In the news release, Anaconda Mining Reports Upgraded and

Expanded Gold Mineral Resource at its Goldboro Project in Support

of Ongoing Feasibility Study, issued 30-Oct-2019 by Anaconda Mining Inc. over CNW, we

are advised by the company that the original release incorrectly

noted in the Mineral Resource footnotes and text describing the

resource modelling parameters that the open pit and underground

Mineral Resources were based on a gold price of US$1,550. The actual long-term metal price used

to report the Mineral Resource is US$1,350 (or approximately CAD$1,753/oz). The Mineral Resource Statement

remains unchanged. The complete, corrected release follows:

Anaconda Mining Reports Upgraded and Expanded Gold Mineral Resource

at its Goldboro Project in Support of Ongoing Feasibility Study

TORONTO, Oct. 30, 2019 /CNW/ - Anaconda Mining Inc.

("Anaconda" or the "Company") (ANX: TSX)(OTCQX: ANXGF) is pleased

to announce an update to the Mineral Resource Estimate ("Mineral

Resource") prepared in accordance with National Instrument 43-101

("NI 43-101") for the 100% owned Goldboro Gold Project ("Goldboro"

or the "Project") located in Guysborough County, Nova Scotia, Canada (Exhibit A). The current

upgraded and expanded Measured and Indicated portion of the Mineral

Resource will form the basis of the mine plan to be outlined in the

Goldboro Feasibility Study anticipated in Q4 2019.

Highlights of the Goldboro Gold Project Updated Mineral

Resource (effective August 21,

2019)

- An 6.9% increase in combined open pit and underground grade in

Measured and Indicated Mineral Resources including a coincident

11.9% increase in underground gold grade (6.18 g/t gold) at a 2.0

grams per tonne "g/t" cut-off;

- A 15.9% increase in combined open pit and underground ounces

within the Measured and Indicated Mineral Resource categories

bringing the total to 698,600 ounces (4.096 million tonnes at 5.30

g/t gold);

- A 51.2% increase in combined open pit and underground Inferred

Mineral Resource ounces and a coincident 6.9% increase in gold

grade bringing the total to 685,100 ounces (3.007 million tonnes at

7.09 g/t gold);

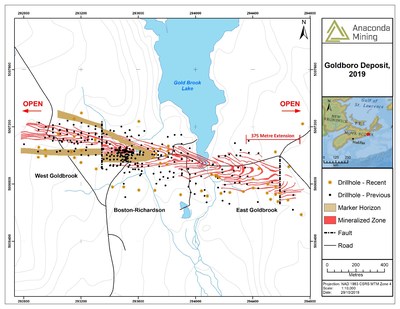

- Expanded the deposit to the east by 375 metres and added 21 new

mineralized zones to the Mineral Resource model (Exhibit A);

The following table summarizes the updated Mineral Resource with

an effective date of August 21, 2019

and the comparative changes from the Previous Mineral Resource (as

defined below) effective July 19,

2018 and filed in December

2018.

|

Category

|

Tonnes*

|

Au*

|

Troy

Ounces*

|

% Change in

Grade

|

% Change in

Ounces

|

|

('000)

|

(g/t)

|

from July

2018**

|

from July

2018**

|

|

Measured

|

1,811

|

4.37

|

254,400

|

+

3.3%

|

+

16.0%

|

|

Indicated

|

2,285

|

6.05

|

444,200

|

+

9.9%

|

+

15.9%

|

|

Measured +

Indicated

|

4,096

|

5.30

|

698,600

|

+

6.9%

|

+

15.9%

|

|

Inferred

|

3,007

|

7.09

|

685,100

|

+

6.9%

|

+

51.2%

|

* Combined Open Pit and Underground Mineral Resources. Open

Pit Mineral Resource based on a 0.5 g/t Au cut-off grade;

Underground Mineral Resource based on 2.0 g/t Au cut-off

grade.

** Refer to the Company's technical report entitled "Anaconda

Mining Inc., Goldboro Project Mineral Resource Update and

Preliminary Economic Assessment" for further details regarding the

previous Mineral Resource with an effective date of July 19, 2018 (the "Previous Mineral

Resource").

