Brookfield Real Estate Opportunity Fund Closes Acquisition of Properties in Dallas and Atlanta and Sale of Office Complex in Mon

August 10 2010 - 4:06PM

Marketwired

Brookfield Asset Management Inc. (TSX: BAM)(NYSE: BAM)(EURONEXT:

BAMA) ("Brookfield") announced today its Real Estate Opportunity

Fund ("BREOF" or the "Fund") closed the acquisition of two

properties for a total of approximately $32 million. In an

unrelated transaction, it completed the sale of Place Innovation, a

six building, 870,000 square foot office and high-tech industrial

campus.

"We are pleased that we are starting to see the much anticipated

opportunity to acquire properties at attractive valuations,

opportunities that have arisen due to poor capital structures and

foreclosures," commented David Arthur, Managing Partner, Brookfield

Opportunistic Real Estate Investments. Arthur added: "We are

gratified to have acquired two prime properties for significant

discounts to replacement cost." The Montreal sale on the other

hand, reflects the investment market's strong demand and ability to

pay full prices for stabilized, income producing properties.

Two Addison Circle - Dallas

Two Addison Circle is a newly constructed, approximately 200,000

square foot Class A office building with structured parking in

Dallas acquired from a lender for $16.0 million ($81 per square

foot), which represents a 50+% discount to replacement cost of $175

per square foot. Brookfield has strong relationships and market

knowledge through the approximately 3.5 million square feet of real

estate it has acquired in the area. Currently vacant, the property

provides the Fund with a wide variety of leasing options for

prospective tenants.

Gwinnett Crossing - Atlanta

Through a partnership with Landmark Residential, the Fund also

acquired Gwinnett Crossing, a distressed, Class B multifamily

property with 564 units from its lender for $16.7 million ($29,000

per unit). The price is materially below replacement cost of

$105,000 per unit. The seller provided 100% financing. The Fund and

its partner committed to invest an additional $8.0 million of

equity capital to renovate the property and implement a new leasing

program to stabilize the property.

Place Innovation - Montreal

Brookfield acquired this property from a corporate owner in June

2007, with 55% of the space already or soon to be vacant. Upon

closing, the Fund implemented an aggressive leasing and asset

management program that resulted in its achieving a 98% occupancy

level. At that point, BREOF marketed the property for sale,

attracting interest from a number of institutional investors, each

of whom was attracted to the strong income stream. The success of

its lease-up program enabled the Fund to sell the property for a

20% premium to underwriting.

Added Arthur, "The two acquisitions represent a strong fit

within the Fund's portfolio and our strategy of investing in

underperforming and distressed real estate that we can proactively

manage, reposition and re-lease to create value for our Fund

clients. Within the current environment and backed by strong

relationships with lenders, we are aggressively pursuing similar

opportunities to acquire properties like Two Addison Circle and

Gwinnett Crossing, and surface value on mature properties."

Brookfield Asset Management Inc., focused on property, renewable

power and infrastructure assets, has over $100 billion of assets

under management and is co-listed on the New York and Toronto Stock

Exchanges under the symbol BAM and on NYSE Euronext under the

symbol BAMA. For more information, please visit our website at

www.brookfield.com.

Brookfield Real Estate Opportunity Fund, established by

Brookfield Asset Management Inc., invests opportunistically in

underperforming and distressed real estate in North America,

including commercial office, industrial and mixed-use

properties.

Note: This news release contains forward-looking information

within the meaning of Canadian provincial securities laws and

"forward-looking statements" within the meaning of Section 27A of

the U.S. Securities Act of 1933, as amended, Section 21E of the

U.S. Securities Exchange Act of 1934, as amended, "safe harbour"

provisions of the United States Private Securities Litigation

Reform Act of 1995 and in any applicable Canadian securities

regulations. The words "intend," "pursue," derivations thereof and

other expressions, including conditional verbs such as "will,"

"should", "may" are predictions of or indicate future events,

trends or prospects or identify forward-looking statements.

Forward-looking statements in this news release include statements

in regards to the proposed repositioning of Two Addison Circle and

Gwinnett Crossing and our beliefs about pursuit of future

investment opportunities. The reader should not place undue

reliance on forward-looking statements and information as such

statements and information involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the company to differ materially

from anticipated future results, performance or achievement

expressed or implied by such forward-looking statements and

information.

Factors that could cause actual results to differ materially

from those contemplated or implied by forward-looking statements

include: economic and financial conditions in the countries in

which we do business; the behaviour of financial markets, including

fluctuations in interest and exchange rates; availability of equity

and debt financing; strategic actions including dispositions; the

ability to complete and effectively integrate acquisitions into

existing operations and the ability to attain expected benefits;

regulatory and political factors within the countries in which the

company operates; acts of God, such as earthquakes and hurricanes;

the possible impact of international conflicts and other

developments including terrorist acts; and other risks and factors

detailed from time to time in the company's form 40-F filed with

the Securities and Exchange Commission as well as other documents

filed by the company with the securities regulators in Canada and

the United States, including the company's most recent Management's

Discussion and Analysis of Financial Results under the heading

"Business Environment and Risks."

We caution that the foregoing factors that may affect future

results is not exhaustive. When relying on our forward-looking

statements to make decisions with respect to Brookfield Asset

Management, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Except as required by law, the company undertakes no obligation to

publicly update or revise any forward-looking statements or

information, whether written or oral, as a result of new

information, future events or otherwise.

For more information, please visit our web site at

www.brookfield.com.

Contacts: Media Andrew Willis SVP, Communications and Media

(416) 369-8236 andrew.willis@brookfield.com Investor Relations

Katherine Vyse SVP, Investor Relations and Communication (416)

369-8246 kvyse@brookfield.com Brookfield Real Estate Opportunity

Fund Steven Ganeless Senior Vice President (212) 417-7269

stephen.ganeless@brookfield.com

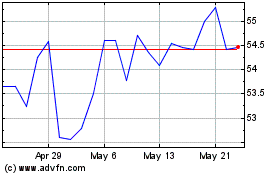

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Dec 2024 to Jan 2025

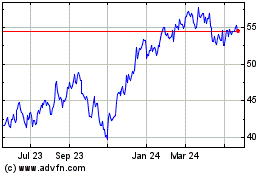

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Jan 2024 to Jan 2025