Voya Financial, Inc. (NYSE: VOYA), announced today the launch of

a new Stable Value solution, the Voya Capital Preservation Fund

(the “Fund”), a bank collective investment trust with Great Gray

Trust Company, LLC, as trustee and fiduciary authority.*

As the latest addition to Voya’s suite of Stable Value

investment solutions, the Fund is now available to Voya’s defined

contribution plan participants in qualified 401(a), 401(k) and

governmental 457(b) plans who are currently eligible to use Stable

Value as an investment option. The Fund is a bank Collective

Investment Trust (CIT) with a focus on providing participants in

these eligible plans with protection for their principal

investment. In addition, the Fund seeks to offer those participants

a competitive yield, low return volatility (in comparison to its

benchmarks) and daily liquidity.

In addition, the Fund offers a short duration to help protect

such participants from market declines and to allow most full plan

withdrawals with a 12-month put as the termination provision.**

This is aligned to Voya’s overall Stable Value philosophy, offering

employees the ability to access their funds at book value where,

when and how they need it.

“Stable Value funds continue to play a critical role in defined

contribution plans and have remained a priority for many

individuals in recent years given increasing interest rates,” said

Doug Murray, senior vice president, Wealth Solutions Distribution

and Client Engagement, Voya Financial. “At Voya, we’ve long

recognized this priority and have leveraged our scale and expertise

to provide flexible solutions that support our clients’ evolving

needs. The introduction of the Voya Capital Preservation Fund does

just that by providing greater support for individuals looking for

a more stable opportunity to generate competitively positive

returns as they navigate potential market stress.”

Stable Value investments have historically been designed to

protect individuals from financial losses that can occur during a

rising interest rate environment, resulting in continued interest

and the growth of these solutions. As a result, according to

industry data, total Stable Value investments reached approximately

$882 billion in 2023.1

“The launch of the Voya Capital Preservation Fund comes at the

right time to take advantage of the current higher interest rate

environment,” added Chris Solimine, senior vice president and head

of Investment Solutions at Voya Financial. “Our focus at Voya has

remained on providing a multi-product Stable Value portfolio that

offers stability and flexibility to meet the unique needs of

participants across several unique institutional plan sizes. We’re

excited to introduce the solution to meet a demand from plan

sponsors and intermediaries — and to also offer more choice during

a time when many individuals need it most.”

The Fund is currently invested in a group annuity contract

issued by Voya Retirement Insurance and Annuity Company (VRIAC).

The group annuity contract, also called the Stabilizer℠ contract,

is a separate, actively managed account that invests in a range of

fixed income instruments through an active management philosophy.

The underlying fixed income portfolio adds unique sectors, such as

private placements, to help increase yield, while not decreasing

credit quality or increasing duration for participants. Voya’s own

asset manager, Voya Investment Management, has been hired by VRIAC

to manage the assets of the separate account.

For more than 40 years in the market, Voya’s Stable Value

solutions have offered a low-risk investment that focuses on

capital preservation and liquidity, while seeking to provide

steady, positive returns for individuals. Voya remains a leader2 in

these solutions with approximately $40 billion in total Stable

Value separate account and synthetic account assets under

management and administration.3 For more information, visit

voyastablevalue.com.

As an industry leader focused on the delivery of benefits,

savings and investment solutions to and through the workplace, Voya

is committed to delivering on its mission to make a secure

financial future possible for all — one person, one family, one

institution at a time.

* The Voya Capital Preservation Fund (“Fund”) is a bank

collective investment fund; it is not a mutual fund. Great Gray

Trust Company, LLC, serves as the Trustee of the Fund and maintains

ultimate fiduciary authority over the management of, and

investments made in, the Fund. The Fund and its units are exempt

from registration under the Investment Company Act of 1940 and the

Securities Act of 1933, respectively.

** Provided the full plan withdrawal is less than 20% of the

Fund’s value, it can be fulfilled at book value upon 12 months’

notice; otherwise, an 18-month notice is required. The plan should

read the participation agreement for a complete description of

terms, restrictions and conditions on Fund investments and

withdrawals.

1. “Stable Value at a Glance,” Stable Value Investment

Association (June 18, 2024). 2. Valerian Capital Group Synthetic

GIC/BVW Market Landscape Report as of Dec. 31, 2023. 3. Internal

Voya statistics as of March 31, 2024.

Investments in the Fund are not bank deposits or obligations

of and are not insured or guaranteed by Great Gray Trust Company,

LLC, any bank, the FDIC, the Federal Reserve, or any other

governmental agency. The Fund is a commingled investment vehicle,

and as such, the values of the underlying investments will rise and

fall according to market activity; it is possible to lose money by

investing in the Fund. Past performance is not predictive of future

performance.

Collective Investment Trust Funds may be suitable investments

for plan fiduciaries seeking to construct a well-diversified

retirement savings program. Investors should consider the

investment objectives, risks, charges, and expenses of any pooled

investment fund carefully before investing. The Additional Fund

Information and Principal Risk Definitions (PRD) contains this and

other information about a Collective Investment Trust Fund and is

available at greatgray.com/principalriskdefinitions or ask for a

free copy by contacting Great Gray Trust Company, LLC, at (866)

427-6885.

About Voya Financial® Voya Financial, Inc. (NYSE: VOYA),

is a leading health, wealth and investment company with

approximately 9,000 employees who are focused on achieving Voya’s

aspirational vision: “Clearing your path to financial confidence

and a more fulfilling life.” Through products, solutions and

technologies, Voya helps its 15.2 million individual, workplace and

institutional clients become well planned, well invested and well

protected. Benefitfocus, a Voya company and a leading benefits

administration provider, extends the reach of Voya’s workplace

benefits and savings offerings by engaging directly with over 12

million employees in the U.S. Certified as a “Great Place to Work”

by the Great Place to Work® Institute, Voya is purpose-driven and

committed to conducting business in a way that is economically,

ethically, socially and environmentally responsible. Voya has

earned recognition as: one of the World’s Most Ethical Companies®

by Ethisphere; a member of the Bloomberg Gender-Equality Index; and

a “Best Place to Work for Disability Inclusion” on the Disability

Equality Index. For more information, visit voya.com. Follow Voya

Financial on Facebook, LinkedIn and Instagram.

VOYA-RET

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731093407/en/

Media: Kris Kagel Voya Financial (201) 221-6534

Kristopher.Kagel@voya.com

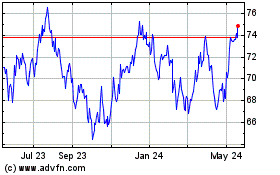

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Jan 2025 to Feb 2025

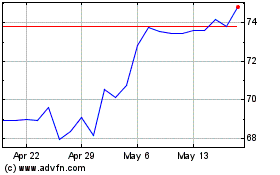

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Feb 2024 to Feb 2025