0001041061false00010410612025-02-062025-02-06

| | |

| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D. C. 20549 |

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 6, 2025

Commission file number 1-13163

________________________

YUM! BRANDS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| North Carolina | | 13-3951308 | |

| (State or other jurisdiction of | | (I.R.S. Employer | |

| incorporation or organization) | | Identification No.) | |

| | | | | | |

| 1441 Gardiner Lane, | Louisville, | Kentucky | | 40213 | |

| (Address of principal executive offices) | | (Zip Code) | |

| | | | | | |

| Registrant’s telephone number, including area code: | (502) | 874-8300 | |

| | | | |

| Former name or former address, if changed since last report: | N/A | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act | |

| | | | |

| | Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | |

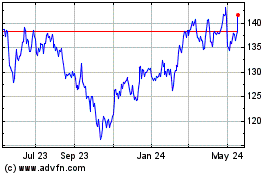

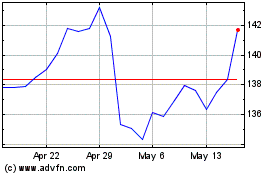

| | Common Stock, no par value | YUM | New York Stock Exchange | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition

On February 6, 2025, Yum! Brands, Inc. issued a press release announcing financial results for the quarter and year ended December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

| (c) | Exhibits |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | YUM! BRANDS, INC. | |

| | | | (Registrant) | |

| | | | | | | | | | | | | | |

| Date: | February 6, 2025 | | /s/ David Russell | |

| | | | Sr. Vice President, Finance and Corporate Controller | |

| | | | (Principal Accounting Officer) | |

Yum! Brands Reports Fourth-Quarter and Full-Year Results

Fourth-Quarter Same-Store Sales Growth at Taco Bell of 5%; KFC International Unit Growth of 8%

Full-Year GAAP Operating Profit of 4% and Core Operating Profit Growth Excluding 53rd Week of 8%

Louisville, KY (February 6, 2025) - Yum! Brands, Inc. (NYSE: YUM) today reported results for the fourth quarter and year ended December 31, 2024. Fourth-quarter GAAP EPS was $1.49 and EPS excluding Special Items was $1.61. Full-year GAAP EPS was $5.22 and EPS excluding Special Items was $5.48, an increase of 6%.

DAVID GIBBS & CHRIS TURNER COMMENTS

David Gibbs, CEO, said “2024 was marked with exceptional core operating profit growth given the complex consumer environment. 2024 again demonstrates the resilience of our business model and the agility of our world-class teams. Our twin growth engines remain strong with Taco Bell U.S. delivering same-store sales growth of 5% in the fourth quarter, meaningfully outpacing the industry, and KFC International delivering its second consecutive year with over 2,000 net new units. Our advantaged brand position, together with our industry-leading talent, franchisees, and technology, position us for another excellent year in 2025.”

Chris Turner, CFO, said “In 2024, we opened 4,535 new stores across more than 100 countries. Our digital progress this year was similarly enviable, with digital sales up approximately 15% and digital mix surpassing 50%, reflecting steady progress towards our ambition to reach 100% digital sales. Today, we are excited to announce Byte by Yum!, our proprietary Software as a Service digital ecosystem. Launching our integrated and comprehensive suite required standardization of our processes and consolidation of teams, which we accomplished as part of last year’s endeavors to remove duplicative efforts, establish centers of excellence, and drive greater efficiency and collaboration across the organization. I’m confident the changes we’ve made and investments we’re making position us to be stronger and more agile. For those reasons and more, we expect 2025 to be another on-algorithm year for Core Operating Profit growth."

RECENT STRATEGIC ANNOUNCEMENTS

•Today, we announced Byte by Yum!, a comprehensive collection of proprietary Software as a Service (SaaS) AI-driven products that deliver integrated and seamless technologies for our restaurants. Byte by Yum! enables easy operations for team members and consumers, while consolidating essential systems into a cohesive, easy-to-manage platform. Byte by Yum! is Yum!’s owned platform of integrated industry-leading restaurant technology, powered by AI, that includes mobile app and web ordering, point of sale, kitchen and delivery optimization, menu management, inventory and labor management, and team member tools. Currently, 25,000 Yum! restaurants across the world are using at least one Byte by Yum! product.

•In January, Yum! Brands announced the promotion of Scott Mezvinsky to KFC Division Chief Executive Officer, effective March 1, 2025. Scott is currently President of Taco Bell North America and International.

•In December, we opened our first test locations of new and innovative concepts. We opened Saucy by KFC, a flavor-forward dining destination offering chicken tender lovers the chance to customize their meal with 11 irresistible sauces. Always made hot, fresh and crispy, Saucy’s tenders pair perfectly with sweet, spicy, savory and smoky global flavors, all complemented by an 11-beverage lineup that includes a variety of teas, freezes and refreshers. Taco Bell opened Live Más Cafe, a new beverage concept where Bellristas provide exceptional flavor and hospitality in a cozy, inviting atmosphere, all while maintaining the great value customers love. Additionally, in December, Pizza Hut unveiled a test of a new restaurant design, with self-service kiosks, a guest-facing pizza-making station, and a drive-thru with a “Hut ‘N Go™” menu for quick orders.

SUMMARY FINANCIAL TABLE

| | | | | | | | | | | | | | | | | | | | |

| Fourth-Quarter | Full-Year |

| 2024 | 2023 | % Change | 2024 | 2023 | % Change |

| GAAP EPS | $1.49 | $1.62 | (8) | $5.22 | $5.59 | (7) |

Special Items EPS1 | $(0.12) | $0.36 | NM | $(0.26) | $0.42 | NM |

| EPS Excluding Special Items | $1.61 | $1.26 | +28 | $5.48 | $5.17 | +6 |

1 See reconciliation of Non-GAAP Measurements to GAAP Results in our Consolidated Summary of Results for further detail of Special Items.

All comparisons are versus the same period a year ago. Our fourth-quarter and full-year 2024 results include an extra week ("53rd week") for business units operating on a weekly periodic calendar. All results presented herein include this 53rd week unless otherwise noted.

System sales growth figures exclude foreign currency translation ("F/X") and core operating profit growth figures exclude F/X and Special Items. Special Items are not allocated to any segment and therefore only impact worldwide GAAP results. See reconciliation of Non-GAAP Measurements to GAAP Results in our Consolidated Summary of Results for further details.

Digital system sales includes all transactions where consumers at system restaurants utilize ordering interaction that is primarily facilitated by automated technology.

Yum! Brands, Inc. • 1900 Colonel Sanders Lane • Louisville, KY 40213

Tel 502 874-8300 • investors.yum.com

FOURTH-QUARTER HIGHLIGHTS

•Worldwide system sales grew 8% excluding foreign currency translation, with KFC at 6%, Taco Bell at 14%, and Pizza Hut at 3%.

•We opened 1,804 gross units leading to 5% year-over-year unit growth excluding the 120 unit divestiture in the second quarter related to stores under the Jeno's Pizza and Telepizza brands.

•Strong digital system sales exceeding $9 billion with digital mix over 50%.

| | | | | | | | | | | | | | | | | |

| % Change |

| System Sales

Ex F/X | Same-Store Sales | Units | GAAP

Operating Profit | Core Operating Profit1 |

| KFC Division | +6 | Even | +7 | +14 | +15 |

| Taco Bell Division | +14 | +5 | +2 | +19 | +19 |

| Pizza Hut Division | +3 | (1) | +2 | (4) | (3) |

| Worldwide | +8 | +1 | +4 | +8 | +17 |

| | | | | | | | |

| Results Excluding 53rd Week % Change |

| System Sales

Ex F/X | Core Operating Profit1 |

| KFC Division | +5 | +12 |

| Taco Bell Division | +8 | +12 |

| Pizza Hut Division | Even | (7) |

| Worldwide | +5 | +12 |

FULL-YEAR HIGHLIGHTS

•Worldwide system sales grew 4% excluding foreign currency translation, with KFC at 3%, Taco Bell at 8%, and Pizza Hut (1)%.

•We opened 4,535 gross units during the year.

