Third Quarter Highlights:

- Net income of $15.8 million, up 30.8% from $12.1 million for

3Q23. Diluted EPS of $0.44, up $0.09 from $0.35 per share for

3Q23

- Core net income(1) of $16.9 million, an increase of 31.2% from

$12.9 million for 3Q23. Core diluted EPS(1) of $0.47, up from $0.37

per share for 3Q23

- Loan production of $476.8 million in UPB, a 12.9% and 64.1%

increase from 2Q24 and 3Q23, respectively

- Nonperforming loans as a percentage of Held for Investment

(HFI)(2) loans was 10.6%, up slightly from 10.5% as of June 30,

2024, and 10.1% as of September 30, 2023, respectively

- Resolutions of nonperforming loans (NPL) and real estate owned

(REO) totaled $68.6 million in UPB

- Realized gains of $2.3 million or 103.4% of UPB resolved

- Portfolio net interest margin (NIM) of 3.60%, an increase of 6

bps Q/Q and 26 bps from 3.34% for 3Q23

- Completed the VCC 2024-4 securitization totaling $253.6 million

of securities issued

- Collapsed the 2020-2 securitization allowing us to redeploy

$25.1 million in retained equity more efficiently

- Liquidity(3) of $92.8 million and total available warehouse

line capacity of $349.3 million as of September 30, 2024

- Recourse debt to equity ratio of 1.5x due to aggregation of new

loans which were securitized after quarter end

- GAAP Book value per common share of $14.91 as of September 30,

2024, a 14.7% increase from $13.00 as of September 30, 2023

Velocity Financial, Inc. (NYSE: VEL) (Velocity or the Company),

a leader in business purpose loans, reported net income of $15.8

million and core net income of $16.9 million for 3Q24, compared to

net income of $12.1 million and core net income of $12.9 million

for 3Q23. Earnings and core earnings per diluted share were $0.44

and $0.47, respectively, for 3Q24, compared to $0.35 and $0.37 for

3Q23.

“Velocity continued to expand on this year’s considerable

achievements by delivering another quarter of solid production

volume and portfolio growth,” said Chris Farrar, President and CEO.

“The third quarter of 2024 marked the sixth consecutive quarter of

profitable production volume growth in an environment where other

lenders have struggled. We have successfully leveraged investments

in our production platform and sales force to expand our reach into

the broker community and generate greater awareness among real

estate investors regarding Velocity’s financing solutions. These

successes have been supported by disciplined capital and asset

management. Resolution gains on nonperforming loans reached $2.3

million, or 3.4% of total unpaid principal resolved. During the

quarter, we successfully issued our fourth securitization of 2024,

which met with strong investor demand and improved pricing. We also

collapsed capital-inefficient securitized debt that was

successfully refinanced, unlocking capital to support future

growth. These strong results have us on track to achieve an

all-time full-year funding record for the Company in 2024 while

also realizing our goal of a $5 billion loan portfolio by

2025.”

Third Quarter

Operating Results

KEY PERFORMANCE INDICATORS ($ in thousands)

3Q 2024

3Q 2023

$ Variance

% Variance

Pretax income

$

21,244.2

$

17,238.5

$

4,005.7

23.2

%

Net income

$

15,803.2

$

12,085.9

$

3,717.2

30.8

%

Diluted earnings per share

$

0.44

$

0.35

$

0.09

26.5

%

Core pretax income

$

23,003.6

$

18,334.9

$

4,668.7

25.5

%

Core net income(a)

$

16,948.7

$

12,918.1

$

4,030.6

31.2

%

Core diluted earnings per share(a)

$

0.47

$

0.37

$

0.10

26.9

%

Pretax return on equity

17.55

%

16.82

%

n.a.

4.3

%

Core pretax return on equity(a)

19.00

%

17.89

%

n.a.

6.2

%

Net interest margin - portfolio

3.60

%

3.34

%

n.a.

7.8

%

Net interest margin - total company

3.06

%

2.90

%

n.a.

