Brookfield to Issue CDN$250 Million of Preferred Shares and Redeem Its Class A Preference Shares, Series 10

March 05 2012 - 7:34AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION TO THE

UNITED STATES

Brookfield Asset Management Inc. (TSX:BAM)(NYSE:BAM) today announced that it has

agreed to issue 10,000,000 Class A Preferred Shares, Series 32 on a bought deal

basis to a syndicate of underwriters led by RBC Capital Markets, CIBC, Scotia

Capital Inc. and TD Securities Inc. for distribution to the public. The

Preferred Shares, Series 32 will be issued at a price of CDN$25.00 per share,

for aggregate gross proceeds of CDN$250,000,000. Holders of the Preferred

Shares, Series 32 will be entitled to receive a cumulative quarterly fixed

dividend yielding 4.50% annually for the initial period ending September 30,

2018. Thereafter, the dividend rate will be reset every five years at a rate

equal to the 5-year Government of Canada bond yield plus 2.90%.

Brookfield has granted the underwriters an option, exercisable until 48 hours

prior to closing, to purchase up to an additional 2,000,000 Preferred Shares,

Series 32 which, if exercised, would increase the gross offering size to

CDN$300,000,000. The Preferred Shares, Series 32 will be offered in all

provinces of Canada by way of a supplement to Brookfield Asset Management's

existing short form base shelf prospectus dated June 7, 2011. The Preferred

Shares, Series 32 may not be offered or sold in the United States or to U.S.

persons absent registration or an applicable exemption from the registration

requirements under the U.S. Securities Act.

Brookfield also announced its intention to redeem all of its outstanding Class A

Preference Shares, Series 10 (TSX:BAM.PR.H) for cash on April 5, 2012. The

redemption price for each such share will be C$25.00 plus accrued and unpaid

dividends thereon (for greater certainty, excluding declared dividends with a

record date prior to the redemption date). Brookfield intends to use the net

proceeds of the issue of Preferred Shares, Series 32 to redeem its Preference

Shares, Series 10 and, to the extent the underwriters' option is exercised, for

general corporate purposes.

About Brookfield Asset Management

Brookfield Asset Management Inc. is a global alternative asset manager with

approximately $150 billion in assets under management. We have over a 100-year

history of owning and operating assets with a focus on real estate,

infrastructure, power and private equity. We have a range of public and private

investment products and services, which leverage our expertise and experience

and provide us with a distinct competitive advantage in the markets where we

operate. Brookfield is co-listed on the New York and Toronto Stock Exchanges

under the symbol BAM and on NYSE Euronext under the symbol BAMA. For more

information, please visit our web site at www.brookfield.com.

For more information, please visit our web site at www.brookfield.com.

Forward-Looking Statements

Note: This news release contains forward-looking information within the meaning

of Canadian provincial securities laws and "forward-looking statements" within

the meaning of Section 27A of the U.S. Securities Act of 1933, as amended,

Section 21E of the U.S. Securities Exchange Act of 1934, as amended, "safe

harbor" provisions of the United States Private Securities Litigation Reform Act

of 1995 and in any applicable Canadian securities regulations. The words "will"

and "intends" and derivations thereof and other expressions that are predictions

of or indicate future events, trends or prospects and which do not relate to

historical matters identify forward-looking statements. Forward-looking

statements in this news release include statements in regards to the use of

proceeds of the preferred share issue described in this news release. Although

Brookfield Asset Management believes that such forward-looking statements and

information are based upon reasonable assumptions and expectations, the reader

should not place undue reliance on forward-looking statements and information as

such statements and information involve known and unknown risks, uncertainties

and other factors which may cause the actual results, performance or

achievements of the company to differ materially from anticipated future

results, performance or achievement expressed or implied by such forward-looking

statements and information.

Factors that could cause actual results to differ materially from those

contemplated or implied by forward-looking statements include: economic and

financial conditions in the countries in which we do business; the behaviour of

financial markets, including fluctuations in interest and exchange rates;

availability of equity and debt financing; and other risks and factors detailed

from time to time in the company's form 40-F filed with the Securities and

Exchange Commission as well as other documents filed by the company with the

securities regulators in Canada and the United States including the company's

most recent Management's Discussion and Analysis of Financial Results under the

heading "Business Environment and Risks."

We caution that the foregoing list of factors that may affect future results is

not exhaustive. When relying on our forward-looking statements to make decisions

with respect to Brookfield Asset Management, investors and others should

carefully consider the foregoing factors and other uncertainties and potential

events. Except as required by law, the company undertakes no obligation to

publicly update or revise any forward-looking statements or information, whether

written or oral, as a result of new information, future events or otherwise.

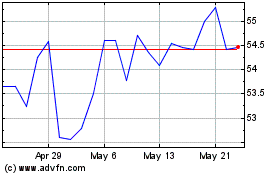

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From Apr 2024 to May 2024

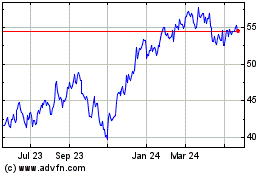

Brookfield Asset Managem... (TSX:BAM)

Historical Stock Chart

From May 2023 to May 2024