Form 8-K - Current report

November 30 2023 - 3:05PM

Edgar (US Regulatory)

0000105770false00001057702023-11-272023-11-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) – November 27, 2023

| | |

WEST PHARMACEUTICAL SERVICES, INC. |

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | |

Pennsylvania | | 1-8036 | | 23-1210010 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

530 Herman O. West Drive, Exton, PA | | | | 19341-1147 |

(Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: 610-594-2900 | | |

Not Applicable |

(Former name or address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.25 per share | WST | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 27, 2023, West Pharmaceutical Services, Inc. (the “Company”) executed an amendment to the global master supply agreement (the “Amendment”) with ExxonMobil Product Solutions Company (“EMPSC”). The Amendment is effective for the period January 1, 2024 through December 31, 2028.

Under the Amendment, EMPSC and certain of its subsidiaries have agreed to supply certain identified Exxon® (Exxon is a registered trademark of ExxonMobil Product Solutions Company) butyl polymers to the Company and certain of its subsidiaries and affiliates. The EMPSC products are used as a principal raw material in a broad range of the Company’s polymer-based pharmaceutical packaging products.

The summary of the terms is qualified in its entirety by reference to the Amendment, which is attached hereto as Exhibit 10.40 and incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

(d) | Exhibit No. | Description |

| 10.40+ | Amendment No. 1 to Global Master Supply Agreement, entered into on November 27, 2023, and effective from January 1, 2024 through December 31, 2028, between West Pharmaceutical Services, Inc. and ExxonMobil Product Solutions Company. |

| 104 | The cover page from the Company’s Current Report on Form 8-K, dated November 27, 2023, formatted in Inline XBRL. |

+Portions of this exhibit (indicated therein by asterisks) have been omitted for confidential treatment.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| WEST PHARMACEUTICAL SERVICES, INC. |

| |

| |

| /s/ Bernard J. Birkett |

| Bernard J. Birkett |

| Senior Vice President, Chief Financial and Operations Officer |

|

| |

November 30, 2023 | |

EXHIBIT INDEX

| | | | | | | | |

Exhibit No. | | Description |

| 10.40+ | | |

104 | | The cover page from the Company’s Current Report on Form 8-K, dated November 27, 2023, formatted in Inline XBRL. |

Exhibit 10.40 [*****] Text omitted for confidential treatment. The redacted information has been excluded because it is both (i) not material and (ii) would be competitively harmful if publicly disclosed. AMENDMENT N°1 to GLOBAL MASTER SUPPLY AGREEMENT This Amendment N°1 ("Amendment") to the Global Master Supply Agreement ("Agreement") is entered into effect as of January 1, 2024, by and between ExxonMobil Product Solutions Company, a division of Exxon Mobil Corporation, having an office at Energy 4, 22777 Springwoods Village Parkway, Spring, Texas 77389, USA ("Seller" or “EMPSC”), on behalf of itself and in the interest of the ExxonMobil affiliates listed on Attachment B (each an "ExxonMobil Selling Affiliate" or "EMPSC/A" or collectively, "ExxonMobil Selling Affiliates"). and West Pharmaceutical Services, Inc. ("Buyer"), having its registered office at 530 Herman O. West Drive, Exton, PA 19341, USA ("Buyer"), on behalf of itself and in the interest of the Buyer affiliates listed on Attachment C of the Agreement (each a "Buyer Affiliate" or collectively, "Buyer Affiliates"). WITNESSETH: WHEREAS, Buyer and Seller entered into an Agreement effective January 1, 2019 (the "Agreement") which sets forth the terms and conditions for the sale and delivery of Product(s) by Seller and its ExxonMobil Selling Affiliates (listed in Attachment B of the Agreement) to Buyer and its Buyer Affiliates (listed in Attachment E of the Agreement);

WHEREAS, as of April 1, 2022, the business of the former division, ExxonMobil Chemical Company (“EMCC”), has been reorganized into a new division of Exxon Mobil Corporation, namely ExxonMobil Product Solutions Company (“EMPSC”) and hence effective as of April 1, 2022, any references in the Agreement to “ExxonMobil Chemical Company,” “EMCC,” “EMCC/A” or any defined term that refers to such name shall be deemed to refer to “ExxonMobil Product Solutions Company,” “EMPSC” or “EMPSC/A,” the division of Exxon Mobil Corporation now responsible for the Agreement; WHEREAS, the Parties now wish to amend certain terms of the Agreement; NOW THEREFORE, in consideration of the premises and the mutual covenants and conditions assumed by the Parties hereto, it is agreed as follows, entering into effect as of January 1, 2024: 1. Section PRODUCTS, QUANTITY, PRICE shall be amended as following: The Products table shall be deleted in its entirety and replaced by the following table, effective January 1, 2024: Products Quantity [Metric Tons/ Year] Container Package Year 2024 2025 2026 2027 2028 [*****] [*****] Minimum Maximum [*****] [*****] [*****] [*****] [*****] [*****] [*****] [*****] [*****] [*****] Leased metal crates, [*****] [*****] [*****] [*****] [*****] [*****] Leased Metal crates [*****] not defined Leased Metal crates The other provisions in this section remain unchanged. 2. Section PRICING shall be deleted in its entirety and replaced by the following: PRICING