5.6

%

Average common equity

$

484,197.4

$

409,954.3

$

74,243.1

18.1

%

(a) Core income, core diluted earnings per share and core

pretax return on equity are non-GAAP measures. Please see the

reconciliation to GAAP net income at the end of this release. n.a.-

not applicable

Discussion of results:

- Net income in 3Q24 was $15.8 million, compared to $12.1 million

for 3Q23

- Strong portfolio earnings driven by production volume growth

and continued focus on optimizing loan resolution gains

- Core net income(1) was $16.9 million, compared to $12.9 million

for 3Q23

- 3Q24 core adjustments included incentive compensation expenses

and costs related to the Company’s employee stock purchase plan

(ESPP)

- Portfolio NIM for 3Q24 was 3.60%, compared to 3.34% for 3Q23, a

7.8% Y/Y increase driven by consistent HFI portfolio growth and

average loan coupons of approximately 11.0% on recent loan

production

TOTAL LOAN PORTFOLIO ($ of UPB in millions)

3Q 2024

3Q 2023

$ Variance % Variance Held

for Investment Investor 1-4 Rental

$

2,565.8

$

2,120.2

$

445.6

21.0

%

Mixed Use

535.8

457.1

78.7

17.2

%

Multi-Family

344.3

305.0

39.3

12.9

%

Retail

405.9

327.8

78.1

23.8

%

Warehouse

300.4

246.6

53.8

21.8

%

All Other

582.1

401.1

181.0

45.1

%

Total

$

4,734.3

$

3,857.8

$

876.5

22.7

%

Held for Sale Investor 1-4

Rental

$

-

$

-

$

-

0.0

%

Government Insured Multifamily (CHHC)

18.9

-

-

n.m. Multi-Family

-

6.6

(6.6

)

n.m. Warehouse

-

11.2

(11.2

)

n.m. All Other

-

1.2

(1.2

)

n.m.

Total Managed Loan Portfolio UPB

$

4,753.3

$

3,876.7

$

876.5

22.6

%

Key loan portfolio metrics: Total loan count

12,235

9,953

Weighted average loan to value

67.0

%

68.0

%

Weighted average coupon

9.37

%

8.63

%

Weighted average total portfolio yield

9.18

%

8.38

%

Weighted average portfolio debt cost

6.15

%

5.63

%

n.m. - non meaningful

Discussion of results:

- Velocity’s total loan portfolio was $4.8 billion in UPB as of

September 30, 2024, an increase of 22.6% from $3.9 billion in UPB

as of September 30, 2023

- Primarily driven by 21.0% Y/Y growth in loans collateralized by

Investor 1-4 Rental properties and 45.1% Y/Y growth in loans

collateralized by “Other” commercial properties

- Government Insured Multifamily loans are originated by our

subsidiary CHHC and sold to investors for cash gains shortly after

closing

- Loan prepayments totaled $173.9 million in UPB, an increase

from $165.8 million for 2Q24, and $104.6 million for 3Q23

- The UPB of fair value option (FVO) loans was $2.2 billion, or

47.3% of total loans, as of September 30, 2024, an increase from

$955.6 million in UPB, or 24.7% as of September 30, 2023

- The weighted average portfolio loan-to-value ratio was 67.0% as

of September 30, 2024, down from 68.0% as of September 30, 2023,

and consistent with the five-quarter trailing average of 67.5%

- The weighted average total portfolio yield was 9.18% as of

September 30, 2024, an increase of 80 bps from September 30, 2023,

driven by a 74 bps increase in the weighted average loan coupons

over the same period

- Portfolio-related debt cost as of September 30, 2024, was

6.15%, an increase of 52 bps from September 30, 2023, driven by the

higher warehouse utilization and rates on recent

securitizations

LOAN PRODUCTION VOLUMES ($ in millions)

3Q 2024

3Q 2023

$ Variance % Variance Investor 1-4 Rental

$

219.9

$

154.3

$

65.7

42.6

%

Traditional Commercial

175.2

97.5

77.7

79.6

%

Government Insured Multifamily (CHHC)

18.9

-

18.9

n.m. Short-term

62.7

38.8

23.9

61.7

%

Total loan production

$

476.8

$

290.6

$

186.2

64.1

%

Acquisitions

$

-

$

-

n.m. - non meaningful

Discussion of results:

- Loan production for 3Q24 totaled $476.8 million in UPB, a 64.1%

increase from $290.6 million for 3Q23

- Traditional Commercial financing demand led the Y/Y growth;

however, Investor 1-4 rental and Short-term financing also

experienced strong demand. The weighted average coupon (WAC) on

3Q24 HFI loan production was 10.8%, a modest decrease from 11.0%

for 3Q23

HFI PORTFOLIO CREDIT PERFORMANCE INDICATORS ($ in thousands)

3Q 2024

3Q 2023

$ Variance % Variance Nonperforming loans(a)

$

503,939.0

$

387,725.0

$

116,214.0

30.0

%

Total HFI loans

$

4,734,319.0

$

3,857,778.7

$

876,540.3

22.7

%

Nonperforming loans % total HFI loans

10.6

%

10.1

%

n.a.

