NAL Oil & Gas Trust ("NAL" or the "Trust") (TSX:NAE.UN) today announced its

financial and operational results for the first quarter of 2010. All amounts are

in Canadian dollars unless otherwise stated.

SUMMARY

Following positive performance in 2009, NAL's active first quarter delivered

results that are on target with guidance announced earlier this year. Commenting

on NAL's first quarter, Mr. Andrew Wiswell, President and CEO stated,

"operationally and financially, the Trust has built on the momentum created in

2009 by completing the Trust's most active capital spending program in its 14

year history. Overall, results were positive and build on management's track

record of delivering consistent results. Operationally, the Trust spent 37

percent of the revised capital program, running 11 rigs concentrated in our core

areas. Financially, the Trust's balance sheet strength and capability were

enhanced through a $100 million equity financing and renewed credit lines at the

existing $550 million level. With approximately $350 million of available credit

today, NAL continues to actively evaluate assets that will add opportunity to

the portfolio and create value for our unitholders."

2010 YEAR TO DATE ACTIVITY HIGHLIGHTS

-- Spent $78 million in capital expenditures of which $56.0 million was directed

toward drilling, completion and tie-in operations, running 11 rigs throughout

each of our core areas, drilling 48 (21.1 net) wells, of which 75 percent were

horizontal oil wells.

-- Participated in 11 Cardium oil wells focused on the Garrington area, which

continue to deliver volumes consistent with expectations and achieving rates of

return in the 30 - 50 percent range.

-- Delineated a new pool discovery at Hoffer in SE Saskatchewan, which was

drilled during the fourth quarter 2009. The initial well came on at a first

month average production rate of 300 bbls/d and continues to produce at

approximately 150 bbls/d after six months (Trust 50 percent working interest).

-- Drilled one natural gas well at Fireweed, BC (Trust 100 percent working

interest). Initial production from the Fireweed Doig horizontal commenced in

April at a rate of 1,000 boe/d. Results in Fireweed have validated the

significant resource potential of this liquids rich gas pool.

-- Opportunistically added strategic land in existing core areas, spending

approximately $20 million on land and seismic in the Edson area of Alberta and

in the Torquay and Hoffer areas in SE Saskatchewan.

-- Delivered record quarterly production volumes in line with expectations in

the first quarter, averaging 30,120 boe per day.

-- Reduced operating costs by 10 percent to $10.81 per boe compared to $11.95

per boe for the quarter ended March 31, 2009. Operating costs continue to trend

down driven by lower natural gas prices impacting the cost of power and

continued gains from an aggressive optimization program in field operations.

-- Renewed the Trust's fully secured revolving credit facility at the current

level of $550 million, approximately $350 million of which is currently

available after taking the recent equity financing into consideration.

-- Completed a $100 million equity financing, with approximately $10 - 15

million of the proceeds to be directed toward second half 2010 drilling and $20

million dedicated toward strategic land acquisition in NAL's core areas. NAL

remains active in evaluating property and corporate acquisitions.

2010 UPDATED GUIDANCE

Based on first quarter performance and the recently completed $100 million

equity financing, the Trust has increased its capital expenditure guidance for

2010 and lowered its operating cost forecast.

May 2010 January 2010

Guidance Guidance

----------------------------------------------------------------------------

Production (boe/d) 29,500 - 30,500 29,500 - 30,500

Net capital expenditures ($MM) 210 175

Operating costs ($/boe) 10.75 - 11.25 11.00 - 11.50

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CAPITAL EXPENDITURE ALLOCATION

The table below illustrates the allocation of the increased capital

expenditures. The incremental capital will be directed toward drilling in the

third and fourth quarters of 2010 in support of the active land acquisition

program in the first quarter. Due to the timing of the incremental spending, the

Trust does not expect material incremental volumes during the year and as a

result, has not adjusted the full year average production volumes guidance at

this time.

2010 Exploration & Development Guidance ($MM)

May January

Drill, Complete & Tie-in 153 140

Recompletion 7 7

Plant & Facilities 10 8

Land & Seismic 30 10

---------------------------

Subtotal E&D 200 165

Other 10 10

---------------------------

Total 210 175

---------------------------

PAYOUT RATIO

NAL's first quarter total payout ratio of 158 percent, based on funds from

operations ("FFO"), is largely the result of an active first quarter drilling

and land acquisition program. Historically and strategically, the Trust's first

quarter capital program tends to be higher in order to complete winter drilling

activities prior to spring break-up and road bans coming into effect. In 2010,

NAL spent $78 million in total capital expenditures which represents

approximately 107 percent of FFO, while the distribution payout represents

approximately 51 percent of FFO. On a full year basis, NAL expects to maintain a

total payout ratio which includes capital expenditures and distributions in the

125 - 130 percent range. Despite this level of spending, and after taking into

consideration the net proceeds from the recent equity financing, the Trust's

balance sheet position remains solid with a forecast total debt to cash flow

ratio of 1.5 times, including debentures, on a full year average basis.

CORPORATE CONVERSION

Currently, NAL plans to convert to a dividend paying corporation in the fall of

2010. By itself, the change in structure of the underlying entity from a trust

to corporation, does not affect our business plan or our disciplined operational

and financial focus.

NAL's Board will continue to assess the Trust's dividend and payout policy based

upon commodity prices, NAL's asset base and opportunities, and other market

factors. Assuming commodity prices remain consistent with current levels, the

Trust has no plans to change the $0.09 per month distribution prior to

conversion. After conversion, the Trust's total return will be driven by a

combination of growth and yield, with yield remaining a strong component of the

overall return. Specific payout and dividend levels will be established closer

to the time of conversion.

FORWARD-LOOKING INFORMATION

Please refer to the disclaimer on forward-looking information set forth under

the Management's Discussion and Analysis in this press release. The disclaimer

is applicable to all forward-looking information in this press release,

including the updated guidance for full year 2010 set forth above.

NON-GAAP MEASURES

Please refer to the discussion of non-GAAP measures set forth under the

Management's Discussion and Analysis regarding the use of the following terms:

"funds from operations", "payout ratio" and "operating netback".

CONFERENCE CALL DETAILS

At 3:30 p.m. MDT (5:30 p.m. EDT) on May 4, 2010, NAL will hold a conference call

to discuss the first quarter 2010 results. Mr. Andrew Wiswell, President and

CEO, will host the conference call with other members of the management team.

The call is open to analysts, investors, and all interested parties. If you wish

to participate, call 1-800-769-8320 toll free across North America. The

conference call will also be accessible through the internet at

http://events.digitalmedia.telus.com/nal/050410/index.php

A recorded playback of the call will be available until May 11, 2010 by calling

1-800-408-3053, reservation 2425380.

Notes: (1) All amounts are in Canadian dollars unless otherwise stated.

(2) When converting natural gas to barrels of oil equivalent (boe)

within this press release, NAL uses the widely recognized

standard of six thousand cubic feet (Mcf) to one barrel of oil.

However, boe's may be misleading, particularly if used in

isolation. A conversion ratio of 6 Mcf:1 boe is based on an

energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead.

