UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

| Filed by the Registrant x |

| |

| Filed by a Party other than the Registrant ¨ |

| |

| Check the appropriate box: |

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting Material under Rule 14a-12 |

| |

| US XPRESS ENTERPRISES, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The following communications relate to the proposed

acquisition of U.S. Xpress Enterprises, Inc., a Nevada corporation (the “Company”) by Knight-Swift Transportation Holdings

Inc., a Delaware corporation (“Knight-Swift”), pursuant to the Agreement and Plan of Merger, dated as of March 20, 2023,

by and among the Company, Knight-Swift and Liberty Merger Sub, Inc., a wholly owned subsidiary of Knight-Swift.

USX Transaction

Non-Driving Employee Letter

Team,

This

morning, we announced an agreement under which U.S. Xpress will be acquired by Knight-Swift Transportation, one of North America’s

largest and most diversified freight transportation companies. You can read more about the announcement here: Knight-Swift

Transportation Agrees to Acquire U.S. Xpress Enterprises for $6.15 Per Share | Business Wire.

Knight-Swift has a long history of retaining the

separate brands and operations of the companies in its group – Knight Transportation, Swift Transportation, Barr-Nunn, Abilene,

AAA Cooper, and others all continue to serve our industry and maintain their historical locations. This is just one reason I am convinced

that joining the Knight-Swift team is an exciting opportunity for our people, our customers, and the communities we call home.

The increased scale, operating expertise and resources

of the combined company will allow U.S. Xpress to drive growth and continue serving customers across the United States. We look forward

to working with Knight-Swift to pursue new levels of service and efficiency, and we are confident this is the best path forward for our

company.

I have spent a great deal of time with the Knight-Swift

team in the weeks leading up to this announcement, and it is clear that we share not just common business views, but a deep appreciation

for our team. Their interest in U.S. Xpress is a testament to all of your hard work and the reputation you have helped build. They would

not have been interested in our company unless they saw the potential for a bright future.

I want to highlight a few key points:

| · | The U.S. Xpress Brand: After the closing of the transaction, U.S. Xpress will continue as a separate

brand and operation to minimize disruptions for our driving associates, shop and office employees, and customers. |

| · | Leadership: The current leadership team will remain in place through closing. At that time, the

U.S. Xpress team will be supplemented by Tim Harrington and Josh Smith, both executives at Swift who gained tremendous experience and

insight in the Knight-Swift merger. They will join U.S. Xpress as President and CFO, respectively. Tim and Josh are both exceptional leaders,

and I know they are looking forward to meeting the U.S. Xpress team later today. At closing, Max Fuller, Eric Peterson, and I will transition

out of our executive roles while remaining available to ensure a smooth transition. We all have confidence that our team is ready to step

up and perform. |

| · | HQ: Knight-Swift plans to retain U.S. Xpress’ headquarters in Chattanooga, and we are pleased

that U.S. Xpress will continue to have an important presence in our community. |

As for next steps, this announcement is just the

beginning of the process. We expect to complete the transaction late in the second quarter or early third quarter of 2023.

I want to emphasize that we expect U.S. Xpress

will continue operating as usual. We will continue to serve the same customers, drivers, and other constituencies that are important to

our company – and they all expect and need us to continue to be our best! Please remain focused on your day-to-day responsibilities

and executing against our current business objectives.

I look forward to talking more about the announcement

at a Town Hall at 11:00 AM ET today. A meeting invite will follow shortly. In the meantime, I have attached an FAQ to help address

some of your immediate questions.

Thank you again for your continued hard work.

I hope you share my excitement about what’s ahead for U.S. Xpress.

Sincerely,

Eric Fuller

President & Chief Executive Officer Fuller

Today’s

announcement may lead to increased interest from the media, investors and analysts. Consistent with usual policies, please direct any

investor and analyst inquiries to Matt Garvie, Vice President, Investor Relations at mgarvie@usxpress.com,

and any media inquiries to Mary Fortune, Communications Director, at mfortune@usxpress.com.

Additional Information and Where to Find

It

This communication is being made in connection

with the proposed transaction between U.S. Xpress Enterprises, Inc. and Knight-Swift Transportation Holdings Inc. In connection with

the proposed transaction, U.S. Xpress Enterprises, Inc. intends to file a proxy statement with the SEC. U.S. Xpress Enterprises, Inc.

may also file other relevant documents with the SEC regarding the proposed transaction. The information in the preliminary proxy statement

will not be complete and may be changed. The definitive proxy statement will be delivered to stockholders of U.S. Xpress Enterprises, Inc.

This communication is not a substitute for any proxy statement or any other document that may be filed with the SEC in connection with

the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF U.S. XPRESS

ENTERPRISES, INC. ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to

obtain free copies of the preliminary proxy statement and the definitive proxy statement (in each case, if and when available) and other

documents containing important information about U.S. Xpress Enterprises, Inc. and the proposed transaction once such documents are

filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by U.S.

Xpress Enterprises, Inc. will be available free of charge on U.S. Xpress Enterprises, Inc.’s website at www.usxpress.com

under the heading “Investors” or, alternatively, by directing a request by telephone or mail to U.S. Xpress Enterprises, Inc.

at (833) 879-7737 or 4080 Jenkins Road, Chattanooga, TN 37421, Attention: Investor Relations.

Participants in the Solicitation

U.S. Xpress Enterprises, Inc., its directors

and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from U.S. Xpress Enterprises, Inc.’s

stockholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of U.S. Xpress Enterprises, Inc. stockholders in connection with the proposed transaction,

including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement

when it is filed with the SEC. Information about these persons is included in U.S. Xpress Enterprises, Inc.’s annual proxy

statement and in other documents subsequently filed with the SEC, and will be included in the proxy statement when filed.

