Baytex Energy Corp. (“Baytex”) (TSX, NYSE: BTE) announces that its

Board of Directors has approved a 2019 capital budget of $550 to

$650 million, which is designed to generate average annual

production of 93,000 to 97,000 boe/d.

Commenting on the announcement, Ed LaFehr,

President and Chief Executive Officer, said: “As we enter 2019, our

top priority is disciplined capital allocation across our strong

portfolio of assets. We will focus activity on our high return,

high netback light oil assets in the Viking and Eagle Ford and we

will continue to prudently advance the East Duvernay Shale.

Importantly, we have the operational flexibility to adjust our

spending plans based on changes in the commodity price

environment.”

Highlights of the 2019

Budget

- Funding of Capital Program. We are targeting 2019 capital

expenditures to approximate adjusted funds flow (assumes a WTI

price of US$52/bbl).

- Capital Allocation. Approximately 80% of our capital

development program will be directed to our high netback light oil

assets in the Eagle Ford and Viking. Approximately 10% of our

capital will be directed to the East Duvernay Shale as we build on

our success in this light oil resource play.

- Stable Production. With a deep inventory of development

projects, we target a long-term production growth rate of 5-10%. In

the current commodity price environment, we believe it is prudent

to deliver a cash flow budget that is designed to deliver stable

production.

- Oil Price Diversification. Over 90% of our operating netback is

expected to come from our light oil assets in the Eagle Ford and

Viking. Our light oil and condensate production in the Eagle Ford

commands premium Louisiana Light Sweet (“LLS”) based pricing.

- Free Cash Flow. Adjusted funds flow in excess of capital

expenditures, lease payments and asset retirement obligations will

be allocated to debt repayment. A US$1.00/bbl change in the price

of WTI impacts our annual adjusted funds flow by approximately $30

million on an unhedged basis ($24 million on a hedged basis).

The 2019 program is approximately 45% weighted

to the first half of the year and we have the operational

flexibility to adjust our spending plans based on changes in

commodity prices. The budget is 90% weighted to drilling and

completion activities.

Based on the mid-point of our guidance range of

95,000 boe/d, approximately 62% of our production is in Canada with

the remaining 38% in the Eagle Ford. Our production mix is forecast

to be 83% liquids (46% light oil and condensate, 27% heavy oil and

10% natural gas liquids) and 17% natural gas, based on a 6:1

natural gas-to-oil equivalency.

Canada

In Canada, our development activity will largely

be focused on the Viking, where we expect to invest approximately

45% of our capital in this shallow, light oil resource play

(approximately 36° API) where we control 460 net sections of

prospective lands. Our program anticipates drilling approximately

245 net wells (85% extended reach horizontals) in 2019.

We will continue to prudently advance the

evaluation of the East Duvernay Shale, an early stage, high netback

light oil resource play where we have amassed over 430 sections of

land. Our initial focus has been to delineate and evaluate the

potential depth of this light oil resource. We now have five

producing wells in the Pembina area. The two most recent wells

brought on-stream in late November are currently producing in

excess of 400 bbl/d of light oil per well. These new wells are

consistent with the strong results achieved from our first three

wells in the Pembina area. Approximately 10% of our planned capital

investment in 2019 will be directed to the Pembina area where we

expect to drill 6-8 net wells.

We expect a modest heavy oil development program

through the first half of 2019, with the potential to scale

activity higher should crude oil prices improve. At Peace River, we

will drill several stratigraphic wells as we continue to delineate

our lands and expand our future drilling inventory. Our 2019

guidance assumes the curtailment of approximately 1,000 bbl/d of

heavy oil for the first six months of the year.

Eagle Ford

Our Eagle Ford asset in South Texas is one of

the premier oil resource plays in North America. The asset

generates a strong operating netback and free cash flow and

contains a significant inventory of development prospects.

Approximately 33% of our planned capital

investment will be directed to the Eagle Ford where we expect to

bring approximately 30 net wells on production. Development will be

concentrated in the Lower Eagle Ford formation across our four

areas of mutual interest.

