ART Advanced Research Technologies Inc. (ART) (TSX: ARA), a

Canadian medical device company and a leader in optical molecular

imaging products for the healthcare and pharmaceutical industries,

is pleased to announce its financial results for the second quarter

ended June 30, 2008. ART reported revenues of $1,212,860 for the

three-month period ended June 30, 2008, compared to $41,951 for the

same quarter a year ago. For the six-month period ended June 30,

2008, revenues were $2,454,781, compared to $436,165, for the

six-month period ended June 30, 2007. For the 2008 second quarter,

the operating loss decreased by $2,181,181, or 67%, to $1,090,963,

from $3,272,144 for the same period a year ago. For the six-month

period ended June 30, 2008, the operating loss was $2,425,284,

compared to $5,476,408, for the six-month period ended June 30,

2007. ART incurred a net loss for the three-month period ended June

30, 2008, of $1,101,220 or $0.01 per share, compared to $3,170,391

or $0.06 per share for the three-month period ended June 30, 2007.

For the six-month period ended June 30, 2008, the net loss was

$2,380,676 or $0.02 per share, compared to $4,739,077 or $0.08 per

share, for the six-month period ended June 30, 2007. All dollar

amounts referenced herein are in U.S. dollars, unless otherwise

stated.

2008 Second Quarter Highlights

- ART identified and secured regional distribution partners in

several key geographic areas for the distribution of its

preclinical product offering, notably Asia and Europe.

- ART announced the closing of a private placement of $1.1

million in preferred shares.

Post Quarter Events

- ART secured three orders, for a total of three Optix� units,

for which it expects to recognize the revenue over the next few

weeks for two of them and by the end of the year for the third.

- ART announced a private placement of approximately $6.0million

in preferred shares.

Revenues

For the three-month period ended June 30, 2008, revenues were

$1,212,860, compared to $41,951 for the same period ended June 30,

2007. Sales resulting from products amounted to $37,177 in the

quarter ended June 30, 2008, compared to $41,951 for the same

quarter of last year. Revenues resulting from sales of products for

the six-month period ended June 30, 2008 amounted to $1,243,389,

compared to $436,165 for the same period of last year. The increase

in product sales in 2008 when compared to 2007 is explained by the

Company's transition to a direct distribution model. By selling

directly to its customers, the Company now generates a higher

revenue per system since it does not have to provide discounts to

an exclusive distributor. During the quarters ended June 30, 2008

and 2007, the Company sold only Fenestra� products. There were no

Optix� or SoftScan� units sold during those periods (one SoftScan

unit and one Optix unit during the six-month period ended June 30,

2008 and one Optix unit for the six-month period ended June 30,

2007). No add-ons resulted in the conversion of Optix systems to

the MX2 version during the quarters ended June 30, 2008 and 2007

(two converted systems during the six-month period ended June 30,

2008 and no systems for the six-month period ended June 30, 2007).

During the three-month period ended June 30, 2008, the Company

recognized revenues totalling $1,075,517 from services rendered on

behalf of GE as ART is completing the transition out of the Optix

distribution agreement with GE. Revenues from service contracts in

the amount of $43,031 were also recognized over the term of the

contracts, which is between 12 to 24 months. During the same period

ended June 30, 2007, there were no sales of services.

Gross Margin

During the three and six-month periods ended June 30, 2008, ART

generated a gross margin of $32,775 or 88% and $991,194 or 80%

respectively from the sales of its products compared to $39,243 or

94% and $213,973 or 49% for the same periods in the previous year.

The gross margin generated on the sales of services and other

revenues was 97% and 95% respectively for the three-month and the

six-month periods ended June 30, 2008. The increase of the gross

margin in the six-month period ended in 2008, compared to the same

period of the previous year, is primarily due to the services and

other revenues as well as the sale of the SoftScan unit in the

first quarter of 2008, where the gross margin represents almost

100% of the sale, given that this unit has been sold as a prototype

and therefore expensed as incurred in previous years.