FINANCIAL AND OPERATING HIGHLIGHTS

Three months ended

(thousands of dollars, except per unit and boe data)

(unaudited)

----------------------------------------

March 31, March 31, December 31,

2010 2009 2009

----------------------------------------------------------------------------

FINANCIAL

Revenue(1) $ 136,883 $ 80,662 $ 111,477

Cash flow from operating

activities 63,648 66,546 53,060

Cash flow per unit - basic 0.46 0.69 0.45

Cash flow per unit - diluted 0.44 0.67 0.44

Funds from operations 73,242 62,024 62,953

Funds from operations per unit

- basic 0.53 0.64 0.53

Funds from operations per unit

- diluted 0.51 0.62 0.51

Net income 29,349 4,724 5,634

Distributions declared 37,185 29,816 32,625

Distributions per unit 0.27 0.31 0.27

Basic payout ratio:

based on cash flow from

operating activities 58% 45% 61%

based on funds from operations 51% 48% 52%

Basic payout ratio including

capital expenditures(2) :

based on cash flow from

operating activities 181% 99% 130%

based on funds from operations 158% 107% 110%

Units outstanding (000's)

Period end 137,881 96,181 137,471

Weighted average 137,660 96,181 118,174

Capital expenditures(3) 78,317 36,936 36,764

Property acquisitions

(dispositions), net (12,702) 1,314 (17,255)

Corporate acquisitions, net(4) 309 - 310,051

Net debt, excluding convertible

debentures(5) 309,136 324,614 282,727

Convertible debentures (at face

value) 194,744 79,744 194,744

OPERATING

Daily production(6)

Crude oil (bbl/d) 11,788 9,990 10,290

Natural gas (Mcf/d) 93,328 68,966 78,265

Natural gas liquids (bbl/d) 2,777 2,352 2,413

Oil equivalent (boe/d) 30,120 23,836 25,748

OPERATING NETBACK ($/boe)

Revenue before hedging gains

(losses) 50.49 37.60 47.06

Royalties (8.54) (6.59) (8.95)

Operating costs (10.81) (11.95) (10.21)

Other income(7) 0.16 0.20 0.15

----------------------------------------------------------------------------

Operating netback before

hedging 31.30 19.26 28.05

Hedging gains (losses) 0.63 12.95 4.71

----------------------------------------------------------------------------

Operating netback 31.93 32.21 32.76

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Oil, natural gas and liquid sales less transportation costs and prior to

royalties and hedging.

(2) Capital expenditures included are net of non-controlling interest amount

of $0.1 million (2009 - $0.6) for the three months ended March 31, 2010,

attributable to the Tiberius and Spear properties.

(3) Excludes property and corporate acquisitions, and is net of drilling

incentive credits of $2.4 million for the quarter ended March 31, 2010.

(4) Represents total consideration for corporate acquisitions including

fees.

(5) Bank debt plus working capital and other liabilities, excluding

derivative contracts, notes payable/receivable and future income tax

balances.

(6) Includes royalty interest volumes.

(7) Excludes minimal Trust interest paid on notes with Manulife Financial

Corporation.

MANAGEMENT'S DISCUSSION AND ANALYSIS

The following discussion and analysis ("MD&A") should be read in conjunction

with the interim unaudited consolidated financial statements for the three

months ended March 31, 2010 and the audited consolidated financial statements

and MD&A for the year ended December 31, 2009 of NAL Oil & Gas Trust ("NAL" or

the "Trust"). It contains information and opinions on the Trust's future outlook

based on currently available information. All amounts are reported in Canadian

dollars, unless otherwise stated. Where applicable, natural gas has been

converted to barrels of oil equivalent ("boe") based on a ratio of six thousand

cubic feet of natural gas to one barrel of oil. The boe rate is based on an

energy equivalent conversion method primarily applicable at the burner tip and

does not represent a value equivalent at the wellhead. Use of boe in isolation

may be misleading.

NON-GAAP FINANCIAL MEASURES

Throughout this discussion and analysis, Management uses the terms funds from

operations, funds from operations per unit, payout ratio, cash flow from

operations per unit, net debt to trailing 12 month cash flow, operating netback

and cash flow netback. These are considered useful supplemental measures as they

provide an indication of the results generated by the Trust's principal business

activities. Management uses the terms to facilitate the understanding of the

results of operations. However, these terms do not have any standardized meaning

as prescribed by Canadian Generally Accepted Accounting Principles ("GAAP").

Investors should be cautioned that these measures should not be construed as an

alternative to net income determined in accordance with GAAP as an indication of

NAL's performance. NAL's method of calculating these measures may differ from

other income funds and companies and, accordingly, they may not be comparable to

measures used by other income funds and companies.

Funds from operations is calculated as cash flow from operating activities

before changes in non-cash working capital. Funds from operations does not

represent operating cash flows or operating profits for the period and should

not be viewed as an alternative to cash flow from operating activities

calculated in accordance with GAAP. Funds from operations is considered by

Management to be a more meaningful key performance indicator of NAL's ability to

generate cash to finance operations and to pay monthly distributions. Funds from

operations per unit and cash flow from operations per unit are calculated using

the weighted average units outstanding for the period.

Payout ratio is calculated as distributions declared for a period as a

percentage of either cash flow from operating activities or funds from

operations; both measures are stated.

Net debt to trailing 12 months cash flow is calculated as net debt as a

proportion of funds from operations for the previous 12 months. Net debt is

defined as bank debt, plus convertible debentures at face value, plus working

capital and other liabilities, excluding derivative contracts, notes

payable/receivable and future income tax balances.

The following table reconciles cash flows from operating activities to funds

from operations:

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

$ (000s) 2010 2009

----------------------------------------------------------------------------

Cash flow from operating activities $63,648 $ 66,546

Add back change in non-cash working capital 9,594 (4,522)

----------------------------------------------------------------------------

Funds from operations $73,242 $ 62,024

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FORWARD-LOOKING INFORMATION

This discussion and analysis contains forward-looking information as to the

Trust's internal projections, expectations and beliefs relating to future events

or future performance. Forward looking information is typically identified by

words such as "anticipate", "continue", "estimate", "expect", "forecast", "may",

"will", "could", "plan", "intend", "should", "believe", "outlook", "project",

"potential", "target", and similar words suggesting future events or future

performance. In addition, statements relating to "reserves" are forward-looking

statements as they involve the implied assessment, based on certain estimates

and assumptions, that the reserves described exist in the quantities estimated

and can be profitably produced in the future.

In particular, this MD&A contains forward-looking information pertaining to the

following, without limitation: the amount and timing of cash flows and

distributions to unitholders; reserves and reserves values; 2010 production;

future tax treatment of the Trust; future corporate conversion of the Trust and

its subsidiaries; the Trust's tax pools; future oil and gas prices; operating,

drilling and completion costs; the amount of future asset retirement

obligations; future liquidity and future financial capacity; the initiation of

an "at-the-market" financing program; future results from operations; payout

ratios; cost estimates and royalty rates; drilling plans; tie-in of wells;

future development, exploration, and acquisition and development activities and

related expenditures; and rates of return.

With respect to forward-looking statements contained in this MD&A and the press

release through which it was disseminated, we have made assumptions regarding,

among other things: future oil and natural gas prices; future capital

expenditure levels; future oil and natural gas production levels; future

exchange rates; the amount of future cash distributions that we intend to pay;

the cost of expanding our property holdings; our ability to obtain equipment in

a timely manner to carry out exploration and development activities; our ability

to market our oil and natural gas successfully to current and new customers; the

impact of increasing competition; our ability to obtain financing on acceptable

terms; and our ability to add production and reserves through our development

and exploitation activities.

