Baytex Energy Corp. ("Baytex") (TSX:BTE), (NYSE:BTE) reports its

operating and financial results for the three months ended March

31, 2018 (all amounts are in Canadian dollars unless otherwise

noted).

“We successfully executed our first quarter plan

which puts us on track to deliver our 2018 guidance. In the Eagle

Ford, we achieved record production rates from new wells and our

strongest operating netback since 2014. In Canada, we continued to

focus on cost and capital efficiency while managing WCS pricing

volatility through active hedging, crude-by-rail and operational

optimization. With our excellent asset quality and current

commodity prices, we are poised to generate significant free cash

flow going forward,” commented Ed LaFehr, President and Chief

Executive Officer.

Highlights

- Generated production of 69,522 boe/d (79% oil and NGL) during

Q1/2018 and delivered adjusted funds flow of $84 million

($0.36 per basic share).

- Realized an operating netback of $32.48/boe in the Eagle Ford,

the strongest since 2014. Our light oil and condensate production

in the Eagle Ford received a premium sales price of US$63.16/bbl

(WTI plus US$0.29/bbl) given its proximity to Gulf Coast

markets.

- Established average 30-day initial gross production rates of

approximately 1,750 boe/d per well from 27 (5.5 net) wells in the

Eagle Ford that commenced production in the first quarter. This

represents an approximate 20% improvement over wells brought on

production in 2017.

- Executed our Q1/2018 drilling program in Canada while

optimizing operations in the face of volatile heavy oil prices. Our

crude by rail volumes expanded by 25% to 6,500 bbl/d in Q1/2018 and

to 8,000 bbl/d currently.

- Extended the maturity of our US$575 million revolving credit

facilities by one year to June 2020. We maintain strong financial

liquidity with the revolving credit facilities approximately 70%

undrawn.

