Baytex Energy Corp. (“Baytex”) (TSX:BTE) (NYSE:BTE) and Raging

River Exploration Inc. (“Raging River”)(TSX:RRX) are pleased to

announce that their respective boards of directors have unanimously

agreed to a strategic combination of the two companies (the

“Transaction”). The combined organization will be a

well-capitalized, oil-weighted company with an attractive growth

and free cash flow profile provided by its world class assets

across North America. The combined organization will have an

enterprise value of approximately $5 billion and operate under the

Baytex name.

Combined Company Highlights (2019 Annual

Estimates)

- Average annual production of 100,000 to 105,000 boe/d (85% oil

and NGLs) with an exploration and development capital program of

$750 to $850 million, representing 5% to 10% production growth

- Debt adjusted production per share growth of approximately

13%

- Adjusted funds flow of approximately $1.0 billion

- Sustaining capital of $575 million equating to a free cash flow

yield of 15%

- Net debt to adjusted funds flow of 1.9x

- Strong operating netback of approximately $30/boe across

portfolio

- Combined management team and board with a track record of value

creation

- Greater than 260,000 acres in the East Duvernay Shale oil play

with recent exploration success validating the prospectivity of the

lands

Notes:

- Pricing assumptions: WTI - US$65/bbl; LLS - US$69/bbl; WCS

differential - US$20/bbl; NYMEX Gas - US$2.75/mcf; and Exchange

Rate (CAD/USD) - 1.275.

- Net debt to adjusted funds flow ratio based on forecast net

debt at year-end 2019 and forecast 2019 adjusted funds flow.

- Certain terms referenced above are non-GAAP measures. See

advisory regarding Non-GAAP Financial and Capital Management

Measures at the end of the press release.

Baytex and Raging River have entered into an

agreement (the “Arrangement Agreement”) to effect the Transaction

by way of a plan of arrangement of Raging River under the Business

Corporations Act (Alberta). The Transaction will result in holders

of common shares of Raging River (“Raging River Shares”) receiving,

directly or indirectly, 1.36 common shares of Baytex (“Baytex

Shares”) for each Raging River Share owned. The exchange ratio was

determined based on the market trading levels of the Baytex Shares

and Raging River Shares at the time the companies entered into

exclusive negotiations. The board of directors of Baytex (the

“Baytex Board”) and the board of directors of Raging River (the

“Raging River Board”) have unanimously approved the Transaction and

have received fairness opinions from their respective financial

advisors. The Transaction is subject to approval by the

shareholders of both companies, the Court of Queen’s Bench of

Alberta and certain regulatory and other authorities, and is

subject to the satisfaction or waiver of other customary closing

conditions. The Transaction is anticipated to close in August

2018.

Mr. Neil Roszell, Executive Chairman and Chief

Executive Officer of Raging River, will serve as Chairman and Mr.

Edward LaFehr, President and Chief Executive Officer of Baytex,

will serve as President and Chief Executive Officer of the combined

company. The balance of the senior management of the combined

company will incorporate senior individuals from both Baytex and

Raging River. The board of directors of the combined company will

consist of members of both the Baytex Board and the Raging River

Board with Mr. Raymond Chan serving as Lead Independent

Director.

“We are uniting two strong oil companies with

exceptional people and assets. This combination creates a

diversified, well-capitalized oil producer that has an impressive

suite of high quality producing assets and the ability to

materially advance our East Duvernay Shale light oil opportunity,

while continuing to develop our Eagle Ford, Viking, Peace River and

Lloydminster core assets. The combination provides a substantial

value proposition for all shareholders of Raging River and Baytex

incremental to what each company could deliver on its own. The

combination with Baytex is an excellent outcome to the

comprehensive strategic process undertaken by the Raging River

Board,” said Mr. Roszell.

“We believe the combined company will deliver a

powerful combination of industry-leading returns, attractive

production growth and strong free cash flow generation. The merger

creates a company with world class assets and a strong balance

sheet while retaining substantial torque to higher crude oil

prices. We will be well-positioned to optimize our capital

investment program across our high rate of return asset base. The

combined company has a dominant 260,000 net acre position in the

emerging East Duvernay Shale oil play which has the potential to

compete for capital with the best plays in North America,” said Mr.

LaFehr.

Strategic Rationale

The combination of two high quality companies

will create a leading oil-weighted producer with a well-capitalized

balance sheet and strong free cash flow generation. The combined

company will have a deep inventory of high quality drilling

prospects that generate top tier returns on invested capital and

have the capability to deliver meaningful organic production

growth.

A World Class Asset Base. The

combined company is expected to have production of approximately

94,000 boe/d from a diverse portfolio of high quality oil

assets that includes the Viking, Peace River, Lloydminster and East

Duvernay Shale in Canada and the Eagle Ford in Texas.

