Tricap Announces Preliminary Discussions With Central Alberta Regarding a Going Private Transaction

March 19 2009 - 8:12AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES.

Tricap Partners II LP ("Tricap") today announced that it has made a proposal to

Central Alberta Well Services Inc. (TSX VENTURE:CWC) ("CAWS" or the "Company")

with respect to a going private transaction pursuant to which Tricap would make

an offer to acquire all outstanding Class A voting common shares ("Class A

Shares") of the Company other than those already held by Tricap or its

affiliates. Tricap currently owns approximately 9.9 million Class A Shares

representing approximately 49.0% of the currently issued and outstanding Class A

Shares. In addition, Tricap owns approximately 7.0 million Class B non-voting

common shares of the Company ("Class B Shares") representing all of the

outstanding shares of that class. The Class B Shares are convertible into Class

A Shares in certain circumstances.

Under the Tricap proposal, Tricap or an affiliate would make an offer of $0.45

per Class A Share subject to the negotiation of a mutually acceptable support

agreement between Tricap and the Company and such other conditions to be set out

in the formal take-over bid circular to be mailed to CAWS shareholders. This

share price translates into premiums of 13% based on the last trade and 14% and

17% based on the weighted average trading price of the Class A Shares on the TSX

Venture Exchange (the "TSXV") for the 20 and 45 trading days, respectively,

ended March 17, 2009.

Tricap was established by Brookfield Asset Management to provide a source of

patient, long-term capital and strategic assistance to mid-market companies

based in North America. With strong industry and financial management expertise,

Tricap is well positioned to assist companies in building value over the

long-term.

This press release contains forward looking information, including

"forward-looking statements" within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. The word "would" and other expressions which are predictions of or

indicate future events and trends and which do not relate to historical matters

identify forward looking statements. Reliance should not be placed on

forward-looking statements because they involve known and unknown risks,

uncertainties and other factors, which may cause the going private transaction

contemplated by the proposal made by Tricap to the Company to differ materially

from the description of the proposal expressed or implied by such

forward-looking statements or to not be made at all. Factors that could cause

the actual proposal not to be made or to differ materially from that described

in the forward looking statements include failure to negotiate a mutually

acceptable support agreement with the Company. Tricap undertakes no obligation

to publicly update or revise any forward looking statements, whether as a result

of new information, future events or otherwise, unless required by law.

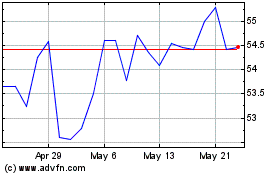

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Apr 2024 to May 2024

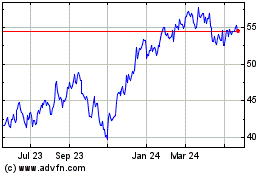

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From May 2023 to May 2024