Forward Looking Statements

This communication contains “forward-looking

statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, regarding

Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc., including, but not limited to, statements about the

strategic rationale and benefits of the proposed transaction between Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including future financial and operating results, Knight-Swift Transportation Holdings Inc.’s or U.S. Xpress Enterprises, Inc.’s

plans, objectives, expectations and intentions and the expected timing of completion of the proposed transaction. You can generally identify

forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “explore,” “evaluate,” “forecast,”

“intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“seek,” “should,” “targeted,” “will,” or “would,” or the negative thereof

or other variations thereon or comparable terminology. However, the absence of these words or similar expressions does not mean that a

statement is not forward-looking. Statements in this announcement that are forward looking may include, but are not limited to, statements

regarding the benefits of the proposed transaction with U.S. Xpress Enterprises, Inc. and the associated integration plans, expected

synergies and revenue opportunities, expected branding, anticipated future operating performance and results of Knight-Swift Transportation

Holdings Inc., including statements regarding anticipated earnings, margins, and cash flows, anticipated future liquidity, anticipated

availability of future resources, financial or otherwise, anticipated growth opportunities, anticipated fleet size, the availability of

the transaction consideration, the expected management and governance of U.S. Xpress Enterprises, Inc. following the transaction

and the expected timing of the closing of the proposed transaction and other transactions contemplated by the proposed transaction. These

forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions

and inherently involve significant risks and uncertainties, many of which are beyond Knight-Swift Transportation Holdings Inc.’s

or U.S. Xpress Enterprises, Inc.’s control. Although we believe the expectations reflected in any forward-looking statements

are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and therefore actual results and

the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and uncertainties associated with: Knight-Swift Transportation Holdings Inc.’s

and U.S. Xpress Enterprises, Inc.’s ability to complete the potential transaction on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and U.S. Xpress Enterprises, Inc.

stockholders’ approvals and the satisfaction of other closing conditions to consummate the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to the termination of the definitive merger agreement relating to the

proposed transaction; failure to realize the expected benefits of the proposed transaction; significant transaction costs and/or unknown

or inestimable liabilities; the risk that U.S. Xpress Enterprises, Inc.’s business will not be integrated successfully, or

that such integration may be more difficult, time-consuming or costly than expected; Knight-Swift Transportation Holdings Inc.’s

financial ability to consummate the proposed transaction, and the continued availability of capital and financing for Knight-Swift Transportation

Holdings Inc. following the proposed transaction; risks related to future opportunities and plans for the combined company, including

the uncertainty of expected future regulatory filings, financial performance, supply chain conditions, gross domestic product changes

and results of the combined company following completion of the proposed transaction; disruption from the proposed transaction, making

it more difficult to conduct business as usual or maintain relationships with customers, employees, drivers or suppliers, including as

it relates to U.S. Xpress Enterprises, Inc.’s ability to successfully renew existing customer contracts on favorable terms

or at all and obtain new customers; the ability of U.S. Xpress Enterprises, Inc. to retain and hire key personnel; the diversion

of management’s attention from ongoing business operations; the business, economic and political conditions in the markets in which

U.S. Xpress Enterprises, Inc. operates; the impact of new or changes in current laws, regulations or other industry standards; effects

relating to the announcement of the proposed transaction or any further announcements or the consummation of the potential transaction

on the market price of U.S. Xpress Enterprises, Inc.’s common stock; the risk of potential stockholder litigation associated

with the potential transaction, including resulting expense or delay; regulatory initiatives and changes in tax laws; the impact of the

COVID-19 pandemic on the operations and financial results of U.S. Xpress Enterprises, Inc. or the combined company; general economic

conditions; and other risks and uncertainties affecting Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including those described from time to time under the caption “Risk Factors” and elsewhere in Knight-Swift Transportation

Holdings Inc.’s and U.S. Xpress Enterprises, Inc.’s SEC filings and reports, including Knight-Swift Transportation Holdings

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022, U.S. Xpress Enterprises, Inc.’s Annual

Report on Form 10-K for the year ended December 31, 2022, and future filings and reports by either company. Moreover, other

risks and uncertainties of which Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. are not currently aware

may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ

materially from those anticipated. Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc. caution investors

that such forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such forward-looking

statements. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated

in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates, even if they are

subsequently made available by Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. on their respective websites

or otherwise. Neither Knight-Swift Transportation Holdings Inc. nor U.S. Xpress Enterprises, Inc. undertakes any obligation to update

or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or

other circumstances that exist after the date as of which the forward-looking statements were made.

USX Transaction

Non-Driving Employee FAQ

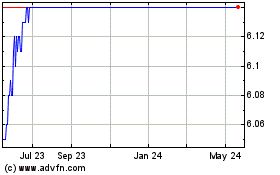

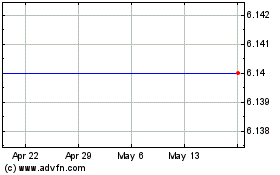

| · | We announced an agreement under which U.S. Xpress will be acquired by Knight-Swift Transportation for

$6.15 per share in cash. |

| · | Following the close of the transaction, U.S. Xpress will continue operating as a separate brand. |

| · | Joining the Knight-Swift team, while retaining our separate operations, is an exciting opportunity for

our people, our customers and the communities we call home. The increased scale, operating expertise and resources of the combined company

will allow U.S. Xpress to drive growth and continue serving customers across the United States. |

| 2. | Who is Knight-Swift? Why are they acquiring U.S. Xpress? |

| · | Knight-Swift is one of North America's largest and most diversified freight transportation companies,

providing multiple truckload transportation, less-than-truckload, logistics and business services to the shipping and transportation sectors. |

| · | Knight-Swift has a long history of retaining the separate brands and operations of the companies in its

group – Knight Transportation, Swift Transportation, Barr-Nunn, Abilene, AAA Cooper, and others all continue to serve our industry

and maintain their historical locations. |

| · | Knight-Swift is also a well-known and respected operator, with a track record of creating value and implementing

positive change and stability. |

| · | Joining the Knight-Swift team is an exciting opportunity for our people, our customers and the communities

we call home, and we are confident this transaction is the best path forward for U.S. Xpress. |

| 3. | What does this mean for employees? |

| · | We expect it to be business as usual at U.S. Xpress – supporting our drivers and customers while

continuously striving to improve. |

| · | After the closing of the transaction, U.S. Xpress will continue as a separate brand and operation to minimize

disruptions for our driving associates, shop and office employees and customers. |

| · | We are counting on you to remain focused on your day-to-day responsibilities and continue serving our

customers. |

| 4. | What will happen to the U.S. Xpress name and brand once the transaction is complete? |

| · | After the closing of the transaction, U.S. Xpress will continue as a separate brand and operation to minimize

disruptions for our driving associates, shop and office employees and customers. |

| · | In short, we expect U.S. Xpress will continue operating business as usual – supporting our drivers