2019 Guidance

|

Exploration and development capital ($ millions) |

$550 - $650 |

| Production (boe/d) |

93,000 - 97,000 |

| |

|

| Adjusted Funds Flow ($

millions) (1) |

$605 |

| Adjusted Funds Flow per

Share (2) |

$1.08 |

| |

|

| Operating Netback (per

boe) (1)(3) |

$22.00 |

| |

|

| Expenses: |

|

| Royalty rate

(%) |

|

20.0% |

| Operating

($/boe) |

$10.75 - $11.25 |

| Transportation

($/boe) |

$1.25 - $1.35 |

| General and

administrative ($ millions) |

$44 ($1.27/boe) |

| Interest ($

millions) |

$112 ($3.23/boe) |

| |

|

| Leasing expenditures ($

millions) |

$7 |

| Asset

retirement obligations ($ millions) |

$17 |

- Pricing assumptions: WTI - US$52/bbl; LLS - US$57/bbl; WCS

differential - US$22/bbl; MSW differential – US$10/bbl, NYMEX Gas -

US$3.00/mcf; AECO Gas - $1.30/mcf and Exchange Rate (CAD/USD) -

1.32.

- Based on weighted average common shares outstanding of 562

million.

- Includes financial derivatives gains (losses).

2019 Adjusted Funds Flow Sensitivities

|

|

Excluding Hedges($

millions) |

Including Hedges ($

millions) |

| Change of US$1.00/bbl

WTI crude oil |

$30.1 |

$24.2 |

| Change of US$1.00/bbl

WCS heavy oil differential |

$8.3 |

$8.3 |

| Change of US$1.00/bbl

MSW light oil differential |

$9.8 |

$9.8 |

| Change of US$0.25/mcf

NYMEX natural gas |

$9.3 |

$7.4 |

| Change of

$0.01 in the C$/US$ exchange rate |

$8.1 |

$8.1 |

2019 Capital Budget and Wells On-Stream by Operating

Area

|

Operating Area |

Amount (1)($

millions) |

Wells On-stream (net) |

| Canada |

$400 |

300 |

| United States (2) |

$200 |

30 |

|

Total |

$600 |

330 |

- Reflects mid-point of capital budget guidance range.

- Based on a Canadian-U.S. exchange rate of 1.32 CAD/USD.

2019 Capital Budget Breakdown

|

Classification |

Amount (1)($

millions) |

| |

|

| Drilling, completion

and equipping |

$545 |

| Facilities |

$45 |

| Land and seismic |

$10 |

|

Total |

$ 600 |

- Reflects mid-point of capital budget guidance range.

Risk Management

As part of our normal operations, we are exposed

to movements in commodity prices. In an effort to manage these

exposures, we utilize various financial derivative contracts,

crude-by-rail and capital allocation optimization to reduce the

volatility in our adjusted funds flow.

For 2019, we have entered into hedges on

approximately 30% of our net crude oil exposure. This includes 25%

of our net WTI exposure with 2% fixed at US$62.85/bbl and 23%

hedged utilizing a 3-way option structure that provides a US$10/bbl

premium to WTI when WTI is at or below US$56.02/bbl and allows

upside participation to US$73.65/bbl. In addition, we have entered

into a Brent-based 3-way option structure for 3,000 bbl/d that

provides a US$10/bbl premium to Brent when Brent is at or below

US$59.50/bbl and allows upside participation to US$78.68/bbl. We

have also entered into hedges on approximately 21% of our net

natural gas exposure through a combination of AECO swaps at

C$2.37/mcf and NYMEX swaps at US$3.09/mmbtu.

Crude-by-rail is an integral part of our egress

and marketing strategy. For 2019, we expect to deliver 11,000 bbl/d

(approximately 40%) of our heavy oil volumes to market by rail, up

from approximately 9,000 bbl/d in 2018. Commencing January 1, 2019,

approximately 70% of our crude by rail commitments are WTI based

contracts with no WCS pricing exposure.

Corporate Restructuring

After completing the merger with Raging River

Exploration, we have recently streamlined our executive team with a

reduction of three executive officers. In addition, we have

consolidated our Peace River and Lloydminster operations into one

heavy oil business unit, resulting in an approximate 10% reduction

in head office staff and contractors.

Advisory Regarding Forward-Looking

Statements

In the interest of providing Baytex's

shareholders and potential investors with information regarding

Baytex, including management's assessment of Baytex's future plans

and operations, certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively, "forward-looking

statements"). In some cases, forward-looking statements can

be identified by terminology such as "anticipate", "believe",

"continue", "could", "estimate", "expect", "forecast", "intend",

"may", "objective", "ongoing", "outlook", "potential", "project",

"plan", "should", "target", "would", "will" or similar words

suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak

only as of the date thereof and are expressly qualified by this

cautionary statement.

