0001423902false00014239022024-05-162024-05-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 16, 2024

WESTERN MIDSTREAM PARTNERS, LP

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | 001-35753 | 46-0967367 |

(State or other jurisdiction

of incorporation or organization) | (Commission

File Number) | (IRS Employer

Identification No.) |

9950 Woodloch Forest Drive, Suite 2800

The Woodlands, Texas 77380

(Address of principal executive office) (Zip Code)

(346) 786-5000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of exchange

on which registered |

| Common units | | WES | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

On May 16, 2024, Western Midstream Operating, LP (“WES Operating”), a subsidiary of Western Midstream Partners, LP (“WES”), entered into an amendment (the “Amendment”) to its senior unsecured revolving credit agreement (the “RCF”), dated April 6, 2023, among itself, Wells Fargo Bank, National Association, as administrative agent, and the lenders party thereto in connection with the extension of the maturity date applicable to the loans and commitments of certain lenders totaling $1,880 million to April 6, 2029, pursuant to Section 2.24 of the RCF.

As of May 16, 2024, there were no borrowings outstanding on the RCF (but with $5.1 million in outstanding letters of credit). The above summary of the Amendment is qualified in its entirety by reference to the Amendment, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Relationships

Certain of the lenders under the RCF and their respective affiliates have, from time to time, performed, and may in the future perform, various financial advisory, commercial, and investment banking services for WES Operating and WES, for which they received or may receive customary fees and expenses. Certain affiliates of such lenders have acted, and may in the future act, as underwriters of certain of WES Operating’s debt issuances and WES’s equity issuances.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 above is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | WESTERN MIDSTREAM PARTNERS, LP |

| | |

| | By: | Western Midstream Holdings, LLC,

its general partner |

| | |

| | |

| Dated: | May 16, 2024 | By: | /s/ Kristen S. Shults |

| | | Kristen S. Shults

Senior Vice President and Chief Financial Officer |

EXHIBIT 10.1

EXECUTION COPY

FIRST AMENDMENT TO FOURTH AMENDED AND RESTATED

REVOLVING CREDIT AGREEMENT

THIS FIRST AMENDMENT TO FOURTH AMENDED AND RESTATED REVOLVING CREDIT AGREEMENT (this “Amendment”), dated as of May 16, 2024, is among WESTERN MIDSTREAM OPERATING, LP, a limited partnership organized under the laws of the State of Delaware, as the Borrower, WELLS FARGO BANK, NATIONAL ASSOCIATION, as Administrative Agent, and the Lenders party hereto.

R E C I T A L S

A. The Borrower, the Administrative Agent and the Lenders are parties to that certain Fourth Amended and Restated Revolving Credit Agreement dated as of April 6, 2023 (the “Existing Credit Agreement” and as amended by this Amendment, the “Credit Agreement”), pursuant to which the Lenders have made certain loans to and extensions of credit for the account of the Borrower.

B. The Borrower has requested, and the Lenders party hereto have agreed, to extend the Maturity Date applicable to such Lenders as set forth in this Amendment.

NOW, THEREFORE, in consideration of the premises and the mutual covenants herein contained, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

Section 1.Defined Terms. Each capitalized term used herein but not otherwise defined herein has the meaning given to such term in the Credit Agreement. Unless otherwise indicated, all article and section references in this Amendment refer to articles and sections of the Credit Agreement.

Section 2.Amendments to Existing Credit Agreement.

(a)Revised Definitions. The following definitions in Section 1.01 are hereby deleted and replaced in their entirety to read as follows:

“Agreement” —this Fourth Amended and Restated Revolving Credit Agreement, as amended by the First Amendment and as the same may from time to time be further amended, modified, supplemented or restated.

(b)New Definitions. The following definition is hereby added to Section 1.01 where alphabetically appropriate to read as follows:

“First Amendment” — the First Amendment to Fourth Amended and Restated Revolving Credit Agreement dated as of May 16, 2024 among the Borrower, the Administrative Agent and the Lenders party thereto.