and customers while continuously striving to improve. |

| · | We will continue to serve the same customers, drivers, and other constituencies that are important to

our company. |

| 5. | Who will lead U.S. Xpress once the transaction closes? |

| · | The current leadership team will remain in place through closing. |

| · | At closing, the U.S. Xpress team will be supplemented by Tim Harrington and Josh Smith, both executives

at Swift who gained tremendous experience and insight in the Knight-Swift merger. They will join U.S. Xpress as President and CFO, respectively. |

| · | At closing, Max Fuller, Eric Fuller, and Eric Peterson will transition out of their executive roles while

remaining available to ensure a smooth transition. |

| 6. | Will there be layoffs as a result of this announcement? |

| · | We expect it to be business as usual at U.S. Xpress – supporting our drivers and customers while

continuously striving to improve. |

| · | We are counting on you to remain focused on your day-to-day responsibilities and continue serving our

customers. |

| 7. | Will my compensation or benefits change? |

| · | We expect that compensation and benefits will remain unchanged. |

| 8. | What happens to U.S. Xpress stock that I own? |

| · | If you are a U.S. Xpress stockholder, you will receive $6.15 per share in cash for each share you own

once the transaction is complete. |

| · | Details about contributions to the Employee Stock Purchase Plan and equity awards will be provided separately. |

| 9. | What happens if I have unvested stock? |

| · | Unvested equity awards (other than options) will be assumed by Knight-Swift and converted into outstanding

equity awards of Knight-Swift and will have the same terms and conditions (including as to vesting, acceleration and forfeiture) as applied

to the awards prior to closing. All outstanding options are underwater and will be cancelled. |

| 10. | What does this mean for our customers and partners? |

| · | The increased scale, operating expertise and resources of the combined company will allow U.S. Xpress

to drive growth and continue serving customers across the United States. |

| · | This announcement will have no impact on how we work with our customers and partners. |

| · | We should all remain focused on providing the same level of service that our customers have come to expect. |

| 11. | When is the transaction expected to close? What are the next steps? |

| · | This is just the beginning of the process. We expect the transaction to close late in the second quarter

or early third quarter of 2023, subject to regulatory and other customary closing conditions. |

| · | In the meantime, a transition team of Knight-Swift and U.S. Xpress members will work together to ensure

a smooth transition once the transaction is completed. |

| 12. | What should I tell customers or partners if I’m asked about the announcement? |

| · | Please emphasize that this announcement will have no impact on how we work with our customers and partners. |

| · | Following the close of the transaction, U.S. Xpress will continue as a separate brand and operation, and

we will remain focused on our mission to make goods move better every day. |

| 13. | Will there be any changes to U.S. Xpress’ headquarters as a result of this announcement? |

| · | Knight-Swift plans to retain U.S. Xpress’ headquarters in Chattanooga, and we are pleased that U.S.

Xpress will continue to have an important presence in our community. |

| 14. | Will there be any changes to my team or manager? |

| · | The U.S. Xpress reporting structure will remain in place through closing. |

| · | At closing, our team will be supplemented by Tim and Josh, and perhaps others from Knight-Swift. |

| · | We expect it to be business as usual at U.S. Xpress – supporting our drivers and customers while

continuously striving to improve. |

| 15. | Do you expect there to be any changes to U.S. Xpress’ operations? |

| · | Knight-Swift has a long history of continuing the separate operations of the companies in its group. |

| · | After the close of the transaction, U.S. Xpress will continue operating as a separate brand with the support

and partnership of one of North America’s strongest transportation companies. |

| · | The increased scale, operating expertise and resources of the combined company will allow U.S. Xpress

to drive growth and continue serving customers across the United States. |

| 16. | What should I do if contacted by the media? |

| · | Please defer any media inquiries to Mary Fortune, Communications Director, at mfortune@usxpress.com. |

| 17. | Who do I contact with questions and where can I find additional information? |

| · | We are committed to keeping you informed as there is news to share, but please keep in mind we only just

announced the transaction. |

| · | You

can read more about the announcement in the joint press release we issued here. |

| · | If you have questions, please contact your manager. |

Additional Information and Where to Find

It

This communication is being made in connection

with the proposed transaction between U.S. Xpress Enterprises, Inc. and Knight-Swift Transportation Holdings Inc. In connection with

the proposed transaction, U.S. Xpress Enterprises, Inc. intends to file a proxy statement with the SEC. U.S. Xpress Enterprises, Inc.

may also file other relevant documents with the SEC regarding the proposed transaction. The information in the preliminary proxy statement

will not be complete and may be changed. The definitive proxy statement will be delivered to stockholders of U.S. Xpress Enterprises, Inc.

This communication is not a substitute for any proxy statement or any other document that may be filed with the SEC in connection with

the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF U.S. XPRESS

ENTERPRISES, INC. ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to

obtain free copies of the preliminary proxy statement and the definitive proxy statement (in each case, if and when available) and other

documents containing important information about U.S. Xpress Enterprises, Inc. and the proposed transaction once such documents are

filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by U.S.

Xpress Enterprises, Inc. will be available free of charge on U.S. Xpress Enterprises, Inc.’s website at www.usxpress.com

under the heading “Investors” or, alternatively, by directing a request by telephone or mail to U.S. Xpress Enterprises, Inc.

at (833) 879-7737 or 4080 Jenkins Road, Chattanooga, TN 37421, Attention: Investor Relations.

Participants in the Solicitation

U.S. Xpress Enterprises, Inc., its directors

and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from U.S. Xpress Enterprises, Inc.’s

stockholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of U.S. Xpress Enterprises, Inc. stockholders in connection with the proposed transaction,

including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement

when it is filed with the SEC. Information about these persons is included in U.S. Xpress Enterprises, Inc.’s annual proxy

statement and in other documents subsequently filed with the SEC, and will be included in the proxy statement when filed.

