Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

August 22 2023 - 5:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

FOR

THE MONTH OF AUGUST 2023

COMMISSION FILE NUMBER: 001-33863

XINYUAN REAL ESTATE CO., LTD.

27/F, China Central Place, Tower II

79 Jianguo Road, Chaoyang District

Beijing 100025

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F

¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Xinyuan Real Estate Co., Ltd. |

| |

|

| |

By: |

/s/ Yong Zhang |

| |

Name: |

Yong Zhang |

| |

Title: |

Chief Executive Officer |

Date: August 22, 2023

Exhibit 99.1

Xinyuan Real Estate Co., Ltd. Announces

Completion of Exchange Offer and Consent Solicitation of Certain Notes

Beijing, August 21, 2023 -- Xinyuan Real

Estate Co., Ltd. (“Xinyuan” or the “Company”) (NYSE: XIN), an NYSE-listed real estate developer operating

primarily in China and also in other countries, announces completion of exchange offer and consent solicitation with respect to certain

waivers and releases of the following securities.

| Description of the Securities (“Existing Notes”) |

ISIN/ Common Code |

Exchange Consideration per US$1,000 in aggregate principal amount of the relevant Existing Notes tendered for exchange |

| 14.5% Senior Notes due 2023 |

XS2176792658

217679265 |

US$1,000.00 in aggregate principal amount of a new senior notes (“New Notes”)and certain cash payment as consent fee (“Consent Fee”). |

| 14.2% Senior Notes due 2023 |

XS2394748706

239474870 |

| 14.0% Senior Notes due 2024 |

XS2290806954

229080695 |

The settlement of the exchange offer and the issuance of the New Notes

has been completed on August 18, 2023. On August 18, 2023, US$307,363,580 of the total aggregate outstanding principal amount

of the Existing Notes were exchanged and the Company (i) delivered the New Notes in the aggregate principal amount of US$331,303,941

and (ii) made a payment of Consent Fees in cash in the amount of US$1,536,863.12 in full satisfaction of the Exchange Consideration

to eligible holders whose Existing Notes have been validly tendered and accepted for exchange.

The notes were offered outside the United States pursuant to Regulation

S under the Securities Act of 1933, as amended (the “Securities Act”). The notes have not been registered under the Securities

Act and may not be offered or sold in the United States absent registration or applicable exemption from the registration requirements.

This press release does not constitute an offer to sell the notes, nor a solicitation for an offer to purchase the notes in the U.S. or

any other jurisdiction.

THE EXCHANGE OFFER AND CONSENT SOLICITATION IS AVAILABLE ONLY TO INVESTORS

WHO ARE NOT U.S. PERSONS AND ARE OUTSIDE THE UNITED STATES.

About Xinyuan Real Estate Co., Ltd.

Xinyuan Real Estate Co., Ltd. (“Xinyuan”) is an NYSE-listed

real estate developer primarily in China and recently in other countries. In China, Xinyuan develops and manages large scale, high quality

real estate projects in over ten tier one and tier two cities, including Beijing, Shanghai, Tianjin, Zhengzhou, Jinan, Qingdao, Chengdu,

Xi’an, Suzhou, Dalian, Zhuhai and Foshan. Xinyuan was one of the first Chinese real estate developers to enter the U.S. market and

over the past few years has been active in real estate development in New York. Xinyuan aims to provide comfortable and convenient real

estate related products and services to middle-class consumers. For more information, please visit http://www.xyre.com.

Forward Looking Statements

Certain statements in this press release constitute “forward-looking

statements”. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements includes statements about future debt and financial position, potential future collaborative

efforts, among others, and can generally be identified by terminology such as “will”, “expects”, “anticipates”,

“future”, “intends”, “plans”, “believes”, “estimates” and similar statements.

Statements that are not historical statements are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties

that could cause actual results to differ materially from those projected or anticipated, including, but not limited to, our ability to

continue to implement our business model successfully; our ability to secure adequate financing for our project development; our ability

to successfully sell or complete our property projects under construction and planning; our ability to enter successfully into new geographic

markets and new business lines and expand our operations; the marketing and sales ability of our third-party sales agents; the performance

of our third-party contractors; the impact of laws, regulations and policies relating to real estate developers and the real estate industry

in the countries in which we operate; our ability to obtain permits and licenses to carry on our business in compliance with applicable

laws and regulations; competition from other real estate developers; the growth of the real estate industry in the markets in which we

operate; the impact of pandemics, such as Covid-19, on the real estate market and the economies in our markets; fluctuations in general

economic and business conditions in the markets in which we operate; and other risks outlined in our public filings with the Securities

and Exchange Commission, including our annual report on Form 20-F for the year ended December 31, 2022. Except as required by

law, we undertake no obligation to update or review publicly any forward-looking statements, whether as a result of new information, future

events or otherwise, after the date on which the statement is made.

For more information, please contact:

Xinyuan Real Estate Co., Ltd.

Mr. Sichao Zhang

Investor Relations

Tel: +86 (10) 8588-9376

Email: irteam@xyre.com

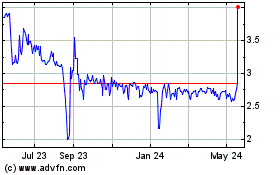

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Jan 2025 to Feb 2025

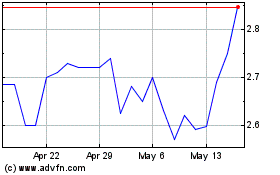

Xinyuan Real Estate (NYSE:XIN)

Historical Stock Chart

From Feb 2024 to Feb 2025