•Foreign currency translation unfavorably impacted divisional operating profit by $28 million.

| | | | | | | | | | | | | | | | | |

| % Change |

| System Sales

Ex F/X | Same-Store Sales | Units | GAAP

Operating Profit | Core Operating Profit1 |

| KFC Division | +3 | (2) | +7 | +4 | +6 |

| Taco Bell Division | +8 | +4 | +2 | +11 | +11 |

| Pizza Hut Division | (1) | (4) | +2 | (5) | (3) |

Worldwide | +4 | (1) | +4 | +4 | +9 |

| | | | | | | | |

| Results Excluding 53rd Week % Change |

| System Sales

Ex F/X | Core Operating Profit1 |

| KFC Division | +3 | +5 |

| Taco Bell Division | +6 | +9 |

| Pizza Hut Division | (1) | (4) |

| Worldwide | +3 | +8 |

1See reconciliation of Non-GAAP Measurements to GAAP Results in our Consolidated Summary of Results for further detail of Core Operating Profit and Core Operating Profit excluding 53rd week.

KFC DIVISION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth-Quarter | Full-Year |

| | | %/ppts Change | | | %/ppts Change |

| 2024 | 2023 | Reported | Ex F/X | 2024 | 2023 | Reported | Ex F/X |

Restaurants | 31,981 | 29,900 | +7 | NA | 31,981 | 29,900 | +7 | NA |

| System Sales ($MM) | 9,429 | 8,888 | +6 | +6 | 34,452 | 33,863 | +2 | +3 |

| Same-Store Sales Growth (%) | Even | +2 | NM | NM | (2) | +7 | NM | NM |

| Franchise & Property Revenues ($MM) | 466 | 444 | +5 | +5 | 1,685 | 1,698 | (1) | +1 |

Operating Profit ($MM) | 377 | 329 | +14 | +15 | 1,363 | 1,304 | +4 | +6 |

| Operating Margin (%) | 39.0 | 43.3 | (4.3) | (3.8) | 44.0 | 46.1 | (2.1) | (1.6) |

| | | | | | | | | | | | | | |

| Fourth-Quarter (% Change) | Full-Year (% Change) |

| International | U.S. | International | U.S. |

| System Sales Growth Ex F/X | +8 | (1) | +5 | (5) |

| Same-Store Sales Growth | +1 | (5) | (2) | (5) |

•KFC Division opened 1,100 gross new restaurants during the quarter.

◦For the year, KFC Division opened 2,892 gross new restaurants across 97 countries.

•For the quarter, the 53rd week provided a benefit of one percentage point to system sales growth and three percentage points to core operating profit growth. For the year, the 53rd week provided a negligible benefit to system sales growth and a benefit of one percentage point to core operating profit growth.

•Foreign currency translation unfavorably impacted operating profit by $1 million for the quarter and $22 million for the year.

| | | | | | | | | | | |

KFC Markets1 | Percent of KFC System Sales2 | System Sales Growth Ex F/X |

Fourth-Quarter

(% Change) | Full-Year

(% Change) |

| China | 27% | +5 | +6 |

| United States | 14% | (1) | (5) |

| Europe (excluding United Kingdom) | 12% | +10 | +8 |

| Asia | 9% | +1 | (5) |

| Latin America | 8% | +13 | +15 |

| Australia | 7% | +11 | +6 |

| United Kingdom | 6% | +5 | (1) |

| Middle East / Turkey / North Africa | 6% | +21 | (2) |

| Africa | 5% | +14 | +11 |

| Thailand | 2% | +3 | +6 |

| Canada | 2% | +11 | +6 |

| India | 2% | +10 | +10 |

1Refer to investors.yum.com/financial-information/financial-reports/ for a list of the countries within each of the markets.

2Reflects Full Year 2024.

TACO BELL DIVISION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth-Quarter | Full-Year |

| | | %/ppts Change | | | %/ppts Change |

| 2024 | 2023 | Reported | Ex F/X | 2024 | 2023 | Reported | Ex F/X |

Restaurants | 8,757 | 8,564 | +2 | NA | 8,757 | 8,564 | +2 | NA |

| System Sales ($MM) | 5,571 | 4,887 | +14 | +14 | 17,193 | 15,915 | +8 | +8 |

| Same-Store Sales Growth (%) | +5 | +3 | NM | NM | +4 | +5 | NM | NM |

| Franchise & Property Revenues ($MM) | 319 | 281 | +13 | +13 | 997 | 918 | +9 | +9 |

Operating Profit ($MM) | 340 | 286 | +19 | +19 | 1,049 | 944 | +11 | +11 |

| Operating Margin (%) | 36.5 | 34.9 | 1.6 | 1.7 | 36.7 | 35.8 | 0.9 | 0.9 |

•Taco Bell Division opened 186 gross new restaurants during the quarter.

◦For the year, Taco Bell Division opened 347 gross new restaurants across 25 countries.

•Taco Bell U.S. system sales grew 14% and Taco Bell International system sales excluding foreign currency grew 10% for the quarter.

◦For the year, Taco Bell U.S. system sales grew 8% and Taco Bell International system sales excluding foreign currency grew 6%.

•Taco Bell U.S. same-store sales grew 5% and Taco Bell International same-store sales grew 3% for the quarter.

◦For the year, Taco Bell U.S. same-store sales grew 4% and Taco Bell International same-store sales were flat.

•For the quarter, the 53rd week provided a benefit of six percentage points to system sales growth and seven percentage points to core operating profit growth for the quarter. For the year, the 53rd week provided a benefit of two percentage points to both system sales growth and core operating profit growth.

•For the quarter, company-owned restaurant margins were 25.5%, a 240 basis point increase year-over-year. The 53rd week provided a benefit of 40 basis points to company-owned restaurant margins for the quarter.

◦For the year, company-owned restaurant margins were 24.4%, a 70 basis point increase year-over-year. The 53rd week provided a benefit of 10 basis points to company-owned restaurant margins for the year.

PIZZA HUT DIVISION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth-Quarter | Full-Year |

| | | %/ppts Change | | | %/ppts Change |

| 2024 | 2023 | Reported | Ex F/X | 2024 | 2023 | Reported | Ex F/X |

Restaurants | 20,225 | 19,866 | +2 | NA | 20,225 | 19,866 | +2 | NA |

| System Sales ($MM) | 3,617 | 3,535 | +2 | +3 | 13,108 | 13,315 | (2) | (1) |

| Same-Store Sales Growth (%) | (1) | (2) | NM | NM | (4) | +2 | NM | NM |

| Franchise & Property Revenues ($MM) | 176 | 168 | +4 | +5 | 622 | 622 | Even | +1 |

Operating Profit ($MM) | 95 | 99 | (4) | (3) | 373 | 391 | (5) | (3) |

| Operating Margin (%) | 32.4 | 35.0 | (2.6) | (2.4) | 37.0 | 38.3 | (1.3) | (0.9) |

| | | | | | | | | | | | | | |

| Fourth-Quarter (% Change) | Full-Year (% Change) |

| International | U.S. | International | U.S. |

| System Sales Growth Ex F/X | +2 | +3 | (1) | Even |

| Same-Store Sales Growth | Even | (2) | (5) | (3) |

•Pizza Hut Division opened 512 gross new restaurants during the quarter.

◦For the year, Pizza Hut Division opened 1,280 gross new restaurants across 62 countries.

•For the quarter, the 53rd week provided a benefit of three percentage points to system sales growth and four percentage points to core operating profit growth. For the year, the 53rd week provided a negligible benefit to system sales growth and a benefit of one percentage point to core operating profit growth.

•Foreign currency translation unfavorably impacted operating profit by $1 million for the quarter and $6 million for the year.

| | | | | | | | | | | |

Pizza Hut Markets1 | Percent of Pizza Hut System Sales2 | System Sales Growth Ex F/X |

Fourth-Quarter

(% Change) | Full-Year

(% Change) |

| United States | 42% | +3 | Even |

| China | 18% | +7 | +3 |

| Asia | 13% | Even | (3) |

| Europe | 11% | (7) | (6) |

| Latin America | 7% | (4) | Even |

| Middle East / Africa | 4% | +20 | Even |

| Canada | 3% | +10 | +6 |

| India | 2% | +10 | +4 |

THE HABIT BURGER GRILL DIVISION

•The Habit Burger Grill Division opened 6 gross new restaurants during the quarter and 16 for the year.

•The Habit Burger Grill Division grew system sales 10% for the quarter and 2% for the year.

•The Habit Burger Grill Division same-store sales were flat for the quarter and declined (4)% for the year.

•For the quarter, the 53rd week provided a benefit of five percentage points to system sales growth. For the year, the 53rd week provided a benefit of one percentage point to system sales growth.

OTHER ITEMS

•The Company's Board of Directors approved a dividend of $0.71 per share of common stock, an increase of 6%. The quarterly dividend will be distributed March 7, 2025 to shareholders of record at the close of business on February 21, 2025.

