Gabriel Resources Ltd. ("Gabriel" or the "Company") (TSX:GBU) announces the

publication of its Third Quarter Financial Statements and Management's

Discussion and Analysis Report for the period ended September 30, 2012.

Additionally, the Company has today filed a new National Instrument 43-101

compliant Technical Report on the Rosia Montana Gold and Silver Project,

Transylvania, Romania, effective as at October 1, 2012 (the "Technical Report")

on the SEDAR website (www.sedar.com).

Summary

-- The political landscape of Romania has shifted significantly since the

start of 2012. The current Prime Minister, Mr. Victor Ponta, is the

third to have served Romania in this role in the last six months. Mr.

Ponta, President of the Social Democrat Party ("PSD"), leads a coalition

government ("USL"), predominantly formed by the PSD and the Liberal

Party ("PNL"), which was formally sworn in by Parliament on May 7, 2012.

At the beginning of September, 2012 the Government announced that the

parliamentary elections will be held on December 9, 2012.

-- Permitting for the Rosia Montana Project ("Project") remains the core

focus of the Company, however Gabriel is still awaiting formal

confirmation from the Technical Analysis Committee ("TAC"), through its

review of the Environmental Impact Assessment ("EIA"), that all

technical aspects have been clarified to its satisfaction.

-- With the uncertainty created by ongoing political change in 2012, and

Government focused on internal domestic (as well as EU related) matters

together with parliamentary elections in the short-term, the Company is

of the view that there will be no material dialogue with the Government

on the Project permitting for the remainder of the year and has scaled

back expenditure in most areas. At this time Gabriel is unable to

provide guidance on the time that it might take the TAC to vote on the

EIA or to release its recommendation to the Government.

-- An independent proposal has been put before the Alba County Council for

the organization of a regional referendum on December 9, 2012 in respect

of the recommencement of mining at Rosia Montana. The Company

understands that Alba County Council has yet to consider the proposal

fully and vote on this matter, however should such a referendum proceed,

the Company would welcome the platform to illustrate the positive impact

of the Project on environmental rehabilitation, job creation and

heritage salvation for an area that has many years of mining tradition

and no viable alternative to the significant economic benefits the

Project can deliver. Should the referendum go ahead, the Company may

have to resume certain activities including media and public relations

and increase its previously reduced expenditure accordingly.

-- The Company's 80.69% owned Romanian subsidiary, Rosia Montana Gold

Corporation S.A. ("RMGC"), recently received the 17th positive court

decision for the progress of the Project from 18 legal challenges to

permitting, licencing and other Project matters since early 2010.

However NGO's against the Project have continued to register new legal

challenges in the quarter against local, regional and national Romanian

authorities that grant licenses, permits, authorizations and approvals

for many aspects of the Project. The Company will continue to work with

local, county and federal authorities to ensure the Project receives a

fair and timely evaluation in accordance with Romanian and EU laws.

-- $89.7 million of cash and cash equivalents was held at September 30,

2012.

-- SRK Consulting (UK) Ltd ("SRK") has provided a Technical Report

commissioned to reflect the status of the Project as at October 1, 2012,

and to present updated capital and operating costs and revenue

projections from those last published by the Company in March 2009 (the

"2009 Report") within the context of the current environment for

commodity, capital equipment and consumable prices. Key highlights

include:

-- No material change to the Proven and Probable Mineral Reserve

previously published as there has been no material change to the

mine plan.

-- Annual production of the Project estimated at an average of

approximately 610,000 ounces of gold and 2.6 million ounces of

silver (years 1-5) and 485,000 ounces of gold and 1.8 million ounces

of silver over the 16 year life-of-mine ("LoM").

-- Initial capital cost of US$1.4 billion and LoM sustaining capital

costs of US$571 million.

-- Operating cash costs of US$16.97 per tonne of ore processed,

equivalent to US$399 per ounce of gold produced over the LoM

(including refining, transport, treatment, a four per cent royalty

and net of silver credits).

-- At a gold price of US$1,200/oz, silver price of US$20/oz and 10%

discount rate, a post-tax, pre-finance NPV of US$865 million, IRR of

19.6% and payback in year four of production.