|

|

| |

Three Months Ended |

|

|

March 31,2018 |

|

|

December 31,2017 |

|

|

March 31, 2017 |

|

|

FINANCIAL(thousands of Canadian dollars, except

per common share amounts) |

|

|

|

| Petroleum and

natural gas sales |

$ |

286,067 |

|

|

$ |

303,163 |

|

|

$ |

260,549 |

|

| Adjusted funds

flow (1) |

84,255 |

|

|

105,796 |

|

|

81,369 |

|

| Per share

– basic |

0.36 |

|

|

0.45 |

|

|

0.35 |

|

| Per share

– diluted |

0.36 |

|

|

0.44 |

|

|

0.34 |

|

| Net income

(loss) |

(62,722) |

|

|

76,038 |

|

|

11,096 |

|

| Per share

– basic |

(0.27) |

|

|

0.32 |

|

|

0.05 |

|

| Per share

– diluted |

(0.27) |

|

|

0.32 |

|

|

0.05 |

|

| Exploration and

development |

93,534 |

|

|

90,156 |

|

|

96,559 |

|

|

Acquisitions, net of divestitures |

(2,026) |

|

|

(3,937) |

|

|

66,004 |

|

|

Total oil and natural gas capital

expenditures |

$ |

91,508 |

|

|

$ |

86,219 |

|

|

$ |

162,563 |

|

| |

|

|

|

| Bank loan

(2) |

$ |

212,571 |

|

|

$ |

213,376 |

|

|

$ |

259,966 |

|

|

Long-term notes (2) |

1,525,595 |

|

|

1,489,210 |

|

|

1,574,116 |

|

| Long-term

debt |

1,738,166 |

|

|

1,702,586 |

|

|

1,834,082 |

|

| Working capital

(surplus) deficiency |

45,213 |

|

|

31,698 |

|

|

16,827 |

|

|

Net debt (3) |

$ |

1,783,379 |

|

|

$ |

1,734,284 |

|

|

$ |

1,850,909 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

March 31,2018 |

December 31,2017 |

March 31,2017 |

|

OPERATING |

|

|

|

|

Daily production |

|

|

|

| Heavy oil (bbl/d) |

24,868 |

24,945 |

24,625 |

| Light oil and condensate (bbl/d) |

20,967 |

21,229 |

21,617 |

| NGL (bbl/d) |

9,143 |

9,872 |

8,306 |

| Total oil and NGL (bbl/d) |

54,978 |

56,046 |

54,548 |

| Natural gas (mcf/d) |

87,261 |

81,063 |

88,502 |

| Oil equivalent (boe/d @ 6:1) (4) |

69,522 |

69,556 |

69,298 |

| |

|

|

|

|

Benchmark prices |

|

|

|

| WTI oil (US$/bbl) |

62.87 |

55.40 |

51.91 |

| WCS heavy oil (US$/bbl) |

38.59 |

43.14 |

37.34 |

| Edmonton par oil ($/bbl) |

72.06 |

69.02 |

63.98 |

| LLS oil (US$/bbl) |

67.07 |

60.50 |

52.50 |

| |

|

|

|

|

Baytex average prices (before hedging) |

|

|

|

| Heavy oil ($/bbl) (5) |

33.33 |

42.03 |

35.96 |

| Light oil and condensate ($/bbl) |

79.20 |

72.64 |

63.26 |

| NGL ($/bbl) |

26.17 |

29.14 |

26.35 |

| Total oil and NGL ($/bbl) |

49.63 |

51.35 |

45.31 |

| Natural gas ($/mcf) |

2.95 |

2.89 |

3.52 |

| Oil equivalent ($/boe) |

42.96 |

44.75 |

40.16 |

| |

|

|

|

|

CAD/USD noon rate at period end |

1.2901 |

1.2518 |

1.3322 |

| CAD/USD average rate for period |

1.2651 |

1.2717 |

1.3229 |

| COMMON SHARE

INFORMATION |

|

|

|

|

TSX |

|

|

|

| Share price (Cdn$) |

|

|

|

| High |

4.35 |

4.59 |

6.97 |

| Low |

3.01 |

2.95 |

4.02 |

| Close |

3.53 |

3.77 |

4.54 |

| Volume traded

(thousands) |

177,572 |

195,013 |

255,645 |

| |

|

|

|

|

NYSE |

|

|

|

| Share price (US$) |

|

|

|

| High |

3.54 |

3.61 |

5.19 |

| Low |

2.37 |

2.30 |

3.01 |

| Close |

2.74 |

3.00 |

3.65 |

| Volume traded

(thousands) |

118,236 |

113,647 |

136,666 |

|

Common shares outstanding (thousands) |

236,578 |

235,451 |

234,203 |

Notes:

(1) Adjusted funds flow is not a measurement based on generally

accepted accounting principles ("GAAP") in Canada, but is a

financial term commonly used in the oil and gas industry. We define

adjusted funds flow as cash flow from operating activities adjusted

for changes in non-cash operating working capital and asset

retirement obligations settled. Our determination of adjusted funds

flow may not be comparable to other issuers. We consider adjusted

funds flow a key measure of performance as it demonstrates our

ability to generate the cash flow necessary to fund capital

investments, debt repayment, settlement of our abandonment

obligations and potential future dividends. In addition, we use the

ratio of net debt to adjusted funds flow to manage our capital

structure. We eliminate changes in non-cash working capital and

settlements of abandonment obligations from cash flow from

operations as the amounts can be discretionary and may vary from

period to period depending on our capital programs and the maturity

of our operating areas. The settlement of abandonment

obligations are managed with our capital budgeting process which

considers available adjusted funds flow. For a reconciliation

of adjusted funds flow to cash flow from operating activities, see

Management's Discussion and Analysis of the operating and financial

results for the three months ended March 31, 2018.(2) Principal

amount of instruments.(3) Net debt is not a measurement based on

GAAP in Canada, but is a financial term commonly used in the oil

and gas industry. We define net debt to be the sum of monetary

working capital (which is current assets less current liabilities

(excluding current financial derivatives and onerous contracts))

and the principal amount of both the long-term notes and the bank

loan.(4) Barrel of oil equivalent ("boe") amounts have been

calculated using a conversion rate of six thousand cubic feet of

natural gas to one barrel of oil. The use of boe amounts may be

misleading, particularly if used in isolation. A boe conversion

ratio of six thousand cubic feet of natural gas to one barrel of

oil is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value

equivalency at the wellhead.(5) We include the cost of blending

diluent when calculating our realized heavy oil price.