•In January, Yum! Brands terminated its franchise agreements with franchisee IS Gida A.S. (IS Gida), the owner and operator of KFC and Pizza Hut restaurants in Turkey after failure to meet Yum! Brands’ standards. The termination affects 284 KFC and 254 Pizza Hut restaurants in Turkey. Yum! Brands is actively identifying the right growth-minded franchise partner to drive future success in Turkey.

•See reconciliation of Non-GAAP Measurements to GAAP results within this release for further detail of Special Items by financial statement line item including the impact of Special Items on General and administrative expenses.

•Disclosures pertaining to outstanding debt in our Restricted Group capital structure will be provided at the time of the filing of the 2024 Form 10-K.

LONG-TERM GROWTH ALGORITHM

•The Company targets the following long-term financial performance metrics, first announced in 2022, that it believes it can achieve over an extended period of time, on average:

•5% Unit Growth

•7% System Sales Growth, excluding F/X and 53rd week; and

•At least 8% Core Operating Profit Growth, excluding F/X and 53rd week3

1Refer to investors.yum.com/financial-information/financial-reports/ for a list of the countries within each of the markets.

2Reflects Full Year 2024.

3At this time, we are unable to forecast any Special Items or any impact from changes in F/X rates, and therefore cannot provide an estimate of Operating Profit Growth on a GAAP basis.

CONFERENCE CALL

Yum! Brands, Inc. will host a conference call to review the company's financial performance and strategies at 8:15 a.m. Eastern Time Thursday, February 6, 2025. The number is 833/470-1428 in the U.S., 833/950-0062 in Canada and +1/929-526-1599 for international callers, conference ID 951337.

The call will be available for playback beginning at 10:00 a.m. Eastern Time February 6, 2025 through February 13, 2025. To access the playback, dial 866/813-9403 in the U.S., 226/828-7578 in Canada, and +1/929-458-6194 internationally, conference ID 189157.

The webcast and the playback can be accessed via the website by visiting Yum! Brands' website, investors.yum.com/events-and-presentations and selecting “Q4 2024 Earnings Conference Call.”

ADDITIONAL INFORMATION ONLINE

Quarter end dates for each division, restaurant count details, definitions of terms and Restricted Group financial information are available at investors.yum.com. Reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures are included within this release.

FORWARD-LOOKING STATEMENTS

This announcement may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We intend all forward-looking statements to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by the fact that they do not relate strictly to historical or current facts and by the use of forward-looking words such as “expect,” “expectation,” “believe,” “anticipate,” “may,” “could,” “intend,” “belief,” “plan,” “estimate,” “target,” “predict,” “likely,” “seek,” “project,” “model,” “ongoing,” “will,” “should,” “forecast,” “outlook” or similar terminology. These statements are based on and reflect our current expectations, estimates, assumptions and/ or projections, our perception of historical trends and current conditions, as well as other factors that we believe are appropriate and reasonable under the circumstances. Forward-looking statements are neither predictions nor guarantees of future events, circumstances or performance and are inherently subject to known and unknown risks, uncertainties and assumptions that could cause our actual results to differ materially from those indicated by those statements. There can be no assurance that our expectations, estimates, assumptions and/or projections, including with respect to the future earnings and performance or capital structure of Yum! Brands, will prove to be correct or that any of our expectations, estimates or projections will be achieved.

Numerous factors could cause our actual results and events to differ materially from those expressed or implied by forward-looking statements, including, without limitation: food safety and food- or beverage-borne illness concerns; adverse impacts of health epidemics, deterioration in public health conditions or the occurrence of other catastrophic or unforeseen events; the success and financial stability of our concepts’ franchisees, particularly in light of challenging macroeconomic conditions; the success of our development strategy; anticipated benefits from past or potential future acquisitions, investments, other strategic transactions or initiatives, or our portfolio business model; our significant exposure to the Chinese market; our global operations and related exposure to geopolitical instability, including as a result of the Middle East conflict as well as potential expansion of restrictive trade policies; foreign currency risks and foreign exchange controls; our ability to protect the integrity or availability of IT systems or the security of confidential information and other cybersecurity risks; compliance with data privacy and data protection legal requirements and reporting obligations; our ability to successfully and securely implement technology initiatives, including utilization of artificial intelligence; our increasing dependence on digital commerce platforms; the impact of social media; our ability to protect our trademarks or other intellectual property; shortages or interruptions in the availability and the delivery of food, equipment and other supplies; the loss of key personnel, labor shortages and increased labor costs, including as a result of state and local legislation related to wages and working conditions; changes in food prices and other operating costs; our corporate reputation, the value and perception of our brands and changes in consumer preferences and wellness trends; evolving expectations and requirements with respect to social and environmental sustainability matters; adverse effects of severe weather and climate change; pending or future litigation and legal claims or proceedings; changes in, or noncompliance with, legal requirements; tax matters, including changes in tax rates or laws, impositions of new taxes, tax implications of our restructurings, or disagreements with taxing authorities; changes in consumer discretionary spending and macroeconomic conditions, including inflationary pressures and elevated interest rates; competition within the retail food industry; risks relating to our level of indebtedness. In addition, other risks and uncertainties not presently known to us or that we currently believe to be immaterial could affect the accuracy of any such forward-looking statements. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. The forward-looking statements included in this announcement are only made as of the date of this announcement and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances.

You should consult our filings with the Securities and Exchange Commission (including the information set forth under the captions “Risk Factors” and “Forward-Looking Statements” in our most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q) for additional detail about factors that could affect our financial and other results.

Yum! Brands, Inc., based in Louisville, Kentucky, and its subsidiaries franchise or operate a system of over 61,000 restaurants in more than 155 countries and territories under the company’s concepts – KFC, Taco Bell, Pizza Hut and Habit Burger & Grill. The Company's KFC, Taco Bell and Pizza Hut brands are global leaders of the chicken, Mexican-inspired food and pizza categories, respectively. Habit Burger & Grill is a fast casual restaurant concept specializing in made-to-order chargrilled burgers, sandwiches and more. In 2024, Yum! was named to the Dow Jones Sustainability Index North America, Newsweek’s list of America’s Most Responsible Companies, USA Today’s America’s Climate Leaders and 3BL’s list of 100 Best Corporate Citizens. In 2025, the Company was recognized among TIME magazine’s list of Best Companies for Future Leaders. In addition, KFC, Taco Bell and Pizza Hut brands were ranked in the top 25 of Entrepreneur’s Top Global Franchises Ranking for 2025, with Taco Bell securing the No. 1 spot for the fifth consecutive year.

Analysts are invited to contact:

Matt Morris, Head of Investor Relations, at 888/298-6986

Members of the media are invited to contact:

Lori Eberenz, Director, Public Relations, at 502/874-8200

YUM! Brands, Inc.

Consolidated Summary of Results

(amounts in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended | | % Change

B/(W) | | Year ended | | % Change

B/(W) |

| | 12/31/24 | | 12/31/23 | | | 12/31/24 | | 12/31/23 | |

| Revenues | | | | | | | | | | | |

| Company sales | $ | 885 | | | $ | 647 | | | 37 | | $ | 2,552 | | | $ | 2,142 | | | 19 |

| Franchise and property revenues | 945 | | | 896 | | | 6 | | 3,295 | | | 3,247 | | | 1 |

| Franchise contributions for advertising and other services | 532 | | | 493 | | | 8 | | 1,702 | | | 1,687 | | | 1 |

| Total revenues | 2,362 | | | 2,036 | | | 16 | | 7,549 | | | 7,076 | | | 7 |

| | | | | | | | | | | |

| Costs and Expenses, Net | | | | | | | | | | | |

| Company restaurant expenses | 727 | | | 535 | | | (36) | | 2,120 | | | 1,774 | | | (20) |

| General and administrative expenses | 351 | | | 353 | | | Even | | 1,181 | | | 1,193 | | | 1 |

| Franchise and property expenses | 44 | | | 28 | | | (49) | | 134 | | | 123 | | | (8) |

| Franchise advertising and other services expense | 542 | | | 500 | | | (9) | | 1,711 | | | 1,683 | | | (2) |

| Refranchising (gain) loss | (3) | | | 11 | | | NM | | (34) | | | (29) | | | NM |

| Other (income) expense | 44 | | | — | | | NM | | 34 | | | 14 | | | NM |

| Total costs and expenses, net | 1,705 | | | 1,427 | | | (20) | | 5,146 | | | 4,758 | | | (8) |

