Virtus Closed-End Funds Announce Results of Joint Annual Meeting of Shareholders

June 04 2024 - 8:00AM

Business Wire

Virtus Artificial Intelligence & Technology Opportunities

Fund (NYSE: AIO), Virtus Convertible & Income 2024 Target Term

Fund (NYSE: CBH), Virtus Convertible & Income Fund (NYSE: NCV),

Virtus Convertible & Income Fund II (NYSE: NCZ), Virtus

Diversified Income & Convertible Fund (NYSE: ACV), Virtus

Dividend, Interest & Premium Strategy Fund (NYSE: NFJ), Virtus

Equity & Convertible Income Fund (NYSE: NIE), Virtus Global

Multi-Sector Income Fund (NYSE: VGI), Virtus Stone Harbor Emerging

Markets Income Fund (NYSE: EDF), and Virtus Total Return Fund Inc.

(NYSE: ZTR) announced the results of the joint annual meeting of

shareholders that was held on June 3, 2024.

The voting results are as follows:

Virtus Artificial Intelligence

& Technology Opportunities Fund (AIO)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

Donald C. Burke

25,221,219

93%

2,000,036

7%

F. Ford Drummond

25,569,178

94%

1,652,077

6%

Connie D. McDaniel

25,684,076

94%

1,537,179

6%

Philip R. McLoughlin

25,111,791

92%

2,109,464

8%

Virtus Convertible &

Income 2024 Target Term Fund (CBH)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

Connie D. McDaniel

14,861,446

95%

709,509

5%

Philip R. McLoughlin

14,937,935

96%

633,020

4%

R. Keith Walton

14,950,872

96%

620,083

4%

Brian T. Zino

14,919,148

96%

651,807

4%

Virtus Convertible &

Income Fund (NCV)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

Deborah A. DeCotis

67,297,614

94%

4,520,554

6%

F. Ford Drummond

5,751,894

99%

43,960

1%

Connie D. McDaniel

68,885,687

96%

2,932,481

4%

Brian T. Zino

67,431,930

94%

4,386,238

6%

Virtus Convertible &

Income Fund II (NCZ)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

F. Ford Drummond

3,413,920

89%

413,085

11%

Connie D. McDaniel

57,831,291

95%

3,185,443

5%

Geraldine M. McNamara

55,553,240

91%

5,463,494

9%

R. Keith Walton

57,670,470

95%

3,346,264

5%

Virtus Diversified Income

& Convertible Fund (ACV)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

Sarah E. Cogan

1,200,000

100%

0

0%

Deborah A. DeCotis

9,547,733

98%

193,903

2%

Connie D. McDaniel

9,572,088

98%

169,548

2%

Philip R. McLoughlin

9,601,380

99%

140,256

1%

Virtus Dividend, Interest

& Premium Strategy Fund (NFJ)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

Donald C. Burke

76,475,199

88%

10,052,498

12%

Connie D. McDaniel

77,955,215

90%

8,572,482

10%

Geraldine M. McNamara

76,363,352

88%

10,164,345

12%

Brian T. Zino

76,427,715

88%

10,099,982

12%

Virtus Equity &

Convertible Income Fund (NIE)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

Donald C. Burke

21,798,438

97%

712,355

3%

F. Ford Drummond

21,791,071

97%

719,722

3%

Connie D. McDaniel

21,773,469

97%

737,324

3%

Philip R. McLoughlin

21,750,017

97%

760,776

3%

Virtus Global Multi-Sector

Income Fund (VGI)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

George R. Aylward

9,041,043

95%

488,380

5%

F. Ford Drummond

9,133,586

96%

395,837

4%

Connie D. McDaniel

9,098,656

95%

430,767

5%

Philip R. McLoughlin

9,032,405

95%

497,018

5%

Virtus Stone Harbor Emerging

Markets Income Fund (EDF)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

George R. Aylward

18,559,627

91%

1,914,014

9%

Deborah A. DeCotis

18,653,535

91%

1,820,106

9%

John R. Mallin

18,491,727

90%

1,981,914

10%

R. Keith Walton

18,532,575

91%

1,941,066

9%

Virtus Total Return Fund Inc.

(ZTR)

For

Withheld

# of

Shares

% of

Shares Voted

# of

Shares

% of

Shares Voted

Donald C. Burke

42,948,062

88%

6,001,110

12%

Sarah E. Cogan

42,780,364

87%

6,168,807

13%

Deborah A. DeCotis

42,749,495

87%

6,199,676

13%

Sidney E. Harris

42,833,482

88%

6,115,689

12%

About the Funds

Virtus Investment Partners offers income-generating closed-end

funds with diversified strategies focused on a variety of asset

classes including multi-sector, high-yield and emerging markets

fixed income, municipal bonds, utility and infrastructure equities,

and convertible securities. Strategies are available from

affiliated managers and unaffiliated subadvisers.

Fund Risks

An investment in a fund is subject to risk, including the risk

of possible loss of principal. A fund’s shares may be worth less

upon their sale than what an investor paid for them. Shares of

closed-end funds may trade at a premium or discount to their NAV.

For more information about each fund’s investment objective and

risks, please see the fund’s annual report. A copy of each fund’s

most recent annual report may be obtained free of charge by

contacting Shareholder Services at (866) 270-7788, by email at

closedendfunds@virtus.com, or through the Closed-End Funds section

of virtus.com.

About Virtus Investment Partners, Inc.

Virtus Investment Partners (NYSE: VRTS) is a distinctive

partnership of boutique investment managers singularly committed to

the long-term success of individual and institutional investors. We

provide investment management products and services from our

affiliated managers, each with a distinct investment style and

autonomous investment process, as well as select subadvisers.

Investment solutions are available across multiple disciplines and

product types to meet a wide array of investor needs. Additional

information about our firm, investment partners, and strategies is

available at virtus.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240604484145/en/

For Further Information:

Shareholder Services (866) 270-7788 closedendfunds@virtus.com

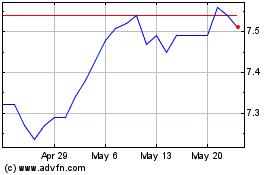

Virtus Global Multi Sect... (NYSE:VGI)

Historical Stock Chart

From Feb 2025 to Mar 2025

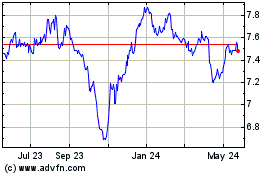

Virtus Global Multi Sect... (NYSE:VGI)

Historical Stock Chart

From Mar 2024 to Mar 2025