The 2010 financial year was a very pleasing one for Hannover Re.

'With net income after tax of EUR 748.9 million we beat our record

result of 2009', Chief Executive Officer Ulrich Wallin noted.

Although operational business was impacted by a heavy major loss

incidence, the resulting strains were more than offset by lower

basic losses and very healthy investment income as well as a

positive special effect associated with a decision of the Federal

Fiscal Court.

2010 financial year

The gross written premium booked by the Hannover Re Group showed

another sharp increase of 11.2% - after vigorous growth in the

previous year - to reach EUR 11.4 billion (EUR 10.3 billion). At

constant exchange rates the premium volume would have risen by

6.8%. The level of retained premium retreated slightly to 90.1%

(92.6%). Net premium earned climbed 7.9% to EUR 10.0 billion (EUR

9.3 billion).

The operating profit (EBIT) improved to EUR 1.2 billion (EUR 1.1

billion). The previous year had been influenced by positive special

effects in life and health reinsurance amounting to EUR 144.7

million. Group net income increased from EUR 733.7 million to EUR

748.9 million. This figure already includes a charge of EUR 69.2

million from the sale of the company's US subsidiary Clarendon. The

result benefited in an amount of EUR 112.2 million on balance from

a positive special effect associated with the decision of the

Federal Fiscal Court regarding the taxation of foreign sourced

income. Yet even without this effect the result would have

surpassed the original profit forecast for 2010. Earnings per share

stood at EUR 6.21 (EUR 6.08).

In the light of this healthy profitability the shareholders'

equity of Hannover Re improved by more than 21.4% on the level as

at 31.12.2009 to reach EUR 4.5 billion (EUR 3.7 billion). The

policyholders' surplus (including minority interests and hybrid

capital) climbed by 24.3% to EUR 7.0 billion (EUR 5.6 billion). The

return on equity amounted to 18.2% (22.4%) and thus comfortably

surpassed the guidance of 15%.

Non-life reinsurance delivers very good profit contribution

despite heavy major loss expenditure 'Even though the competitive

pressure in non-life reinsurance intensified, we are still

satisfied with the development of our operational business. Prices

and conditions were for the most part preserved on a stable level

thanks to the largely disciplined underwriting practice among

reinsurers', Mr. Wallin stressed.

Gross written premium in the non-life reinsurance business group

increased as expected by 10.3% to EUR 6.3 billion (EUR 5.7

billion). At constant exchange rates - especially against the US

dollar - growth would have come in at 6.7%. The level of retained

premium fell to 88.9% (94.1%). Net premium earned climbed by 3.1%

to EUR 5.4 billion (EUR 5.2 billion).

The situation as regards major claims was extremely strained in

2010, causing total net expenditure of EUR 661.9 million (EUR 239.7

million) for Hannover Re; the expected level had been around EUR

500 million.

Three severe earthquakes dominated the year under review: the

largest single event for Hannover Re was the earthquake in Chile

with a net loss burden of EUR 181.9 million. The earthquake in New

Zealand gave rise to net loss expenditure of EUR 113.8 million. On

account of lower insured values in Haiti the loss amount here was

relatively moderate at EUR 27.2 million. Also noteworthy were

winter storm 'Xynthia' in Europe, numerous flood events in various

parts of the world and the loss of the 'Deepwater Horizon' drilling

rig in the Gulf of Mexico.

Despite the heavy burden of major losses the combined ratio

increased only modestly from 96.6% to 98.2%. The underwriting

result for non-life reinsurance contracted accordingly by 42.6% to

EUR 82.4 million (EUR 143.5 million). The operating profit (EBIT)

climbed to EUR 879.6 million (EUR 731.4 million). Group net income

in the non-life reinsurance business group surged by an appreciable

22.9% to EUR 581.0 million (EUR 472.6 million). Earnings per share

amounted to EUR 4.82 (EUR 3.92).

Life and health reinsurance books further substantial growth 'We

again accomplished our growth targets in 2010', Mr. Wallin

emphasised. 'This was assisted by the very positive development of

our business in the United Kingdom, most notably in the area of

longevity risks.' Particularly vigorous growth was also recorded in

China, where Hannover Re was the first reinsurer to write

liquidity-affecting financing contracts.

Gross written premium in life and health reinsurance increased

by 12.4% to EUR 5.1 billion (EUR 4.5 billion) in the year under

review. At constant exchange rates growth would have amounted to

6.8%. Net premium earned surged by 14.1% to EUR 4.7 billion (EUR

4.1 billion). The life and health reinsurance business group now

contributes 44.5% of Hannover Re's total premium volume.