"Anaconda continues to successfully expand the Goldboro

Deposit which now contains 698,600 ounces of combined Measured and

Indicated Mineral Resource and a further 685,100 ounces of Inferred

Mineral Resource, making it the single largest gold deposit in

Nova Scotia and remains open for

expansion. Since acquiring the Project just over two years ago, we

have increased Measured and Indicated Mineral Resource categories

by 52.7% and the Inferred Mineral Resource category by 83.7% all at

a combined cost of less than $10 per

ounce, demonstrating the value creation potential of the Project.

With an 11.9% increase in the average underground Measured and

Indicated Mineral Resource grade to 6.18 g/t gold, this robust

Mineral Resource update will provide the basis for a new optimized

Goldboro mine plan to support the

ongoing Feasibility Study, which is expected to be released by year

end."

~ Kevin Bullock, President and

CEO, Anaconda Mining Inc.

Goldboro Gold Project – Mineral Resource Estimate (effective

August 21, 2019)

The Mineral Resource was prepared by WSP Canada Inc. under the

supervision of Todd McCracken, P.

Geo., an "Independent Qualified Person", as defined in NI

43-101. The Mineral Resource is based on validated results of

485 surface and underground drill holes, for a total of 93,916

metres of diamond drilling that was completed between 1984 and

August 21st, 2019. The Mineral

Resource includes 27,467 metres of drilling conducted by Anaconda

including 15,112 metres of diamond drilling in 57 holes since the

Previous Mineral Resource estimate of July

19, 2018. The effective date of this Mineral Resource is

August 21, 2019.

Mineral Resource Statement for the Goldboro Gold Project

(effective August 21, 2019)

^:

|

Resource

Type

|

Au

Cut-off

|

Category

|

Tonnes

|

Au

|

Troy

Ounces

|

|

(g/t)

|

|

('000)

|

(g/t)

|

|

|

Open Pit

|

0.5

|

Measured

|

844

|

2.40

|

65,200

|

|

Indicated

|

111

|

2.63

|

9,400

|

|

Measured +

Indicated

|

955

|

2.43

|

74,600

|

|

Inferred

|

22

|

2.79

|

2,000

|

|

Underground

|

2.0

|

Measured

|

967

|

6.08

|

189,200

|

|

Indicated

|

2,174

|

6.22

|

434,800

|

|

Measured +

Indicated

|

3,141

|

6.18

|

624,000

|

|

Inferred

|

2,985

|

7.12

|

683,200

|

|

Combined*

|

0.5/2.0

|

Measured

|

1,811

|

4.37

|

254,400

|

|

Indicated

|

2,285

|

6.05

|

444,200

|

|

Measured +

Indicated

|

4,096

|

5.30

|

698,600

|

|

Inferred

|

3,007

|

7.09

|

685,100

|

|

^Mineral

Resource Estimate Notes

|

|

1.

|

Mineral Resources

were prepared in accordance with NI 43-101 and the CIM Definition

Standards (2014). Mineral resources that are not mineral reserves

do not have demonstrated economic viability. This estimate of

mineral resources may be materially affected by environmental,

permitting, legal, title, taxation, sociopolitical, marketing, or

other relevant issues.

|

|

2.

|

Open pit Mineral

Resources are reported at a cut-off grade of 0.5 g/t gold that is

based on a gold price of CAD$1,753/oz (~US$1,350/oz). and a gold

processing recovery factor of 95%.

|

|

3.

|

Underground

Mineral Resource is reported at a cut-off grade of 2.0 g/t gold

that is based on a gold price of CAD$1,753/oz (~US$1,350/oz). and a

gold processing recovery factor of 95%.

|

|

4.

|

Appropriate mining

costs, processing costs, metal recoveries, and inter ramp pit slope

angles were used by WSP to generate the pit shell.

|

|

5.

|

Appropriate mining

costs, processing costs, metal recoveries and stope dimensions were

used by WSP to generate the potential underground

resource.

|

|

6.

|

Rounding may

result in apparent summation differences between tonnes, grade, and

contained metal content.

|

|

7.

|

Tonnage and grade

measurements are in metric units. Contained gold ounces are in troy

ounces.

|

|

8.

|

Contributing assay

composites were capped at 80 g/t Au.

|

|

9.

|

A bulk density

factor was calculated for each block based on a regression

formula.