Operating Expenses

The Company's research and development ("R&D") expenditures

for the three-month period ended June 30, 2008, net of investment

tax credits, amounted to $618,279, compared to $1,689,083 for the

same period ended June 30, 2007. For the six-month period ended

June 30, 2008, R&D expenditures, net of investment tax credits,

were $1,472,929, compared to $2,897,498 for the six-month period

ended June 30, 2007. The R&D expenditures during the

three-month and the six-month periods ended June 30, 2008,

decreased by 63% and 49% compared to the same periods in 2007. The

decrease was related to the medical sector given that the SoftScan

program reached important approval milestones in the first quarter

of 2007, by obtaining the CE marking for Europe. As well, in the

preclinical sector, a decrease in R&D expenses was due to the

completion of the project leading to the new Optix MX2 system. The

costs associated with the achievement of these milestones,

therefore, did not have to be incurred again in the first half of

2008.

Selling, general, and administrative ("SG&A") expenses for

the three-month period ended June 30, 2008, totaled $1,468,810,

compared to $1,533,667 for the same period ended June 30, 2007. For

the six-month period ended June 30, 2008, SG&A expenses were

$2,752,064, compared to $2,618,195 for the six-month period ended

June 30, 2007. The SG&A expenses decreased by $64,857 during

the three-month period ended June 2008 while they increased by

$133,869 in the six-month period ended June 30, 2008, compared to

the same periods of 2007. The decrease was mainly due to a decrease

in professional fees, while the increase is explained by the hiring

of the new direct sales force, which was effective in the first

quarter of 2008, and the direct marketing expenses incurred to

support the commercialization of the Optix, SoftScan and Fenestra

products.

Net Loss

The net loss for the three-month period ended June 30, 2008 was

$1,101,220 or $0.01 per share, compared to $3,170,391 or $0.06 per

share for the three-month period ended June 30, 2007. For the

six-month period ended June 30, 2008, the net loss was $2,380,676

or $0.02 per share, compared to $4,739,077 or $0.08 per share, for

the six-month period ended June 30, 2007.

Financial Outlook

As part of its commercial strategy, the Company intends to sell

some of its existing SoftScan prototypes, which could represent

cash inflows of up to $1.5 million. Moreover, $2 to $3 million in

revenue could be generated through its Optix inventory, with

minimal investment. On a proforma basis following the $6.0 million

round of financing, the Company has in cash and cash equivalents

$7.1 million, a working capital of $9.2 million.

The financial statements, accompanying notes to the financial

statements, and Management's Discussion and Analysis for the

three-month period ended June 30, 2008, will be available online at

www.sedar.com, or at www.art.ca, in the "Investors" section.

Summary financial tables are provided below. A detailed list of the

risks and uncertainties affecting the Company can be found in the

Management's Discussion and Analysis for the year ended December

31, 2007, and in the Company's most recent Annual Information Form,

available on SEDAR at www.sedar.com.

Conference Call

ART will host a conference call today at 5:00 PM (EDT). The

telephone number to access the conference call is (514) 861-1531

when dialing within the Montreal area, or (877) 667-7766 for the

rest of North America. Outside of North America, please dial (514)

861-1531. A replay of the call will be available until August 26,

2008. To listen to the replay from the Montreal area, please dial

(514) 861-2272, or, (800) 408-3053 for the rest of North America.

From outside of North America, please dial (514) 861-2272. The

access code for the replay is 3267501#.

About ART

ART Advanced Research Technologies Inc. is a leader in molecular

imaging products for the healthcare and pharmaceutical industries.

ART has developed products in medical imaging, medical diagnostics,

disease research, and drug discovery with the goal of bringing new

and better treatments to patients faster. The Optix� optical

molecular imaging system, designed for monitoring physiological

changes in living systems at the preclinical study phases of new

drugs, is used by industry and academic leaders worldwide. The

SoftScan� optical medical imaging device is designed to improve the

diagnosis and treatment of breast cancer. Finally, the Fenestra�

line of molecular imaging contrast products provides image

enhancement for a wide range of preclinical Micro CT applications

allowing scientists to see greater detail in their imaging studies,

with potential extension into other major imaging modalities. ART

is commercializing some of these products in a global strategic

alliance with GE Healthcare, a world leader in mammography and

imaging. ART's shares are listed on the TSX under the ticker symbol

ARA. For more information on ART, visit our website at

www.art.ca.