| | | | | | | | | | | |

| Operating Profit | 657 | | | 609 | | | 8 | | 2,403 | | | 2,318 | | | 4 |

| Investment (income) expense, net | — | | | 14 | | | NM | | 21 | | | (7) | | | NM |

| Other pension (income) expense | (2) | | | (1) | | | NM | | (7) | | | (6) | | | NM |

| Interest expense, net | 131 | | | 132 | | | 1 | | 489 | | | 513 | | | 5 |

| Income before income taxes | 528 | | | 464 | | | 14 | | 1,900 | | | 1,818 | | | 5 |

| Income tax provision | 105 | | | 1 | | | NM | | 414 | | | 221 | | | (88) |

| Net income | $ | 423 | | | $ | 463 | | | (9) | | $ | 1,486 | | | $ | 1,597 | | | (7) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Basic EPS | | | | | | | | | | | |

| EPS | $ | 1.51 | | | $ | 1.65 | | | (8) | | $ | 5.28 | | | $ | 5.68 | | | (7) |

| Average shares outstanding | 280 | | | 281 | | | — | | 282 | | | 281 | | | — |

| | | | | | | | | | | |

| Diluted EPS | | | | | | | | | | | |

| EPS | $ | 1.49 | | | $ | 1.62 | | | (8) | | $ | 5.22 | | | $ | 5.59 | | | (7) |

| Average shares outstanding | 283 | | | 285 | | | 1 | | 285 | | | 285 | | | — |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Dividends declared per common share | $ | 0.67 | | | $ | 0.605 | | | | | $ | 2.68 | | | $ | 2.42 | | | |

See accompanying notes.

Percentages may not recompute due to rounding.

YUM! Brands, Inc.

KFC DIVISION Operating Results

(amounts in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended | | % Change

B/(W) | | Year ended | | % Change

B/(W) |

| | 12/31/24 | | 12/31/23 | | | 12/31/24 | | 12/31/23 | |

| | | | | | | | | | | |

| Company sales | $ | 313 | | | $ | 142 | | | 121 | | $ | 801 | | | $ | 484 | | | 66 |

| Franchise and property revenues | 466 | | | 444 | | | 5 | | 1,685 | | | 1,698 | | | (1) |

| Franchise contributions for advertising and other services | 186 | | | 175 | | | 6 | | 613 | | | 648 | | | (5) |

| Total revenues | 965 | | | 761 | | | 27 | | 3,099 | | | 2,830 | | | 10 |

| | | | | | | | | | | |

| Company restaurant expenses | 275 | | | 122 | | | (125) | | 703 | | | 417 | | | (68) |

| General and administrative expenses | 110 | | | 118 | | | 7 | | 363 | | | 383 | | | 5 |

| Franchise and property expenses | 17 | | | 15 | | | (10) | | 63 | | | 72 | | | 13 |

| Franchise advertising and other services expenses | 186 | | | 178 | | | (5) | | 610 | | | 648 | | | 6 |

| Other (income) expense | — | | | (1) | | | NM | | (3) | | | 6 | | | NM |

| Total costs and expenses, net | 588 | | | 432 | | | (36) | | 1,736 | | | 1,526 | | | (14) |

| Operating Profit | $ | 377 | | | $ | 329 | | | 14 | | $ | 1,363 | | | $ | 1,304 | | | 4 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Company restaurant margin %1 | 12.3 | % | | 14.0 | % | | (1.7) ppts. | | 12.2 | % | | 13.7 | % | | (1.5) ppts. |

| | | | | | | | | | | |

| Operating margin | 39.0 | % | | 43.3 | % | | (4.3) ppts. | | 44.0 | % | | 46.1 | % | | (2.1) ppts. |

See accompanying notes.

Percentages may not recompute due to rounding.

1See reconciliation of Non-GAAP Measurements to GAAP results within this release for further detail of Company restaurant margin %.

YUM! Brands, Inc.

TACO BELL DIVISION Operating Results

(amounts in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended | | % Change

B/(W) | | Year ended | | % Change

B/(W) |

| | 12/31/24 | | 12/31/23 | | | 12/31/24 | | 12/31/23 | |

| | | | | | | | | | | |

| Company sales | $ | 380 | | | $ | 331 | | | 15 | | $ | 1,155 | | | $ | 1,069 | | | 8 |

| Franchise and property revenues | 319 | | | 281 | | | 13 | | 997 | | | 918 | | | 9 |

| Franchise contributions for advertising and other services | 231 | | | 207 | | | 12 | | 708 | | | 654 | | | 8 |

| Total revenues | 930 | | | 819 | | | 14 | | 2,860 | | | 2,641 | | | 8 |

| | | | | | | | | | | |

| Company restaurant expenses | 282 | | | 256 | | | (11) | | 872 | | | 817 | | | (7) |

| General and administrative expenses | 62 | | | 63 | | | 2 | | 199 | | | 204 | | | 3 |

| Franchise and property expenses | 11 | | | 11 | | | 2 | | 33 | | | 32 | | | (3) |

| Franchise advertising and other services expenses | 235 | | | 205 | | | (15) | | 708 | | | 644 | | | (10) |

| Other (income) expense | — | | | (2) | | | NM | | (1) | | | — | | | NM |

| Total costs and expenses, net | 590 | | | 533 | | | (11) | | 1,811 | | | 1,697 | | | (7) |

| Operating Profit | $ | 340 | | | $ | 286 | | | 19 | | $ | 1,049 | | | $ | 944 | | | 11 |

| | | | | | | | | | | |

Company restaurant margin %1 | 25.5 | % | | 23.1 | % | | 2.4 ppts. | | 24.4 | % | | 23.7 | % | | 0.7 ppts. |

| | | | | | | | | | | |

| Operating margin | 36.5 | % | | 34.9 | % | | 1.6 ppts. | | 36.7 | % | | 35.8 | % | | 0.9 ppts. |

See accompanying notes.

Percentages may not recompute due to rounding.

1See reconciliation of Non-GAAP Measurements to GAAP results within this release for further detail of Company restaurant margin %.

YUM! Brands, Inc.

PIZZA HUT DIVISION Operating Results

(amounts in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended | | % Change

B/(W) | | Year ended | | % Change

B/(W) |

| | 12/31/24 | | 12/31/23 | | | 12/31/24 | | 12/31/23 | |

| | | | | | | | | | | |

| Company sales | $ | 3 | | | $ | 3 | | | 12 | | $ | 8 | | | $ | 14 | | | (45) |

| Franchise and property revenues | 176 | | | 168 | | | 4 | | 622 | | | 622 | | | Even |

| Franchise contributions for advertising and other services | 114 | | | 110 | | | 3 | | 378 | | | 383 | | | (1) |

| Total revenues | 293 | | | 281 | | | 4 | | 1,008 | | | 1,019 | | | (1) |

| | | | | | | | | | | |

| Company restaurant expenses | 3 | | | 3 | | | (4) | | 8 | | | 14 | | | 45 |

| General and administrative expenses | 66 | | | 66 | | | Even | | 219 | | | 221 | | | 1 |

| Franchise and property expenses | 15 | | | 1 | | | NM | | 34 | | | 15 | | | (122) |

| Franchise advertising and other services expenses | 120 | | | 116 | | | (3) | | 390 | | | 389 | | | Even |

| Other (income) expense | (6) | | | (4) | | | NM | | (16) | | | (11) | | | NM |

| Total costs and expenses, net | 198 | | | 182 | | | (8) | | 635 | | | 628 | | | (1) |

| Operating Profit | $ | 95 | | | $ | 99 | | | (4) | | $ | 373 | | | $ | 391 | | | (5) |

| | | | | | | | | | | |

Company restaurant margin %1 | 1.9 | % | | (5.4) | % | | 7.3 ppts. | | (0.6) | % | | 0.1 | % | | (0.7) ppts. |

| | | | | | | | | | | |

| Operating margin | 32.4 | % | | 35.0 | % | | (2.6) ppts. | | 37.0 | % | | 38.3 | % | | (1.3) ppts. |

See accompanying notes.

Percentages may not recompute due to rounding.

1See reconciliation of Non-GAAP Measurements to GAAP results within this release for further detail of Company restaurant margin %.

YUM! Brands, Inc.