5.5

%

Average nonperforming loans subject to CECL reserve (b)

$

320,135.3

$

351,848.0

$

(31,712.7

)

(9.0

)%

Total charge offs

$

319.6

$

95.2

$

224.4

235.7

%

Charge-offs as a % of avg. nonperforming CECL loans(c)

0.40

%

0.11

%

n.a.

269.0

%

Loan loss reserve

$

4,851.2

$

4,684.8

$

166.4

3.6

%

Gain on transfer to REO

$

2,248.6

$

1,935.4

$

312.9

16.2

%

REO valuations, net

$

(1,642.0

)

$

(224.5

)

$

(1,417.9

)

(631.5

)%

Gain (loss) on sale of REO

$

615.1

$

(137.0

)

$

752.2

548.9

%

(a) Total HFI nonperforming/nonaccrual loans include loans

90+ days past due, loans in foreclosure, bankruptcy and on

nonaccrual. (b) Reflects monthly average nonperforming loans held

for investment, excluding FVO loans, during the period. (c)

Reflects the annualized quarter-to-date charge-offs to average

nonperforming loans for the period. n.a.- not applicable

Discussion of results:

- Nonperforming loans (NPL) totaled $503.9 million in UPB as of

September 30, 2024, or 10.6% of loans HFI, compared to $387.7

million and 10.1% as of September 30, 2023

- NPLs in foreclosure status comprised 8.1% of loans HFI as of

September 30, 2024, down slightly from 8.2% as of September 30,

2023

- Charge-offs for 3Q24 totaled $319.6 thousand, compared to $95.2

thousand for 3Q23

- The trailing five-quarter charge-off average was $381.5

thousand

- Net charge-off and REO activity comprises charge-offs, gain on

transfer of REO, gain (loss) on sale of REO, and REO valuations.

For 3Q24, net charge-off and REO activity resulted in a net gain of

$0.9 million, compared to a net gain of $1.5 million for 3Q23,

primarily driven by gains on loans transferred to REO

- The loan loss reserve totaled $4.9 million as of September 30,

2024, a 3.6% increase from $4.7 million as of September 30, 2023

- Mainly driven by updated valuation of the individually assessed

NPL portfolio

- The CECL reserve rate was 0.19% (CECL Reserve as % of Amortized

Cost HFI loans), which was in line with the recent five-quarter

average rate of 0.18% and within management’s expected range of

0.15% to 0.20%

NET REVENUES ($ in thousands)

3Q 2024

3Q 2023

$ Variance % Variance Interest income

$

105,069.6

$

79,088.4

$

25,981.2

32.9

%

Interest expense - portfolio related

(63,870.5

)

(47,583.0

)

(16,287.6

)

34.2

%

Net Interest Income - portfolio related

41,199.0

31,505.5

9,693.6

30.8

%

Interest expense - corporate debt

(6,142.8

)

(4,137.9

)

(2,004.8

)

48.4

%

Loan loss provision

68.9

(153.8

)

222.7

(144.8

)%

Net interest income after provision for loan losses

$

35,125.2

$

27,212.7

$

7,912.4

29.1

%

Gain on disposition of loans

2,291.0

3,606.3

(1,315.3

)

(36.5

)%

Unrealized (loss) gain on fair value loans

35,529.7

(1,283.5

)

36,813.2

2868.1

%

Unrealized gain (loss) on fair value of securitized debt

(24,995.4

)

9,692.3

(34,687.7

)

(357.9

)%

Unrealized gain/(loss) on mortgage servicing rights

(993.4

)

341.1

(1,334.5

)

(391.3

)%

Origination fee income(a)

6,703.8

3,323.5

3,380.3

101.7

%

Interest income on cash balance

1,676.2

1,341.9

334.3

24.9

%

Other operating income (expense)

518.8

339.7

179.1

52.7

%

Total other operating income (expense)

$

20,731.7

$

17,360.2

$

3,371.4

19.4

%

Net revenue

$

55,856.8

$

44,573.0

$

11,283.8

25.3

%

(a) 3Q23 includes a reclass of production fees to expenses

Discussion of results:

- Net Revenue for 3Q24 was $55.9 million, an increase of 25.3%

from $44.6 million for 3Q23

- Driven by strong production-driven portfolio growth and

disciplined focus on maintaining a net interest margin above

3.0%

- Total net interest income for 3Q24, including corporate debt

interest expense and loan loss provision, was $35.1 million, a

29.1% increase from $27.2 million for 3Q23

- Portfolio net Interest income was $41.2 million for 3Q24, an

increase of 30.8% from 3Q23 resulting from portfolio growth and a

26bps increase in NIM

- Total other operating income was $20.7 million for 3Q24, an

increase from $17.4 million for 3Q23

- Net unrealized FVO gains on loans and securitized debt were

$10.5 million, compared to a net gain of $8.4 million for 3Q23

- Origination income totaled $6.7 million, resulting from

improved origination fees of 1.4% charged on 3Q24 new loan

production

- Gain on disposition of loans totaled $2.3 million for 3Q24,

driven by loans transferred to Real Estate Owned (REO)

OPERATING EXPENSES ($ in thousands)

3Q 2024

3Q 2023

$ Variance % Variance Compensation and employee

benefits

$

17,585.9

$

12,522.8

$

5,063.1

40.4

%

Origination (income)/expense(a)

866.6

273.2

593.4

217.2

%

Securitization expenses

3,186.1

4,930.5

(1,744.3

)

(35.4

)%

Rent and occupancy

518.8

472.4

46.4

9.8

%

Loan servicing

5,656.1

4,901.4

754.6

15.4

%

Professional fees

2,304.5

853.8

1,450.7

169.9

%

Real estate owned, net

1,951.0

1,238.7

712.3

57.5

%

Other expenses

2,542.6

2,141.6

401.0

18.7

%

Total operating expenses

$

34,612.6

$

27,334.5

$

7,278.1

26.6

%

(a) 3Q23 includes a reclass of production fees to expenses

Discussion of results:

- Operating expenses totaled $34.6 million for 3Q24, an increase

of 26.6% from 3Q23, primarily driven by the continued growth of our

origination platform and higher production volume

- Compensation expense totaled $17.6 million, compared to $12.5

million for 3Q23

- Driven by higher commissions on increased production volume and

growth of the production team

- Securitization expenses totaled $3.2 million from issuing one

securitization during the quarter, compared to costs of $4.9

million for two securitizations during 3Q23

- Loan servicing expense totaled $5.7 million, a 15.4% increase

from $4.9 million for 3Q23, driven by portfolio growth

- Professional fees totaled $2.3 million, a 169.9% increase from

$0.9 million for 3Q23, driven by increased legal expenses

- REO expenses totaled $2.0 million, a 57.5% increase from $1.2

million for 3Q23, driven by higher valuation adjustment and

property preservation expenses

SECURITIZATIONS ($ in thousands)