This press release may contain forward-looking statements

subject to risks and uncertainties that would cause actual events

to differ materially from expectations. These risks and

uncertainties are described in the most recent Annual Information

Form and the financial statements for the year ended December 31,

2007, available on SEDAR (www.sedar.com).

Financial Statements (in U.S. dollars)

ART Advanced Research Technologies Inc.

Balance sheets

(In U.S. dollars)

June 30, 2008 December 31, 2007

(unaudited)

--------------------------------------------------------------------------

ASSETS

Current assets

Cash $537,291 $561,325

Term deposits, 2.4%

maturing in July 2008 589,044 3,026,329

Accounts receivable 2,055,490 1,768,146

Investment tax credits receivable 627,510 1,558,709

Inventories 1,668,130 1,510,499

Prepaid expenses 803,212 260,199

--------------------------------------------------------------------------

6,280,677 8,685,207

Property and equipment 571,895 551,210

Patents 1,936,689 2,135,855

Deferred development costs 1,989,832 1,268,438

--------------------------------------------------------------------------

$10,779,093 $12,640,710

--------------------------------------------------------------------------

--------------------------------------------------------------------------

LIABILITIES

Current liabilities

Bank loan 589,044 605,266

Accounts payable and

accrued liabilities 2,156,652 2,652,219

Deferred revenues 199,314 156,167

Deferred grant 153,961 152,305

Current portion of obligations

under capital leases 19,968 -

--------------------------------------------------------------------------

3,118,939 3,565,957

Obligations under capital leases 89,784 -

SHAREHOLDERS' EQUITY

Share capital and share

purchase warrants 33,317,942 32,217,942

Contributed surplus 4,611,496 4,537,336

Deficit (33,470,133) (31,007,264)

Accumulated other comprehensive income 3,111,065 3,326,739

--------------------------------------------------------------------------

7,570,370 9,074,753

--------------------------------------------------------------------------

$10,779,093 $12,640,710

--------------------------------------------------------------------------

--------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Shareholders's Equity

As at June 30, 2008

(In U.S. dollars)

Common Shares Preferred Shares

--------------------------------------------------------------------------

Number Amount Number Amount

--------------------------------------------------------------------------

Balance as at

January 1, 2007 52,248,981 $14,561,504 8,341,982 $7,907,043

Net loss

Translation adjustment

--------------------------------------------------------------------------

Comprehensive loss

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Issue of shares for

business acquisition 162,369 95,262

Issue of shares for

cash 42,129,242 8,373,257

Issue of share

purchase warrants

Share and share purchase

warrant issue expenses

Stock-based compensation

Expired warrants

--------------------------------------------------------------------------

Balance as at

December 31, 2007 94,540,592 $23,030,023 8,341,982 $7,907,043

--------------------------------------------------------------------------

--------------------------------------------------------------------------

(unaudited)

Balance as at

January 1, 2008 94,540,592 $23,030,023 8,341,982 $7,907,043

Net loss

Translation adjustment

--------------------------------------------------------------------------

Comprehensive income

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Issue of shares for cash 7,008,868 1,100,000

Share issue expenses

Stock-based compensation

Expired warrants

--------------------------------------------------------------------------

Balance as at

June 30, 2008 94,540,592 $23,030,023 15,350,850 $9,007,043

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Share Capital

and Share

Warrants Purchase

Warrants

--------------------------------------------------------------------------

Number Amount Total

--------------------------------------------------------------------------

Balance as at January 1, 2007 3,958,523 $1,562,623 $24,031,170

Net loss

Translation adjustment

--------------------------------------------------------------------------

Comprehensive loss

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Issue of shares for

business acquisition 95,262

Issue of shares for cash 8,373,257

Issue of share

purchase warrants 2,175,841 497,288 497,288

Share and share purchase

warrant issue expenses

Stock-based compensation

Expired warrants (1,278,573) (779,035) (779,035)