Forward Looking Statements

This communication contains “forward-looking

statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, regarding

Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc., including, but not limited to, statements about the

strategic rationale and benefits of the proposed transaction between Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including future financial and operating results, Knight-Swift Transportation Holdings Inc.’s or U.S. Xpress Enterprises, Inc.’s

plans, objectives, expectations and intentions and the expected timing of completion of the proposed transaction. You can generally identify

forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “explore,” “evaluate,” “forecast,”

“intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“seek,” “should,” “targeted,” “will,” or “would,” or the negative thereof

or other variations thereon or comparable terminology. However, the absence of these words or similar expressions does not mean that a

statement is not forward-looking. Statements in this announcement that are forward looking may include, but are not limited to, statements

regarding the benefits of the proposed transaction with U.S. Xpress Enterprises, Inc. and the associated integration plans, expected

synergies and revenue opportunities, expected branding, anticipated future operating performance and results of Knight-Swift Transportation

Holdings Inc., including statements regarding anticipated earnings, margins, and cash flows, anticipated future liquidity, anticipated

availability of future resources, financial or otherwise, anticipated growth opportunities, anticipated fleet size, the availability of

the transaction consideration, the expected management and governance of U.S. Xpress Enterprises, Inc. following the transaction

and the expected timing of the closing of the proposed transaction and other transactions contemplated by the proposed transaction. These

forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions

and inherently involve significant risks and uncertainties, many of which are beyond Knight-Swift Transportation Holdings Inc.’s

or U.S. Xpress Enterprises, Inc.’s control. Although we believe the expectations reflected in any forward-looking statements

are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and therefore actual results and

the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and uncertainties associated with: Knight-Swift Transportation Holdings Inc.’s

and U.S. Xpress Enterprises, Inc.’s ability to complete the potential transaction on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and U.S. Xpress Enterprises, Inc.

stockholders’ approvals and the satisfaction of other closing conditions to consummate the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to the termination of the definitive merger agreement relating to the

proposed transaction; failure to realize the expected benefits of the proposed transaction; significant transaction costs and/or unknown

or inestimable liabilities; the risk that U.S. Xpress Enterprises, Inc.’s business will not be integrated successfully, or

that such integration may be more difficult, time-consuming or costly than expected; Knight-Swift Transportation Holdings Inc.’s

financial ability to consummate the proposed transaction, and the continued availability of capital and financing for Knight-Swift Transportation

Holdings Inc. following the proposed transaction; risks related to future opportunities and plans for the combined company, including

the uncertainty of expected future regulatory filings, financial performance, supply chain conditions, gross domestic product changes

and results of the combined company following completion of the proposed transaction; disruption from the proposed transaction, making

it more difficult to conduct business as usual or maintain relationships with customers, employees, drivers or suppliers, including as

it relates to U.S. Xpress Enterprises, Inc.’s ability to successfully renew existing customer contracts on favorable terms

or at all and obtain new customers; the ability of U.S. Xpress Enterprises, Inc. to retain and hire key personnel; the diversion

of management’s attention from ongoing business operations; the business, economic and political conditions in the markets in which

U.S. Xpress Enterprises, Inc. operates; the impact of new or changes in current laws, regulations or other industry standards; effects

relating to the announcement of the proposed transaction or any further announcements or the consummation of the potential transaction

on the market price of U.S. Xpress Enterprises, Inc.’s common stock; the risk of potential stockholder litigation associated

with the potential transaction, including resulting expense or delay; regulatory initiatives and changes in tax laws; the impact of the

COVID-19 pandemic on the operations and financial results of U.S. Xpress Enterprises, Inc. or the combined company; general economic

conditions; and other risks and uncertainties affecting Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including those described from time to time under the caption “Risk Factors” and elsewhere in Knight-Swift Transportation

Holdings Inc.’s and U.S. Xpress Enterprises, Inc.’s SEC filings and reports, including Knight-Swift Transportation Holdings

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022, U.S. Xpress Enterprises, Inc.’s Annual

Report on Form 10-K for the year ended December 31, 2022, and future filings and reports by either company. Moreover, other

risks and uncertainties of which Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. are not currently aware

may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ

materially from those anticipated. Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc. caution investors

that such forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such forward-looking

statements. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated

in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates, even if they are

subsequently made available by Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. on their respective websites

or otherwise. Neither Knight-Swift Transportation Holdings Inc. nor U.S. Xpress Enterprises, Inc. undertakes any obligation to update

or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or

other circumstances that exist after the date as of which the forward-looking statements were made.

USX Transaction

Driving Employee Letter

Team,

This morning, we announced an agreement under

which U.S. Xpress will be acquired by Knight-Swift Transportation, one of North America’s largest and most diversified freight transportation

companies.

You

can read more about the announcement here: Knight-Swift Transportation Agrees to Acquire U.S. Xpress Enterprises for $6.15

Per Share | Business Wire.

Knight-Swift has a long history of retaining the

separate brands and operations of the companies in its group – Knight Transportation, Swift Transportation, Barr-Nunn, Abilene,

AAA Cooper, and others all continue to serve our industry and maintain their historical locations. This is just one reason I am convinced

that joining the Knight-Swift team is an exciting opportunity for our people, our customers, and the communities we call home.

I want to highlight a few key points:

| · | It will be business as usual for you and our customers. |

| · | U.S. Xpress will continue to operate as a separate brand from its locations. |

| · | You will keep your driver manager, shop locations, and pay package. |

As for next steps, this announcement is just the

beginning of the process. We expect to complete the transaction late in the second quarter or early third quarter of 2023.

We understand you may have questions about this

announcement and what it means for you, and we are committed to keeping you informed. I have attached an FAQ that we hope will help address

some of your immediate questions.

Thank you for your continued hard work. I hope

you share my excitement about what’s ahead for U.S. Xpress.

Sincerely,

Eric Fuller

President & Chief Executive Officer

Additional Information and Where to Find

It

This communication is being made in connection

with the proposed transaction between U.S. Xpress Enterprises, Inc. and Knight-Swift Transportation Holdings Inc. In connection with

the proposed transaction, U.S. Xpress Enterprises, Inc. intends to file a proxy statement with the SEC. U.S. Xpress Enterprises, Inc.

may also file other relevant documents with the SEC regarding the proposed transaction. The information in the preliminary proxy statement

will not be complete and may be changed. The definitive proxy statement will be delivered to stockholders of U.S. Xpress Enterprises, Inc.

This communication is not a substitute for any proxy statement or any other document that may be filed with the SEC in connection with

the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF U.S. XPRESS

ENTERPRISES, INC. ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to

obtain free copies of the preliminary proxy statement and the definitive proxy statement (in each case, if and when available) and other

documents containing important information about U.S. Xpress Enterprises, Inc. and the proposed transaction once such documents are

filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by U.S.