Consolidated Balance Sheets

(amounts in millions)

(unaudited)

| | | | | | | | | | | |

| | 12/31/24 | | 12/31/23 |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 616 | | | $ | 512 | |

| Accounts and notes receivable, less allowance: $74 in 2024 and $39 in 2023 | 775 | | | 737 | |

| Prepaid expenses and other current assets | 480 | | | 360 | |

| Total Current Assets | 1,871 | | | 1,609 | |

| | | |

| Property, plant and equipment, net of accumulated depreciation of $1,384 in 2024 | 1,304 | | | 1,197 | |

| and $1,332 in 2023 | | | |

| Goodwill | 736 | | | 642 | |

| Intangible assets, net | 416 | | | 377 | |

| Other assets | 1,329 | | | 1,361 | |

| Deferred income taxes | 1,071 | | | 1,045 | |

| Total Assets | $ | 6,727 | | | $ | 6,231 | |

| | | |

| LIABILITIES AND SHAREHOLDERS' DEFICIT | | | |

| Current Liabilities | | | |

| Accounts payable and other current liabilities | $ | 1,211 | | | $ | 1,169 | |

| Income taxes payable | 31 | | | 55 | |

| Short-term borrowings | 27 | | | 53 | |

| Total Current Liabilities | 1,269 | | | 1,277 | |

| | | |

| Long-term debt | 11,306 | | | 11,142 | |

| Other liabilities and deferred credits | 1,800 | | | 1,670 | |

| Total Liabilities | 14,375 | | | 14,089 | |

| | | |

| Shareholders' Deficit | | | |

| Common Stock, no par value, 750 shares authorized; 279 and 281 shares issued in 2024 and 2023, respectively | — | | | 60 | |

| Accumulated deficit | (7,256) | | | (7,616) | |

| Accumulated other comprehensive loss | (392) | | | (302) | |

| Total Shareholders' Deficit | (7,648) | | | (7,858) | |

| Total Liabilities and Shareholders' Deficit | $ | 6,727 | | | $ | 6,231 | |

See accompanying notes.

YUM! Brands, Inc.

Consolidated Statements of Cash Flows

(amounts in millions)

(unaudited)

| | | | | | | | | | | |

| | Year ended |

| | 12/31/24 | | 12/31/23 |

| Cash Flows - Operating Activities | | | |

| Net income | $ | 1,486 | | | $ | 1,597 | |

| Depreciation and amortization | 175 | | | 153 | |

| Impairment and closure expense | 12 | | | 13 | |

| Refranchising (gain) loss | (34) | | | (29) | |

| Investment (income) expense, net | 21 | | | (7) | |

| | | |

| | | |

| Deferred income taxes | (30) | | | (290) | |

| Share-based compensation expense | 69 | | | 95 | |

| Changes in accounts and notes receivable | (53) | | | (89) | |

| Changes in prepaid expenses and other current assets | (12) | | | (15) | |

| Changes in accounts payable and other current liabilities | 8 | | | (30) | |

| Changes in income taxes payable | (29) | | | 43 | |

| Other, net | 76 | | | 162 | |

| Net Cash Provided by Operating Activities | 1,689 | | | 1,603 | |

| | | |

| Cash Flows - Investing Activities | | | |

| Capital spending | (257) | | | (285) | |

| | | |

| Proceeds from sale of Devyani Investment | 104 | | | — | |

| Proceeds from sale of KFC Russia | — | | | 121 | |

| Acquisition of KFC U.K. and Ireland restaurants | (174) | | | — | |

| Proceeds from refranchising of restaurants | 49 | | | 60 | |

| Maturities (purchases) of Short term investments, net | (91) | | | — | |

| Other, net | (53) | | | (3) | |

| Net Cash Used in Investing Activities | (422) | | | (107) | |

| | | |

| Cash Flows - Financing Activities | | | |

| Proceeds from long-term debt | 237 | | | — | |

| Repayments of long-term debt | (479) | | | (397) | |

| Revolving credit facilities, three months or less, net | 345 | | | (279) | |

| | | |

| | | |

| | | |

| | | |

| Repurchase shares of Common Stock | (441) | | | (50) | |

| Dividends paid on Common Stock | (752) | | | (678) | |

| | | |

| Other, net | (73) | | | (25) | |

| Net Cash Used in Financing Activities | (1,163) | | | (1,429) | |

| Effect of Exchange Rate on Cash and Cash Equivalents | (21) | | | 10 | |

| Net Increase in Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents | 83 | | | 77 | |

| Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents - Beginning of Year | 724 | | | 647 | |

| Cash, Cash Equivalents, Restricted Cash and Restricted Cash Equivalents - End of Year | $ | 807 | | | $ | 724 | |

| | | |

See accompanying notes.

Reconciliation of Non-GAAP Measurements to GAAP Results

(amounts in millions, except per share amounts)

(unaudited)

In addition to the results provided in accordance with Generally Accepted Accounting Principles in the United States of America ("GAAP"), the Company provides the following non-GAAP measurements.

•Diluted Earnings Per Share ("EPS") excluding Special Items (as defined below) and, in 2024, Diluted EPS excluding Special Items and the 53rd week;

•Effective Tax Rate excluding Special Items and, in 2024, Effective Tax Rate excluding Special Items and the 53rd week;

•Core Operating Profit and, in 2024, Core Operating Profit excluding the 53rd week. Core Operating Profit excludes Special Items and foreign currency translation ("F/X") and we use Core Operating Profit for the purposes of evaluating performance internally;

•Net Income excluding Special Items and, in 2024, Net Income excluding Special Items and the 53rd week;

•Company restaurant profit and Company restaurant margin as a percentage of sales (as defined below).

These non-GAAP measurements are not intended to replace the presentation of our financial results in accordance with GAAP. Rather, the Company believes that the presentation of these non-GAAP measurements provide additional information to investors to facilitate the comparison of past and present operations.

Special Items are not included in any of our Division segment results as the Company does not believe they are indicative of our ongoing operations due to their size and/or nature. Our chief operating decision maker does not consider the impact of Special Items when assessing segment performance. The Special Items are described in (a) - (e) in the accompanying notes.

Company restaurant profit is defined as Company sales less Company restaurant expenses, both of which appear on the face of our Consolidated Statements of Income. Company restaurant expenses include those expenses incurred directly by our Company-owned restaurants in generating Company sales, including cost of food and paper, cost of restaurant-level labor, rent, depreciation and amortization of restaurant-level assets and advertising expenses incurred by and on behalf of that Company restaurant. Company restaurant margin as a percentage of sales ("Company restaurant margin %") is defined as Company restaurant profit divided by Company sales. We use Company restaurant profit for the purposes of internally evaluating the performance of our Company-owned restaurants and we believe Company restaurant profit provides useful information to investors as to the profitability of our Company-owned restaurants. In calculating Company restaurant profit, the Company excludes revenues and expenses directly associated with our franchise operations as well as non-restaurant-level costs included in General and administrative expenses, some of which may support Company-owned restaurant operations. The Company also excludes restaurant-level asset impairment and closures expenses, which have historically not been significant, from the determination of Company restaurant profit as such expenses are not believed to be indicative of ongoing operations. Further, while we generally include depreciation and amortization of restaurant-level assets within Divisional Company restaurant expenses used to derive Divisional Company restaurant profit, we record amortization of reacquired franchise rights arising from acquisition accounting within Corporate and unallocated restaurant expenses as such amortization is not believed to be indicative of ongoing Divisional results as well as to enhance comparability of stores' margins with those of existing restaurants. Company restaurant profit and Company restaurant margin % as presented may not be comparable to other similarly titled measures of other companies in the industry.

Certain non-GAAP measurements are presented excluding the impact of F/X. These amounts are derived by translating current year results at prior year average exchange rates. We believe the elimination of the F/X impact provides better year-to-year comparability without the distortion of foreign currency fluctuations.