Securities

Balance at Balance at Trusts Issued

9/30/2024 W.A. Rate 9/30/2023 W.A. Rate

2017-2 Trust

245,601

36,321

4.14

%

48,206

3.95

%

2018-1 Trust

176,816

26,820

4.14

%

35,010

3.99

%

2018-2 Trust

307,988

63,005

4.49

%

80,409

4.43

%

2019-1 Trust

235,580

64,004

4.12

%

79,215

4.06

%

2019-2 Trust

207,020

50,835

3.42

%

69,216

3.40

%

2019-3 Trust

154,419

50,268

3.28

%

60,482

3.29

%

2020-1 Trust

248,700

96,201

2.89

%

110,958

2.89

%

2020-2 Trust

96,352

-

-

49,528

4.59

%

2021-1 Trust

251,301

157,675

1.77

%

176,529

1.76

%

2021-2 Trust

194,918

129,046

2.06

%

149,431

2.02

%

2021-3 Trust

204,205

142,029

2.47

%

161,467

2.47

%

2021-4 Trust

319,116

219,627

3.23

%

250,941

3.24

%

2022-1 Trust

273,594

221,565

3.94

%

240,733

3.94

%

2022-2 Trust

241,388

198,288

5.07

%

221,631

5.08

%

2022-MC1 Trust

84,967

18,401

6.88

%

35,677

6.90

%

2022-3 Trust

296,323

239,881

5.71

%

262,308

5.71

%

2022-4 Trust

308,357

239,871

6.21

%

283,270

6.23

%

2022-5 Trust

188,754

138,941

7.08

%

171,183

7.05

%

2023-1 Trust

198,715

156,125

7.03

%

181,006

7.01

%

2023-1R Trust

64,833

44,985

7.61

%

60,515

7.69

%

2023-2 Trust

202,210

168,556

7.33

%

194,955

7.19

%

2023-RTL1 Trust

81,608

81,608

8.24

%

81,608

8.23

%

2023-3 Trust

234,741

217,620

7.94

%

232,802

7.80

%

2023-4 Trust

202,890

196,999

8.40

%

2024-1 Trust

209,862

187,751

7.64

%

2024-2 Trust

286,235

267,393

7.06

%

2024-3 Trust

204,599

196,559

7.20

%

2024-4 Trust

253,612

252,307

6.90

%

$

5,974,704

$

3,862,681

5.72

%

$

3,237,080

5.01

%

Discussion of results

- The weighted average rate on Velocity’s outstanding

securitizations was 5.72% as of September 30, 2024, an increase of

71 bps from September 30, 2023

- The company completed one securitization during 3Q24, totaling

$253.6 million of securities issued with a weighted average rate of

6.9%

- Down from a weighted average rate of 7.6% for securitizations

issued during 3Q23

- Sold two retained tranches from 2023 securitizations during

3Q24, totaling $36.6 million of securities issued

- Subsequent to quarter end, the company completed the VCC 2024-5

securitization totaling $300.4 million of securities issued with a

weighted average rate of 6.0%

- Collapsed the VCC 2020-2 securitization totaling $39.4 million

in outstanding bonds in 3Q24, which unlocked $25.1 million of

retained equity

- The collateral from the collapsed securitization was refinanced

on warehouse lines and will be securitized in future periods

RESOLUTION ACTIVITIES LONG-TERM

LOANS RESOLUTION ACTIVITY THIRD QUARTER

2024 THIRD QUARTER 2023 ($ in thousands)

UPB $

Gain / (Loss)$ UPB $ Gain / (Loss)$ Paid in

full

$

23,874.5

$

965.2

$

20,668.0

$

758.0

Paid current

34,956.6

567.0

26,950.0

206.0

REO sold (a)

1,431.4

290.0

6,341.0

162.0

Total resolutions

$

60,262.6

$

1,822.2

$

53,959.0

$

1,126.0

Resolutions as a % of nonperforming UPB

103.0

%

102.1

%

SHORT-TERM AND FORBEARANCE

LOANS RESOLUTION ACTIVITY THIRD QUARTER

2024 THIRD QUARTER 2023 ($ in thousands)

UPB $

Gain / (Loss)$ UPB $ Gain / (Loss)$ Paid in

full

$

4,974.1

$

151.0

$

2,967.0

$

38.0

Paid current

2,122.0

7.3

6,292.0

-

REO sold

1,260.3

325.1

2,434.0

(11.0

)

Total resolutions

$

8,356.3

$

483.5

$

11,693.0

$

27.0

Resolutions as a % of nonperforming UPB

105.8

%

100.2

%

Grand total resolutions

$

68,618.9

$

2,305.6

$

65,652.0

$

1,153.0

Grand total resolutions as a % of nonperforming UPB

103.4

%

101.8

%

Discussion of results:

- NPL resolution totaled $68.6 million in UPB, realizing 103.4%

of UPB resolved compared to $65.7 million in UPB and realization of

101.8% of UPB resolved for 3Q23

- The UPB of loan resolutions in 3Q24 was in line with the recent

five-quarter resolution average of $68.1 million in UPB and 102.1%

of UPB resolved

Velocity’s executive management team will host a conference call

and webcast on November 7th, 2024, at 2:00 p.m. Pacific Time / 5:00

p.m. Eastern Time to review 3Q24 financial results.

Webcast Information

The conference call will be webcast live in listen-only mode and

can be accessed through the Events and Presentations section of the

Velocity Financial Investor Relations website:

https://www.velfinance.com/events-and-presentations. To listen to

the webcast, please visit Velocity’s website at least 15 minutes

before the call to register, download, and install any needed

software. An audio replay of the call will also be available on

Velocity’s website after the conference call is completed.

Conference Call Information

To participate by phone, please dial in 15 minutes before the

start time to allow for wait times to access the conference call.

The live conference call will be accessible by dialing

1-833-316-0544 in the U.S. and Canada and 1-412-317-5725 for

international callers. Callers should ask to join the Velocity

Financial, Inc. conference call.

A replay of the call will be available through midnight on

November 29, 2024, and can be accessed by dialing 1-877-344-7529 in

the U.S. and 855-669-9658 in Canada or 1-412-317-0088

internationally. The passcode for the replay is #8544057. The

replay will also be available on the Investor Relations section of

the Company's website under "Events and Presentations.”

About Velocity Financial, Inc.

Based in Westlake Village, California, Velocity is a vertically

integrated real estate finance company that primarily originates

and manages business purpose loans secured by 1-4 unit residential

rental and small commercial properties. Velocity originates loans

nationwide across an extensive network of independent mortgage

brokers built and refined over 20 years.