Although NAL believes that the expectations reflected in the forward-looking

information contained in the MD&A and the press release through which it was

disseminated, and the assumptions on which such forward-looking information are

made, are reasonable, readers are cautioned not to place undue reliance on such

forward looking statements as there can be no assurance that the plans,

intentions or expectations upon which the forward-looking information are based

will occur. Such information involves known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ materially from

those anticipated and which may cause NAL's actual performance and financial

results in future periods to differ materially from any estimates or projections

of future performance. These risks and uncertainties include, without

limitation: changes in commodity prices; unanticipated operating results or

production declines; the impact of weather conditions on seasonal demand and

NAL's ability to execute its capital program; risks inherent in oil and gas

operations; the imprecision of reserve estimates; limited, unfavorable or no

access to capital or credit markets; the impact of competitors; the lack of

availability of qualified operating or management personnel; the inability to

obtain industry partner and other third party consents and approvals, when

required; failure to realize the anticipated benefits of acquisitions; general

economic conditions in Canada, the United States and globally; fluctuations in

foreign exchange or interest rates; changes in government regulation of the oil

and gas industry, including environmental regulation; changes in royalty rates;

changes in tax laws; stock market volatility and market valuations; OPEC's

ability to control production and balance global supply and demand for crude oil

at desired price levels; political uncertainty, including the risk of

hostilities in the petroleum producing regions of the world; and other risk

factors discussed in other public filings of the Trust including the Trust's

current Annual Information Form.

NAL cautions that the foregoing list of factors that may affect future results

is not exhaustive. The forward-looking information contained in the MD&A is made

as of the date of this MD&A. The forward-looking information contained in the

MD&A is expressly qualified by this cautionary statement.

EXPLORATION & DEVELOPMENT ACTIVITIES

The Trust spent $56.0 million on drilling, completion and tie-in operations

during the first quarter of 2010 compared to $30.5 million during the first

quarter of 2009. There were 48 (21.1 net) wells drilled in the first quarter

compared to 26 (9.8 net) wells during the same period in 2009 which is

consistent with an expanded capital program year over year. Operations were

conducted across NAL's operations with 22 wells drilled in Saskatchewan, two in

British Columbia and 24 in Alberta.

The Trust participated in 36 (18 net) horizontal wells with 85 percent of the

activity focused on oil projects across Saskatchewan and Alberta. There were two

(1.5 net) water injectors drilled in East Prairie for pressure support in an

existing oil pool and one (0.5 net) dry and abandoned Leduc well drilled in the

Sylvan Lake area. The Trust will continue to focus on horizontal oil drilling

for the remainder of the year with significant programs in the Cardium drilling

15 (10 net) additional wells and in the Mississippian throughout southeast

Saskatchewan drilling 40 (19 net) wells.

First Quarter Drilling Activity

Service Dry &

Crude Oil Natural Gas Wells Abandoned Total

----------------------------------------------------------------------------

Gross Net Gross Net Gross Net Gross Net Gross Net

----------------------------------------------------------------------------

Operated wells 33 16.0 2 1.5 2 1.5 1 0.5 38 19.5

Non-operated

wells 6 0.7 4 0.9 0 0 0 0 10 1.6

----------------------------------------------------------------------------

Total wells

drilled 39 16.7 6 2.4 2 1.5 1 0.5 48 21.1

----------------------------------------------------------------------------

Southeast Saskatchewan

In Saskatchewan, there were 22 (10.1 net) horizontal oil wells drilled during

the first quarter with activity focused on the Mississippian in Alida,

Nottingham and Hoffer.

A new pool discovery at Hoffer was drilled in the fourth quarter of 2009. The

1D15-31/1D7-6-2-15W2 well has had cumulative oil production of 34,000 bbls over

a six month period with a water cut less than 30 percent and is expected to

capture over 200,000 bbls of oil reserves. Current production from this well is

150 bbls of oil per day. The Trust has successfully completed the first program

of delineation drilling with five additional wells on stream in April at rates

of 75 - 200 bbls of oil per day. Seismic and mapping support significant running

room on this play over a large contiguous land block (35 sections at 50 percent

working interest) which NAL controls. Additional capital of $5 million has been

layered in to support step out drilling over the next three quarters allowing

NAL to test the continuity and extent of the play. It is expected that the Trust

will drill between 10 - 15 gross wells in this area over the remainder of the

year. Plans to build a full scale battery are in the preliminary stages with

expectations for construction starting in the first quarter of 2011. These wells

qualify for the 100,000 bbl royalty holiday in Saskatchewan which, coupled with

current oil prices, yield netbacks of approximately $45/boe and a recycle ratio

of three times.

A successful 10 well drilling program in Alida and Nottingham continues to

deliver efficient production additions to existing infrastructure where

incremental operating costs are less than $5/bbl and capital efficiency is

between $10 - 15/boe. This program will continue with an expectation of 10

additional wells being drilled over the next three quarters.

Alberta

In Alberta, NAL participated in drilling 24 (9.6 net) locations including 11 (6

net) Cardium wells: six (3.5 net) at Garrington and five (2.5 net) at Pine Creek

with production expected to commence during the second quarter. The Trust is

currently drilling a three well pad through break up in Garrington and it is

expected that another three well pad will be drilled in July. The 16-9-34-4W5M

well was completed using water and has been on production for 14 days. Early

results appear to be in line with surrounding wells completed using oil which

lends support for a broader application of water as a completion fluid in this

area. Savings are anticipated to be $300,000 - $400,000 per well, but we will

continue to monitor well performance to get more history before we move forward

with a change in completion practices. Cardium well results to date continue to

meet production expectations with first month average actual production rates of

166 boe/d and six month average rates at 77 boe/d. These production rates

combined with drill and completion costs of $2.5 - 3.0 million yield 40 percent

rates of return at current prices which continue to support an active

development program going forward.

NAL has updated its' corporate presentation that lists those Cardium wells in

the Garrington area which have at least one month of production history. NAL's

corporate presentation may be found on the website at www.nal.ca.

In Pine Creek, drilling and completion costs were higher in the Cardium than

expected due to lower penetration rates and increased rock stress creating

additional difficulties for placing proppant / sand during completion

operations. Outcomes are highly variable and the Trust will be monitoring

results from recent wells before considering an expanded program.

NAL is planning a three well Cardium program at Lochend/North Cochrane in order

to evaluate the considerable land base in the area. Drilling is expected to

commence in July.

The Trust has the financial capability and prospect inventory to capture the

maximum drilling incentives available in the current Alberta program through the

end of the first quarter in 2011 with a focus on resource style oil drilling.

The continuation of the five percent royalty program and a reduction in the cap

on maximum royalty rates for oil from 50 to 40 percent and natural gas from 50

to 36 percent will continue to support competitive economics and encourage

activity in Alberta.

Northeast British Columbia

There were two (1.5 net) wells drilled in Fireweed and Trutch during the first

quarter. Production from the Fireweed Doig horizontal A-A086-I/094-A-12

commenced in April at a rate of 1,000 boe/d (5 mmcf/d + 40 bbls/mmcf of free

condensate) at a flowing tubing pressure of 12 mpa. Continued good results in

Fireweed have validated the significant resource potential of this pool. A

second Fireweed well at D-B007-A/94-A-12 was rig released in April with

completion activity to commence in June and production expected in the third

quarter. The Trutch halfway horizontal C-A024-I/094-G-10 was testing at rates of

2.2 mmcf/d and is expected to be tied in by the end of the third quarter

depending on access conditions.