The operating profit (EBIT) in life and health reinsurance

declined to EUR 284.4 million (EUR 374.7 million). EBIT would have

grown by 24% if positive special effects in the previous year

associated with the acquisition of the US ING life reinsurance

portfolio as well as fair value adjustments were factored out. The

EBIT margin of 6.1% was in line with expectations. Group net income

in life and health reinsurance totalled EUR 219.6 million (EUR

298.1 million); earnings per share came in at EUR 1.82 (EUR

2.47).

Very good investment income The portfolio of assets under own

management grew substantially to EUR 25.4 billion (EUR 22.5

billion) on the back of positive cash inflows from the technical

account and changes in fair values. Even though interest rate

levels were lower overall, ordinary investment income therefore

surpassed the previous year (EUR 810.5 million) to reach EUR 880.5

million.

Income from investments under own management increased by 11.7%

to EUR 942.5 million (EUR 843.6 million). Including income on funds

withheld and contract deposits, net investment income totalled EUR

1.3 billion (EUR 1.1 billion). The return on investment stood at

3.9% (4.0%).

In the third quarter of 2010 Hannover Re began to move back into

listed equities with a limited budget. The equity allocation at

year-end was 2.1%.

Increased dividend proposal for 2010: EUR 2.30 'In view of our

gratifying Group net income and our dividend policy of paying out

35% to 40% of our profit, the Executive Board and Supervisory Board

will propose to the Annual General Meeting that the dividend should

be increased by EUR 0.20 relative to the previous year to an amount

of EUR 2.30 per share', Mr. Wallin stated. Outlook for 2011

Hannover Re is optimistic about the prospects for the current

financial year. The treaty renewals as at 1 January 2011 in

non-life reinsurance passed off better than expected. The company

anticipates premium growth of up to 3% and a good profit

contribution for the current financial year. In 2011 Hannover Re

will again concentrate - in keeping with its strategy of active

cycle management - on segments in which adequate premiums can be

obtained or prices are rising. The more exacting requirements for

risk capital at insurance companies (Solvency II), for whom the

transfer of risk to reinsurers with good ratings offers an

economically attractive alternative, are expected to open up

potential growth opportunities.

In life and health reinsurance the company is looking to

generate growth of 10% to 12% in net premium. In developed

insurance markets such as the United States, United Kingdom and

Germany the ageing of the population should lead to stronger

demand, especially for annuity and health insurance products.

Progressive urbanisation in major emerging markets such as China,

India and Brazil is producing a rapidly expanding middle class with

an increasing need for insurance solutions.

For 2011 Hannover Re anticipates a return on investment of

around 3.5%.

Hannover Re is looking to generate a good result for the full

2011 financial year. 'Assuming that the burden of major losses does

not significantly exceed the anticipated level of roughly EUR 530

million and provided there are no drastically adverse movements on

capital markets, we continue to expect Group net income in the

order of EUR 650 million for the current year', Mr. Wallin stated.

Hannover Re stands by its targeted payout ratio in the range of 35%

to 40% of IFRS Group net income after tax.

For further information please contact:

Corporate Communications: Karl Steinle (tel. +49 511 5604-1500,

e-mail: karl.steinle@hannover-re.com)

Media Relations: Gabriele Handrick (tel. +49 511 5604-1502,

e-mail: gabriele.handrick@hannover-re.com)

Investor Relations: Klaus Paesler (tel. +49 511 5604-1736,

e-mail: klaus.paesler@hannover-re.com)

Please visit: www.hannover-re.com

Hannover Re, with a gross premium of around EUR 11 billion, is

the third-largest reinsurer in the world. It transacts all lines of

non-life and life and health reinsurance. It maintains business

relations with more than 5,000 insurance companies in about 150

countries. Its worldwide network consists of more than 100

subsidiaries, branch and representative offices on all five

continents with a total staff of roughly 2,200. The rating agencies

most relevant to the insurance industry have awarded Hannover Re

very strong insurer financial strength ratings (Standard &

Poor's AA- 'Very Strong' and A.M. Best A 'Excellent').

Disclaimer: Some of the statements in this press release may be

forward-looking statements or statements of future expectations

based on currently available information. Such statements are

naturally subject to risks and uncertainties. Factors such as the

development of general economic conditions, future market

conditions, unusual catastrophic loss events, changes in the

capital markets and other circumstances may cause the actual events

or results to be materially different from those anticipated by

such statements. Hannover Re does not make any representation or

warranty, express or implied, as to the accuracy, completeness or

updated status of such statements. Therefore, in no case whatsoever

will Hannover Re and its affiliate companies be liable to anyone

for any decision made or action taken in conjunction with the

information and/or statements in this press release or for any

related damages.