For 2024 we provided Core Operating Profit excluding the 53rd week, Net Income excluding Special Items and the 53rd week, Diluted EPS excluding Special Items and the 53rd week and Effective Tax Rate excluding Special Items and the 53rd week to further enhance comparability given the 53rd week that was part of our fiscal calendar in 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended | | Year ended |

| Reconciliation of GAAP Operating Profit to Core Operating Profit and Core Operating Profit, excluding the 53rd Week | 12/31/24 | | 12/31/23 | | 12/31/24 | | 12/31/23 |

| | | | | | | |

| Consolidated | | | | | | | |

| GAAP Operating Profit | $ | 657 | | | $ | 609 | | | $ | 2,403 | | | $ | 2,318 | |

| Detail of Special Items: | | | | | | | |

(Gain) loss associated with market-wide refranchisings(a) | (2) | | | 12 | | | 1 | | | 5 | |

Operating (profit) loss impact from decision to exit Russia(b) | — | | | 1 | | | — | | | 11 | |

Charges associated with Resource Optimization(c) | 21 | | | 8 | | | 79 | | | 21 | |

German acquisition and Turkey termination-related costs(d) | 61 | | | — | | | 61 | | | — | |

| Other Special Items (Income) Expense | — | | | (1) | | | — | | | 2 | |

| Special Items (Income) Expense - Operating Profit | 80 | | | 20 | | | 141 | | | 39 | |

| Negative Foreign Currency Impact on Divisional Operating Profit | 2 | | | N/A | | 28 | | | N/A |

| Core Operating Profit | 739 | | | 629 | | | 2,572 | | | 2,357 | |

| Impact of 53rd Week Operating Profit | (36) | | | N/A | | (36) | | | N/A |

| Core Operating Profit, excluding the 53rd Week | $ | 703 | | | $ | 629 | | | $ | 2,536 | | | $ | 2,357 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Special Items as shown above were recorded to the financial statement line items identified below: |

| Quarter ended | | Year ended |

| 12/31/24 | | 12/31/23 | | 12/31/24 | | 12/31/23 |

| Consolidated Summary of Results Line Item | | | | | | | |

| Franchise and property revenues | $ | 18 | | | $ | — | | | $ | 18 | | | $ | — | |

| General and administrative expenses | 27 | | | 9 | | | 84 | | | 28 | |

| Franchise and property expenses | — | | | — | | | — | | | 1 | |

| Refranchising (gain) loss | (2) | | | 12 | | | 1 | | | 5 | |

| Other (income) expense | 37 | | | (1) | | | 38 | | | 5 | |

| Special Items (Income) Expense - Operating Profit | $ | 80 | | | $ | 20 | | | $ | 141 | | | $ | 39 | |

| | | | | | | |

| KFC Division | | | | | | | |

| GAAP Operating Profit | $ | 377 | | | $ | 329 | | | $ | 1,363 | | | $ | 1,304 | |

| Negative (Positive) Foreign Currency Impact | 1 | | | N/A | | 22 | | | N/A |

| Core Operating Profit | 378 | | | 329 | | | 1,385 | | | 1,304 | |

| Impact of 53rd Week | (9) | | | N/A | | (9) | | | N/A |

| Core Operating Profit, excluding the 53rd Week | $ | 369 | | | $ | 329 | | | $ | 1,376 | | | $ | 1,304 | |

| | | | | | | |

| Taco Bell Division | | | | | | | |

| GAAP Operating Profit | $ | 340 | | | $ | 286 | | | $ | 1,049 | | | $ | 944 | |

| Negative (Positive) Foreign Currency Impact | — | | | N/A | | — | | | N/A |

| Core Operating Profit | 340 | | | 286 | | | 1,049 | | | 944 | |

| Impact of 53rd Week | (21) | | | N/A | | (21) | | | N/A |

| Core Operating Profit, excluding the 53rd Week | $ | 319 | | | $ | 286 | | | $ | 1,028 | | | $ | 944 | |

| | | | | | | |

| Pizza Hut Division | | | | | | | |

| GAAP Operating Profit | $ | 95 | | | $ | 99 | | | $ | 373 | | | $ | 391 | |

| Negative (Positive) Foreign Currency Impact | 1 | | | N/A | | 6 | | | N/A |

| Core Operating Profit | 96 | | | 99 | | | 379 | | | 391 | |

| Impact of 53rd Week | (5) | | | N/A | | (5) | | | N/A |

| Core Operating Profit, excluding the 53rd Week | $ | 91 | | | $ | 99 | | | $ | 374 | | | $ | 391 | |

| | | | | | | |

| Habit Burger & Grill Division | | | | | | | |

| GAAP Operating Profit (Loss) | $ | 2 | | | $ | (10) | | | $ | — | | | $ | (14) | |

| Negative (Positive) Foreign Currency Impact | — | | | N/A | | — | | | N/A |

| Core Operating Profit (Loss) | 2 | | | (10) | | | — | | | (14) | |

| Impact of 53rd Week | (1) | | | N/A | | (1) | | | N/A |

| Core Operating Profit (Loss), excluding the 53rd Week | $ | 1 | | | $ | (10) | | | $ | (1) | | | $ | (14) | |

| | | | | | | |

| Reconciliation of GAAP Net Income to Net Income excluding Special Items and the 53rd Week | | | | | | | |

| GAAP Net Income | $ | 423 | | | $ | 463 | | | $ | 1,486 | | | $ | 1,597 | |

| Special Items Expense - Operating Profit | 80 | | | 20 | | | 141 | | | 39 | |

| | | | | | | |

Special Items Tax (Benefit) Expense(e) | (47) | | | (125) | | | (66) | | | (161) | |

| Net Income excluding Special Items | 456 | | | 358 | | | 1,561 | | | 1,475 | |

| Impact of 53rd Week | (25) | | | — | | | (25) | | | — | |

| Net Income excluding Special Items and the 53rd Week | $ | 431 | | | $ | 358 | | | $ | 1,536 | | | $ | 1,475 | |

| | | | | | | |

| Reconciliation of Diluted EPS to Diluted EPS excluding Special Items and the 53rd Week | | | | | | | |

| Diluted EPS | $ | 1.49 | | | $ | 1.62 | | | $ | 5.22 | | | $ | 5.59 | |

| Less Special Items Diluted EPS | (0.12) | | | 0.36 | | | (0.26) | | | 0.42 | |

| Diluted EPS excluding Special Items | 1.61 | | | 1.26 | | | 5.48 | | | 5.17 | |

| Less Impact of 53rd Week | 0.09 | | | — | | | 0.09 | | | — | |

| Diluted EPS excluding Special Items and the 53rd Week | $ | 1.52 | | | $ | 1.26 | | | $ | 5.39 | | | $ | 5.17 | |

| | | | | | | |

| Reconciliation of GAAP Effective Tax Rate to Effective Tax Rate excluding Special Items and the 53rd Week | | | | | | | |

| GAAP Effective Tax Rate | 19.9 | % | | — | % | | 21.8 | % | | 12.1 | % |

| Impact on Tax Rate as a result of Special Items | (5.2) | % | | (26.0) | % | | (1.8) | % | | (8.5) | % |

| Effective Tax Rate excluding Special Items | 25.1 | % | | 26.0 | % | | 23.6 | % | | 20.6 | % |

| Impact on Tax Rate as a result of the 53rd Week | — | % | | N/A | | 0.1 | % | | N/A |

| Effective Tax Rate excluding Special Items and the 53rd Week | 25.1 | % | | 26.0 | % | | 23.5 | % | | 20.6 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of GAAP Operating Profit to Company Restaurant Profit |

| | Quarter Ended 12/31/24 |

| | KFC Division | | Taco Bell Division | | Pizza Hut Division | | Habit Burger & Grill Division | | Corporate and Unallocated | | Consolidated |

| GAAP Operating Profit (Loss) | | $ | 377 | | | $ | 340 | | | $ | 95 | | | $ | 2 | | | $ | (157) | | | $ | 657 | |

| Less: | | | | | | | | | | | | |

| Franchise and property revenues | | 466 | | | 319 | | | 176 | | | 2 | | | (18) | | | 945 | |

| Franchise contributions for advertising and other services | | 186 | | | 231 | | | 114 | | | 1 | | | — | | | 532 | |

| Add: | | | | | | | | | | | | |

| General and administrative expenses | | 110 | | | 62 | | | 66 | | | 16 | | | 97 | | | 351 | |

| Franchise and property expenses | | 17 | | | 11 | | | 15 | | | 1 | | | — | | | 44 | |

| Franchise advertising and other services expense | | 186 | | | 235 | | | 120 | | | 1 | | | — | | | 542 | |

| Refranchising (gain) loss | | — | | | — | | | — | | | — | | | (3) | | | (3) | |

| Other (income) expense | | — | | | — | | | (6) | | | 9 | | | 41 | | | 44 | |

| Company restaurant profit | | $ | 38 | | | $ | 98 | | | $ | — | | | $ | 26 | | | $ | (4) | | | $ | 158 | |

| Company sales | | $ | 313 | | | $ | 380 | | | $ | 3 | | | $ | 189 | | | $ | — | | | $ | 885 | |

| Company restaurant margin % | | 12.3 | % | | 25.5 | % | | 1.9 | % | | 14.0 | % | | N/A | | 17.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended 12/31/23 |

| | KFC Division | | Taco Bell Division | | Pizza Hut Division | | Habit Burger & Grill Division | | Corporate and Unallocated | | Consolidated |

