical Therapy,

Inc.

Founded in 1990, U.S. Physical Therapy, Inc. operates 491

outpatient physical and occupational therapy clinics in 42 states.

The Company's clinics provide preventative and post-operative care

for a variety of orthopedic-related disorders and sports-related

injuries, treatment for neurologically-related injuries and

rehabilitation of injured workers. In addition to owning and

operating clinics, the Company manages 17 physical therapy

facilities for third parties, including hospitals and physician

groups.

More information about U.S. Physical Therapy, Inc. is available

at www.usph.com. The information included on that website is not

incorporated into this press release.

U.S.

PHYSICAL THERAPY, INC. AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF NET INCOME (IN THOUSANDS, EXCEPT PER SHARE

DATA) (unaudited) Three Months Ended June

30, Six Months Ended June 30, 2014 2013

2014 2013 Net patient revenues $ 76,470 $ 65,227 $

144,867 $ 126,659 Other revenues 1,731 1,642

3,101 2,966 Net revenues 78,201

66,869 147,968 129,625 Clinic operating costs: Salaries and related

costs 40,109 35,526 78,051 69,585 Rent, clinic supplies, contract

labor and other 15,205 12,550 29,421 25,284 Provision for doubtful

accounts 1,054 1,198 2,004 2,295 Closure costs (2 ) 8

11 26 Total clinic operating

costs 56,366 49,282 109,487

97,190 Gross margin 21,835 17,587 38,481

32,435 Corporate office costs 7,614 6,528

14,746 12,941 Operating income

from continuing operations 14,221 11,059 23,735 19,494 Interest and

other income, net - 1 1 3 Interest expense (332 )

(130 ) (585 ) (265 ) Income before taxes from

continuing operations 13,889 10,930 23,151 19,232 Provision for

income taxes 4,469 3,288 7,408

5,781 Net income from continuing operations

including non-controlling interests 9,420 7,642 15,743 13,451

Discontinued operations, net of tax - (268 )

- (468 ) Net income including non-controlling

interests 9,420 7,374 15,743 12,983 Less: net income attributable

to non-controlling interests (2,988 ) (2,460 )

(5,083 ) (4,348 ) Net income attributable to common

shareholders $ 6,432 $ 4,914 $ 10,660 $ 8,635

Basic earnings per share attributable to common

shareholders: From continuing operations $ 0.53 $ 0.42 $ 0.88 $

0.74 From discontinued operations - (0.01 )

- (0.02 ) Basic $ 0.53 $ 0.41 $

0.88 $ 0.72 Diluted earnings per share attributable

to common shareholders: From continuing operations $ 0.53 $ 0.42 $

0.87 $ 0.74 From discontinued operations -

(0.01 ) - (0.02 ) Diluted $ 0.53 $ 0.41

$ 0.87 $ 0.72 Shares used in computation:

Basic 12,224 12,089 12,177

12,022 Diluted 12,226

12,110 12,184 12,044

Dividends declared per common share $ 0.12 $ 0.10 $

0.24 $ 0.20 Earnings attributable to common

shareholders: From continuing operations $ 6,432 $ 5,079 $ 10,660 $

8,930 From discontinued operations - (165 )

- (295 ) $ 6,432 $ 4,914 $

10,660 $ 8,635

U.S. PHYSICAL THERAPY, INC. AND

SUBSIDIARIES

CONSOLIDATED EARNINGS PER SHARE(IN THOUSANDS,

EXCEPT PER SHARE DATA)(unaudited) Three Months

Ended Six Months Ended June 30, June 30,

2014 2013 2014 2013 Earnings

attributable to common shareholders: From continuing operations $

6,432 $ 5,079 $ 10,660 $ 8,930 From discontinued operations

- (165 ) - (295 ) 6,432 4,914

10,660 8,635 Revaluation of redeemable non-controlling interests,

net of tax * (119 ) - (1,086 ) -

$ 6,313 $ 4,914 $ 9,574 $ 8,635

Diluted earnings per share attributable to common

shareholders: From continuing operations $ 0.53 $ 0.42

$ 0.87 $ 0.74 Basic earnings per share

attributable to common shareholders: From continuing operations $

0.53 $ 0.42 $ 0.88 $ 0.74 Charges to additional-paid-in-capital -

revaluation of redeemable non-controlling interests, net of tax

(0.01 ) - (0.09 ) - From discontinued operations -

(0.01 ) - (0.02 ) Basic $ 0.52 $

0.41 $ 0.79 $ 0.72 Diluted earnings per share

attributable to common shareholders: From continuing operations $

0.53 $ 0.42 $ 0.87 $ 0.74 Charges to additional-paid-in-capital -

revaluation of redeemable non-controlling interests, net of tax

(0.01 ) - (0.09 ) - From discontinued operations -

(0.01 ) - (0.02 ) Diluted $ 0.52

$ 0.41 $ 0.78 $ 0.72 Shares used in

computation: Basic earnings per share - weighted-average shares

12,224 12,089 12,177 12,022 Effect of dilutive securities - stock

options 2 21 7 22

Denominator for diluted earnings per share - adjusted

weighted-average

shares

12,226 12,110 12,184

12,044 * Actual purchases of

non-controlling interests in two partnerships; recorded as a change

in additional-paid-in capital, not reflected in statement of

operations or net income.