In Sukunka, the d-27-F well was shut in for March and most of April to repair a

casing leak resulting in a 130 boe/d negative impact to average production in

the first and second quarters. The well is now back on stream and producing 400

boe/d net to the Trust.

CAPITAL EXPENDITURES

Capital expenditures, before property acquisitions and dispositions, for the

quarter ended March 31, 2010 totaled $78.3 million compared with $36.9 million

for the quarter ended March 31, 2009. The year-over-year increase is tied to the

corresponding increase in wells drilled as well as a continued shift towards

horizontal drilling and multi stage frac completions which significantly

increases per well costs. First quarter land expenditures of $18.1 million

represent a combination of Crown and private land purchases adding 26.5 net

sections to core positions in the Pine Creek and Edson area of Alberta and

contiguous lands on trend with Hoffer and Torquay in southeast Saskatchewan.

Capital Expenditures ($000s)

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Drilling, completion and production equipment 55,993 30,464

Plant and facilities 427 2,859

Seismic 1,661 89

Land 18,149 1,975

----------------------------------------------------------------------------

Total exploitation and development 76,230 35,387

----------------------------------------------------------------------------

Office equipment 290 238

Capitalized G&A 1,524 1,159

Capitalized unit-based compensation 275 152

----------------------------------------------------------------------------

Total other capital 2,089 1,549

----------------------------------------------------------------------------

Total capitalized expenditures before

acquisitions 78,319 36,936

----------------------------------------------------------------------------

Property acquisitions (dispositions), net (12,702) 1,314

----------------------------------------------------------------------------

Total capitalized expenditures 65,617 38,250

----------------------------------------------------------------------------

----------------------------------------------------------------------------

PRODUCTION

First quarter 2010 production of 30,120 boe/d was slightly above the guidance

mid-point of 30,000 boe/d after taking into account 100 boe/d of dispositions.

This production level represents an increase of 26 percent over production of

23,836 boe/d in the comparable period of 2009. The increase is due to the

ongoing execution of the Trust's capital program as well as the impact of

acquisitions completed in 2009.

Average Daily Production Volumes

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Oil (bbl/d) 11,788 9,990

Natural gas (Mcf/d) 93,328 68,966

NGLs (bbl/d) 2,777 2,352

Oil equivalent (boe/d) 30,120 23,836

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Oil equivalent volumes of 30,120 boe/d for the first quarter of 2010 include 301

boe/d (2009 - 442 boe/d), attributable to the non-controlling interest in the

Tiberius and Spear properties (see "Related Party Transactions").

For the quarter ended March 31, 2010, oil and natural gas liquids production

represented 48 percent of total production volume with natural gas representing

52 percent of total production volume.

Production Weighting

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Oil 39% 42%

Natural gas 52% 48%

NGLs 9% 10%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

REVENUE

Gross revenue from oil, natural gas and natural gas liquids sales, after

transportation costs and prior to hedging, totaled $136.9 million for the three

months ended March 31, 2010, 70 percent higher than the first quarter of 2009.

The increase is due to a 26 percent increase in production and a 34 percent

increase in the average realized price per boe, driven by a 69 percent increase

in the realized crude oil price partially offset by a five percent decrease in

the realized natural gas price. The increase in realized prices reflects higher

West Texas Intermediate ("WTI") prices, slightly offset by a stronger Canadian

dollar.

Revenue

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Revenue(1) ($000s)

Oil 81,085 40,684

Gas 42,064 32,576

NGLs 13,752 6,977

Sulphur (18) 425

----------------------------------------------------------------------------

Total revenue 136,883 80,662

$/boe 50.49 37.60

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Oil, natural gas and liquid sales less transportation costs and prior to

royalties and hedging.

OIL MARKETING

NAL markets its crude oil based on refiners' posted prices at Edmonton, Alberta

and Cromer, Manitoba adjusted for transportation and the quality of crude oil at

each field battery. The refiners' posted prices are influenced by the WTI

benchmark price, transportation costs, exchange rates and the supply/demand

situation of particular crude oil quality streams during the year.

NAL's first quarter average realized Canadian crude oil price per barrel, net of

transportation costs excluding hedging, was $76.43, as compared to $45.25 for

the comparable quarter of 2009. The increase in realized price

quarter-over-quarter of 69 percent, or $31.18/bbl, was primarily driven by a 83

percent increase in the WTI price (U.S.$/bbl) over the comparable period,

partially offset by a 16 percent increase in the value of the Canadian dollar.

For the first quarter of 2010, NAL's crude oil price differential was 93

percent, an increase of nine percentage points from the comparable period in

2009. The differential is calculated as realized price as a percentage of the

WTI price stated in Canadian dollars. The increase in 2010 resulted from a

tighter differential between WTI and Edmonton/Cromer posted prices, due to

relatively strong demand for light crude in western Canada during the first

quarter.

Natural gas liquids averaged $55.02/bbl in the first quarter of 2010, a 67

percent increase from the $32.96/bbl realized in 2009.

NATURAL GAS MARKETING

Approximately 70 percent of NAL's current gas production is sold under marketing

arrangements tied to the Alberta monthly or daily spot price ("AECO"), with the

remaining 30 percent tied to NYMEX or other indexed reference prices.

For the three months ended March 31, 2010, the Trust's natural gas sales

averaged $5.01/Mcf compared to $5.25/Mcf in the comparable period of 2009, a

decrease of five percent. The quarter-over-quarter decrease in gas price was

largely attributable to marketing a portion of natural gas based on the monthly

benchmark. The AECO monthly price decreased five percent quarter-over-quarter,

compared to a one percent increase in the daily AECO price.

Prices for Lake Erie natural gas decreased to $5.70/Mcf in the first quarter of

2010, compared to $6.32/Mcf in 2009, a decrease of ten percent. Lake Erie

production of 3.2 mmcf/d accounted for three percent of the Trust's natural gas

production in the first quarter of 2010, as compared to five percent in the

comparable period of 2009. Natural gas sales from the Lake Erie property

generally receive a higher price due to the close proximity of the Ontario and

Northeastern U.S. markets.

Average Pricing

(net of transportation charges)

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Liquids

WTI (US$/bbl) 78.69 43.08

NAL average oil (Cdn$/bbl) 76.43 45.25

NAL natural gas liquids (Cdn$/bbl) 55.02 32.96

Natural Gas (Cdn$/mcf)

AECO - daily spot 4.96 4.92

AECO - monthly 5.36 5.63

NAL Western Canada natural gas 4.98 5.19

NAL Lake Erie natural gas 5.70 6.32

NAL average natural gas 5.01 5.25

NAL Oil Equivalent before hedging

(Cdn$/boe - 6:1) 50.49 37.60

Average Foreign Exchange Rate (Cdn$/US$) 1.041 1.245

----------------------------------------------------------------------------

----------------------------------------------------------------------------

RISK MANAGEMENT

NAL employs risk management practices to assist in managing cash flows and to

support capital programs and distributions. NAL currently has derivative

contracts in place to assist in managing the risks associated with commodity

prices, interest rates and foreign exchange rates.

NAL's commodity hedging policy currently provides authorization for management

to hedge up to 60 percent of forecasted total production, net of royalties.

Management's practice is to hedge more near-term volumes on a six to 12 month

forward basis with more limited volumes hedged in future periods. The execution

of NAL's commodity hedging program is layered in using a combination of swaps

and collars. As at March 31, 2010, NAL had several financial WTI oil contracts

and AECO natural gas contracts in place.