Xpress Enterprises, Inc. will be available free of charge on U.S. Xpress Enterprises, Inc.’s website at www.usxpress.com

under the heading “Investors” or, alternatively, by directing a request by telephone or mail to U.S. Xpress Enterprises, Inc.

at (833) 879-7737 or 4080 Jenkins Road, Chattanooga, TN 37421, Attention: Investor Relations.

Participants in the Solicitation

U.S. Xpress Enterprises, Inc., its directors

and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from U.S. Xpress Enterprises, Inc.’s

stockholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of U.S. Xpress Enterprises, Inc. stockholders in connection with the proposed transaction,

including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement

when it is filed with the SEC. Information about these persons is included in U.S. Xpress Enterprises, Inc.’s annual proxy

statement and in other documents subsequently filed with the SEC, and will be included in the proxy statement when filed.

Forward Looking Statements

This communication contains “forward-looking

statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, regarding

Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc., including, but not limited to, statements about the

strategic rationale and benefits of the proposed transaction between Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including future financial and operating results, Knight-Swift Transportation Holdings Inc.’s or U.S. Xpress Enterprises, Inc.’s

plans, objectives, expectations and intentions and the expected timing of completion of the proposed transaction. You can generally identify

forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “explore,” “evaluate,” “forecast,”

“intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“seek,” “should,” “targeted,” “will,” or “would,” or the negative thereof

or other variations thereon or comparable terminology. However, the absence of these words or similar expressions does not mean that a

statement is not forward-looking. Statements in this announcement that are forward looking may include, but are not limited to, statements

regarding the benefits of the proposed transaction with U.S. Xpress Enterprises, Inc. and the associated integration plans, expected

synergies and revenue opportunities, expected branding, anticipated future operating performance and results of Knight-Swift Transportation

Holdings Inc., including statements regarding anticipated earnings, margins, and cash flows, anticipated future liquidity, anticipated

availability of future resources, financial or otherwise, anticipated growth opportunities, anticipated fleet size, the availability of

the transaction consideration, the expected management and governance of U.S. Xpress Enterprises, Inc. following the transaction

and the expected timing of the closing of the proposed transaction and other transactions contemplated by the proposed transaction. These

forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions

and inherently involve significant risks and uncertainties, many of which are beyond Knight-Swift Transportation Holdings Inc.’s

or U.S. Xpress Enterprises, Inc.’s control. Although we believe the expectations reflected in any forward-looking statements

are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and therefore actual results and

the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and uncertainties associated with: Knight-Swift Transportation Holdings Inc.’s

and U.S. Xpress Enterprises, Inc.’s ability to complete the potential transaction on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and U.S. Xpress Enterprises, Inc.

stockholders’ approvals and the satisfaction of other closing conditions to consummate the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to the termination of the definitive merger agreement relating to the

proposed transaction; failure to realize the expected benefits of the proposed transaction; significant transaction costs and/or unknown

or inestimable liabilities; the risk that U.S. Xpress Enterprises, Inc.’s business will not be integrated successfully, or

that such integration may be more difficult, time-consuming or costly than expected; Knight-Swift Transportation Holdings Inc.’s

financial ability to consummate the proposed transaction, and the continued availability of capital and financing for Knight-Swift Transportation

Holdings Inc. following the proposed transaction; risks related to future opportunities and plans for the combined company, including

the uncertainty of expected future regulatory filings, financial performance, supply chain conditions, gross domestic product changes

and results of the combined company following completion of the proposed transaction; disruption from the proposed transaction, making

it more difficult to conduct business as usual or maintain relationships with customers, employees, drivers or suppliers, including as

it relates to U.S. Xpress Enterprises, Inc.’s ability to successfully renew existing customer contracts on favorable terms

or at all and obtain new customers; the ability of U.S. Xpress Enterprises, Inc. to retain and hire key personnel; the diversion

of management’s attention from ongoing business operations; the business, economic and political conditions in the markets in which

U.S. Xpress Enterprises, Inc. operates; the impact of new or changes in current laws, regulations or other industry standards; effects

relating to the announcement of the proposed transaction or any further announcements or the consummation of the potential transaction

on the market price of U.S. Xpress Enterprises, Inc.’s common stock; the risk of potential stockholder litigation associated

with the potential transaction, including resulting expense or delay; regulatory initiatives and changes in tax laws; the impact of the

COVID-19 pandemic on the operations and financial results of U.S. Xpress Enterprises, Inc. or the combined company; general economic

conditions; and other risks and uncertainties affecting Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including those described from time to time under the caption “Risk Factors” and elsewhere in Knight-Swift Transportation

Holdings Inc.’s and U.S. Xpress Enterprises, Inc.’s SEC filings and reports, including Knight-Swift Transportation Holdings

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022, U.S. Xpress Enterprises, Inc.’s Annual

Report on Form 10-K for the year ended December 31, 2022, and future filings and reports by either company. Moreover, other

risks and uncertainties of which Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. are not currently aware

may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ

materially from those anticipated. Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc. caution investors

that such forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such forward-looking

statements. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated

in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates, even if they are

subsequently made available by Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. on their respective websites

or otherwise. Neither Knight-Swift Transportation Holdings Inc. nor U.S. Xpress Enterprises, Inc. undertakes any obligation to update

or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or

other circumstances that exist after the date as of which the forward-looking statements were made.

USX Transaction

Driving Employee FAQ

| · | We announced an agreement under which U.S. Xpress will be acquired by Knight-Swift Transportation for

