UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

| Filed by the

Registrant x |

| |

| Filed by a Party

other than the Registrant ¨ |

| |

| Check the appropriate box: |

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting Material under Rule 14a-12 |

| |

| US XPRESS ENTERPRISES, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The following communications relate to the proposed

acquisition of U.S. Xpress Enterprises, Inc., a Nevada corporation (the “Company”) by Knight-Swift Transportation Holdings

Inc., a Delaware corporation (“Knight-Swift”), pursuant to the Agreement and Plan of Merger, dated as of March 20, 2023,

by and among the Company, Knight-Swift and Liberty Merger Sub, Inc., a wholly owned subsidiary of Knight-Swift.

Knight-Swift

Announcement to USX Employees

Headline: Hear from members of the Knight-Swift

family

During a town hall with employees, Knight-Swift

leadership shared a video message from other companies across their enterprise.

The news of our acquisition by Knight-Swift brought

together leaders from both companies and employees across our business for a town hall last week. At that event, leadership shared a video

message from people at Knight, Swift, and other companies in their portfolio, including AAA Cooper, Bar-Nunn, Abilene Motor Express, and

Eleos Technologies.

Knight-Swift has a long history of retaining the

separate brands and operations of the companies in its group, which all continue to serve our industry and maintain their historical locations.

After the closing of the transaction with Knight-Swift later this year, U.S. Xpress will continue as a separate brand and operation to

minimize disruptions for our professional drivers, shop and office employees, and customers.

View the video here. Review other information

and messages about the Knight-Swift acquisition at these links:

Employee message

FAQ

Additional Information and Where to Find

It

This communication is being made in connection

with the proposed transaction between U.S. Xpress Enterprises, Inc. and Knight-Swift Transportation Holdings Inc. In connection with

the proposed transaction, U.S. Xpress Enterprises, Inc. intends to file a proxy statement with the SEC. U.S. Xpress Enterprises, Inc.

may also file other relevant documents with the SEC regarding the proposed transaction. The information in the preliminary proxy statement

will not be complete and may be changed. The definitive proxy statement will be delivered to stockholders of U.S. Xpress Enterprises, Inc.

This communication is not a substitute for any proxy statement or any other document that may be filed with the SEC in connection with

the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF U.S. XPRESS

ENTERPRISES, INC. ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to

obtain free copies of the preliminary proxy statement and the definitive proxy statement (in each case, if and when available) and other

documents containing important information about U.S. Xpress Enterprises, Inc. and the proposed transaction once such documents are

filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by U.S.

Xpress Enterprises, Inc. will be available free of charge on U.S. Xpress Enterprises, Inc.’s website at www.usxpress.com

under the heading “Investors” or, alternatively, by directing a request by telephone or mail to U.S. Xpress Enterprises, Inc.

at (833) 879-7737 or 4080 Jenkins Road, Chattanooga, TN 37421, Attention: Investor Relations.

Participants in the Solicitation

U.S. Xpress Enterprises, Inc., its directors

and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from U.S. Xpress Enterprises, Inc.’s

stockholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of U.S. Xpress Enterprises, Inc. stockholders in connection with the proposed transaction,

including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement

when it is filed with the SEC. Information about these persons is included in U.S. Xpress Enterprises, Inc.’s annual proxy

statement and in other documents subsequently filed with the SEC, and will be included in the proxy statement when filed.

Forward Looking Statements

This communication contains “forward-looking

statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, regarding

Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc., including, but not limited to, statements about the

strategic rationale and benefits of the proposed transaction between Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including future financial and operating results, Knight-Swift Transportation Holdings Inc.’s or U.S. Xpress Enterprises, Inc.’s

plans, objectives, expectations and intentions and the expected timing of completion of the proposed transaction. You can generally identify

forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “explore,” “evaluate,” “forecast,”

“intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“seek,” “should,” “targeted,” “will,” or “would,” or the negative thereof

or other variations thereon or comparable terminology. However, the absence of these words or similar expressions does not mean that a

statement is not forward-looking. Statements in this announcement that are forward looking may include, but are not limited to, statements

regarding the benefits of the proposed transaction with U.S. Xpress Enterprises, Inc. and the associated integration plans, expected

synergies and revenue opportunities, expected branding, anticipated future operating performance and results of Knight-Swift Transportation