- Production will be comprised of approximately 83% liquids (45%

light oil and condensate, 28% heavy oil and 10% NGLs) and 17%

natural gas. By geography, production will be weighted

approximately 62% from Canada and 38% from the United

States.

- Proved and proved plus probable reserves total 338 mmboe and

539 mmboe, respectively (as at December 31, 2017). The reserves

life index is approximately 10 years on a proved basis and 16 years

on a proved plus probable basis.

Attractive Growth & Free Cash

Flow. The combined asset base has the potential to deliver

annual production growth of 5% to 10%. Assuming a WTI oil price of

US$65/bbl, the combined company is forecasting 2019 average annual

production of 100,000 to 105,000 boe/d and approximately $1 billion

of adjusted funds flow. Free cash flow (net of $575 million

sustaining capital) is expected to be $425 million. Given the

significant free cash flow, the combined company will be

well-positioned to pursue organic growth (including the

acceleration of the East Duvernay Shale oil play), reduce debt,

pursue strategic acquisitions in core areas, and/or reinstate a

dividend. Each US$5/bbl increase in WTI above US$65/bbl provides an

additional $140 million of adjusted funds flow on an unhedged

basis.

Strong Balance Sheet. The

combined company has strong financial liquidity and its first

long-term note maturity is not until 2021. At year-end 2019, the

combined company’s net debt to Bank EBITDA ratio and net debt to

adjusted funds flow ratio are forecast to be 1.7x and 1.9x,

respectively. As a result, the combined company is expected to have

the ability to internally fund the growth of its projects.

High Return Oil-Weighted

Assets. The assets of the combined company are

characterized by high margins and strong capital efficiencies,

resulting in industry-leading returns. Assuming a constant WTI oil

price of US$65/bbl and average capital efficiencies of

approximately $17,000 per boe/d, the combined portfolio of assets

is expected to generate internal rates of return (before-tax) per

well of 50% to 110% and payouts ranging from 6 to 18 months. Baytex

will have a well-defined, low-risk drilling inventory that

represents over 10 years of development opportunities in each core

play.

Superior Capability to Optimize Capital

Allocation. The combined company will have four core high

quality assets with exposure to Canadian light oil, Canadian heavy

oil and US light oil, and will manage the combined portfolio to

choose the best projects and optimize capital allocation. The

diverse oil-weighted asset portfolio and associated capital

allocation optimization is expected to provide more profitable

growth than either company could achieve on a stand-alone

basis.

Strong Oil Price

Diversification. The combined company will have a

diversified marketing portfolio, with 30% of liquids production

commanding WTI-based pricing and 26% of liquids production (light

oil and condensate in the Eagle Ford) commanding premium Louisiana

Light Sweet (“LLS”) based pricing. Approximately 34% of total

liquids production will be based on the WCS heavy oil benchmark

with the balance being NGLs that are priced relative to WTI.

Enhanced Platform for Developing

Emerging Plays. The larger cash flow base from the

combined portfolio of assets and combined technical team with

best-in-class core competencies positions the combined company to

unlock the potential within the emerging East Duvernay Shale oil

play.

Top Tier Team with a Focus on

Operational Excellence. The board of directors and

management will be comprised of members from both Baytex and Raging

River. The combined management, technical and operational teams

will be ideally positioned to continue to build on the strong

operational momentum and new play development with its highly

aligned strategy and culture of operational excellence and

innovation. Operational momentum across the asset portfolio is

expected to continue in the second half of 2018.

Increased Scale and Trading

Liquidity. The combined company, with a total enterprise

value of approximately $5 billion, will be a leading oil-weighted

producer with a high quality asset base and unique portfolio of

future catalysts. Both sets of shareholders will benefit from

improved liquidity and greater institutional investor interest

through Baytex’s listings on both the Toronto Stock Exchange and

the New York Stock Exchange.

Board of Directors and Management

Team

The combined organization will be led by Mr.

Edward LaFehr, President and Chief Executive Officer of Baytex, Mr.

Richard Ramsay, Chief Operating Officer of Baytex, and Mr. Rodney

Gray, Chief Financial Officer of Baytex. Mr. Bruce Beynon, the

current President of Raging River, will join Baytex as Executive

Vice President with responsibility for Exploration, Land and

Corporate Development. Mr. Jason Jaskela, the current Chief

Operating Officer of Raging River, will join Baytex as Vice

President of the East Duvernay Shale oil play, reporting directly

to the CEO. In addition, a majority of the Raging River management

team and staff will have key roles in the combined company.

The Board of Directors of the combined company

will consist of six members of the Baytex Board and four members of

the Raging River Board. Mr. Roszell will serve as Chairman and Mr.

Raymond Chan will serve as Lead Independent Director. The Board of

Directors of the combined company will also include Mr. Edward

LaFehr, Mr. Mark Bly, Ms. Trudy Curran, Mr. Naveen Dargan and Mr.