Non-GAAP Financial Measures

To supplement our financial statements presented in accordance

with United States generally accepted accounting principles (GAAP),

the Company uses non-GAAP core net income and core diluted EPS,

which are non-GAAP financial measures.

Non-GAAP core net income and non-GAAP core diluted EPS are

non-GAAP financial measures that represent our net income (loss)

and net income (loss) per diluted share, adjusted to eliminate the

effect of certain costs incurred from activities that are not

normal recurring operating expenses, such as COVID-stressed charges

and recoveries of loan loss provision, nonrecurring debt

amortization, the impact of operational measures taken to address

the COVID-19 pandemic and workforce reduction costs, and costs

associated with acquisitions. To calculate non-GAAP core diluted

EPS, we use the weighted average number of shares of common stock

outstanding that is used to calculate net income per diluted share

under GAAP.

We have included non-GAAP core net income, and non-GAAP core

diluted EPS because they are key measures used by our management to

evaluate our operating performance, generate future operating

plans, and make strategic decisions, including those relating to

operating expenses and the allocation of internal resources.

Accordingly, we believe that non-GAAP core net income and non-GAAP

core diluted EPS provide useful information to investors and others

in understanding and evaluating our operating results in the same

manner as our management and board of directors. In addition, they

provide useful measures for period-to-period comparisons of our

business, as they remove the effect of certain items that we expect

to be nonrecurring.

These non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, financial information

prepared in accordance with GAAP. These non-GAAP financial measures

are not based on any standardized methodology prescribed by GAAP

and are not necessarily comparable to similarly titled measures

presented by other companies.

For more information on Core Income, please refer to the section

of this press release below titled “Adjusted Financial Metric

Reconciliation to GAAP Net Income” at the end of this press

release.

Forward-Looking Statements

Some of the statements contained in this press release may

constitute forward-looking statements within the meaning of the

federal securities laws. Forward-looking statements relate to

anticipated results, expectations, projections, plans and

strategies, anticipated events or trends, and similar expressions

concerning matters that are not historical facts. In some cases,

you can identify forward-looking statements by the use of

forward-looking terminology such as “may,” “will,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,”

“predicts,” “goal,” ”position,” or “potential” or the negative of

these words and phrases or similar words or phrases that are

predictions of or indicate future events or trends and which do not

relate solely to historical matters. You can also identify

forward-looking statements by discussions of strategy, plans, or

intentions.

The forward-looking statements contained in this press release

reflect our current views about future events and are subject to

numerous known and unknown risks, uncertainties, assumptions, and

changes in circumstances that may cause actual results to differ

significantly from those expressed or contemplated in any

forward-looking statement. While forward-looking statements reflect

our good faith projections, assumptions, and expectations, they are

not guarantees of future results. Furthermore, we disclaim any

obligation to publicly update or revise any forward-looking

statement to reflect changes in underlying assumptions or factors,

new information, data or methods, future events, or other changes,

except as required by applicable law. Factors that could cause our

results to differ materially include, but are not limited to, (1)

the continued course and severity of the COVID-19 pandemic and its

direct and indirect impacts, (2) general economic and real estate

market conditions, including the risk of recession (3) regulatory

and/or legislative changes, (4) our customers' continued interest

in loans and doing business with us, (5) market conditions and

investor interest in our future securitizations, and (6) the

continued conflict in Ukraine and Israel and (7) changes in federal

government fiscal and monetary policies.

Additional information relating to these and other factors that

could cause future results to differ materially from those

expressed or contemplated in any forward-looking statements can be

found in the section titled ‘‘Risk Factors” in our Form 10-Q filed

with the SEC on May 14, 2020, as well as other cautionary

statements we make in our current and periodic filings with the

SEC. Such filings are available publicly on our Investor Relations

web page at www.velfinance.com.

Velocity Financial,

Inc.

Consolidated Balance

Sheet

Quarter Ended 9/30/2024 6/30/2024

3/31/2024 12/31/2023 9/30/2023

Unaudited Unaudited Unaudited Audited

Unaudited (In thousands)