--------------------------------------------------------------------------

Balance as at

December 31, 2007 4,855,791 $1,280,876 $32,217,942

--------------------------------------------------------------------------

(unaudited)

Balance as at January 1, 2008 4,855,791 $1,280,876 $32,217,942

Net loss

Translation adjustment

--------------------------------------------------------------------------

Comprehensive income

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Issue of shares for cash 1,100,000

Share issue expenses

Stock-based compensation

Expired warrants

--------------------------------------------------------------------------

Balance as at June 30, 2008 4,855,791 $1,280,876 $33,317,942

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Accumulated

Other

Contributed Comprehensive

Surplus Deficit Income Total

--------------------------------------------------------------------------

Balance as at

January 1, 2007 $3,586,059 $(21,247,643) $1,841,127 $8,210,713

Net loss (8,623,447) (8,623,447)

Translation adjustment 1,485,612 1,485,612

--------------------------------------------------------------------------

Comprehensive loss (8,623,447) 1,485,612 (7,137,835)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Issue of shares for

business acquisition 95,262

Issue of shares

for cash 8,373,257

Issue of share

purchase warrants 497,288

Share and share

purchase warrant

issue expenses (1,136,174) (1,136,174)

Stock-based

compensation 172,242 172,242

Expired warrants 779,035

--------------------------------------------------------------------------

Balance as at

December 31, 2007 4,537,336 $(31,007,264) $3,326,739 $9,074,753

--------------------------------------------------------------------------

(unaudited)

Balance as at

January 1, 2008 4,537,336 $(31,007,264) $3,326,739 $9,074,753

Net loss (2,380,676) (2,380,676)

Translation adjustment (215,674) (215,674)

--------------------------------------------------------------------------

Comprehensive income (2,380,676) (215,674) (2,596,350)

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Issue of shares

for cash 1,100,000

Share issue expenses (82,193) (82,193)

Stock-based

compensation 74,160 74,160

Expired warrants

--------------------------------------------------------------------------

Balance as at

June 30, 2008 $4,611,496 $(33,470,133) $3,111,065 $7,570,370

--------------------------------------------------------------------------

--------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Operations

(In U.S. dollars)

(Unaudited)

Three-month Periods Six-month Periods

ended June 30 ended June 30

--------------------------------------------------------------------------

2008 2007 2008 2007

--------------------------------------------------------------------------

Sales

Products $37,177 $41,951 $1,243,389 $436,165

Services and other

revenues 1,175,683 - 1,211,392 -

--------------------------------------------------------------------------

1,212,860 41,951 2,454,781 436,165

--------------------------------------------------------------------------

Cost of sales

Products 4,402 2,708 252,195 222,192

Services and other

revenues 38,995 - 57,100 -

--------------------------------------------------------------------------

43,397 2,708 309,295 222,192

--------------------------------------------------------------------------

Gross margin 1,169,463 39,243 2,145,486 213,973

--------------------------------------------------------------------------

Operating expenses

Research and

development, net

of investment tax

credits 618,279 1,689,083 1,472,929 2,897,498

Selling, general

and administrative 1,468,810 1,533,667 2,752,064 2,618,195

Amortization 173,337 88,637 345,777 174,688

--------------------------------------------------------------------------

2,260,426 3,311,387 4,570,770 5,690,381

--------------------------------------------------------------------------

Operating loss 1,090,963 3,272,144 2,425,284 5,476,408

Other expenses

(revenues) 10,257 38,878 (44,608) 73,974

--------------------------------------------------------------------------

Loss from operations

before income taxes 1,101,220 3,311,022 2,380,676 5,550,382

Current income taxes

(recovery) - (140,631) - (811,305)

--------------------------------------------------------------------------

Net loss $1,101,220 $3,170,391 $2,380,676 $4,739,077

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic and diluted net

loss per share $0.01 $0.06 $0.02 $0.08

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Basic and diluted

weighted average

number of common

shares

outstanding 94,540,592 54,016,714 94,540,592 58,551,176

--------------------------------------------------------------------------

Number of common

shares outstanding,

end of period 94,540,592 63,290,592 94,540,592 63,290,592

--------------------------------------------------------------------------

--------------------------------------------------------------------------

ART Advanced Research Technologies Inc.