Gregory Melchin from the Baytex Board and Mr. Gary Bugeaud, Mr.

Kevin Olson and Mr. Dave Pearce from the Raging River

Board.

Summary of the Combination

|

Equity Value (1) |

$2.8 billion |

| Net Debt (2) |

$2.1 billion |

| Enterprise Value |

$4.9 billion |

| |

|

| Common Shares

Outstanding |

555 million |

| |

|

| Production (3) |

93,640 boe/d |

| Oil and NGLs |

83% |

| |

|

| Reserves at December

31, 2017 (4) |

|

| Proved developed

producing |

135 mmboe |

| Proved |

338 mmboe |

|

Proved plus probable |

539 mmboe |

Notes:

- Based on the closing price of the Baytex Shares of $5.10 on

June 15, 2018.

- Pro forma net debt as at March 31, 2018 and inclusive of

transaction costs.

- Combined production based on Q1/2018 volumes of 69,522 boe/d

for Baytex and 24,118 boe/d for Raging River.

- Reserves based on Baytex gross reserves as at December 31,

2017, as evaluated by Sproule Unconventional Limited and Ryder

Scott Company, L.P., and Raging River gross reserves as at December

31, 2017, as evaluated by Sproule Associates Limited and GLJ

Petroleum Consultants Ltd.

2019 Growth Plans and Preliminary

Guidance

The combined asset base has the potential to

deliver approximate annual production growth of 5-10% while

spending less than adjusted funds flow. Baytex is forecasting a pro

forma 2018 exit production rate of approximately 97,000 to 99,000

boe/d, based on exploration and development expenditures of $350 to

$375 million for the combined company in the second half of

2018.

For 2019, total exploration and development

expenditures are expected to be $750 to $850 million, which is

designed to generate average annual production of 100,000 to

105,000 boe/d. At the mid-point, this represents production growth

of approximately 8% over 2018 pro forma average annual production.

The combined company expects to generate adjusted funds flow in

2019 of approximately $1 billion, resulting in a net debt to

adjusted funds flow ratio of 1.9x at year-end 2019.

Development plans for 2019 include an expanded

heavy oil program in Canada with two drilling rigs running in each

of Peace River (32 net wells) and Lloydminster (100 net wells),

along with a consistent activity set in the Viking (275 net wells)

and the Eagle Ford (30 net wells), both of which are expected to

generate significant free cash flow. In addition, the combined

company will continue to delineate the East Duvernay Shale oil play

with an increased pace of activity (12-20 net wells).

Baytex will provide official 2019 guidance in

late 2018 upon approval by the board of directors of the combined

company. Summary of Preliminary 2019 Guidance

|

Exploration and Development Capital |

$750 - $850 million |

| |

|

| Production |

100,000

- 105,000 boe/d |

| Oil and NGLs |

~

85% |

| |

|

| Bank EBITDA (1) |

$1.1

billion |

| Adjusted Funds Flow

(1) |

$1.0

billion |

| Operating Netback

(1) |

$30/boe |

| |

|

| Net Debt to Bank EBITDA

(2) |

1.7x |

| Net Debt

to Adjusted Funds Flow (2) |

1.9x |

Notes:

- Pricing assumptions: WTI - US$65/bbl; LLS - US$69/bbl; WCS

differential - US$20/bbl; NYMEX Gas - US$2.75/mcf; and Exchange

Rate (CAD/USD) - 1.275.

- Net debt ratios based on forecast net debt at year-end 2019 and

forecast 2019 Bank EBITDA and adjusted funds flow.

- Certain terms referenced above are non-GAAP measures. See

advisory regarding Non-GAAP Financial and Capital Management

Measures at the end of the press release.

High Quality Assets

The combined company will have high quality

assets and the capability to efficiently allocate capital to

maximize returns. Specific highlights of the diversified

oil-weighted asset base include:

Eagle Ford

Baytex’s Eagle Ford asset in South Texas is one

of the premier oil resource plays in North America where strong

well performance continues to be driven by enhanced completions in

Karnes County. The Eagle Ford is proximal to Gulf Coast markets

with light oil and condensate production priced off the LLS oil

benchmark, which is a function of the Brent price. As a result, the

light oil and condensate production receives a premium sales price,

generates strong operating netbacks and 80% to 105% IRRs at a WTI

price of US$65/bbl. Production averaged 36,000 boe/d (78% oil and

NGL) in Q1/2018. On a pro forma basis, this represents 38% of total

production, down from 52% previously.

In the Eagle Ford, wells that commenced

production in Q1/2018 established 30-day initial gross production

rates of approximately 1,750 boe/d per well, a 20% improvement over

wells brought on production in 2017. Two wells drilled in late 2017

in the northern Austin Chalk fracture trend achieved 30-day initial

gross production rates of approximately 2,400 boe/d per well; six

additional Austin Chalk wells are planned for the second half of

2018.