$6.15 per share in cash. |

| · | Following the close of the transaction, U.S. Xpress will continue operating as a separate brand. |

| · | Joining the Knight-Swift team, while retaining our separate operations, is an exciting opportunity for

our people, our customers and the communities we call home. The increased scale, operating expertise and resources of the combined company

will allow U.S. Xpress to drive growth and continue serving customers across the United States. |

| 2. | Who is Knight-Swift? Why are they acquiring U.S. Xpress? |

| · | Knight-Swift is one of North America's largest and most diversified freight transportation companies,

providing multiple truckload transportation, less-than-truckload, logistics and business services to the shipping and transportation sectors. |

| · | Knight-Swift has a long history of retaining the separate brands and operations of the companies in its

group – Knight Transportation, Swift Transportation, Barr-Nunn, Abilene, AAA Cooper, and others all continue to serve our industry

and maintain their historical locations. |

| · | Knight-Swift is also a well-known and respected operator, with a track record of creating value and implementing

positive change and stability. |

| · | Joining the Knight-Swift team is an exciting opportunity for our people, our customers and the communities

we call home, and we are confident this transaction is the best path forward for U.S. Xpress. |

| 3. | What does this mean for employees? |

| · | We expect it to be business as usual at U.S. Xpress – supporting our drivers and customers while

continuously striving to improve. |

| · | After the closing of the transaction, U.S. Xpress will continue as a separate brand and operation to minimize

disruptions for our driving associates, shop and office employees and customers. |

| · | We are counting on you to remain focused on your day-to-day responsibilities and continue serving our

customers. |

| 4. | What will happen to the U.S. Xpress name and brand once the transaction is complete? |

| · | After the closing of the transaction, U.S. Xpress will continue as a separate brand and operation to minimize

disruptions for our driving associates, shop and office employees and customers. |

| · | In short, we expect U.S. Xpress will continue operating business as usual – supporting our drivers

and customers while continuously striving to improve. |

| · | We will continue to serve the same customers, drivers, and other constituencies that are important to

our company. |

| 5. | Who will lead U.S. Xpress once the transaction closes? |

| · | The current leadership team will remain in place through closing. |

| · | At closing, the U.S. Xpress team will be supplemented by Tim Harrington and Josh Smith, both executives

at Swift who gained tremendous experience and insight in the Knight-Swift merger. They will join U.S. Xpress as President and CFO, respectively. |

| · | At closing, Max Fuller, Eric Fuller, and Eric Peterson will transition out of their executive roles while

remaining available to ensure a smooth transition. |

| 6. | Will there be layoffs as a result of this announcement? |

| · | We expect it to be business as usual at U.S. Xpress – supporting our drivers and customers while

continuously striving to improve. |

| · | We are counting on you to remain focused on your day-to-day responsibilities and continue serving our

customers. |

| 7. | Will my compensation or benefits change? |

| · | We expect that compensation and benefits will remain unchanged. |

| 8. | What happens to U.S. Xpress stock that I own? |

| · | If you are a U.S. Xpress stockholder, you will receive $6.15 per share in cash for each share you own

once the transaction is complete. |

| · | Details about contributions to the Employee Stock Purchase Plan and equity awards will be provided separately. |

| 9. | What happens if I have unvested stock? |

| · | Unvested equity awards (other than options) will be assumed by Knight-Swift and converted into outstanding

equity awards of Knight-Swift and will have the same terms and conditions (including as to vesting, acceleration and forfeiture) as applied

to the awards prior to closing. All outstanding options are underwater and will be cancelled. |

| 10. | What does this mean for our customers and partners? |

| · | The increased scale, operating expertise and resources of the combined company will allow U.S. Xpress

to drive growth and continue serving customers across the United States. |

| · | This announcement will have no impact on how we work with our customers and partners. |

| · | We should all remain focused on providing the same level of service that our customers have come to expect. |

| 11. | When is the transaction expected to close? What are the next steps? |

| · | This is just the beginning of the process. We expect the transaction to close late in the second quarter

or early third quarter of 2023, subject to regulatory and other customary closing conditions. |

| · | In the meantime, a transition team of Knight-Swift and U.S. Xpress members will work together to ensure

a smooth transition once the transaction is completed. |

| 12. | What should I tell customers or partners if I’m asked about the announcement? |

| · | Please emphasize that this announcement will have no impact on how we work with our customers and partners. |

| · | Following the close of the transaction, U.S. Xpress will continue as a separate brand and operation, and

we will remain focused on our mission to make goods move better every day. |

| 13. | Will there be any changes to my routes? Will I continue to work in the same terminal locations? |

| · | There will be no changes to your current routes or terminal locations. |

| 14. | Will there be any policy changes regarding the equipment I work with e.g., fuel reimbursement, vehicles

I can operate, etc.? |

| · | We do not expect any changes in policy as a result of this announcement. |

| 15. | What should I do if contacted by the media? |

| · | Please defer any media inquiries to Mary Fortune, Communications Director, at mfortune@usxpress.com. |

| 16. | Who do I contact with questions and where can I find additional information? |

| · | We are committed to keeping you informed as there is news to share, but please keep in mind we only just

announced the transaction. |

| · | You

can read more about the announcement in the joint press release we issued here: Knight-Swift

Transportation Agrees to Acquire U.S. Xpress Enterprises for $6.15 Per Share | Business Wire. |

| · | If you have questions, please contact your manager. |

Additional Information and Where to Find

It

This communication is being made in connection

with the proposed transaction between U.S. Xpress Enterprises, Inc. and Knight-Swift Transportation Holdings Inc. In connection with

the proposed transaction, U.S. Xpress Enterprises, Inc. intends to file a proxy statement with the SEC. U.S. Xpress Enterprises, Inc.

may also file other relevant documents with the SEC regarding the proposed transaction. The information in the preliminary proxy statement

will not be complete and may be changed. The definitive proxy statement will be delivered to stockholders of U.S. Xpress Enterprises, Inc.

This communication is not a substitute for any proxy statement or any other document that may be filed with the SEC in connection with

the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF U.S. XPRESS

ENTERPRISES, INC. ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to

obtain free copies of the preliminary proxy statement and the definitive proxy statement (in each case, if and when available) and other

documents containing important information about U.S. Xpress Enterprises, Inc. and the proposed transaction once such documents are

filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by U.S.

Xpress Enterprises, Inc. will be available free of charge on U.S. Xpress Enterprises, Inc.’s website at www.usxpress.com

under the heading “Investors” or, alternatively, by directing a request by telephone or mail to U.S. Xpress Enterprises, Inc.

at (833) 879-7737 or 4080 Jenkins Road, Chattanooga, TN 37421, Attention: Investor Relations.

Participants in the Solicitation

U.S. Xpress Enterprises, Inc., its directors

and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from U.S. Xpress Enterprises, Inc.’s

stockholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of U.S. Xpress Enterprises, Inc. stockholders in connection with the proposed transaction,

including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement

when it is filed with the SEC. Information about these persons is included in U.S. Xpress Enterprises, Inc.’s annual proxy

statement and in other documents subsequently filed with the SEC, and will be included in the proxy statement when filed.