Holdings Inc., including statements regarding anticipated earnings, margins, and cash flows, anticipated future liquidity, anticipated

availability of future resources, financial or otherwise, anticipated growth opportunities, anticipated fleet size, the availability of

the transaction consideration, the expected management and governance of U.S. Xpress Enterprises, Inc. following the transaction

and the expected timing of the closing of the proposed transaction and other transactions contemplated by the proposed transaction. These

forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions

and inherently involve significant risks and uncertainties, many of which are beyond Knight-Swift Transportation Holdings Inc.’s

or U.S. Xpress Enterprises, Inc.’s control. Although we believe the expectations reflected in any forward-looking statements

are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and therefore actual results and

the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and uncertainties associated with: Knight-Swift Transportation Holdings Inc.’s

and U.S. Xpress Enterprises, Inc.’s ability to complete the potential transaction on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and U.S. Xpress Enterprises, Inc.

stockholders’ approvals and the satisfaction of other closing conditions to consummate the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to the termination of the definitive merger agreement relating to the

proposed transaction; failure to realize the expected benefits of the proposed transaction; significant transaction costs and/or unknown

or inestimable liabilities; the risk that U.S. Xpress Enterprises, Inc.’s business will not be integrated successfully, or

that such integration may be more difficult, time-consuming or costly than expected; Knight-Swift Transportation Holdings Inc.’s

financial ability to consummate the proposed transaction, and the continued availability of capital and financing for Knight-Swift Transportation

Holdings Inc. following the proposed transaction; risks related to future opportunities and plans for the combined company, including

the uncertainty of expected future regulatory filings, financial performance, supply chain conditions, gross domestic product changes

and results of the combined company following completion of the proposed transaction; disruption from the proposed transaction, making

it more difficult to conduct business as usual or maintain relationships with customers, employees, drivers or suppliers, including as

it relates to U.S. Xpress Enterprises, Inc.’s ability to successfully renew existing customer contracts on favorable terms

or at all and obtain new customers; the ability of U.S. Xpress Enterprises, Inc. to retain and hire key personnel; the diversion

of management’s attention from ongoing business operations; the business, economic and political conditions in the markets in which

U.S. Xpress Enterprises, Inc. operates; the impact of new or changes in current laws, regulations or other industry standards; effects

relating to the announcement of the proposed transaction or any further announcements or the consummation of the potential transaction

on the market price of U.S. Xpress Enterprises, Inc.’s common stock; the risk of potential stockholder litigation associated

with the potential transaction, including resulting expense or delay; regulatory initiatives and changes in tax laws; the impact of the

COVID-19 pandemic on the operations and financial results of U.S. Xpress Enterprises, Inc. or the combined company; general economic

conditions; and other risks and uncertainties affecting Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including those described from time to time under the caption “Risk Factors” and elsewhere in Knight-Swift Transportation

Holdings Inc.’s and U.S. Xpress Enterprises, Inc.’s SEC filings and reports, including Knight-Swift Transportation Holdings

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022, U.S. Xpress Enterprises, Inc.’s Annual

Report on Form 10-K for the year ended December 31, 2022, and future filings and reports by either company. Moreover, other

risks and uncertainties of which Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. are not currently aware

may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ

materially from those anticipated. Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc. caution investors

that such forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such forward-looking

statements. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated

in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates, even if they are

subsequently made available by Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. on their respective websites

or otherwise. Neither Knight-Swift Transportation Holdings Inc. nor U.S. Xpress Enterprises, Inc. undertakes any obligation to update

or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or

other circumstances that exist after the date as of which the forward-looking statements were made.

Transcript

of Video Message to Employees

Michelle Lewis

CFO, AAA Cooper speaking:

I feel like since we’ve become part of the

Knight family of companies, there’s just a renewed and a greater energy around what we are trying to accomplish.

[MUSIC]

TEXT “THE KNIGHT-SWIFT FAMILY

ACHIEVING MORE TOGETHER”

Rene Beacom

President, Barr-Nunn Transportation speaking:

I think the largest concern immediately following

the announcement of the acquisition, was the reaction that we might see from our drivers, from our customers, from our non-drivers, from

people that had been associated with the company or had a stake in the organization.

Jim Fitzsimmons

Executive VP of Fleet Operations, Swift Transportation

speaking:

And over the years, you know I have been at Swift

at that time for about 24 years. We buy a lot of companies, where when we would buy them, we would roll them right into Swift, completely

destroy their identify, change their culture. Probably my biggest concern was that Swift was going to basically just become Knight.