East Duvernay

Raging River holds a 100% working interest in

greater than 260,000 net acres of lands in the emerging East

Duvernay Shale oil play in central Alberta. The Duvernay is among

the largest oil and gas resources in Western Canada with activity

in the east shale basin increasing over the last three years in

pursuit of light oil (average 36-42° API). During the first quarter

of 2018, Raging River embarked on a three well evaluation program,

which included an initial discovery in the Pembina area that has

produced at an average rate of 430 boe/d (88% light oil and NGLs)

in its first 80 days since coming on production on March 23, 2018.

The well continues to produce at strong rates with the last seven

days averaging 400 boe/d (88% light oil and NGLs). Given the

success of the exploration program, four additional locations are

being licensed offsetting the discovery well in preparation for an

expanded capital program in the second half of 2018 and a 2019 plan

that will include 12-20 net wells.

The two drilled and uncompleted (“DUC”) wells

from the first quarter drilling program are currently being

completed. Fracture stimulation operations on the second Ferrybank

well have proceeded as planned with a total of 66, 100 tonne frac

stages placed in the well. The second DUC well at Gilby is

currently being fracture stimulated. Results from both wells are

expected over the next sixty days.

Viking

Raging River has built a dominant position in

the Viking light oil resource play in western Canada with over 460

net sections of highly prospective land and approximately 10 years

of drilling inventory at the current pace of development.

Production in the Viking averaged 23,000 boe/d in the first quarter

of 2018 (approximately 36° API). The Viking generates an

exceptional operating netback of approximately $44/boe at a WTI

price of US$65/bbl with well payouts averaging approximately 10

months. Raging River currently has four drilling rigs running and

anticipates a continuous program through year end. The Viking

extended reach horizontal results continue to exceed expectations

with multiple new, previously untested sections being proven as

economically drillable during the first quarter. The Viking is

expected to continue to generate significant free cash flow in the

current commodity price environment. Waterflood initiatives

continue to advance with continued positive results at Gleneath,

Eureka, Plato and Forgan.

Peace River

The Peace River region, located in northwest

Alberta, has been a core asset for Baytex since operations

commenced in the area in 2004. Through innovative multi-lateral

horizontal drilling and production techniques, Baytex’s Peace River

properties generate strong capital efficiencies. Baytex’s recent

northern Seal well (13-leg multi-lateral) generated a 30-day

initial production rate of 900 boe/d (facility constrained); a

total of 10 wells are anticipated to be drilled in the area in

2018. Production averaged 16,500 boe/d (90% heavy oil) in

Q1/2018. Baytex has a dominant land position of 725 net sections

and an inventory of approximately 350 drilling locations that

generate 50% to 75% IRRs at a WTI price of US$65/bbl. Baytex

expects to have two rigs running in the second half of the year as

it continues to build operational momentum heading into 2019.

Lloydminster

Baytex’s Lloydminster region is characterized by

multiple stacked pay formations at relatively shallow depths. The

area has been successfully developed through vertical and

horizontal drilling, water flood, steam-assisted gravity drainage

operations and, more recently, the implementation of polymer

flooding to further enhance reserves recovery. Baytex has adopted,

where applicable, the multi-lateral well design and geosteering

capability it has successfully utilized in Peace River.

Lloydminster drilling locations generate 50% to 110% IRRs at a WTI

price of US$65/bbl. Production averaged 10,000 boe/d (99% heavy

oil) in Q1/2018. Baytex will recommence its Soda Lake multi-lateral

drilling program in June and expects to have two rigs running in

the second half of the year.

Recommendations of the Raging River

Board and the Baytex Board

Based on the unanimous recommendation from a

special committee comprised of independent directors of Raging

River (the “Special Committee”), the Raging River Board has

unanimously approved the Transaction, determined that the

Transaction is in the best interests of Raging River and the

holders of Raging River Shares, and has recommended that the

holders of Raging River Shares vote in favour of the Transaction.

GMP FirstEnergy has provided the Raging River Board with its verbal

opinion that, subject to its review of the final form of documents

effecting the Transaction, the consideration to be received by

holders of Raging River Shares pursuant to the terms of the

Arrangement Agreement is fair, from a financial point of view, to

Raging River shareholders. National Bank Financial Inc. (“National

Bank”) has provided the Special Committee with its verbal opinion

that, subject to its review of the final form of documents

effecting the Transaction, the consideration to be received by

holders of Raging River Shares pursuant to the terms of the

Arrangement Agreement is fair, from a financial point of view, to

Raging River shareholders. All of the directors and officers of

Raging River have entered into agreements with Baytex pursuant to

which they have agreed to vote their Raging River Shares in favour

of the Transaction.