-- At a gold price of US$1,800/oz, silver price of US$35/oz and 10%

discount rate, the post-tax, pre-finance NPV increases to US$2.5

billion, the IRR rises to 32.5% and payback accelerates to year two

of production.

-- Estimated capital required to bring the Project to positive cashflow

is approximately US$1.54 billion.

Jonathan Henry, Gabriel's President and Chief Executive Officer, stated:

"The potential for a local referendum is a positive development for the Company

- this would allow an open and transparent platform for those that will be

directly impacted to demonstrate their true support for the Project. The Project

will provide substantial economic, social and environmental benefits not only

for the local area around Rosia Montana but also for Romania as a whole. In the

absence of any public commitment from the Romanian Government, the timeline for

permitting the Project remains uncertain, and is likely to remain so until after

the December parliamentary elections."

Further information on the highlights of the Technical Report, and commentary on

the operations and results in the third quarter of 2012 is given below. The

Company has filed its Condensed Consolidated Financial Statements, Management's

Discussion & Analysis and Technical Report on SEDAR at www.sedar.com and each is

available for review on the Company's website at www.gabrielresources.com.

About Gabriel

Gabriel is a Canadian TSX-listed resource company focused on permitting and

developing its world-class Rosia Montana gold and silver project. The Project,

the largest undeveloped gold deposit in Europe, is owned through Rosia Montana

Gold Corporation ("RMGC"), a Romanian company in which Gabriel holds an 80.69%

stake with the 19.31% balance held by CNCAF Minvest S.A., a Romanian state-owned

mining enterprise. Gabriel and RMGC are committed to responsible mining and

sustainable development in the communities in which they operate. The Project is

anticipated to bring US$19 billion to Romania as potential direct and indirect

contribution to GDP according to 2010 estimates from UK-based Oxford Policy

Management (using a gold price of US$900/oz). This contribution increases to

over US$30 billion at today's gold price. The Project will generate thousands of

employment opportunities. Gabriel intends to build a state-of-the-art mine using

best available techniques and implementing the highest environmental standards

whilst preserving local and national cultural heritage in Romania. For more

information please visit the Company's website at www.gabrielresources.com.

Further Information

Financial Performance

-- The net loss for the third quarter was $3.7 million, or $0.01 per share.

Liquidity and Capital Resources

-- Cash and cash equivalents at September 30, 2012 totaled $89.7 million.

-- The Company has been implementing its previously announced plans to

reduce substantially monthly costs until such time as the Government

moves ahead with Project permitting. Notwithstanding, should the

proposed referendum go ahead, the Company may have to re-activate

certain activities.

NI 43-101 Technical Report

-- The Technical Report filed today reflects the status of the Project as

at October 1, 2012 and presents updated capital and operating costs and

revenue projections from those previously published within the context

of the current environment for commodity, capital equipment and

consumable prices.

-- There is no material change to the Proven and Probable Mineral Reserve

previously published as there has been no material change to the mine

plan. SRK's audited Mineral Reserve Statement reflects the ore planned

to be mined as assumed by the economic model and simply comprises the

portion of the Mineral Resource that, inclusive of mining dilution and

allowing for mining losses, falls within the pit outlines designed.

-- SRK considers the Mineral Reserve statement summarized below, and the

following Mineral Resource statement, to be in accordance with the

Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM

Standards on Mineral Resources and Reserves, Definitions and Guidelines

(CIM Standards).

Reserve Category Tonnage Au Grade Ag Grade Au Metal Ag Metal

(Mt) (g/t) (g/t) (Moz) (Moz)

-----------------------------------------------------------------------

Proven 112.5 1.63 9.01 5.9 32.6

Probable 102.5 1.27 4.55 4.2 15

-----------------------------------------------------------------------

Total 214.9 1.46 6.88 10.1 47.6

-----------------------------------------------------------------------

-- The audited Mineral Resource statement is reported by SRK at a cut-off

of 0.4 g/t Au (rather than 0.6 g/t Au used in the 2009 Report) to

reflect the fact that at current gold prices this material has potential

to be economic and is summarized below.