Ricky Preito

Million Mile Driver, Swift Transportation speaking:

If our culture was going to be respectable or

are they going to respect our values – are they going to change that? I also thought you know, are they going to minimize, are they

going to shorten our terminals? Are we going to become smaller as a company?

Victor Ochoa

Million Mile Driver, Swift Transportation speaking:

I was expecting a lot of drastic changes that

did not happen.

Alan Jones

President, Abilene Motor Express speaking:

What I heard from Knight is what I think the family

wanted to occur you know the fact that Abilene would remain its own brand and would have its own identify. Where you know you kind of

have the skepticism is that what you’re being told because that’s what you want to hear and is it actually going to happen.

We had the autonomy to go to Knight and say, “Hey we need help with this? Could you give us advice on this?” The knowledge

that we were exposed to both from … you know the financial knowledge I was able to learn from both Dave and Adam you know being

involved in that – you know it took us to a whole other level.

Michelle Lewis

CFO, AAA Cooper speaking:

What was communicated to us from the Knight leadership

team and the reality after the acquisition – those two things were in sync.

Jim Fitzsimmons

Executive VP of Fleet Operations, Swift Transportation

speaking:

The goal was to make Swift a better Swift, and

not make it Knight.

Michelle Lewis

CFO, AAA Cooper speaking:

How do we achieve greater things within our own

brand and in our own way and Knight is really helping us do that.

Rene Beacom

President, Barr-Nunn Transportation speaking:

I have been with the company for 25 years, 9 of

those have been post-Knight since the acquisition. And from that point that that acquire that happened, I believe it increased the

potential for our future in virtually every respect.

Reid Dove

President, AAA Cooper speaking:

You know we were a primer and LTL dedicated company,

well now we have truckload, we have brokerage, we have intermodal, we have warehousing, we have software, you know technology through

Eleos. So we’ve got all of these different levers that we did not have within AAA Cooper and so when we go see customers, fortunately,

we’re able to talk about a lot of different services that we can provide for them.

Unidentified Drivers speaking:

I noticed that we have more new trucks and more

new trailers.

You know, it’s opened up other terminals

for us and other shops. You know, it gives the driver more flexibility when getting his truck repaired.

Reid Dove

President, AAA Cooper speaking:

We now have more locations, so if we have a driver

you know that AAA Cooper doesn’t serve - the West, for instance, so if we have drivers that need to move for whatever reason, for

family reason or what have you, we, the operating companies you know we can move people within the operating companies as well, so I think

that’s been a great benefit.

Rene Beacom

President, Barr-Nunn Transportation speaking:

We get the benefit of being our size company.

We get the benefit of having our relationships with our customers. In many ways, we get the best of both worlds. As an independent brand,

which is how we function, having our relationships with our drivers backed-up and supported by a larger, stable, very secure and capable

organization.

Kevin Survance

CEO, Eleos Technologies speaking:

We love being part of the K&S family. This

is a strong and powerful company with a wonderful reputation. It’s a wonderful reputation because the executives who lead the company

are of good character and they’re known for that I believe in the industry. There is a high level of trust and credibility there

and we are very, very happy to have our brand, our company and our team to be a part of that.

Jim Fitzsimmons

Executive VP of Fleet Operations, Swift Transportation

speaking:

Prior to the merger, we obviously always cared

about the driver, but after the merger, that was clearly the #1 goal like was to take care of the driver, and then the rest would fall

into place.

Unidentified Driver speaking:

The, our facilities you know and everything has

continued to improve and it looks very successful.

Michelle Lewis

CFO, AAA Cooper speaking:

From my perspective, the experience of joining

the Knight family of companies has been nothing but extraordinary. I found that we really became part of, at least from my view, really

became part of a collaborative team. There were significant bench strengths in all areas of our company that we could rely upon, call

upon, when needed. That’s proven to be very helpful to our entire team.

Kevin Survance

CEO, Eleos Technologies speaking:

The leadership at Knight-Swift has done everything

they said that would do before the deal and I know that’s not common.

Rene Beacom

President, Barr-Nunn Transportation speaking:

Everyone we met portrayed a certain culture. I

think a certain integrity and a certain respect for people – that’s what we saw. Nine years later, that’s still there.

Even though some of the people are different, some of the relationships are different, that’s still there.