| GAAP Operating Profit (Loss) | | $ | 329 | | | $ | 286 | | | $ | 99 | | | $ | (10) | | | $ | (95) | | | $ | 609 | |

| Less: | | | | | | | | | | | | |

| Franchise and property revenues | | 444 | | | 281 | | | 168 | | | 3 | | | — | | | 896 | |

| Franchise contributions for advertising and other services | | 175 | | | 207 | | | 110 | | | 1 | | | — | | | 493 | |

| Add: | | | | | | | | | | | | |

| General and administrative expenses | | 118 | | | 63 | | | 66 | | | 18 | | | 88 | | | 353 | |

| Franchise and property expenses | | 15 | | | 11 | | | 1 | | | 1 | | | — | | | 28 | |

| Franchise advertising and other services expense | | 178 | | | 205 | | | 116 | | | 1 | | | — | | | 500 | |

| Refranchising (gain) loss | | — | | | — | | | — | | | — | | | 11 | | | 11 | |

| Other (income) expense | | (1) | | | (2) | | | (4) | | | 11 | | | (4) | | | — | |

| Company restaurant profit | | $ | 20 | | | $ | 75 | | | $ | — | | | $ | 17 | | | $ | — | | | $ | 112 | |

| Company sales | | $ | 142 | | | $ | 331 | | | $ | 3 | | | $ | 171 | | | $ | — | | | $ | 647 | |

| Company restaurant margin % | | 14.0 | % | | 23.1 | % | | (5.4) | % | | 9.4 | % | | N/A | | 17.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended 12/31/24 |

| | KFC Division | | Taco Bell Division | | Pizza Hut Division | | Habit Burger & Grill Division | | Corporate and Unallocated | | Consolidated |

| GAAP Operating Profit (Loss) | | $ | 1,363 | | | $ | 1,049 | | | $ | 373 | | | $ | — | | | $ | (382) | | | $ | 2,403 | |

| Less: | | | | | | | | | | | | |

| Franchise and property revenues | | 1,685 | | | 997 | | | 622 | | | 9 | | | (18) | | | 3,295 | |

| Franchise contributions for advertising and other services | | 613 | | | 708 | | | 378 | | | 3 | | | — | | | 1,702 | |

| Add: | | | | | | | | | | | | |

| General and administrative expenses | | 363 | | | 199 | | | 219 | | | 54 | | | 346 | | | 1,181 | |

| Franchise and property expenses | | 63 | | | 33 | | | 34 | | | 4 | | | — | | | 134 | |

| Franchise advertising and other services expense | | 610 | | | 708 | | | 390 | | | 3 | | | — | | | 1,711 | |

| Refranchising (gain) loss | | — | | | — | | | — | | | — | | | (34) | | | (34) | |

| Other (income) expense | | (3) | | | (1) | | | (16) | | | 10 | | | 44 | | | 34 | |

| Company restaurant profit | | $ | 98 | | | $ | 283 | | | $ | — | | | $ | 59 | | | $ | (8) | | | $ | 432 | |

| Company sales | | $ | 801 | | | $ | 1,155 | | | $ | 8 | | | $ | 588 | | | $ | — | | | $ | 2,552 | |

| Company restaurant margin % | | 12.2 | % | | 24.4 | % | | (0.6) | % | | 10.1 | % | | N/A | | 16.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended 12/31/23 |

| | KFC Division | | Taco Bell Division | | Pizza Hut Division | | Habit Burger & Grill Division | | Corporate and Unallocated | | Consolidated |

| GAAP Operating Profit (Loss) | | $ | 1,304 | | | $ | 944 | | | $ | 391 | | | $ | (14) | | | $ | (307) | | | $ | 2,318 | |

| Less: | | | | | | | | | | | | |

| Franchise and property revenues | | 1,698 | | | 918 | | | 622 | | | 9 | | | — | | | 3,247 | |

| Franchise contributions for advertising and other services | | 648 | | | 654 | | | 383 | | | 2 | | | — | | | 1,687 | |

| Add: | | | | | | | | | | | | |

| General and administrative expenses | | 383 | | | 204 | | | 221 | | | 59 | | | 326 | | | 1,193 | |

| Franchise and property expenses | | 72 | | | 32 | | | 15 | | | 3 | | | 1 | | | 123 | |

| Franchise advertising and other services expense | | 648 | | | 644 | | | 389 | | | 2 | | | — | | | 1,683 | |

| Refranchising (gain) loss | | — | | | — | | | — | | | — | | | (29) | | | (29) | |

| Other (income) expense | | 6 | | | — | | | (11) | | | 10 | | | 9 | | | 14 | |

| Company restaurant profit | | $ | 67 | | | $ | 252 | | | $ | — | | | $ | 49 | | | $ | — | | | $ | 368 | |

| Company sales | | $ | 484 | | | $ | 1,069 | | | $ | 14 | | | $ | 575 | | | $ | — | | | $ | 2,142 | |

| Company restaurant margin % | | 13.7 | % | | 23.7 | % | | 0.1 | % | | 8.5 | % | | N/A | | 17.2 | % |

| | | | | | | | | | | | |

YUM! Brands, Inc.

Segment Results

(amounts in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended 12/31/24 | KFC Division | | Taco Bell Division | | Pizza Hut Division | | Habit Burger & Grill Division | | Corporate and Unallocated | | Consolidated |

| Total revenues | $ | 965 | | | $ | 930 | | | $ | 293 | | | $ | 192 | | | $ | (18) | | | $ | 2,362 | |

| | | | | | | | | | | |

| Company restaurant expenses | 275 | | | 282 | | | 3 | | | 163 | | | 4 | | | 727 | |

| General and administrative expenses | 110 | | | 62 | | | 66 | | | 16 | | | 97 | | | 351 | |

| Franchise and property expenses | 17 | | | 11 | | | 15 | | | 1 | | | — | | | 44 | |

| Franchise advertising and other services expense | 186 | | | 235 | | | 120 | | | 1 | | | — | | | 542 | |

| Refranchising (gain) loss | — | | | — | | | — | | | — | | | (3) | | | (3) | |

| Other (income) expense | — | | | — | | | (6) | | | 9 | | | 41 | | | 44 | |

| Total costs and expenses, net | 588 | | | 590 | | | 198 | | | 190 | | | 139 | | | 1,705 | |

| Operating Profit (Loss) | $ | 377 | | | $ | 340 | | | $ | 95 | | | $ | 2 | | | $ | (157) | | | $ | 657 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended 12/31/23 | KFC Division | | Taco Bell Division | | Pizza Hut Division | | Habit Burger & Grill Division | | Corporate and Unallocated | | Consolidated |

| Total revenues | $ | 761 | | | $ | 819 | | | $ | 281 | | | $ | 175 | | | $ | — | | | $ | 2,036 | |

| | | | | | | | | | | |

| Company restaurant expenses | 122 | | | 256 | | | 3 | | | 154 | | | — | | | 535 | |

| General and administrative expenses | 118 | | | 63 | | | 66 | | | 18 | | | 88 | | | 353 | |

| Franchise and property expenses | 15 | | | 11 | | | 1 | | | 1 | | | — | | | 28 | |

| Franchise advertising and other services expense | 178 | | | 205 | | | 116 | | | 1 | | | — | | | 500 | |

| Refranchising (gain) loss | — | | | — | | | — | | | — | | | 11 | | | 11 | |

| Other (income) expense | (1) | | | (2) | | | (4) | | | 11 | | | (4) | | | — | |

| Total costs and expenses, net | 432 | | | 533 | | | 182 | | | 185 | | | 95 | | | 1,427 | |

| Operating Profit (Loss) | $ | 329 | | | $ | 286 | | | $ | 99 | | | $ | (10) | | | $ | (95) | | | $ | 609 | |

| | | | | | | | | | | |

The above tables reconcile segment information, which is based on management responsibility, with our Consolidated Summary of Results. Corporate and unallocated expenses comprise items that are not allocated to segments for performance reporting purposes.

The Corporate and Unallocated column in the above tables includes, among other amounts, all amounts that we have deemed Special Items. See reconciliation of Non-GAAP Measurements to GAAP Results.

YUM! Brands, Inc.