Operating Results

Our operating results for the first quarter of

2018 were consistent with our expectations as we continued to

deliver on our operational and financial targets. We successfully

executed our first quarter drilling program and continued to drive

cost and capital efficiency in our business. In addition, we

optimized our heavy oil operations in the face of volatile heavy

oil prices by curtailing production where appropriate, building

crude inventory and deferring several completions until after

spring break-up.

Production averaged 69,522 boe/d (79% oil and

NGL) in Q1/2018, as compared to 69,556 boe/d (81% oil and NGL) in

Q4/2017. Capital expenditures for exploration and development

activities totaled $94 million in Q1/2018 and included the drilling

of 55 (29.8 net) crude oil wells, one (1.0 net) natural gas

well and six (6.0 net) stratigraphic and service wells with a 100%

success rate. During the first quarter, our operating,

transportation and general and administrative expenses totaled

$13.65/boe, 3% below the mid-point of our annual

guidance.

Our 2018 production guidance range is unchanged

at 68,000 to 72,000 boe/d with budgeted exploration and development

capital expenditures of $325 to $375 million.

Eagle Ford

Our Eagle Ford asset in South Texas is one of

the premier oil resource plays in North America. The asset

generates the highest cash netbacks in our portfolio and contains a

significant inventory of development prospects. In Q1/2018, we

allocated 45% of our exploration and development expenditures to

this asset.

Production averaged 36,017 boe/d (78% oil and

NGL) during the first quarter, as compared to 37,362 boe/d in

Q4/2017. The reduced volumes reflect the timing of completion

activity.

We continue to see strong well performance

driven by enhanced completions in Karnes County. In addition, early

results from Atascosa County are encouraging as we exploit the oil

window on the western portion of our lands. In Q1/2018, we

participated in the drilling of 25 (6.9 net) wells and commenced

production from 27 (5.5 net) wells. The wells that have been on

production for more than 30 days established 30-day initial

production rates of approximately 1,750 boe/d, which represents an

approximate 20% improvement over wells brought on production in

2017. These wells were completed with approximately 29 effective

frac stages per well (compared to 23 in 2015) and proppant per

completed foot of approximately 2,100 pounds (compared to 1,100

pounds in 2015).

Peace River

Our Peace River region, located in northwest

Alberta, has been a core asset since we commenced operations in the

area in 2004. Through our innovative multi-lateral horizontal

drilling and production techniques, we are able to generate some of

the strongest capital efficiencies in the oil and gas industry.

Production averaged 16,500 boe/d (90% heavy oil)

during the first quarter, as compared to 16,700 boe/d in Q4/2017.

We drilled three (3.0 net) wells in Q1/2018. Our two multi-lateral

horizontal wells at Reno averaged 19,255 metres of horizontal

length and our first multi-lateral horizontal well on our northern

Seal acreage (acquired in January 2017) was successfully drilled at

15,867 metres of horizontal length. These wells are expected

to be brought on-stream during the second quarter.

Lloydminster

Our Lloydminster region, which straddles the

Alberta and Saskatchewan border, is characterized by multiple

stacked pay formations at relatively shallow depths, which we have

successfully developed through vertical and horizontal drilling,

water flood and steam-assisted gravity drainage (“SAGD”)

operations. We have also adopted, where applicable, the

multi-lateral well design and geosteering capability that we have

successfully utilized at Peace River.

Production averaged 10,000 boe/d (99% heavy oil)

during the first quarter as compared to 9,600 boe/d in Q4/2017. We

drilled 27 (19.9 net) crude oil wells and six (6.0)

stratigraphic and service wells in Q1/2018. During the first

quarter, four operated wells drilled in late 2017 established an

average 30-day initial production rate of approximately 200 bbl/d

per well. In addition, we completed the drilling of three (3.0 net)

SAGD well pairs at our Kerrobert thermal project. Production at

Kerrobert averaged 700 boe/d in Q1/2018 and we expect to exit

2018 producing approximately 2,000 boe/d.

Financial Review

We generated adjusted funds flow of $84 million

($0.36 per basic share) in Q1/2018, compared to $106 million ($0.45

per basic share) in Q4/2017 and $81 million ($0.35 per basic share)

in Q1/2017. The reduction in adjusted funds flow relative to the

fourth quarter is largely attributable to wider heavy oil

differentials, which resulted in lower price realizations for our

Canadian production, and realized financial derivatives losses.