Alan Jones

President, Abilene Motor Express speaking:

The willingness to always be available –

from the top of the organization down to – you know, how many levels you want to go down …

Jim Fitzsimmons

Executive VP of Fleet Operations, Swift Transportation

speaking:

The style of leadership – it’s a very

common sense, down-to-earth, common sense approach on just about everything.

Alan Jones

President, Abilene Motor Express speaking:

Sometimes I feel like I’m more of a family

with the Knight family than I am with the previous ownership of my own family.

Unidentified Driver speaking:

It really is a family here. I lost my son two

years ago, and everybody from Cory Webster – I even got a text message from Dave Jackson giving us his condolences. That goes a

long way with me.

Reid Dove

President, AAA Cooper speaking:

Being a part of the Knight organization has allowed

us to continue that long-standing tradition in our company.

Ricky Preito

Million Mile Driver, Swift Transportation speaking:

At the beginning, I was very skeptical, right

now I’m very at ease to tell you that I am proud to continue to work with this Knight-Swift company.

[CLOSING MUSIC AND COMPANY CREDITS]

Additional Information and Where to Find

It

This communication is being made in connection

with the proposed transaction between U.S. Xpress Enterprises, Inc. and Knight-Swift Transportation Holdings Inc. In connection with

the proposed transaction, U.S. Xpress Enterprises, Inc. intends to file a proxy statement with the SEC. U.S. Xpress Enterprises, Inc.

may also file other relevant documents with the SEC regarding the proposed transaction. The information in the preliminary proxy statement

will not be complete and may be changed. The definitive proxy statement will be delivered to stockholders of U.S. Xpress Enterprises, Inc.

This communication is not a substitute for any proxy statement or any other document that may be filed with the SEC in connection with

the proposed transaction.

INVESTORS AND SECURITY HOLDERS OF U.S. XPRESS

ENTERPRISES, INC. ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to

obtain free copies of the preliminary proxy statement and the definitive proxy statement (in each case, if and when available) and other

documents containing important information about U.S. Xpress Enterprises, Inc. and the proposed transaction once such documents are

filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by U.S.

Xpress Enterprises, Inc. will be available free of charge on U.S. Xpress Enterprises, Inc.’s website at www.usxpress.com

under the heading “Investors” or, alternatively, by directing a request by telephone or mail to U.S. Xpress Enterprises, Inc.

at (833) 879-7737 or 4080 Jenkins Road, Chattanooga, TN 37421, Attention: Investor Relations.

Participants in the Solicitation

U.S. Xpress Enterprises, Inc., its directors

and certain of its executive officers and employees may be deemed to be participants in the solicitation of proxies from U.S. Xpress Enterprises, Inc.’s

stockholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC,

be deemed participants in the solicitation of U.S. Xpress Enterprises, Inc. stockholders in connection with the proposed transaction,

including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement

when it is filed with the SEC. Information about these persons is included in U.S. Xpress Enterprises, Inc.’s annual proxy

statement and in other documents subsequently filed with the SEC, and will be included in the proxy statement when filed.

Forward Looking Statements

This communication contains “forward-looking

statements” as that term is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, regarding

Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc., including, but not limited to, statements about the

strategic rationale and benefits of the proposed transaction between Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including future financial and operating results, Knight-Swift Transportation Holdings Inc.’s or U.S. Xpress Enterprises, Inc.’s

plans, objectives, expectations and intentions and the expected timing of completion of the proposed transaction. You can generally identify

forward-looking statements by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “explore,” “evaluate,” “forecast,”

“intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“seek,” “should,” “targeted,” “will,” or “would,” or the negative thereof

or other variations thereon or comparable terminology. However, the absence of these words or similar expressions does not mean that a

statement is not forward-looking. Statements in this announcement that are forward looking may include, but are not limited to, statements

regarding the benefits of the proposed transaction with U.S. Xpress Enterprises, Inc. and the associated integration plans, expected

synergies and revenue opportunities, expected branding, anticipated future operating performance and results of Knight-Swift Transportation