Assets Cash and cash

equivalents

$

44,094

$

47,366

$

34,829

$

40,566

$

29,393

Restricted cash

23,167

32,293

24,216

21,361

17,703

Loans held for sale, at fair value

19,231

-

-

17,590

19,536

Loans held for investment, at fair value

2,354,718

1,971,683

1,649,540

1,306,072

951,990

Loans held for investment, at amortized cost

2,526,320

2,619,619

2,727,518

2,828,123

2,945,840

Total loans, net

4,900,269

4,591,302

4,377,058

4,151,785

3,917,366

Accrued interest receivables

32,944

31,124

29,374

27,028

24,756

Receivables due from servicers

93,681

82,359

87,523

85,077

70,139

Other receivables

4,265

6,566

2,113

8,763

236

Real estate owned, net

62,361

50,757

46,280

44,268

29,299

Property and equipment, net

1,693

1,912

2,013

2,785

2,861

Deferred tax asset

14,501

1,144

1,580

2,339

705

Mortgage Servicing Rights, at fair value

12,416

12,229

9,022

8,578

9,786

Derivative assets

-

-

1,967

-

1,261

Goodwill

6,775

6,775

6,775

6,775

6,775

Other assets

6,308

9,566

5,468

5,248

7,028

Total Assets

$

5,202,474

$

4,873,393

$

4,628,218

$

4,404,573

$

4,117,308

Liabilities and members' equity Accounts payable and

accrued expenses

$

140,534

$

138,033

$

123,988

$

121,969

$

97,869

Secured financing, net

284,371

283,909

283,813

211,083

210,774

Securitized debt, at amortized cost

2,105,099

2,228,941

2,329,906

2,418,811

2,504,334

Securitized debt, at fair value

1,749,268

1,509,952

1,073,843

877,417

669,139

Warehouse & repurchase facilities

434,027

237,437

360,216

334,755

215,176

Derivative liability

1,486

374

-

3,665

-

Total Liabilities

4,714,785

4,398,646

4,171,766

3,967,700

3,697,292

Stockholders' Equity Stockholders' equity

484,636

471,323

452,941

433,444

416,398

Noncontrolling interest in subsidiary

3,053

3,424

3,511

3,429

3,618

Total equity

487,689

474,747

456,452

436,873

420,016

Total Liabilities and members' equity

$

5,202,474

$

4,873,393

$

4,628,218

$

4,404,573

$

4,117,308

Book value per share

$

14.91

$

14.52

$

14.01

$

13.49

$

13.00

Shares outstanding

32,712

(1)

32,701

(2)

32,574

(3)

32,395

(4)

32,314

(5)

(1)

Based on 32,711,910 common shares outstanding as of September 30,

2024, and excludes unvested shares of common stock authorized for

incentive compensation totaling 402,935.

(2)

Based on 32,701,185 common shares outstanding as of June 30, 2024,

and excludes unvested shares of common stock authorized for

incentive compensation totaling 397,450.

(3)

Based on 32,574,498 common shares outstanding as of March 31, 2024,

and excludes unvested shares of common stock authorized for

incentive compensation totaling 411,296.

(4)

Based on 32,395,423 common shares outstanding as of December 31,

2023, and excludes unvested shares of common stock authorized for

incentive compensation totaling 470,413.

(5)

Based on 32,313,744 common shares outstanding as of September 30,

2023, and excludes unvested shares of common stock authorized for

incentive compensation totaling 589,634.

Velocity Financial,

Inc.

Consolidated Statements of

Income (Quarters)

Quarter Ended ($ in thousands)

9/30/2024

6/30/2024 3/31/2024 12/31/2023

9/30/2023 Unaudited Unaudited Unaudited

Unaudited Unaudited Revenues Interest income

$

105,070

$

97,760

$

90,529

$

86,269

$

79,088

Interest expense - portfolio related

63,871

59,188

55,675

51,405

47,583

Net interest income - portfolio related

41,199

38,572

34,854

34,864

31,505

Interest expense - corporate debt

6,143

6,155

5,380

4,140

4,138

Net interest income

35,056

32,417

29,474

30,724

27,367

Provision for loan losses

(69

)

218

1,002

827

154

Net interest income after provision for loan losses

35,125

32,199

28,472

29,897

27,213

Other operating income Gain on disposition of loans

2,291

3,168

1,699

1,482

3,606

Unrealized gain (loss) on fair value loans

35,530

17,123

18,925

39,367

(1,284

)

Unrealized gain (loss) on fair value securitized debt

(24,995

)

(4,643

)

(2,318

)

(24,085

)

9,692

Unrealized gain/(loss) on mortgage servicing rights

(993

)

(373

)

444

(1,208

)

341

Origination fee income

6,704

5,072

4,986

3,981

3,323

Interest income on cash balance

1,676

1,731

1,631

1,716

1,342

Other income (expense)