Excluding realized financial derivatives gains

and losses, adjusted funds flow in Q1/2018 was $94 million,

compared to $104 million in Q4/2017. Despite the wide heavy

oil differentials experienced during the first quarter, this

represents the second highest quarterly adjusted funds flow

(unhedged) since mid-2015 and demonstrates the benefit of our

diversified asset portfolio.

Financial Liquidity

We maintain strong financial liquidity with our

US$575 million revolving credit facilities approximately 70%

undrawn and our first long-term note maturity not until 2021. With

our strategy to target exploration and development capital

expenditures at a level that approximates our adjusted funds flow,

we expect this liquidity position to be stable going forward.

On April 25, 2018, we extended the maturity of

our revolving credit facilities by one year to June 2020. These

facilities are covenant-based and do not require annual or

semi-annual reviews. We have also elected to end the covenant

relief period that was set to expire on December 31, 2018 to

benefit from reduced borrowing costs. We are well within the

revised financial covenants on these facilities as our Senior

Secured Debt to Bank EBITDA ratio as at March 31, 2018 was 0.5:1.0,

compared to a maximum permitted ratio of 3.5:1.0, and our interest

coverage ratio was 4.6:1.0, compared to a minimum required ratio of

2.0:1.0.

Our net debt totaled $1.78 billion at March 31,

2018, which is down from $1.85 billion at March 31, 2017.

Operating Netback

Our Q1/2018 operating netback of $20.71/boe

(excluding financial derivatives) demonstrates the strength of our

diversified asset portfolio. During the first quarter, we benefited

from continued strong liquids pricing in the Eagle Ford, which was

offset by the recent volatility in heavy oil price realizations in

Canada. The Eagle Ford generated an operating netback of $32.48/boe

during Q1/2018 while our Canadian operations generated an operating

netback of $8.04/boe.

In Q1/2018, the price for West Texas

Intermediate light oil (“WTI”) averaged US$62.87/bbl, as compared

to US$51.91/bbl in Q1/2017. The discount for Canadian heavy oil, as

measured by the price differential between Western Canadian Select

(“WCS”) and WTI, widened during Q1/2018 to US$24.28/bbl, as

compared to US$14.57/bbl in Q1/2017. Subsequent to quarter-end, the

WCS price differential has improved with the May Index averaging

US$16.92/bbl.

In the Eagle Ford, our assets are proximal to

Gulf Coast markets with light oil and condensate production priced

off the Louisiana Light Sweet (“LLS”) crude oil benchmark, which is

a function of the Brent price. As a result, we benefit from a

widening of the Brent-WTI spread. In addition, increased

competition for physical field supplies has resulted in improved

price realizations relative to LLS. During the first quarter, our

light oil and condensate price in the Eagle Ford of US$63.16/bbl

(or $79.90/bbl) represented a US$0.29/bbl premium to WTI and a

US$3.91/bbl discount to LLS.

The following table summarizes our operating

netbacks for the periods noted.

