Vivendi Enters Into Structured Financing Agreements to Cover the Potential Redemption of Its Bonds

September 27 2024 - 11:31AM

Business Wire

Regulatory News:

Vivendi (Paris:VIV) has entered today into financing agreements

to cover the potential redemption of its outstanding bond debt

should the Group’s split project, which feasibility study was

announced on September 13, 2023, be pursued and approved at an

extraordinary general meeting of its shareholders.

Bilateral structured financing agreements involving purely

cash-settled derivatives on a portion of Vivendi’s Universal Music

Group (UMG) shares have been entered into with five banks for a

nominal value of €2 billion. These agreements will benefit from

pledges on shares held by Vivendi in UMG, Telefonica, Telecom

Italia and MediaForEurope and may be subject to margin calls.

These financing agreements, maturing in September 2026 and

extendable by one year, would provide Vivendi with the funds to

redeem all its outstanding bond debt, in accordance with the terms

and conditions of the relevant bonds, as soon as possible following

the approval of the split project by the extraordinary general

meeting of its shareholders and, in any event, before the effective

date of the split up of the Group.

The first utilization of the proceeds under these bilateral

structured financing agreements would require, as a condition

precedent, the cancellation of all available commitments under

Vivendi’s syndicated revolving facility agreement and its eight

bilateral revolving facility agreements.

The information and consultation procedures of the employee

representative bodies of the concerned Group entities about the

split project are still ongoing (cf. Vivendi’s July 22, 2024 press

release). It should be noted that at this stage, and according to

applicable law, no decision to carry out this project has been or

can be taken, and that no further action, even potential, can be

presumed with regard to this project.

Should this project go ahead following the information and

consultation procedure, a decision could be taken at the end of

October 2024 with a view to submitting it to an extraordinary

general meeting of shareholders which could be held in December

2024. In such a case, this transaction would still require the

approval by a two-thirds majority of shareholder votes.

About Vivendi

Vivendi is a global leader in content, media and communications.

Canal+ Group is a major player in the creation and distribution of

cinema and audiovisual content on all continents. With Lagardère,

Vivendi is the world’s third-largest book publisher for the general

public and educational markets, and a leading global player in

travel retail. Havas is one of the largest global communications

groups with a presence in more than 100 countries. Vivendi is also

active in the magazine business (Prisma Media) and in video games

(Gameloft). As a committed group, Vivendi contributes to building

more open, inclusive, and responsible societies by supporting

diverse and inventive creative works, promoting broader access to

culture, education, and its industries, and increasing awareness of

21st century challenges and opportunities. In December 2023,

Vivendi launched the study of a split project where Canal+, Havas

and Louis Hachette Group, the company grouping the assets in

publishing and distribution, would become independent entities

listed on the stock market. www.vivendi.com.

Important disclaimers

This press release contains information that may have

characterized, before becoming public, inside information as

defined by Article 7(1) of Regulation (EU) No 596/2014 of April 16,

2014, on market abuse, as amended. It also contains forward

-looking statements with respect to Vivendi’s financial condition,

results of operations, business, strategy, plans and outlook,

including the impact of certain transactions such as the split and

listing projects, as well as related operations. Although Vivendi

believes that such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

completion of the split and listing projects nor of Vivendi’s

future performance. Actual results may differ materially from the

forward-looking statements as a result of a number of risks and

uncertainties, many of which are outside our control, including,

but not limited to, the risks related to obtaining regulatory,

administrative, third - party or any other approvals, and the risks

described in the documents of the Group filed by Vivendi with the

Autorité des Marchés Financiers (the French securities regulator),

which are also available in English on Vivendi’s website

(www.vivendi.com). Investors and security holders may obtain a free

copy of documents filed by Vivendi with the Autorité des Marchés

Financiers at www.amf-france.org, or directly from Vivendi.

Accordingly, we caution readers against relying on such

forward-looking statements. These forward-looking statements are

made as of the date of this press release. Vivendi disclaims any

intention or obligation to provide, update or revise any forward-

looking statements, whether as a result of new information, future

events or otherwise. This press release does not contain or

constitute an offer of securities or a solicitation of an offer to

subscribe to or purchase, nor an invitation to sell, buy, or

subscribe to securities in France or abroad. This press release

must in no way be interpreted as a recommendation to readers.

The dissemination of this press release may be restricted,

limited, or prohibited by law in certain states, and anyone wishing

to distribute it must inform themselves about the existence of such

restrictions, limitations, or prohibitions, and adhere to them. Any

failure to do so may constitute a violation of the applicable

securities regulations in those states.

Unsponsored ADRs. Vivendi does not sponsor an American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is “unsponsored” and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

This document has been certified by Vivendi SE using the

blockchain and Nodle Connecting SDK’s Click solution to ensure its

authenticity. View this certificate of authenticity by logging in

to https://www.certification.vivendi.com or using a blockchain

explorer such as https://etherscan.io or

https://www.blockchain.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240927812063/en/

Vivendi

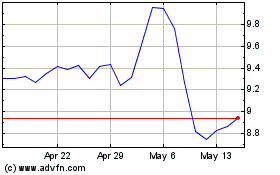

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Oct 2024 to Nov 2024

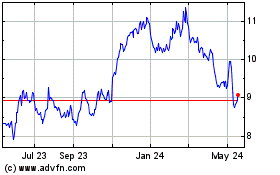

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Nov 2023 to Nov 2024