Baytex Energy Corp. (TSX:BTE) (NYSE:BTE)

("

Baytex") and Raging River Exploration Inc.

(TSX:RRX) ("

Raging River") are pleased to announce

that they have filed a joint management information circular and

proxy statement (the "

Circular") for their

respective special shareholders' meetings to be held in connection

with the proposed strategic combination of Baytex and Raging River

pursuant to a statutory plan of arrangement under the Business

Corporations Act (Alberta) (the

"

Arrangement"). Pursuant to the Arrangement,

holders of common shares of Raging River will receive, directly or

indirectly, 1.36 common shares of Baytex for each common share of

Raging River.

The mailing of the Circular and other materials

has commenced and shareholders of Baytex and Raging River should

receive them within approximately 7 days. An electronic copy

of the Circular is available on Baytex's website at

www.baytexenergy.com/special-meeting and on Raging River's

website at www.rrexploration.com. The Circular is also available on

SEDAR under the issuer profiles of both companies at

www.sedar.com and on EDGAR under Baytex’s profile at

www.sec.gov/edgar.shtml.

Your vote is important regardless of the

number of shares you own. Baytex and Raging River

encourage shareholders to read the Circular in detail.

YOUR VOTE IS IMPORTANT - PLEASE VOTE

TODAY

The Board of Directors of Raging River

UNANIMOUSLY recommends thatRaging River

Shareholders vote IN FAVOUR of the Arrangement

The Board of Directors of Baytex

UNANIMOUSLY recommends thatBaytex Shareholders

vote IN FAVOUR of the Issuance Resolution

Reasons for and Benefits of the Arrangement

Both Baytex and Raging River expect the Arrangement to offer a

number of long-term strategic, financial and operational benefits

and advantages for shareholders, including the following:

- A World Class Asset Base

- Attractive Growth and Free Cash Flow

- Strong Balance Sheet

- High Return Oil-Weighted Assets

- Superior Capability to Optimize Capital

Allocation

- Strong Oil Price Diversification

- Enhanced Platform for Developing Emerging

Plays

- Top Tier Team with a Focus on Operational

Excellence

- Increased Scale and Trading Liquidity

Share Exchange Information and Tax

Treatment

Pursuant to the Arrangement, Raging River

shareholders will receive the Baytex shares they are entitled to

receive on a taxable basis unless they complete and file a Letter

of Transmittal and Election Form and elect to receive the Baytex

shares on a tax-deferred basis.

Generally, a Raging River

shareholder whose adjusted cost base of their Raging River

shares is greater than the fair market value of

the Raging River shares should not need to elect to receive the

Baytex shares pursuant to the Arrangement on a tax-deferred basis

since, absent such election, such Raging River shareholder will

realize a capital loss on the disposition of the Raging River

shares pursuant to the Arrangement.

Generally, a Raging River

shareholder whose adjusted cost base of their Raging River

shares is less than the fair market value of the

Raging River shares should consider electing to receive the Baytex

shares pursuant to the Arrangement on a tax-deferred basis prior to

the Election Deadline in order to receive the Baytex shares

pursuant to the Arrangement on a tax-deferred basis and,

accordingly, not realize a capital gain on the disposition of their

Raging River shares pursuant to the Arrangement.

Raging River shareholders who wish to receive

the Baytex shares on a tax-deferred basis must send in

(i) their Letter of Transmittal and Election Form and

(ii) their share certificate(s) or Direct Registration System

Advice representing their Raging River shares to Computershare

Investor Services Inc. (the "Depositary")

prior to 5:00 p.m. (Calgary time) on August 20,

2018 (unless such time is extended by agreement of Raging

River and Baytex) (the "Election Deadline").

Raging River shareholders who do not hold their

Raging River shares in their own name should instruct their broker

or other intermediary to complete and deliver a Letter of

Transmittal and Election Form in respect of such holders' Raging

River shares to the Depositary prior to the Election Deadline.