The Baytex Board has unanimously approved the

Transaction, determined that the Transaction is in the best

interests of Baytex and the holders of Baytex Shares, and has

recommended that the holders of Baytex Shares vote in favour of the

issuance of Baytex Shares pursuant to the Transaction. CIBC World

Markets Inc. (“CIBC”) has provided the Baytex Board with its verbal

opinion that, subject to its review of the final form of documents

effecting the Transaction, the exchange ratio pursuant to the

Arrangement Agreement is fair, from a financial point of view, to

Baytex. All of the directors and officers of Baytex have entered

into agreements with Raging River pursuant to which they have

agreed to vote their Baytex Shares in favour of the

Transaction.

Additional Transaction

Details

Baytex and Raging River have entered into the

Arrangement Agreement pursuant to which Baytex and Raging River

have agreed that the Transaction will be effected by way of a plan

of arrangement of Raging River under the Business Corporations Act

(Alberta). The Transaction will result in holders of Raging River

Shares receiving, directly or indirectly, approximately

315 million Baytex Shares for all of the outstanding Raging

River Shares, subject to the terms and conditions of the

Arrangement Agreement. The outstanding long-term notes of Baytex

will remain outstanding following completion of the merger.

The Transaction requires approval by at least

66⅔% of the votes cast by holders of Raging River Shares present in

person or represented by proxy at a special meeting of holders of

Raging River Shares to be called to consider the Transaction and a

majority of the votes cast by holders of Raging River Shares after

excluding the votes cast by those persons whose votes may not be

included under Multilateral Instrument 61-101 - Protection of

Minority Security Holders in Special Transactions.

The issuance of the Baytex Shares pursuant to

the Transaction requires approval by at least 50% of the votes cast

by holders of Baytex Shares represented in person or by proxy at a

special meeting of holders of Baytex Shares to be called to

consider the issuance of Baytex Shares pursuant to the Transaction,

as required by the rules of the Toronto Stock Exchange. The

Arrangement Agreement contemplates that Baytex and Raging River

shareholders will hold their respective shareholder meetings in

August 2018. It is expected that a joint management information

circular will be sent to the shareholders of each of Baytex and

Raging River in mid-July 2018. Closing of the Transaction is

expected to occur in August 2018.

The Arrangement Agreement provides for mutual

non-solicitation covenants, subject to the fiduciary duty

obligations of each of the Raging River Board and the Baytex Board,

and the right to match any superior proposal received by either

party. The Arrangement Agreement provides for mutual non-completion

fees of $50 million in the event the Transaction is not completed

or is terminated by either party in certain circumstances.

The Arrangement Agreement provides that

completion of the Transaction is subject to certain conditions,

including the receipt of all required regulatory approvals, the

approval of the Toronto Stock Exchange and the New York Stock

Exchange, the approval of the shareholders of Baytex and Raging

River (as described above), the approval of the Court of Queen's

Bench of Alberta and approval under the Competition Act

(Canada).

Advisors

CIBC and Scotiabank acted as co-financial

advisors to Baytex with respect to the Transaction. Stikeman

Elliott LLP is acting as Baytex’s legal advisor.

GMP FirstEnergy is acting as exclusive financial

advisor to Raging River and National Bank is acting as advisor to

the Special Committee with respect to the Transaction. Burnet,

Duckworth & Palmer LLP is acting as Raging River’s legal

advisor.

Conference Call and Webcast

Baytex and Raging River will host a conference

call and webcast to discuss the proposed merger today. The details

of the conference call and webcast are below.

An updated corporate presentation highlighting

the strategic combination of Baytex and Raging River is available

on Baytex’s website at www.baytexenergy.com and Raging River’s

website at www.rrexploration.com.

|

Conference Call Today8:00 a.m. MDT (10:00

a.m. EDT) |

|

Baytex and Raging River will host a conference call today, June 18,

2018, starting at 8:00am MDT (10:00am EDT). To participate, please

dial toll free in North America 1-800-319-4610 or international

1-416-915-3239. Alternatively, to listen to the conference call

online, please enter

http://services.choruscall.ca/links/baytex20180618.html in your web

browser. An archived recording of the conference call will be

available shortly after the event by accessing the webcast link

above. The conference call will also be archived on the Baytex’s

website at www.baytexenergy.com. |

Advisory Regarding Forward-Looking

Statements

In the interest of providing the shareholders of

Baytex and Raging River and potential investors with information

regarding Baytex, Raging River and the combined company resulting

from the Transaction, including management's assessment of future

plans and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can be

identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: our

expectation that the combined organization will be a top tier North

American oil producer well-capitalized, with exceptional assets and

a strong balance sheet, be oil-weighted and have an attractive

growth and free cash flow profile; our estimates for the combined

organization’s 2019 annual average production, exploration and

development capital, debt adjusted per share growth, adjusted funds

flow, sustaining capital, net debt to adjusted funds flow and

operating netback; the expected timing for closing the Transaction;

