Century Global Commodities

Corporation (“

Century” or the

“

Company”) today announced it has made a binding

offer (the “

Offer to Purchase”) to WISCO Canada

ADI Resources Development & Investment Limited (“

WISCO

ADI”), a 23.5% shareholder of Century, to purchase WISCO

ADI’s joint venture interests in Century’s Attikamagen and Sunny

Lake iron ore projects (the “

Joint Venture

Interests”) in exchange for net cash consideration of

$1.17 million. The Company has submitted the Offer to Purchase the

Joint Venture Interests through the facilities of the Shanghai

United Assets and Equity Exchanges (the “

Shanghai United

Exchange”). WISCO ADI listed the Joint Venture Assets on

the Shanghai United Exchange in June 2020. Century’s Offer to

Purchase remains subject to WISCO ADI’s acceptance.

The Proposed

Transaction

The Joint Venture Interests include WISCO ADI’s

interests in the Attikamagen and Sunny Lake joint venture

agreements which include the following:

- a 40% interest

in Labec Century Iron Ore Inc. (“Labec Century”),

the joint venture company for Century’s Attikamagen property,

- a 40% interest

in WISCO Century Sunny Lake Iron Mines Limited

(“Century Sunny Lake”), the legal

trustee of Century’s Sunny Lake Project, and

- a 18.9%

interest in the Sunny Lake Project.

If accepted, Century anticipates that the Joint

Venture Interests (the “Transaction”) would be

acquired pursuant to a transfer agreement to be entered into

between Century and WISCO ADI following WISCO ADI’s acceptance of

the Offer to Purchase (the “Acquisition

Agreement”). It is anticipated that the Acquisition

Agreement would provide for (i) the transfer of all of WISCO ADI’s

shares in Labec Century and Century Sunny Lake to a subsidiary of

Century, (ii) the assignment of a shareholder loan receivable to

the Century subsidiary, and (iii) the assumption of a shareholder

loan payable obligation of WISCO ADI by the Century subsidiary. In

addition, the shareholder and joint venture agreements between

Century and WISCO ADI, and their respective affiliates, for the

Attikamagen and Sunny Lake iron projects would be terminated on

closing. As consideration for the above, Century will pay to WISCO

ADI cash in the amount of $1.17 million in cash.

If Century’s Offer to Purchase is accepted,

Century anticipates that Transaction would be completed in November

2020.

If the Offer to Purchase is accepted and the

Transaction completes, WISCO ADI will have no equity ownership in

either Labec Century, the Attikamagen project, Century Sunny Lake

or the Sunny Lake project, all of which will be 100% owned by

Century on a consolidated basis. WISCO ADI will continue to

own its approximate 23.5% equity interest in Century which will not

be impacted by the completion of the Transaction. In

addition, WISCO ADI will not have any funding obligations payable

to either Labec Century or Century Sunny Lake, and neither Labec

Century nor Century Sunny Lake will owe any funds to WISCO ADI.

WISCO ADI is presently the owner of 23,197,768

common shares of the Company, representing 23.5% of the issued and

outstanding shares of Century, and will continue to hold this

position both before and after completion of the Transaction.

Approval of the Transaction

The Offer to Purchase the Joint Venture

Interests from WISCO ADI was approved by the board of directors of

Century (the “Century Board”) at a meeting held on

October 12, 2020. The nominees of WISCO ADI on the Century Board

did not attend this meeting due to the interest of WISCO ADI in the

transaction and, accordingly, did not participate in the approval

of the transaction.

At the meeting, the Century Board received the

report of Century’s management that included an assessment of the

value of the Joint Venture Interests to be acquired and the

consideration to be paid to WISCO ADI should an agreement be

concluded. Century’s management evaluated the transaction and

concluded that the value of the consideration to be paid to WISCO

ADI, including the cash of $1.17 million, is approximately $2.6

million (the “Consideration Value”). The

Consideration Value accounts for the cash to be paid by Century to

WISCO ADI and the value of a shareholder loan obligation of WISCO

ADI to be assumed by Century with offsets to account for (i) the

increase to the consolidated cash to Century resulting from the

acquisition of Labec Century, (ii) the offset of the WISCO ADI

shareholder loan receivable against the WISCO ADI shareholder loan

payable, and (iii) the 40% interest of WISCO ADI in the shareholder

loan payable.