Cash Flows

(In U.S. dollars)

(Unaudited)

Three-month Periods Six-month Periods

ended June 30 ended June 30

--------------------------------------------------------------------------

2008 2007 2008 2007

--------------------------------------------------------------------------

OPERATING ACTIVITIES

Net loss $(1,101,220) $(3,170,391) $(2,380,676) $(4,739,077)

Items not

affecting cash

Amortization 173,337 88,637 345,777 174,688

Stock-based

compensation 37,080 43,682 74,160 101,134

Gain on disposal

of fixed assets (26,707) - (26,707) -

Net changes in

working capital

items

Accounts receivable (731,199) 178,309 (335,270) (139,584)

Investment tax

credits receivable (236,413) (176,379) 903,656 (282,353)

Inventories (254,966) (23,308) (199,477) 61

Prepaid expenses 282,647 29,339 (559,589) 15,135

Accounts payable

and accrued

liabilities (666,239) 631,743 (426,700) (931,069)

Deferred revenues 83,236 - 47,527 -

Deferred grant - - 5,821 -

Income taxes

payable - (140,630) - (811,304)

--------------------------------------------------------------------------

Cash flows from

operating

activities (2,440,444) (2,538,998) (2,551,478) (6,612,369)

--------------------------------------------------------------------------

INVESTING ACTIVITIES

Short-term investments - (369,565) - (2,759,459)

Additions of fixed

assets (9,745) (74,176) (9,745) (96,151)

Proceed from

disposal of

fixed assets 33,481 - 59,172 -

Patents (42,668) - (131,843) -

Deferred development

costs (468,375) (88,255) (763,546) (241,807)

--------------------------------------------------------------------------

Cash flows from

investing

activities (487,307) (531,996) (845,962) (3,097,417)

--------------------------------------------------------------------------

FINANCING ACTIVITIES

Bank loan - 546,398 - 546,398

Repayment of

obligations under

capital leases (12,456) - (17,995) -

Issue of

convertible

preferred shares 1,100,000 - 1,100,000 -

Issue of common

shares and share

purchase warrants - - - 3,887,999

Equity issue

expenses (82,193) (124,728) (82,193) (195,403)

--------------------------------------------------------------------------

Cash flows from

financing

activities 1,005,351 421,670 999,812 4,238,994

Effect of foreign

currency translation

adjustments 53,047 226,596 (63,691) 256,448

--------------------------------------------------------------------------

1,058,398 648,266 936,121 4,495,442

--------------------------------------------------------------------------

Net decrease in

cash and cash

equivalents (1,869,353) (2,422,728) (2,461,319) (5,214,344)

Cash and cash

equivalents,

beginning of

period 2,995,688 3,755,320 3,587,654 6,546,936

--------------------------------------------------------------------------

Cash and cash

equivalents,

end of period $1,126,335 $1,332,592 $1,126,335 $1,332,592

--------------------------------------------------------------------------

--------------------------------------------------------------------------

CASH AND CASH

EQUIVALENTS

Cash $537,291 $816,090 $537,291 $816,090

Term deposits 589,044 516,502 589,044 516,502

--------------------------------------------------------------------------

$1,126,335 $1,332,592 $1,126,335 $1,332,592

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Supplemental

disclosure

of cash flow

information

Interest paid $24,382 $1,305 $33,016 $25,573

Interest received 9,720 18,362 30,109 23,333

--------------------------------------------------------------------------

--------------------------------------------------------------------------

Contacts: ART Advanced Research Technologies Inc. Jacques Bedard

Chief Financial Officer 514-832-0777 jbedard@art.ca www.art.ca

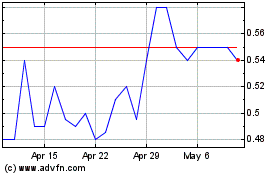

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Jun 2024 to Jul 2024

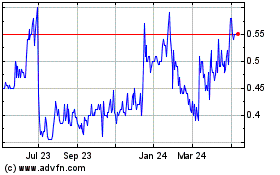

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Jul 2023 to Jul 2024