|

|

| |

Three Months Ended March 31 |

|

|

2018 |

2017 |

|

($ per boe except for sales volume) |

Canada |

U.S. |

Total |

Canada |

U.S. |

Total |

| Sales volume

(boe/d) |

33,505 |

|

36,017 |

|

69,522 |

|

33,217 |

|

36,081 |

|

69,298 |

|

| |

|

|

|

|

|

|

| Realized sales

price |

$ |

29.69 |

|

$ |

55.30 |

|

$ |

42.96 |

|

$ |

32.81 |

|

$ |

46.93 |

|

$ |

40.16 |

|

| Less: |

|

|

|

|

|

|

|

Royalties |

3.76 |

|

16.51 |

|

10.36 |

|

4.23 |

|

13.72 |

|

9.17 |

|

| Operating

expense |

15.06 |

|

6.31 |

|

10.53 |

|

14.52 |

|

6.38 |

|

10.28 |

|

|

Transportation expense |

2.83 |

|

— |

|

1.36 |

|

2.69 |

|

— |

|

1.29 |

|

| Operating netback |

$ |

8.04 |

|

$ |

32.48 |

|

$ |

20.71 |

|

$ |

11.37 |

|

$ |

26.83 |

|

$ |

19.42 |

|

| Realized

financial derivatives (loss) gain |

|

— |

|

|

— |

|

|

(1.57) |

|

|

— |

|

|

— |

|

|

0.04 |

|

| Operating netback after

financial derivatives gain |

$ |

8.04 |

|

$ |

32.48 |

|

$ |

19.14 |

|

$ |

11.37 |

|

$ |

26.83 |

|

$ |

19.46 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk Management

As part of our normal operations, we are exposed

to movements in commodity prices, foreign exchange rates and

interest rates. In an effort to manage these exposures, we utilize

various financial derivative contracts which are intended to

partially reduce the volatility in our adjusted funds flow. We

realized a financial derivatives loss of $10 million in Q1/2018 due

to the increased price of crude oil relative to the prices set in

our contracts.

For the balance of 2018, we have entered into

hedges on approximately 55% of our net crude oil exposure. This

includes 45% of our net WTI exposure with 39% fixed at US$52.31/bbl

and 6% hedged utilizing a 3-way option structure that provides us

with downside price protection at US$54.40/bbl and upside

participation to US$60.00/bbl. In addition, we have entered into a

Brent-based hedge for 4,000 bbl/d at US$61.31/bbl. We have also

entered into hedges on approximately 36% of our net WCS

differential exposure at a price differential to WTI of

US$14.43/bbl and 30% of our net natural gas exposure through a

combination of AECO swaps at C$2.82/mcf and NYMEX swaps at

US$3.01/mmbtu.

For 2019, we have entered into hedges on

approximately 15% of our net crude oil exposure. This includes 13%

of our net WTI exposure with 8% fixed at US$61.99/bbl and 5% hedged

utilizing a 3-way option structure that provides us with downside

price protection at US$60.00/bbl and upside participation to

US$70.00/bbl. In addition, we have entered into a Brent-based 3-way

option structure for 1,000 bbl/d that provides us with downside

price protection at US$65.50/bbl and upside participation to

US$75.50/bbl.

As part of our risk management program, we also

transport crude oil to markets by rail when economics warrant. In

Q1/2018, we delivered 6,500 bbl/d (approximately 25%) of our heavy

oil volumes to market by rail, up from 5,000 bbl/d in 2017. We have

secured additional rail capacity, which will see our crude oil

volumes delivered to market by rail increase to approximately 8,000

bbl/d in Q2/2018.

A complete listing of our financial derivative

contracts can be found in Note 17 to our Q1/2018 financial

statements.

2018 Guidance

The following table summarizes our 2018 annual

guidance and compares it to our Q1/2018 actual results.

|

|

Guidance (1) |

Q1/2018 |

Variance |

|

|

Exploration and development capital ($ millions) |

325 - 375 |

93.5 |

-% |

|

| Production (boe/d) |

68,000

- 72,000 |

69,522 |

-% |

|

| |

|

|

|

| Expenses: |

|

|

|

| Royalty

rate (%) |

~

23.0 |

24.1 |

1% |

|

| Operating

($/boe) |

10.50 -

11.25 |

10.53 |

-% |

|

|

Transportation ($/boe) |

1.35 -

1.45 |

1.36 |

-% |

|

| General

and administrative ($ millions) |

~ 44

(1.72/boe) |

11.0

(1.76/boe) |

-% |

|

|

Interest ($ millions) |

~ 100 (3.95/boe) |

24.5 (3.92/boe) |

(2)% |

|

Note:

(1) As announced on December 7, 2017.

Additional Information

Our condensed consolidated interim unaudited

financial statements for the three months ended March 31, 2018 and

the related Management's Discussion and Analysis of the operating

and financial results can be accessed immediately on our website at

www.baytexenergy.com and will be available shortly through

SEDAR at www.sedar.com and EDGAR at

www.sec.gov/edgar.shtml.

|

Conference Call Tomorrow9:00 a.m. MDT

(11:00 a.m. EDT) |

|

Baytex will host a conference call tomorrow, May 4, 2018, starting

at 9:00am MDT (11:00am EDT). To participate, please dial toll free

in North America 1-800-319-4610 or international 1-416-915-3239.