the expected composition of the Board of Directors and management

team of the combined company; the expected benefits of the

Transaction; the ability of the combined company to advance the

East Duvernay Shale light oil opportunity; the expectation that the

Transaction offers substantial value to all shareholders of Raging

River and Baytex incremental to what each company could deliver on

its own; the expectation that the combined company will deliver

industry leading returns, attractive production growth, strong free

cash flow generation, have a strong balance sheet, retain

substantial torque to higher crude oil prices and be able to

optimize its capital investment program across high rate of return

assets; expectations as to the combined company's inventory and

ability to deliver top tier returns on invested capital and

meaningful organic production growth; the combined company's

estimates of reserves and reserves life index; expectations as to

the combined company's annual production growth rate, forecast 2019

average annual production, adjusted funds flow, free cash flow and

free cash flow net of sustaining capital; expectations that the

combined company will be well-positioned to pursue organic growth,

further reduce debt, pursue strategic acquisitions, and/or

reinstate a dividend; the impact of each US$5/bbl increase in the

price of WTI above US$65/bbl on the combined company’s free cash

flow; the 2019 net debt to adjusted funds flow ratio; that the

combined company will have the ability to internally fund the

growth of its projects; expected internal rates of return,

undiscounted payout range, capital efficiencies and drilling

inventory of the combined company; expectations as to how the

combined company will manage its portfolio of assets; the

expectation that the combined company will be able to provide more

profitable growth than either company could achieve on a

stand-alone basis; that the combined company will have a diverse

marketing portfolio and the percentage of exposure to various

benchmark prices for crude oil; that the combined company is

positioned to unlock the East Duvernay Shale oil play; that the

combined company will continue to build on strong operational

momentum; the expectation that shareholders of the combined company

will benefit from improved liquidity and greater institutional

investor interest; guidance relating to annual production growth,

the 2018 production exit rate and, for 2019, exploration and

development expenditures, average annual production, the percentage

of production that will be oil and NGLs, Bank EBITDA, adjusted

funds flow, operating netback, year-end net debt to adjusted funds

flow ratio and year-end net debt to Bank EBITDA ratio; expectations

as to drilling and completion programs associated with certain

assets of the combined company; in the Eagle Ford: that production

receives premium sales price, that operating netbacks are strong

and the IRR of wells at $65 WTI; in the East Duvernay: the drilling

plans for 2018-2019 and upcoming well completion plans; in the

Viking: the impact of extended reach horizontal wells and that it

will continue to generate significant free cash flow; in Peace

River: the inventory, the IRR of wells at $65 WTI and drilling

plans for the remainder of the year; in Lloydminster: the IRR of

wells at $65 WTI and drilling plans for the remainder of the year;

the timing and anticipated dates for mailing the joint management

information circular to Baytex and Raging River shareholders and

the shareholder meetings; and certain other matters relating to the

Transaction. In addition, information and statements relating to

reserves are deemed to be forward-looking statements, as they

involve implied assessment, based on certain estimates and

assumptions, that the reserves described exist in quantities

predicted or estimated, and that they can be profitably produced in

the future.

These forward-looking statements are based on

certain key assumptions regarding, among other things: the timing

of receipt of regulatory and shareholder approvals for the

Transaction; the ability of the combined company to realize the

anticipated benefits of the Transaction; petroleum and natural gas

prices and differentials between light, medium and heavy oil

prices; well production rates and reserve volumes; the ability to

add production and reserves through exploration and development

activities; capital expenditure levels; the ability to borrow under

credit agreements; the receipt, in a timely manner, of regulatory

and other required approvals for operating activities; the

availability and cost of labour and other industry services;

interest and foreign exchange rates; the continuance of existing

and, in certain circumstances, proposed tax and royalty regimes;

the ability to develop crude oil and natural gas properties in the

manner currently contemplated; and current industry conditions,

laws and regulations continuing in effect (or, where changes are

proposed, such changes being adopted as anticipated). Readers are

cautioned that such assumptions, although considered reasonable by

Baytex and Raging River at the time of preparation, may prove to be

incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: completion of the Transaction

could be delayed if parties are unable to obtain the necessary

regulatory, stock exchange, shareholder and court approvals on the

timeline planned; the Transaction will not be completed if all of

these approvals are not obtained or some other condition of closing

is not satisfied; the volatility of oil and natural gas prices and

price differentials; the availability and cost of capital or

borrowing; that credit facilities may not provide sufficient

liquidity or may not be renewed; failure to comply with the

covenants in debt agreements; risks associated with a third-party

operating the combined company's Eagle Ford properties;

