Cardinal Energy Announces First Quarter Results

May 05 2014 - 6:36PM

Marketwired Canada

Cardinal Energy Ltd. ("Cardinal") (TSX:CJ) is pleased to announce its operating

and financial results for the quarter ended March 31, 2014. Cardinal also

announces that its unaudited interim financial statements and related

Management's Discussion and Analysis for the quarter ended March 31, 2014 is

available on the System for Electronic Analysis and Retrieval ("SEDAR") and on

Cardinal's website at www.cardinalenergy.ca.

Highlights

-- Production averaged 6,235 boe/day in the first quarter of 2014 an

increase of 7% over the year end exit rate of approximately 5,850

boe/day;

-- Increases in production and commodity prices resulted in cash flow from

operations for the quarter of $19.2 million;

-- Cardinal's simple payout ratio was 31% for the quarter;

-- Operating costs were reduced by 17% to average $23.83 boe compared to

the fourth quarter of 2013;

-- Field netbacks increased to $41.49 per boe, an increase of 42% from the

fourth quarter of 2013;

-- Net debt was $3.9 million as at March 31, 2014; and

-- Increased our land position in Bantry by 14 net sections which are

prospective for Manville oil.

March 31, 2014 marked the first full operating quarter for Cardinal as a public

company.

Our primary focus going into the quarter was to complete the integration of the

assets and new staff acquired in SE Alberta. We also began to work on increasing

our understanding of the base assets as well as drilling and optimization

upside.

Cardinal has seen some initial benefits from our early initiatives, including:

Drilling: Successfully drilled and completed 2 Glauconite horizontal wells. The

two wells are currently producing at combined rate of 650 boe/day after being on

production for 60 days. Subsequent to quarter end, we have drilled and completed

a third Glauconite horizontal well and are currently flowing back the frac.

Cardinal plans to drill one additional Glauconite horizontal well in the second

quarter.

Payout Ratio: We have seen our dividend payout ratio drop month over month with

the increase in production volumes as well as higher field netbacks. Cardinal

has set a target simple dividend payout ratio of 30 - 35% and our average for

the first quarter was 31%. Including the effect of our stock dividend plans

(dividend reinvestment plan and stock dividend program) our dividend payout

ratio drops to 29% for the quarter. Cardinal will continue to monitor our payout

ratios as well as the actual dividend rate, and adjust the dividend amount when

it deems appropriate.

Operating costs: Cardinal began several initiatives to reduce operating costs in

the first quarter 2014. We have seen operating costs drop by 17% from $28.72/boe

in the fourth quarter of 2013 to an average of $23.83/boe in the first quarter

of 2014. We have identified several projects to further reduce operating costs

which we will undertake throughout 2014.

Field Netbacks: Field netbacks have improved considerably from our exit 2013

numbers. A combination of strong commodity prices and a reduction in operating

costs have pushed our field netbacks to an average of $41.48/boe for the

quarter.

Liquidity: Our net debt was $3.9 million as at March 31, 2014. Our bank facility

is currently set at $125 million providing Cardinal with the necessary financial

flexibility on a go forward basis. We are currently undergoing our year end

banking review and expect to have our borrowing base increased in second

quarter.

Growth: We are continually adding to and expanding our core areas. During the

first quarter we completed 2 acquisitions adding approximately 300 boe/d of

production and 14 net sections of land. During the quarter we also participated

at a land sale adding significant acreage which we feel is prospective of

additional Mannville drilling.

Management's primary focus for the first quarter of 2014, was to successfully

integrate the acquired assets in SE Alberta as well as the staff associated with

the acquisition; both in our Calgary office and our new field office in Medicine

Hat. We are pleased with the results of this integration and with the quality

and resourcefulness of our new staff.

Cardinal was able to grow organically in the quarter while spending only 69% of

its cash flow (net of acquisitions and financings); to pay its dividend, offset

declines on base production and grow production by 3 percent. As this is our

first full quarter of results as a public company, we are quite pleased that we

are able to demonstrate the strength in our business model which focuses on a

low corporate decline rate. Management estimates that even with the drilling

activity in the quarter, we were able to maintain a corporate decline rate of

less than 15 percent on an annualized basis.

Cardinal exited the quarter with $3.9 million of net debt (we currently have no

debt). This, combined with a peer group leading low decline rate and a

disciplined allocation of capital, make it one of the most sustainable companies

in the junior/intermediate dividend paying oil focused companies. We look

forward to reporting our next quarterly results as we feel confident that we can

achieve more aggressive growth rates while still spending on an all in basis,

less than 100 percent of our cash flow.

About Cardinal Energy Ltd.

Cardinal is a junior Canadian oil focused company built to provide investors

with a stable platform for dividend income and growth. Cardinal's operations are

focused in all season access areas in Alberta.

Advisory Regarding Forward-Looking Statements

In the interest of providing Cardinal's shareholders and potential investors

with information regarding Cardinal, including management's assessment of

Cardinal's future plans and operations, certain statements in this press release

are "forward-looking statements" within the meaning of applicable Canadian

securities legislation. In some cases, forward-looking statements can be

identified by terminology such as "anticipate", "believe", "continue", "could",

"estimate", "expect", "forecast", "intend", "may", "objective", "ongoing",

"outlook", "potential", "project", "plan", "should", "target", "would", "will"

or similar words suggesting future outcomes, events or performance. The

forward-looking statements contained in this press release speak only as of the

date thereof and are expressly qualified by this cautionary statement.

