Brookfield Asset Management Inc. (TSX: BAM.A)(NYSE: BAM)(EURONEXT:

BAMA) -

Investors, analysts and other interested parties can access

Brookfield Asset Management's 2009 Q2 Results as well as the

Shareholders' Letter and Supplemental Information on Brookfield's

web site under the Investor Centre/Financial Reports section at

www.brookfield.com.

The 2009 Q2 Results conference call can be accessed via webcast

on August 7, 2009 at 11 a.m. Eastern Time at www.brookfield.com or

via teleconference at 1-800-319-4610 toll free in North America.

For overseas calls please dial 1-604-638-5340, at approximately

10:50 a.m. Eastern Time. The teleconference taped rebroadcast can

be accessed at 1-800-319-6413 or 604-638-9010 (Password 2811).

Brookfield Asset Management Inc. (TSX: BAM.A)(NYSE:

BAM)(EURONEXT: BAMA) today announced its results for the second

quarter ended June 30, 2009.

US$ millions Three months ended June 30 Six months ended June 30

(except per share amounts) 2009 2008 2009 2008

----------------------------------------------------------------------------

Cash flow from operations $ 276 $ 378 $ 549 $ 821

- per share 0.46 0.62 0.92 1.34

Net income $ 147 $ 110 $ 240 $ 307

- per share 0.24 0.17 0.39 0.48

----------------------------------------------------------------------------

Operating Cash Flow

Cash flow from operations was $276 million ($0.46 per share)

during the second quarter. Last year's comparable results were $378

million ($0.62 per share) and included a number of special

items.

"We took a number of important steps during the quarter to

increase the amount of liquidity available for investment

opportunities, increased the stability of our capitalization, and

advanced many business initiatives," commented Bruce Flatt, Senior

Managing Partner of Brookfield Asset Management. "Our solid

operating results are due in large part to our high quality office

property portfolio, which is 95% occupied and allows us to generate

stable long-duration contracted rental income streams. In addition,

we have contracted approximately 80% of our expected renewable

power generation for the balance of 2009 and 2010."

Net Income

Net income for the second quarter of 2009 was $147 million

($0.24 per share) compared to $110 million ($0.17 per share) for

the same period in 2008.

US$ millions Three months ended June 30 Six months ended June 30

(except per share amounts) 2009 2008 2009 2008

----------------------------------------------------------------------------

Net income $ 147 $ 110 $ 240 $ 307

- per share 0.24 0.17 0.39 0.48

----------------------------------------------------------------------------

Basis of Presentation

This news release and accompanying financial statements make

reference to cash flow from operations on a total and per share

basis. Cash flow from operations is defined as net income excluding

depreciation and amortization, interests of non-controlling

shareholders, future income taxes and other items as described as

such in the consolidated statements of income, and including

dividends and disposition gains that are not otherwise included in

net income. Brookfield uses cash flow from operations to assess its

operating results and the value of its business and believes that

many of its shareholders and analysts also find this measure of

value to them. The company provides the components of cash flow

from operations and a reconciliation between cash flow from

operations and net income with the supplemental information

accompanying this news release. Cash flow from operations is a

non-GAAP measure which does not have any standard meaning

prescribed by GAAP and therefore may not be comparable to similar

measures presented by other companies.

Dividend Declaration

The Board of Directors declared a dividend of US$0.13 per Class

A Common Share, payable on November 30, 2009, to shareholders of

record as at the close of business on November 1, 2009. The Board

also declared all of the regular monthly and quarterly dividends on

its preferred shares.

Information on Brookfield Asset Management's declared share

dividends can be found on the company's web site under Investor

Centre/Stock and Dividend Information.

Additional Information

The Letter to Shareholders and the company's Supplemental

Information for the six months ended June 30, 2009 contain further

information on the company's strategy, operations and financial

results. Shareholders are encouraged to read these documents, which

are available on the company's web site.

Brookfield Asset Management Inc., is a global asset management

company focused on property, power and infrastructure assets, has

over $80 billion of assets under management and is co-listed on the

New York and Toronto Stock Exchanges under the symbol BAM and on

NYSE Euronext under the symbol BAMA. For more information, please

visit our web site at www.brookfield.com.

Please note that Brookfield's audited annual and unaudited

quarterly reports have been filed on Edgar and Sedar and can also

be found in the investor section of our web site at

www.brookfield.com. Hard copies of the annual and quarterly reports

can be obtained free of charge upon request.

For more information, please visit our web site at

www.brookfield.com.