Specifically, this press release contains

forward-looking statements relating to but not limited to: our

business strategies, plans and objectives; our capital budget for

2019; our average annual production rate for 2019; our top priority

being disciplined capital allocation; that we will focus on our

Eagle Ford and Viking assets and prudently advance the East

Duvernay Shale; that we have operational flexibility to adjust our

plans based on commodity prices; our target of funding 2019 capital

expenditures with adjusted funds flow; that our 2019 capital budget

assumes a WTI price of $52/bbl; our capital allocations as between

assets for 2019; our long term target of 5-10% production growth;

that we expect 90% of our operating netback to come from Eagle Ford

and Viking; that excess funds will be spent on debt repayment; the

impact of a $1.00 change in WTI on our adjusted funds flow; the

timing and flexibility of our capital spending; the percentage of

our capital expenditures to be spent on drilling and completions;

the product mix for 2019 production; the breakdown of our 2019

capital budget by geographic area, expenditure type and number of

wells to be drilled or brought on production; the geographic

breakdown and product mix for 2019 production; in Canada, the

number and type of wells to be drilled in the Duvernay and in Peace

River, our expectation that we will expand our future drilling

inventory in Peace River and the amount of production we expect to

curtail in the first six months of the year; our expected adjusted

funds flow, adjusted funds flow per share, operating netback,

royalty rate and operating, transportation, general and

administrative, interest costs, leasing expenditures and asset

retirement obligations for 2019; the sensitivity of our 2019

Adjusted Funds Flow to changes in WTI, WCS, MSW and NYMEX prices

and the C$/US$ exchange rate; the expected capital budget and wells

on-stream by operating area in 2019 and capital budget by spending

type for 2019; the existence, operation and strategy of our risk

management program for commodity prices; and the percentage of our

net crude oil and natural gas exposure that is hedged for 2019 and

the amount and percentage of heavy oil production we expect to

delivery by crude by rail and the percentage of crude by rail

deliveries that do not have WCS exposure.

In addition, information and statements relating

to reserves are deemed to be forward-looking statements, as they

involve implied assessment, based on certain estimates and

assumptions, that the reserves described exist in quantities

predicted or estimated, and that the reserves can be profitably

produced in the future. Although Baytex believes that the

expectations and assumptions upon which the forward-looking

statements are based are reasonable, undue reliance should not be

placed on the forward-looking statements because Baytex can give no

assurance that they will prove to be correct.

These forward-looking statements are based on

certain key assumptions regarding, among other things: petroleum

and natural gas prices and differentials between light, medium and

heavy oil prices; well production rates and reserve volumes; our

ability to add production and reserves through our exploration and

development activities; capital expenditure levels; our ability to

borrow under our credit agreements; the receipt, in a timely

manner, of regulatory and other required approvals for our

operating activities; the availability and cost of labour and other

industry services; interest and foreign exchange rates; the

continuance of existing and, in certain circumstances, proposed tax

and royalty regimes; our ability to develop our crude oil and

natural gas properties in the manner currently contemplated; and

current industry conditions, laws and regulations continuing in

effect (or, where changes are proposed, such changes being adopted

as anticipated). Readers are cautioned that such assumptions,

although considered reasonable by Baytex at the time of

preparation, may prove to be incorrect.

Actual results achieved will vary from the

information provided herein as a result of numerous known and

unknown risks and uncertainties and other factors. Such factors

include, but are not limited to: the volatility of oil and natural

gas prices and price differentials; the availability and cost of

capital or borrowing; that our credit facilities may not provide

sufficient liquidity or may not be renewed; failure to comply with

the covenants in our debt agreements; risks associated with a

third-party operating our Eagle Ford properties; availability and

cost of gathering, processing and pipeline systems; public

perception and its influence on the regulatory regime; changes in

government regulations that affect the oil and gas industry;

changes in environmental, health and safety regulations;

restrictions or costs imposed by climate change initiatives;