(c)Lender Maturity Dates. Annex I to the Existing Credit Agreement is hereby amended as set forth on Annex I attached hereto to reflect each Lender's Maturity Date after giving effect to the Extension (as defined in Section 3 below).

Section 3.Extension of Maturity Date. With respect to the Borrower’s request pursuant to Section 2.24 of the Existing Credit Agreement to extend the Maturity Date applicable to each Lender for one additional year from the existing Maturity Date (the “Extension”), subject to the satisfaction of the conditions precedent set forth in Section 4 (and the conditions set forth in Section 2.24(c) of the Credit Agreement as of the effective date of such Extension), the Maturity Date applicable to each Lender party hereto is hereby extended one year from April 6, 2028 to April 6, 2029. The Borrower hereby acknowledges and agrees that (i) pursuant to Section 2.24(a), the Borrower may make not more than two requests during the term of the Credit Agreement for a one-year extension of the Maturity Date, (ii) the Borrower’s request for the Extension is the Borrower’s first such request under Section 2.24 and (iii) the Borrower has one remaining request under Section 2.24 of the Credit Agreement. The parties hereto hereby agree that with respect to the Extension, the certification by the Borrower required by Section 2.24(c)(iii)(B) of the Credit Agreement is hereby satisfied by the Borrower’s execution and delivery of this Amendment.

Section 4.Conditions Precedent. This Amendment shall not become effective until the date on which each of the following conditions is satisfied (or waived in accordance with Section 10.02) (the “Amendment Effective Date”):

(a)The Administrative Agent shall have received from the Lenders and the Borrower, counterparts (in such number as may be requested by the Administrative Agent) of this Amendment signed on behalf of such Persons.

(b)The Administrative Agent and the Lenders shall have received all extension and other fees and other amounts due and payable on the Amendment Effective Date, including, to the extent invoiced at least one Business Day prior to the Amendment Effective Date (unless the Borrower otherwise consents), reimbursement or payment of all out-of-pocket expenses required to be reimbursed or paid by the Borrower pursuant to Section 10.03.

(c)(i) The representations and warranties contained in each Loan Document shall be true and accurate in all material respects (unless qualified by materiality or Material Adverse Change, in which case such representation and warranty shall be true and accurate in all respects) on and as of the Amendment Effective Date as though made on and as of such date (except to the extent that such representations and warranties relate solely to an earlier date, and except that for purposes hereof, the representations and warranties contained in Section 3.01(f) of the Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to Sections 4.01(a) and (b) thereof) and (ii) no Default or Event of Default shall have occurred and be continuing, both immediately prior and after giving effect to the terms of this Amendment.

(d)The Administrative Agent shall have received (i) copies of corporate resolutions certified by the Secretary or Assistant Secretary of the General Partner, or such other evidence as may be satisfactory to the Administrative Agent, demonstrating that the Borrower’s incurrence of indebtedness under the Credit Agreement with a Maturity Date as extended pursuant to Section 3 hereof has been duly authorized by all necessary corporate action and (ii) such other documents as the Administrative Agent or special counsel to the Administrative Agent may reasonably request.

The Administrative Agent is hereby authorized and directed to declare this Amendment to be effective when it has received documents confirming or certifying, to the satisfaction of the Administrative Agent, compliance with the conditions set forth in this Section 4 or the waiver of such conditions as permitted hereby. The Administrative Agent shall notify the Borrower and the Lenders of the Amendment Effective Date and such notice shall be final, conclusive and binding upon all parties to the Credit Agreement for all purposes.

Section 5.Miscellaneous.

(a)Confirmation. The provisions of the Credit Agreement shall remain in full force and effect following the effectiveness of this Amendment. The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any of the Loan Documents, nor constitute a waiver of any provision of any of the Loan Documents. This Amendment is a Loan Document, and all provisions in the Credit Agreement pertaining to Loan Documents apply hereto.