Holdings Inc., including statements regarding anticipated earnings, margins, and cash flows, anticipated future liquidity, anticipated

availability of future resources, financial or otherwise, anticipated growth opportunities, anticipated fleet size, the availability of

the transaction consideration, the expected management and governance of U.S. Xpress Enterprises, Inc. following the transaction

and the expected timing of the closing of the proposed transaction and other transactions contemplated by the proposed transaction. These

forward-looking statements are based on each of the companies’ current plans, objectives, estimates, expectations and intentions

and inherently involve significant risks and uncertainties, many of which are beyond Knight-Swift Transportation Holdings Inc.’s

or U.S. Xpress Enterprises, Inc.’s control. Although we believe the expectations reflected in any forward-looking statements

are based on reasonable assumptions, we can give no assurance that our expectations will be attained, and therefore actual results and

the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and uncertainties associated with: Knight-Swift Transportation Holdings Inc.’s

and U.S. Xpress Enterprises, Inc.’s ability to complete the potential transaction on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to securing the necessary regulatory and U.S. Xpress Enterprises, Inc.

stockholders’ approvals and the satisfaction of other closing conditions to consummate the proposed transaction; the occurrence

of any event, change or other circumstance that could give rise to the termination of the definitive merger agreement relating to the

proposed transaction; failure to realize the expected benefits of the proposed transaction; significant transaction costs and/or unknown

or inestimable liabilities; the risk that U.S. Xpress Enterprises, Inc.’s business will not be integrated successfully, or

that such integration may be more difficult, time-consuming or costly than expected; Knight-Swift Transportation Holdings Inc.’s

financial ability to consummate the proposed transaction, and the continued availability of capital and financing for Knight-Swift Transportation

Holdings Inc. following the proposed transaction; risks related to future opportunities and plans for the combined company, including

the uncertainty of expected future regulatory filings, financial performance, supply chain conditions, gross domestic product changes

and results of the combined company following completion of the proposed transaction; disruption from the proposed transaction, making

it more difficult to conduct business as usual or maintain relationships with customers, employees, drivers or suppliers, including as

it relates to U.S. Xpress Enterprises, Inc.’s ability to successfully renew existing customer contracts on favorable terms

or at all and obtain new customers; the ability of U.S. Xpress Enterprises, Inc. to retain and hire key personnel; the diversion

of management’s attention from ongoing business operations; the business, economic and political conditions in the markets in which

U.S. Xpress Enterprises, Inc. operates; the impact of new or changes in current laws, regulations or other industry standards; effects

relating to the announcement of the proposed transaction or any further announcements or the consummation of the potential transaction

on the market price of U.S. Xpress Enterprises, Inc.’s common stock; the risk of potential stockholder litigation associated

with the potential transaction, including resulting expense or delay; regulatory initiatives and changes in tax laws; the impact of the

COVID-19 pandemic on the operations and financial results of U.S. Xpress Enterprises, Inc. or the combined company; general economic

conditions; and other risks and uncertainties affecting Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc.,

including those described from time to time under the caption “Risk Factors” and elsewhere in Knight-Swift Transportation

Holdings Inc.’s and U.S. Xpress Enterprises, Inc.’s SEC filings and reports, including Knight-Swift Transportation Holdings

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2022, U.S. Xpress Enterprises, Inc.’s Annual

Report on Form 10-K for the year ended December 31, 2022, and future filings and reports by either company. Moreover, other

risks and uncertainties of which Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. are not currently aware

may also affect each of the companies’ forward-looking statements and may cause actual results and the timing of events to differ

materially from those anticipated. Knight-Swift Transportation Holdings Inc. and U.S. Xpress Enterprises, Inc. caution investors

that such forward-looking statements are not guarantees of future performance and that undue reliance should not be placed on such forward-looking

statements. The forward-looking statements made in this communication are made only as of the date hereof or as of the dates indicated

in the forward-looking statements and reflect the views stated therein with respect to future events as at such dates, even if they are

subsequently made available by Knight-Swift Transportation Holdings Inc. or U.S. Xpress Enterprises, Inc. on their respective websites

or otherwise. Neither Knight-Swift Transportation Holdings Inc. nor U.S. Xpress Enterprises, Inc. undertakes any obligation to update

or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations or

other circumstances that exist after the date as of which the forward-looking statements were made.

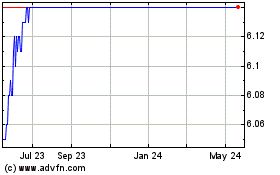

US Xpress Enterprises (NYSE:USX)

Historical Stock Chart

From Nov 2024 to Dec 2024

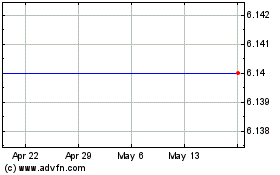

US Xpress Enterprises (NYSE:USX)

Historical Stock Chart

From Dec 2023 to Dec 2024