Note: This news release contains forward-looking information

within the meaning of Canadian provincial securities laws and

"forward-looking statements" within the meaning of Section 27A of

the U.S. Securities Act of 1933, as amended, Section 21E of the

U.S. Securities Exchange Act of 1934, as amended, "safe harbor"

provisions of the United States Private Securities Litigation

Reform Act of 1995 and in any applicable Canadian securities

regulations. The words "stable," "allows," "contracted,"

"expected," and "intend," derivations thereof and other

expressions, including conditional verbs such as "may" that are

predictions of or indicate future events, trends or prospects and

which do not relate to historical matters identify forward-looking

statements. Forward-looking statements in this news release include

statements regarding our ability to generate stable long duration

contracted rental income streams, our contracted renewable

generation and our expected renewable generation for the balance of

2009 and 2010, procedures and assumptions that we intend to use in

adopting International Financial Reporting Standards ("IFRS") and

date of our first IFRS reporting period. Although Brookfield Asset

Management believes that its anticipated future results,

performance or achievements expressed or implied of such assets by

the forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on forward-looking statements and information

as such statements and information involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the company to differ materially

from anticipated future results, performance or achievement

expressed or implied by such forward-looking statements and

information.

Factors that could cause actual results to differ materially

from those contemplated or implied by forward-looking statements

include: economic and financial conditions in the countries in

which we do business; the behaviour of financial markets, including

fluctuations in interest and exchange rates; availability of equity

and debt financing; strategic actions including dispositions; the

ability to complete and effectively integrate acquisitions into

existing operations and the ability to attain expected benefits;

tenant renewal rates, availability of new tenants to fill office

property vacancies, tenant bankruptcies, adverse hydrology

conditions; regulatory and political factors within the countries

in which the company operates; acts of God, such as earthquakes and

hurricanes; the possible impact of international conflicts and

other developments including terrorist acts; changes in accounting

policies to be adopted under IFRS and other risks and factors

detailed from time to time in the company's form 40-F filed with

the Securities and Exchange Commission as well as other documents

filed by the company with the securities regulators in Canada and

the United States including the company's most recent Management's

Discussion and Analysis of Financial Results under the heading

"Business Environment and Risks."

We caution that the foregoing factors that may affect future

results is not exhaustive. When relying on our forward-looking

statements to make decisions with respect to Brookfield Asset

Management, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Except as required by law, the company undertakes no obligation to

publicly update or revise any forward-looking statements or

information, whether written or oral, as a result of new

information, future events or otherwise.

STATEMENTS OF NET CASH FLOW FROM OPERATIONS

(Unaudited) Three months ended June 30 Six months ended June 30

US$ millions (except

per share amounts) 2009 2008 2009 2008

----------------------------------------------------------------------------

Fees earned $ 123 $ 113 $ 228 $ 227

Revenues less direct

operating costs

Commercial properties 221 156 388 338

Power generation 91 143 222 291

Infrastructure 15 40 34 68

Development and

other properties 52 102 67 131

Specialty funds 15 71 23 115

Investment and other

income 101 81 228 302

----------------------------------------------------------------------------

618 706 1,190 1,472

Expenses

Interest 79 84 151 162

Other operating costs 151 141 308 305

Current income taxes 6 1 6 3

Non-controlling

interests 106 102 176 181

----------------------------------------------------------------------------

Cash flow from operations $ 276 $ 378 $ 549 $ 821

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash flow from

operations per

common share - diluted $ 0.46 $ 0.62 $ 0.92 $ 1.34

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Notes

The statements of net cash flow from operations above are

prepared on a basis that is consistent with Management's Discussion

and Analysis of Financial Results ("MD&A") and differ from the

company's consolidated financial statements presented in its 2008

Annual Report, which are prepared in accordance with Canadian

generally accepted accounting principles ("GAAP"). Management uses

cash flow from operations as a key measure to evaluate performance

and to determine the underlying value of its businesses. Readers

are encouraged to consider both measures in assessing Brookfield

Asset Management's results. Cash flow from operations is equal to

net income excluding "other items" as presented in the consolidated

statements of income on page 6 of this release.

Cash flow from operations in this statement represents the

operations of Brookfield Asset Management and Brookfield Properties

Corporation ("Brookfield Properties") on a combined basis and is

net of carrying charges associated with related liabilities and

cash flows attributable to non-controlling interests. Readers are

encouraged to refer to the company's supplemental information or

the MD&A contained in the 2008 Annual Report, both of which are

available at www.brookfield.com.