availability and cost of gathering, processing and pipeline

systems; public perception and its influence on the regulatory

regime; changes in government regulations that affect the oil and

gas industry; changes in environmental, health and safety

regulations; restrictions or costs imposed by climate change

initiatives; variations in interest rates and foreign exchange

rates; risks associated with hedging activities; the cost of

developing and operating assets; depletion of reserves; risks

associated with the exploitation of properties and ability to

acquire reserves; changes in income tax or other laws or government

incentive programs; uncertainties associated with estimating oil

and natural gas reserves; inability to fully insure against all

risks; risks of counterparty default; risks associated with

acquiring, developing and exploring for oil and natural gas and

other aspects of operations; risks associated with large projects;

risks related to thermal heavy oil projects; risks associated with

use of information technology systems; risks associated with the

ownership of Baytex, Raging River or the combined company

securities, including changes in market-based factors; risks for

United States and other non-resident shareholders, including the

ability to enforce civil remedies, differing practices for

reporting reserves and production, additional taxation applicable

to non-residents and foreign exchange risk; and other factors, many

of which are beyond control. These and additional risk factors are

discussed in Baytex's Annual Information Form, Annual Report on

Form 40-F and Management's Discussion and Analysis for the year

ended December 31, 2017, filed with Canadian securities regulatory

authorities and the U.S. Securities and Exchange Commission and in

Raging River's Annual Information Form for the year ended December

31, 2017, filed with Canadian securities regulatory authorities and

in Baytex's and Raging River's other public filings.

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on the combined company's current and future operations

and such information may not be appropriate for other purposes.

There is no representation by Baytex or Raging

River that actual results achieved will be the same in whole or in

part as those referenced in the forward-looking statements and

neither Baytex nor Raging River undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

law. Non-GAAP Financial and Capital Management

Measures

This press release contains certain financial

measures that do not have a standardized meaning prescribed by

International Financial Reporting Standards (“IFRS”) and therefore

are considered non-GAAP measures. These non-GAAP measures may not

be comparable to similar measures presented by other issuers.

“Adjusted funds flow”, “Bank EBITDA”, “free cash flow”, “internal

rate of return”, “net debt” and “operating netback” are not

recognized measures under IFRS, but are presented in this press

release as they relate to the combined company.

“Adjusted funds flow” is defined as cash flow

from operating activities adjusted for changes in non-cash

operating working capital and asset retirement obligations settled.

Management of Baytex and Raging River consider adjusted funds flow

a key measure of performance as it demonstrates the combined

entity’s ability to generate the cash flow necessary to fund

capital investments, debt repayment, settlement of abandonment

obligations and potential future dividends. In addition, the ratio

of net debt to adjusted funds flow is used to manage the combined

company’s capital structure.

“Bank EBITDA” is defined as consolidated net

income attributable to shareholders before interest, taxes,

depletion and depreciation, and certain other non-cash items as set

out in the credit agreement governing Baytex’s revolving credit

facilities. Management of Baytex and Raging River use Bank EBITDA

to measure compliance with certain financial covenants in Baytex’s

credit agreement.

“Free cash flow” is defined as adjusted funds

flow less sustaining capital. Sustaining capital is an estimate of

the amount of exploration and development capital required to

offset production declines on an annual basis and maintain flat

production volumes.

“Free cash flow yield” is calculated as free

cash flow divided by market capitalization (share price multiplied

by number of shares outstanding).

“Internal rate of return” of “IRR” is a rate of

return measure used to compare the profitability of an investment

and represents the discount rate at which the net present value of

costs equals the net present value of the benefits. The higher a

project’s IRR, the more desirable the project.

“Net debt” is defined as the sum of monetary

working capital (which is current liabilities (excluding current

financial derivatives and onerous contracts)) and the principal

amount of both the long-term notes of Baytex and the bank loans of

Baytex and Raging River. Management of Baytex and Raging River

believe that net debt assists in providing a more complete

understanding of the combined company’s cash liabilities.

“Operating netback” is defined as petroleum and

natural gas sales less blending expense, royalties, production and

operating expense and transportation expense divided by barrels of

oil equivalent sales volume for the applicable period. Management

of Baytex and Raging River believe that operating netback assists

in characterizing the combined company’s ability to generate cash

margin on a unit of production basis.

Advisory Regarding Oil and Gas

Information

The reserves information contained in this press

release has been prepared in accordance with National Instrument

51-101 -Standards of Disclosure for Oil and Gas Activities of the

Canadian Securities Administrators ("NI 51-101"). Listed below are

cautionary statements that are specifically required by NI

51-101:

- Where applicable, oil equivalent amounts have been calculated

using a conversion rate of six thousand cubic feet of natural gas

to one barrel of oil. BOEs may be misleading, particularly if used

in isolation. A boe conversion ratio of six thousand cubic feet of

natural gas to one barrel of oil is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead.

- This press release contains estimates of the net present value

of future net revenue from reserves. Such amounts do not represent

the fair market value of reserves.