Segment Results

(amounts in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended 12/31/24 | KFC Division | | Taco Bell Division | | Pizza Hut Division | | Habit Burger & Grill Division | | Corporate and Unallocated | | Consolidated |

| Total revenues | $ | 3,099 | | | $ | 2,860 | | | $ | 1,008 | | | $ | 600 | | | $ | (18) | | | $ | 7,549 | |

| | | | | | | | | | | |

| Company restaurant expenses | 703 | | | 872 | | | 8 | | | 529 | | | 8 | | | 2,120 | |

| General and administrative expenses | 363 | | | 199 | | | 219 | | | 54 | | | 346 | | | 1,181 | |

| Franchise and property expenses | 63 | | | 33 | | | 34 | | | 4 | | | — | | | 134 | |

| Franchise advertising and other services expense | 610 | | | 708 | | | 390 | | | 3 | | | — | | | 1,711 | |

| Refranchising (gain) loss | — | | | — | | | — | | | — | | | (34) | | | (34) | |

| Other (income) expense | (3) | | | (1) | | | (16) | | | 10 | | | 44 | | | 34 | |

| Total costs and expenses, net | 1,736 | | | 1,811 | | | 635 | | | 600 | | | 364 | | | 5,146 | |

| Operating Profit (Loss) | $ | 1,363 | | | $ | 1,049 | | | $ | 373 | | | $ | — | | | $ | (382) | | | $ | 2,403 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended 12/31/23 | KFC Division | | Taco Bell Division | | Pizza Hut Division | | Habit Burger & Grill Division | | Corporate and Unallocated | | Consolidated |

| Total revenues | $ | 2,830 | | | $ | 2,641 | | | $ | 1,019 | | | $ | 586 | | | $ | — | | | $ | 7,076 | |

| | | | | | | | | | | |

| Company restaurant expenses | 417 | | | 817 | | | 14 | | | 526 | | | — | | | 1,774 | |

| General and administrative expenses | 383 | | | 204 | | | 221 | | | 59 | | | 326 | | | 1,193 | |

| Franchise and property expenses | 72 | | | 32 | | | 15 | | | 3 | | | 1 | | | 123 | |

| Franchise advertising and other services expense | 648 | | | 644 | | | 389 | | | 2 | | | — | | | 1,683 | |

| Refranchising (gain) loss | — | | | — | | | — | | | — | | | (29) | | | (29) | |

| Other (income) expense | 6 | | | — | | | (11) | | | 10 | | | 9 | | | 14 | |

| Total costs and expenses, net | 1,526 | | | 1,697 | | | 628 | | | 600 | | | 307 | | | 4,758 | |

| Operating Profit (Loss) | $ | 1,304 | | | $ | 944 | | | $ | 391 | | | $ | (14) | | | $ | (307) | | | $ | 2,318 | |

The above tables reconcile segment information, which is based on management responsibility, with our Consolidated Summary of Results. Corporate and unallocated expenses comprise items that are not allocated to segments for performance reporting purposes.

The Corporate and Unallocated column in the above tables includes, among other amounts, all amounts that we have deemed Special Items. See reconciliation of Non-GAAP Measurements to GAAP Results.

Notes to the Consolidated Summary of Results, Consolidated Balance Sheets

and Consolidated Statements of Cash Flows

(amounts in millions)

(unaudited)

Amounts presented as of and for the quarter and year ended December 31, 2024 are preliminary.

(a)Due to their size and volatility, we have reflected as Special Items those refranchising gains and losses that were recorded in connection with market-wide refranchisings.

(b)In April 2023, we completed our exit from the Russia market by selling the KFC business in Russia to Smart Service Ltd. Our GAAP operating results presented herein for the year ended December 31, 2023, reflect revenues from and expenses to support the Russian operations for KFC prior to the date of sale, within their historical financial statement line items and operating segments. However, given our decision to exit Russia and our pledge to direct any future net profits attributable to Russia subsequent to the date of invasion of Ukraine to humanitarian efforts, we reclassed such net operating profits or losses from the KFC Division segment results to Unallocated Other income (expense). Additionally, we incurred certain expenses related to the dispositions of the business and other one-time costs related to our exit from Russia which we recorded within Corporate and unallocated G&A and Unallocated Franchise and property expenses. The resulting net Operating Loss of $1 million and $11 million for the quarter and year ended December 31, 2023, respectively, have been reflected as Special Items.

(c)We recorded charges of $21 million and $78 million during the quarter and year ended December 31, 2024, respectively and $8 million and $21 million during the quarter and year ended December 31, 2023, respectively, to General and administrative expenses and charges of $1 million during the year ended December 31, 2024, to Other (income) expense related to a resource optimization program. This program has allowed us to reallocate significant resources to accelerate our digital, technology and innovation capabilities to deliver a modern, world-class team member and customer experience and improve unit economics. In 2024, we expanded the program to identify further opportunities to optimize the company’s spending and identify additional, critical areas in which to potentially reallocate resources, both with a goal to enable the acceleration of the Company’s growth rate. Costs incurred to date related to the program primarily include severance associated with positions that have been eliminated or relocated and consultant fees. Due to their scope and size, these charges have been reflected as Special Items.

(d)On January 8, 2025, we terminated our franchise agreements with franchisee IS Gida A.S. (IS Gida), the owner and operator of KFC and Pizza Hut restaurants in Turkey and a subsidiary of IS Holding A.S. (IS Holding), after failure by IS Gida to meet our standards. The termination affects 284 KFC restaurants and 254 Pizza Hut restaurants in Turkey. We also re-acquired the master franchise rights in Germany for KFC and Pizza Hut from the owner of IS Holding in December 2024. As a result, we recorded charges of $37 million to Unallocated Other (income) expense, $18 million to Unallocated Franchise and property revenues and $6 million to Corporate and unallocated General and administrative expenses consisting primarily of transaction costs associated with the German acquisition and termination-related costs associated with the Turkey business in both the quarter and year ended December 31, 2024, that have been reflected as Special Items.

(e)The below table includes the detail of Special Items Tax (Benefit) Expense:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter ended | | Year ended |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Tax (Benefit) on Special Items Operating Profit | $ | (13) | | | $ | (6) | | | $ | (28) | | | $ | (8) | |

| Tax (Benefit) Expense - Other Income tax impacts from decision to exit Russia | — | | | 5 | | | — | | | (7) | |

| Tax (Benefit) - Intra-entity transfers and valuations of intellectual property | (32) | | | (165) | | | (32) | | | (183) | |

| Tax (Benefit) Expense - Other Income tax impacts recorded as Special | (2) | | | 41 | | | (6) | | | 37 | |

| Special Items Tax (Benefit) Expense | $ | (47) | | | $ | (125) | | | $ | (66) | | | $ | (161) | |

Tax (Benefit) Expense on Special Items Operating Profit was determined by assessing the tax impact of each individual component within Special Items based upon the nature of the item and jurisdictional tax law.

Special Items Tax (Benefit) Expense includes $32 million and $183 million of tax benefit recorded in the years ended December 31, 2024 and 2023, respectively, associated with intra-entity transfers and valuations of certain intellectual property (“IP”) rights. The benefit recorded in the quarter and year ended December 31, 2024, resulted primarily from the tax liquidation of certain subsidiaries in Israel and Australia as well as the intra-entity transfer of software from those subsidiaries to subsidiaries in the U.S. The benefit recorded in the quarter and year ended December 31, 2023, resulted primarily from $99 million of deferred tax benefit arising from the remeasurement of deferred tax assets associated with previously transferred IP rights in Switzerland as a result of an increase in our jurisdictional tax rate, as well as a $29 million deferred tax benefit associated with credits granted by local Swiss tax authorities. The benefit recorded in the quarter and year ended December 31, 2023, also includes $30 million of deferred tax benefit associated with the intra-entity transfer of certain Asian IP rights for our brands from subsidiaries in the U.S. and Malta to subsidiaries in Singapore during the quarter.

Other Income Tax impacts recorded as Special in the quarter and year ended December 31, 2023, include $41 million of expense associated with a correction in the timing of capital loss utilization related to refranchising gains previously recorded as Special Items to tax years with a lower statutory tax rate.

v3.25.0.1

Cover Page Document

|

Feb. 06, 2025 |

| Cover Page [Abstract] |

|

| Entity Central Index Key |

0001041061

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 06, 2025

|

| Entity File Number |

1-13163

|

| Entity Registrant Name |

YUM! BRANDS, INC.

|

| Entity Incorporation, State or Country Code |

NC

|

| Entity Tax Identification Number |

13-3951308

|

| Entity Address, Address Line One |

1441 Gardiner Lane,

|

| Entity Address, City or Town |

Louisville,

|

| Entity Address, State or Province |

KY

|

| Entity Address, Postal Zip Code |

40213

|

| City Area Code |

(502)

|

| Local Phone Number |

874-8300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

YUM

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act