519

483

408

418

340

Total other operating income

20,732

22,561

25,775

21,670

17,360

Net revenue

55,857

54,760

54,247

51,567

44,573

Operating expenses Compensation and employee benefits

17,586

16,562

15,357

15,143

12,523

Origination expenses

867

749

646

173

273

Securitizations expenses

3,186

6,232

2,874

2,709

4,930

Rent and occupancy

519

617

498

551

472

Loan servicing

5,656

5,160

4,824

4,636

4,901

Professional fees

2,305

1,718

2,115

1,733

854

Real estate owned, net

1,951

1,355

2,455

2,068

1,239

Other operating expenses

2,543

2,494

2,242

2,248

2,142

Total operating expenses

34,613

34,887

31,011

29,260

27,334

Income before income taxes

21,244

19,873

23,236

22,307

17,239

Income tax expense

5,627

5,162

5,903

5,141

5,070

Net income

15,617

14,711

17,333

17,166

12,169

Net income attributable to noncontrolling interest

(186

)

(67

)

82

(189

)

83

Net income attributable to Velocity Financial, Inc.

15,803

14,778

17,251

17,355

12,086

Less undistributed earnings attributable to participating

securities

191

182

217

225

183

Net earnings attributable to common shareholders

$

15,612

$

14,596

$

17,034

$

17,130

$

11,903

Basic earnings (loss) per share

$

0.48

$

0.45

$

0.52

$

0.53

$

0.37

Diluted earnings (loss) per common share

$

0.44

$

0.42

$

0.49

$

0.50

$

0.35

Basic weighted average common shares outstanding

32,711

32,585

32,541

32,326

32,275

Diluted weighted average common shares outstanding

35,895

35,600

35,439

34,991

34,731

Velocity Financial,

Inc.

Net Interest Margin ‒

Portfolio Related and Total Company

(Unaudited)

Quarters:

Quarter Ended September 30, 2024 Quarter Ended

September 30, 2023 Interest Average

Interest Average Average Income /

Yield / Average Income / Yield / ($

in thousands) Balance Expense Rate(1)

Balance Expense Rate(1) Loan portfolio:

Loans held for sale

$

3,166

$

3,170

Loans held for investment

4,575,745

3,770,460

Total loans

$

4,578,911

$

105,070

9.18

%

$

3,773,630

$

79,088

8.38

%

Debt: Warehouse and repurchase facilities

$

311,560

7,105

9.12

%

$

192,855

4,943

10.25

%

Securitizations

3,840,480

56,766

5.91

%

3,186,756

42,640

5.35

%

Total debt - portfolio related

4,152,040

63,871

6.15

%

3,379,611

47,583

5.63

%

Corporate debt

290,000

6,143

8.47

%

215,000

4,138

7.70

%

Total debt

$

4,442,040

$

70,014

6.30

%

$

3,594,611

$

51,721

5.76

%

Net interest spread - portfolio related (2)

3.03

%

2.75

%

Net interest margin - portfolio related

3.60

%

3.34

%

Net interest spread - total company (3)

2.87

%

2.63

%

Net interest margin - total company

3.06

%

2.90

%

(1) Annualized. (2) Net interest spread — portfolio related

is the difference between the rate earned on our loan portfolio and

the interest rates paid on our portfolio-related debt. (3) Net

interest spread — total company is the difference between the rate

earned on our loan portfolio and the interest rates paid on our

total debt.

Velocity Financial,

Inc.

Adjusted Financial Metric

Reconciliation to GAAP Net Income

(Unaudited)

Quarters:

Core Net Income Quarter Ended ($ in

thousands) 9/30/2024 6/30/2024 3/31/2024

12/31/2023 9/30/2023 Net Income

$

15,803

$

14,778

$

17,251

$

17,355

$

12,086

Tax liability reduction

-

-

(1,866

)

-

Equity award & ESPP costs

1,146

1,140

998

673

832

Core Net Income

$

16,949

$

15,918

$

18,249

$

16,161

$

12,918

Diluted weighted average common shares outstanding

35,895

35,600

35,439

34,991

34,731

Core diluted earnings per share

$

0.47

$

0.45

$

0.51

$

0.46

$

0.37

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107057086/en/

Investors and Media: Chris Oltmann (818) 532-3708

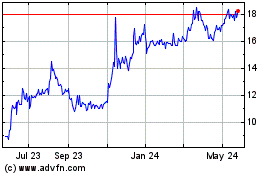

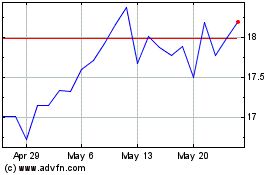

Velocity Financial (NYSE:VEL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Velocity Financial (NYSE:VEL)

Historical Stock Chart

From Nov 2023 to Nov 2024