Century has also received the conditional

approval of the Toronto Stock Exchange (“TSX”) to

the completion of the Transaction, subject to the Company meeting

the requirements of the TSX. As the Company is a non-exempt issuer

under the policies of the TSX and the Consideration Value is in

excess of 10% of the Company’s current market capitalization, the

TSX has required the Company to obtain the approval of a majority

of the Company’s disinterested shareholders for the Transaction

pursuant to section 501(c) of the TSX Company Manual. In

determining the majority of disinterested shareholders, the

23,197,768 common shares of the Company held by WISCO ADI is not

included in this calculation of majority approval. This approval

has been obtained by Century through the delivery of written

consent of shareholders holding a majority of Century’s outstanding

shares, exclusive of the common shares held by WISCO ADI. As the

position of WISCO ADI in Century will be same both before and after

the completion of the Transaction, as outlined above, there will

not be an effect on the control of Century resulting from the

completion of the Transaction.

As the Consideration Value is less than 25% of

Century’s current market capitalization, Century will rely on the

exemption from the formal valuation and minority approval

requirements under Multi-lateral Instrument 61-101 – Protection of

Minority Security Holders in Special Transactions.

Sandy Chim, CEO of Century commented: “We are

very pleased with the transaction, which will consolidate 100%

interests of our joint ventures with our strategic partner, Baowu,

to allow Century the full flexibility to advance our iron projects

particularly our flag ship Joyce Lake at a time when the iron ore

market has been performing very well for a couple of years.

And Baowu will remain as a strategic partner holding approximately

23.5% of the Company.”

About Century

Century Global Commodities Corporation (TSX:CNT)

has established a large portfolio of iron ore projects with

extensive resources in Canada and has other metals and non-metals

operations as follows.

Iron Ore

With Baowu and Minmetals, both Global Fortune

500 companies, as Chinese strategic partners, Century owns one of

the largest iron ore mineral resource bases in the world, across

five projects in Quebec and Newfoundland and Labrador. Joyce Lake,

a direct shipping ore project in Newfoundland and Labrador, is our

most advanced project. It has completed feasibility and permitting

studies and can be brought to production within approximately 30

months. We are maintaining our properties ready for advancement

after a return to sustained higher iron ore prices.

Quality Food Services

Century has established a professional marketing

team and built a distribution system of quality food products

sourced from advanced countries to serve the Hong Kong market.

For further information please

contact:

Sandy Chim, President & CEO

Century Global Commodities Corporation

416-977-3188

IR@centuryglobal.ca

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

THIS PRESS RELEASE CONTAINS “FORWARD-LOOKING

INFORMATION” WITHIN THE MEANING OF CANADIAN SECURITIES LEGISLATION.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE

REPRESENTS THE EXPECTATIONS OF CENTURY AS OF THE DATE OF THIS PRESS

RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE.

FORWARD-LOOKING INFORMATION INCLUDES INFORMATION THAT RELATES TO,

AMONG OTHER THINGS, CENTURY’S INTENTION TO COMPLETE THE WISCO ADI

ACQUISITION TRANSACTIONS. FORWARD-LOOKING INFORMATION IS BASED ON,

AMONG OTHER THINGS, OPINIONS, ASSUMPTIONS, ESTIMATES AND ANALYSES

THAT, WHILE CONSIDERED REASONABLE BY CENTURY AT THE DATE THE

FORWARD-LOOKING INFORMATION IS PROVIDED, ARE INHERENTLY SUBJECT TO

SIGNIFICANT RISKS, UNCERTAINTIES, CONTINGENCIES AND OTHER FACTORS

THAT MAY CAUSE ACTUAL RESULTS AND EVENTS TO BE MATERIALLY DIFFERENT

FROM THOSE EXPRESSED OR IMPLIED BY THE FORWARD-LOOKING INFORMATION.

THE RISKS, UNCERTAINTIES, CONTINGENCIES AND OTHER FACTORS THAT MAY

CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED OR

IMPLIED BY THE FORWARD-LOOKING INFORMATION MAY INCLUDE, BUT ARE NOT

LIMITED TO, RISKS GENERALLY ASSOCIATED WITH CENTURY’S BUSINESS, AS

DESCRIBED IN CENTURY’S ANNUAL INFORMATION FORM FOR THE YEAR ENDED

MARCH 31, 2020. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON

FORWARDLOOKING INFORMATION AND SHOULD NOT RELY UPON THIS

INFORMATION AS OF ANY OTHER DATE. WHILE CENTURY MAY ELECT TO, IT

DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR

TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

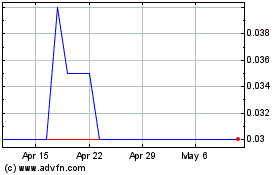

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Jan 2024 to Jan 2025