Century Global Commodities Corporation

(“

Century” or the “

Company”) is

pleased to provide a strategic update of its flagship project, the

Joyce Lake DSO Iron Ore Project (or “Joyce Lake”) in the context of

the current strong iron ore price recovery, since reaching a bottom

in 2015, and the positive outlook for the global seaborne iron ore

market.

Iron ore has been the best performing metal

commodity in 2020 trading at a price level the market has not seen

since about the beginning of the decade. Underpinning this

performance is a strong and steady Chinese market growth and

looking forward to the anticipated post COVID-19 global stimuli

will be an additional key driver, continuing to support the growth

in demand and strong price cycle.

The lack of major new iron ore mine developments

or capital expansions by the major mining companies over the last

few years has capped supply, which fails to match continuous

incremental demand growth. To date in 2020, the capped supply and

strong Chinese demand dynamic has gradually built tremendous market

momentum, recently driving prices close to US$180/t (62% Fe CFR

China).

At current price levels, Joyce Lake looks very

promising with a positive feasibility study in place (the “2015

Study” or “Study”) which assumed a price of only US$95/t. If the

demand and price cycle continues its recent trajectory, the Joyce

Lake project offers the potential of a near-term production open

pit operation, with only crushing and screening required for the

direct shipping ore, that offers the potential to capture this

cycle and generate a much higher return than forecasted in the 2015

Study.

Over the last several years the Company has also

been trying to improve the already feasible project by coming up

with post-feasibility optimization ideas to capture further capital

and operating cost reductions and, as viability is confirmed,

intends to combine these initiatives in an enhanced study as well

as an updated environmental impact study, leading to completion of

permitting and a production decision.

To finance this next phase of project

development, the Company is reviewing the option of spinning out

Joyce Lake as a stand-alone newly listed public company, with the

Company retaining a majority ownership, controlling shareholder

position. The Company would then pursue financing for Joyce Lake on

a stand-alone basis to enhance the 2015 Study and advance the

project towards a production decision. The proposed spin-out would

be completed in a manner similar to its successful spin-out of

Century Metals Inc. (“Century Metals”) completed in June 2019. The

Century Metals spin-out included distributing to Company

shareholders a dividend in-kind of shares in Century Metals,

independent financings and a subsequent successful

reverse-take-over transaction with Reyna Silver Corporation in

2020.

This option is being reviewed further to the

November 2020 announced consolidation of the Company’s interest in

its iron ore assets to 100% ownership, which included Joyce Lake,

and with the ongoing support of its strategic partners will make

any spinout transaction smoother and more effective.

The Company will provide further updates as to

any major developments.

The Joyce Lake Project

Century controls among the largest iron

resources in Canada which includes 8.4 billion tonnes of

measured and indicated resources together with 11 billion

tonnes of inferred resources.

Following an expenditure of more than $40M, the

company’s most advanced project is the Joyce Lake DSO Iron Ore

project which has reserves of 17.72M tonnes at 59.71% Fe and the

Study published on SEDAR in April 2015 as follows.

Mineral Reserves

The mineral resources and mineral reserves are

reported in accordance with Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) definition standards for Mineral

Resources, Mineral Reserves and their Guidelines, and are compliant

with NI43-101.

The mineral reserves estimate for Joyce Lake DSO

Project is set below and was estimated during the Study.

|

|

Tonnage |

Grade |

Grade |

Grade |

Grade |

|

Mineral Reserves |

(t) |

(%Fe) |

(%SiO2) |

(%Al2O3) |

(%Mn) |

|

High Grade Proven (Above 55% Fe) |

11.63 M |

61.35 |

9.16 |

0.54 |

0.84 |

|

Low Grade Proven (52% - 55% Fe) |

2.89 M |

53.31 |

20.70 |

0.60 |

0.70 |

|

High Grade Probable (Above 55% Fe) |

2.45 M |

61.50 |

9.48 |

0.50 |

0.61 |

|

Low Grade Probable (52% - 55% Fe) |

0.75 M |

53.09 |

21.90 |

0.58 |

0.30 |

|

Total Reserve (Above 52% Fe) |

17.72 M |

59.71 |

11.62 |

0.55 |

0.76 |

The strip ratio is 4.09.

The 2015 Study contemplated an open pit of 2.5M

t/a over a 7-year LOM producing both lump and fines from crushing

and screening with no tailings generated and used a long term price

of US$95 per tonne, a capital cost of $259.6M and operating costs

of US$46.60 FOB the port at Sept-Iles, which generated an after tax

NPV8% of $61.4M. The NI 43-101 Technical Report of the 2015 Study

is available on SEDAR.