The information contained above relating to the

tax impacts of the Arrangement and the procedure relating to the

exchange of Raging River shares for Baytex shares is of a summary

nature and therefore is not complete and is qualified in its

entirety by the more detailed information contained in the Circular

which is important and should be reviewed carefully. Raging River

shareholders should review the discussion under "Certain Canadian

Federal Income Tax Considerations" and "Procedure for the

Arrangement to Become Effective - Procedure for Exchange of Raging

River Share Certificates" in the Circular and are urged to consult

their own tax advisors regarding the tax consequences of the

Arrangement.

Raging River Meeting

The special meeting of shareholders of Raging

River is scheduled to be held at 9:30 a.m.

(Calgary time) on Tuesday, August 21, 2018 in the

Devonian Room at the Calgary Petroleum Club located at 319 – 5th

Avenue S.W., Calgary, Alberta, to approve the Arrangement.

The record date for determination of shareholders entitled to

receive notice of and to vote at the meeting was the close of

business on July 9, 2018.

Baytex Meeting

The special meeting of shareholders of Baytex is

scheduled to be held at 10:30 a.m. (Calgary time)

on Tuesday, August 21, 2018 in the Devonian Room

at the Calgary Petroleum Club located at 319 – 5th Avenue S.W.,

Calgary, Alberta, to approve the issuance of Baytex shares to be

issued to Raging River shareholders pursuant to the Arrangement

(the “Issuance Resolution”). The record date

for determination of shareholders entitled to receive notice of and

to vote at the meeting was the close of business on July 9,

2018.

Shareholder Information and

Questions

Baytex and Raging River shareholders who have

questions about the Circular, need assistance with voting their

shares or making the appropriate election on the Letter of

Transmittal and Election Form can contact our proxy solicitation

agent, Laurel Hill Advisory Group:

Laurel Hill Advisory GroupNorth

America Toll Free: 1-877-452-7184Collect Calls Outside North

America: 1-416-304-0211Email: assistance@laurelhill.com

Shareholders are encouraged to vote today using

the internet, telephone or facsimile.

Advisory Regarding Forward-Looking

Statements

In the interest of providing the shareholders of

Baytex and Raging River and potential investors with information

regarding Baytex, Raging River and the combined company resulting

from the Arrangement, including management's assessment of future

plans and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can be

identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: the

expected long-term benefits of the Arrangement; that the combined

organization will have world class assets, have an attractive

growth and free cash flow profile, have a strong balance sheet,

have high return oil-weighted assets, have a superior capability to

optimize capital allocation, have strong oil price diversification,

have an enhanced platform for developing emerging plays, have a top

tier team with a focus on operational excellence and have increased

scale and trading liquidity; whether the Election Deadline will be

extended; and certain other matters relating to the

Arrangement.

These forward-looking statements are based on

certain key assumptions regarding, among other things: the timing

of receipt of regulatory and shareholder approvals for the

Arrangement; the ability of the combined company to realize the

anticipated benefits of the Arrangement; petroleum and natural gas

prices and differentials between light, medium and heavy oil

prices; well production rates and reserve volumes; the ability to

add production and reserves through exploration and development

activities; capital expenditure levels; the ability to borrow under

credit agreements; the receipt, in a timely manner, of regulatory

and other required approvals for operating activities; the

availability and cost of labour and other industry services;

interest and foreign exchange rates; the continuance of existing

and, in certain circumstances, proposed tax and royalty regimes;

the ability to develop crude oil and natural gas properties in the

manner currently contemplated; and current industry conditions,

laws and regulations continuing in effect (or, where changes are

proposed, such changes being adopted as anticipated). Readers are

cautioned that such assumptions, although considered reasonable by

Baytex and Raging River at the time of preparation, may prove to be

incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: completion of the Arrangement