STATEMENTS OF UNDERLYING VALUE AND NET INVESTED CAPITAL

Net Invested Capital

(Unaudited) Underlying Value --------------------

US$ millions December 31, 2008 June 30, 2009 December 31, 2008

----------------------------------------------------------------------------

Assets

Operating platforms

Commercial properties $ 7,485 $ 4,885 $ 4,575

Power generation 6,639 1,361 1,215

Infrastructure 974 726 761

Development and other

properties 3,313 3,945 3,334

Specialty funds 903 933 870

Investments 701 743 704

Cash and financial assets 1,073 842 1,073

Other assets 2,650 2,817 2,551

----------------------------------------------------------------------------

$ 23,738 $ 16,252 $ 15,083

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Liabilities

Corporate borrowings $ 2,284 $ 2,241 $ 2,284

Subsidiary borrowings 733 762 733

Capital securities 1,425 1,494 1,425

Other liabilities 3,267 2,626 2,654

----------------------------------------------------------------------------

7,709 7,123 7,096

----------------------------------------------------------------------------

Capitalization

Co-investor interests in

consolidated operations 3,228 2,229 2,206

Preferred equity 870 1,144 870

Common equity 11,931 5,756 4,911

----------------------------------------------------------------------------

16,029 9,129 7,987

----------------------------------------------------------------------------

$ 23,738 $ 16,252 $ 15,083

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net invested capital and underlying value above includes the operations of

the company and Brookfield Properties collectively, and is presented on a

deconsolidated basis meaning that assets are presented net of associated

liabilities and non-controlling interests.

UNDERLYING VALUE OF COMMON EQUITY

As at December 31, 2008 (unaudited)

US$ millions (except per share amounts) Total Per Share

----------------------------------------------------------------------------

Common equity - including future tax liability $ 11,931 $ 20.62

Add back: future tax liability 2,220 3.70

----------------------------------------------------------------------------

Common equity - excluding future tax liability $ 14,151 $ 24.32

----------------------------------------------------------------------------

----------------------------------------------------------------------------

This news release contains a preliminary analysis of the

underlying value of the company and its common equity, based on the

procedures and assumptions that we expect to follow in preparing

our pro forma opening balance sheet for our adoption of

International Financial Reporting Standards ("IFRS"). Accordingly,

certain assets, such as appraisal surplus relating to inventories

and intangible assets, and the value of the company's asset

management business, have not been reflected. Please refer to our

Supplemental Information under "Performance Review," which is

available on the company's web site for further information.

This information has been prepared using the standards and

interpretations currently issued and expected to be effective at

the end of our first IFRS reporting period, which we intend to be

March 31, 2010. Consequently, in preparing this information,

assumptions have been made about the accounting policies expected

to be adopted. Certain accounting policies expected to be adopted

under IFRS may not be adopted and the application of such policies

to certain transactions or circumstances may be modified and as a

result underlying values are subject to change. Furthermore, the

underlying values have not been audited or subject to a review by

the company's auditor.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) Three months ended June 30 Six months ended June 30

US$ millions (except

per share amounts) 2009 2008 2009 2008

----------------------------------------------------------------------------

Total revenues $ 2,978 $ 3,436 $ 5,629 $ 6,646

Fees earned $ 123 $ 113 $ 228 $ 227

Revenues less direct

operating costs

Commercial properties 424 427 824 848

Power generation 211 264 450 515

Infrastructure 16 44 56 92

Development and

other properties 95 119 118 183

Specialty funds 35 119 74 223

Investment and other

income 222 148 391 466

----------------------------------------------------------------------------

1,126 1,234 2,141 2,554

Expenses

Interest 452 475 867 1,002

Other operating costs 166 148 325 313

Current income taxes 31 21 42 38

Non-controlling

interests 201 212 358 380

----------------------------------------------------------------------------

276 378 549 821

Other items

Depreciation and

amortization (300) (328) (629) (642)

Equity accounted

losses from

investments - (21) - (40)

Revaluation and

other items (73) (46) (76) (109)

Future income taxes 97 3 99 21

Non-controlling

interests in the

foregoing items 147 124 297 256

----------------------------------------------------------------------------

Net income $ 147 $ 110 $ 240 $ 307

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income per common share

Diluted $ 0.24 $ 0.17 $ 0.39 $ 0.48

Basic $ 0.24 $ 0.17 $ 0.39 $ 0.49

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Note

The consolidated statements of income are prepared on a basis

consistent with the company's financial statements presented in its

interim report, which are prepared in accordance with Canadian

GAAP.

Contacts: Investor Relations: Brookfield Asset Management

Katherine Vyse SVP, Investor Relations and Communications (416)

369-8246 (416) 363-2856 (FAX) kvyse@brookfield.com Media:

Brookfield Asset Management Denis Couture SVP, Corporate and

International Affairs (416) 956-5189 (416) 363-2856 (FAX)

dcouture@brookfield.com www.brookfield.com

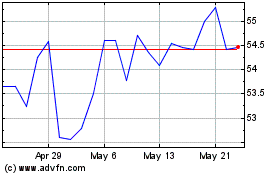

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From May 2024 to Jun 2024

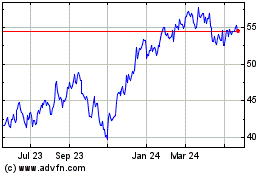

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Jun 2023 to Jun 2024