Tonnage Au Grade Ag Grade Au Metal Ag Metal

Resource Category (Mt) (g/t) (g/t) (Koz) (Koz)

----------------------------------------------------------------------------

Measured 171.5 1.32 8 7,260 43,160

Indicated 341.2 0.9 3 9,890 37,960

----------------------------------------------------------------------------

Measured and

Indicated 512.7 1.04 5 17,142 81,117

----------------------------------------------------------------------------

Inferred 44.8 0.98 3 1,420 4,100

----------------------------------------------------------------------------

-- The annual production of the Project is estimated at an average of

approximately 610,000 ounces of gold and 2.6 million ounces of silver

during its first five years of operation and an average of approximately

485,000 ounces of gold and 1.8 million ounces of silver over the 16 year

life-of-mine.

-- The initial and sustaining capital costs for the Project have been

updated for the purposes of the Technical Report as at the third quarter

of 2012. These updated estimates are a combination of first principle

estimates, quotes and escalations of previous estimates. Overall the

initial capital cost has increased from US$876 million in the 2009

Report to US$1.4 billion and the sustaining capital costs from US$366

million in the 2009 Report to US$571 million.

-- Operating cash costs, estimated in accordance with standard industry

practices and valid as at the third quarter of 2012, equate to some

US$16.97 per tonne of ore processed, equivalent to US$399 per ounce of

gold produced over the LoM (including refining, transport, treatment, a

four per cent royalty and net of silver credits).

-- The economic analysis presented by SRK in the Technical Report, which

considers the Proven and Probable Mineral Reserve planned to be mined

and processed over a 16 year period at the Project derived the following

key post-tax, pre-finance LoM results at a gold price of US$1,200/oz and

silver price of US$20/oz:

-- Undiscounted cash flow US$3.6 billion;

-- NPV at a 10% discount rate of US$865 million;

-- IRR of 19.6%; and

-- Payback of initial capital outlay in Year 4 of production.

-- SRK further reports that, assuming a spot price of US$1,800/oz for gold

and US$35/oz for silver in the economic analysis, the operating cash

cost, net of silver credits reduces to US$371/oz. On the same basis, the

following key post-tax, pre-finance LoM results are reported:

-- Undiscounted cash flow of US$7.7 billion;

-- NPV at a 10% discount rate of US$2.5 billion;

-- IRR of 32.5%; and

-- Payback of initial capital outlay in Year 2 of production.

-- Including estimated interest, financing and corporate costs the Company

estimates the capital required to bring the Project into production and

to a position of positive cashflow is approximately US$1.54 billion.

Political Environment

-- During 2012, the intense domestic political infighting has limited

significantly the level of Government engagement on the Project and

continues to be a cause for concern inside and outside of Romania with

pronouncements from the EU and European governments.

-- On July 6, 2012, Romania's Parliament voted to suspend the President

pending a public referendum on the President's removal. The referendum,

which was held on July 29, 2012, fell short of the 50% turnout threshold

required for the result to be binding, despite a majority voting for the

President's dismissal. The result was approved one month later by the

Constitutional Court and President Basescu was reinstated in his

official position on September 4, 2012.

-- With the uncertainty created by ongoing political change in 2012, and

Government focused on internal domestic (as well as EU related) matters

together with parliamentary elections in the short-term, the Company is

of the view that there will be no material dialogue with the USL

Government on the Project's permitting for the remainder of the year.

-- The Company will continue to pursue a strategy of engagement with all

stakeholders, to explain the critical importance of the Project as part

of the sustained economic development for Romania, and its commitment to

adhere to the highest standards on engineering, environmental, cultural

and social matters.

-- On October 18, 2012 the Romanian media reported that a proposal had been

put before the Alba County Council for the organization of a regional

referendum on December 9, 2012 in respect of the recommencement of

mining at Rosia Montana, the location of the Project. The Company

understands that Alba County Council has yet to consider the proposal

fully and vote on this matter. There are multiple benefits that the

Project will bring to an area that is facing extreme poverty whilst

continuing to suffer a growing legacy of environmental damage and decay

of cultural heritage caused by past unregulated mining activities.