NAL hedges floating rate debt for periods of up to five years. As at March 31,

2010, NAL had several interest rate swaps outstanding with a total notional

value of US$139 million.

NAL's foreign exchange hedging policy currently provides authorization to hedge

up to 50 percent of US dollar exposure for up to 24 months. As at March 31,

2010, NAL had several exchange rate swaps outstanding with a total notional

value of US$72 million.

All derivative contract counterparties are Canadian chartered banks in the

Trust's lending syndicate.

Realized gains on derivative contracts were $1.4 million for the first quarter

of 2010, compared to $27.8 million in the comparable quarter of 2009. Gains are

lower due primarily to rising oil prices versus hedge positions and lower gains

on gas positions due to lower gas prices. Oil losses are somewhat offset by

foreign exchange gains related to a rising Canadian dollar.

All derivative contracts are recorded on the balance sheet at fair value based

upon forward curves at March 31, 2010. Changes in the fair value of the

derivative contracts are recognized in net income for the period.

Fair value is calculated at a point in time based on an approximation of the

amounts that would be received or paid to settle these instruments, with

reference to forward prices at March 31, 2010. Accordingly, the magnitude of the

unrealized gain or loss will continue to fluctuate with changes in commodity

prices, interest rates and foreign exchange rates.

The fair value of the derivatives at March 31, 2010 was a net asset of $16.0

million, comprised of a $19.0 million asset on gas contracts, partially offset

by a $11.3 million liability on oil contracts, a $5.7 million asset on foreign

exchange contracts and a $2.7 million asset on interest rate swaps.

First quarter income for 2010 includes an $18.5 million unrealized gain on

derivatives resulting from the change in the fair value of the derivative

contracts during the quarter from an unrealized loss of $2.5 million at December

31, 2009 to an unrealized gain of $16.0 million at March 31, 2010. The $18.5

million unrealized gain was comprised of a $1.5 million unrealized gain on crude

oil contracts, a $0.2 million unrealized gain on interest rate swaps, a $15.0

million unrealized gain on natural gas contracts and a $1.8 million unrealized

gain on foreign exchange swaps.

The gain/loss on all forward derivative contracts is as follows:

Gain / (Loss) on Derivative Contracts ($000s)

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Unrealized gain (loss):

Crude oil contracts 1,546 (21,198)

Natural gas contracts 15,021 2,701

Interest rate swaps 191 (678)

Exchange rate swaps 1,751 671

----------------------------------------------------------------------------

Unrealized gain (loss) 18,509 (18,504)

Realized gain (loss):

Crude oil contracts (2,082) 20,752

Natural gas contracts 2,497 6,956

Interest rate swaps (257) (29)

Exchange rate swaps 1,290 83

----------------------------------------------------------------------------

Realized gain 1,448 27,762

----------------------------------------------------------------------------

Gain on derivative contracts 19,957 9,258

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The following is a summary of the realized gains and losses on risk

management contracts:

Realized Gain (Loss) on Derivative Contracts

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Commodity contracts:

Average crude volumes hedged (bbl/d) 6,366 3,603

Crude oil realized gain (loss) ($000s) (2,082) 20,752

Gain (loss) per bbl hedged ($) (3.63) 63.99

Average natural gas volumes hedged (GJ/d) 37,967 29,000

Natural gas realized gain ($000s) 2,497 6,956

Gain per GJ hedged ($) 0.73 2.67

Average BOE hedged (boe/d) 12,363 8,185

Total realized commodity contracts gain

($000s) 415 27,708

Gain per boe hedged ($) 0.37 37.61

Gain per boe ($) 0.15 12.91

Exchange rate swaps realized gain ($000s) 1,290 83

Gain per boe ($) 0.48 0.04

Interest rate swaps realized gain (loss)

($000s) (257) (29)

Gain (loss) per boe ($) (0.09) (0.01)

Total realized gain ($000s) 1,448 27,762

Gain per boe ($) 0.54 12.94

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Average hedged boes for the first quarter of 2010 were 12,363 as compared to

10,226 for the fourth quarter of 2009.

NAL has the following interest rate risk management contracts outstanding:

----------------------------------------------------------------------------

Amount Trust

INTEREST RATE (millions) Fixed Counterparty

CONTRACT Remaining Term (1) Rate Floating Rate

----------------------------------------------------------------------------

Swaps-floating

to fixed Mar 2010 - Dec 2011 $39.0 1.5864% CAD-BA-CDOR (3 months)

Swaps-floating

to fixed Mar 2010 - Jan 2013 $22.0 1.3850% CAD-BA-CDOR (3 months)

Swaps-floating

to fixed Mar 2010 - Jan 2014 $22.0 1.5100% CAD-BA-CDOR (3 months)

Swaps-floating

to fixed Mar 2010 - Mar 2013 $14.0 1.8500% CAD-BA-CDOR (3 months)

Swaps-floating

to fixed Mar 2010 - Mar 2013 $14.0 1.8750% CAD-BA-CDOR (3 months)

Swaps-floating

to fixed Mar 2010 - Mar 2014 $14.0 1.9300% CAD-BA-CDOR (3 months)

Swaps-floating

to fixed Mar 2010 - Mar 2014 $14.0 1.9850% CAD-BA-CDOR (3 months)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Notional debt amount

NAL has the following exchange rate risk management contracts outstanding:

----------------------------------------------------------------------------

EXCHANGE RATE Amount(1) Trust Counterparty

CONTRACT Remaining Term (US$ MM) Fixed Rate Floating Rate

----------------------------------------------------------------------------

Swaps-floating

to fixed Apr - Dec 2010 $8.0 1.0966 BofC Average Noon Rate

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Notional US$ denominated commodity sales per month.

From April 1 to December 31, 2010, NAL also has a commitment to sell US$9

million ($1 million/month) at 1.045 if the monthly Bank of Canada average noon

rate exceeds 1.045. NAL is paid a premium of approximately $10,000 a month when

the average noon rate falls between 0.95 and 1.045.

NAL has the following commodity risk management contracts outstanding:

CRUDE OIL Q2-10 Q3-10 Q4-10 Q1-11 Q2-11

----------------------------------------------------------------------------

US$ Collar Contracts

-------------------------

$US WTI Collar Volume

(bbl/d) 3,700 2,800 2,600 800 800

Bought Puts - Average

Strike Price ($US/bbl) $ 63.59 $ 65.63 $ 65.87 $ 81.25 $ 81.25

Sold Calls - Average

Strike Price ($US/bbl) $ 74.94 $ 77.55 $ 78.05 $ 94.47 $ 94.47

US$ Swap Contracts

-------------------------

$US WTI Swap Volume

(bbl/d) 2,800 3,200 3,300 - -

Average WTI Swap Price

($US/bbl) $ 79.45 $ 83.91 $ 83.82 - -

Total Oil Volume (bbl/d) 6,500 6,000 5,900 800 800

----------------------------------------------------------------------------

----------------------------------------------------------------------------

NATURAL GAS Q2-10 Q3-10 Q4-10 Q1-11 Q2-11

----------------------------------------------------------------------------

Swap Contracts

-------------------------

AECO Swap Volume (GJ/d) 39,000 40,000 27,337 4,000 4,000

AECO Average Price

($Cdn/GJ) $ 5.60 $ 5.61 $ 5.66 $ 5.78 $ 5.78

Total Natural gas Volume

(GJ/d) 39,000 40,000 27,337 4,000 4,000

----------------------------------------------------------------------------

----------------------------------------------------------------------------

For the remainder of 2010, the Trust has outstanding contracts representing

approximately 48 percent of its net liquids and natural gas production after

royalties.

