Mastercard and Western Union Explore Digital Model for Refugee Camps

June 20 2017 - 12:00AM

Business Wire

Research indicates need to integrate access to

goods, services and finances in digital format

With more than 65 million people around the world currently

displaced from their homes due to political conflict and natural

disasters, there is a growing need to find better ways for refugees

to achieve self-sufficiency and become economic engines in their

host countries.

On World Refugee Day, Mastercard and Western Union announced a

collaboration to explore the development of a digital model to help

refugees more easily access basic human goods, services and

finances within refugee settlements. The aim is to enable refugees,

their host communities and donors to send and receive funds

digitally, allowing for more transparency and long-term empowerment

of refugees.

Over the last year, Mastercard and Western Union examined the

needs, challenges and opportunities for refugees and their host

communities at two settlement camps in northwestern Kenya. The

findings have led to the development of Smart Communities: Using

Digital Technology to Create Sustainable Refugee Economies, a

blueprint that would combine digital access to remittances,

banking, education, healthcare and other basic needs in way that is

unified and trackable.

“Today’s camps were not built to sustain a global refugee crisis

of this magnitude,” said Tara Nathan, executive vice president of

public-private partnerships at Mastercard. “Our plans to

reinvent the existing model can help the world’s refugee

populations achieve self-sufficiency faster, while also

contributing to the economic growth of their host communities.”

“Refugees across the world want to be empowered to break the

chains of dependence and to rebuild their lives in meaningful ways,

while also contributing positively to their host communities,” said

Maureen Sigliano, head of customer relationship management at

Western Union. “The new digital infrastructure model would focus on

solutions that might include the delivery of mobile money, digital

vouchers, prepaid cards, and track other goods and services. The

goal is to drive personal empowerment, stimulate growth and promote

social cohesion among the world’s refugee populations, while

driving better governance and transparency.”

The UN High Commissioner for Refugees (UNHCR) estimates that the

average length of a refugee settlement dependency is approximately

26 years. Many of today’s refugee camps founded in the 1960s and

70s, were built as a temporary solution and are unable to sustain

today’s systemic long-term dependence.

The qualitative research conducted at the Kakuma and Kalobeyei

camps in Kenya uncovered the complexity of needs in the camps and

the surrounding community. The Mastercard and Western Union

blueprint would address these various needs by:

- Laying the groundwork for a set of

multipurpose transactional tools that refugees and residents can

access, which are optimized to work in low infrastructure

areas.

- Giving residents greater control over

their livelihoods, well-being, and dignity, while providing

agencies access to data that informs community planning and

development.

- Providing a digital platform which

would serve as a unique identifier for both local and refugee

populations, advancing the critical goals of social cohesion and

cooperation across the settlement.

- Encouraging adoption of digital

payments as an entry point to the formal financial system and can

be extended to incorporate a wider set of use cases.

Both Mastercard and Western Union are founding members of the

Tent Partnership for Refugees, a coalition of more than 70

companies committed to addressing the global refugee crisis.

“The private sector is uniquely positioned to bring greater

innovation and ingenuity to this crisis,” said Gideon Maltz,

executive director of Tent. “Today’s announcement offers an

exciting new approach to helping refugees, and reflects the

contributions that companies can make when they identify problems,

collaborate with each other, and work tirelessly to find and fund

scalable solutions to fix them. It’s our hope that initiatives such

as these encourage even more companies and entrepreneurs to step

up."

About Mastercard

Mastercard (NYSE:MA), www.mastercard.com, is a technology

company in the global payments industry. We operate the world’s

fastest payments processing network, connecting consumers,

financial institutions, merchants, governments and businesses in

more than 210 countries and territories. Mastercard products and

solutions make everyday commerce activities – such as shopping,

traveling, running a business and managing finances – easier, more

secure and more efficient for everyone. Follow us on Twitter

@MastercardNews, join the discussion on the Beyond the Transaction

Blog and subscribe for the latest news on the Engagement

Bureau.

About Western Union

The Western Union Company (NYSE:WU) is a leader in global

payment services. Together with its Vigo, Orlandi Valuta, Pago

Facil and Western Union Business Solutions branded payment

services, Western Union provides consumers and businesses with

fast, reliable and convenient ways to send and receive money around

the world, to send payments and to purchase money orders. As of

March 31, 2017, the Western Union, Vigo and Orlandi Valuta branded

services were offered through a combined network of over 550,000

agent locations in 200 countries and territories and over 150,000

ATMs and kiosks, and included the capability to send money to

billions of accounts. For more information, visit

www.westernunion.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170619006378/en/

Mastercard CommunicationsMarisa Grimes,

914-325-8367Marisa.Grimes@mastercard.comorWestern Union

CommunicationsRachel Rogala,

720-332-2686Rachel.rogala@wu.com

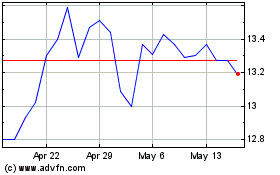

Western Union (NYSE:WU)

Historical Stock Chart

From Oct 2024 to Nov 2024

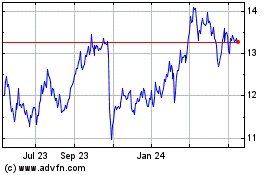

Western Union (NYSE:WU)

Historical Stock Chart

From Nov 2023 to Nov 2024