Alternatively, to listen to the conference call online, please

enter http://services.choruscall.ca/links/baytexq120180504.html

in your web browser. An archived recording of the conference

call will be available shortly after the event by accessing the

webcast link above. The conference call will also be archived on

the Baytex website at www.baytexenergy.com. |

Advisory Regarding Forward-Looking

Statements

In the interest of providing Baytex's

shareholders and potential investors with information regarding

Baytex, including management's assessment of Baytex's future plans

and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can

be identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: our

business strategies, plans and objectives; that we expect to

generate significant free cash flow going forward; our 2018

production and capital expenditure guidance; our Eagle Ford assets,

including our assessment that: it is a premier oil resource play,

generates our highest cash netbacks and has a significant

development inventory; that we can generate some of the strongest

capital efficiencies in the oil and gas industry at our Peace River

assets; initial production rates from new wells; our expected exit

production for 2018 at our Kerrobert thermal project; our strategy

to target capital expenditures at a level that approximates our

adjusted funds flow; our belief that we have strong financial

liquidity and that our liquidity position will remain stable going

forward; our ability to partially reduce the volatility in our

adjusted funds flow by utilizing financial derivative contracts for

commodity prices, foreign exchange rates and interest rates; the

percentage of our anticipated 2018 and 2019 oil and natural gas

production that is hedged; the volume of oil that we expect to

deliver to market by railways in Q2/2018; and our expected royalty

rate and operating, transportation, general and administration and

interest expenses for 2018. In addition, information and statements

relating to reserves and contingent resources are deemed to be

forward-looking statements, as they involve implied assessment,

based on certain estimates and assumptions, that the reserves and

contingent resources described exist in quantities predicted or

estimated, and that they can be profitably produced in the

future.

These forward-looking statements are based on

certain key assumptions regarding, among other things: petroleum

and natural gas prices and differentials between light, medium and

heavy oil prices; well production rates and reserve volumes; our

ability to add production and reserves through our exploration and

development activities; capital expenditure levels; our ability to

borrow under our credit agreements; the receipt, in a timely

manner, of regulatory and other required approvals for our

operating activities; the availability and cost of labour and other

industry services; interest and foreign exchange rates; the

continuance of existing and, in certain circumstances, proposed tax

and royalty regimes; our ability to develop our crude oil and

natural gas properties in the manner currently contemplated; and

current industry conditions, laws and regulations continuing in

effect (or, where changes are proposed, such changes being adopted

as anticipated). Readers are cautioned that such assumptions,

although considered reasonable by Baytex at the time of

preparation, may prove to be incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: the volatility of oil and natural

gas prices and price differentials; the availability and cost of

capital or borrowing; that our credit facilities may not provide

sufficient liquidity or may not be renewed; failure to comply with

the covenants in our debt agreements; risks associated with a

third-party operating our Eagle Ford properties; availability and

cost of gathering, processing and pipeline systems; public

perception and its influence on the regulatory regime; changes in

government regulations that affect the oil and gas industry;

changes in environmental, health and safety regulations;

restrictions or costs imposed by climate change initiatives;

variations in interest rates and foreign exchange rates; risks

associated with our hedging activities; the cost of developing and

operating our assets; depletion of our reserves; risks associated

with the exploitation of our properties and our ability to acquire

reserves; changes in income tax or other laws or government

incentive programs; uncertainties associated with estimating oil

and natural gas reserves; our inability to fully insure against all

risks; risks of counterparty default; risks associated with

acquiring, developing and exploring for oil and natural gas and

other aspects of our operations; risks associated with large

projects; risks related to our thermal heavy oil projects; risks

associated with our use of information technology systems; risks

associated with the ownership of our securities, including changes

in market-based factors; risks for United States and other

non-resident shareholders, including the ability to enforce civil

remedies, differing practices for reporting reserves and

production, additional taxation applicable to non-residents and

foreign exchange risk; and other factors, many of which are beyond

our control. These and additional risk factors are discussed

in our Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2017, as filed with Canadian securities regulatory authorities

and the U.S. Securities and Exchange Commission.

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on Baytex’s current and future operations and such

information may not be appropriate for other purposes.