Forward Looking Statements

This communication contains “forward-looking

statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, regarding

Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc., including, but not limited to, statements about the

strategic rationale and benefits of the proposed transaction between Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including future financial and operating results, Knight-Swift Transportation Holdings Inc.’s or U.S. Xpress Enterprises, Inc.’s

plans, objectives, expectations and intentions and the expected timing of completion of the proposed transaction. You can generally identify

forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “explore,” “evaluate,” “forecast,”

“intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“seek,” “should,” “targeted,” “will,” or “would,” or the negative thereof

or other variations thereon or comparable terminology. However, the absence of these words or similar expressions does not mean that a

statement is not forward-looking. Statements in this announcement that are forward looking may include, but are not limited to, statements

regarding the benefits of the proposed transaction with U.S. Xpress Enterprises, Inc. and the associated integration plans, expected

synergies and revenue opportunities, expected branding, anticipated future operating performance and results of Knight-Swift Transportation

Holdings Inc., including statements regarding anticipated earnings, margins, and cash flows, anticipated future liquidity, anticipated

availability of future resources, financial or otherwise, anticipated growth opportunities, anticipated fleet size, the availability of

the transaction consideration, the expected management and governance of U.S. Xpress Enterprises, Inc. following the transaction

and the expected timing of the closing of the proposed transaction and other transactions contemplated by the proposed transaction. These

forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions

and inherently involve significant risks and uncertainties, many of which are beyond Knight-Swift Transportation Holdings Inc.’s

or U.S. Xpress Enterprises, Inc.’s control. Although we believe the expectations reflected in any forward-looking statements

are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and therefore actual results and

the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and uncertainties associated with: Knight-Swift Transportation Holdings Inc.’s

and U.S. Xpress Enterprises, Inc.’s ability to complete the potential transaction on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and U.S. Xpress Enterprises, Inc.

stockholders’ approvals and the satisfaction of other closing conditions to consummate the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to the termination of the definitive merger agreement relating to the

proposed transaction; failure to realize the expected benefits of the proposed transaction; significant transaction costs and/or unknown

or inestimable liabilities; the risk that U.S. Xpress Enterprises, Inc.’s business will not be integrated successfully, or

that such integration may be more difficult, time-consuming or costly than expected; Knight-Swift Transportation Holdings Inc.’s

financial ability to consummate the proposed transaction, and the continued availability of capital and financing for Knight-Swift Transportation

Holdings Inc. following the proposed transaction; risks related to future opportunities and plans for the combined company, including

the uncertainty of expected future regulatory filings, financial performance, supply chain conditions, gross domestic product changes

and results of the combined company following completion of the proposed transaction; disruption from the proposed transaction, making

it more difficult to conduct business as usual or maintain relationships with customers, employees, drivers or suppliers, including as

it relates to U.S. Xpress Enterprises, Inc.’s ability to successfully renew existing customer contracts on favorable terms

or at all and obtain new customers; the ability of U.S. Xpress Enterprises, Inc. to retain and hire key personnel; the diversion

of management’s attention from ongoing business operations; the business, economic and political conditions in the markets in which

U.S. Xpress Enterprises, Inc. operates; the impact of new or changes in current laws, regulations or other industry standards; effects

relating to the announcement of the proposed transaction or any further announcements or the consummation of the potential transaction

on the market price of U.S. Xpress Enterprises, Inc.’s common stock; the risk of potential stockholder litigation associated

with the potential transaction, including resulting expense or delay; regulatory initiatives and changes in tax laws; the impact of the

COVID-19 pandemic on the operations and financial results of U.S. Xpress Enterprises, Inc. or the combined company; general economic

conditions; and other risks and uncertainties affecting Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including those described from time to time under the caption “Risk Factors” and elsewhere in Knight-Swift Transportation

Holdings Inc.’s and U.S. Xpress Enterprises, Inc.’s SEC filings and reports, including Knight-Swift Transportation Holdings

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022, U.S. Xpress Enterprises, Inc.’s Annual

Report on Form 10-K for the year ended December 31, 2022, and future filings and reports by either company. Moreover, other

risks and uncertainties of which Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. are not currently aware

may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ

materially from those anticipated. Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc. caution investors

that such forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such forward-looking

statements. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated

in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates, even if they are

subsequently made available by Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. on their respective websites

or otherwise. Neither Knight-Swift Transportation Holdings Inc. nor U.S. Xpress Enterprises, Inc. undertakes any obligation to update

or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or

other circumstances that exist after the date as of which the forward-looking statements were made.

USX Transaction

- Total Transportation Driving Employee Letter

Team,

This

morning, we announced an agreement under which U.S. Xpress and TOTAL Transportation will be acquired by Knight-Swift Transportation.

You can read more about the announcement here: Knight-Swift Transportation Agrees to Acquire U.S. Xpress Enterprises for $6.15

Per Share | Business Wire.

Knight-Swift has a long history of retaining the

separate brands and operations of the companies in its group – Knight Transportation, Swift Transportation, Barr-Nunn, Abilene,

AAA Cooper, and others all continue to serve our industry and maintain their historical locations. This is just one reason I am convinced

that joining the Knight-Swift team is an exciting opportunity for our people, our customers, and the communities we call home.

I want to highlight a few key points:

| · | It will be business as usual for you and our customers. |

| · | TOTAL will continue to operate as a separate brand from its locations. |

| · | You will keep your driver manager, shop locations, and pay package. |

As for next steps, this announcement is just the

beginning of the process. We expect to complete the transaction late in the second quarter or early third quarter of 2023. I have attached

an FAQ that we hope will help address any immediate questions you may have.

Thank you for your continued hard work. I hope

you share my excitement about what’s ahead for TOTAL.

Sincerely,

Craig Savell

President & Chief Executive Officer,

TOTAL Transportation of Mississippi

Additional Information and Where to Find

It

This communication is being made in connection

with the proposed transaction between U.S. Xpress Enterprises, Inc. and Knight-Swift Transportation Holdings Inc. In connection with

the proposed transaction, U.S. Xpress Enterprises, Inc. intends to file a proxy statement with the SEC. U.S. Xpress Enterprises, Inc.

may also file other relevant documents with the SEC regarding the proposed transaction. The information in the preliminary proxy statement

will not be complete and may be changed. The definitive proxy statement will be delivered to stockholders of U.S. Xpress Enterprises, Inc.