For calendar years 2024, 2025, 2026, 2027 and 2028, the price of Products sold by Seller/ExxonMobil Selling Affiliates to Buyer/Buyer Affiliates will comprise the Base price, the crude adjustment, the natural gas to crude adjustment, the United States Gulf Coast isobutylene adjustment and the freight cost depending on Incoterms. Base price Requested delivery date 01.01.2024 – 31.12.2024: All [*****] grades except [*****]: [*****] $/MT [*****]: [*****] $/MT [*****]: [*****] $/MT 01.01.2025 – 31.12.2025: All [*****] grades except [*****]: [*****] $/MT [*****]: [*****] $/MT [*****]: [*****] $/MT 01.01.2026 – 31.12.2026: All [*****] grades except [*****]: [*****] $/MT [*****]: [*****] $/MT [*****]: [*****] $/MT 01.01.2027 – 31.12.2027: All [*****] grades except [*****]: [*****] $/MT [*****]: [*****] $/MT [*****]: [*****] $/MT 01.01.2028 – 31.12.2028: All [*****] grades except [*****]: [*****] $/MT [*****]: [*****] $/MT

[*****]: [*****] $/MT [*****] Base prices listed above are non-delivered pricing (i.e., Ex-Works designated ExxonMobil Affiliate/ Division location (see Attachment B) - lncoterms 2020 ("EXW") and does not include freight or insurance. Seller and Buyer shall meet on or before December 31, [*****] to assess the requirements for a price and/or volume adjustment in good faith on the price for Products sold by Seller/ExxonMobil Selling Affiliates to Buyer/Buyer Affiliates for years [*****] and [*****]. Notwithstanding anything to the contrary in Attachments A, G and H to the Agreement, the parties agree that any permitted adjustments to the price, freight or payment terms for Products sold hereunder will be governed by the terms of the Pricing section (as amended herein t) and Payment Terms section of the Agreement. Buyer Affiliates shall pay ExxonMobil's Selling Affiliates invoice(s) not later than the days set forth in Attachment E hereto. All invoices shall be paid in full by wire transfer in accordance with the invoice's instructions. Crude price adjustments Product price(s) shall be subject to the Average Brent crude oil price evolution (as further detailed below) in order to reflect the cost of energy. Should the Average Brent crude oil at any moment during the term of this Agreement move to a different Average Brent crude oil price bracket as mentioned below, Seller may increase or decrease the Product price by $[*****] for every $[*****] change in the Average Brent crude oil price. In no event shall the Product price’s increase or decrease exceed $[*****] for every $[*****] change in the Average Brent crude oil price brackets. Each Average Brent crude oil bracket is calculated on a $5 range basis (e.g., $30-$35, $40-$45, $50-$55, etc.). The average Brent crude oil price evolution shall be expressed as the three-month average

spot price per barrel of the Brent crude oil (as published in the Wall Street Journal - https://www.wsj.com/market-data/quotes/futures/UK/IFEU/BRN00). This average shall be calculated as the average of the prices for the immediately preceding three consecutive calendar months, with each month’s price calculated as the average of the daily prices. Any Product price adjustment shall take effect the month immediately following Seller’s notification of an increase or decrease in Product price. Natural gas to crude price adjustments Product price(s) of Product manufactured at our affiliate, ExxonMobil Chemical Limited’s, Fawley Petrochemical Complex shall be subject to the ratio of Average United Kingdom (UK) natural gas and Average Brent crude oil price evolution (as further detailed below) in order to reflect the cost from the Average UK natural gas to Average Brent crude ratio exceeding historical norms. Should the Average UK natural gas to Average Brent crude oil ratio multiplied by ten (10) at any moment during the term of this Agreement move to a different ratio bracket as mentioned below, Seller may increase or decrease the Product price by $[*****] for every [*****] change in ratio up to a maximum of $[*****]. Each Average UK natural gas to Average Brent crude oil ratio is calculated on a 0.5 range basis (e.g., 1.5-2.0, 2.0-2.5, 2.5-3.0). If the Average UK natural gas to Average Brent crude oil ratio multiplied by [*****] is less than [*****] no surcharge will be applied. The average UK natural gas price evolution shall be expressed as the three-month average spot price per one million British Thermal Units (MMBTU) of UK natural gas (as per Platts). This average shall be calculated as the average of the prices for the immediately preceding three consecutive calendar months, with each month’s price calculated as the average of the daily prices. The average Brent crude oil price evolution shall be expressed as the three-month average spot price per barrel of Brent crude oil (as per the Wall Street Journal). This average shall be calculated as the average of the prices for the immediately preceding three consecutive calendar months, with each month’s price calculated as the average of the daily prices.