U.S. PHYSICAL THERAPY, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS(IN THOUSANDS, EXCEPT

SHARE DATA) June 30, December 31,

2014 2013 (unaudited) ASSETS Current assets:

Cash and cash equivalents $ 12,934 $ 12,898 Patient accounts

receivable, less allowance for doubtful accounts of $1,713 and

$1,430, respectively 34,286 30,820 Accounts receivable - other,

less allowance for doubtful accounts of $198 and $198, respectively

1,924 1,844 Other current assets 2,703 4,098

Total current assets 51,847 49,660 Fixed assets: Furniture

and equipment 41,310 38,965 Leasehold improvements 22,065

21,891 63,375 60,856 Less accumulated

depreciation and amortization 47,517 45,896

15,858 14,960 Goodwill 156,207 143,955 Other intangible

assets, net 15,727 14,479 Other assets 1,141

1,081 $ 240,780 $ 224,135 LIABILITIES

AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable -

trade $ 1,835 $ 1,722 Accrued expenses 20,112 20,625 Current

portion of notes payable 850 825 Total

current liabilities 22,797 23,172 Notes payable 450 650 Revolving

line of credit 45,000 40,000 Deferred rent 1,095 996 Other

long-term liabilities 6,053 4,196 Total

liabilities 75,395 69,014 Commitments and contingencies Redeemable

non-controlling interests 1,086 4,104 Shareholders' equity:

U.S. Physical Therapy, Inc. shareholders'

equity:

Preferred stock, $.01 par value, 500,000 shares authorized, no

shares issued and outstanding

-

-

Common stock, $.01 par value, 20,000,000 shares authorized,

14,450,836 and 14,315,882 shares

issued, respectively

145 143 Additional paid-in capital 41,306 40,569 Retained earnings

126,934 119,206 Treasury stock at cost, 2,214,737 shares

(31,628 ) (31,628 )

Total U.S. Physical Therapy, Inc.

shareholders' equity

136,757 128,290 Non-controlling interests 27,542

22,727 Total equity 164,299

151,017 $ 240,780 $ 224,135

U.S. PHYSICAL THERAPY, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS (IN

THOUSANDS) (unaudited) Six Months Ended June

30, 2014 2013 OPERATING ACTIVITIES Net

income including non-controlling interests $ 15,743 $ 12,983

Adjustments to reconcile net income including non-controlling

interests to net cash provided by operating activities: - -

Depreciation and amortization 2,825 2,730 Provision for doubtful

accounts 2,004 2,282 Equity-based awards compensation expense 1,593

1,370 Loss on sale of business and sale or abandonment of assets,

net 34 84 Excess tax benefit from exercise of stock options (215 )

- Deferred income tax 2,422 (796 ) Other - 33 Changes in operating

assets and liabilities: - - Increase in patient accounts receivable

(4,442 ) (2,542 ) (Increase) decrease in accounts receivable -

other (80 ) 4 Decrease in other assets 1,540 3,867 (Decrease)

increase in accounts payable and accrued expenses (774 ) 682

Increase in other liabilities 404 19

Net cash provided by operating activities 21,054 20,716

INVESTING ACTIVITIES - Purchase of fixed assets (2,132 )

(2,394 ) Purchase of businesses, net of cash acquired (10,750 )

(9,998 ) Acquisitions of non-controlling interests (4,945 ) (1,064

) Proceeds on sale of business and fixed assets, net 38

15 Net cash used in investing activities

(17,789 ) (13,441 )

FINANCING ACTIVITIES Distributions to

non-controlling interests (4,982 ) (4,410 ) Cash dividends to

shareholders (2,932 ) (2,418 ) Proceeds from revolving line of

credit 77,000 62,550 Payments on revolving line of credit (72,000 )

(64,200 ) Payment of notes payable (575 ) (234 ) Excess tax benefit

from stock options exercised 215 33 Other 45

20 Net cash used in financing activities (3,229 ) (8,659 )

Net increase in cash 36 (1,384 ) Cash - beginning of period

12,898 11,671 Cash - end of period $ 12,934

10,287

SUPPLEMENTAL DISCLOSURES OF CASH

FLOW INFORMATION Cash paid during the period for: Income taxes

$ 3,235 $ 1,999 Interest $ 657 $ 237 Non-cash investing and

financing transactions during the period: Purchase of business -

seller financing portion $ 400 $ 800 Revaluation of redeemable

non-controlling interests $ 1,841 $ -

U.S. PHYSICAL

THERAPY, INC. AND SUBSIDIARIES RECAP OF CLINIC COUNT

Number of Date Clinics

December 31, 2012 431 March 31, 2013 441 June 30, 2013 449

September 30, 2013 447 December 31, 2013 472 March 31, 2014

472 June 30, 2014 486

U.S. Physical Therapy, Inc.Larry McAfee, (713) 297-7000Chief

Financial OfficerorChris Reading, (713) 297-7000Chief Executive

OfficerorWestwicke PartnersBob East, (443) 213-0502

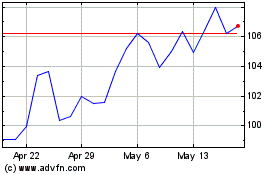

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

From Jun 2024 to Jul 2024

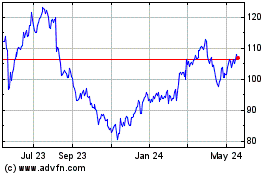

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

From Jul 2023 to Jul 2024