ROYALTY EXPENSES

Crown, freehold and overriding royalties were $23.1 million for the three months

ended March 31, 2010. Expressed as a percentage of gross sales net of

transportation costs, before gain/loss on derivative contracts, the net royalty

rate was 16.9 percent for the quarter ended March 31, 2010, a decrease from the

17.5 percent experienced in the same period of the previous year.

Royalties increased to $8.54 per boe for the first quarter of 2010, an increase

of 30 percent compared to the first quarter of 2009. The increase is

attributable to higher commodity prices on a quarter-over-quarter basis.

On March 11, 2010 the Alberta Government announced measures to improve the

Province of Alberta's competitive position in the oil and gas industry. The

current royalty framework for natural gas and conventional oil will be modified

for all production effective January 1, 2011. The government will make the five

percent maximum royalty rate during the first year of production incentive

permanent and the maximum royalties paid on oil and gas production will be

lowered from 50 percent to 40 percent for oil and 36 percent for natural gas.

For the quarter ended March 31, 2010, 45 percent of crude oil and 67 percent of

natural gas production was from Alberta.

Royalty Expenses

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Royalties ($000s) 23,146 14,134

As % of revenue 16.9 17.5

$/boe 8.54 6.59

----------------------------------------------------------------------------

----------------------------------------------------------------------------

OPERATING COSTS

Operating costs averaged $10.81 per boe for the quarter ended March 31, 2010,

down 10 percent from $11.95 per boe for the quarter ended March 31, 2009.

Operating costs continue to trend down driven by lower natural gas prices

impacting the cost of power and continued gains from an aggressive optimization

program in field operations. Based on emerging cost trends the Trust has lowered

its guidance for operating costs to a range of $10.75 - 11.25 per boe.

Operating Costs

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Operating costs ($000s) 29,304 25,640

As a % of revenue 21.4 31.8

$/boe 10.81 11.95

----------------------------------------------------------------------------

----------------------------------------------------------------------------

OTHER INCOME

Other income was $0.12 per boe for the first quarter of 2010 compared to $0.45

per boe in the comparable quarter of 2009. Other income includes gas processing

fees, other miscellaneous income and fees and interest income and interest

expense on notes due from and to MFC (see "Related Party Transactions"). In the

first quarter of 2010, interest expense totaled $0.1 million, as compared to net

interest income of $0.5 million for the comparable period of 2009, the decrease

being attributable to the repayment of a note receivable from MFC in the first

quarter of 2009.

Other Income

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Interest on notes with MFC ($000s) (112) 544

Other ($000s) 443 420

----------------------------------------------------------------------------

Total other income ($000s) 331 964

As a % of revenue 0.2 1.20

Interest on notes with MFC ($/boe) (0.04) 0.25

Other ($/boe) 0.16 0.20

----------------------------------------------------------------------------

Total other income ($/boe) 0.12 0.45

----------------------------------------------------------------------------

----------------------------------------------------------------------------

OPERATING NETBACK

For the quarter ended March 31, 2010, NAL's operating netback, before hedging

gains, was $31.30 per boe, an increase of 63 percent from $19.26 per boe for the

quarter ended March 31, 2009. The increase was due to higher revenues, a result

of higher crude oil prices, and decreased operating costs, partially offset by

increased royalty expense. Hedging gains, related to commodity and exchange rate

derivative contracts, were $0.63 per boe in the first quarter of 2010, as

compared to $12.95 per boe in 2009, the decrease in 2010 attributable mainly to

higher realized crude oil prices.

Operating Netback

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

AVERAGE DAILY PRODUCTION

Oil (bbl/d) 11,788 9,990

Gas (Mcf/d) 93,328 68,966

NGLs (bbl/d) 2,777 2,352

----------------------------------------------------------------------------

Total (boe/d) 30,120 23,836

REVENUE

Oil ($/bbl) 76.43 45.25

Gas ($/Mcf) 5.01 5.25

NGLs ($/bbl) 55.02 32.96

----------------------------------------------------------------------------

Total ($/boe) 50.49 37.60

ROYALTIES

Oil ($/bbl) 15.11 8.62

Gas ($/Mcf) 0.47 0.77

NGLs ($/bbl) 12.54 7.73

----------------------------------------------------------------------------

Total ($/boe) 8.54 6.59

OPERATING EXPENSES

Oil ($/bbl) 10.92 11.36

Gas ($/Mcf) 1.83 2.16

NGLs ($/bbl) 9.28 9.59

----------------------------------------------------------------------------

Total ($/boe) 10.81 11.95

OTHER INCOME(1)

Oil ($/bbl) 0.25 0.24

Gas ($/Mcf) 0.02 0.03

NGLs ($/bbl) 0.18 0.19

----------------------------------------------------------------------------

Total ($/boe) 0.16 0.20

OPERATING NETBACK, BEFORE HEDGING

Oil ($/bbl) 50.65 25.51

Gas ($/Mcf) 2.73 2.35

NGLs ($/bbl) 33.38 15.83

----------------------------------------------------------------------------

Total ($/boe) 31.30 19.26

HEDGING GAINS/(LOSSES)(2)

Oil ($/bbl) (0.75) 23.17

Gas ($/Mcf) 0.30 1.12

NGLs ($/bbl) - -

----------------------------------------------------------------------------

Total ($/boe) 0.63 12.95

OPERATING NETBACK, AFTER HEDGING

Oil ($/bbl) 49.90 48.68

Gas ($/Mcf) 3.03 3.47

NGLs ($/bbl) 33.38 15.83

----------------------------------------------------------------------------

Total ($/boe) 31.93 32.21

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Excludes interest on notes with MFC.

(2) Realized hedging gains/losses on commodity and exchange rate derivative

contracts.

GENERAL AND ADMINISTRATIVE EXPENSES

General and administrative ("G&A") expenses include direct costs incurred by the

Trust plus the reimbursement of the G&A expenses incurred by NAL Resources

Management Limited (the "Manager") on the Trust's behalf.

For the three months ended March 31, 2010, G&A expenses were $4.4 million,

compared with $2.6 million in the comparable quarter of 2009. In addition, $1.5

million of G&A costs relating to exploitation and development activities were

capitalized in the first quarter of 2010, compared with $1.2 million in the

first quarter of 2009. G&A expense per boe was $1.61 in the quarter, as compared

to $1.22 for the same period in 2009.

The year-over-year increase in total G&A of $2.1 million is attributable to a

lower payout under the 2008 short term incentive plan of the Manager than was

provided for at December 31, 2008, resulting in lower charges in the first

quarter of 2009 ($0.8 million), plus slightly higher compensation costs in the

first quarter of 2010 as compared to 2009.

General and Administrative Expenses

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

G&A ($000s)

Expensed 4,359 2,618

Capitalized 1,524 1,159

----------------------------------------------------------------------------

Total G&A ($000s) 5,883 3,777

Expensed G&A costs:

($/boe) 1.61 1.22

As % of revenue 3.2 3.2

Per trust unit ($) 0.03 0.03

----------------------------------------------------------------------------

----------------------------------------------------------------------------

UNIT-BASED INCENTIVE COMPENSATION PLAN

The employees of the Manager are all members of a unit-based incentive plan (the

"Plan"). The Plan results in employees of the Manager receiving cash

compensation based upon the value and overall return of a specified number of

notional trust units. The Plan consists of Restricted Trust Units ("RTUs") and

Performance Trust Units ("PTUs"). RTUs vest as to one third of the amount of the

grant on November 30 in each of three years after the date of grant. PTUs vest

on November 30, three years from the date of grant. Distributions paid on the

Trust's outstanding trust units during the vesting period are assumed to be paid

on the awarded notional trust units and reinvested in additional notional units

on the date of distribution. Upon vesting, the employee of the Manager is

entitled to a cash payout based on the trust unit price at the date of vesting

of the units held. In addition, the PTUs have a performance multiplier which is

based on the Trust's performance relative to its peers and may range from zero

to two times the market value of the notional trust units held at vesting.