The Joyce Lake Project is located in

Newfoundland and Labrador close to the town of Schefferville,

Quebec which is serviced by a rail link directly to ocean shipping

iron ore ports at Sept-Iles. A new 43km dedicated haul road will be

used from the Joyce Lake Project to the rail link.

In late 2015 we placed the Joyce Lake Project on

care and maintenance during a protracted period of low iron ore

prices. Today, after careful analysis we believe that period is now

over and we expect the market is entering into the early phase of a

new cycle where we could see an improved and better future price

environment than that when the US$95/t was used in the 2015

Study.

Allan (Wenlong) Gan, P. Geo, a Qualified Person

as defined by NI 43-101, has reviewed and approved the technical

information contained in this news release.

About Century

Century Global Commodities Corporation (TSX:CNT)

is primarily a resource exploration and development company with a

large portfolio of iron ore projects in Canada containing extensive

multi-billion tonne resources mostly discovered from its own

mineral exploration activities. It also has other non-ferrous

metals mineral properties under exploration together with a

well-established food distribution business in Hong Kong (Century

Food).

Joyce Lake DSO and Other Iron Ore

Projects

With Baowu and Minmetals, both Global Fortune

500 companies, as Chinese strategic partners and shareholders,

Century owns one of the largest iron ore mineral resource bases in

the world, across five projects in Quebec and Newfoundland and

Labrador. Joyce Lake, a DSO (direct shipping ore) project in

Newfoundland and Labrador, is our most advanced project. It has

completed feasibility and permitting studies and can be brought to

production within approximately 30 months.

Century Food

Century Food is a subsidiary operation of the

Company which it started a few years ago and is a value-adding

marketing and distribution business of quality food products

sourced from such regions as Europe and Australia to the Hong Kong

market.

For further information please contact:

Sandy Chim, President & CEOCentury Global Commodities

Corporation416-977-3188IR@centuryglobal.ca

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

THIS PRESS RELEASE CONTAINS “FORWARD-LOOKING

INFORMATION” WITHIN THE MEANING OF CANADIAN SECURITIES LEGISLATION.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE

REPRESENTS THE EXPECTATIONS OF CENTURY AS OF THE DATE OF THIS PRESS

RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE.

FORWARD-LOOKING INFORMATION INCLUDES INFORMATION THAT RELATES TO,

AMONG OTHER THINGS, CENTURY’S OWNERSHIP OF ITS ATTIKAMAGEN AND

SUNNY LAKE PROJECTS. FORWARD-LOOKING INFORMATION IS BASED ON, AMONG

OTHER THINGS, OPINIONS, ASSUMPTIONS, ESTIMATES AND ANALYSES THAT,

WHILE CONSIDERED REASONABLE BY CENTURY AT THE DATE THE

FORWARD-LOOKING INFORMATION IS PROVIDED, ARE INHERENTLY SUBJECT TO

SIGNIFICANT RISKS, UNCERTAINTIES, CONTINGENCIES AND OTHER FACTORS

THAT MAY CAUSE ACTUAL RESULTS AND EVENTS TO BE MATERIALLY DIFFERENT

FROM THOSE EXPRESSED OR IMPLIED BY THE FORWARD-LOOKING INFORMATION.

THE RISKS, UNCERTAINTIES, CONTINGENCIES AND OTHER FACTORS THAT MAY

CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED OR

IMPLIED BY THE FORWARD-LOOKING INFORMATION MAY INCLUDE, BUT ARE NOT

LIMITED TO, RISKS GENERALLY ASSOCIATED WITH CENTURY’S BUSINESS, AS

DESCRIBED IN CENTURY’S ANNUAL INFORMATION FORM FOR THE YEAR ENDED

MARCH 31, 2020. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON

FORWARDLOOKING INFORMATION AND SHOULD NOT RELY UPON THIS

INFORMATION AS OF ANY OTHER DATE. WHILE CENTURY MAY ELECT TO, IT

DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR

TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.

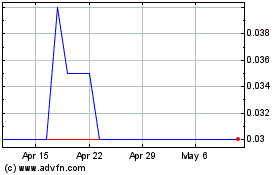

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Century Global Commodities (TSX:CNT)

Historical Stock Chart

From Jan 2024 to Jan 2025