Key figures of the Hannover Re Group (IFRS basis) for the full

2010 financial year

in EUR million 2010 20091) +/- previous year

Gross written premium 11,428.7 10,274.8 +11.2% Net premium earned

10,047.0 9,307.2 +7.9% Net underwriting result (185,1) (100.4)

+84.3% Net investment income2) 1,258.9 1,120.4 +12.4% Operating

profit / loss (EBIT) 1,173.8 1,142.5 +2.7% Group net income (loss)

748.9 733.7 +2.1% Earnings per share in EUR 6.21 6.08 +2.1%

Retention 90.1% 92.6% EBIT margin4) 11.7% 12.3% Return on equity

(after tax) 18.2% 22.4%

in EUR million 2010 20091) +/- previous year

Policyholders' surplus3) 6,987.0 5,621.6 +24.3% Investments (excl.

funds held by ceding 25,411 22,507 companies) .1 .0 +12.9% 46,725

40,837 Total assets .3 .6 +14.4% Book value per share in EUR 37.39

30.80 +21.4%

Non-life reinsurance

in EUR million 2010 20091) +/- previous year

Gross written premium 6,339.3 5,746.6 +10.3% Net premium earned

5,393.9 5,229.5 +3.1% Net underwriting result 82.4 143.5 -42.6%

Operating profit / loss (EBIT) 879.6 731.4 +20.3% Group net income

(loss) 581.0 472.6 +22.9% Retention 88.9% 94.1% Combined Ratio5)

98.2% 96.6% EBIT margin4) 16.3% 14.0%

Life and health reinsurance

in EUR million 2010 20091) +/- previous year

Gross written premium 5,090.1 4,529.3 +12.4% Net premium earned

4,653.9 4,078.7 +14.1% Operating profit / loss (EBIT) 284.4 374.7

-24.1% Group net income (loss) 219.6 298.1 -26.3% Retention 91.7%

90.7% EBIT margin4) 6.1% 9.2%

1) Figures adjusted in connection with the acquisition of the

ING life reinsurance portfolio

2) Including expense on funds withheld and contract deposits

3) Total shareholders' equity + minority interests + hybrid

capital

4) Operating profit / loss (EBIT) / net premium earned

5) Including interest income on contract deposits and funds

withheld

Key figures of the Hannover Re Group (IFRS basis) for

Q4/2010

in EUR million Q4/2010 Q4/20091) +/- previous

year Gross written premium 2,874.1 2,603.3 +10.4% Net premium

earned 2,575.8 2,580.8 -0.2% Net underwriting result (32.1) (16.5)

+94.8% Net investment income2) 386.7 269.9 +43.3% Operating profit

/ loss (EBIT) 311.8 290.7 +7.3% Group net income (loss) 166.9 137.1

+21.7% Earnings per share in EUR 1.38 1.13 +21.7% Retention 87.6%

93.6% EBIT margin4) 12.1% 11.3% Return on equity (after tax)5)

14.9% 15.1%

Non-life reinsurance

in EUR million Q4/2010 Q4/20091) +/- previous

year Gross written premium 1,514.4 1,341.4 +12.9% Net premium

earned 1,327.1 1,464.1 -9.4% Net underwriting result 50.0 45.4

+10.0% Operating profit / loss (EBIT) 246.2 254.4 -3.2% Group net

income (loss) 143.3 141.3 +1.5% Retention 83.6% 96.5% Combined

Ratio6) 95.9% 95.9% EBIT margin4) 18.5% 17.4%

Life and health reinsurance

in EUR million Q4/2010 Q4/20091) +/- previous

year Gross written premium 1,359.8 1,263.0 +7.7% Net premium earned

1,249.0 1,117.7 +11.7% Operating profit / loss (EBIT) 70.7 36.4

+94.3% Group net income (loss) 49.4 18.2 +171.4% Retention 92.1%

90.4% EBIT margin4) 5.7% 3.3%

1) Figures adjusted in connection with the acquisition of the

ING life reinsurance portfolio

2) Including expense on funds withheld and contract deposits

3) Total shareholders' equity + minority interests + hybrid

capital

4) Operating profit / loss (EBIT) / net premium earned

5) Annualised

6) Including interest income on contract deposits and funds

withheld

End of Corporate News

---------------------------------------------------------------------

Language: English Company: Hannover

Rückversicherung AG Karl-Wiechert-Allee 50 30625 Hannover

Deutschland Phone: +49-(0)511-5604-1500 Fax: +49-(0)511-5604-1648

E-mail:

info@hannover-re.com

Internet:

www.hannover-re.com

ISIN: DE0008402215 WKN: 840 221 Listed:

Regulierter Markt in Frankfurt (Prime

Standard), Hannover; Freiverkehr in Berlin, Düsseldorf, Hamburg,

München, Stuttgart; Terminb�rse EUREX

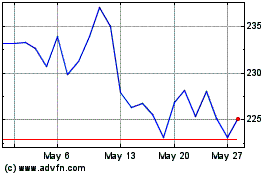

Hannover Ruck (TG:HNR1)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hannover Ruck (TG:HNR1)

Historical Stock Chart

From Nov 2023 to Nov 2024