During the first quarter of 2010, the Trust recorded a $0.7 million charge for

unit-based incentive compensation that reflects the impact of vesting,

additional notional units and an increase in the PTU performance multiplier for

the 2009 grant. These factors were partially offset by a decrease in the unit

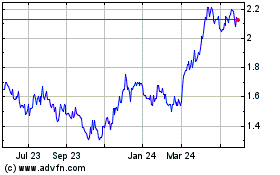

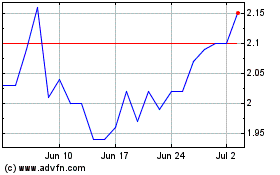

price of the Trust of six percent, from $13.74 at December 31, 2009 to $12.95 at

March 31, 2010. A decrease in unit price results in previously accrued amounts

being reversed to the extent not vested.

Unit-based incentive compensation increased by 57 percent compared to the first

quarter of 2009, from $0.5 million in 2009 to $0.7 million in 2010. The increase

is a reflection of a 90 percent increase in unit price used to determine the

compensation, year-over-year, from $6.80 a unit at March 31, 2009 to $12.95 at

March 31, 2010. In addition, during the first quarter of 2010 the unit price

decreased from the December 31, 2009 unit price by six percent, resulting in a

decrease to previously accrued amounts.

At March 31, 2010, the unit price used to determine unit-based incentive

compensation was $12.95. The closing unit price of the Trust on the Toronto

Stock Exchange on May 3, 2010 was $12.67.

The calculation of unit-based compensation expense is made at the end of each

quarter based on the quarter end trust unit price and estimated performance

factors. The compensation charges relating to the units granted are recognized

over the vesting period based on the trust unit price, number of RTUs and PTUs

outstanding, and the expected performance multiplier. As a result, the expense

recorded in the accounts will fluctuate in each quarter and over time.

At March 31, 2010, the Trust has recorded a total accumulated liability for

unit-based incentive compensation in the amount of $10.2 million, of which $5.4

million is recorded as current as it is payable in December 2010, and $4.8

million is long-term as it is payable in December 2011 and December 2012.

Unit-Based Compensation

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Unit-based compensation ($000s):

Expensed 439 302

Capitalized 275 152

----------------------------------------------------------------------------

Total unit-based compensation 714 454

Expensed unit-based compensation:

As % of revenue 0.3 0.37

$/boe 0.16 0.14

Per trust unit ($) - -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

RELATED PARTY TRANSACTIONS

The Trust is managed by the Manager. The Manager is a wholly-owned subsidiary of

Manulife Financial Corporation ("MFC") and also manages NAL Resources Limited

("NAL Resources"), another wholly-owned subsidiary of MFC. NAL Resources and the

Trust maintain ownership interests in many of the same oil and natural gas

properties in which NAL Resources is the joint operator. As a result, a

significant portion of the net operating revenues and capital expenditures

during the year are based on joint amounts from NAL Resources. These

transactions are in the normal course of joint operations and are measured using

the fair value established through the original transactions with third parties.

The Manager provides certain services to the Trust and its subsidiary entities

pursuant to an administrative services and cost sharing agreement. This

agreement requires the Trust to reimburse the Manager at cost for G&A and

unit-based compensation expenses incurred by the Manager on behalf of the Trust

calculated on a unit of production basis. The Agreement does not provide for any

base or performance fees to be payable to the Manager.

The Trust paid $3.6 million (2009 - $1.9 million) for the reimbursement of G&A

expenses during the first quarter. The Trust also pays the Manager its share of

unit-based incentive compensation expense when cash compensation is paid to

employees under the terms of the Plan, of which $6.9 million was paid in the

first quarter of 2010, representing units that vested on November 30, 2009 (2009

- $2.3 million).

At March 31, 2010 the Trust owed the Manager $1.7 million for the reimbursement

of G&A and had a payable to NAL Resources of $0.8 million, relating to capital

expenditures less net operating revenues.

The Trust and a wholly owned subsidiary of MFC jointly own a limited partnership

(the "Partnership"). This Partnership holds the assets acquired from the

acquisitions of Tiberius Exploration Inc. ("Tiberius") and Spear Exploration

Inc. ("Spear") in February 2008. In addition, both the Trust and MFC entered

into net profit interest royalty agreements ("NPI") with the Partnership. These

agreements entitle each royalty holder to a 49.5 percent interest in the cash

flow from the Partnership's reserves. In exchange for this interest, the royalty

holders each paid $49.6 million to the Partnership by way of promissory notes in

2008.

The Trust, by virtue of being the owner of the general partner of the

Partnership under the partnership agreement, is required to consolidate the

results of the Partnership into its financial statements on the basis that the

Trust has control over the Partnership. Accordingly, the Trust reports all

revenues, expenses, assets and liabilities of the Partnership, together with its

wholly owned subsidiaries and partnerships, in its consolidated financial

statements. The 50 percent share of net income and net assets of the Partnership

attributable to MFC is then deducted from net income and net assets as a

one-line entry, in the income statement and balance sheet, ensuring that the

bottom line net income and net assets reported represent only the Trust's

interest.

During the first quarter of 2009, MFC repaid the note receivable to the

Partnership of $49.6 million. The Partnership then paid an equal distribution of

$49.6 million to MFC. This resulted in a $49.6 million reduction to the

non-controlling interest on the balance sheet.

As at March 31, 2010, there is a note payable of $8.3 million to MFC arising

from the Tiberius and Spear acquisition. The note payable is included on

consolidation of the Partnership, but is effectively eliminated through the

non-controlling interest. The note is due on demand, unsecured and bears

interest at prime plus three percent. The amount of the note payable to MFC is

adjusted to reflect MFC's share of the capital expenditures of the Partnership

which MFC has funded, less any loan repayments made.

Net interest expense on this note of $0.1 million was payable by the Trust for

the first quarter of 2010 (2009 - $0.5 million net interest income) and is

reported as other income.

INTEREST

Interest on bank debt includes the interest rate charge on borrowings, plus a

standby fee, a stamping fee and the fee for renewal. Interest on bank debt for

the first quarter of 2010 was $3.1 million, an increase of $1.1 million from

$2.0 million for the comparable period in 2009. The increase was due to an

increase in average effective interest rates, partially offset by a decrease in

average debt levels. Average outstanding bank debt for the first quarter of 2010

was $232.5 million, $63.9 million lower than the $296.4 million outstanding for

the first quarter of 2009. NAL's effective interest rate averaged 5.39 percent

during the first quarter of 2010, compared to 2.58 percent during the comparable

period in 2009. The increase in the rate from the first quarter of 2009 is

attributable to increases in the bank fees that are included in debt costs.

NAL's interest is calculated based upon a floating rate before the effect of any

interest rate swaps.