This press release discloses drilling inventory

and potential drilling locations. Drilling inventory and drilling

locations refers to the combined company’s total proved, probable

and unbooked locations. Proved locations and probable locations

account for drilling locations in our inventory that have

associated proved and/or probable reserves. Unbooked locations are

internal estimates based on our prospective acreage and an

assumption as to the number of wells that can be drilled per

section based on industry practice and internal review. Unbooked

locations do not have attributed reserves. Unbooked locations are

farther away from existing wells and, therefore, there is more

uncertainty whether wells will be drilled in such locations and if

drilled there is more uncertainty whether such wells will result in

additional oil and gas reserves, resources or production. In the

Eagle Ford, the combined company’s net drilling locations include

187 proved, 69 probable and 263 unbooked locations. In the Viking,

the combined company’s net drilling locations include 1,109 proved,

51 probable and 1,340 unbooked locations. In Peace River, the

combined company’s net drilling locations include 73 proved, 91

probable and 204 unbooked locations. In Lloydminster, the combined

company’s net drilling locations include 213 proved, 47 probable

and 690 unbooked locations. In the East Duvernay Shale, the

combined company’s net drilling locations include 2 proved, 2

probable and 746 unbooked locations.

References herein to average 30-day initial

production rates and other short-term production rates are useful

in confirming the presence of hydrocarbons, however, such rates are

not determinative of the rates at which such wells will commence

production and decline thereafter and are not indicative of long

term performance or of ultimate recovery. While encouraging,

readers are cautioned not to place reliance on such rates in

calculating aggregate production for us or the assets for which

such rates are provided. A pressure transient analysis or well-test

interpretation has not been carried out in respect of all wells.

Accordingly, we caution that the test results should be considered

to be preliminary.

Notice to United States

Readers

The petroleum and natural gas reserves contained

in this press release have generally been prepared in accordance

with Canadian disclosure standards, which are not comparable in all

respects to United States or other foreign disclosure standards.

For example, the United States Securities and Exchange Commission

(the "SEC") requires oil and gas issuers, in their filings with the

SEC, to disclose only "proved reserves", but permits the optional

disclosure of "probable reserves" and "possible reserves" (each as

defined in SEC rules). Canadian securities laws require oil and gas

issuers disclose their reserves in accordance with NI 51-101, which

requires disclosure of not only "proved reserves" but also

"probable reserves" and permits the optional disclosure of

"possible reserves". Additionally, NI 51-101 defines "proved

reserves", "probable reserves" and "possible reserves" differently

from the SEC rules. Accordingly, proved, probable and possible

reserves disclosed in this press release may not be comparable to

United States standards. Probable reserves are higher risk and are

generally believed to be less likely to be accurately estimated or

recovered than proved reserves. Possible reserves are higher risk

than probable reserves and are generally believed to be less likely

to be accurately estimated or recovered than probable reserves.

In addition, under Canadian disclosure

requirements and industry practice, reserves and production are

reported using gross volumes, which are volumes prior to deduction

of royalty and similar payments. The SEC rules require reserves and

production to be presented using net volumes, after deduction of

applicable royalties and similar payments.

All amounts in this press release are stated in

Canadian dollars unless otherwise specified.

Baytex Energy Corp.

Baytex is an oil and gas corporation based in

Calgary, Alberta. The company is engaged in the acquisition,

development and production of crude oil and natural gas in the

Western Canadian Sedimentary Basin and in the Eagle Ford in the

United States. Approximately 80% of Baytex’s production is weighted

toward crude oil and natural gas liquids. Baytex’s common shares

trade on the Toronto Stock Exchange and the New York Stock Exchange

under the symbol BTE.

For further information about Baytex, please

visit the company website at www.baytexenergy.com or contact:

Brian Ector, Senior Vice President,

Capital Markets and Public Affairs

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

Raging River Exploration Inc.

Raging River is a crude oil and natural gas

exploration, development and production company based in Calgary,

Alberta, Canada. The Company’s operations are in the Viking light

oil resource play in western Canada in addition to the recently

added East Duvernay Shale oil play. Raging River’s common shares

trade on the Toronto Stock Exchange under the symbol RRX.

For further information about Raging River,

please visit the company website at www.rrexploration.com or

contact:

| Mr. Neil

Roszell, P. Eng.CEO and Executive

ChairmanTel: (403) 767-1250 |

Mr. Bruce

Beynon, P. GeolPresidentTel: (403)

767-1251 |

Mr. Jerry

Sapieha, CAVice President, Finance and Chief

Financial OfficerTel: (403) 767-1265 |

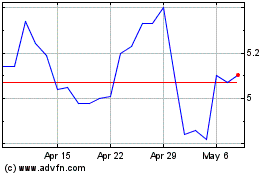

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Feb 2024 to Feb 2025