This communication is not a substitute for any proxy statement or any other document that may be filed with the SEC in connection with

the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF U.S. XPRESS

ENTERPRISES, INC. ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to

obtain free copies of the preliminary proxy statement and the definitive proxy statement (in each case, if and when available) and other

documents containing important information about U.S. Xpress Enterprises, Inc. and the proposed transaction once such documents are

filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by U.S.

Xpress Enterprises, Inc. will be available free of charge on U.S. Xpress Enterprises, Inc.’s website at www.usxpress.com

under the heading “Investors” or, alternatively, by directing a request by telephone or mail to U.S. Xpress Enterprises, Inc.

at (833) 879-7737 or 4080 Jenkins Road, Chattanooga, TN 37421, Attention: Investor Relations.

Participants in the Solicitation

U.S. Xpress Enterprises, Inc., its directors

and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from U.S. Xpress Enterprises, Inc.’s

stockholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of U.S. Xpress Enterprises, Inc. stockholders in connection with the proposed transaction,

including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement

when it is filed with the SEC. Information about these persons is included in U.S. Xpress Enterprises, Inc.’s annual proxy

statement and in other documents subsequently filed with the SEC, and will be included in the proxy statement when filed.

Forward Looking Statements

This communication contains “forward-looking

statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, regarding

Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc., including, but not limited to, statements about the

strategic rationale and benefits of the proposed transaction between Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including future financial and operating results, Knight-Swift Transportation Holdings Inc.’s or U.S. Xpress Enterprises, Inc.’s

plans, objectives, expectations and intentions and the expected timing of completion of the proposed transaction. You can generally identify

forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “explore,” “evaluate,” “forecast,”

“intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“seek,” “should,” “targeted,” “will,” or “would,” or the negative thereof

or other variations thereon or comparable terminology. However, the absence of these words or similar expressions does not mean that a

statement is not forward-looking. Statements in this announcement that are forward looking may include, but are not limited to, statements

regarding the benefits of the proposed transaction with U.S. Xpress Enterprises, Inc. and the associated integration plans, expected

synergies and revenue opportunities, expected branding, anticipated future operating performance and results of Knight-Swift Transportation

Holdings Inc., including statements regarding anticipated earnings, margins, and cash flows, anticipated future liquidity, anticipated

availability of future resources, financial or otherwise, anticipated growth opportunities, anticipated fleet size, the availability of

the transaction consideration, the expected management and governance of U.S. Xpress Enterprises, Inc. following the transaction

and the expected timing of the closing of the proposed transaction and other transactions contemplated by the proposed transaction. These

forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions

and inherently involve significant risks and uncertainties, many of which are beyond Knight-Swift Transportation Holdings Inc.’s

or U.S. Xpress Enterprises, Inc.’s control. Although we believe the expectations reflected in any forward-looking statements

are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and therefore actual results and

the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and uncertainties associated with: Knight-Swift Transportation Holdings Inc.’s

and U.S. Xpress Enterprises, Inc.’s ability to complete the potential transaction on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and U.S. Xpress Enterprises, Inc.

stockholders’ approvals and the satisfaction of other closing conditions to consummate the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to the termination of the definitive merger agreement relating to the

proposed transaction; failure to realize the expected benefits of the proposed transaction; significant transaction costs and/or unknown

or inestimable liabilities; the risk that U.S. Xpress Enterprises, Inc.’s business will not be integrated successfully, or

that such integration may be more difficult, time-consuming or costly than expected; Knight-Swift Transportation Holdings Inc.’s

financial ability to consummate the proposed transaction, and the continued availability of capital and financing for Knight-Swift Transportation

Holdings Inc. following the proposed transaction; risks related to future opportunities and plans for the combined company, including

the uncertainty of expected future regulatory filings, financial performance, supply chain conditions, gross domestic product changes

and results of the combined company following completion of the proposed transaction; disruption from the proposed transaction, making

it more difficult to conduct business as usual or maintain relationships with customers, employees, drivers or suppliers, including as

it relates to U.S. Xpress Enterprises, Inc.’s ability to successfully renew existing customer contracts on favorable terms

or at all and obtain new customers; the ability of U.S. Xpress Enterprises, Inc. to retain and hire key personnel; the diversion

of management’s attention from ongoing business operations; the business, economic and political conditions in the markets in which

U.S. Xpress Enterprises, Inc. operates; the impact of new or changes in current laws, regulations or other industry standards; effects

relating to the announcement of the proposed transaction or any further announcements or the consummation of the potential transaction

on the market price of U.S. Xpress Enterprises, Inc.’s common stock; the risk of potential stockholder litigation associated

with the potential transaction, including resulting expense or delay; regulatory initiatives and changes in tax laws; the impact of the

COVID-19 pandemic on the operations and financial results of U.S. Xpress Enterprises, Inc. or the combined company; general economic

conditions; and other risks and uncertainties affecting Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including those described from time to time under the caption “Risk Factors” and elsewhere in Knight-Swift Transportation

Holdings Inc.’s and U.S. Xpress Enterprises, Inc.’s SEC filings and reports, including Knight-Swift Transportation Holdings

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022, U.S. Xpress Enterprises, Inc.’s Annual

Report on Form 10-K for the year ended December 31, 2022, and future filings and reports by either company. Moreover, other

risks and uncertainties of which Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. are not currently aware

may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ

materially from those anticipated. Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc. caution investors

that such forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such forward-looking

statements. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated

in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates, even if they are

subsequently made available by Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. on their respective websites

or otherwise. Neither Knight-Swift Transportation Holdings Inc. nor U.S. Xpress Enterprises, Inc. undertakes any obligation to update

or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or

other circumstances that exist after the date as of which the forward-looking statements were made.

USX Transaction

– Total Transportation Driving Employee FAQ

| · | We announced an agreement under which U.S. Xpress and TOTAL Transportation will be acquired by Knight-Swift

Transportation. |

| · | Following the close of the transaction, TOTAL will continue operating as a separate brand. |

| · | Joining the Knight-Swift team, while retaining our separate operations, is an exciting opportunity for

our people, our customers and the communities we call home. |

| · | The increased scale, operating expertise and resources of the combined company will allow TOTAL to drive

growth and continue serving customers across the United States. |

| 2. | Who is Knight-Swift? Why are they acquiring U.S. Xpress and TOTAL Transportation? |

| · | Knight-Swift is one of North America’s largest and most diversified freight transportation companies,