Specifically, this press release contains forward-looking statements relating

to: our business strategies, focus, plans and objectives; future drilling plans

and targets; expected production rates and decline rates; target payout ratios;

dividend policy and plans; plans to reduce operating costs; anticipated

increases in our credit facility and the timing thereof; and plans to achieve

more aggressive growth rates while still spending less than 100 percent of

anticipated cash flow. These forward-looking statements are based on certain key

assumptions regarding, among other things: petroleum and natural gas prices and

pricing differentials; well production rates and reserve volumes; estimated

operating costs; our ability to market our oil and natural gas successfully; our

ability to add production and reserves through our exploration and development

activities; capital expenditure levels; the receipt, in a timely manner, of

regulatory and other required approvals for our operating activities; the

availability and cost of labour and other industry services; the availability

and cost of financing and our ability to access capital; the amount of future

cash dividends that we intend to pay; interest and foreign exchange rates; the

continuance of existing and, in certain circumstances, proposed tax and royalty

regimes; our ability to develop our crude oil and natural gas properties in the

manner currently contemplated; and current industry conditions, laws and

regulations continuing in effect (or, where changes are proposed, such changes

being adopted as anticipated). You are cautioned that such assumptions, although

considered reasonable by Cardinal at the time of preparation, may prove to be

incorrect.

Actual results achieved during the forecast period will vary from the

information provided herein as a result of numerous known and unknown risks and

uncertainties and other factors. Such factors include, but are not limited to:

declines in oil and natural gas prices; risks related to the accessibility,

availability, proximity and capacity of gathering, processing and pipeline

systems; risks inherent in oil and gas operations; variations in interest rates

and foreign exchange rates; access to external sources of capital; risks

associated with the exploitation of our properties and our ability to acquire

reserves; increases in operating costs; changes in government regulations that

affect the oil and gas industry; changes to royalty or mineral/severance tax

regimes; risks relating to hydraulic fracturing; changes in income tax or other

laws or government incentive programs; uncertainties associated with estimating

petroleum and natural gas reserves; changes in environmental, health and safety

regulations; competition in the oil and gas industry for, among other things,

acquisitions of reserves, undeveloped lands, skilled personnel and drilling and

related equipment; or key personnel and information systems; risks associated

with the ownership of our securities, including the discretionary nature of

dividend payments and changes in market-based factors; and other factors, many

of which are beyond the control of Cardinal.

The above summary of assumptions and risks related to forward-looking statements

in this press release has been provided in order to provide shareholders and

potential investors with a more complete perspective on Cardinal's current and

future operations and such information may not be appropriate for other

purposes. There is no representation by Cardinal that actual results achieved

during the forecast period will be the same in whole or in part as those

forecast and Cardinal does not undertake any obligation to update publicly or to

revise any of the included forward-looking statements, whether as a result of

new information, future events or otherwise, except as may be required by

applicable securities law.

Non-GAAP Financial Measures

Cardinal uses terms within this press release that do not have a standardized

prescribed meaning under GAAP and these measurements may not be comparable with

the calculation of similar measurements of other entities.

The terms "cash flow from operations", "netback" or "netback per boe", "net

debt" and "simple payout ratio" in this press release are not recognized

measures under GAAP. Management believes that in addition to net earnings and

cash flow from operating activities as defined by GAAP, these terms are useful

supplemental measures to evaluate operating performance and assess leverage.

Users are cautioned however, that these measures should not be construed as an

alternative to net earnings or cash flow from operating activities determined in

accordance with GAAP as an indication of Cardinal's performance.

Management utilizes "cash flow from operations" as a key measure to assess the

ability of the Company to generate the funds necessary to finance dividends,

operating activities and capital expenditures. All references to cash flow from

operations throughout this press release are based on cash from operating

activities before the change in non-cash working capital and decommissioning

expenditures since Cardinal believes the timing of collection, payment or

incurrence of these items involves a high degree of discretion and as such may

not be useful for evaluating Cardinal's operating performance.

The term "net debt" is not recognized under GAAP and is calculated as bank debt

plus or minus working capital (adjusted for the fair value of financial

instruments). Net debt is used by management to analyze the financial position

and leverage of Cardinal. "Simple payout ratio" represents the ratio of the

amount of dividends declared, divided by cash flow from operations. Simple

payout ratio is another key measure to assess Cardinal's ability to finance

dividends, operating activities and capital expenditures.

FOR FURTHER INFORMATION PLEASE CONTACT:

Cardinal Energy Ltd.

M. Scott Ratushny

Chief Executive Officer and Chairman

(403) 216-2706

Cardinal Energy Ltd.

Douglas Smith

Chief Financial Officer

(403) 216-2709

Cardinal Energy Ltd.

(403) 234-8681

(403) 234-0603 (FAX)

info@cardinalenergy.ca

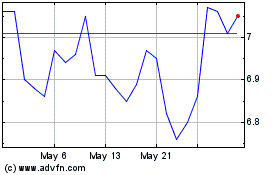

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

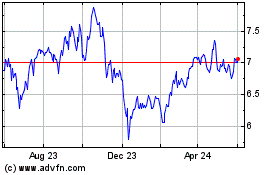

Cardinal Energy (TSX:CJ)

Historical Stock Chart

From Jul 2023 to Jul 2024