variations in interest rates and foreign exchange rates; risks

associated with our hedging activities; the cost of developing and

operating our assets; depletion of our reserves; risks associated

with the exploitation of our properties and our ability to acquire

reserves; changes in income tax or other laws or government

incentive programs; uncertainties associated with estimating oil

and natural gas reserves; our inability to fully insure against all

risks; risks of counterparty default; risks associated with

acquiring, developing and exploring for oil and natural gas and

other aspects of our operations; risks associated with large

projects; risks related to our thermal heavy oil projects; risks

associated with our use of information technology systems; risks

associated with the ownership of our securities, including changes

in market-based factors; risks for United States and other

non-resident shareholders, including the ability to enforce civil

remedies, differing practices for reporting reserves and

production, additional taxation applicable to non-residents and

foreign exchange risk; and other factors, many of which are beyond

our control. These and additional risk factors are discussed in our

Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2017, as filed with Canadian securities regulatory authorities

and the U.S. Securities and Exchange Commission.

The above summary of assumptions and risks

related to forward-looking statements has been provided in order to

provide shareholders and potential investors with a more complete

perspective on Baytex’s current and future operations and such

information may not be appropriate for other purposes.

There is no representation by Baytex that actual

results achieved will be the same in whole or in part as those

referenced in the forward-looking statements and Baytex does not

undertake any obligation to update publicly or to revise any of the

included forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities law.

All amounts in this press release are stated in

Canadian dollars unless otherwise specified.

Non-GAAP Financial Measures

Adjusted funds flow is not a measurement based

on generally accepted accounting principles ("GAAP") in Canada, but

is a financial term commonly used in the oil and gas

industry. We define adjusted funds flow as cash flow from

operating activities adjusted for changes in non-cash operating

working capital and asset retirement obligations settled. Our

determination of adjusted funds flow may not be comparable to other

issuers. We consider adjusted funds flow a key measure of

performance as it demonstrates our ability to generate the cash

flow necessary to fund capital investments, debt repayment,

payments on our lease obligations, settlement of our abandonment

obligations and potential future dividends. In addition, we use the

ratio of net debt to adjusted funds flow to manage our capital

structure. We eliminate changes in non-cash working capital and

settlements of abandonment obligations from cash flow from

operations as the amounts can be discretionary and may vary from

period to period depending on our capital programs and the maturity

of our operating areas. The settlement of abandonment

obligations are managed with our capital budgeting process which

considers available adjusted funds flow. The most directly

comparable measures calculated in accordance with GAAP are cash

flow from operating activities and net income.

Free cash flow is not a measurement based on

GAAP in Canada. We define free cash flow as adjusted funds flow

less sustaining capital. Sustaining capital is an estimate of the

amount of exploration and development capital required to offset

production declines on an annual basis and maintain flat production

volumes.

Operating netback is not a measurement based on

GAAP in Canada, but is a financial term commonly used in the oil

and gas industry. Operating netback is equal to petroleum and

natural gas sales less blending expense, royalties, production and

operating expense and transportation expense divided by barrels of

oil equivalent sales volume for the applicable period. Our

determination of operating netback may not be comparable with the

calculation of similar measures for other entities. We

believe that this measure assists in characterizing our ability to

generate cash margin on a unit of production basis.

Advisory Regarding Oil and Gas Information

Where applicable, oil equivalent amounts have

been calculated using a conversion rate of six thousand cubic feet

of natural gas to one barrel of oil. The use of boe amounts

may be misleading, particularly if used in isolation. A boe

conversion ratio of six thousand cubic feet of natural gas to one

barrel of oil is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a

value equivalency at the wellhead.

Baytex Energy Corp.

Baytex Energy Corp. is an oil and gas

corporation based in Calgary, Alberta. The company is engaged in

the acquisition, development and production of crude oil and

natural gas in the Western Canadian Sedimentary Basin and in the

Eagle Ford in the United States. Approximately 83% of Baytex’s

production is weighted toward crude oil and natural gas liquids.

Baytex’s common shares trade on the Toronto Stock Exchange and the

New York Stock Exchange under the symbol BTE.

For further information about Baytex, please

visit our website at www.baytexenergy.com or contact:

Brian Ector, Vice President, Capital

Markets

Toll Free Number: 1-800-524-5521Email:

investor@baytexenergy.com

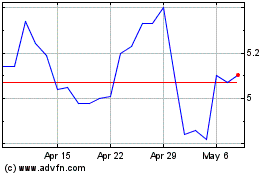

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Baytex Energy (TSX:BTE)

Historical Stock Chart

From Feb 2024 to Feb 2025