Should the referendum proceed, the Company would welcome the platform to

illustrate the positive impact of the Project on environmental

rehabilitation, job creation and heritage salvation for an area that has

many years of mining tradition and no viable alternative to the

significant economic benefits the Project can deliver.

Project Ownership and Royalty Rates

-- On July 31, 2012 it was reported that Mr. Ponta had requested a

resumption of the legislative approval process of proposed amendments to

the royalty rates applicable to certain resources including precious

metals. There have been no official announcements since July 2012 and

the Company has had no discussions with the USL Government in respect of

Project ownership or royalty rates.

Environmental/Permitting

-- As a consequence of the recent political changes, the Company awaits

further clarification from the USL Government and the Technical Analysis

Committee as to whether further meetings or documentation will be

requested and the next steps in its environmental review process.

Gabriel remains unable to provide guidance on the time that it might

take the TAC to vote on the EIA or to release its recommendation to the

Government.

-- The permitting progress of the Project relies heavily on Government

approval of the environmental permit ("EP") and the issuance, in

accordance with due process and Romanian law, of various permits and

approvals at local, county and federal levels of government. The USL

Government has stated it will re-analyze the Project in a transparent

manner and based on an open and democratic dialogue, so that the

decisions are in accordance with the national interest, environmental

protection and European legislation. The Company is looking forward to

having an open dialogue with the Government, in whatever form it takes

following the December 2012 parliamentary election, to understand and

discuss any and all issues and concerns in relation to the Project.

-- As a result of the ongoing delays to the permitting process, two of the

19 endorsements to the Company's amended industrial zonal urbanism plan

("Industrial Area PUZ"), which designates an industrial zone under the

footprint of the proposed new mine at Rosia Montana, have expired. One

equivalent endorsement for the zonal urbanism plan for the Rosia Montana

historical protected area ("Historical Area PUZ") has also expired. In

due course the Company plans to submit the necessary documents to obtain

new endorsements.

-- The validity of the existing General Urbanism Plans ("PUGs") for Rosia

Montana and Abrud has been extended, pursuant to local council

decisions, through to July 2014 in both cases. Furthermore, RMGC has

obtained an extension to the validity of its urbanism certificate, UC-

87, for a period until April 2013.

Archaeology and Preservation of Cultural Heritage

-- The Company has continued maintenance work on 160 houses located in the

historical center of the village of Rosia Montana ("Protected Area"),

with the aim of preventing their deterioration. Through Q3 2012, the

restoration of sixteen of these houses has been completed and these are

now in use. Whilst these village houses are not designated as historic,

the restoration will contribute to maintaining the character of the

village.

-- RMGC, in partnership with the local council of Rosia Montana, is

progressing the restoration of two iconic buildings (the old school

house and former town hall) in the Protected Area, along with the

rehabilitation of a number of houses, which will be used for tourism

initiatives. The restoration of the former town hall achieved practical

completion during Q3 2012. The remaining restoration works are planned

to be scaled back until such time as the Government moves ahead with

Project permitting.

-- RMGC has continued further detailed archaeological work in the old

underground Roman mining galleries that lie under the Protected Area.

This work has focused on restoring previously unexplored galleries with

a view to opening them as a permanent museum, a visible testimony to the

2,000 year mining history at Rosia Montana and an accessible example of

historical mining activities for parties with interests in the regional

mining sector. One such example is the Catalina Monulesti underground

mining gallery which is in the process of being successfully restored

and has been opened to the public. The Company has already hosted

approximately one thousand visitors, representing various stakeholder

groups.

Corporate and Social Responsibility (CSR)

-- Gabriel takes pride in its commitment to achieving the highest levels of

sustainability from workplace safety to community and environmental

responsibility. It has a clear goal of attaining business performance

through a dynamic process of continuous improvement in all aspects of

its business and respecting all stakeholders. The Company invests

significant resources into its CSR programs, which in Romania is a

multi-dimensional commitment managed by RMGC covering employee training

and safety, local communities, living traditions, direct and indirect

social impacts, educational programs, environmental protection,

community sponsorship and heritage aspects.