Any Product price adjustment shall take effect the month immediately following Seller’s notification of an increase or decrease in Product price. United States Gulf Coast Isobutylene price adjustments Product price(s) of Product manufactured at ExxonMobil Product Solutions Company, a division of Exxon Mobil Corporation’s, Baytown Petrochemical Complex and Baton Rouge Petrochemical Complex shall be subject to the United States Gulf Coast (USGC) isobutylene and Brent crude oil price evolution (as further detailed below) in order to reflect the difference between the Average USGC isobutylene vs. Average Brent crude exceeding historical norms. The USGC isobutylene price shall be indexed to the USGC Methyl Tertiary Butyl Ether (MTBE). Should the Average USGC MTBE price minus the Average Brent crude oil price divided by [*****] rounded up to the nearest integer at any moment during the term of this Agreement move to a different bracket as mentioned below, Seller/ExxonMobil Selling Affiliates may increase or decrease the Product price by $[*****] for every [*****] integer change in spread. Each bracket is defined on a one (1) integer basis (e.g., 1, 2, 3, etc.). If the Average USGC MTBE price minus the Average Brent crude oil price divided by [*****], rounded up to the nearest integer is less than or equal to [*****] no surcharge will be applied. The Average USGC isobutylene evolution shall be expressed as the three-month average spot price per one gallon (gal) of MTBE FOB USGC Barge (as per Platts) converted to the three- month average spot price per metric ton (MT). This average shall be calculated as the average of the prices for the immediately preceding three consecutive calendar months, with each month’s price calculated as the average of the daily prices. The Average Brent crude oil price evolution shall be expressed as the three-month average spot price per barrel of Brent crude oil (as per the Wall Street Journal) converted to the three- month average spot price per metric ton (MT). This average shall be calculated as the average of the prices for the immediately preceding three consecutive calendar months, with each month’s price calculated as the average of the daily prices. Any Product price adjustment shall take effect the month immediately following Seller’s notification of an increase or decrease in Product price.

Nothwithstanding the foregoing and as an incentive for Buyer/Buyer Affiliates’ approval for Product qualification at the Baton Rouge Petrochemical Complex by the targeted date of [*****], Seller/ExxonMobil Selling Affiliates agree that the isobutylene price adjustments shall not apply for Product purchased by Buyer/Buyer Affiliates for the contract period of January 1, 2024 to December 31, 2028 only (“Incentive Period”); provided, however, such price adjustment shall be effective after such Incentive Period unless otherwise agreed by the parties. 3. Section AGREEMENT PERIOD is deleted in its entirety and replaced with the following: “AGREEMENT PERIOD Effective Date: January 1, 2019 Termination Date: December 31, 2028” 4. A new Section shall be added as following: SUSTAINABILITY Both parties agree to continue the discussion on possible collaboration efforts related to sustainability. Specifically, the parties plan to meet to jointly discuss the vision and dedicated scope for potential sustainability activities, opportunities and milestones. 5. In all other respects, the Agreement shall remain unchanged and in full force and effect. 6. Any capitalized terms not defined in this Amendment are defined as set forth in the Agreement. 7. This Amendment N°1 together with the Agreement constitutes the entire understanding and agreement between the Parties with respect to the subject matter hereof and there are no representations, understandings or agreements, oral or written, which are not included herein.

8. The Parties' rights and obligations hereunder shall be construed and enforced under the same governing law and pursuant to the dispute resolution and jurisdiction requirements agreed upon by the Parties in the Agreement. CONFIDENTIALITY Seller and Buyer acknowledge the Confidentiality Agreement between Seller’s affiliate, ExxonMobil Technology and Engineering Company (“EMTEC”), and Buyer (effective June 1, 2022, and referenced as ExxonMobil No. LAW-2022-0373), as amended in Amendment No. 1 effective November 6, 2023, which covers certain exchanges of information between EMTEC, Buyer and their respective affiliates. IN WITNESS WHEREOF, each of the Parties has caused its duly authorized representative to execute this Amendment to be effective as of the day and year first written above. West Pharmaceutical Services, Inc. ExxonMobil Product Solutions Company, a division of Exxon Mobil Corporation Signature: Signature: Name: Name: Title: Title: Date: Date:

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

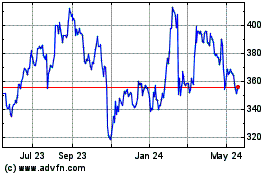

West Pharmaceutical Serv... (NYSE:WST)

Historical Stock Chart

From Oct 2024 to Nov 2024

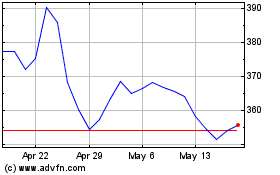

West Pharmaceutical Serv... (NYSE:WST)

Historical Stock Chart

From Nov 2023 to Nov 2024