There is no representation by Baytex that actual

results achieved will be the same in whole or in part as those

referenced in the forward-looking statements and Baytex does not

undertake any obligation to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

All amounts in this press release are stated in

Canadian dollars unless otherwise specified.

Non-GAAP Financial and Capital

Management Measures

Adjusted funds flow is not a measurement based

on generally accepted accounting principles ("GAAP") in Canada, but

is a financial term commonly used in the oil and gas industry. We

define adjusted funds flow as cash flow from operating activities

adjusted for changes in non-cash operating working capital and

asset retirement obligations settled. Our determination of adjusted

funds flow may not be comparable to other issuers. We consider

adjusted funds flow a key measure of performance as it demonstrates

our ability to generate the cash flow necessary to fund capital

investments, debt repayment, settlement of our abandonment

obligations and potential future dividends. In addition, we use the

ratio of net debt to adjusted funds flow to manage our capital

structure. We eliminate changes in non-cash working capital and

settlements of abandonment obligations from cash flow from

operations as the amounts can be discretionary and may vary from

period to period depending on our capital programs and the maturity

of our operating areas. The settlement of abandonment

obligations are managed with our capital budgeting process which

considers available adjusted funds flow. For a reconciliation of

adjusted funds flow to cash flow from operating activities, see

Management's Discussion and Analysis of the operating and financial

results for the year ended December 31, 2017.

Net debt is not a measurement based on GAAP in

Canada. We define net debt to be the sum of monetary working

capital (which is current assets less current liabilities

(excluding current financial derivatives and onerous contracts))

and the principal amount of both the long-term notes and the bank

loan. We believe that this measure assists in providing a more

complete understanding of our cash liabilities.

Bank EBITDA is not a measurement based on GAAP

in Canada. We define Bank EBITDA as our consolidated net

income attributable to shareholders before interest, taxes,

depletion and depreciation, and certain other non-cash items as set

out in the credit agreement governing our revolving credit

facilities. Bank EBITDA is used to measure compliance with certain

financial covenants.

Operating netback is not a measurement based on

GAAP in Canada, but is a financial term commonly used in the oil

and gas industry. Operating netback is equal to petroleum and

natural gas sales less blending expense, royalties, production and

operating expense and transportation expense divided by barrels of

oil equivalent sales volume for the applicable period. Our

determination of operating netback may not be comparable with the

calculation of similar measures for other entities. We

believe that this measure assists in characterizing our ability to

generate cash margin on a unit of production basis.

Advisory Regarding Oil and Gas Information

Where applicable, oil equivalent amounts have

been calculated using a conversion rate of six thousand cubic feet

of natural gas to one barrel of oil. The use of boe amounts

may be misleading, particularly if used in isolation. A boe

conversion ratio of six thousand cubic feet of natural gas to one

barrel of oil is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead.

References herein to average 30-day initial

production rates and other short-term production rates are useful

in confirming the presence of hydrocarbons, however, such rates are

not determinative of the rates at which such wells will commence

production and decline thereafter and are not indicative of long

term performance or of ultimate recovery. While encouraging,

readers are cautioned not to place reliance on such rates in

calculating aggregate production for us or the assets for which

such rates are provided. A pressure transient analysis or well-test

interpretation has not been carried out in respect of all wells.

Accordingly, we caution that the test results should be considered

to be preliminary.

Baytex Energy Corp.

Baytex Energy Corp. is an oil and gas

corporation based in Calgary, Alberta. The company is engaged in

the acquisition, development and production of crude oil and

natural gas in the Western Canadian Sedimentary Basin and in the

Eagle Ford in the United States. Approximately 80% of Baytex’s

production is weighted toward crude oil and natural gas liquids.

Baytex’s common shares trade on the Toronto Stock Exchange and the

New York Stock Exchange under the symbol BTE.

For further information about Baytex, please

visit our website at www.baytexenergy.com or contact:

Brian Ector, Senior Vice President,

Capital Markets and Public Affairs

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

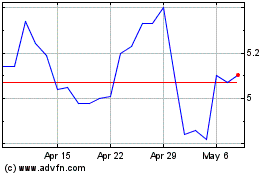

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Feb 2024 to Feb 2025