-- RMGC has been a long-standing sponsor to the annual 'Miner's Day &

Mining Communities and Mining Traditions Festival', which in August 2012

involved almost 4,000 attendees.

-- RMGC currently employs approximately 500 people directly and numerous

others indirectly, with approximately 85% hired from the local Rosia

Montana community, and the Company is investing in training and skills

assessments for the construction phase of the Project.

Litigation

-- Over the years certain foreign and domestically-funded non-governmental

organizations ("NGOs") have initiated a multitude of legal challenges

against licenses, permits, authorizations and approvals obtained for the

exploration and development of the Project.

-- The publicly stated objective of the NGOs in initiating and maintaining

these legal challenges is to use the Romanian court system not only to

delay as much as possible, but to ultimately stop the development of the

Project. While a small number of these actions over many years have been

successful, most have been, and continue to be proved to be, frivolous

in the Romanian courts. Since early 2010 17 court decisions (from 18

legal challenges to permitting, licencing and other Project matters)

have been positive for the progress of the Project.

-- Cases concluded during the third quarter of 2012 include:

-- An action commenced by two NGOs which sought the cancellation and

suspension of UC-87 was dismissed by the Bucharest Tribunal on

December 21, 2011. The NGOs appealed this decision, an appeal which

was irrevocably rejected by the Bucharest Court of Appeal on October

15, 2012.

-- A claim initiated by the Archaeological Restoration Association

("ARA") in the Alba Iulia Tribunal which sought to commence the

procedure of classifying certain buildings from Rosia Montana as

historical monuments was rejected at a hearing on February 3, 2012.

This decision was appealed by the ARA to the Alba Iulia Court of

Appeal, an appeal which was irrevocably rejected by that Court of

Appeal on October 3, 2012.

-- Upcoming hearings in the fourth quarter of 2012 include:

-- A claim seeking the cancellation of the Strategic Environmental

Assessment endorsement ("SEA") to the Industrial Area PUZ, which was

issued by the Regional Agency for Environmental Protection of Sibiu

in March 2011, is scheduled to be heard on November 9, 2012.

-- A claim seeking the suspension of the SEA, initiated by the same

NGOs, is also scheduled to be heard in the same court on November 9,

2012.

-- The next hearing of a claim by three NGOs in the Cluj Tribunal

seeking the suspension of the Archaeological Discharge Certificate

("ADC"), issued in July 2011 for the Carnic open-pit, is scheduled

to be heard on November 9, 2012.

-- On November 19, 2012 a request filed by the same three NGOs for the

cancellation of the ADC is scheduled to be heard with the Cluj

Tribunal.

-- A further hearing is scheduled for November 26, 2012 in respect of

the outstanding legal challenge originally commenced by RMGC in

November 16, 2007 to compel the MoE to resume the EIA review. On

June 19, 2012 the High Court of Cassation and Justice quashed a 2009

decision of the Bucharest Court of Appeal and further ordered that

the file should be returned to the Bucharest Court of Appeal to be

reheard on its merits. RMGC now awaits confirmation from the

Bucharest Court of Appeal that it has accepted RMGC's request to

discontinue a related monetary damages claim against the MoE and its

former officials and the case as a whole due to a lack of interest

(as the EIA review has recommenced).

-- Due to the inherent uncertainties of the judicial process, the Company

is unable to predict the ultimate outcome or impact, if any, with

respect to matters challenged in the Romanian courts. In all

circumstances, the Company and/or RMGC will vigorously maintain its

legal rights and will continue to work with local, county and federal

authorities to ensure the Project receives a fair and timely evaluation

in accordance with Romanian and EU laws. However, there can be no

assurance that the Company and/or RMGC (as the case may be) will prevail

in these matters. If any claims are not resolved in the Company's or

RMGC's favour, then such a negative ruling may have a material adverse

effect on the timing and/or outcome of the permitting process for the

Project and the Company's financial condition. The implications of a

negative court ruling will only be known once such a decision is issued

and the position of the Government is assessed.