Interest on convertible debentures represents interest charges of $3.1 million

for the three months ended March 31, 2010 as compared to $1.3 million for the

same period in 2009. The interest includes the interest on the 2007 debentures

at 6.75 percent and the interest on the debentures issued in December 2009 at

6.25 percent. Accretion of the debt discount was $1.0 million for the three

months ended March 31, 2010 as compared to $0.4 million for the same period in

2009. The increase in interest and accretion is due to the December 2009

issuance of convertible debentures.

Interest and Debt

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Interest on bank debt ($000s)(1) 3,086 1,963

Interest and accretion on convertible

debentures ($000s) 4,133 1,724

----------------------------------------------------------------------------

Total interest ($000) 7,219 3,687

Bank debt outstanding at period end ($000s) 244,695 304,918

Convertible debentures at period end ($000s)(2) 178,624 74,382

$/boe:

Interest on bank debt 1.14 0.92

Interest on convertible debentures 1.16 0.63

Accretion on convertible debentures 0.37 0.17

----------------------------------------------------------------------------

Total interest 2.67 1.72

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Excludes interest rate contract impact.

(2) Debt component of the debentures, as reported on the balance sheet.

CASH FLOW NETBACK

For the quarter ended March 31, 2010, NAL's cash flow netback was $27.73 per

boe, a six percent decrease from $29.54 per boe for the comparable period in

2009. The decrease was due to a lower operating netback after hedging, higher

G&A expenses, including unit-based incentive compensation, and higher interest

charges.

Cash Flow Netback ($/boe)

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Operating netback, after hedging 31.93 32.21

G&A expenses, including unit-based incentive

compensation (1.77) (1.36)

Interest on bank debt and convertible

debentures(1) (2.30) (1.55)

Interest on notes with MFC(2) (0.04) 0.25

Realized loss on interest rate derivative

contracts (0.09) (0.01)

----------------------------------------------------------------------------

Cash flow netback 27.73 29.54

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Excludes non-cash accretion on convertible debentures.

(2) Reported as other income.

DEPLETION, DEPRECIATION AND ACCRETION OF ASSET RETIREMENT OBLIGATIONS ("DDA")

Depletion of oil and natural gas properties, including the capitalized portion

of the asset retirement obligations, and depreciation of equipment is provided

for on a unit-of-production basis using estimated proved reserves volumes.

For the quarter ended March 31, 2010, depletion on property, plant and equipment

and accretion on the asset retirement obligations was $23.86 per boe, 14 percent

higher than the $20.99 per boe for the same period in 2009. The increase in

depletion rate per boe in 2010 reflects a higher depletion rate associated with

the oil and gas properties of Breaker Energy Ltd. which was acquired in December

2009.

The DDA rate will fluctuate period-over-period depending on the amount and type

of capital expenditures and the amount of reserves added.

Depletion, Depreciation and Accretion Expenses

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Depletion and depreciation ($000s) 62,036 43,208

Accretion of asset retirement obligation

($000s) 2,631 1,828

----------------------------------------------------------------------------

Total DDA ($000s) 64,667 45,036

DDA rate per boe ($) 23.86 20.99

----------------------------------------------------------------------------

----------------------------------------------------------------------------

TAXES

In the first quarter of 2010, NAL had a future income tax recovery of $2.2

million compared to a $6.1 million recovery in the corresponding period of the

prior year.

The Trust is a taxable entity and files a trust income tax return annually. The

Trust's taxable income consists of royalty income, distributions from a

subsidiary trust and interest and dividends from other subsidiaries, less

deductions for the Trust's G&A expenses, Canadian Oil and Gas Property Expense

("COGPE") and issue costs. In addition, Canadian Exploration Expense ("CEE"),

Canadian Development Expense ("CDE") and Undepreciated Capital Cost ("UCC") are

incurred and deducted by the Trust's subsidiaries. The Trust is taxable only on

remaining income, if any, that is not distributed to unitholders.

As at March 31, 2010, the Trust's (including all subsidiaries) estimated tax

pools (unaudited) available for deduction from future taxable income

approximated $1.3 billion, of which approximately 34 percent represented COGPE,

21 percent represented UCC, with the balance represented by CEE, CDE, trust unit

issue costs and non-capital loss carry forwards.

Estimated Tax Pools ($ millions)

----------------------------------------------------------------------------

December 31,

March 31, 2010 2009

----------------------------------------------------------------------------

Canadian exploration expense 51 50

Canadian development expense 412 379

Canadian oil and gas property expense 440 436

Undepreciated capital costs 272 274

Other (including loss carry forwards) 123 128

----------------------------------------------------------------------------

Total estimated tax pools 1,298 1,267

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Based on current strip prices at March 31, 2010, the Trust is not expected to be

taxable in 2010.

Under the specified investment flow-through ("SIFT") legislation, effective

January 1, 2011, distributions to unitholders will not be deductible against

income by publicly traded income trusts and, as a result, the Trust will be

taxed on its income similar to corporations. These measures are considered

enacted for purposes of GAAP. Accordingly, the Trust has measured future income

tax assets and liabilities under the SIFT tax rules. The scheduling of the

reversal of temporary differences is based on management's best estimates and

current assumptions, which may change. Bill C-10, containing the legislation for

the provincial SIFT rate, received Royal Assent on March 12, 2009. The Alberta

provincial tax rate for 2011 is expected to be 10 percent. This will result in

an effective combined SIFT rate of 26.5 percent in 2011 and 25.0 percent in

2012, a three percent decrease from that in the original legislation. The Trust

has tax effected all temporary differences.

NON-CONTROLLING INTEREST

The Trust has recorded a non-controlling interest in respect of the 50 percent

ownership interest held by MFC in the Partnership holding the Tiberius and Spear

assets (see "Related Party Transactions").

The non-controlling interest presented in the statement of income has two

components: the royalty paid to MFC under the NPI, being a cash payment to the

royalty holder, and 50 percent of net income remaining in the Partnership, after

NPI expense, attributable to MFC. This share of net income attributable to MFC

is a non-cash item.

The non-controlling interest in the consolidated statement of income is

comprised of:

Non-Controlling Interest ($000s)

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Net profits interest expense (income) 618 243

Share of net income attributable to MFC 174 616

----------------------------------------------------------------------------

792 859

----------------------------------------------------------------------------

----------------------------------------------------------------------------

NET INCOME

Net income is a measure impacted by both cash and non-cash items. The largest

non-cash items impacting the Trust's net income are DDA, unrealized gains or

losses on derivative contracts and future income taxes.

Net income for the first quarter of 2010 was $29.3 million compared to $4.7

million for the comparable period in 2009. The increase of $24.6 million was

mainly due to increased revenues net of royalties ($47.8 million) and increased

gains on derivative contracts ($10.7 million), offset by increased operating

costs ($3.7 million), increased G&A ($1.7 million), increased DD&A expense

($18.8 million), a lower tax recovery ($4.0 million) and increased interest

charges ($3.5 million).

Net Income ($000s)

----------------------------------------------------------------------------

Three months ended March 31

-----------------------------

2010 2009

----------------------------------------------------------------------------

Net income 29,349 4,724

----------------------------------------------------------------------------

----------------------------------------------------------------------------

CAPITAL RESOURCES AND LIQUIDITY

The capital structure of the Trust is comprised of trust units, bank debt and

convertible debentures.

As at March 31, 2010, NAL had 137,880,631 trust units outstanding, compared with

137,471,209 trust units as at December 31, 2009. The increase from December 31,