Western Midstream Announces Third-Quarter 2023 Distribution Increase and Earnings Conference Call

October 19 2023 - 6:00AM

Business Wire

Today Western Midstream Partners, LP (NYSE: WES) (“WES” or the

“Partnership”) announced that the board of directors of its general

partner declared a quarterly cash distribution (“Base

Distribution”) of $0.5750 per unit for the third quarter of 2023,

or $2.30 on an annualized basis. This distribution represents a

2.2% increase compared to the second-quarter’s Base Distribution of

$0.5625 and is consistent with prior communications regarding a

distribution increase upon the close of the acquisition of Meritage

Midstream Services II, LLC. WES’s third-quarter 2023 Base

Distribution is payable on November 13, 2023, to unitholders of

record at the close of business on November 1, 2023.

The Partnership plans to report its third-quarter results after

market close on Wednesday, November 1, 2023. Management will host a

conference call on Thursday, November 2, 2023, at 1:00 p.m. CDT

(2:00 p.m. EDT) to discuss the Partnership’s quarterly results.

Participants are encouraged to dial into the conference call ten to

fifteen minutes before the scheduled start time to avoid any delays

entering the call. The full text of the release announcing the

results will be available on the Partnership’s website at

www.westernmidstream.com.

Third-Quarter 2023 Results Thursday,

November 2, 2023 1:00 p.m. CST (2:00 p.m. EDT)

Dial-in number: 888-770-7129 International dial-in

number: 929-203-2109 Participant access code:

2187921

To participate in WES’s scheduled third-quarter 2023 earnings

call, refer to the above-listed dial-in number and participant

access code. To access the live audio webcast of the conference

call, please visit the investor relations section of the

Partnership’s website at www.westernmidstream.com. A replay of the

conference call will also be available on the website following the

call.

ABOUT WESTERN MIDSTREAM

Western Midstream Partners, LP (“WES”) is a Delaware master

limited partnership formed to acquire, own, develop, and operate

midstream assets. With midstream assets located in the Rocky

Mountains, North-central Pennsylvania, Texas, and New Mexico, WES

is engaged in the business of gathering, compressing, treating,

processing, and transporting natural gas; gathering, stabilizing,

and transporting condensate, NGLs, and crude oil; and gathering and

disposing of produced water for its customers. In addition, in its

capacity as a processor of natural gas, WES also buys and sells

natural gas, NGLs, and condensate on behalf of itself and as an

agent for its customers under certain of its contracts.

For more information about Western Midstream Partners, LP and

Western Midstream Flash Feed updates, please visit

www.westernmidstream.com.

This news release contains forward-looking statements. WES and

its general partner believe that their expectations are based on

reasonable assumptions. No assurance, however, can be given that

such expectations will prove to have been correct. A number of

factors could cause actual results to differ materially from the

projections, anticipated results or other expectations expressed in

this news release. These factors include our ability to meet

distribution expectations and financial guidance; our ability to

safely and efficiently operate WES’s assets; the supply of, demand

for, and price of oil, natural gas, NGLs, and related products or

services; our ability to meet projected in-service dates for

capital-growth projects; construction costs or capital expenditures

exceeding estimated or budgeted costs or expenditures; and the

other factors described in the “Risk Factors” section of WES’s

most-recent Form 10-K and Form 10-Q filed with the Securities and

Exchange Commission and other public filings and press releases.

WES undertakes no obligation to publicly update or revise any

forward-looking statements.

Note regarding Non-United States Investors: This release is

intended to be a qualified notice under Treasury Regulation

Sections 1.1446-4(b) and 1.1446(f)-4. Brokers and nominees should

treat one hundred percent (100.0%) of Western Midstream Partners,

LP’s distributions to non-U.S. investors as being attributable to

income that is effectively connected with a United States trade or

business. Accordingly, Western Midstream Partners, LP’s

distributions to non-U.S. investors are subject to federal income

tax withholding at the highest applicable effective tax rate.

Furthermore, one hundred percent (100.0%) of Western Midstream

Partners, LP’s distributions to non-U.S. investors is in excess of

cumulative net income for purposes of Treasury Regulation Section

1.1446(f)-4(c)(iii). Brokers and nominees are treated as

withholding agents responsible for withholding on distributions

received by them on behalf of non-U.S. investors. The CUSIP number

of Western Midstream Partners, LP’s common units is 958669 103.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231018436927/en/

WESTERN MIDSTREAM CONTACTS Daniel Jenkins Director,

Investor Relations Investors@westernmidstream.com 866-512-3523

Rhianna Disch Manager, Investor Relations

Investors@westernmidstream.com 866-512-3523

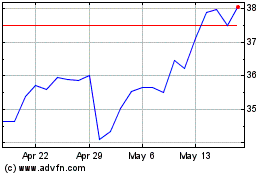

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Feb 2025 to Mar 2025

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Mar 2024 to Mar 2025