Outlook

-- The Company's key objectives in the short term include to:

-- Operate on a reduced cost basis until such time as the Government

moves ahead with Project permitting;

-- Continue efforts to increase the Romanian public and Government

awareness of the Project benefits, economic and otherwise, and

support for the permitting of the Project;

-- Obtain approval of the EP and all other required permits that allow

construction activities to commence;

-- Maximize shareholder value, while optimizing the Project benefits to

those in the community and the surrounding area.

Qualified Person

The Technical Report was authored by Dr. Mike Armitage, FGS, C.Geol, MIMMM, CEng

of independent consultants, SRK. Dr Armitage is a Qualified Person for the

purposes of the Technical Report, under the standards set forth by National

Instrument 43-101 "Standards of Disclosure for Mineral Projects", of the

Canadian Securities Administrators. The Mineral Resources and Mineral Reserve

statements in the Technical Report are reported in accordance with CIM

Standards. Dr. Armitage has consented to the public filing of the Technical

Report and has reviewed and approved the extracts of, or summary from, the

Technical Report within this news release, as applicable.

Forward-looking Statements

This press release contains forward-looking information as defined in applicable

securities laws relating to the Company and/or the Project (referred to herein

as "forward-looking statements") that are based on management's current

expectations, estimates and projections. Specifically, this press release

contains forward-looking statements regarding the returns to Romania of a change

in equity and royalty rates applicable to the Project. All statements other than

statements of historical facts included herein, including without limitation,

those incorporated by reference, those which may refer to the Company's

financial position, business strategy, plans, objectives of management for

future operations (including development plans and objectives relating to the

Company's business) the economic impact, job creation, costs estimates,

patrimony plans, future ability of the Company to finance the Project, Project

delivery and estimates regarding the timing of completion of various aspects of

the Projects' development or of future performance are forward-looking

statements.

The words "believe", "expect", "anticipate", "contemplate", "target", "plan",

"intends", "continue", "budget", "estimate", "projects", "may", "will",

"schedule", and similar expressions identify forward-looking statements.

Forward-looking statements are necessarily based upon a number of estimates and

assumptions that are inherently subject to significant business, economic and

competitive uncertainties and contingencies.

Forward-looking statements are not guarantees of future performance and are

subject to known and unknown risks, uncertainties and other factors which are

difficult, or may be beyond Gabriel's ability, to predict or control and that

may cause the actual outcomes, level of activity, financial results, performance

or achievements to differ materially from those expressed or implied by the

forward-looking statements, These risks, uncertainties and other factors

include, without limitation, changes in the worldwide price of precious metals;

fluctuations in exchange rates; legislative, political or economic developments

including changes to mining and other relevant legislation in Romania;

geopolitical uncertainty, uncertain legal enforcement; changes in, and the

effects of, the government policies affecting the Company's operations;

uncertainties related to timelines for awaited approvals; changes in general

economic conditions, and the financial markets; operating or technical

difficulties in connection with exploration, development or mining;

environmental risks; the risks of diminishing quantities or grades of reserves;

and the Company's requirements for substantial additional funding.

Accordingly, readers should not place undue reliance on forward-looking

statements. Gabriel undertakes no obligation to update publicly or otherwise

revise any forward-looking statements contained herein whether as a result of

new information or future events or otherwise, except as may be required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

Gabriel Resources Ltd.

Jonathan Henry

President and Chief Executive Officer

+44 7798 801783

jh@gabrielresources.com

Gabriel Resources Ltd.

Max Vaughan

Chief Financial Officer

+44 7823 885503

max.vaughan@gabrielresources.com

www.gabrielresources.com

Buchanan

Bobby Morse

+44 207 466 5000 or Mobile: +44 7802 875227

bobbym@buchanan.uk.com

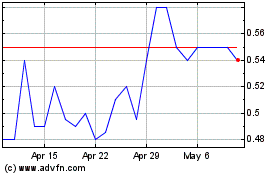

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Oct 2024 to Nov 2024

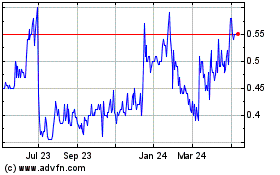

Aclara Resources (TSX:ARA)

Historical Stock Chart

From Nov 2023 to Nov 2024