(b)Ratification and Affirmation; Representations and Warranties. The Borrower hereby (i) ratifies and affirms its respective obligations under, and acknowledges, renews and extends its respective continued liability under, each Loan Document to which it is a party and agrees that each Loan Document to which it is a party remains in full force and effect, except as expressly amended hereby, and (ii) represents and warrants to the Lenders that, as of the date hereof, both immediately before and after giving effect hereto and the Extension: (A) the representations and warranties contained in each Loan Document are true and accurate in all material respects (unless qualified by materiality or Material Adverse Change, in which case such representation and warranty is true and accurate in all respects) on and as of the Amendment Effective Date as though made on and as of such date (except to the extent that such representations and warranties relate solely to an earlier date, and except that for purposes hereof, the representations and warranties contained in Section 3.01(f) of the Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to Sections 4.01(a) and (b) thereof), (B) no event has occurred and is continuing or would result from the execution, delivery and effectiveness of this Amendment and such Extension which constitutes an Event of Default or a Default and (C) no Material Adverse Change has occurred.

(c)Counterparts. This Amendment may be executed by one or more of the parties hereto in any number of separate counterparts, and all of such counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of an executed counterpart of this Amendment by facsimile or in electronic (i.e., “pdf” or “tif”) format shall be effective as delivery of a manually executed counterpart hereof.

(d)No Oral Agreement. This Amendment, the Credit Agreement and the other Loan Documents and any separate letter agreements with respect to fees payable to the Administrative Agent constitute the entire contract among the parties relating to the subject matter hereof and thereof and supersede any and all previous agreements and understandings, oral or written, relating to the subject matter hereof and thereof. This Amendment, the Credit Agreement and the other Loan Documents represent the final agreement among the parties hereto and thereto and may not be contradicted by evidence of prior, contemporaneous or subsequent oral agreements of the parties. There are no unwritten oral agreements between the parties.

(e)GOVERNING LAW. THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

[SIGNATURES BEGIN NEXT PAGE]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date first written above.

| | | | | | | | |

| BORROWER: | WESTERN MIDSTREAM OPERATING, LP |

| | |

| By: | Western Midstream Operating GP, LLC,

its general partner |

| | |

| By: | /s/ Scott M. Peterson |

| Name: | Scott M. Peterson |

| Title: | Vice President and Treasurer |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

LENDERS: | WELLS FARGO BANK,

NATIONAL ASSOCIATION, |

| as Administrative Agent and a Lender |

| | |

| By: | /s/ Borden Tennant |

| Name: | Borden Tennant |

| Title: | Executive Director |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| PNC BANK, NATIONAL ASSOCIATION, |

| as a Lender |

| | |

| By: | /s/ Anvar Musayev |

| Name: | Anvar Musayev |

| Title: | Vice President |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| BARCLAYS BANK PLC, as a Lender |

| |

| | |

| By: | /s/ Sydney G. Dennis |

| Name: | Sydney G. Dennis |

| Title: | Director |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| CITIBANK N.A., as a Lender |

| |

| | |

| By: | /s/ Maureen Maroney |

| Name: | Maureen Maroney |

| Title: | Vice President |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| MIZUHO BANK, LTD., as a Lender |

| |

| | |

| By: | /s/ Edward Sacks |

| Name: | Edward Sacks |

| Title: | Managing Director |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| MUFG BANK, LTD., as a Lender |

| |

| | |

| By: | /s/ Christopher Facenda |

| Name: | Christopher Facenda |

| Title: | Authorized Signatory |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| U.S. BANK NATIONAL ASSOCIATION, as a Lender |

| |

| | |

| By: | /s/ Luke Fernie |

| Name: | Luke Fernie |

| Title: | Vice President |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| THE TORONTO-DOMINION BANK, NEW YORK BRANCH, as a Lender |

