Centamin PLC Announces 2013 Annual Results

March 24 2014 - 3:05AM

Marketwired

Centamin PLC Announces 2013 Annual Results

PERTH, AUSTRALIA--(Marketwired - Mar 24, 2014) - Centamin

plc (LSE: CEY) (TSX: CEE)

Centamin plc ("Centamin" or "the Company") (LSE: CEY;

TSX:CEE)

This is not the full announcement. For the full announcement,

please click here:

http://www.rns-pdf.londonstockexchange.com/rns/9799C_1-2014-3-24.pdf

HIGHLIGHTS FOR THE YEAR (1) (2)

Centamin remains in a robust position to continue delivering on

its track record of production growth and solid cash flow

generation during 2014 and beyond, as demonstrated by the following

highlights:

- Full year production was 356,943, a 36% increase on 2012 and

above guidance of 320,000 ounces.

- Cash costs of production of US$663 per ounce (2012: $669 per

ounce).

- Record EBITDA of US$234.2 million, up 1% on the prior

year.

- Basic earnings per share 16.87 cents, down 8% on prior

year.

- Stage 4 plant expansion (to nameplate capacity of 10Mtpa)

expenditure at the year end was US$327.8 million of the reforecast

cost of US$331.2 million, including contingency.

- Centamin remains debt-free and un-hedged with cash, bullion on

hand, gold sales receivable and available-for-sale financial assets

of US$142.5 million as at 31 December 2013.

Centamin delivered strong operational and financial results in

2013, producing 356,943 ounces of gold (2012: 262,828 ounces) and

generating profit after tax for the year of US$184.0 million (2012:

US$199.0 million). Centamin has continued to return strong earnings

and cash flow generation despite the weaker gold price environment,

owing to the Group's emphasis on maximising productivity and

maintaining rigorous cost control. Now in its fifth year of

production, the Sukari Gold Mine remains highly cash generative,

with EBITDA of US$234.2 million (2012: US$233.3 million). Centamin

has a robust cash and cash equivalents balance of US$106.0 million

(2012: US$147.1 million) as at 31 December 2013.

2013 saw the Sukari operation performing well across all areas.

Most notably, the processing plant operated consistently at c.15%

above nameplate capacity and the output from the underground mine

continued to rise quarter-on-quarter to end the year at levels

significantly above original expectations. The completion of

construction of the Stage 4 plant expansion, which is currently

under commissioning, sets the stage for the next step-up in

production towards Sukari's long-term target of 450-500,000 ounces

per annum from 2015 onwards.

An updated resource and reserve statement for Sukari was

announced on 18 December 2013, with the total Measured and

Indicated resource containing 13.4 million ounces (Moz) and the

total reserve containing 8.2Moz. This takes into account the latest

drill results, higher cost environment and the timing of the Stage

4 commissioning. The underground reserve of 2.30 million

tonnes (Mt) represented a 120% increase on the December 2011

reserve, despite mining depletion. We remain confident of

further significant reserve expansion, with the 0.52Mt Proven

component of this reserve showing a grade of 11.4g/t gold, and

continued positive results from on-going drilling into the target

high-grade extensions.

The Company progressed its medium and long-term growth strategy

during 2013. In September, Centamin entered into a joint venture

with AIM-listed Alecto Minerals over their exploration projects in

Ethiopia, thus expanding the Company's presence in this important

region of focus. A recommended all-share takeover offer for

ASX-listed Ampella Mining Ltd, valued at A$40.9 million, was

announced on 10 December 2013. This takeover provides Centamin with

an extensive licence holding over a highly prospective and

underexplored 100km+ trend of gold mineralization in Burkina Faso.

Centamin will implement a systematic exploration programme, aimed

at developing the potential for further substantial growth of the

existing resource base, being 1.92Moz Indicated and 1.33Moz

Inferred.

The Company continues to hold equity interests in Nyota Minerals

Limited and Sahar Minerals Limited, however, these investments have

been impaired during the year to reflect their fair value.

The Supreme Administrative Court appeal and Diesel Fuel Oil

("DFO") Court Case are both ongoing. Operations continue as normal

and any enforcement of the Administrative Court decision has been

suspended pending the appeal ruling. We remain confident that a

satisfactory outcome will ultimately be achieved in both cases.

With respect to the DFO case, management recognises the

practical difficulties associated with re-claiming funds from the

government and, for this reason, has fully provided against the

cumulative prepayment of US$97.0 million as an exceptional item

(refer to Note 6 to the Financial Statements). In the meantime the

Group is continuing to pay international prices for DFO.

1. Cash cost of Production, EBITDA and cash, bullion on hand and

available-for-sale financial assets are non-GAAP measures.

2. Basic EPS, EBITDA, Cash costs of Production reported includes

an exceptional provision against prepayments to reflect the removal

of fuel subsidies which occurred in January 2012 (refer to Note 6

of the Financial Statements for further details). The provision had

no further impact on the 2012 and 2013 results other than

previously reported.

________________________________

Centamin will host a conference call on Monday, 24 March at

9.00am (London, UK time) to update investors and analysts on its

results. Participants may join the call by dialling one of the

following three numbers, approximately 10 minutes before the start

of the call.

From UK: 0808 237 0040 Canada: +1 866 404

5783 Rest of world: +44 203 428

1542

Participant pass code: 93268020#

________________________________

For details of the full announcement please visit

http://www.centamin.com/centamin/investors/news-media/news/2013-annual-results

This information is provided by RNS The company news service

from the London Stock Exchange

Contacts: RNS Customer Services 0044-207797-4400

rns@londonstockexchange.com http://www.rns.com

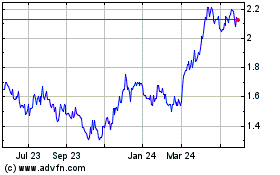

Centamin (TSX:CEE)

Historical Stock Chart

From Feb 2025 to Mar 2025

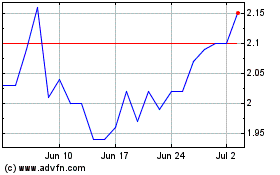

Centamin (TSX:CEE)

Historical Stock Chart

From Mar 2024 to Mar 2025