|

Modeling was performed using GEOVIA Surpac®

2019 software with gold grades estimated using ordinary kriging

(OK) interpolation methodology. Samples were composited at 1.0

metre down hole and composites were capped at 80 g/t. Measured

mineral resources are defined as all interpolated blocks within the

first search pass and any interpolated block in the second pass

with at least 8 contributing composites samples and no more than

two composites from any one drill hole. Indicated Mineral Resources

are defined as all interpolated blocks within the second search

pass not classified as Measured and any interpolated block in the

third pass with at least 6 contributing composites samples and no

more than two composites from any one drill hole. Inferred Mineral

Resources are defined as all remaining interpolated blocks that

occur within the various belt model solids. Block size is 1 metre *

by 1 metre (y) by 1 metre (z). The drilling-defined deposit is

divided into three spatial domains for modeling purposes, these

being (1) the Boston Richardson Zone, (2) the West Goldbrook Zone

and (3) the East Goldbrook Zone. At a long-term metal price of

CAD$1,753 (~$US1,350) per ounce, reasonable prospects are

considered to exist for eventual economic extraction of Mineral

Resources defined at a 0.5 g/t Au cut-off value within limits of

the conceptual final pit shell prepared by WSP. Mineral Resources

defined external to this pit shell are reported at a 2.0 g/t Au

cut-off value and are considered to have reasonable prospects for

eventual economic extraction using underground mining methods at

the same long-term gold price. Additional information about the

Mineral Resource modeling methodology will be documented in the

upcoming NI 43-101 technical report (the "Technical Report").

Technical Report and Qualified Persons

A Technical Report prepared in accordance with NI 43-101 for the

Goldboro Gold Project will be filed on SEDAR (www.sedar.com) within

45 days of this news release. Readers are encouraged to read the

Technical Report in its entirety, including all qualifications,

assumptions and exclusions that relate to the Mineral Resource. The

Technical Report is intended to be read as a whole, and sections

should not be read or relied upon out of context.

This news release has been reviewed and approved by

Paul McNeill, P. Geo., VP

Exploration with Anaconda Mining Inc., a "Qualified Person", and

Todd McCracken, P. Geo., Manager –

Mining, WSP Canada Inc., an "Independent Qualified Person" under

National Instrument 43-101 Standard for Disclosure for Mineral

Projects.

ABOUT ANACONDA

Anaconda is a TSX and OTCQX-listed gold mining, development, and

exploration company, focused in Atlantic

Canada. The company operates mining and milling operations

in the prolific Baie Verte Mining District of Newfoundland which includes the

fully-permitted Pine Cove Mill, tailings facility and deep-water

port, as well as ~11,000 hectares of highly prospective mineral

lands including those adjacent to the past producing, high-grade

Nugget Pond Mine at its Tilt Cove Gold Project. Anaconda is also

developing the Goldboro Gold Project in Nova Scotia, a high-grade resource and the

subject of an on-going feasibility study.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking information"

within the meaning of applicable Canadian and United States securities legislation.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as "plans", "expects", or "does

not expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "does not anticipate", or

"believes" or variations of such words and phrases or state that

certain actions, events or results "may", "could", "would",

"might", or "will be taken", "occur", or "be achieved".

Forward-looking information is based on the opinions and estimates

of management at the date the information is made, and is based on

a number of assumptions and is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Anaconda to be

materially different from those expressed or implied by such

forward-looking information, including but not limited to risks

associated with the exploration, development and mining such as

economic factors as they effect exploration, future commodity

prices, changes in foreign exchange and interest rates, actual

results of current production, development and exploration

activities, government regulation, political or economic

developments, environmental risks, permitting timelines, capital

expenditures, operating or technical difficulties in connection

with development activities, employee relations, the speculative

nature of gold exploration and development, including the risks of

diminishing quantities of grades of resources, contests over title

to properties, and changes in project parameters as plans continue

to be refined as well as those risk factors discussed in Anaconda's

annual information form for the year ended December 31, 2018, available on www.sedar.com.

Although Anaconda has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such information.

Accordingly, readers should not place undue reliance on

forward-looking information. Anaconda does not undertake to update

any forward-looking information, except in accordance with

applicable securities laws.

SOURCE Anaconda Mining Inc.