MediSolution Ltd. to Be Acquired by Its Controlling Shareholder, Brookfield Asset Management Inc.

March 16 2009 - 7:35AM

Marketwired Canada

MediSolution Ltd. (TSX:MSH) ("MediSolution") and Brookfield Asset Management

Inc. (TSX:BAM)(NYSE:BAM)(EURONEXT:BAMA)("Brookfield") today announced that

MediSolution has entered into an agreement with Brookfield to effect a going

private transaction whereby Brookfield will acquire all of the outstanding

common shares ("Shares") of MediSolution not already owned by Brookfield or its

affiliates at a price of $0.30 per Share in cash, representing a total cash

consideration of approximately $19 million.

The price of $0.30 per Share offered by Brookfield represents a premium of

approximately 53.8% over the closing price of the Shares on the Toronto Stock

Exchange (the "TSX") on March 13, 2009, the last day on which the Shares traded

prior to the announcement of the proposed transaction, and a premium of

approximately 54% over the 20-day average closing price of the Shares on the

TSX.

The board of directors of MediSolution established a special committee of

independent directors (the "Special Committee") to select an independent

valuator, supervise the preparation of a formal valuation of the Shares and to

consider the proposed transaction. The Special Committee selected Meyers Norris

Penny LLP ("MNP"), Chartered Business Valuators and an independent member of the

Horwath International Network, as the independent valuator. Subject to the

analyses, assumptions, qualifications and limitations contained in the

valuation, MNP reached the opinion that the fair market value of the Shares was

in the range of $0.28 to $0.32 per Share. MNP also delivered a fairness opinion

that the consideration offered under the proposed transaction is fair, from a

financial point of view, to the minority shareholders of MediSolution.

Based on MNP's conclusions, among other matters considered, the Special

Committee unanimously determined that the proposed transaction is in the best

interests of MediSolution and is fair, from a financial point of view, to the

shareholders of MediSolution other than Brookfield. In light of the conclusions

of the Special Committee and MNP, among other matters considered, the board of

directors of MediSolution has unanimously approved (with interested directors

abstaining) the proposed transaction and recommends that shareholders vote in

favour of the proposed transaction.

The proposed transaction will be effected through an amalgamation of

MediSolution and a newly incorporated company wholly-owned by Brookfield.

Pursuant to the amalgamation, each shareholder of MediSolution, other than

Brookfield and its affiliates, will receive one redeemable preferred share of

the amalgamated company for each Share held immediately prior to the

amalgamation. Each redeemable preferred share will then be redeemed for $0.30 in

cash. As at March 13, 2009, MediSolution had outstanding 158,292,332 Shares.

"A privatized MediSolution will be better positioned to focus on customers and

to deliver improved products, leveraging Brookfield's significant financial

resources and global platform," commented Mr. Paul Lepage, MediSolution's

president and chief executive officer. "In addition, as a private company,

MediSolution will incur lower administrative costs, having eliminated the

expenses associated with being a publicly traded company."

A special meeting of shareholders of MediSolution will be held in early May 2009

to consider the proposed transaction. Completion of the proposed transaction is

subject to customary conditions including, but not limited to, the approval of

at least two-thirds of the votes cast by shareholders of MediSolution voting at

the meeting and a simple majority of the votes cast by minority shareholders of

MediSolution voting at the meeting and there being no material adverse change

with respect to MediSolution. Assuming the satisfaction of all conditions, the

proposed transaction is expected to close as soon as practicable following the

special meeting of shareholders. However, there can be no assurances that the

proposed transaction, or any other transaction with Brookfield, will be

completed.

The terms and conditions of the proposed transaction, including copies of the

formal valuation and fairness opinion prepared by MNP, will be detailed in a

management information circular to be mailed to shareholders of MediSolution as

soon as practicable.

About MediSolution

MediSolution (TSX:MSH), a Brookfield Asset Management company, is a leading

information technology company, providing enterprise resource planning and

specialized blood bank software, solutions and services to healthcare and

service sector customers across North America. More than 300 healthcare, public

and service sector organizations rely on MediSolution's systems to maximize

their operational efficiencies, lower their costs and improve the delivery of

services. The company's product portfolio is comprised of Financial Management

software such as accounts receivable, budgeting and materials management,

Business Intelligence solutions as well as Human Capital Management tools and

services including human resources management, staff scheduling and payroll

processing. The company also provides speciality hemovigilance solutions that

improve patient safety, reduce waste and increase efficiency for blood

transfusion services. For more information, please visit www.medisolution.com.

About Brookfield

Brookfield Asset Management Inc., focused on property, power and infrastructure

assets, has approximately $80 billion of assets under management and is

co-listed on the New York and Toronto Stock Exchanges under the symbol BAM and

on NYSE Euronext under the symbol BAMA. For more information, please visit

www.brookfield.com.

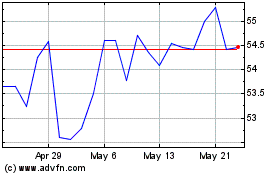

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From May 2024 to Jun 2024

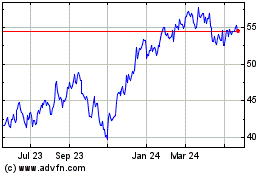

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Jun 2023 to Jun 2024