could be delayed if parties are unable to obtain the necessary

regulatory, stock exchange, shareholder and court approvals on the

timeline planned; the Arrangement will not be completed if all of

these approvals are not obtained or some other condition of closing

is not satisfied; the volatility of oil and natural gas prices and

price differentials; the availability and cost of capital or

borrowing; that credit facilities may not provide sufficient

liquidity or may not be renewed; failure to comply with the

covenants in debt agreements; risks associated with a third-party

operating the Eagle Ford properties; availability and cost of

gathering, processing and pipeline systems; public perception and

its influence on the regulatory regime; changes in government

regulations that affect the oil and gas industry; changes in

environmental, health and safety regulations; restrictions or costs

imposed by climate change initiatives; variations in interest rates

and foreign exchange rates; risks associated with hedging

activities; the cost of developing and operating assets; depletion

of reserves; risks associated with the exploitation of properties

and ability to acquire reserves; changes in income tax or other

laws or government incentive programs; uncertainties associated

with estimating oil and natural gas reserves; inability to fully

insure against all risks; risks of counterparty default; risks

associated with acquiring, developing and exploring for oil and

natural gas and other aspects of operations; risks associated with

large projects; risks related to thermal heavy oil projects; risks

associated with use of information technology systems; risks

associated with the ownership of securities of Baytex and Raging

River, including changes in market-based factors; risks for United

States and other non-resident shareholders, including the ability

to enforce civil remedies, differing practices for reporting

reserves and production, additional taxation applicable to

non-residents and foreign exchange risk; and other factors, many of

which are beyond control. These and additional risk factors are

discussed in Baytex's Annual Information Form, Annual Report on

Form 40-F and Management's Discussion and Analysis for the year

ended December 31, 2017, filed with Canadian securities regulatory

authorities and the U.S. Securities and Exchange Commission and in

Raging River's Annual Information Form for the year ended December

31, 2017, filed with Canadian securities regulatory authorities and

in Baytex's and Raging River's other public filings.

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on the combined company's current and future operations

and such information may not be appropriate for other purposes.

There is no representation by Baytex or Raging

River that actual results achieved will be the same in whole or in

part as those referenced in the forward-looking statements and

neither Baytex nor Raging River undertake any obligation to update

publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by applicable securities

law.

About Baytex Energy Corp.

Baytex is an oil and gas corporation based in

Calgary, Alberta. The company is engaged in the acquisition,

development and production of crude oil and natural gas in the

Western Canadian Sedimentary Basin and in the Eagle Ford in the

United States. Approximately 80% of Baytex’s production is weighted

toward crude oil and natural gas liquids. Baytex’s common shares

trade on the Toronto Stock Exchange and the New York Stock Exchange

under the symbol BTE.

For further information about Baytex, please

visit the company website at www.baytexenergy.com or

contact:

Brian EctorSenior Vice

President, Capital Markets and Public Affairs Toll Free

Number: 1-800-524-5521 Email: investor@baytexenergy.com

About Raging River Exploration

Inc.

Raging River is a crude oil and natural gas

exploration, development and production company based in Calgary,

Alberta, Canada. The Company’s operations are in the Viking light

oil resource play in western Canada in addition to the recently

added East Duvernay Shale oil play. Raging River’s common shares

trade on the Toronto Stock Exchange under the symbol RRX.

For further information about Raging River,

please visit the company website at www.rrexploration.com or

contact:

|

Neil Roszell, P. Eng.CEO and Executive

ChairmanTel: (403) 767-1250 |

Bruce Beynon, P.

GeolPresidentTel: (403) 767-1251 |

Jerry Sapieha,

CAVice President, Finance & Chief Financial

OfficerTel: (403) 767-1265 |

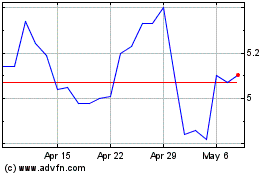

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Feb 2024 to Feb 2025