Bengal Energy Announces Credit Facility Amendment and Principal Deferral

March 22 2018 - 7:30AM

Bengal Energy Ltd. (TSX:BNG) (“Bengal” or the

“Company”) announces that it has successfully negotiated an

amendment (the “Amendment”) to its secured credit facility (the

“Credit Facility”) with the Australian based Westpac Institutional

Bank (“Westpac”), which includes a deferment of principal payments

on the Credit Facility. The Credit Facility continues to have

an expiry date of December 31, 2019 and provides a borrowing base

of US$12.5 million, of which the full amount is currently drawn.

Under the Amendment, the June 30, 2018 principal

payment of US$2.5MM has been deferred and the December 30, 2018

principal payment has been reduced to US$1.5MM (from

US$2.5MM). The Amendment requires Bengal to make a principal

payment of US$5MM on June 30, 2019 and a principal payment of

US$6MM on December 31, 2019. In addition, there have been

minor revisions to the definitions of Debt Service Coverage Ratio

and Cash Available for Debt Service. A new cash sharing

arrangement has been included in the Amendment that requires Bengal

to prepay an amount that in aggregate equals 50% of free cash

received by the Company in the preceding six months. The cash

sharing calculation and payment will be done quarterly and will be

credited to any outstanding loan amount under the Credit

Facility. Between March 2018 and April 2019, any amounts

posted to the cash sharing arrangement can be withdrawn by Bengal

for any necessary corporate purposes so long as the Company is in

compliance with the terms of the Credit Facility, as amended.

After April 30, 2019, if the Credit Facility has not been cancelled

or repaid in full, Bengal must prepay such amounts as necessary to

ensure that 100% of the free cash over the previous six month

period ending on April 30, 2019 has been prepaid. These

payments will not be available for withdrawal under the Credit

Facility.

Concurrently with the signing of the Amendment,

Bengal will initiate a program to hedge approximately 15,000

barrels of crude oil from January 2019 to March 2019.

“This extension demonstrates the strong support

from our lenders at Westpac and delivers additional value to our

shareholders,” said Chayan Chakrabarty, Bengal’s President and CEO.

“The financial flexibility afforded by the extension provides

additional liquidity to evaluate near term development and

exploration opportunities.”

Copies of the Credit Facility, including the

Amendment, are available under the Company’s profile on

www.sedar.com.

About Bengal

Bengal Energy Ltd. is an international junior

oil and gas exploration and production company with assets in

Australia. The Company is committed to growing shareholder

value through international exploration, production and

acquisitions. Bengal’s common shares trade on the Toronto Stock

Exchange under the symbol “BNG”. Additional information is

available at www.bengalenergy.ca.

Forward-Looking Statements

This news release contains certain

forward-looking statements or information (“forward-looking

statements”) as defined by applicable securities laws that involve

substantial known and unknown risks and uncertainties, many of

which are beyond Bengal’s control. These forward-looking statements

relate to future events or our future performance. All statements

other than statements of historical fact may be forward-looking

statements. The use of any of the words “plan”, “expect”,

“prospective”, “project”, “intend”, “believe”, “should”,

“anticipate”, “estimate”, or other similar words or statements that

certain events “may” or “will” occur are intended to identify

forward-looking statements. The projections, estimates and

beliefs contained in such forward-looking statements are based on

management’s estimates, opinions, and assumptions at the time the

statements were made, including assumptions relating to: the

current commodity price environment; the impact of economic

conditions in North America, Australia and globally; industry

conditions; changes in laws and regulations including, without

limitation, the adoption of new environmental laws and regulations

and changes in how they are interpreted and enforced;

increased competition; the availability of qualified operating or

management personnel; fluctuations in commodity prices, foreign

exchange or interest rates; stock market volatility and

fluctuations in market valuations of companies with respect to

announced transactions and the final valuations thereof; results of

exploration and testing activities; and the ability to obtain

required approvals and extensions from regulatory authorities.

Bengal believes the expectations reflected in those forward-looking

statements are reasonable but, no assurances can be given that any

of the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do so, what benefits that

Bengal will derive from them. As such, undue reliance should not be

placed on forward-looking statements.

Forward-looking statements contained herein

include, but are not limited to, statements regarding: the effect

of the Amendments on the Company and the expected reductions to,

and payments required under, the Credit Facility; and the Company's

plans to initiate a hedging program. The forward-looking

statements contained herein are subject to numerous known and

unknown risks and uncertainties that may cause Bengal’s actual

financial results, performance or achievement in future periods to

differ materially from those expressed in, or implied by, these

forward-looking statements, including but not limited to, risks

associated with: further amendments to, and extensions of, the

Credit Facility; Bengal’s development and exploration

opportunities; fluctuations in commodity prices, foreign exchange

or interest rates; the failure to obtain required regulatory

approvals or extensions; failure to satisfy the conditions under

farm-in and joint venture agreements; failure to secure required

equipment and personnel; changes in general global economic

conditions including, without limitations, the economic conditions

in North America and Australia; increased competition; the

availability of qualified operating or management personnel;

changes in laws and regulations including, without limitation, the

adoption of new environmental and tax laws and regulations and

changes in how they are interpreted and enforced; the results of

exploration and development drilling and related activities; the

ability to access sufficient capital from internal and external

sources; and stock market volatility. Readers are encouraged

to review the material risks discussed in Bengal’s Annual

Information Form under the heading “Risk Factors” and in Bengal’s

annual MD&A under the heading “Risk Factors”. The Company

cautions that the foregoing list of assumptions, risks and

uncertainties is not exhaustive. The forward-looking

statements contained in this news release speak only as of the date

hereof and Bengal does not assume any obligation to publicly update

or revise them to reflect new events or circumstances, except as

may be require pursuant to applicable securities laws.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Bengal Energy

Ltd.Chayan Chakrabarty, President & Chief

Executive OfficerMatthew Moorman, Chief Financial

OfficerPhone : (403)

205-2526Email:

investor.relations@bengalenergy.ca Website:

www.bengalenergy.ca

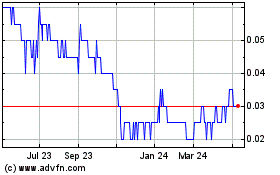

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Jan 2025 to Feb 2025

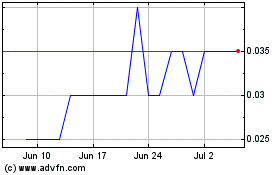

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Feb 2024 to Feb 2025