| |

| | |

| By: | /s/ Jonathan Schwartz |

| Name: | Jonathan Schwartz |

| Title: | Authorized Signatory |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| BANK OF AMERICA, N.A., as a Lender |

| |

| | |

| By: | /s/ Ajay Prakash |

| Name: | Ajay Prakash |

| Title: | Director |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| SUMITOMO MITSUI BANKING CORPORATION, |

| as a Lender |

| | |

| By: | /s/ Mary Harold |

| Name: | Mary Harold |

| Title: | Executive Director |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| DEUTSCHE BANK AG NEW YORK BRANCH, |

| as a Lender |

| | |

| By: | /s/ Marko Lukin |

| Name: | Marko Lukin |

| Title: | Vice President |

| | |

| By: | /s/ Alison Lugo |

| Name: | Alison Lugo |

| Title: | Vice President |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| ROYAL BANK OF CANADA, as a Lender |

| |

| | |

| By: | /s/ Jay T. Sartain |

| Name: | Jay T. Sartain |

| Title: | Authorized Signatory |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| TRUIST BANK, as a Lender |

| |

| | |

| By: | /s/ Lincoln LaCour |

| Name: | Lincoln LaCour |

| Title: | Director |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| COMERICA BANK, as a Lender |

| | |

| By: | /s/ Robert Kret |

| Name: | Robert Kret |

| Title: | Senior Vice President |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

| | | | | | | | |

| ZIONS BANCORPORATION, N.A. DBA AMEGY BANK, as a Lender |

| | |

| By: | /s/ John Moffitt |

| Name: | John Moffitt |

| Title: | Senior Vice President |

[Signature Page – First Amendment to Fourth Amended and Restated Revolving Credit Agreement]

ANNEX I

LIST OF COMMITMENTS

| | | | | | | | | | | |

| Lenders | Initial Amount of

Commitment | Applicable Percentage | Maturity Date |

| Wells Fargo Bank, National Association | $148,000,000 | 7.40% | April 6, 2029 |

| PNC Bank, National Association | $148,000,000 | 7.40% | April 6, 2029 |

| Barclays Bank PLC | $148,000,000 | 7.40% | April 6, 2029 |

| Citibank, N.A. | $148,000,000 | 7.40% | April 6, 2029 |

| Mizuho Bank, Ltd. | $148,000,000 | 7.40% | April 6, 2029 |

| MUFG Bank, Ltd. | $148,000,000 | 7.40% | April 6, 2029 |

| U.S. Bank National Association | $148,000,000 | 7.40% | April 6, 2029 |

| The Toronto-Dominion Bank, New York Branch | $148,000,000 | 7.40% | April 6, 2029 |

| Bank of America, N.A. | $148,000,000 | 7.40% | April 6, 2029 |

| Sumitomo Mitsui Banking Corporation | $148,000,000 | 7.40% | April 6, 2029 |

| Deutsche Bank AG New York Branch | $100,000,000 | 5.00% | April 6, 2029 |

| Royal Bank of Canada | $100,000,000 | 5.00% | April 6, 2029 |

| The Bank of Nova Scotia, Houston Branch | $100,000,000 | 5.00% | April 6, 2028 |

| Truist Bank | $100,000,000 | 5.00% | April 6, 2029 |

| Comerica Bank | $50,000,000 | 2.50% | April 6, 2029 |

| Zions Bancorporation, N.A. dba Amegy Bank | $50,000,000 | 2.50% | April 6, 2029 |

| Stifel Bank & Trust | $20,000,000 | 1.00% | April 6, 2028 |

| Total | $2,000,000,000.00 | 100% | |

Annex I

List of Commitments

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

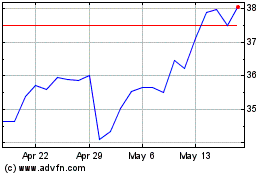

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Dec 2024 to Jan 2025

Western Midstream Partners (NYSE:WES)

Historical Stock Chart

From Jan 2024 to Jan 2025